President Biden Meets Chinese Leader Xi: What May Occur

Details of ag-related provisions in House-passed continuing resolution

|

Today’s Digital Newspaper |

MARKET FOCUS

- U.S. retail sales decreased by 0.1% month-over-month in October

- Notable decline in U.S. producer prices, dropping by 0.5% month-over-month

- FDIC’s chair faces tough questioning over the agency’s culture

- Ken Griffin: Miami may eventually unseat New York as financial capital of world

- Inflation rate in U.K. decreases to 4.6%

- Japanese economy contracted by 0.5%, worse than market anticipated

- Yield on U.S. 10-year Treasury at 4.43%, lowest level seen in past seven weeks

- Ag markets today

- USDA daily export sale: 124,000 MT corn to Japan during 2023-24 marketing year

- Thailand raises rice export forecast

- India signed contracts for export of approximately 500,000 MT new-crop basmati rice

- Ag trade update

- Google DeepMind unveils faster, more accurate weather forecast AI model

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House passes stopgap funding bill by vote of 336-95

- What’s in and out of House-cleared CR

- Details of ag-related provisions in House CR

- McCarthy elbows his way back into the news

- Senate committee advances resolution to bypass blockade on military promotions

ISRAEL/HAMAS CONFLICT

- UN resumes fuel deliveries to Gaza after Hamas attacks

RUSSIA & UKRAINE

- EU discussing reinforcement of $60 per barrel price cap on Russian oil exports

- Ukraine launches insurance program for grain vessels .

- Ukraine imposes restrictions on delivery of grain by railways to port of Odesa ,

- U.S. Treasury has alarmed tanker owners

POLICY

- Stabenow urges farm leaders to push for new farm ‘in the spring, before summer’

- Stabenow urges tangible benefits from AI in agriculture

PERSONNEL

- USDA announces several key appointments

CHINA

- China bolsters economy with large cash injection via one-year policy loans

- China’s central bank keeps key policy rates unchanged

- Biden and Xi aim to prevent escalating competition to conflict

- China marriages set to end 9-year run of declines in 2023, demographic issues remain

TRADE POLICY

- Biden and Lopez Obrador to discuss bilateral relations and migration at APEC summit

ENERGY & CLIMATE CHANGE

- Greenhouse gas emissions from U.S. agriculture

- Biodiesel production robust despite challenge

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Trends in breakeven prices for cattle finishing

HEALTH UPDATE

- Gap in life expectancy between men and women in U.S. widest in nearly 30 years

POLITICS & ELECTIONS

- Poll in Wisconsin could hold crucial insight for 2024 presidential election

OTHER ITEMS OF NOTE

- Bill Gates buying up land, threatening small farms under guise of saving planet: author

|

MARKET FOCUS |

— Equities today: Asian and European markets were mixed to firmer in overnight trading. U.S. Dow opened around 90 points higher. Inflation in Britain fell to its lowest level in two years. And consumer spending and industrial output in China rebounded last month, a hopeful sign for the world’s No. 2 economy. In Asia, Japan +2.5%. Hong Kong +3.9%. China +0.6%. India +1.1%. In Europe, at midday, London +1.1%. Paris +0.7%. Frankfurt +0.8%.

U.S. equities yesterday: All three major indices scored sizable gains in the wake of U.S. inflation data. The Dow ended up 489.83 points, 1.43%, at 34,827.70. The Nasdaq rose 326.44 points, 2.37%, at 14,094.38. The S&P 500 gained 84/15 points, 1.91%, at 4,495.70.

— The FDIC’s chair faces tough questioning over the agency’s culture. Senators asked Martin Gruenberg yesterday about how the regulator handles accusations of harassment and discrimination after the Wall Street Journal reported on toxic work conditions there. (“What the hell is going on at the FDIC?” asked Sen. John Kennedy (R-La.). Gruenberg said he was “personally disturbed” by the report and was conducting an internal review. It will likely be a big target when Gruenberg appears in the House this morning. House Financial Services Chair Patrick McHenry (R-N.C.) is asking for the FDIC IG to brief the committee on the matter.

— Agriculture markets yesterday:

- Corn: March corn futures rose 1 1/2 cents to $4.94 1/4 and nearer the session high.

- Soy complex: January soybeans rose 7 1/4 cents to $13.89 3/4, the highest close since Aug. 30. December meal rose $4.50 to $473.60, a new high-close. December soyoil rose 121 points to 52.75 cents, marking a mid-range close.

- Wheat: March SRW wheat closed down 4 1/2 cents to $5.97 3/4 today. March HRW wheat closed down 2 1/2 cents to $6.49 1/2. Prices closed nearer their daily lows. March spring wheat rose 3 1/4 cents to $7.47 1/4.

- Cotton: December cotton rose 120 points to 78.68 cents, the highest close since Nov. 3.

- Cattle: December live cattle futures rallied 92.5 cents to $175.85, while deferred contracts saw additional gains. January feeder cattle futures rallied 70 cents to $229.00, despite expiring November futures falling 67.5 cents to $230.05.

- Hogs: The nearby contracts led hog futures lower, with December futures losing $1.05 to $72.30 at the close.

— Ag markets today: Soybeans and soymeal led price gains overnight after high-range closes on Tuesday. Wheat followed to the upside, while corn chopped around unchanged. As of 7:30 a.m. ET, corn futures were trading fractionally lower, soybeans were mostly 4 to 5 cents higher, winter wheat markets were 1 to 3 cents higher and spring wheat was mostly 3 to 4 cents higher. Front-month crude oil futures were modestly weaker, while the U.S. dollar index was more than 150 points higher.

Wholesale beef still looking for a low. Wholesale beef prices fell on Tuesday, with Choice down $2.18 to $295.67 and Select $1.36 lower to $267.88. Both are trading below previous “value” levels of $300.00 and $275.00, respectively, suggesting retailers are struggling to find consistent retailer demand. Retailers are currently more selective buyers than value seekers.

Cash hog index hints it may be stabilizing. The CME lean hog index is up 8 cents to $76.13 as of Nov. 13. While the index posted a new low for the move the previous day, it has now firmed four of the past six days, suggesting it is stabilizing. After a $1.05 drop on Tuesday, December hog futures widened their discount to $3.83.

— Quotes of note:

- Inflation watch. Some note the “core” inflation data in yesterday’s CPI reading, which strips out volatile energy and food prices, was just a tenth of a percentage point below estimates. “I’m afraid that inflation may not go away that quickly,” Jamie Dimon of JPMorgan Chase told Bloomberg Television.

- "I have been preaching for the past year that the rate of inflation would fall as fast as it rose, and this report supports that assertion," Investing Group Leader Lawrence Fuller, author of The Portfolio Architect, wrote to his subscribers. The CPI report “ends the discussion of rate hikes and should also end the discussion about rates staying higher for longer... It looks like the little guy was one step ahead of Wall Street this time around. The professional money management community has been extraordinarily bearish as of late, which means there is plenty of fuel left for our year-end rally."

- Ken Griffin says Miami may eventually unseat New York as the financial capital of the world. The Citadel boss, who is building a more than $1 billion waterfront tower, said the city “represents the future of America.” Major Wall Street firms have been shifting to the Sun Belt in recent years on account of lower taxes, cheaper real estate and labor, and warmer weather compared to New York.

- Biden/Xi confab: "It would be naive to expect this meeting to result in breakthrough developments, but I am optimistic this meeting will steer the two countries in the right direction to manage geopolitical risks better," said Investing Group Leader Dilantha De Silva. Catering to multinationals that might boost the Chinese economy, Xi will also meet with a group of high-profile CEOs to shore up investor confidence. Meetings are expected with Tesla's Elon Musk, Microsoft's Satya Nadella, Exxon Mobil's Darren Woods, and Citigroup's Jane Fraser, among other executives.

— Retail sales in the United States decreased by 0.1% month-over-month in October 2023, putting an end to a six-month streak of increases and compared with the market consensus of a 0.3% decline. Sales at miscellaneous store retailers recorded the biggest decrease (-1.7%), followed by furniture stores (-2.0%), motor vehicle dealers (-1.0%), sporting goods, musical instruments and book sellers (-0.8%), gasoline stations (-0.3%) and general merchandise stores (-0.2%).

— In October 2023, producer prices in the U.S. experienced a notable decline, dropping by 0.5% month-over-month. This decline was the most significant since April 2020. The drop in goods prices was even more pronounced, down by 1.4%, marking the first decrease since May. The primary driver of this decline was a substantial 15.3% drop in gasoline prices. Prices for diesel fuel, hay, hayseeds, oilseeds, home heating oil, liquefied petroleum gas, and light motor trucks also fell. However, prices for tobacco products increased by 2.4%. Additionally, the indexes for butter and residual fuels saw price increases.

On the services front, prices remained unchanged following six consecutive increases. The 1.5% increase in the index for final demand transportation and warehousing services, along with a 0.1% rise in prices for final demand services less trade, transportation, and warehousing, offset a 0.7% decline in margins for final demand trade services.

— In October 2023, the inflation rate in the United Kingdom decreased to 4.6%, down from 6.7% in both September and August. This drop was unexpected as it fell short of market expectations, which were at 4.8%. This marks the lowest inflation rate since October 2021.

Several factors contributed to this decline in inflation. One significant factor was the reduction in energy prices, which followed Ofgem's decision to lower the cap on household bills. The cost of housing and utilities decreased by 3.5% in October, a notable improvement from the 6.9% decline in September. Both gas and electricity costs experienced their most substantial decrease since January 1989.

Food inflation also eased in October, standing at 10.1%, which is the lowest it has been since June 2022. Additionally, other categories of consumer prices showed slower growth. Transport costs increased by 0.5% (compared to 0.7% in the previous month), while restaurants and hotels saw a rise of 7.5% (down from 8.6%). The categories of furniture, household equipment, and maintenance (3.1% vs. 3.7%), clothing and footwear (6.2% vs. 6.9%), and miscellaneous goods and services (5.1% vs. 5.3%) also experienced slower inflation rates.

The core inflation rate, which excludes volatile items like food and energy, also decreased to 5.7%, the lowest since March 2022. On a monthly basis, the Consumer Price Index (CPI) remained unchanged.

In summary, the U.K. experienced a notable drop in inflation in October 2023, driven by factors such as lower energy prices and reduced inflation in various consumer spending categories. This decline was unexpected as it fell below market expectations.

— In Q3 of 2023, the Japanese economy contracted by 0.5% quarter-on-quarter, which was worse than the market had anticipated (forecasting a 0.1% decline) and followed a 1.1% growth in Q2. This marks the first GDP contraction since Q4 of 2022 and is attributed to increased cost pressures and growing global economic challenges.

Private consumption, accounting for over half of the economy, unexpectedly remained sluggish, falling short of estimates with a 0.2% decline and following a 0.9% drop in Q2. Capital expenditure also unexpectedly declined for the second consecutive quarter, with a steeper rate of -0.6% compared to the consensus expectation of 0.3% growth (in contrast to -0.1% in Q2). Public investment declined for the first time in three quarters, with a -0.5% decrease compared to the previous 0.3% growth.

The net trade balance had a negative impact on GDP as exports grew by 0.5% (down from 3.9% in Q2), while imports increased by 1.0% (compared to -3.8% in Q2). Additionally, government spending showed a slight pickup with a 0.3% increase after previously showing no growth.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro and British pound weaker against the greenback. The yield on the 10-year U.S. Treasury note was higher (see next item), trading around 4.48%, with a mixed-to-negative tone in global government bond yields. Crude oil futures were lower, with U.S. crude around $78.05 per barrel and Brent around $82.30 per barrel. Gold and silver futures were up ahead of US wholesale inflation data, with gold around $1,976 per troy ounce and silver around $23.50 per troy ounce.

— The yield on the U.S. 10-year Treasury today remained at 4.43%, which is the lowest level seen in the past seven weeks. This followed a significant drop of up to 20 basis points the previous day. The decline in yields was primarily driven by softer-than-expected inflation data, which strengthened the belief that the Federal Reserve has completed its interest rate hikes. The latest Consumer Price Index (CPI) data revealed that headline inflation had fallen more than anticipated, dropping to 3.2% in October. Additionally, the core inflation rate reached a two-year low of 4%. These numbers align with the expectations of investors who anticipate that the U.S. central bank will hold off on implementing another rate hike. This sentiment stems from indications that the U.S. economy may not be as resilient to higher borrowing costs as it was earlier in 2023.

— Thailand raises rice export forecast. Thailand increased its rice export forecast for 2023-24 to 8.5 MMT, the head of the Thai Rice Exporters Association, told Reuters, as rice prices from competitors like Vietnam increase. The country previously expected rice exports to reach 8 MMT this year.

— India signed contracts for the export of approximately 500,000 metric tons of new-crop basmati rice due to robust demand in Europe and the Middle East. In October, India had initially set a higher minimum export price (MEP) of $1,200 per metric ton for basmati rice, but later lowered it to $950 per metric ton. This reduction in the MEP has led to increased interest in India's new basmati rice crop, with export contracts being signed for the current amount. According to Prem Garg, president of the Indian Rice Exporters Federation, they typically start receiving orders for the new crop in September and October. However, the higher MEP of $1,200 per metric ton had posed challenges in signing deals. With the MEP now at $950, Garg believes that India can export around 4 million metric tons of basmati rice, which is considered a normal amount. This development suggests some relief in supply constraints on rice, which had contributed to a rise in global rice prices and triggered trade restrictions in several countries.

— USDA daily export sale: 124,000 MT corn to Japan during 2023-24 marketing year.

— Ag trade update: Jordan tendered to buy up to 120,000 MT of optional origin milling wheat. Iran passed on a tender to buy 180,000 MT of corn and 120,000 MT of soymeal.

— Google DeepMind unveils faster, more accurate weather forecast AI model. Google DeepMind debuted a weather forecast AI model, GraphCast, it claims is more accurate and faster than the industry's best weather systems. Link for details.

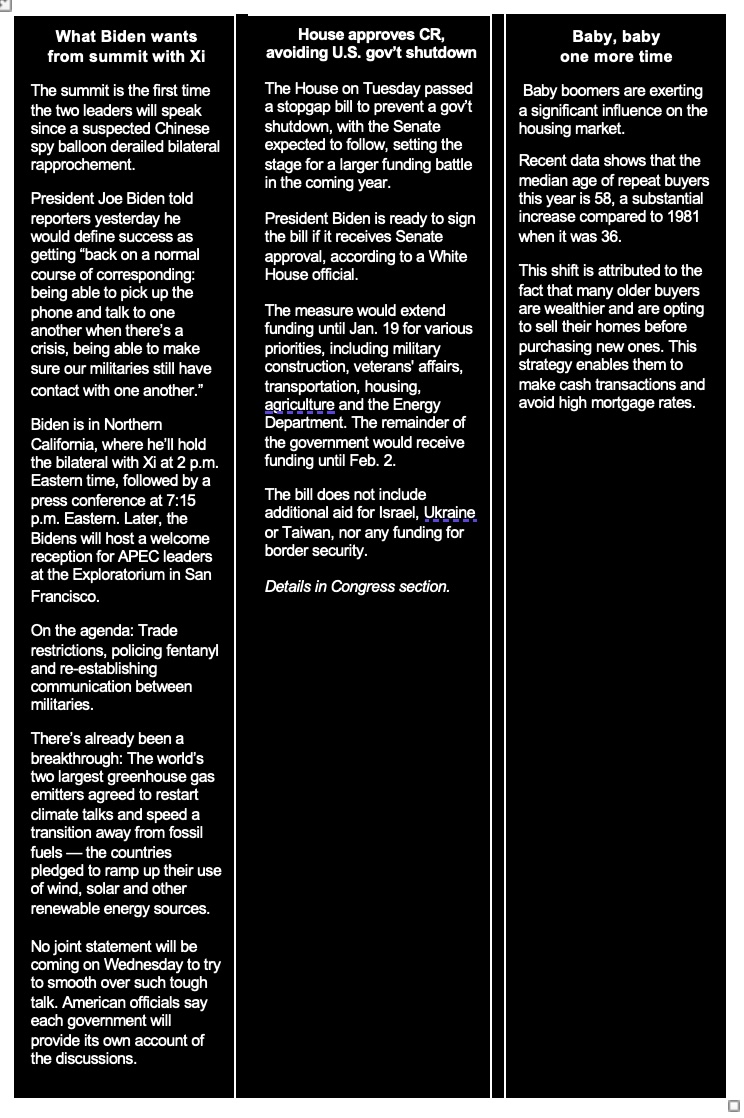

— NWS weather outlook: Heavy rainfall and locally significant urban flash flooding will be a major concern today and tonight for southeast Florida... ...Locally heavy snowfall expected today across portions of the Northern Rockies... ...Unsettled weather remains in the forecast across much of California... ...Dry and mild conditions will continue across the Intermountain West, Plains, and Midwest while gradually expanding toward the Mid-Atlantic and Northeast over the next couple of days.

Items in Pro Farmer's First Thing Today include:

• Grains mostly firmer overnight

• NOPA October crush expected to be the highest ever

• France raises non-EU wheat export forecast

• China’s industrial production and retail sales rise, fixed asset investment slips

|

CONGRESS |

— House passes stopgap funding bill by vote of 336-95, with 127 Republicans and 209 Democrats voting to send the bill to the Senate, exceeding a two-thirds threshold required under a special procedure (suspension of the rules) employed by House Speaker Mike Johnson (R-La.) to sidestep internal GOP disagreements. Ninety-three Republicans voted no, along with two Democrats.

The legislation sets up two funding deadlines: Agriculture, Energy and Water, MilCon-VA and Transportation-HUD – until Jan 19. The rest of the federal government, including the Pentagon, will be funded until Feb. 2.

“I believe that we can fight on principle and do these things simultaneously,” Johnson said. “When you have a small majority, it requires some things are going to have to be bipartisan.” The House currently has 434 members — 221 Republicans and 213 Democrats. The bill needed the support of 290 lawmakers to reach the two-thirds threshold.

Now that the two-step CR passed the House, it is expected to clear the Senate, where both Majority Leader Chuck Schumer (D-N.Y.) and Minority Leader Mitch McConnell (R-Ky.) endorsed the two-tiered plan Monday. If the Senate amends the CR bill, it would have to go back to the House.

The decision to maintain current funding levels made the House bill acceptable to Democrats.

What some conservative and rebel Republicans continue to fail to understand: Any successful spending bill requires Democratic votes to pass the House and Senate and get signed by President Biden.

The House Freedom Caucus opposed the bill for lack of spending reductions and money for the border.

The measure includes an extension of the 2018 Farm Bill through September 2024, and funds 21 “orphan” programs via offsetting funding from USDA’s Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program. (See next item for details.)

What the stopgap bill does not include: Military aid to Israel, Ukraine or Taiwan, nor border funding or changes in border policy. It also does not include White House-requested additional funding for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

Of note: The GOP rebels aren’t threatening to depose Johnson for relying on the minority for passage — which was their reason/excuse for ousting Kevin McCarthy (R-Calif.), generating three weeks of leaderless chaos. Difference this time? More goodwill for Johnson.

Bottom line: Congress just moved the deadline to January or February when the real shutdown drama could go down. So, again, Congress is dragging this process on for months. Key spending issues must be made in the months ahead. Rep. Rosa DeLauro (D-Conn.), the top House Democrat on the Appropriations Committee, said that the two-phase CR “doubles the likelihood of future crises.” Democrats say Republicans should stick to the terms of the June debt-ceiling deal, agreed to by President Biden and former Speaker McCarthy that laid out spending levels for the fiscal year. House conservatives and rebels want spending cuts.

Clock is ticking, again. The House may adjourn Wednesday and would not return until Nov. 28. Under its current calendar, the House isn’t scheduled to be in session during the last two weeks of December and the first week of January, returning Jan. 9. Result: Only 21 legislative days for the House between now and Jan. 19. Johnson said Tuesday he won’t ever pass another short-term government funding bill.

— Details of ag-related programs extended via House CR measure.

- Commodity Programs: The measure would extend commodity support programs through the 2024 crop year for commodities such as wheat, corn, barley, sugarcane, and sugar beets, as well as loan commodities.

It would continue to suspend permanent price support authorities for the 2024 crop year or program year, which would otherwise revert most commodity programs to outdated laws from the 1930s and 1940s.

The measure would extend the Price Loss Coverage program’s payment amounts through the 2024 crop year. The program pays farmers when crop prices or revenue fall below guaranteed amounts, and covers crops such as corn, wheat, soybeans, and cotton. - Dairy: The measure would extend the Dairy Margin Coverage (DMC) program for dairy producers through Dec. 31, 2024.

The Dairy Forward Pricing Program‘s contracts would be extended through Sept. 30, 2027. The program allows milk producers and associations to enter into forward price contracts with milk buyers. - Conservation: The measure would provide the following mandatory amounts for conservation programs:

* $15 million for the Feral Swine Eradication and Control Pilot Program.

* $10 million for the Voluntary Public Access and Habitat Incentive Program. - Research: Within 30 days of the bill’s enactment, the measure would provide $10 million from Commodity Credit Corporation (CCC) funds for scholarships for students at 1890 Land-Grant Institutions.

The measure would also allocate $37 million of CCC funds for the Foundation for Food and Agriculture Research.

Other Provisions: The measure also would:

- Rescind $177.3 million for loan guarantees to fund the development, construction, and retrofitting of commercial-scale biorefineries using certain technology.

- Extend the Pima Agriculture Cotton Trust Fund, Agriculture Wool Apparel Manufacturers Trust Fund, and Wool Research and Promotion grants for one year.

- Prohibit the Grazinglands Research Laboratory in Oklahoma to be declared excess or surplus federal property or be transferred through Sept. 30, 2024.

- Extend for one year a requirement for USDA to purchase certain commodities for the Feedstock Flexibility Program, including raw or refined sugar eligible to be marketed in the U.S., and sell them to bioenergy producers.

— Tensions high in Congress. A senator challenged a witness to a fistfight in a hearing yesterday (link), and Rep. Kevin McCarthy (R-Calif.) was accused of elbowing another lawmaker (link).

— Senate committee advances resolution to bypass blockade on military promotions. The Senate Rules Committee advanced a resolution that could allow the consideration of 350 nonpolitical military promotions at one time, bypassing Sen. Tommy Tuberville’s (R-Ala.) blockade of nominees in protest of the Pentagon's abortion policy.

|

ISRAEL/HAMAS CONFLICT |

— In Gaza today, UN trucks are scheduled to deliver fuel, marking the first such delivery since the Oct. 7 Hamas attacks. Israeli officials have accused Hamas of diverting fuel meant for medical facilities and using hospital basements for command centers, an accusation denied by Hamas. At the same time, Israel has stated that it is conducting a "precise and targeted operation" at Al-Shifa Hospital, the largest in the Gaza Strip. Reports indicate that hundreds of staff and patients, as well as several thousand people seeking shelter from Israel's offensive, are inside Al-Shifa Hospital.

|

RUSSIA/UKRAINE |

— EU officials are discussing the reinforcement of the $60 per barrel price cap on Russian oil exports, which has raised concerns because "almost none" of Russia's oil exports are being traded below this cap. In contrast, the U.S. has different priorities, as it worries about the potential impact of stricter sanctions and enforcement on global oil prices. The goal of the price cap is not only to maximize the amount of Russian oil sold under it but also to change Russia's incentives.

Russia has been skilled at working with shadow tankers and oil traders to trade oil without relying on Western insurance or to avoid detection for sanctions violations. Despite these efforts, Western oil sanctions have increased the cost of Russian oil sales to Asia by an estimated $36 per barrel. This has affected netback revenue from oil sales, even as the gap between Russia's Urals blend and the European Brent benchmark has narrowed to less than $10 per barrel.

Of note: Petroleum products that originate in Russia take a circuitous path to a Greek refinery that serves the U.S. military and other Western nations, a Washington Post examination of shipping and trade data shows. The finding underscores the porousness of the sanctions and the failure to aggressively enforce them.

Recently, the U.S. Treasury Department sent notices to 30 ship managers of nearly 100 vessels suspected of violating sanctions. This action reflects ongoing efforts to enforce sanctions on Russian oil exports.

— Ukraine launches insurance program for grain vessels. Ukraine has initiated an insurance program in collaboration with broker Marsh McLennan and Lloyd's of London to provide coverage for grain vessels departing from Ukraine's deep-sea ports, Bloomberg reports (link). This move comes shortly after a Russian missile struck a ship. The program, valued at $50 million, offers insurance against military risks for ships, aiming to facilitate easier access to coverage for transporting goods from Ukraine via sea. This initiative is particularly important for Ukraine, a major agricultural exporter reliant on foreign exchange earnings from food exports. Despite the ongoing conflict and security concerns in the Black Sea region, ships continue to transport grain and metals from Ukraine's ports.

— Ukraine has imposed restrictions on the delivery of grain by railways to the port of Odesa, citing the need for necessary railway repairs. However, there is no indication from the state railway as to when these restrictions will be lifted.

In terms of grain exports, Ukraine's numbers for the 2023-24 season are slightly below 11 million metric tons, according to data from the Ukrainian Agriculture Ministry. This falls behind the 15.6 million metric tons exported by this point in the previous year, up to November 16. The breakdown of exports for 2023-24 includes 5.2 million metric tons of wheat, 4.9 million metric tons of corn, and nearly 750,000 metric tons of barley. In November, exports have reached 1.7 million metric tons so far, which is below the 2.4 million metric tons shipped by the same date in 2022.

— The U.S. Treasury has alarmed tanker owners after sending a flurry of letters about potential breaches of a Group of Seven price cap on Russian oil trades. Those included a warning that noncompliance with the probe could lead to prison time. Link for details.

|

POLICY UPDATE |

— Stabenow urges farm leaders to push for new farm ‘in the spring, before summer.’ Senate Ag Committee Chairwoman Debbie Stabenow (D-Mich.) emphasized the need for farm leaders to express a sense of urgency in passing a new farm bill. While a continuing resolution includes an extension of the expired 2018 Farm Bill through September 2024, Stabenow stressed the importance of passing a new farm bill “in the spring, before summer” and urged farm leaders to coalesce around the effort.

Meanwhile, Sen. John Boozman (R-Ark.), ranking member on the committee, noted that farm groups understand the differences in the current situation compared to 2018 but stressed the need to do the right thing, including potential changes to reference prices. The biggest issue currently facing the committee is awaiting scores from the Congressional Budget Office, with the potential inclusion of agricultural funding from the Inflation Reduction Act (IRA/Climate Bill) into the farm bill being a consideration. Stabenow and other Democrats have said that if the IRA provisions are brought into the farm bill, they still want the money devoted to the climate-smart conservation programs that are in the IRA.

— Stabenow urges tangible benefits from AI in agriculture. Senate Ag Chairwoman Debbie Stabenow (D-Mich.) emphasized that artificial intelligence (AI) and advanced technologies should offer tangible benefits to growers without overshadowing existing production-boosting technologies. She expressed concerns that the attention given to AI might divert resources from readily available technologies accessible to growers. Stabenow also raised questions about whether the companies developing AI solutions could potentially control the supply of recommended fertilizers and seeds, leading to conflicts of interest.

Witnesses at the Senate Ag Committee hearing acknowledged the benefits of new technologies, including increased crop yields and reduced waste, but stressed the importance of providing clear benefits to growers. They emphasized that technology products must offer practical solutions to address the challenges faced by farmers and should be deployed thoughtfully and responsibly.

The hearing follows President Joe Biden's executive order on AI, which requires developers to share safety test results and other critical data with the federal government. The order also directs cabinet agencies, including the Agriculture secretary, to provide guidance on the use of AI and algorithms in government services.

Jahmy Hindman, Senior Vice President and Chief Technology Officer for Deere & Co., supported legislative proposals to broaden eligibility for USDA conservation and loan programs, encouraging more growers to adopt technology-driven products. He emphasized the importance of incentives for increasing growers' productivity and profitability, which would contribute to meeting the needs of the growing world population. Hindman urged the committee to consider including these bills in the next five-year farm bill reauthorization, expected in 2024.

Privacy concerns regarding growers' data were also discussed during the hearing, with Sen. Stabenow highlighting the need to protect growers' data privacy while harnessing the benefits of AI and precision agriculture tools.

|

PERSONNEL |

— USDA announces several key appointments:

- Eric Womack has been named deputy general counsel in the Office of the General Counsel. Previously, Womack was detailed to the White House Counsel's Office.

- Brian Sowyrda has assumed the role of director of external affairs in the Office of Congressional Relations. He previously worked for Xochitl Torres Small, who currently holds the position of deputy secretary of Agriculture.

- Elaine Trevino has been selected as the associate administrator in the Foreign Agricultural Service.

|

CHINA UPDATE |

— China bolsters economy with large cash injection via one-year policy loans. China has taken significant measures to support its economy by injecting a substantial amount of cash into the financial system through one-year policy loans. The People's Bank of China initiated this move by offering 1.45 trillion yuan, which is equivalent to $200 billion. This cash injection is the largest since late 2016 and exceeds market expectations.

This additional financial support coincided with reports indicating that China's consumer spending and industrial output had improved in the previous month. These positive economic indicators provided a much-needed boost to the world's second-largest economy, signaling signs of recovery and stability.

— China’s central bank keeps key policy rates unchanged. China’s central bank kept its key policy rates unchanged Wednesday while adding more liquidity to the market amid rising demand for cash (see previous item).

— Biden and Xi aim to prevent escalating competition to conflict. When President Biden meets with President Xi Jinping of China in Silicon Valley, their primary goal is to find a way to prevent their increasingly bitter competition from escalating into conflict. Despite their disagreements, there are hints of how they might reach some agreements:

- They may outline an agreement where Beijing commits to regulating components of fentanyl, a drug responsible for a devastating opioid epidemic in the United States. However, China has made similar commitments in the past.

- They could announce a new forum for discussing how to prevent artificial intelligence programs from being used in nuclear command and control. This comes at a time when the U.S. is denying China advanced chips needed for developing and training AI programs.

- Resuming military-to-military communications may be on the agenda, which China had cut off after a visit to Taiwan by Nancy Pelosi last year.

U.S. and China already agreed to displace fossil fuels by ramping up renewables. A detailed action plan including holding new talks and policy exchanges was released Tuesday.

The interactions between the two leaders have been carefully planned, and both sides have discussed them extensively. However, there are complex issues to navigate, including Ukraine and Gaza conflicts and the upcoming Taiwan election.

Biden administration officials have tried to temper expectations, emphasizing that the fact that the leaders of the world's top two economies are communicating again is a positive sign. The meeting highlights the tension between the U.S. and China as they are both fierce rivals and in need of some level of cooperation for their survival.

Of note: President Biden arrived in San Francisco for the Asia-Pacific Economic Cooperation (APEC) summit, with Treasury Secretary Janet Yellen meeting President Xi upon his arrival. The summit is crucial in addressing economic issues and regional dynamics. No joint statement is expected from the Biden/Xi meeting; each government will provide its account of the discussions separately.

— China population: marriages set to end 9-year run of declines in 2023, but demographic issues remain. China recorded 5.69 million marriages in the first three quarters, with the trend set to push the annual total above 7 million and end a run of nine consecutive years of decline. Link to details via the South China Morning Post.

|

TRADE POLICY |

— Biden and Lopez Obrador to discuss bilateral relations and migration at APEC summit. President Biden and Mexican President Lopez Obrador are scheduled to hold a bilateral meeting Nov. 17 on the sidelines of the Asia-Pacific Economic Cooperation (APEC) forum. While this meeting may not immediately address irregular migration, it will pave the way for broader regional discussions on migration, especially in the lead-up to the 2024 elections in both countries, reports note.

Lopez Obrador intends to advocate for an economic aid package for Latin America and the Caribbean to tackle the root causes of migration, presenting a joint agreement developed by 12 regional countries that proposes regional solutions to promote trade, combat crime, and protect vulnerable groups during migration routes.

The U.S./Mexico border saw 2.5 million migrant encounters in the 2023 fiscal year, with an overall increase compared to the previous year. However, there was a decrease in migrants entering the U.S. without prior authorization between ports of entry. The October summit in Mexico voiced dissatisfaction with U.S. sanctions on Venezuela and Cuba, which were labeled as "coercive unilateral measures" contributing to outward migration.

|

ENERGY & CLIMATE CHANGE |

— Greenhouse gas emissions from U.S. agriculture "over the past three decades have been steadily rising," although production became more efficient; climate change will push growing zones northward, according to the Fifth National Climate Assessment report (link).

— Biodiesel production robust despite challenge. The boom in renewable diesel was expected to wipe out biodiesel producers, but they were more profitable than thought and biodiesel production has remained robust. Link to FarmDoc item.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

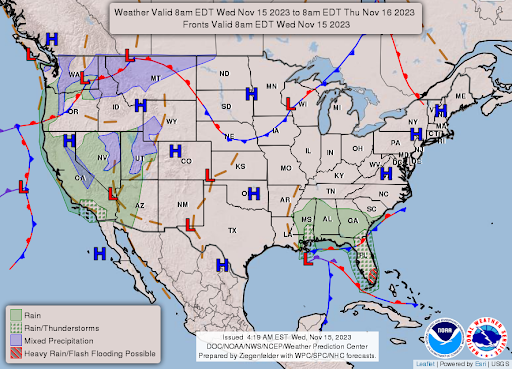

— Trends in breakeven prices for cattle finishing. A Purdue University report (link) notes that average fed cattle prices have increased by 12% from the first quarter of 2023 to the third quarter. Additionally, feeding cost of gain has declined from its earlier peak. However, feeder steer prices have risen substantially. The article emphasizes that net returns in cattle finishing depend on factors like fed cattle prices, feeder cattle prices, and feeding cost of gain.

Historical breakeven prices are shown from January 2013 to September 2023, with projections for 2024. Breakeven prices have been rising rapidly since the fourth quarter of 2022, increasing from around $155 per cwt. in the fourth quarter of 2022 to approximately $174.20 per cwt. in the third quarter of 2023. The article also mentions that fed cattle prices have been higher than breakeven prices since April, resulting in positive net returns.

Looking ahead, the article projects that breakeven prices will average about $186 per cwt. in the fourth quarter of 2023, with the highest breakeven price of $196 per cwt. expected in December. It anticipates a shift from positive to negative gaps between fed cattle and breakeven prices in December. For the first half of 2024, breakeven prices are projected to range from $193 to $197 per cwt., potentially leading to cattle finishing losses.

Bottom line: The article highlights the recent strengthening of fed cattle prices and lower feeding costs but also emphasizes the significant increase in breakeven prices, which creates uncertainty regarding net returns in the cattle finishing sector in the coming months.

|

HEALTH UPDATE |

— The gap in life expectancy between men and women in the U.S. has grown to its widest in nearly 30 years, driven mainly by more men dying of Covid and drug overdoses.

|

POLITICS & ELECTIONS |

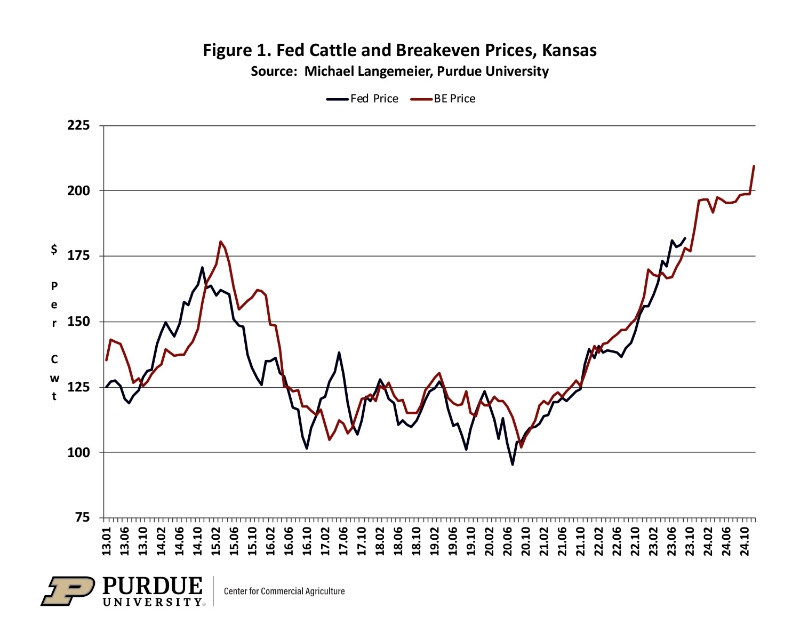

— A recent Marquette Law poll in Wisconsin could hold a crucial insight for the 2024 presidential election. The poll suggests that the general election might pivot on the "somewhat disapprovers" — voters who express mild disapproval of President Joe Biden's job performance. These "somewhat disapprovers" are willing to vote for Biden over Donald Trump, albeit with some reluctance. However, the poll indicates that they are more inclined to support other GOP presidential candidates who are not Donald Trump. This finding underscores the significance of this voter group in shaping the dynamics of the 2024 presidential race.

In the poll, Biden narrowly leads Trump in Wisconsin in a hypothetical head-to-head contest among registered voters, 50% to 48%, while Florida Gov. Ron DeSantis narrowly leads Biden (50% to 48%), and UN Ambassador Nikki Haley is ahead of Biden by 9 points (53% to 44%).

And Biden’s approval rating in the battleground state is at 42%.

|

OTHER ITEMS OF NOTE |

— Bill Gates buying up land, threatening small farms under guise of saving planet, author claims. A new book authored by Seamus Bruner aimed at “exposing the billionaire class” says Microsoft co-founder Bill Gates’ investments in patented fertilizers, fake meat and U.S. farmland aren’t saving the planet but rather enriching his bank account. Controligarchs, which hit bookshelves Tuesday, examines billionaires like Bill Gates and how their wealth controls the levers of power that dominate the everyday life of average Americans. Link for details via the New York Post.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |