Update on PARP: Program Overprescribed, Payments by End of CR (Nov. 17)

Fed chair Powell: ‘We’re trying to make a judgment at this point whether we need to do more’

|

Today’s Digital Newspaper |

MARKET FOCUS

- Equity buzzkill: Powell hasn’t dismissed the possibility of raising rates

- Another equity shock came from a dud of an auction for 30-year Treasury notes

- In the third quarter, the British economy experienced stagnation

- Inflation causes IRS to raise tax brackets, standard deduction by 5.4%

- The way Americans spend their money has been significantly reshaped

- Oil prices continued to tumble this week, but some see trend change ahead

- Ag markets today

- Surprise: Record U.S. corn crop (not yield)… reasons listed for big crop

- China has been importing wheat in huge amounts

- Exchange: Argentine farmers could plant more soybeans

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House Republicans continue to have internal disagreements over gov’t spending

- Senate Judiciary Committee delays subpoena vote amid Republican opposition

ISRAEL/HAMAS CONFLICT

- Israel is planning daily four-hour pauses in the fighting in parts of northern Gaza

RUSSIA & UKRAINE

- Russian missile strike on civilian vessel in Black Sea does not close shipping corridor

POLICY

- An update on PARP

- USDA unveiles new initiatives aimed at bolstering specialty crops industry

CHINA

- White House announces Biden and Xi to meet in SF Bay area Nov. 15

- U.S. and China to meet as shifting economic fortunes alter relationship

- Yellen comments on U.S./China developments

- U.S. unit of world’s biggest financial institution was hit by a ransomware attack

- China is making too much stuff — and other countries are worried

- Adviser: China can raise budget debt ratio

TRADE POLICY

- U.S. to reopen market to Paraguay beef imports

ENERGY & CLIMATE CHANGE

- How Midwest landowners halted major carbon dioxide pipeline project

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Hong Kong culls 5,600 pigs after ASF find

HEALTH UPDATE

- Surgeons in N.Y. successfully conducted world's first complete eye transplant

- AstraZeneca gets into anti-obesity race

POLITICS & ELECTIONS

- Manchin announces he will not seek re-election… potential impacts

- Rep. Brad Wenstrup (R-Ohio) will retire from Congress at the end of next year

- Jill Stein announces candidacy for 2024 presidential election, Green Party candidate

OTHER ITEMS OF NOTE

- Cotton AWP eases

|

MARKET FOCUS |

— Equities today: Asian and European markets were mostly weaker in overnight trading. U.S. Down opened up around 150 points. In Asia, Japan -0.2%. Hong Kong -1.8%. China -0.5%. India +0.1%. In Europe, at midday, London -1.3%. Paris -1.2%. Frankfurt -0.8%.

U.S. equities yesterday: Stocks fell in the wake of what were viewed as hawkish remarks from Fed Chairman Jerome Powell (see related item). The Dow fell 220.33 points, 0.65%, at 33,891.94. The Nasdaq lost 128.97 points, 0.94%, at 13,521.45. The S&P 500 declined 35.43 points, 0.81%, at 4,347.35.

Another shock came from a dud of an auction for 30-year Treasury notes. The scheduled event wrapped up shortly before Fed Chairman Powell spoke, with fairly tepid investor uptake. The weak demand sent yields spiking for long-duration government bonds; bond yields rise when prices fall.

— Agriculture markets yesterday:

- Corn: December corn futures fell 8 cents before settling at $4.68, nearer the session low.

- Soy complex: January soybeans plunged 22 1/4 cents to $13.43 1/2, the largest daily loss since Sept. 29. December meal rose 10 cents to $449.90, marking a high-range close. December soyoil rose 50 points to 50.45 cents, ending nearer the session high.

- Wheat: December SRW wheat fell 11 1/2 cents to $5.80 3/4. December HRW wheat closed down 7 3/4 cents at $6.47 1/4. Prices closed near mid-ranges. December spring wheat futures fell 1 cent to $7.34 1/2.

- Cotton: December cotton futures rallied 163 points on corrective buying before settling at 76.52 cents.

- Cattle: Ideas that cattle supplies are set to surge seemed to sink the cattle markets Thursday, with nearby December live cattle diving $5.05 to $174.30 and most-active January feeders plummeting $7.85 to $224.925. Expiring November feeders also tanked by $5.55 to $229.00.

- Hogs: December lean hogs fell 5 cents to $71.45 and nearer the session low.

— Ag markets today: Corn, soybeans and wheat tried to work higher early in the overnight session, but buyer interest was limited, and light pressure ensued. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny lower, soybeans were 4 to 5 cents lower, winter wheat markets were 1 to 3 cents lower and spring wheat was 3 to 4 cents lower. Front-month crude oil futures were around $1.00 higher, and the U.S. dollar index was about 100 points lower.

Cash cattle weaken amid futures selloff. The sharp plunge in cattle futures triggered increased cash cattle sales on Thursday, with prices $4 to $5 lower. While not all feedlots moved cattle, they will either need to bite the bullet and accept the sharply lower prices or carry supplies into next week.

Cash hog index rises again. The CME lean hog index is 18 cents higher to $76.87 (as of Nov. 8), marking the third straight daily gain. That’s the longest daily string of gains since late July, when the index was rising to its seasonal peak. December hog futures finished Thursday $5.42 below today’s cash quote.

— Quotes of note:

- Federal Reserve Chair Jerome Powell signaled that the central bank will not signal an end to its historic interest rate increases until there is stronger evidence that inflation is subsiding. Recent developments have seen a decrease in price and wage pressures, causing some investors to believe that the Fed might stop raising rates. However, Powell disappointed those investors in a recent speech by explaining why he believes the Fed is more inclined to tighten its policy rather than loosen it.

While Powell did not make a case for raising rates immediately, he highlighted past instances of inflation "head fakes," where price pressures temporarily eased before unexpectedly resurging. This suggests that the Fed is cautious and vigilant about the potential for inflation to bounce back, and it implies that they may continue their rate-raising efforts until they are confident in the stability of inflation.

- “If it becomes appropriate to tighten policy further, we will not hesitate to do so.” — Federal Reserve Chair Jerome Powell, saying it might be too early to declare victory against inflation. A slide in stock prices accelerated after his statement.

- "A full separation of our economies would be economically disastrous for both our countries, and for the world. We seek a healthy economic relationship with China that benefits both countries over time." — Treasury Secretary Janet Yellen, in comments to her counterpart He Lifeng, at the start of their meeting

— In the third quarter, the British economy experienced stagnation, with no significant growth compared to a 0.2% expansion in the previous three months (April to June). This lackluster performance was attributed to several factors: high borrowing costs that deterred investment, resulting in a 4.2% decline in investment, and the burden of high living costs, which led to a 0.4% reduction in consumer spending. However, despite these challenges, the U.K. managed to avoid slipping into a recession, thanks to an improvement in its trade balance. Looking ahead, the Bank of England has a bleak outlook, expecting zero growth in 2024, which suggests that the economic challenges may persist.

— Inflation causes IRS to raise tax brackets, standard deduction by 5.4%. More of your income will be taxed at lower rates next year. The Internal Revenue Service announced its annual inflation adjustments to federal income-tax brackets for 2024 Thursday. The adjustments, based on formulas set out in the tax code, are meant to keep inflation from hiking taxes. The standard deduction and the thresholds for each tax bracket are up 5.4%, the second largest adjustment in the last three decades after last year’s 7.1% hike.

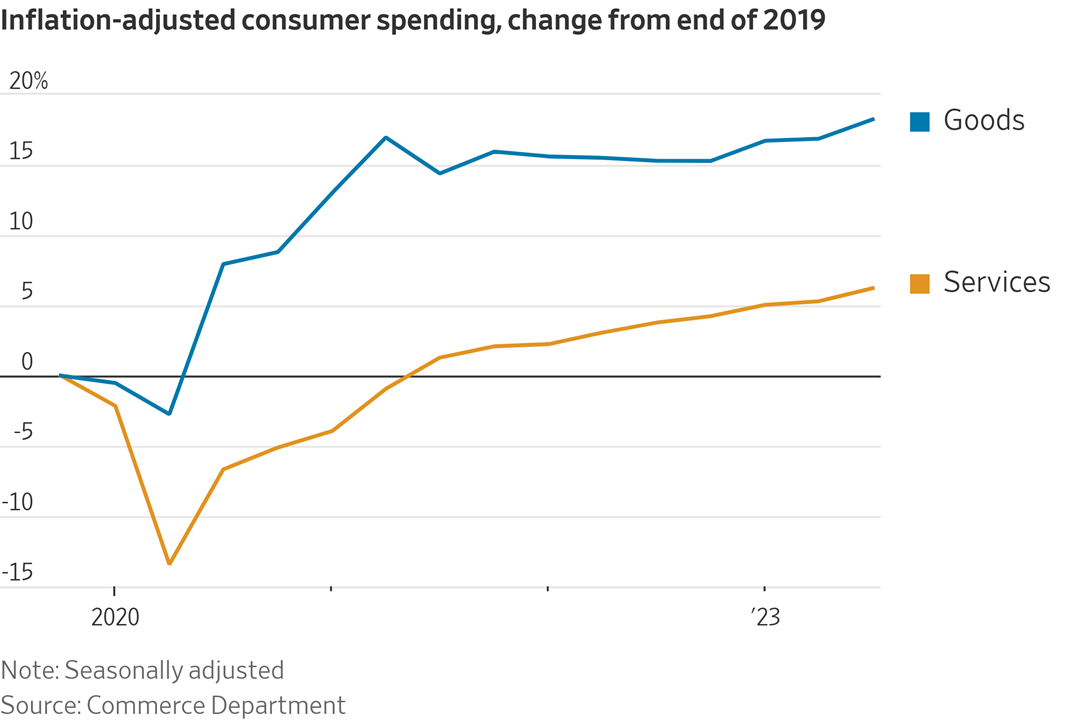

— The way Americans spend their money has been significantly reshaped by the work-from-home trend during the pandemic. Even though the economy has gradually reopened, Americans are still allocating a larger portion of their spending on physical goods compared to before the pandemic. This shift in consumer behavior has had a lasting impact, the Wall Street Journal reports (link).

In the early stages of the pandemic, when people were confined to their homes, there was a surge in buying goods. As restrictions eased and the economy reopened, there was a temporary reversal with increased spending on dining out and various services. However, it appears that the rebound in spending on services has stalled.

This shift towards buying more goods and fewer services has implications for retailers, the WSJ article notes. The demand for physical items continues to be robust, suggesting that the trend of purchasing goods is likely to persist. This change in consumer spending habits is significant, as it influences various sectors of the economy and the retail industry in particular.

Bottomline: The work-from-home trend during the pandemic has reshaped American spending habits, with a sustained focus on purchasing goods over services. This trend is expected to have lasting effects on the economy and retailers.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro and yen both firmer against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.58%, with a higher tone in global government bond yields. Crude oil futures are higher, with U.S. crude around $76.55 per barrel and Brent around $80.90 per barrel. Gold and silver are under significant pressure ahead of U.S. trading, with gold around $1,950 per troy ounce and silver around $22.59 per troy ounce.

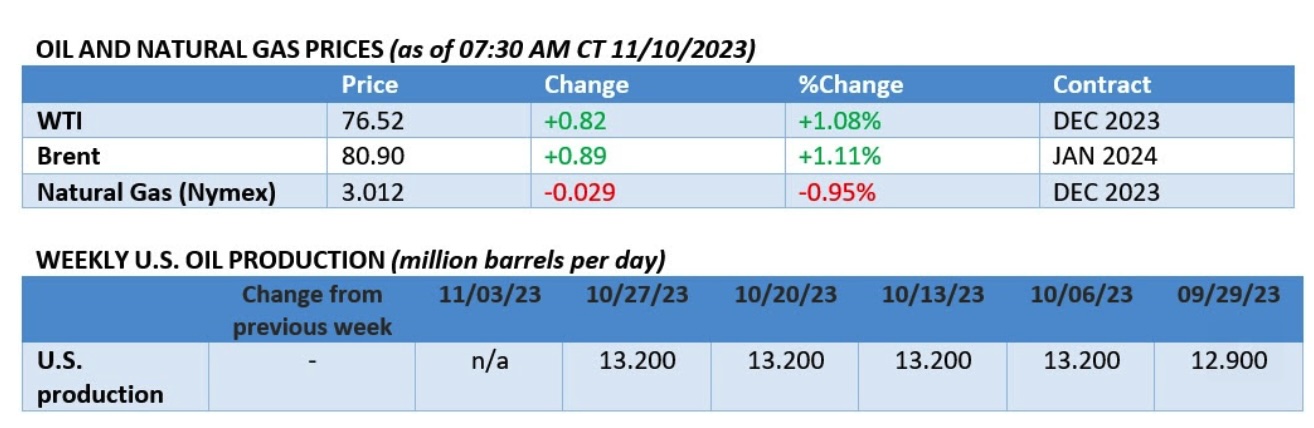

— Oil prices continued to tumble this week as demand concerns and inventory build-ups added to bearish sentiment, but with an OPEC+ meeting at the end of the month and the potential of an escalation in the Gaza war, some observers note things could change rapidly.

— Record U.S. corn crop. So much for the summer of drought and extreme heat in the U.S. that triggered early fears about crop damage. On Thursday, USDA said this year’s corn harvest was the biggest ever. The U.S. corn crop will total 15.234 billion bushels, USDA said in its latest set of estimates, surpassing the previous peak of 15.148 billion bu. set in 2016. USDA will review its latest estimate in January.

Asked why the U.S. corn crop surprised to the upside, farmers and analysts said: (1) Crop genetics, (2) Seed/crop management, (3) Pest pressure was down due to dry weather early, so even with very abnormal weather, yields still came through, (4) Fertilizing crop in June and (5) Some "just-in-time" rains in a few locations and weather stayed open most of the fall allowing corn to move to maturity without major challenges and to reach moisture levels that meant little artificial drying was needed.

Perspective: The corn yield would still be 3.6% below trendline (assuming you adhere to USDA's trend) and 1.0% below the record in 2021. A record crop but not record yield. Just think what could have been with favorable weather. A big corn acreage pushed the U.S. to the record crop.

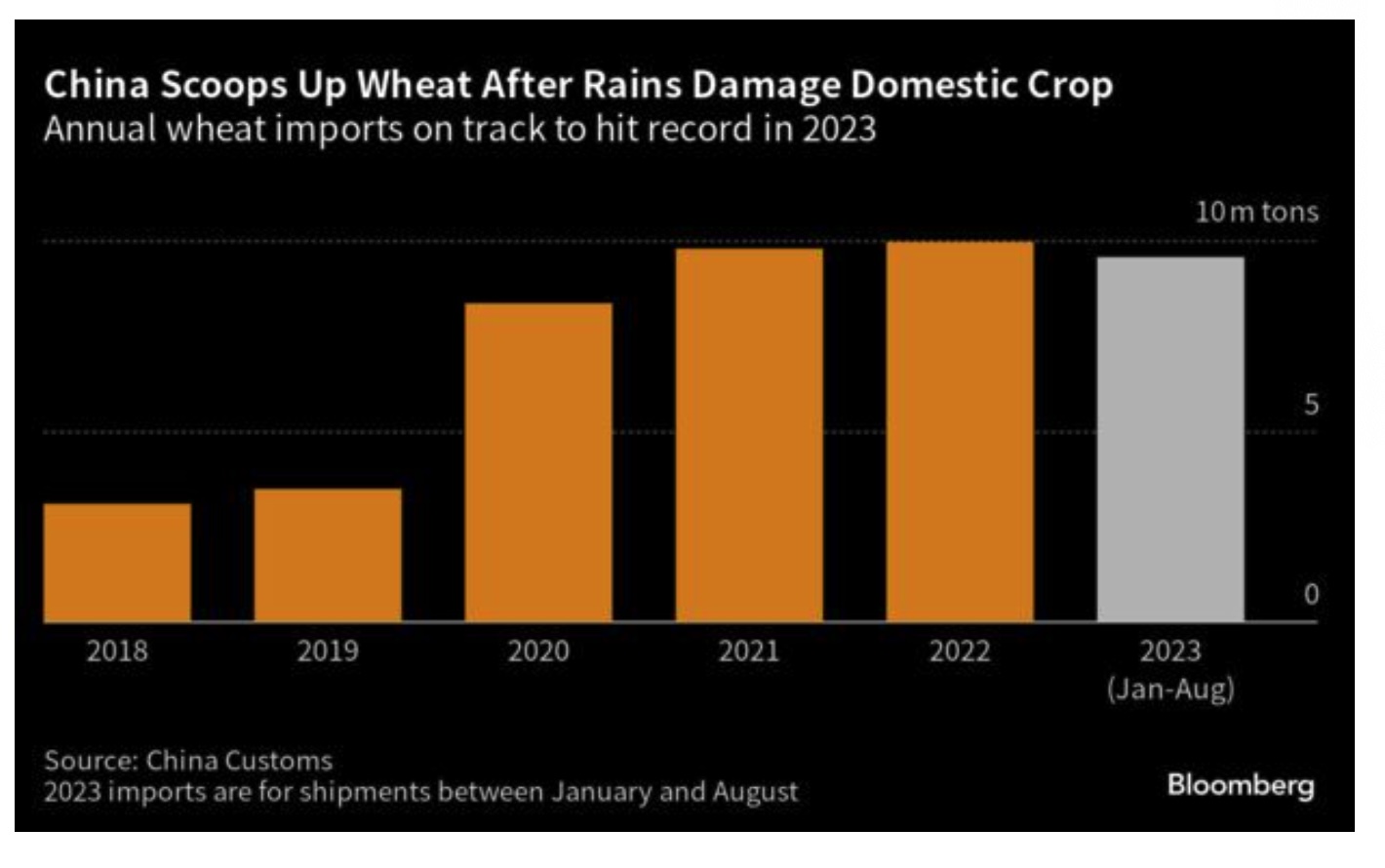

— China has been importing wheat in huge amounts, with imports heading for a record. Following a splurge on Australian wheat earlier in the year, large volumes were purchased last month from other main exporters including the U.S., Canada and France.

— Exchange: Argentine farmers could plant more soybeans. Argentine farmers could plant more fields with soybeans than initially estimated, the Buenos Aires Grain Exchange said, as rains put an end to a drought that affected large parts of key growing regions. The exchange said soybean planted area could extend beyond the 17.1 million hectares it initially forecast. Rainfall arrived too late for fields originally intended for some crops, such as early corn in the north part of Argentina’s agricultural core and sunflower crop in western areas, the exchange said, causing them to be re-destined for soybeans.

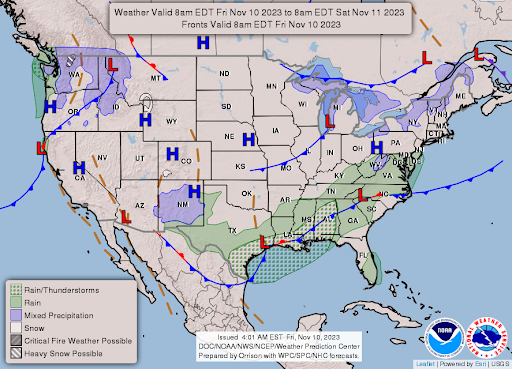

— NWS weather outlook: Heavy snow for the Northern Cascades and lighter amounts over parts of the Northern Rockies... ...Snow for the western portion of the Upper Peninsula of Michigan... ...High wind watch for parts of the Northern Rockies on Saturday and Sunday.

Items in Pro Farmer's First Thing Today include:

• Light followthrough selling in grains overnight

• Adviser: China can raise budget debt ratio

• U.S. to reopen market to Paraguay beef imports

|

CONGRESS |

— House Republicans continue to have internal disagreements over government spending, leading to the abrupt suspension of legislative work and leaving Washington without progress on funding the government, as a shutdown deadline approaches. House Speaker Mike Johnson (R-La.) has not yet outlined a plan to prevent a gov’t shutdown after Nov. 17 if Congress fails to act. The challenge for Johnson is to gather support among conservative Republicans for a stopgap funding bill, which is expected to be rejected by the Democratic-controlled Senate. Instead of presenting a clear path to keep the government open, Johnson spent the week trying unsuccessfully to pass two individual spending bills, revealing the deep divisions within House Republicans.

The GOP divisions stem from differing interests, personalities, and district priorities among the Republican members. The House GOP's narrow majority has made it challenging to achieve unity on key issues.

Meanwhile, Senate Majority Leader Chuck Schumer (D-N.Y.) initiated procedural steps in the Senate to prepare for a stopgap spending measure if necessary, indicating that Democrats are ready to act to avoid a government shutdown.

Bottom line: Some GOP rebels have stated their opposition to any stopgap bill to avert a shutdown, further complicating Johnson's options. The outcome of this impasse will likely determine whether a government shutdown can be averted or not.

Meanwhile, the U.S. government initiated formal preparations for a potential federal shutdown. The White House's top budget office instructed federal agencies to prepare for a significant disruption, which could result in millions of civilian workers and military personnel being furloughed or forced to work without pay after Nov. 17.

— A walk back. The Senate Judiciary Committee on Thursday walked back a planned vote to subpoena two megadonors connected to Supreme Court Justices Clarence Thomas and Samuel Alito after Republicans threatened to file a series of amendments to slow the process.

|

ISRAEL/HAMAS CONFLICT |

— Israel is planning daily four-hour pauses in the fighting in parts of northern Gaza. Iran, though, said that the “intensity of the war” against Gaza’s civilians made it “inevitable” that the conflict would spread.

|

RUSSIA/UKRAINE |

— Russia’s missile strike on a Liberian-flagged civilian vessel entering a Black Sea port in the Odesa region has not led to the closure of the shipping corridor established by Ukraine. However, reports suggest that the incident has caused an increase in freight costs. Spike Brokers company mentioned on the social media platform Telegram that due to the Russian missile hitting a cargo ship, sea freight rates have risen by $20 per ton, and there is a decrease in the number of shipowners willing to load their cargo in Ukrainian ports. This incident has disrupted shipping in the region and has led to higher expenses for those involved in maritime trade.

|

POLICY UPDATE |

— An update on PARP. The Pandemic Assistance Revenue Program (PARP) was the catch-all program for revenue losses caused by the pandemic. A USDA official informs: “Unfortunately the program is overprescribed, more applications than funds available. We are trying to glean all Consolidated Appropriations Act funds across the department before finalizing payments. Our goal and hope: to issue those payments before the end of the continuing resolution” (on Nov. 17).

— USDA unveiled new initiatives aimed at bolstering the specialty crops industry in the United States. These efforts include the creation of a Specialty Crops Resource Directory, intended to serve as a comprehensive resource for the specialty crop sector. USDA is actively seeking feedback from stakeholders in the specialty crop industry through a Request for Information (RFI) published on Nov. 9 (link), with comments due by March 8, 2024.

Additionally, USDA announced $70.2 million in new investments through the Specialty Crop Research Initiative to support research in the sector. Specialty crops are expected to be a key focus in the upcoming farm bill, indicating the government's commitment to enhancing the specialty crop industry in the United States.

|

CHINA UPDATE |

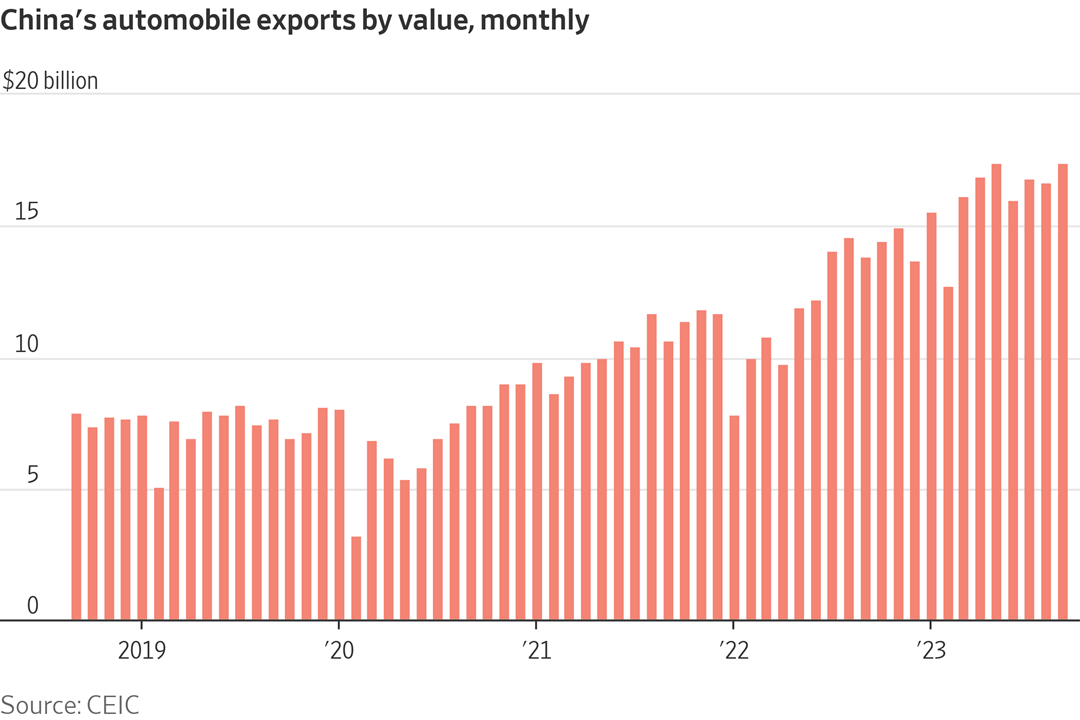

— China is making too much stuff — and other countries are worried. Chinese factories facing overcapacity in a challenging economic environment are attempting to address their problems by increasing exports, which is causing concerns and trade tensions with other countries. Manufacturers of products like electric vehicles and solar panels are lowering prices and intensifying their efforts to expand into international markets due to reduced demand within China. The Wall Street Journal reports (link) this strategy, while aimed at survival and growth, is unsettling competitors who perceive it as a threat to their own profitability. The situation underscores the complexities of global trade and the challenges posed by overcapacity in China's manufacturing sector, which has broader implications for international trade relations.

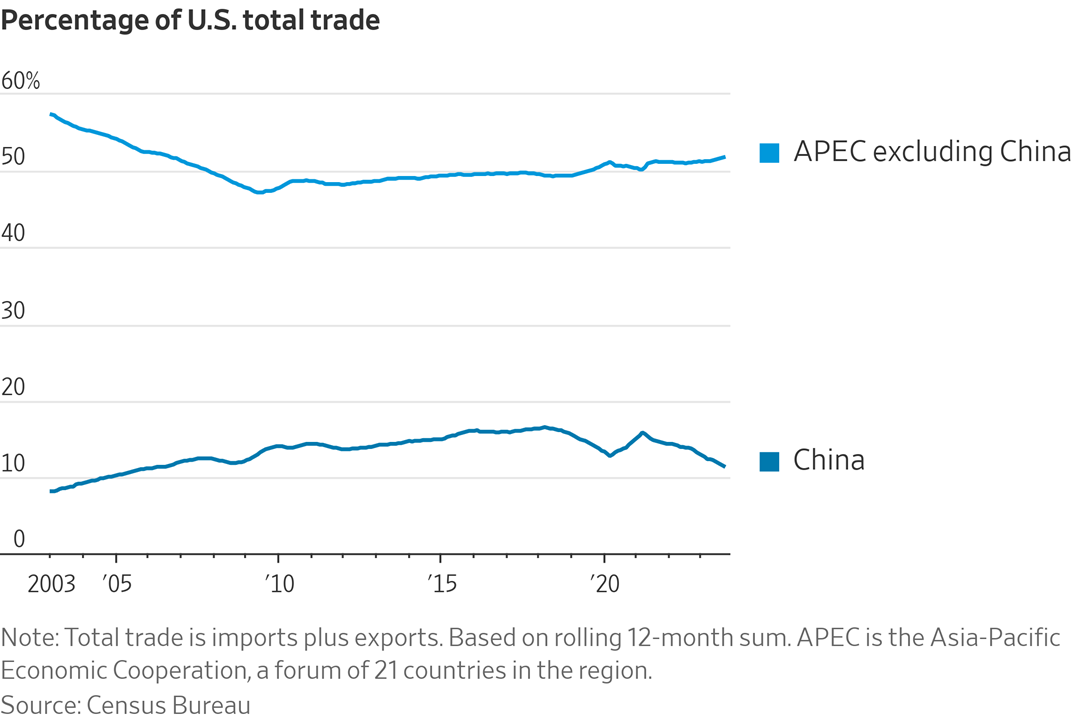

— U.S. Treasury Secretary Janet Yellen is meeting with Chinese Vice Premier He Lifeng, and the two nations are experiencing an economic role reversal. The U.S. economy has surged ahead this year, driven by strong consumer spending and government subsidies for specific industries, defying predictions of a recession. In contrast, China is grappling with a property market downturn that has had a negative impact on its overall economy. Observers say these shifting economic fortunes are likely to influence the discussions between Yellen and He this week, as well as the upcoming meeting between President Biden and Chinese President Xi next week. The changing dynamics highlight the evolving nature of the economic relationship between the two countries and could have implications for future economic and trade policies.

— U.S. subsidiary of China's largest bank, ICBC Financial Services, fell victim to a ransomware attack this week, causing concerns about potential disruptions in the Treasury bond market. ICBC Financial Services, based in New York and owned by the Industrial and Commercial Bank of China (ICBC), primarily focuses on clearing transactions in the financial market. Following the ransomware attack, the company had to disconnect and isolate some of its IT systems. However, it assured that it successfully cleared all U.S. Treasury trades executed on Wednesday and repo financing that occurred on Thursday.

Of note: Chinese institutions still hold over $800 billion worth of U.S. Treasury bonds, and Chinese banks play a significant role in the U.S. government-bond market. China's holdings of U.S. Treasurys have been declining over the past few months, with Japan now being the largest foreign holder of U.S. government bonds.

The ransomware used in the attack was reportedly developed by the Russian hacking group LockBit, and it's likely that an affiliate of LockBit was behind the attack. Ransomware attacks involve paralyzing computers or networks with the promise of ending the attack upon payment, typically in cryptocurrency, making it difficult to trace.

Lockbit has also been linked to hits on Boeing, while there have been other recent attacks and ransoms paid by Clorox, Caesars and MGM Resorts. According to cybersecurity firm Corvus Insurance, ransomware attacks have nearly doubled in the first three quarters of this year, compared with the same period in 2022.

Bottom line: This incident marks a significant development, as large banks have not previously been targeted with ransomware attacks. It raises concerns about the broader financial system's vulnerability, given the complexity and high transaction volume of banks.

— Adviser: China can raise budget debt ratio. China can raise its budget deficit ratio next year to support the economic recovery because there is still space for the central government to issue more debt, Wang Yiming, a policy adviser to the central bank, said. “In the short term, we need to increase the intensity of fiscal policy,” Wang, a member of the Monetary Policy Committee of the People’s Bank of China (PBOC), said at the Caixin Summit in Beijing. “The central government’s leverage ratio is relatively low and there is still a lot of room.” A higher budget deficit next year would help drive the country’s economic recovery, he said.

|

TRADE POLICY |

— U.S. to reopen market to Paraguay beef imports. The U.S. will allow imports of Paraguayan beef next month after 25 years as regulators concluded an extensive review. The U.S. Embassy in Paraguay said new regulations make Paraguay one of 18 countries permitted to export beef products to the United States, effective Dec. 14. USDA sought public comments through late May on the proposal, noting that the imports would take place if certain conditions are met.

|

ENERGY & CLIMATE CHANGE |

— How landowners in the U.S. Midwest helped derail one of the biggest carbon dioxide pipelines ever proposed. Link to Inside Climate News item.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Hong Kong decided to cull 5,600 pigs on a local hog farm after the discovery of African Swine Fever (ASF). The authorities plan to clean and disinfect the affected farm, and they will closely monitor other local hog farms to prevent the spread of the disease. The Hong Kong Agriculture, Fisheries and Conservation Department has reassured consumers that there is no need for concern regarding the outbreak, as it will not impact live hog supplies or the functioning of local slaughterhouses. This action is being taken to contain the spread of ASF and safeguard the local pork industry.

|

HEALTH UPDATE |

— Surgeons in New York have successfully conducted the world's first complete eye transplant, a groundbreaking procedure that took 21 hours to complete. The patient had lost his left eye due to a high-voltage electrical accident in 2021. Although the patient is reportedly recovering well from the surgery performed in May, it remains uncertain whether his vision will be fully restored. This achievement represents a significant advancement in the field of transplantation because, until now, surgeons had only been able to transplant corneas, which is a smaller part of the eye.

— AstraZeneca gets into the anti-obesity race. The drugmaker said it had licensed a pill from China’s Eccogene that could see it pay up to nearly $2 billion if certain testing milestones are reached. The pill could eventually rival the weight-loss drugs from Novo Nordisk that have drastically bolstered that company’s fortunes.

|

POLITICS & ELECTIONS |

— Sen. Joe Manchin (D-W.Va.) announced he will not seek re-election after serving two terms in the Senate. This decision comes after a series of public disagreements with fellow congressional Democrats and President Joe Biden. Instead of running for re-election, Manchin has expressed his intention to travel the country and explore the possibility of mobilizing the political center and bringing Americans together. In a video posted on social media, he criticized the current state of Washington politics, stating that the incentives in politics encourage extremism. If he runs as a third-party candidate — in association with the billionaire-backed No Labels group — he could draw voters away from Biden.

Manchin's history in the Senate includes siding with Republicans on key votes, which has caused friction with many Democrats. Manchin's departure from the Senate marks the end of an influential political career marked by his status as a centrist Democrat in a polarized political landscape.

His departure from the Senate is expected to have significant political implications, as West Virginia is a deeply conservative state. Republicans are likely to gain another Senate seat from his decision, and the National Republican Senatorial Committee Chairman, Steve Daines, expressed confidence in their prospects in West Virginia. Former President Donald Trump speculated that Manchin's decision not to run for reelection was influenced by his endorsement of Republican West Virginia Governor Jim Justice in the 2024 Senate race.

Impact: Democrats who already face an uphill battle to preserve their razor-thin Senate majority now have additional pressure to protect Jon Tester of Montana and Sherrod Brown of Ohio, whose states Trump won in 2020. The party’s only (slim) chances of flipping Republican-held Senate seats are in Texas and Florida.

— Rep. Brad Wenstrup (R-Ohio) announced he will retire from Congress at the end of the next year. He shared this news through a post on the social media platform X. Wenstrup has been serving as a representative since 2012, representing Ohio's second congressional district, which encompasses Cincinnati and around 16 counties extending to the southeastern border with West Virginia. This announcement marks the end of his congressional career after over a decade in office.

— Jill Stein has announced her candidacy for the 2024 presidential election as a Green Party candidate, reprising her role from the 2016 campaign. Some Democrats have argued that her 2016 campaign contributed to Hillary Clinton's loss in that election. Stein emphasized her belief that the political system is broken, and that the bipartisan establishment has failed the American people. She expressed the need for a party that truly serves the people.

|

OTHER ITEMS OF NOTE |

— Cotton AWP eases. The Adjusted World Price (AWP) for cotton fell to 64.62 cents per pound, effective today (Nov. 10), down from 68.11 cents per pound the prior week and the lowest since the week of June 30 when it was 63.57 cents per pound. However, the AWP remains well above the 52-cent mark that would trigger an LDP under farm program provisions. Meanwhile, USDA announced that Special Import Quota #4 would be established Nov. 16 for the import of 35,998 bales of upland cotton, applying to supplies purchased not later than Feb. 13 and entered into the U.S. not later than May 13.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |