Congress on Holiday Break but Similar Unresolved Issues Confront in Early 2024

Rosalynn Carter dies at age 96 | Libertarian Milei set to win Argentina’s presidency

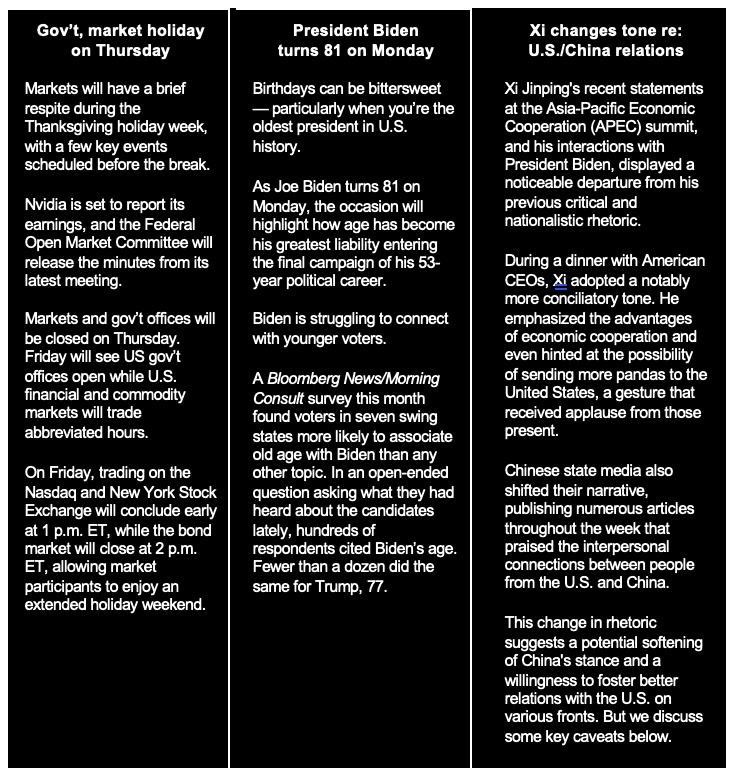

Washington Focus

Congress is out on a Thanksgiving break — the Senate returns to Washington Nov. 27, and the House is in the following day. But they eventually must deal with lingering issues they have either punted on or not dealt with.

- FY 2024 spending. The fiscal year began Oct. 1, and as usual, both chambers of Congress are far behind in inking annual appropriations measures. They do not even have an agreement on topline spending numbers. GOP conservatives have made it difficult to get some individual fiscal year (FY) 2024 spending bills approved. The current stopgap spending bill goes until Jan. 19 for some departments (20%) including Agriculture, and Feb. 2 for the majority (80%) of government spending. Link to a CRS report on the recent history of continuing resolutions. House Republicans want Speaker Mike Johnson (R-La.) to demand sharp budget cuts as the price for agreement to major spending bills. The Democratic-controlled Senate and the White House oppose such cuts. Sound familiar? Bottom line on the House: “This is an unmanageable majority right now. Effectively, there’s not a majority.” — Rep. Garret Graves (R-La.), who said some Republicans are exploiting the narrow margin for personal gain or petty grievances. That suggests turmoil ahead and heightened risk of a government shutdown in the new year.

- Will House Speaker Johnson face challenge from his House rebels? They certainly were not happy with the two-prong stopgap spending measure. But they already are giving Johnson more leeway than former House Speaker Kevin McCarthy (R-Calif.). Johnson is about as far right in his views as any House member, so even if the House GOP rebels want to attack their speaker again, it will prove more difficult. And, House Democrats could neuter House GOP rebels by simply supplying the votes to thwart any challenge of Johnson, a tactic some say the Democrats should have implemented to protect McCarthy, who is less conservative than Johnson.

- Aid to Israel, Ukraine and Taiwan. Look to the Senate for the answer to this as there is a bipartisan push to link this with border policy reform and additional border protection funding.

- New farm bill. With farm-state lawmakers extending the 2018 Farm Bill, the near-term pressure for a new omnibus measure is off, which is why some Ag panel leaders have told farm groups to increase the pressure to finish a measure. Farm bill leaders say they still want a new farm bill sometime in early 2024. Veteran farm bill watchers say there is still wide disagreement on two lingering issues (1) where to find additional funding to improve the Title I safety net and (2) key policy differences between and within political parties. If there is no official new farm bill by July, election politics will rule even more than now.

— Rosalynn Carter, a significant political and policy adviser to her husband, President Jimmy Carter, passed away at the age of 96 at her home in Plains, Georgia. She was known for her role in creating the modern Office of the First Lady, advocating for improved care for the mentally ill during her time in the White House, and continuing this work for four decades afterward. Her death followed a battle with dementia, and she was in hospice care at home in the days leading up to her passing.

The Carters had a remarkable marriage lasting over 77 years, setting a record for the longest presidential marriage in U.S. history. Their final months were spent together at their family home in Plains, Georgia. Earlier, in February, President Jimmy Carter had decided to discontinue medical treatment for an aggressive form of melanoma skin cancer.

— Hoeven and Harris urge re-evaluation of USDA's 2022 ERP changes. Sen. John Hoeven (R-N.D.), and House Agriculture Appropriations Subcommittee Chairman Andy Harris (R-Md.) have jointly sent a letter (link) to USDA Secretary Tom Vilsack, urging him to reconsider the changes made by USDA to the Emergency Relief Program (ERP) for compensating producers for losses in 2022.

In their letter, Hoeven and Harris noted they had secured over $3.7 billion in annual funding legislation to aid farmers and ranchers in recovering from natural disasters, aligning with the assistance provided under ERP in 2020 and 2021. They expressed concern that ERP 2022 had introduced significant changes that deviated from statutory requirements and Congressional intent, including:

- Implementing a "progressive" payment factor that penalizes producers with the largest losses. In contrast, in 2020 and 2021, ERP had utilized a flat payment factor to ensure that producers were reimbursed at the same rate regardless of the extent of their losses.

- Offering crop insurance premium reimbursements exclusively to socially-disadvantaged, limited-resource, beginning, and veteran farmers and ranchers. Statute, however, mandates that USDA provide a crop insurance premium reimbursement to all producers receiving ERP assistance, as had been the practice in previous versions of the program.

Comments: The only thing surprising about the letter is how long it took to get lawmakers’ attention to a problem that has been obvious for a long time.

— Last week’s U.S./China summit between President Biden and President Xi reached several agreements and commitments. They agreed to restart military-to-military dialogues and establish direct communication lines between themselves. Both leaders pledged to maintain open channels for discussing various economic and security issues, particularly concerning the use of artificial intelligence in military applications, with a focus on reducing security threats, especially related to nuclear weapons.

Furthermore, they cooperated on combatting fentanyl trafficking, with President Xi vowing to clamp down on the production and distribution of drug precursors and pill presses originating from China.

Additionally, Biden and Xi agreed to increase the number of flights between China and the U.S. and strengthen cultural and educational ties between the two countries.

Reality check: Both leaders maintained their previous positions on trade disputes, economic competition, human rights concerns, conflicts in Ukraine and the Gaza Strip, and the status of Taiwan. The meeting did not yield any new specific agreements on these contentious issues.

— Biden and López Obrador reaffirm commitment on migration and fentanyl at APEC. President Biden and Mexican President Andrés Manuel López Obrador met last Friday (Nov. 17) during the Asia-Pacific Economic Cooperation (APEC) conference and reaffirmed their commitment to addressing migration issues and combating fentanyl trafficking to the United States. These are key areas that have been targeted by 2024 Republican presidential candidates as points of criticism against the Biden administration.

Cooperation not discord. While the two leaders have sometimes had public disagreements, during this meeting, they were largely complimentary towards each other. They pledged to collaborate on tackling these longstanding areas of conflict between their nations, although they did not announce significant new initiatives.

López Obrador expressed Mexico's commitment to preventing drug trafficking, particularly the entry of fentanyl and other chemical precursors, recognizing the harm they cause to American youth. Biden mentioned a conversation with China's President Xi Jinping about this issue, suggesting an agreement to reduce the flow of fentanyl from China to the U.S.

The Mexican leader also thanked the Biden administration for its work on migration, emphasizing the need for further progress in addressing this issue collaboratively.

— USDA on Monday is introducing a new category within its National Weekly Direct Swine Non-Carcass Merit Premium report. This category specifically focuses on hogs that are raised in compliance with animal confinement laws (ACL), including initiatives like California's Proposition 12 and Massachusetts' Question 3, which mandate that pork sold in those states must come from hogs born to sows raised in housing meeting specific standards. Several other states also have laws regulating sow housing. Previously, USDA had included information about non-carcass merit premiums for ACL-compliant hogs under an "other" category, which also encompassed other non-carcass characteristics like being antibiotic-free. Link for details.

The National Pork Producers Council (NPPC) advocated for this change and maintained engagement with the USDA's Agricultural Marketing Service throughout the process. The decision to establish a separate category for ACL-compliant hogs is driven by the increasing number of merit premiums submitted under the Livestock Mandatory Reporting (LMR) Program.

NPPC says this new category will be valuable for stakeholders in the pork industry, providing them with more detailed information when making decisions related to production and marketing.

— A Wall Street Journal editorial (link) criticizes a Senate bill introduced by Republicans that proposes a carbon tariff, which the editorial board views as a new tax. The bill, known as the Foreign Pollution Fee Act, has been sponsored by Sens. Bill Cassidy of Louisiana and Lindsey Graham of South Carolina. The editorial argues that this bill is problematic for several reasons:

- Misleading Arguments: The editorial suggests that the arguments put forth by the bill's proponents, including Sen. Cassidy, are misleading. They argue that the bill's intent is to protect American businesses from foreign competition as they face rising energy costs due to green energy policies.

- Scope of the Carbon Tariff: The bill proposes tariffs on 16 categories of goods from countries with higher CO2 emissions than the United States. These categories include various products such as steel, aluminum, solar panels, and more. The editorial points out that many of these goods are not produced domestically in sufficient quantities to meet demand, making tariffs inevitable.

- Creation of Bureaucracy: The bill would create a new bureaucracy, the National Laboratory Advisory Board on Global Pollution Challenges, with significant powers. This expansion of the administrative state is seen as problematic and potentially difficult to control by future Congresses.

- Impact on Consumers: The editorial argues that the tariffs imposed by the bill would ultimately be absorbed by American businesses, workers, and consumers, resulting in higher prices for various products.

- Trade and Retaliation: The bill's proposal of a carbon border tax could lead to retaliatory duties from foreign governments, similar to previous steel and aluminum tariffs. Such retaliatory actions could harm U.S. consumers and businesses.

- Unintended Economic Distortions: The editorial contends that adding a carbon tax on top of existing green energy subsidies would create economic distortions and increase costs for U.S. manufacturers.

Bottom line: The editorial criticizes the Republican-sponsored carbon tariff bill, arguing that it may have negative consequences for the U.S. economy, businesses, and consumers. It also questions the bill's underlying intentions and its alignment with conservative economic principles.

— Rep. George Santos (R-N.Y.) is again in jeopardy of being expelled from the House of Representatives following an ethics investigation that uncovered evidence of financial misconduct during his 2022 campaign. If he is indeed removed from office, as is likely, a special election will be held in his district, which includes sections of Long Island and Queens and had been under Democratic control until his election.

— A high-level court case. David Boies, an attorney known for his involvement in landmark legal cases, is now focused on challenging the U.S. government's stance on cannabis. At 82 years old, he's filed a lawsuit against Attorney General Merrick Garland on behalf of several cannabis companies in Massachusetts.

Boies' objective is not to legalize marijuana nationwide, but rather to make intrastate cannabis commerce legal. This means that if a state has legalized marijuana within its borders, it would also be considered legal at the federal level. If successful, Boies' efforts could resolve the current paradox where cannabis is illegal at the federal level but legal in some form in 38 states. Link to details via Forbes.

— Louisiana Republicans sweep statewide runoff elections. In Louisiana, Republicans on Saturday won three statewide runoff elections for the positions of attorney general, secretary of state, and treasurer. This marks the first time since 2015 that Republicans have secured every statewide elected office, according to the Associated Press.

Details: Liz Murrill became the attorney general, Nancy Landry became the secretary of state, and John Fleming was elected as treasurer, with all three receiving more than 65% of the votes. Nancy Landry is not related to the governor-elect.

— Javier Milei, a 53-year-old radical libertarian with a Trump-like style, is poised to become Argentina's next president. He has limited governing experience and comes from a far-right economic background. His main opponent, center-left government minister Sergio Massa, conceded defeat even before the official results were announced. Milei's victory represents a significant rightward shift in Argentina's political landscape, marking one of the sharpest turns to the right in the country's four decades of democracy.

While official results are yet to be announced, provisional and partial results suggest that Milei made significant gains in Cordoba and Buenos Aires City. wing Economy Minister Sergio Massa is reported to be ahead in the Province of Buenos Aires, Argentina's largest district. Link for live election results.

Javier Milei's strong performance aligns with earlier poll predictions of a closely contested election.

A Milei win could potentially lead to widespread protests due to his plans to significantly cut public spending on welfare, education, and healthcare. Additionally, his proposal to replace the Argentine peso with the U.S. dollar might spark bank runs if people fear an unfavorable exchange rate for the conversion.

A Massa victory would likely maintain social stability by preserving generous welfare benefits for many citizens. However, it might also hinder efforts to address inflation and attract investment through deregulation.

Bottom line: The outcome of this election will have significant implications for Argentina's economic and social landscape.

— Missouri jury orders Bayer to pay $1.56 billion over Roundup weedkiller. A Missouri jury has ruled against Bayer, ordering the company to pay $1.56 billion in a case involving its Roundup weedkiller. This marks the fourth consecutive legal loss for Bayer in a five-year legal battle over Roundup, a widely used herbicide. The lawsuits have been filed by tens of thousands of individuals, including farmers and gardeners, who claim that Roundup caused their cancers.

The mounting legal charges related to Roundup come at a time when Bayer is undergoing a corporate restructuring. This restructuring may lead to the separation of Bayer's health business from its agriculture unit, which includes Monsanto, the U.S.-based company that developed Roundup. The division of Roundup-related liabilities will have implications for the valuation of these two businesses.

Bayer maintains that Roundup, containing the main ingredient glyphosate, is safe to use and points to reviews by regulatory agencies like the U.S. Environmental Protection Agency that have found no cancer risk associated with it. However, the recent jury decision in Missouri contradicts this claim.

The plaintiffs in this case were awarded a combined $61.1 million in damages and an additional $1.5 billion in punitive awards. They argued that years of using Roundup in their gardens led to their non-Hodgkin's lymphomas. Bayer has expressed its intention to challenge the verdict.

— A Forbes article (link) explores the Thanksgiving Industrial Complex, focusing on America's largest private company, Cargill, and its role in producing key components of many iconic Thanksgiving dishes. Cargill plays a significant part in the Thanksgiving meal, providing essential ingredients for gravy, cranberry sauce, packaged dinner rolls, cornbread mix, and marshmallows used in sweet potato casseroles.

Additionally, Cargill is involved in producing vegetable oils for roasting potatoes and crisping turkey skin, as well as being the country's largest salt producer through Diamond Crystal.

The sugar alternative, Truvia, sweetens pies and post-dinner coffee, and even the candles on the Thanksgiving table might be made from Cargill's vegetable wax.

Cargill supplies one out of every three Thanksgiving turkeys, highlighting its dominant presence in the holiday food industry. The feature delves into Cargill's influence on Thanksgiving and examines the broader state of the turkey industry.

Of note: Cargill kept its number one spot for the third consecutive year on Forbes’ annual list (link) of America’s Largest Private Companies

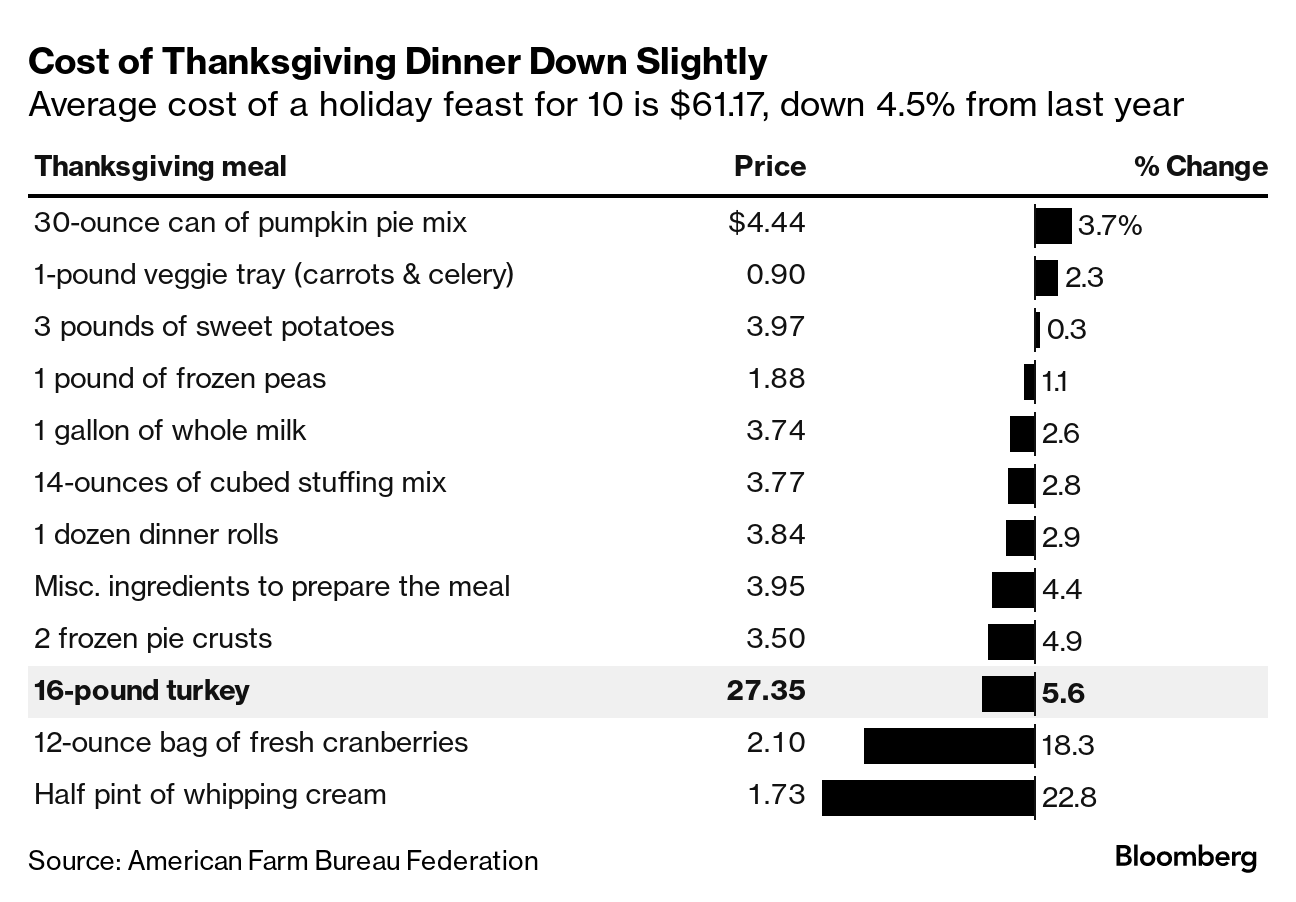

— The cost to host a Thanksgiving dinner is down a bit this year. The American Farm Bureau Federation’s annual survey of the average price of a classic holiday feast for 10 is $61.17 this year. That's down 4.5% from last year’s record-high average of $64.05, but the meal is still 25% pricier than it was in 2019. The most expensive part – the turkey – is down 5.6% from last year. Regionally, costs are a bit less in the Midwest where the cost was $58.66, followed by the South at $59.10, the West, $63.89, and the Northeast $64.38.

Hearings & Other Events

Monday, Nov. 20

- Turkey pardon. President Joe Biden participates in the National Thanksgiving Turkey Presentation at the White House.

- White House Christmas Tree. White House hosts the official receipt of the 2023 White House Christmas Tree, an 18-and-one-half foot Fraser Fir from Fleetwood, North Carolina, alongside military-connected families.

- WTO ministerial meeting. Center for Strategic and International Studies discussion on “What's at Stake for the United States at the 13th World Trade Organization (WTO) Ministerial?”

- Climate and Latin America. Georgetown University 2023 Conference on Latin America and the Caribbean, including a discussion on “Navigating Climate Change: Sustainable Strategies and Policies.”

- APEC summit. Center for Strategic and International Studies virtual discussion on “APEC 2023: Analysis and Outcomes.”

- Energy workforce. Department of Energy virtual meeting of the 21st Century Energy Workforce Advisory Board for a discussion on the Energy Department's role in meeting future energy workforce needs.

Tuesday. Nov. 21

- Israel/Hamas conflict. Middle East Institute virtual discussion on “Escalating Israeli Violence & Extremism in the West Bank & East Jerusalem.”

- Oil and gas issues. United States Energy Association virtual media briefing on “The Oil and Gas Dilemma.”

- APEC summit recap. Asia Society Policy Institute virtual discussion on “Asia-Pacific Economic Corporation (APEC) 2023: Achievements, Insights, and the Road Ahead.”

- Methane emissions. Center for Global Development virtual discussion on “Practical Action on Methane Emissions: How the IMF and Others Can Help.”

- COP28 and African countries. Atlantic Council virtual discussion on “African Solutions at COP28: A Turning Point?”

Wednesday, Nov. 22

- Markets. U.S. financial and commodity markets trade normal hours and will be closed Thursday.

- AI and ChatGPT. Broadband Breakfast virtual discussion on “Artificial Intelligence (AI) One Year After ChatGPT.”

Thursday, Nov. 23

- Holiday. U.S. Thanksgiving holiday. U.S. financial and commodity markets and U.S. gov’t offices are closed for the holiday.

Friday, Nov. 24

- Markets. U.S. financial and commodity markets trade abbreviated market hours with U.S. gov’t offices open.

- National Zoo holiday display. Smithsonian's National Zoo 15th annual ZooLights, with more than half a million LED lights and illuminations, and live musical performances; runs through Dec. 30.

Economic Reports for the Week

The FOMC will release its early November meeting minutes on Wednesday. The Fed's policymaking group has held the federal-funds rates steady at 5.25%-5.50% since July. According to the CME FedWatch Tool, traders are pricing in less than a 1% chance that the Fed raises rates again before cutting them.

Monday, Nov. 20

- Conference Board Leading Economic Index for October. The consensus estimate is for a 0.6% month-over-month decline.

Tuesday, Nov. 21

- National Association of Realtors reports existing-home sales for October. Economists forecast a seasonally adjusted annual rate of 3.9 million homes sold, slightly less than in September.

Wednesday, Nov. 22

- MBA Mortgage Applications

- Census Bureau releases the durable goods report for October. The consensus call is for new orders for durable manufactured goods to decrease 3.4% month over month, following a 4.6% jump in September.

- Jobless claims: The Labor Department is expected to report initial claims for state unemployment benefits likely fell 5,000 to a seasonally adjusted 226,000 for the week ended Nov. 18.

- The University of Michigan's preliminary reading of its Consumer Sentiment Index likely rose to 60.6 in November from a reading of 60.4 in October.

Thursday, Nov. 23

- Holiday

Friday, Nov. 24

- S&P Global releases both its manufacturing and services purchasing managers’ indexes for November. Consensus estimates are for a 49.6 reading for the manufacturing PMI and 50.4 for the services PMI. Both figures are slightly less than the October data.

Key USDA & international Ag & Energy Reports and Events

Ag agenda: The U.K. will host a global food security summit on Monday to address hunger and malnutrition. USDA on Wednesday updates their food price forecasts.

Energy sector: Oil market participants will be watching for clues on OPEC+ production policy, with ministers from the group heading to meetings in Vienna on the weekend of Nov. 25-26.

Monday, Nov. 20

Ag reports and events:

- Export Inspections

- Crop Progress

- Fruit and Tree Nuts Data

- Vegetables and Pulses Data

- Cotton and Wool Yearbook

- Chickens and Eggs

- Milk Production

- Poultry Slaughter

- U.K. hosts global food security summit

- World Association of Beet & Cane Growers Consultation

- Malaysia Nov 1-20 palm oil exports

- Holiday: Argentina, Mexico

Energy reports and events:

- China’s third batch of October trade data, including country breakdowns for energy and commodities

- WTI December futures expire

Tuesday, Nov. 21

Ag reports and events:

- Agricultural Exchange Rate Data Set

- Sugar: World Markets and Trade

- ISO International Seminar sugar conference, London (Day 1 of 2)

- Annual Roundtable Conference on Sustainable Palm Oil, Jakarta (Day 1 of 2)

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- EU lawmakers in Strasbourg, France vote on parliament’s position on the Net Zero Industry Act

- Earnings: Motor Oil 3Q

Wednesday, Nov. 22

Ag reports and events:

- Broiler Hatchery

- Food Price Outlook

- Cotton Ginnings

- Cold Storage

- Farm Labor

- Livestock Slaughter

- ISO International Seminar sugar conference, London

- Annual Roundtable Conference on Sustainable Palm Oil, Jakarta

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- EIA natural gas storage change

- Genscape weekly crude inventory report for Europe’s ARA region

- Baker Hughes weekly rig count report

Thursday, Nov. 23

Ag reports and events:

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Sugar production and cane crush data from Brazil’s Unica (tentative)

- Port of Rouen data on French grain exports

- Holiday: U.S., Japan

Energy reports and events:

- Insights Global weekly oil product inventories in Europe’s ARA region

Friday, Nov. 24

Ag reports and events:

- Peanut Prices

- Weekly Export Sales

- FranceAgriMer’s weekly crop condition report

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

Saturday, Nov. 25

- OPEC meeting

Sunday, Nov. 26

- Joint Ministerial Monitoring Committee, noon Vienna time

- OPEC+ meeting

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |