Thompson Switch: New Farm Bill Before House Not Until January ‘At the Earliest’

CR issues unresolved | Yellen meets Chinese counterpart | Brazil soybeans | Electric grid

|

Today’s Digital Newspaper |

An abbreviated report today as I am attending and speaking at a USMEF meeting in New Orleans.

— Asian and European markets were mostly firmer in overnight trading. U.S. stock indexes are pointed toward narrowly mixed openings.

— Continuing resolution (CR) in Senate: Senate Majority Leader Chuck Schumer (D-N.Y.) is expected to file cloture on a short-term CR to keep federal agencies open past the Nov. 17 deadline. This will lead to an initial procedural vote in the coming week. While no definite CR end date has been confirmed, sources signal it will likely extend into mid-December. House Republicans want a longer timeline.

— House CR: Speaker Mike Johnson (R-La.) as not revealed his, but talks continued about a "laddered CR" approach, where some spending bills would expire in December and others in January or February. Johnson's leadership team plans to introduce a stopgap funding bill on Tuesday. That means must post the legislation online by Saturday to adhere to the 72-hour rule. House Democrats insist on supporting only a clean CR and reject the laddered-CR approach.

— White House again issues budget funding level veto threat. President Joe Biden and administration officials are issuing veto threats over any bill that doesn't adhere to the Fiscal Responsibility Act.

— New farm bill, same issues. While it is now well-known farm-state lawmakers have no solutions yet on funding and policy issues relative to getting a new farm bill, now there is disagreement over what language should be in a likely one-year extension of the 2018 Farm Bill. House Ag Chair G.T. Thompson (R-Pa.) may want to withhold providing funding for 21 so-called “orphan” programs to put leverage on lawmakers to get a new bill completed in 2024.

As for funding issues, USDA Secretary Tom Vilsack has now been added to the list of officials who say they should or are looking at “creative” ways to find additional funding, saying “we would encourage Congress to consider them as quickly as possible.”

Meanwhile, Thompson cited scoring, lack of agreement on key details for no longer expecting December House farm bill vote. He said a new farm bill will not come before the full House until January “at the earliest,” citing issues he has previously noted — delays in getting scoring on proposals and technical responses from USDA and a lack of agreement on key issues. Thompson also pointed to the current House schedule of the chamber only scheduled to be in session two weeks in December as another factor. “Quite frankly, we’re still being held back by USDA technical assistance, CBO scores and we’re working on the funding part of it,” he remarked. “It’s just challenging as we’re in two weeks in December, and that’s the limitation we have.”

— Yellen to discuss U.S./China issues with her counterpart ahead of Biden/Xi summit. Treasury Secretary Janet Yellen is scheduled to engage in two days of discussions with He Lifeng, China's Deputy Prime Minister responsible for economic policy. These talks are expected to pave the way for a rare meeting between President Joe Biden and Chinese President Xi Jinping next week. The discussions between Yellen and He will cover various topics. Yellen recently expressed "serious concerns" about China's unfair economic practices, highlighting issues like China's use of non-market tools, barriers to market access, and coercive actions against U.S. companies. Chinese officials are dissatisfied with the Biden administration's strict regulations on American companies' investments in China, and they are also concerned about the diversification of critical supply chains away from China.

— Electric grid concerns. EPA officials are facing criticism and concerns about their plans to address greenhouse gas emissions from power plants, with some suggesting it could negatively impact grid reliability. At the annual reliability technical conference hosted by the Federal Energy Regulatory Commission (FERC), EPA representatives will provide an overview of their regulatory agenda, and a stakeholder panel will offer reactions. This issue has created division within the industry. Prior to the conference, the chairs of the House Energy and Commerce committee expressed concerns in a letter dated Nov. 7. They questioned EPA's analysis of the potential impact on electric reliability in developing its proposed rules for the power sector. They urged FERC commissioners to evaluate the consequences of the EPA's proposals.

Besides these concerns, the North American Electric Reliability Corporation (NERC) has issued a warning that nearly half of the U.S. is at risk of experiencing power outages this winter. According to NERC's winter reliability assessment, power grids spanning from Texas to New England may face electricity shortages during an extended cold spell or severe storms this winter. John Moura, NERC's director of reliability assessment, emphasized that certain areas lack sufficient natural gas pipeline and infrastructure to support gas-based power generation, leading to potential reliability challenges.

— The U.S. is currently achieving a record-high oil production rate, reaching 13.2 million barrels per day in the first week of November. This increased production is contributing to a decrease in crude oil prices, despite efforts by Russia and Saudi Arabia to reduce their own production levels to raise prices. Meanwhile, global demand for oil has been on the decline, with a particular drop in demand from China. This drop in demand is one of the key factors influencing the oil market, even as production levels remain high in the U.S.

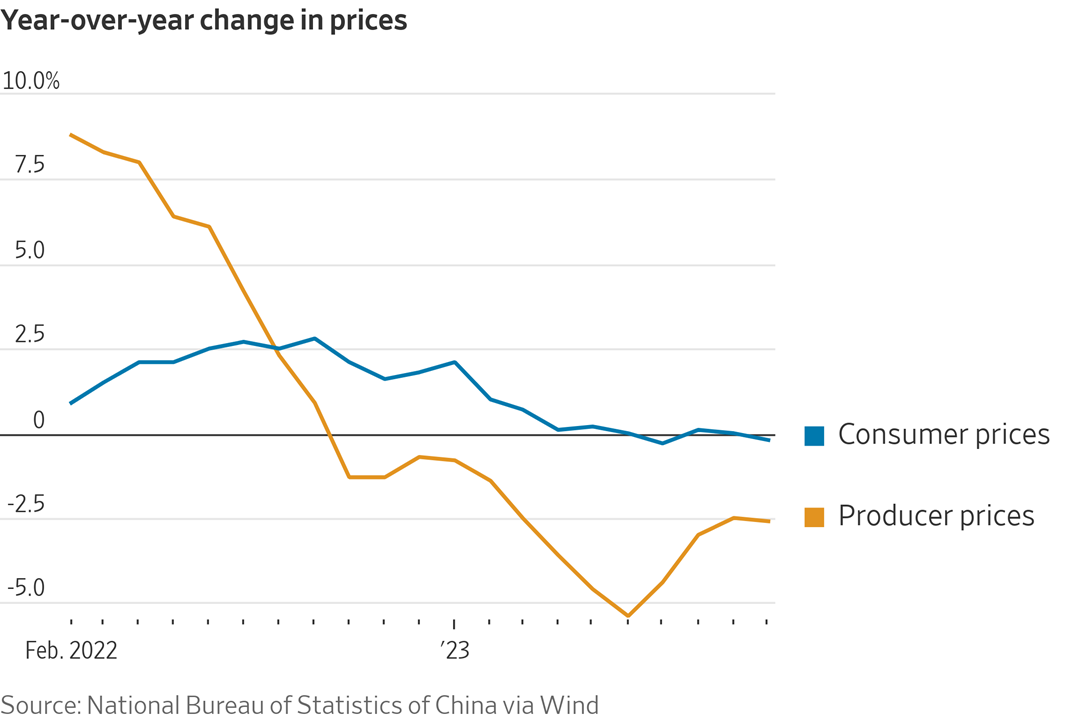

— In October, China's consumer prices experienced a year-on-year decline of 0.2%, contrasting with the unchanged figures seen in September and falling slightly short of market expectations, which anticipated a 0.1% decrease. The primary factor contributing to this decline was a significant drop in food prices, the most substantial decrease observed in 25 months, driven by abundant supply and reduced consumption following the Golden Week holiday. Additionally, factory gate prices decreased by 2.6% during the same period.

— AgResource forecasts Brazil soybean production well below others. Brazil’s soybean production is estimated at 156.08 MMT by AgResource. The firm pegs Brazil’s corn crop at 123.5 MMT. USDA is out today with its latest forecasts. USDA’s currently forecasts 2023-24 Brazilian soybeans at 163.0 MMT, corn at 129.00 MMT.

Of note: Conab today raised its official 2023-24 Brazilian soybean crop forecast by 417,000 MT to a record 162.42 MMT, despite erratic weather through the first two months of the growing season, as its planted acreage estimate increased. Conab cut its corn crop forecast by 338,000 MT to 119.07 MMT.

— U.S. beef exports slump to more than three-year low in September. The U.S. exported 231.5 million lbs. of beef during September, the lowest monthly total since June 2020. Beef shipments dropped 28.0 million lbs. (10.8%) from August and were 47.8 million lbs. (17.1%) below last year. Through the first nine months of the year, the U.S. shipped 2.315 billion lbs. of beef, down 383.7 million lbs. (14.2%) from the same period last year.

— U.S. pork exports totaled 512.0 million lbs. in September, down 14.7 million lbs. (2.8%) from August and 4.1 million lbs. (0.8%) less than year-ago. During the first nine months of the year, the U.S. shipped 4.994 billion lbs. of pork, up 331.0 million lbs. (7.1%) from the same period last year.

— Ukraine remains steadfast in asserting that its export corridor in the Black Sea is operational, despite a recent attack by Russia on a civilian vessel. Deputy Prime Minister Oleksandr Kubrakov conveyed through social media platform X that vessel traffic continues to flow both to and from the ports in the Big Odesa region. He highlighted that six vessels carrying 231,000 metric tons of agricultural products had departed the region and were en route to the Bosphorus Strait. Furthermore, there were five additional vessels awaiting entry to ports for loading. Earlier reports had indicated that a Russian missile had damaged a Liberian-flagged civilian ship entering a Black Sea port in the Odesa region, resulting in one fatality and four injuries. This vessel was intended to transport iron ore to China. Despite this incident, Ukraine is maintaining the functionality of its Black Sea export corridor.

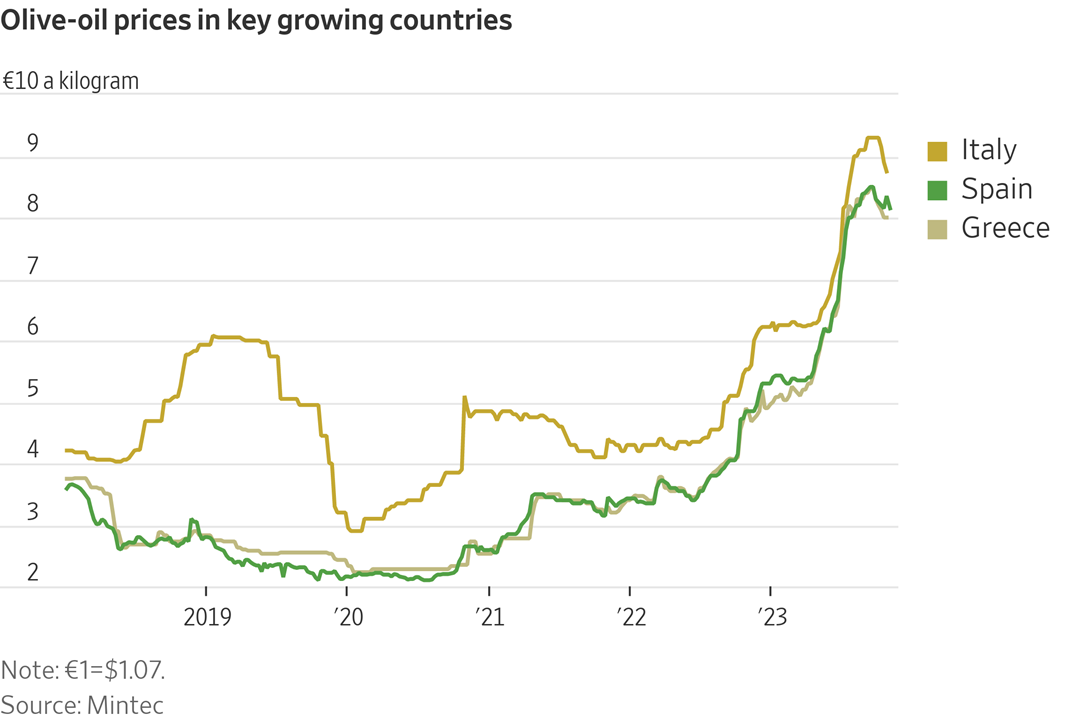

— Olive oil prices are on the rise due to a trend seen in other essential food products like cocoa, sugar, and robusta coffee beans. This increase in prices is a result of extreme weather conditions causing damage to harvests. The issue originates in Spain, which has experienced two consecutive years of drought. Spain plays a crucial role in the olive industry, producing approximately half of the world's olives and generating a similar share of global olive oil production. This makes Spain a significant player in the edible-oil market, even more so than Saudi Arabia is in the crude oil industry. Link for more via the Wall Street Journal.

— Goolsbee: Fed will need to monitor risks of overshooting on rates. Austan Goolsbee, who serves as the president of the Federal Reserve Bank of Chicago, emphasized the need for the Federal Reserve to closely monitor the impact of rising longer-term bond yields. He expressed concern that these elevated yields could potentially have a more significant effect on the economy than anticipated in the coming year. Goolsbee highlighted that this concern becomes increasingly important as the central bank shifts its focus from determining how high to raise interest rates to considering how long to maintain them at a 22-year high.

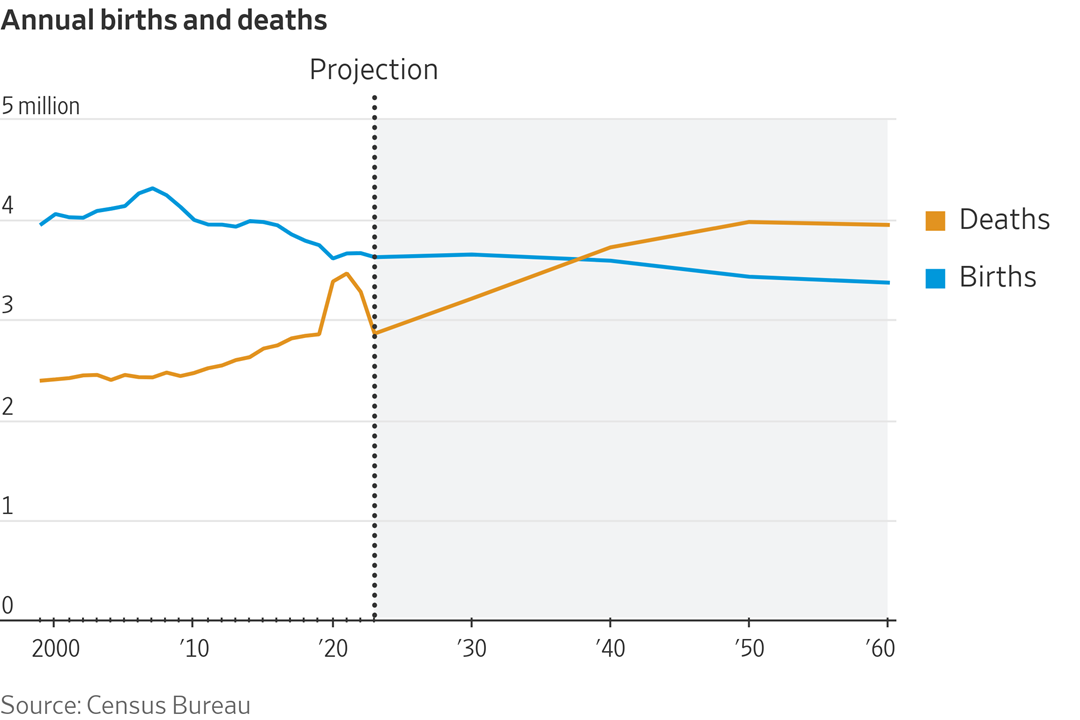

— America’s long streak of population growth is expected to come to an end by 2080, and shrink slightly by 2100. It is the first time that the Census Bureau has projected a population decline as part of its main outlook for the coming decades. The projections — the first issued since 2018 — reflect years of declining birthrates, higher death rates because of an aging population, and increased reliance on immigration for population growth.

Impacts: The shift will weigh on the U.S. economy. With fewer young workers to support the elderly, entitlement programs such as Social Security and Medicare would face greater strains.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |