Trial Allowing Faster Pork Processing Line Speeds Ends Nov. 30

OECD economic outlook | COP28 | Hostages released | Farm income & ag trade forecasts

Washington Focus

Congress returns this week and lawmakers have a host of work they have punted on, but the ball keeps returning. Some bottom-line assessments of Congress’ tardy work schedule include:

- Ukraine aid: Senate Republicans are demanding a crackdown at the U.S.-Mexico border before backing President Biden’s request for emergency funding for Ukraine.

- New farm bill: The pressure is off for now because the recent continuing resolution extended both the 2018 Farm Bill and provided funding for the so-called 21 “orphan” program. Besides, sources say the two chambers, and with the chambers, are considerably apart when it comes to farm bill funding and key policy issues.

- Fiscal year (FY) 2024 funding: Both chambers will try to get individual spending measures completed and conferenced before the two deadlines of Jan. 19 and Feb. 2. Most see that as not happening as lawmakers in both chambers are making it difficult for some appropriations measures (including the Ag funding measure in the House) to complete floor debate.

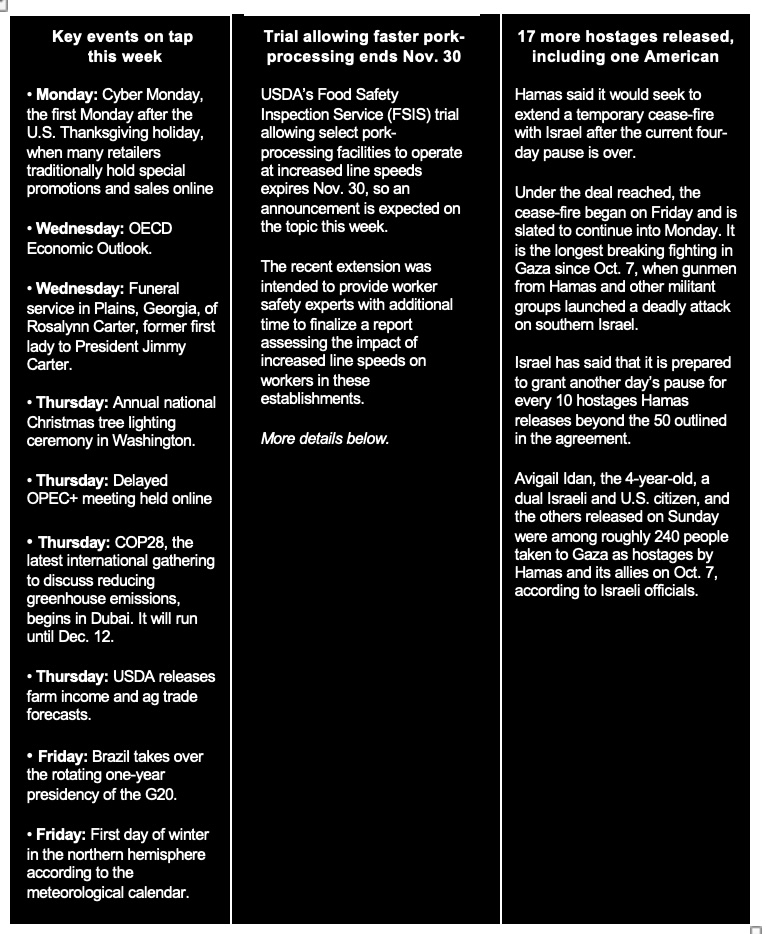

— USDA's trial allowing faster pork-processing ends on Nov. 30. USDA’s Food Safety Inspection Service (FSIS) trial allowing select pork-processing facilities to operate at increased line speeds expires Nov. 30, so an announcement is expected on the topic this week. The recent extension was intended to provide worker safety experts with additional time to finalize a report assessing the impact of increased line speeds on workers in these establishments. The findings from this report were expected to help the agency make informed decisions about future actions regarding line speeds in pork-processing facilities.

Previously, USDA accepted a ruling from March 2021 that prohibited the removal of maximum line speeds in pork-processing plants, as determined by the U.S. District Court for the District of Minnesota. However, in the same year, USDA initiated a "time-limited" trial that allowed facilities participating in the New Swine Slaughter Inspection System (NSIS) to apply for permission to operate at speeds higher than the current maximum line speed of 1,106 hogs per hour. The first NSIS establishment received approval for this in March 2022.

Participating facilities in the trial were required to implement worker safety measures outlined in agreements with workers' unions or worker safety committees representing employees.

The NSIS was established by FSIS in a 2019 final rule, which revoked the existing maximum line speed limit at processing plants that adopted the NSIS. However, this rule faced legal challenges from a coalition consisting of the United Food and Commercial Workers International Union, three local affiliate unions, and the watchdog group Public Citizen. The U.S. District Court for Minnesota ruled that FSIS had not adequately considered worker safety during the rulemaking process, violating the Administrative Procedure Act of 1946.

Of note: According to a recent analysis conducted by the Republican staff of the Senate Ag Committee (link), approximately 40% of the US’ hog supply is produced within a 100-mile radius of six specific processing plants located in Illinois, Michigan, Minnesota, Nebraska, and Pennsylvania. The analysis emphasizes that without a permanent solution or an extension of the current time-limited trials allowing these plants to operate at increased line speeds, these pork processors may be compelled to reduce their operational capacity. This reduction would lead to decreased demand for hogs, resulting in significant economic challenges for hog farmers who are already facing the most adverse economic conditions in over two decades.

— The Senate Ag Committee will focus on two nominations (link):

- Confirmation Hearing for Basil Ivanhoe Gooden, nominated for the position of undersecretary for rural development at USDA. This role was previously held by Xochitl Torres Small, who assumed the position of deputy secretary in July. Gooden, who holds a doctorate in social work from the University of North Carolina, previously served as the Virginia agriculture secretary from 2016 to 2018 and has been overseeing state operations for USDA Rural Development the past two years.

- Nomination of Summer Mersinger for a new term on the Commodity Futures Trading Commission (CFTC). Mersinger, a former aide to Sen. John Thune (R-S.D.), served as the chief of staff to former CFTC member Dawn Stump before joining the commission in 2022.

— On Wednesday, former first lady Rosalynn Carter will be buried at the Carter family residence in Plains, Georgia, one day after memorial services in Atlanta. Rosalynn Carter, who as first lady worked tirelessly on behalf of mental health reform and professionalized the role of the president’s spouse, died Nov. 19 at the age of 96.

— On Thursday, the UN Climate Change Conference (COP28) begins in Dubai. This conference is important because among proponents, there is a growing urgency to address the irreversible damage caused by fossil fuel pollution. Instead of just focusing on reducing emissions, discussions now revolve around how the world should prepare for and adapt to the increasing threats of deadly heat waves, stronger storms, and a significant rise in sea levels. Global leaders, negotiators, climate advocates, and industry representatives are engaged in these discussions.

— The UN Food & Agriculture Organization (FAO) is set to release a global food systems' road map during the COP28 summit, aiming to align the agrifood industry with the goals of the Paris climate agreement. Key points of the plan include:

- Meat Consumption Reduction: Developed nations will be advised to reduce their meat consumption to align with climate goals. This suggests that countries with high meat consumption, such as the average American consuming about 127 kilograms of meat per year, will need to limit their intake.

- Developing Countries' Livestock Farming: Developing countries, where under-consumption of meat contributes to nutritional challenges, will be encouraged to improve their livestock farming practices.

The plan aims to address the environmental impact of meat production and consumption, and will cite changes needed both in nations with “excessive meat consumption” and those facing nutritional challenges.

— Rep. Dean Phillips (D-Minn.), running for president, won't seek re-election to Congress. Returning to Congress after his primary challenge to President Biden would be "both unproductive and uncomfortable," Phillips said. Phillips told the Minneapolis Star Tribune in an interview that he intends to "pass the torch" to another Democrat, just as he has asked Biden to do for him or another presidential candidate. Running for president does not prevent Phillips from seeking re-election to his House seat, since Minnesota's filing deadline for Congress isn't until early June. "The fact is, I intend to be running for president well beyond that," Phillips said, adding that he thinks "it would be irresponsible to continue to string both my constituents along and the other candidates who both have entered the race and who might be interested in entering the race."

The third-term congressman's decision leaves Minnesota's Third Congressional District seat up for grabs. DFL state Sen. Kelly Morrison, who's also a practicing OB-GYN, and Democratic National Committee member Ron Harris have both announced campaigns for Phillips' congressional seat. And DFL Minnesota Secretary of State Steve Simon recently said he would consider a run if Phillips left his seat.

Economic Reports for the Week

Several economic reports this week will likely provide more evidence that escalating interest rates are starting to impact economic activity. The OECD Economic Outlook is released Wednesday.

Monday, Nov. 27

- New Home Sales: From a lower-than-expected 676,000 in August and September's much higher-than-expected 759,000, forecasters see annual sales falling back to 725,000 in October.

- Dallas Fed Manufacturing Survey: The activity index is expected to extend its long contraction, at a consensus minus 16.5 in November versus minus 19.2 in October.

Tuesday, Nov. 28

- Case-Shiller Home Price Index: Forecasters see the adjusted 20-city monthly rate rising 0.7% in September versus August's strong 1.0% increase; unadjusted annual growth was 2.2% in August and is seen higher in September at 3.8%.

- FHFA House Price Index: The house price index is expected to rise 0.4% in September following a 0.6% increase in August.

- Consumer Confidence: The consumer confidence index is expected to fall further in November, at a consensus 101.5 versus 102.6 in October which was higher than expected but 1.7 points below September. This index remains historically depressed and has fallen for three straight months.

- Richmond Fed Manufacturing Index: Richmond Fed's manufacturing index is expected to decline in November to 1 versus 3 in October.

- Federal Reserve board governor Christopher Waller speaks on the economic outlook before an American Enterprise Institute event in Washington. His fellow board governor Michelle Bowman will be speaking on “Monetary Policy and the Economy” at a Utah Bankers Association breakfast in Salt Lake City.

Wednesday, Nov. 29

- MBA Mortgage Applications

- GDP: The second estimate of third-quarter GDP, at 4.9% consensus growth, is expected to show no change from 4.9% growth in the quarter's first estimate. Personal consumption expenditures, at 4.0% growth in the first estimate, are also expected to be unchanged at 4.0% in the second estimate.

- International Trade in Goods (Advance): The U.S. goods deficit (Census basis) is expected to narrow marginally by $0.1 billion to $86.7 billion in October after widening by $2.1 billion in September to $86.8 billion.

- Corporate Profits

- Retail Inventories (Advance)

- Wholesale Inventories (Advance) are expected to increase 0.2% in the advance report for October that would follow a 0.2% rise in September.

- Survey of Business Uncertainty

- Federal Reserve Beige Book

- Federal Reserve: Loretta Mester speaks

- OECD Economic Outlook

Thursday, Nov. 30

- Jobless Claims for the Nov. 25 week are expected to rebound to 219,000 versus 209,000 in the prior week.

- Personal Income and Outlays: Personal income is expected to rise 0.2% in October with consumption expenditures also expected to increase 0.2%. These would compare with September's percent respective increases of 0.3% and 0.7%. Inflation readings for October are expected at muted monthly increases of 0.1% overall and 0.2% for the core (versus September's increases of 0.4% and 0.3%). Annual rates are expected at 3.1% overall and 3.5% for the core (versus September's 3.4% and 3.7%).

- Chicago PMI is expected to rise in November to 45.1 versus 44.0 in October which was the 14th straight month of sub-50 contraction.

- Pending Home Sales Index: Pending home sales in October, which in September rebounded 1.1% after falling 7.1% in August, are expected to fall back 2.0%.

- Fed Balance Sheet

- Money Supply

Friday, Dec. 1

- PMI Manufacturing Final

- ISM Manufacturing Index, expected at 47.5 in November, is expected to extend its run below 50, at 46.7 in October.

- Construction Spending has yet shown much effect from rising financing rates. After rising an expected 0.4% in September, spending in October is expected to rise another 0.3%s.

Key USDA & international Ag & Energy Reports and Events

USDA on Thursday will release updated farm income forecasts.

OPEC+ ministers will convene on Thursday to discuss production policy for the coming months, after the discussions were postponed amid tensions over output quotas. The United Nations’ COP28 climate change conference begins in Dubai the same day.

Monday, Nov. 27

Ag reports and events:

- Export Inspections

- Crop Progress

- Peanut Stocks and Processing

- CFTC Commitments of Traders report; delayed from Friday by U.S. holiday

- MARS monthly EU crop conditions report

- Holiday: India, Myanmar

Energy reports and events:

- BNEF Summit Shanghai (through Nov. 28)

- Abu Dhabi Finance Week (through Nov. 30)

- Brent’s January options expire

Tuesday, Nov. 28

Ag reports and events:

- Livestock and Meat Domestic Data

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- BNEF Summit Shanghai (last day)

- World LNG Summit, Athens (through Dec. 1)

- North Sea loading programs for January due

Wednesday, Nov. 29

Ag reports and events:

- Broiler Hatchery

- Brazil’s Conab releases sugar, cane and ethanol output dataXx

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- World LNG Summit, Athens (day 2)

- North Sea loading programs for January due

Thursday, Nov. 30

Ag reports and events:

- Weekly Export Sales

- Highlights from November 2023 Farm Income Forecast

- Dairy products: Per capita consumption (Annual)

- Outlook for U.S. Agricultural Trade

- Per capita consumption of selected cheese varieties (Annual)

- Supply and allocation of milk fat and skim solids by product (Annual)

- Agricultural Prices

- Egg Products

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Port of Rouen data on French grain exports

- Malaysia’s Nov. 1-30 palm oil exports

- Holiday: Scotland

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- COP28, Dubai (through Dec. 12)

- OPEC+ meeting

- BofA 2024 Energy Outlook

- Brent’s January futures expire

- World LNG Summit, Athens (day 3)

Friday, Dec. 1

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Cotton System Consumption and Stocks

- Fats & Oils: Oilseed Crushings, Production, Consumption and Stocks

- Grain Crushings and Co-Products Production

- FranceAgriMer’s weekly crop condition report

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- COP28, Dubai (through Dec. 12)

- World LNG Summit, Athens (last day)

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |