“GT” Thompson Now Supports One-Year Farm Bill Extension, But Still Wants New Bill

Falling pork prices may push China back into deflation | IMF boosts China’s GDP forecasts

|

Today’s Digital Newspaper |

MARKET FOCUS

- Neel Kashkari says it’s too soon to declare victory on inflation

- Barclays warns of potential further price decline for commercial real estate

- U.S. banks tighten lending standards

- South Korea experienced growth in exports for first time in nearly a year

- Reserve Bank of Australia increased cash rate by 25 basis points to 4.35%

- U.S. debt interest bill surpasses $1 trillion a year

- European natgas traders detecting increased demand for natural gas this winter

- Ag markets today

- USDA daily export sale: 110,000 MT soybeans to China during 2023-2024 MY

- Indonesia planning rice import quota of 2 million metric tons (MMT) for year 2024

- U.S. wheat exports have reached a 20-year low

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House Republicans preparing a temporary spending bill to avoid gov’t shutdown

- Senate taking far different approach than House to avoid gov’t shutdown

ISRAEL/HAMAS CONFLICT

- Netanyahu says Israel will control Gaza Security indefinitely

POLICY

- G.T. Thompson extends his farm bill extension timeline

- One hurdle in extending 2018 Farm Bill: $100 million in funding for ‘orphan’ programs

CHINA

- China tightens controls over rare earth exports, imports of key commodities

- China's economic challenges intensified as exports decreased by 6.4% year-on-year

- Chinese soybean imports slow dramatically in October

- China’s meat imports decline in

- Tumbling pork prices may push China back into deflation

- China increasingly using own currency for invoicing trade

- China issues sovereign bonds to boost economy

- IMF raises China’s 2023, 2024 GDP forecasts

- How China became the world’s top development financier

ENERGY & CLIMATE CHANGE

- Electric vehicle market is facing a slowdown

- Bipartisan bill aims to clarify standards for Sustainable Aviation Fuel (SAF)

- ITA report for lowering countervailing duty rates on Moroccan phosphate fertilizers

- U.S. Forest service proposes regs to enable carbon storage on national forest land.

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA final rule on Transparency in poultry grower contracting and tournaments

- UN FAO report reveals $10 trillion hidden costs in global agrifood system

POLITICS & ELECTIONS

- Third 2024 presidential debate Wednesday in Miami, featuring five participants

- Arkansas Gov. Sarah Huckabee Sanders to endorse Trump

OTHER ITEMS OF NOTE

- Former illegal marijuana farm in Oklahoma sees drastic price drop in auction

|

MARKET FOCUS |

— Equities today: Asian and European markets were mostly lower in overnight trading. U.S. Dow opened around 30 points lower. In Asia, Japan -1.3%. Hong Kong -1.7%. China flat. India flat. In Europe, at midday, London flat. Paris -0.6%. Frankfurt -0.3%.

U.S. equities yesterday: All three major indices registered higher finishes despite falling into negative territory early in the afternoon. The Dow ended up 34.54 points, 0.10%, at 34,085.86. The Nasdaq rose 40.50 points, 0.30%, at 13,418.78. The S&P 500 was up 7.64 points, 0.18%, at 4,365.98.

— Agriculture markets yesterday:

- Corn: December corn was unchanged at $4.77 1/4, near the session low.

- Soy complex: January soybeans rallied 12 1/4 cents before closing at $13.64, the highest close since Sept. 14. December soybean meal dropped $4.60 to $437.50, though deferred contracts pared losses. December bean oil rallied 144 points to 50.80 cents, closing near the midpoint of today’s session.

- Wheat: December SRW wheat closed up 3 1/4 cents to $5.75 3/4. December HRW wheat rose 2 1/4 cents to $6.45 3/4. Prices closed nearer the session highs. Spring wheat futures rallied 7 3/4 cents before closing at $7.28 3/4.

- Cotton: December cotton plunged 162 points to 78.00 cents, marking the lowest close since June 28.

- Cattle: December live cattle dropped $2.55 to $181.325 and near the session low. January feeder cattle fell $3.325 to $236.425 and near the session low.

- Hogs: December lean hog figures rallied 65 cents to $72.40, settling nearer the session high.

— Ag markets today: Soybeans pulled back from recent strong gains amid corrective selling overnight, while corn and wheat also traded lower. As of 7:30 a.m. ET, corn futures were trading mostly 4 cents lower, soybeans were 3 to 4 cents lower, winter wheat futures were 4 to 8 cents lower and spring wheat was 2 to 4 cents lower. Front-month crude oil futures were more than $1.25 lower, and the U.S. dollar index was nearly 400 points higher.

Cash cattle firmed, futures plunged. Cattle futures faced heavy followthrough selling from long liquidation on Monday, despite an 87-cent rise in the average cash cattle price to $184.89 last week. Cash sources came into the week expecting steady/firmer prices, but a sharp extension of yesterday’s losses in futures would likely derail those expectations.

Hog futures continue to rise despite falling cash prices. The CME lean hog index dropped another 22 cents to $76.23 (as of Nov. 3). December lean hog futures firmed 65 cents on Monday to $72.40. That narrowed the spread between the cash market and futures to $3.83.

— Quotes of note:

- Fedspeak. Federal Reserve Bank of Minneapolis President Neel Kashkari said it is too soon to declare victory over inflation, despite signs in recent economic releases that price pressures are easing. “Let’s get more data and see how the economy evolves,’’ he said in an interview with Fox News, adding that three months of promising numbers on inflation isn’t enough.

- Morgan Stanley’s James Gorman signaled he plans to step down as the firm’s chairman by the end of 2024. He pushed back on the notion of entering politics, saying, “I don’t like sharks.”

- Barclays warns of potential further price decline for commercial real estate, especially for "high-quality" office buildings. Barclays has issued a warning about the commercial real estate market, stating that prices for office buildings, which have already declined by about 20% to 30% from their peak levels, could potentially see further declines. The bank suggests that the sector may not have yet experienced the full impact of the Federal Reserve's aggressive interest rate hikes. In particular, "high-quality" office buildings are expected to face a significant price drop of approximately 40%, while distressed properties may only fetch the cost of the land.

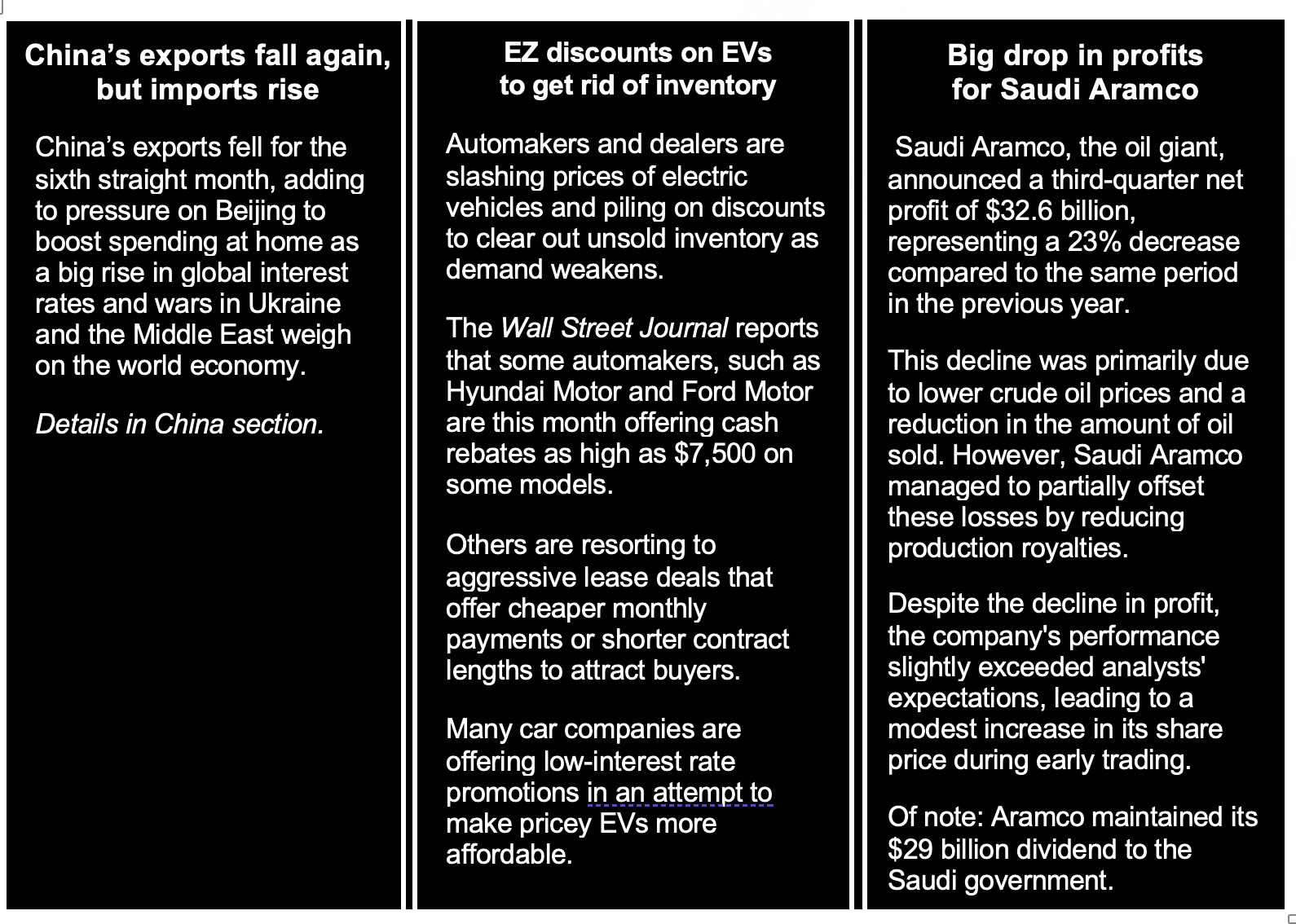

- U.S. banks tighten lending standards. Lending officers at U.S. banks told the Federal Reserve they tightened standards and saw weaker demand for business loans over the past three months. The Fed's latest Senior Loan Officer Opinion Survey also found weaker demand among households for residential real estate, credit card, auto and other consumer loans. "This report clearly shows that banks are tightening their lending screws. It’s undeniable that credit conditions affect economic activity, so the most pertinent question to ask is when tighter conditions will restrict GDP growth," said Nationwide economist Oren Klachkin.

— South Korea experienced growth in its exports for the first time in nearly a year. South Korean exports are often seen as an indicator of global demand trends, so this development suggests potential improvements in the global economy.

— The Reserve Bank of Australia (RBA) increased its cash rate by 25 basis points to 4.35% in November. This move followed a series of four meetings where the rate was held steady at 4.1%. The decision was in line with market expectations and marked the 13th rate hike since May 2022. This rate hike brings borrowing costs in Australia to their highest level since January 2011. The reason for this tightening of monetary policy is primarily driven by persistent inflation, which has proven to be more lasting than anticipated a few months ago, particularly due to rising prices in the services sector.

The RBA now projects that Consumer Price Index (CPI) inflation will be around 3.5% by the end of 2024, surpassing the top end of the target range of 2 to 3%. Furthermore, they anticipate it will remain at the upper limit of this target range by the end of 2025. In her statement, the new governor, Michelle Bullock, mentioned that whether further tightening is necessary to bring inflation back to the target range within a reasonable timeframe will depend on incoming data and evolving risk assessments.

The RBA board reiterated its commitment to closely monitoring various factors, including the global economy, domestic demand trends, inflation outlook, and the labor market.

Additionally, the board also raised the interest rate on Exchange Settlement balances to 4.25%.

— U.S. debt interest bill surpasses $1 trillion a year. The United States may face increased selling pressure on its Treasuries in the coming year, driven by the growing burden of debt repayment. Bloomberg analysis reveals that estimated annualized interest payments on the U.S. government's debt surpassed $1 trillion by the end of last month. This amount has doubled in the past 19 months and now accounts for a significant 15.9% of the entire federal budget for fiscal year 2022.

These figures are based on data from the U.S. Treasury, which tracks the government's monthly debt balances and the average interest payments it makes. The deteriorating financial metrics could revive concerns about the country's fiscal trajectory, particularly as the government continues to borrow heavily. This trend has already led to increases in bond yields, raised concerns about the return of the "bond vigilantes" (investors demanding higher interest rates on government debt), and prompted a downgrade of U.S. government debt by Fitch Ratings in August.

Impact: Bloomberg Intelligence strategists Ira Jersey and Will Hoffman predict that there will be further increases in Treasury coupon auctions and outstanding T-bills in the future. They attribute this to deficits exceeding $2 trillion in the foreseeable future and the need to refinance growing maturities stemming from increased issuance starting in March 2020.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro and British pound both slightly weaker. The yield on the 10-year U.S. Treasury note was weaker, trading around 4.62%, with a mostly lower tone in global government bond yields. Crude oil futures were under pressure, with crude around $79.10 per barrel and Brent around $83.35 per barrel. Gold and silver were under significant pressure ahead of US market action, with gold around $1,965 per troy ounce and silver around $22.62 per troy ounce.

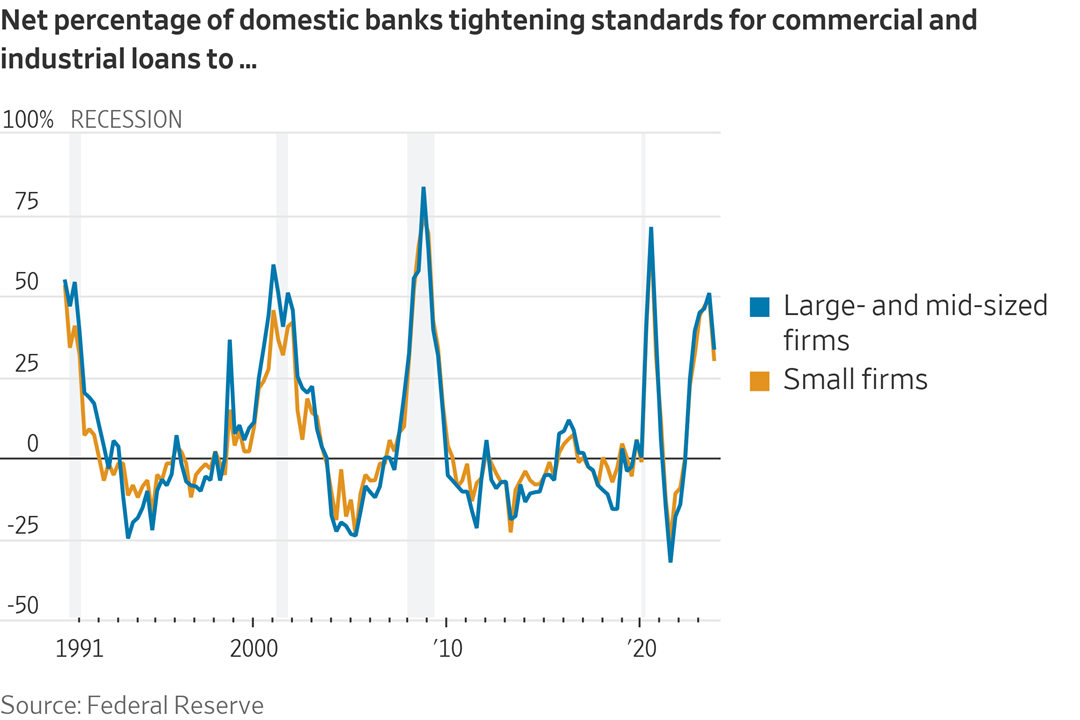

— European natural gas traders are detecting early indications of increased demand for natural gas this winter. In October, consumption rose by 1%, according to International Energy Agency analyst Gergely Molnar. That marks the first year-on-year increase in any month since the energy crisis. During the previous heating season, Europe managed to avoid blackouts primarily due to significant consumption reductions, aided by relatively mild weather, transitioning to alternative fuels, and implementing energy-saving measures.

— USDA daily export sale: 110,000 MT soybeans to China during 2023-2024 MY.

— Indonesia is planning to establish a rice import quota of 2 million metric tons (MMT) for the year 2024, as announced by the state procurement company Bulog. This quota represents a decrease from the 2023 level. Initially, Indonesia had set a 2023 import quota at 2 MMT with a carryover of 300,000 metric tons from 2022. In October, the country increased the quota by an additional 1.5 MMT and some of these additional imports may enter the country in early 2024. Import duties were waived on the extra 1.5 MMT of imports. Indonesia, along with other countries in the region, has been taking measures to boost domestic rice supplies in response to reduced output and to combat rising food prices.

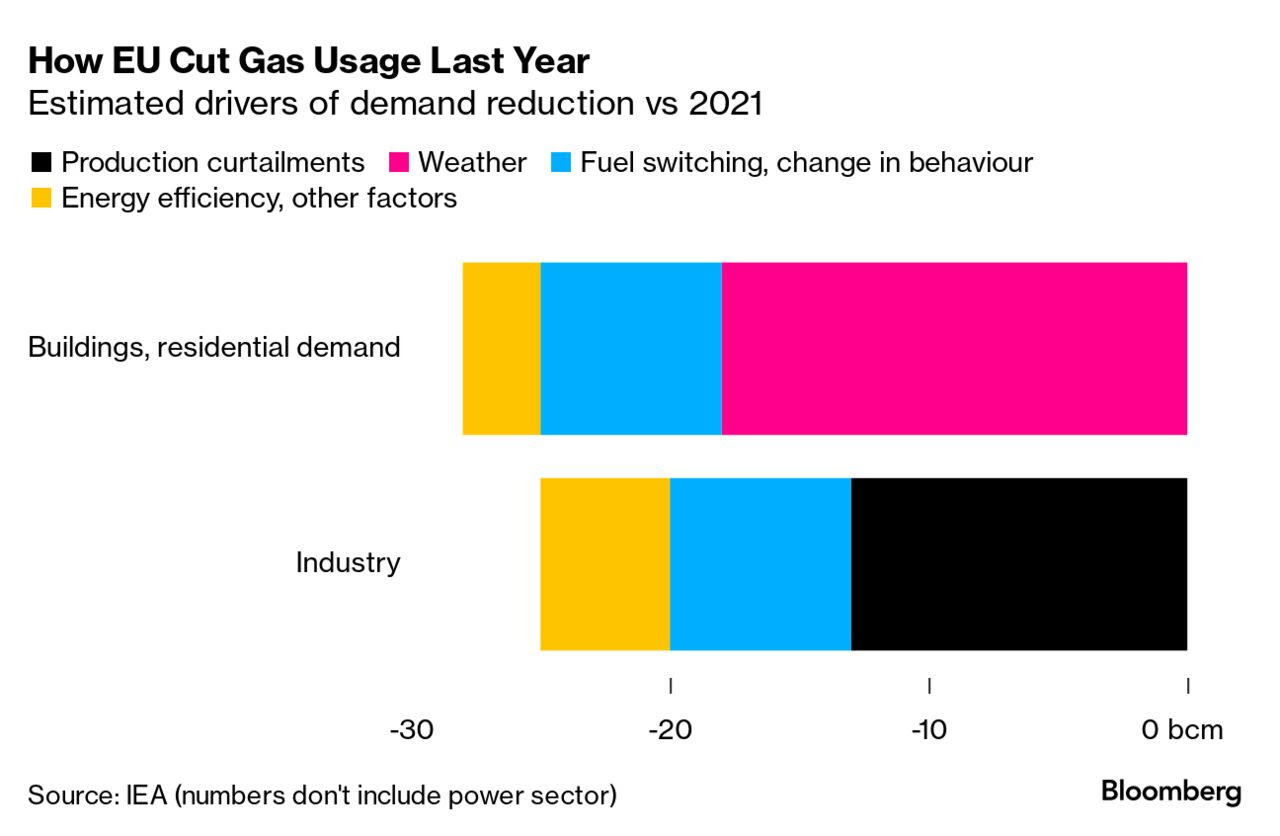

— U.S. wheat exports have reached a 20-year low due to several factors, including the shrinking Mississippi River and competition from abundant global grain supplies, Bloomberg reports (link). The drought has significantly reduced the water levels in the Mississippi River, historically a key route for shipping about two-thirds of U.S. grain exports to the U.S. Gulf. While water levels have slightly improved from a record low last month, global crop buyers have already turned to alternative sources for their grain needs, diminishing demand for US wheat and causing the country to lose its preferred shipper status. In the week ending Nov. 2, export inspections of American wheat totaled only 71,608 metric tons. While some wheat was shipped from Duluth, Minnesota, via the Great Lakes, very little moved along the Mississippi River, according to USDA.

— Ag trade update: Japan is seeking 108,890 MT of milling wheat in its weekly tender.

— NWS weather outlook: Cooler temperatures and beneficial precipitation expected through midweek across the northern tier states... ...Very warm weather including some record high temperatures can be expected along with dry conditions for much of the Central and Eastern U.S. through the middle of the week... ...Some rain to begin impacting parts of the South by Thursday.

NWS

Items in Pro Farmer's First Thing Today include:

• Grains weaker overnight

• Cordonnier keeps South American crop estimates unchanged but has lower bias

• Winter wheat CCI ratings post modest improvements

• Crop progress report highlights

|

CONGRESS |

— House Republicans are preparing a temporary spending bill to avoid a government shutdown after Nov. 17. While some say a vote on the bill may occur this week, others say that timeline appears optimistic.

The proposed plan would establish two new "funding cliff" dates on Dec. 7 and Jan. 19, allowing some government agencies to remain funded through Dec. 7 while the House and Senate work on full-year funding. The remaining agencies would receive funding through Jan. 19. Under this plan, agencies that have faced opposition from some conservative Republicans, such as the Justice Department, would be funded until Jan. 19, while departments with broader support, like Veterans Affairs, would have the shorter deadline.

The Democratic response to the stopgap proposal will depend on whether the GOP includes immediate spending cuts or policy provisions. Some Democrats are skeptical of the two-step approach, suggesting that it could lead to multiple shutdowns over different calendar years.

There are other options under consideration, including extending funding for all agencies until Jan. 19 or negotiating a compromise with Senate Democrats, who are interested in attaching assistance for Ukraine. It's unclear whether Republicans will attempt to attach demands like increased border security to any of the stopgap bills.

House Republican leaders will discuss the legislation's design options in a closed-door meeting today. They aim to avoid the internal dissent that led to the downfall of then-Speaker Kevin McCarthy (R-Calif.) after he allowed a vote on the previous stopgap spending bill ahead of the October 1 shutdown deadline.

— Senate taking a far different approach than House to avoid gov’t shutdown. Senate leaders and appropriators are considering the possibility of combining the remaining nine unpassed Senate appropriations bills into one large "maxi-bus" to be brought to the floor. This move is motivated by the limited time available to pass all the Senate spending bills and reach an agreement with the House before the Thanksgiving and Christmas breaks.

If lawmakers fail to pass the necessary bills, they risk a gov’t shutdown or the passage of an extended stopgap measure, which could freeze or even cut government funding until next year.

Passing a maxi-bus after Thanksgiving would give the Senate more leverage in year-end spending negotiations with the House, as it could secure a significant bipartisan majority in the upper chamber.

But Senate conservatives may resist the idea of a maxi-bus due to its overall size, exceeding $1 trillion. These conservatives have advocated for individual consideration of spending bills and are opposed to massive omnibus packages. Some have proposed stopgap measures to fund the government until January or mid-April.

|

ISRAEL/HAMAS CONFLICT |

— Israeli Prime Minister Binyamin Netanyahu suggested that Israel could assume "overall security responsibility" for the Gaza Strip for an "indefinite period" following the war. In comments to ABC News, he also dismissed calls for a ceasefire but mentioned the possibility of "tactical little pauses" of short durations. UN Secretary-General António Guterres expressed concern about the situation in Gaza, warning that it could become a "graveyard for children."

Meanwhile, the Biden administration is planning a $320 million transfer of precision bombs for Israel, arranging a major weapons deal as President Biden and senior officials press Israel to do more to protect civilians in its military campaign in Gaza. The administration sent formal notification on Oct. 31 to congressional leaders of the planned transfer of Spice Family Gliding Bomb Assemblies, a type of precision-guided weapon fired by warplanes, according to correspondence viewed by the Wall Street Journal.

|

POLICY UPDATE |

— G.T. Thompson extends his farm bill extension timeline. Rep. G.T. Thompson (R-Pa.), Chairman of the House Ag Committee, continued to express optimism about the possibility of passing a new farm bill in December in the House of Representatives. He made this statement during the American Bankers Association's 71st Agricultural Bankers Conference in Oklahoma City. Thompson was asked about the impact of Mike Johnson (R-La.) being elected as Speaker of the House on the Farm Bill reauthorization, to which he confidently responded that they are determined to get the farm bill done.

However, Thompson acknowledged that an extension of the current farm bill would still be necessary while the Senate and others complete their work on the farm bill. He explained that even if they had passed a farm bill last September, a long-term extension would have been required because both the House and Senate versions need to be reconciled through a conference process. Additionally, USDA needs time to align its provisions with the emerging farm bill. So, this is a change in Thompson’s prior farm bill extension thoughts.

Thompson mentioned that the House's extension language is currently being assessed by the Congressional Budget Office, and if approved, it would extend the current farm bill until the end of the fiscal year (Sept. 30). He expressed his desire to receive the extension and new bill language on the House floor as an early Christmas present, emphasizing his goal of acting as quickly as possible in this regard.

Comments: Not many think the House will complete a new farm bill this calendar year. Thompson also identified key issues in the farm bill including finding funding to make changes to the farmer safety net, potentially addressing base acres and other changes that have been well known through the process so far — issues still without a consensus.

— One hurdle in extending 2018 Farm Bill: $100 million in funding for ‘orphan’ programs. Even though both House and Senate Ag panel officials and staff have been looking for billions of additional dollars to help improve the Title I safety net, it appears a far smaller amount, $100 million, is needed to help fund the around 20 so-called “orphan programs,” which are solely authorized and funded under the farm bill rather than other appropriations streams in Congress. That discussion is taking place now.

|

CHINA UPDATE |

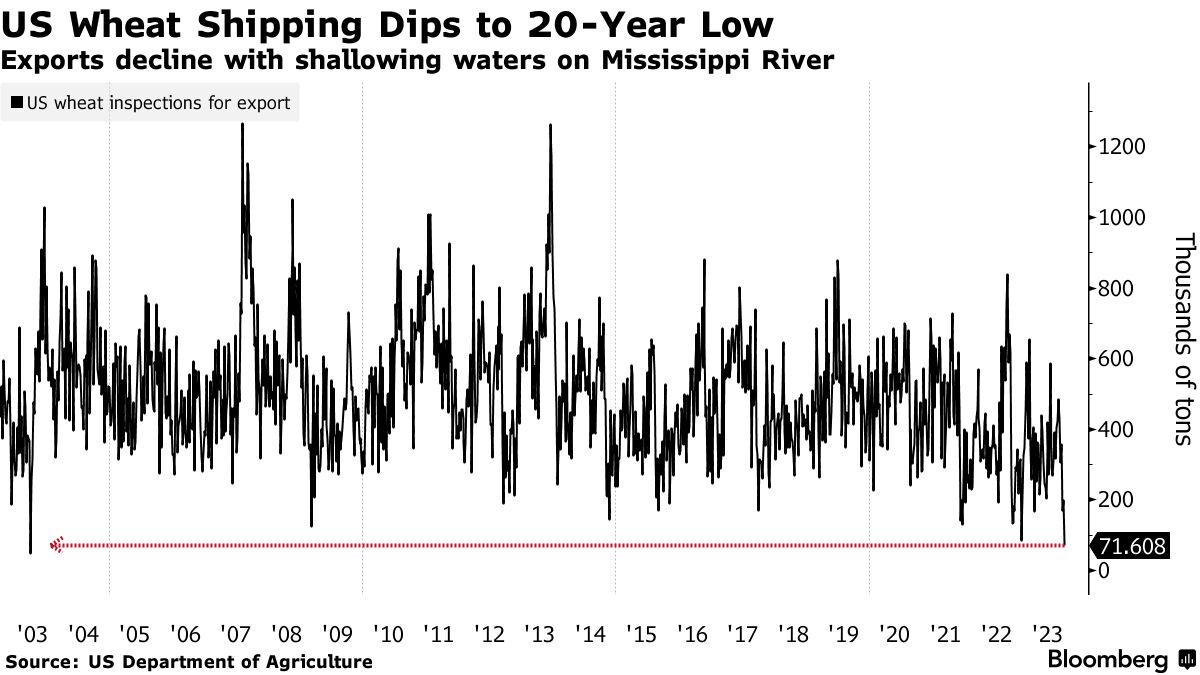

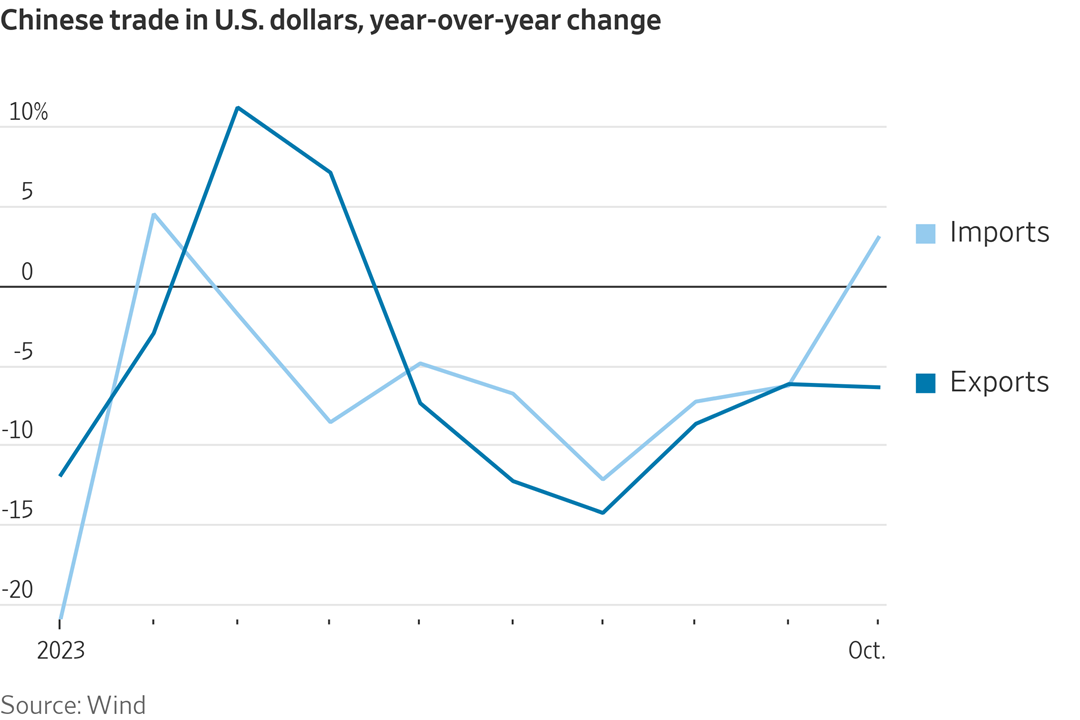

— China's economic challenges intensified as its exports decreased by 6.4% year-on-year in October, reflecting a drop in overseas shipments. Surprisingly, imports in China increased by 3% during the same period. These numbers indicate that Chinese trade has been negatively affected by the global economic slowdown.

Details: In October 2023, China saw an unexpected increase of 3.0% in year-on-year imports, totaling $218.3 billion. Market expectations had anticipated a 4.8% decrease, and marked a significant improvement from the 6.2% drop observed in September. This change can be attributed to Beijing's efforts to stimulate domestic demand and signs of stockpiling.

Several categories of imports experienced growth, including crude oil (up by 13.51%), refined products (up by 63.24%), natural gas (up by 15.51%), unwrought copper (up by 23.68%), copper ore & concentrates (up by 23.60%), soybeans (up by 24.6%), and edible oil (up by 27.19%). However, there were contractions in imports for steel products (down by 12.99%), rubber (down by 2.02%), and meat (down by 12.70%).

Geographically, imports expanded from the European Union (up by 5.8%), Australia (up by 12.0%), and the Association of Southeast Asian Nations (ASEAN) (up by 10.2%). In contrast, imports decreased from the United States (down by 3.7%), Japan (down by 8.3%), South Korea (down by 8.9%), and Taiwan (down by 2.8%).

For the cumulative period from January to October, imports in 2023 were down by 6.5% compared to the same period in 2022.

— Chinese soybean imports slow dramatically in October. China imported 5.16 MMT of soybeans in October, down 27.8% from September and lower than the 6.5 MMT to 7 MMT traders expected as some cargoes were delayed. However, that was up 24.6% from last year. Through the first 10 months of this year, China imported 82.42 MMT of soybeans, up 14.6% from the same period last year.

— China’s meat imports decline in October. China imported 552,000 MT of meat during October, down 43,000 MT (7.2%) from September. Its meat imports during the first 10 months of this year totaled 6.26 MMT, up 3.8% from the same period last year.

— China to require commodity traders provide real-time shipment data for additional products. China's Commerce Ministry announced new provisions requiring commodity traders dealing with products such as crude oil, iron ore, copper concentrate, and potash to provide real-time shipment data. These rules aim to stabilize trade in products that are subject to import licenses. Additionally, exporters of rare earth materials will also have to provide shipment information under these regulations.

While similar rules were already in place for various commodities like soybeans, soybean meal, milk powder, and meats, the expansion of these requirements to other products may indicate a move by the Chinese government to exert more control over trade in specific commodities.

The exact impact of these new rules on trade remains unclear, but they are intended to contribute to the stability of foreign trade according to the Ministry's statement.

— Tumbling pork prices may push China back into deflation when it releases consumer-price data on Thursday, the Financial Times says (link)/paywall. Live hog futures on China's Dalian Commodity Exchange have declined by approximately 15% since the beginning of October, reflecting a sharp decrease in expectations for nationwide pork prices. Wholesale pork prices in China have dropped by over 40% compared to the previous year.

Pork and China’s CPI. FT notes that economists predict that the declining cost of pork, which holds significant weight in China's official consumer price index (CPI), is likely to push the country back into a state of deflation when October's CPI data is released. This return to deflation would pose challenges to Chinese officials' efforts to restore confidence in the nation's economy, which faces weak consumer confidence and a liquidity crisis in the property sector.

What happened: This year, despite a rebound in pork prices in July, large hog farmers like Muyuan and New Hope did not reduce capacity despite weaker demand, contributing to falling prices. Typically, large producers reduce output by selling breeding sows and raising fewer piglets until demand pushes prices up again. However, Chinese piglet prices have only declined by 10% from a year ago, indicating relatively strong demand for young pigs despite the significant drop in pork prices. Analysts believe that this strategy was successful for large producers last year, but there are currently no signs of an imminent fourth quarter rebound in demand. Muyuan, the world's largest hog farmer, has seen its stock decline by over 20% this year, even after announcing a share buyback worth approximately $137 million. The company recently canceled a planned share sale in Zurich due to unspecified "objective factors."

— China is increasingly using its own currency for invoicing trade. The yuan accounted for more than 24% of goods commerce in the first nine months of 2023, a record high for recent years, data showed recently.

Of note: The value of China’s direct holdings of U.S. Treasuries has slumped to the lowest level since 2009. And, Chinese investors offloaded the most U.S. bonds and stocks in four years in August.

— China issues sovereign bonds to boost economy. China approved a 1 trillion-yuan ($137 billion) sovereign bond issue and passed a bill to allow local governments to frontload part of their 2024 bond quotas, Xinhua news reported, in a move to support the economy. Funds raised from the new sovereign bonds will support the rebuilding of disaster-hit areas in the country and improve urban drainage prevention infrastructure to boost China’s ability to withstand natural disasters. That will widen the country’s 2023 budget deficit to around 3.8% of GDP from a previously set 3%, Xinhua said.

— IMF raises China’s 2023, 2024 GDP forecasts. China’s economy is set to grow 5.4% this year, having made a “strong” recovery from the pandemic, the International Monetary Fund (IMF) said, making an upward revision to its earlier forecast of 5% growth. IMF said continued weakness in the property sector and subdued external demand could restrict GDP growth to 4.6% in 2024, which was still better than the 4.2% growth it forecast last month. “The authorities have introduced numerous welcome measures to support the property market,” the IMF’s first deputy managing director Gita Gopinath said in a statement. “But more is needed to secure a quicker recovery and lower economic costs during the transition.”

“A strategy to contain the risks from the ongoing property sector adjustment and manage local government debt is needed to lift sentiment and boost near-term prospects,” the fund said. “Supportive macroeconomic policies should complement these efforts.”

Bottom line: Beijing officials express optimism, but analysts say weak export data shows recovery remains fragile. Private analysts say many more years of high economic expansion are only possible if the country restructures to boost domestic consumption.

— How China became the world’s top development financier. A Wall Street Journal deep dive into $1.34 trillion in lending shows Beijing’s retooling to get repaid. Link.

|

ENERGY & CLIMATE CHANGE |

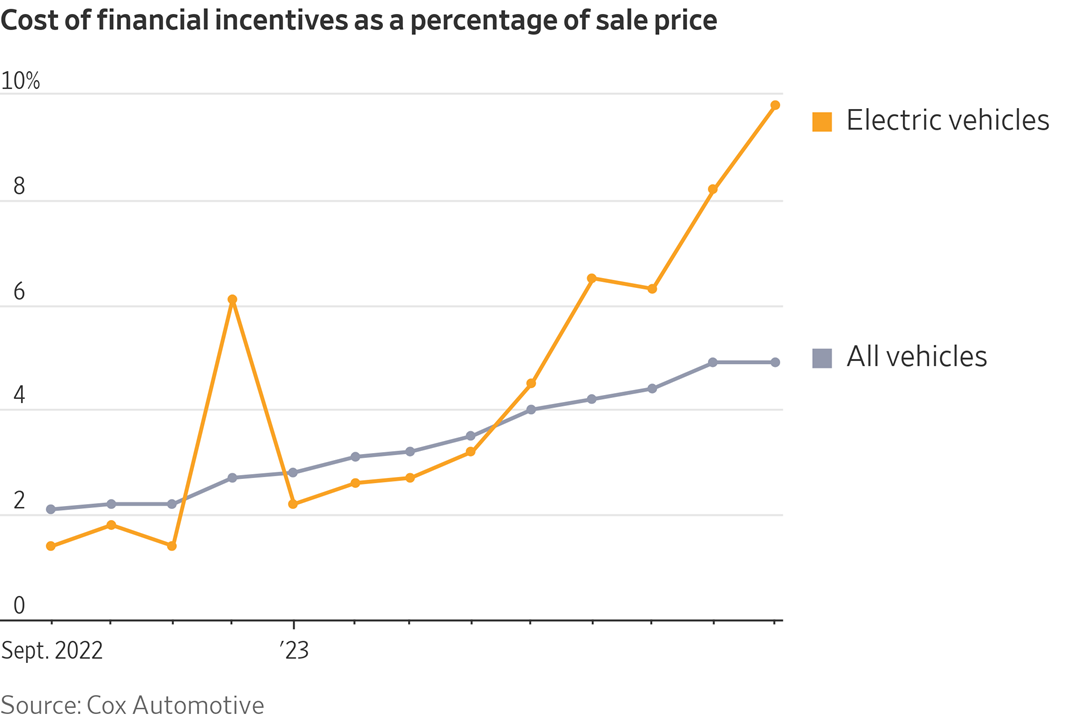

— Electric vehicle (EV) market is facing a slowdown, leading automakers and dealers to reduce prices and offer discounts to clear unsold inventory, the Wall Street Journal reports (link). While this can benefit consumers by narrowing the price gap between EVs and traditional gasoline vehicles, it also reflects a declining interest in EVs, signaling a cooling of the once-booming EV market.

— Bipartisan bill aims to clarify standards for Sustainable Aviation Fuel (SAF) with agricultural commodities. Politico reports that today, Rep. Max Miller (R-Ohio) is set to introduce a bipartisan bill known as the Farm to Fly Act, aimed at providing clarity and standards for sustainable aviation fuel (SAF) made from agricultural commodities. The bill has garnered support from various cosponsors across party lines. SAF presents a promising biofuel opportunity for farmers and enjoys support from agricultural commodity groups, the Fuels America coalition, major airlines, and USDA Secretary Tom Vilsack.

The proposed legislation seeks to define SAF eligibility within the USDA's agricultural bioenergy programs, establish a common SAF definition for USDA purposes, and promote collaboration for aviation biofuels through USDA programs and public-private partnerships. Rep. Miller believes the bill will open new markets for farmers, stimulate rural economic development, and enhance domestic energy resources.

— ITA issues report for lowering countervailing duty rates on Moroccan phosphate fertilizers. The International Trade Administration (ITA) has published (link) the results of its countervailing duty (CVD) review on phosphate fertilizers from Morocco. In this review, the ITA significantly reduced the duties imposed on imports of the product from the Moroccan firm OCP, bringing them down to 2.12%. The ITA will provide the detailed calculations used to determine the results within five days. Customs and Border Protection (CBP) will receive assessment instructions from the ITA in at least 35 days following the publication of the notice. This move follows Commerce's previous announcement of the final determination, making the publication in the Federal Register a procedural step.

— U.S. Forest service proposes regulations to enable carbon storage on national forest land. The U.S. Forest Service put forth a regulatory proposal (link) that would allow the consideration of carbon capture and storage projects on its 193 million acres of national forests and grasslands. The move aims to support President Biden's goal of achieving net-zero U.S. greenhouse gas emissions by 2050. Currently, the Forest Service is prohibited from granting "exclusive and perpetual use and occupancy" of its land to external parties, which would typically include carbon storage. The proposed regulation would create an exemption for such projects, subject to public comment until January 2, 2024. If approved, it would align carbon storage regulations with the Bureau of Land Management's policy, which was issued in July 2022.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA is preparing to release a final rule on transparency in poultry grower contracting and tournaments after the Office of Management and Budget (OMB) completed its review. This rule is part of the Biden administration's efforts to address issues in the U.S. livestock industry. The final rule aims to update the requirements for disclosures and information that live poultry dealers must provide to growers and sellers when entering poultry growing agreements. It also sets guidelines for the use of poultry grower ranking systems by dealers to determine settlement payments.

USDA's regulatory agenda describes the rule as intended to enhance transparency in poultry production contracting and provide poultry growers with relevant information for making business decisions. During the OMB review, two meetings were held to discuss the final rule, involving representatives from the U.S. poultry industry and a group focused on reforming poultry contracting.

Typically, USDA announces new regulations shortly after OMB completes its review, so the release of this final rule is expected soon. Additionally, another final rule related to competition and market integrity under the Packers and Stockyards Act is currently under review at OMB.

— UN FAO report reveals $10 trillion hidden costs in global agrifood system. The UN Food and Agriculture Organization (FAO) unveiled (link) the hidden costs of the global agrifood system, totaling at least $10 trillion annually. These costs stem primarily from the consequences of unhealthy diets and include factors like disease and lost productivity. The FAO's State of Food and Agriculture report calls on governments and the private sector to adopt true-cost accounting systems to identify and address the flaws in the agrifood system. These hidden costs amounted to 10% of global GDP in 2020, equivalent to $35 billion per day. The report highlights the need for action and plans to focus on targeted assessments to mitigate these hidden costs in future reports.

|

POLITICS & ELECTIONS |

— Third 2024 presidential debate for the Republican candidates is scheduled to take place Wednesday in Miami, featuring five qualifying participants. These include former New Jersey Gov. Chris Christie, Florida Gov. Ron DeSantis, former South Carolina Gov. Nikki Haley, entrepreneur Vivek Ramaswamy, and South Carolina Sen. Tim Scott. However, North Dakota Gov. Doug Burgum and former Arkansas Gov. Asa Hutchinson did not meet the criteria and will not be part of the debate. Former Vice President Mike Pence, who initially qualified for the first two debates, withdrew from the Republican primary last month. Notably, front-runner Donald Trump has opted not to participate in this debate, as he did with the previous two. Instead, he plans to host a rally in South Florida as an alternative event.

Meanwhile, Arkansas Gov. Sarah Huckabee Sanders is set to endorse her one-time boss, former President Donald Trump, later this week, Sanders’ office confirmed. Sanders’ endorsement will come at a rally in Hialeah, Fla. on Wednesday night meant to serve as a counterprograming event for the GOP primary debate taking place that same evening. Trump, for the third time, is skipping participation in the debate. Link to more via Politico.

|

OTHER ITEMS OF NOTE |

— Former illegal marijuana farm in Oklahoma sees drastic price drop in auction. A former illegal marijuana farm in Johnston County, Oklahoma, which was previously listed with a minimum bid of $755,006, has seen a significant reduction in its minimum bid price to $100,000 as it goes up for auction. This property was among several marijuana grow operations seized two years ago by authorities, resulting in the confiscation of around 20,000 illegally grown marijuana plants valued at over $30 million on the street. The auction for this 19-acre former marijuana farm is being conducted online by Bid4Assets, a Maryland-based firm specializing in the sale of distressed real estate properties. The auction is set to take place from 10 a.m. Eastern Time on Tuesday until 10 a.m. Eastern Time on Wednesday. Link for details via The Oklahoman.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |