Passing New Farm Bill in Congress Facing Insurmountable Near-term Challenges

House GOP leaders still mulling options for stopgap spending bill to avoid gov’t shutdown

|

Today’s Digital Newspaper |

MARKET FOCUS

- South Korean stocks jump as short selling is banned again

- Berkshire Hathaway’s war chest reaches a record

- Saudi Arabia & Russia stick to planned oil cuts

- Bond vigilantes throwing in the towel for now

- Griffin says SEC should focus on banks’ basis trade risk: Financial Times

- Germany's service sector experienced a contraction in October

- Eurozone saw a decline in business activity

- Steel prices rise to six-month high

- Container shipping lines facing significant challenges

- Ag markets today

- USDA daily export sales:

— 126,000 MT soybeans to China, 2023-2024 marketing year

— 289,575 MT corn to Mexico, 2023-2024 marketing year - Indonesia extends rice donation program until June 2024

- India to extend free food program by five years

- Wheat futures sees a rebound

- Ag trade update

- More than 60 record-high temps this week in various U.S. regions

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- House on Friday passed bill known as the Stop Harboring Iranian Petroleum Act

- Reports: No action likely this week on House stopgap spending plan

ISRAEL/HAMAS CONFLICT

- Latest developments in the Israel-Gaza conflict

RUSSIA & UKRAINE

- Moscow finds ways to circumvent a Western price cap on Russian oil

POLICY

- Passing new farm bill facing insurmountable near-term challenges

CHINA

- Foreign investment in China turns negative for first time

- Gallup withdraws from China, becoming latest foreign company to do so

- Treasury Secretary Yellen to meet with her Chinese counterpart, He Lifeng

- Chinese Premier Li Qiang pledges to expand market access and boost imports

- China says Australia's exporters can come back, but some say no thanks

- BBC News: U.S. is quietly arming Taiwan to the teeth

- Brookings Institution: Peak China: Why do China's growth projections differ so much?

TRADE POLICY

- Trade rule called ‘de minimis’ causing new challenges for U.S. retailers

- Is global trade really in decline?

ENERGY & CLIMATE CHANGE

- EPA defends decision to modify the RFS program against some fuel refiners

- Virgin Atlantic gets U.K. approval for 100% SAF in transatlantic flight

- Saudi Arabia looks to China to help build up its renewables industry

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- Tyson Foods issues recall for chicken patty products

- No Burger King to expand plant-based menu offerings in U.S.

- USDA to reconvene hearing on milk marketing orders

- New York City Council passes bill for items with high sugar content

HEALTH UPDATE

- Chinese scientists claim anti-ageing breakthrough with spinal cord discovery

POLITICS & ELECTIONS

- David Axelrod openly wondering whether Biden should run for re-election

OTHER ITEMS OF NOTE

- ABA holds Agricultural Bankers Conference, through Wednesday, Oklahoma City

|

MARKET FOCUS |

— Equities today: Asian and European markets were mostly higher in overnight trading. U.S. Dow opened up around 30 points higher. In Asia, Japan +2.4%. Hong Kong +1.7%. China +0.9%. India +0.9%. In Europe, at midday, London flat. Paris -0.5%. Frankfurt -0.3%. South Korea is prohibiting stock short selling until June 2024, in a move that triggered a big rally for equities and increased trading volumes. The benchmark KOSPI and the tech heavy KOSDAQ soared 5.7% and 7.3%, respectively, resulting in both indexes closing out their best session since late March 2020.

The Hang Seng, Hong Kong's stock market index, experienced a significant surge, gaining 302.47 points 1.71% to close at 17,966.60 on Monday. This marks the third consecutive session of bullish momentum. Several factors contributed to this positive performance:

- Encouragement from U.S. Markets: The Hang Seng was boosted by a rise in US stock futures, following a strong week for major US stock indices. Last week, US markets had their best performance of the year, driven by expectations of a potential end to the Federal Reserve's tightening of monetary policy, a soft monthly jobs report that lowered bond yields, and strong corporate earnings reports.

- Positive Announcement by Chinese Premier: Chinese Premier Li Qiang's announcement on Sunday that China would increase imports while promoting economic globalization with openness and balance further contributed to the market's optimism.

- Sector Performance: The technology sector led the market's upturn, recording a gain of around 4%. Other sectors such as consumer goods, financials, and property also showed positive movements. Specific companies like Li Auto and Kuaishou Tech experienced significant gains of 11.3% and 7.1%, respectively. Additionally, companies like China Resources Beer, Longfor Group, and Meituan saw their shares rise by 6.6%, 5.9%, and 5.6%, respectively.

- Upcoming Chinese Economic Data: Traders are now preparing for the release of several key Chinese economic data points for October later in the week. These include export and import data, inflation figures, new bank loan statistics, and vehicle sales data.

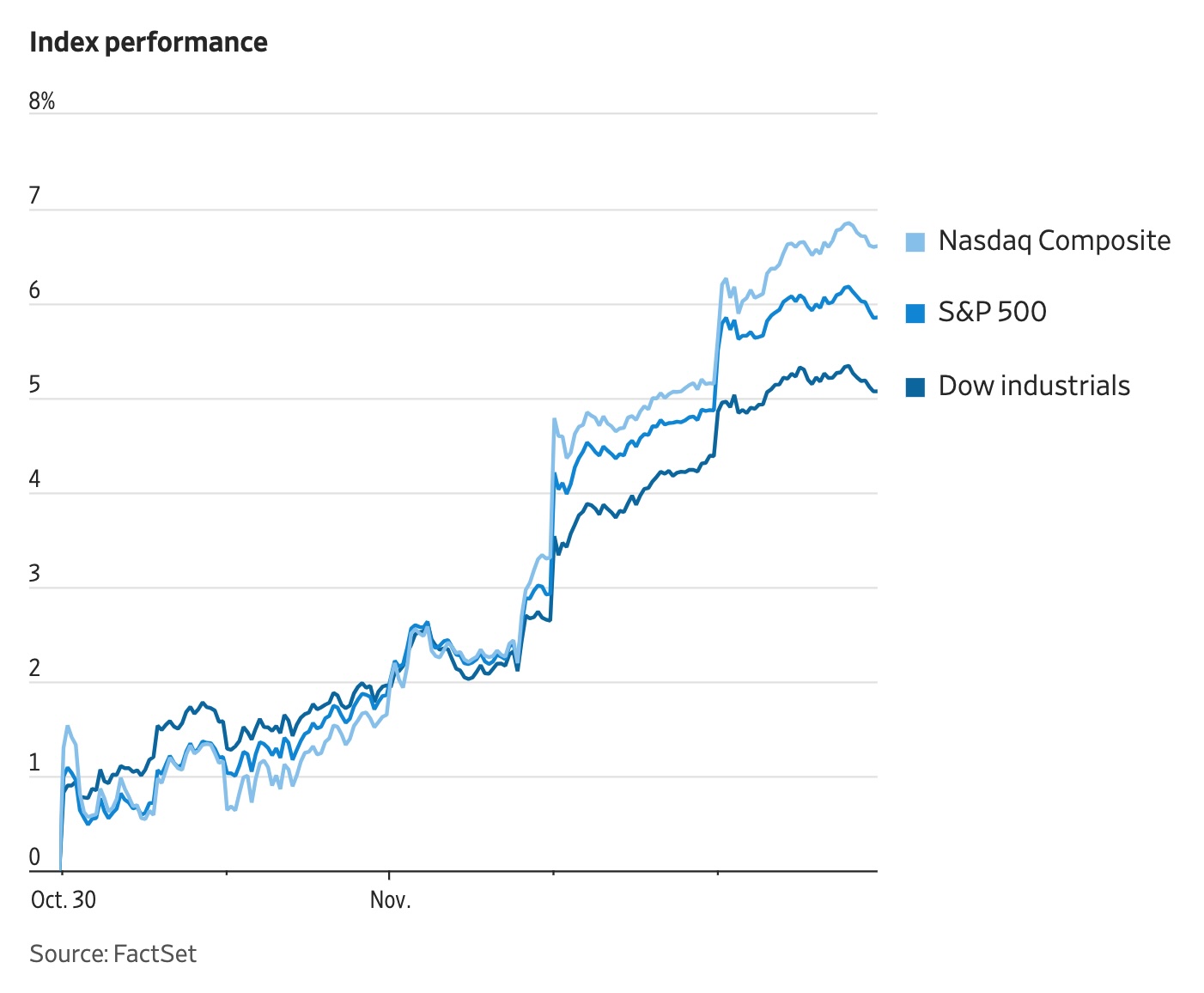

U.S. equities Friday and for the week: All three major indices registered their best weekly gains of the year in the wake of the subdued jobs report. For the week, the Dow was up 5.1%, the Nasdaq rose 6.6% and the S&P 500 added 5.9% — the index is up 14% this year.

On Friday, the Dow was up 222.24 points, 0.66%, at 34,061.32. The Nasdaq gained 184.09 points, 1.38%, at 13,478.28. The S&P 500 rose 40.56 points, 0.94%, at 4,358.34.

Bond yields tumbled for the week, with the 10-year Treasury yield sliding to 4.57% after touching 5% in recent weeks. The shorter-end more rate-sensitive 2-year yield was down 11 basis points to 4.86%. The 30-year yield fell 0.273 percentage point to 4.75%, marking its largest one-week decline since March 6, 2020.

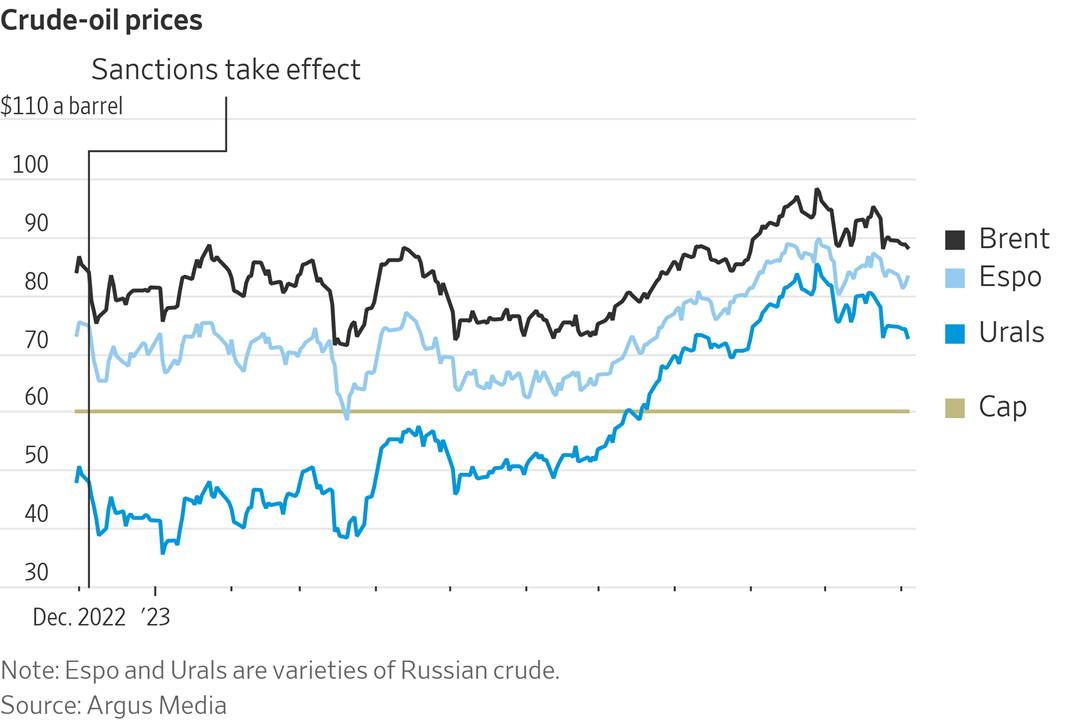

Oil prices were lower Friday and lower week over week. WTI traded down $1.95 or -2.4% to close at $80.51. Brent traded down $1.92 or -2.3% to close at $84.89. WTI was down $5.03 per barrel week-over-week. Brent was down $5.59 per barrel week-over-week.

— Warren Buffett's conglomerate, Berkshire Hathaway, had a robust quarter with operating earnings surging by over 40% to reach $10.76 billion. Additionally, the company's cash reserves reached a record high of approximately $157 billion by the end of September. This significant cash accumulation reflects Berkshire Hathaway's financial strength and its ability to make strategic investments or acquisitions. In terms of stock performance, the company's Class A shares have seen a nearly 14% increase in value this year, indicating investor confidence in its performance and management.

— Agriculture markets Friday:

- Corn: December corn futures surged 7 1/4 cents to $4.77 1/4 but marked a 3 1/2 cent loss on the week.

- Soy complex: January soybeans rallied 23 1/2 cents to 13.51 3/4, marking the highest close since Sept. 15 and a 32 1/4-cent gain on the week. December meal surged $15.80 to $442.10 but lost 30 cents from a week ago. December soyoil fell 96 points to 49.36 cents, a near five-month-low close and lost 291 points on the week.

- Wheat: December SRW wheat futures rose 7 cents to $5.72 1/2 and nearer the session high. On the week, December SRW lost 3 cents. December HRW wheat futures gained 2 cents to $6.43 1/2 and near mid-range. For the week, December HRW rose 1/2 cent. December spring wheat futures rose 10 1/4 cents to $7.21 and gained 1 1/4 cents on the week.

- Cotton: December cotton fell 18 points to 79.62 cents and plummeted 476 points on the week.

- Cattle: December live cattle futures fell 80 cents to $183.875 and nearer the session low. For the week, December live cattle rose $1.65. January feeder cattle futures fell $2.425 to $239.75 and nearer the session low. For the week, January feeders rose $4.05.

- Hogs: Nearby December fell $1.525 to $71.755. That represented a weekly gain of $1.275.

— Ag markets today: Soybean futures posted strong gains overnight, which spilled over to corn, while wheat faced light selling pressure. As of 7:30 a.m. ET, corn futures were trading a penny higher, soybeans were 13 to 14 cents higher and wheat futures were 4 to 5 cents lower. Front-month crude oil futures were around $1.00 higher, and the U.S. dollar index was more than 100 points lower this morning.

Bigger cattle showlists this week. Cash cattle traded steady/firmer on Friday, though traders will have to wait until late this morning to get the official average cash price. Some feedlots passed on steady bids, opting to carry cattle forward to this week, which will increase showlist numbers. Packers also have November contract supplies to pull from. But there’s an underlying belief among some cash sources cash cattle prices will firm this week.

Cash hog decline continues. The CME lean hog index is down another 39 cents to $76.45 (as of Nov. 2), extending the seasonal decline. December lean hog futures finished Friday at $71.75, a $4.70 discount to the cash index. The pork cutout value softened 13 cents on Friday, though the wholesale price seems to have stabilized in the mid-$80 range.

— Quotes of note:

- Fedspeak. "We're not confident that we haven't, but we're not confident that we have." That statement sums up Federal Reserve Chair Jerome Powell's press conference last Wednesday, which outlined that the central bank is still not sure whether it is done with a hiking cycle to "sufficiently bring down inflation to 2% over time."

- “The bond vigilantes are throwing in the towel for now,” writes Andrew Brenner, head of international fixed income at NatAlliance Securities. “The bear market trend in bonds looks over for now, or at least stalled.”

- Griffin says SEC should focus on banks’ basis trade risk: FT. Citadel founder Ken Griffin said regulators should focus on banks, not hedge funds, as they seek to limit financial risks stemming from highly leveraged trades in the Treasury market, the Financial Times reported, citing an interview. Griffin also said China could prop up the global economy this year, helping avert an “ugly” slowdown in growth if the U.S. suffers a recession, saying he was optimistic China could beat its growth target.

- “Because of the intense market competition, factory owners in Bangladesh must also strike a balance between raising the minimum wage and maintaining competitiveness.” — Sheng Lu, associate professor of fashion and apparel studies at the University of Delaware.

- “Our view is that inventory is much better positioned than last year.” — Lorraine Hutchinson, retail-sector equity analyst at BofA Global Research, on retailers’ preparations for holiday sales.

— Germany's service sector experienced a contraction in October, as indicated by a survey conducted by S&P Global and Hamburg Commercial Bank. The purchasing managers' index (PMI) for the country dropped to 48.2, a decrease from 50.3 in September. In the context of PMI, a reading below 50 typically signifies a contraction in the sector.

Meanwhile, the Eurozone also saw a decline in business activity. The PMI for the euro zone decreased from 47.2 in September to 46.5 in October. This reading is the lowest recorded in nearly three years, indicating a significant contraction in business activity across the Eurozone during that period.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro, yen and British pound all firmer against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.6%, with a mixed tone in global government bond yields. Crude oil futures maintained gains seen overnight, with U.S. crude around $81.50 per barrel and Brent around $85.80 per barrel. Futures rose in Asian trading following Russia and Saudi Arabia opting to not change their output policies. Gold and silver futures were under pressure ahead of US market action, with gold around $1,991 per troy ounce and silver around $23.25 per troy ounce.

— Steel prices have risen to a six-month high due to strong demand, reduced inventories, government support for infrastructure projects, and environmental factors affecting supply in key production areas. Several factors have contributed to this rise in steel prices:

- Robust Demand: Strong demand for steel is one of the driving forces behind the price increase.

- Lower Inventories: There has been a decrease in steel inventories, with key warehouses in China experiencing a nearly 2% drop in the final week of October. This reduction in stockpiles has supported higher steel prices.

- Government Initiatives: The Chinese government has announced plans to accelerate the issuance of new bonds. They have also widened the budget deficit for the current year to accommodate an additional CNY 1 trillion worth of sovereign debt. These funds are expected to target manufacturing and steel-intensive infrastructure projects. This move aligns with calls from various market players, such as Rio Tinto and JPMorgan, who believe that increased infrastructure spending in China will help offset challenges faced by property developers and maintain a robust metal commodity market.

- Environmental Concerns: Worsening air quality in key steel production areas in Northern China has raised concerns. There are worries that mills and blast furnaces may be required to suspend their activities to comply with pollution standards, potentially disrupting the supply of steel.

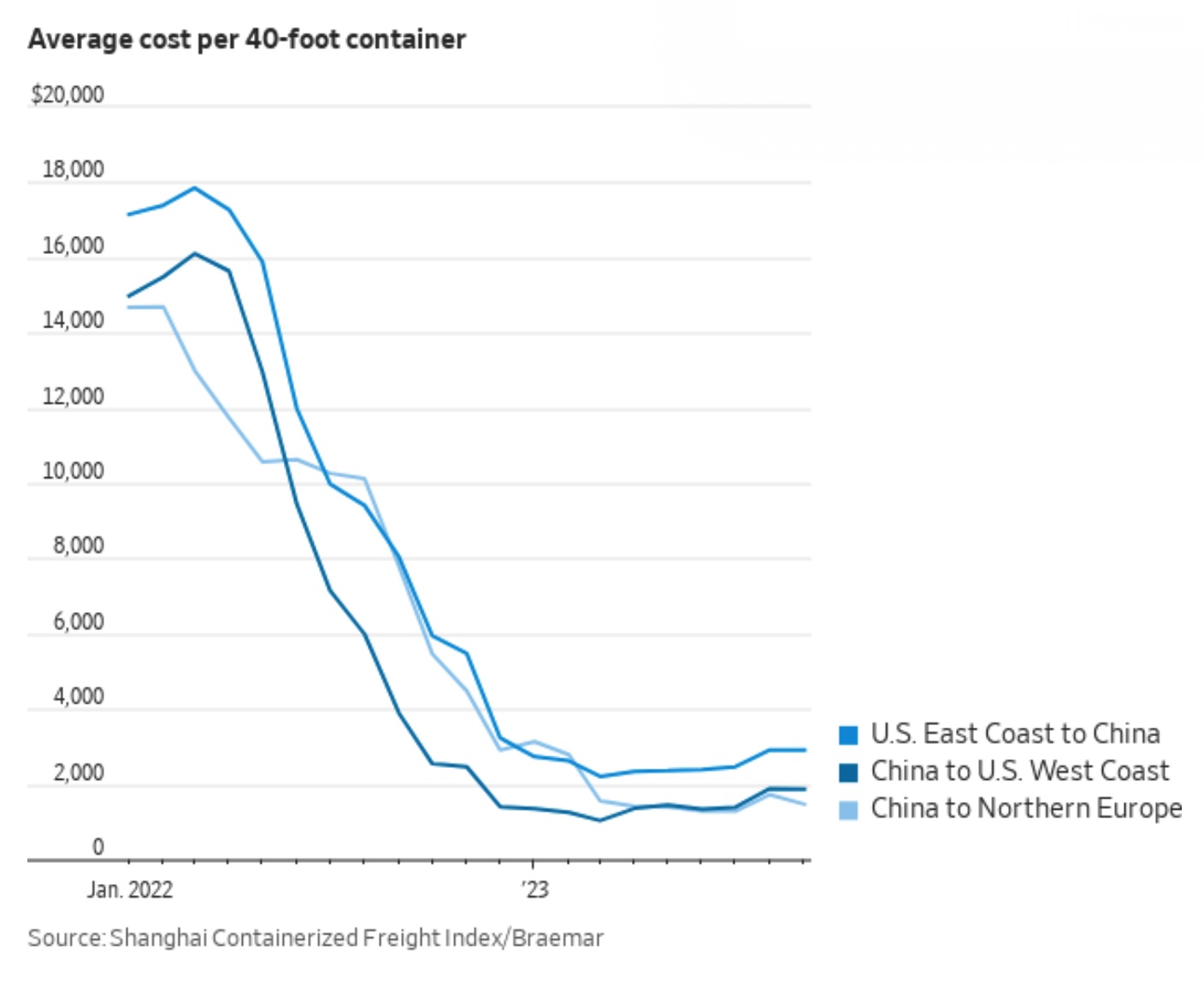

— Container shipping lines, including A.P. Moller-Maersk, are facing significant challenges, with a sharp decline in profits and the need to cut more than 10,000 jobs. A.P. Moller-Maersk's profits have plummeted from $8.88 billion to $521 million, and its core Maersk Line container revenue has fallen by 56% compared to the previous year. The most concerning signal is that the Ocean division has posted a loss for the first time in several years. A Wall Street Journal report (link) says these challenges go beyond the typical cyclical trends in the shipping industry. Container lines have ordered too many ships, leading to overcapacity and a decline in freight rates. Unlike retailers, who can reduce their inventory during periods of overstock, carriers cannot easily eliminate excess capacity. A.P. Moller-Maersk's job cuts indicate their preparation for a prolonged period of supply-demand imbalance in the industry.

— USDA daily export sales:

- 126,000 MT soybeans to China, 2023-2024 marketing year

- 289,575 MT corn to Mexico, 2023-2024 marketing year

— Indonesia extended its rice donation program for certain lower-income households until June 2024. This extension was announced by Chief Economic Affairs Minister Airlangga Hartarto. Initially, the program was scheduled to run until December. The extended effort will benefit approximately 21.3 million lower-income households. Additionally, the government of Indonesia plans to remove import duties on specific types of rice, although the exact details of these rice types were not provided in the reports. Furthermore, the Indonesian Food Procurement Import Company (Bulog) has stated that it will set a rice import quota of 2 million metric tons (MMT) for the year 2024. However, actual rice imports will depend on domestic supply and demand conditions. This decision to import additional rice aligns with Indonesia's efforts to address reduced rice supplies and ensure an adequate food supply for its population.

— India to extend free food program by five years. India plans to extend its free food grains program by five years, Prime Minister Narendra Modi said on Saturday, as the government tries to shield consumers from rising food prices ahead of a general election early next year. The extension will offer relief to consumers, but it will also lead to higher government spending and require New Delhi to procure more wheat and rice from farmers to sustain the welfare program. However, a government source contended there will not be a major fiscal impact in 2024 and 2025 because of the extension, calling the situation “manageable.”

— Wheat futures have experienced a rebound, reaching the level of $5.70 per bushel. This rebound comes after hitting a one-month low of $5.56 on October 31. The increase in wheat prices is attributed to ongoing supply uncertainty in Europe's major wheat-producing region. There have been reports of the Russian military shelling Black Sea shipping routes in Ukraine, which has raised concerns about the safety of civilian ships involved in grain trade from Ukrainian ports. Meanwhile, drier weather conditions in Argentina and Australia have eased previous expectations of abundant wheat supplies from these key producers. However, poor wheat crop prospects in Brazil have traders signaling the need for imports, initialy from Argentina. Despite the recent rebound, wheat futures remain nearly 28% lower year-to-date due to strong supplies from other sources. According to the latest WASDE (World Agricultural Supply and Demand Estimates) report from USDA, Russia is expected to produce 85 million tonnes of wheat in the 2023/34 marketing year, resulting in record-high exports of 50 million tonnes for that period, making Russia the largest wheat exporter in the world.

— Ag trade update: Algeria tendered to buy 50,000 MT of optional origin soft milling wheat.

— Over the course of this week, more than 60 record-high temperatures are anticipated in various regions from Arizona to New York. The unseasonably warm conditions are expected to persist from today through Wednesday. Initially, the above-average temperatures will affect parts of the southwestern United States and gradually spread eastward as the week progresses, as indicated by meteorologists. However, this warm spell is not expected to last long in some areas, as cold air is predicted to return by Friday. For example, St. Louis is projected to experience a sharp temperature drop, going from a high of 83 degrees on Wednesday to 61 degrees. Similarly, Denver and several other Western areas are expected to see a rapid decline in temperatures, transitioning from highs in the mid-70s on Tuesday to the high 40s within a single day.

— NWS weather outlook: More unsettled weather expected to bring beneficial precipitation across the Pacific Northwest and the Northern Rockies over the next couple of days... ...Mixed light rain and snow will brush the northern borders of the Northern Plains to the interior Northeast... ...Fair and mild weather expected to continue from the southwestern U.S. to much of the eastern U.S; cool Pacific air arrives over the West today.

NWS

Items in Pro Farmer's First Thing Today include:

• Soybeans and corn higher, wheat weaker overnight

• Some weekend rains in dry areas of Brazil

|

CONGRESS |

— House on Friday passed a bill known as the Stop Harboring Iranian Petroleum Act (SHIPS) in a decisive vote of 342-69 — 133 Democrats joining all but one Republican. This bill calls for sanctions on entities involved in Iranian oil exports, including port owners and operators of vessels transporting Iranian oil. It also places pressure on the Biden administration to address Iran's support for Hamas in the aftermath of the recent attack on Israel. The administration had frozen $6 billion in Qatar, originally intended for negotiations concerning American hostages, due to the attack. While a companion bill exists in the Senate, it has not yet been scheduled for a vote.

— No action likely this week on House stopgap spending plan. House Republicans are not expected to attempt passing a stopgap funding bill this week, according to reports. Government funding is set to run out on Nov. 17, and if the House does not pass a continuing resolution (CR) this week, Congress will face a tight deadline next week. House Speaker Mike Johnson's (R-La.) leadership team reportedly is considering the possibility of a "laddered CR," which would fund individual government agencies on a rolling basis. They are also exploring the option of attaching aid for Israel to a stopgap funding bill.

Up next: The House Republican Conference will discuss their strategy for addressing government funding this week.

|

ISRAEL/HAMAS CONFLICT |

— Latest developments in the Israel-Gaza conflict:

- Israeli troops have reportedly encircled Gaza City and divided the coastal enclave into two parts. Their intention is to enter the city within the next two days, as reported by Israeli media. This suggests a significant military operation within Gaza City by Israeli forces.

- There have been reports of partial restoration of internet services in Gaza. This comes after the region experienced its third communications and internet blackout since the conflict began. The blackout may have had significant implications for communication and information flow in Gaza.

- A Jordanian cargo plane conducted an airdrop of aid supplies over the Gaza Strip. Israeli media indicated that this operation was coordinated with Israel's army. This airdrop is noteworthy as it marks the first known parachute delivery of aid during the ongoing conflict.

|

RUSSIA/UKRAINE |

— Moscow has found ways to circumvent a Western price cap on Russian oil, moving crude on a fleet of aging tankers on which the sanctions have limited traction. The discount at which Moscow sells its oil relative to global prices has shrunk, boosting Russia’s war chest, the Wall Street Journal explains (link). The U.S. and its allies are discussing new ways to tighten enforcement and squeeze Russia’s profits.

Of note: Oil and gas tax revenue to the Russian budget in October more than doubled from September.

|

POLICY UPDATE |

— Passage of a new farm bill in Congress is facing insurmountable near-term challenges, with House Democrats charging Republicans are pushing for subsidies for specific Southern crops, potentially at the expense of food aid and conservation programs. As noted previously, House Agriculture Committee ranking member David Scott (D-Ga.) has called for a temporary one-year extension to the bill due to what he sees as increasing extremism and cynicism in the House Republican Conference, making a five-year farm bill reauthorization by year-end less likely.

But House Ag Chairman G.T. Thompson (R-Pa.) told a home-state newspaper (link) to expect a farm bill vote in the House during December. This would require a tight timeline for drafting, debating, and voting on the $1.51 trillion bill in December. House Speaker Mike Johnson (R-La.) has allotted one week for House debate of the farm bill in December, said Thompson, so he planned to release a first-round draft two weeks ahead of debate, with the Agriculture Committee to approve it the following week.

The thorny issue: Democrats say the proposed changes in the House bill include increasing subsidies for select crops such as peanuts, cotton, and rice, which will not receive price increases under the prior 2018 Farm Bill like corn and soybeans To fund these increases, Republican supporters reportedly want to cut food stamp aid and divert funds from conservation payments.

Of note: Even a “simple” one-year extension is not so simple. Reason: House GOP conservatives are looking to cut spending, not add. Extending the farm bill would likely include funding for so-called “orphan” programs no longer covered. Another critical need is extending the Dairy Margin Coverage program.

|

CHINA UPDATE |

— Gallup, a prominent polling and consulting group based in Washington, has decided to withdraw from China, becoming the latest foreign company to do so amid increasing scrutiny of western consultancies and growing geopolitical tensions. Gallup had been operating in China since 1993, with offices in Beijing, Shanghai, and Shenzhen. It employed dozens of staff who worked as consultants to help Chinese companies restructure and improve their marketing strategies. Conducting public opinion surveys was challenging due to strict Chinese regulations governing foreign organizations conducting such surveys. As a result, Gallup informed its clients this week that it would be retreating from China, relocating some projects outside the country, and canceling others. The company released a statement saying, "Regrettably, Gallup has made the decision to close its operations in China." The Chinese state-owned tabloid Global Times accused Gallup of serving as a tool to contain China and maintain U.S. dominance.

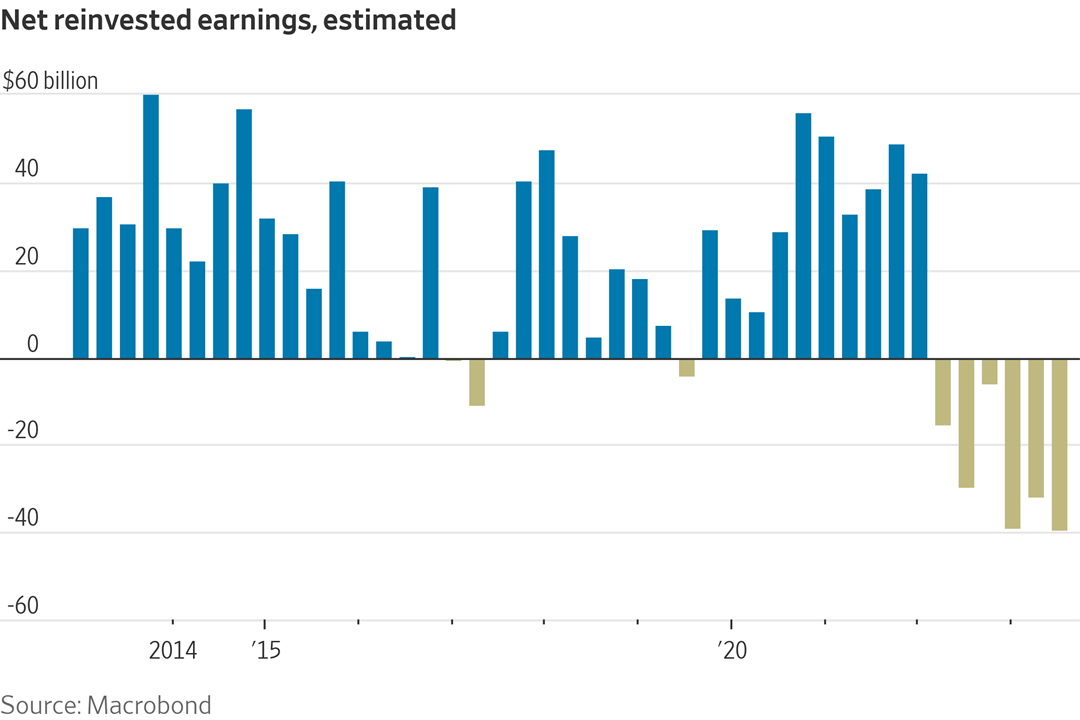

— Foreign companies are pulling profits out of China. After years of plowing money made in China back into China, foreign companies are now taking their earnings out of the country amid slowing economic growth and tensions between Beijing and Washington. The Wall Street Journal (link) looked into an unusually sustained run of profit outflows that has pushed overall foreign direct investment in the world’s second-largest economy into the red for the first time in a quarter of a century.

— Treasury Secretary Janet Yellen is scheduled to meet with her Chinese counterpart, He Lifeng, who is the Chinese Vice Premier. These talks are set to take place on Nov. 9-10 in San Francisco. This meeting represents a move towards improving and normalizing relations between the U.S. and China. It also precedes the anticipated meeting between President Joe Biden and Chinese President Xi Jinping at the upcoming APEC (Asia-Pacific Economic Cooperation) summit.

— Chinese Premier Li Qiang pledged to expand market access and boost imports as part of efforts to stimulate economic growth and maintain openness in China. He made these commitments in a speech at the China International Import Expo in Shanghai. Key points from Li Qiang's speech and related developments include:

- Market Access and Import Expansion: Premier Li stated that China would continue to promote openness with inclusiveness and benefit-sharing and actively expand imports. This pledge comes at a time when the Chinese economy has been experiencing a slowdown, and imports have declined for several consecutive months.

- Protection of Foreign Investors' Rights: Premier Li also assured that China would protect the rights and interests of foreign investors in accordance with the law. This assurance follows concerns about foreign investment into China turning negative for the first time since records began in 1998. The declining foreign direct investment (FDI) reflects factors such as strained international relations, increased attractiveness of keeping funds overseas, and differing interest rate policies between China and advanced economies.

- Economic Recovery and Foreign Investment: China has been actively seeking to attract more foreign investors to aid its economic recovery. While advanced economies have been raising interest rates, China has been lowering them to stimulate its economy.

- Positive Developments with Australia: Australian Prime Minister Anthony Albanese, attending the expo, expressed a desire to work constructively with China, emphasizing the importance of dialogue and cooperation. He highlighted recent positive steps in trade relations between Australia and China, including the removal of trade restrictions on Australian products like barley, coal, and timber.

- Data Flow and Data Law: Premier Li also pledged that China would be more proactive in promoting the orderly and free flow of data in accordance with the law. This commitment is significant in the context of China's data regulations, which have raised concerns among multinational corporations operating in the country. China has recently proposed relaxing some data flow restrictions to address these concerns and boost economic growth.

- China International Import Expo (CIIE): The CIIE is an annual event aimed at providing foreign exporters with opportunities to increase trade with China. The pandemic has affected attendance in recent years, but the expo remains a key platform for international trade relations.

Bottom line: Premier Li Qiang's speech at the China International Import Expo underscores China's commitment to openness, boosting imports, and protecting foreign investors' rights amid economic challenges and evolving international dynamics. It also reflects efforts to address concerns related to data regulations and promote trade cooperation with other countries.

— China says Australia’s exporters can come back. Some say no thanks. Trade leads agenda for Anthony Albanese on first visit by Australian leader to China since diplomatic rift in 2020. Link for more via the Wall Street Journal.

— BBC News: The U.S. is quietly arming Taiwan to the teeth. When President Joe Biden recently signed off on a $80 million grant to Taiwan for the purchase of American military equipment, China said it "deplores and opposes" what Washington had done. Link for more.

— Brookings Institution: Peak China: Why do China’s growth projections differ so much? Are China’s problems merely a slump, or signs of lasting decline? Link for details.

|

TRADE POLICY |

— An almost century-old trade rule called "de minimis" is causing new challenges for U.S. retailers, particularly in the face of e-commerce competition, the New York Times’ DealBook reports.

Background. The "de minimis" rule exempts packages shipped into the U.S. from duties and fees if their value is less than $800. In other words, packages worth less than $800 are not subject to import taxes or charges.

Chinese-founded online retailers like Shein and Temu have disrupted the U.S. retail industry by delivering merchandise directly from their overseas warehouses to customers' homes. Because of this, most of their packages are valued at less than $800, allowing them to avoid duties and fees. They are estimated to account for around 30% of daily packages shipped under this provision.

Products made overseas and shipped in bulk to the U.S. by traditional retailers are typically stored in U.S. warehouses before being sent to customers. These products are less likely to fall under the $800 threshold and are thus subject to import fees.

U.S. retailers argue that the de minimis rule puts them at a competitive disadvantage. They believe that if the rule is not changed, it could lead to job losses in the United States. Some U.S. retailers are urging Congress to expand the de minimis rule to include U.S. distribution centers located in foreign trade zones. In these zones, companies are not required to immediately pay duty fees for imported products, allowing them to manage cash flow more effectively.

Some industry leaders prefer alternative approaches. For instance, there is support for legislation that would exclude "nonmarket economies" like China and Russia from using the de minimis exception. Others even advocate for banning all e-commerce shipments from utilizing the de minimis exception.

Incentive for offshoring. Critics argue that the current de minimis rule creates an incentive for companies to move their distribution offshore to take advantage of the exemption. They seek to address this issue through changes to the rule.

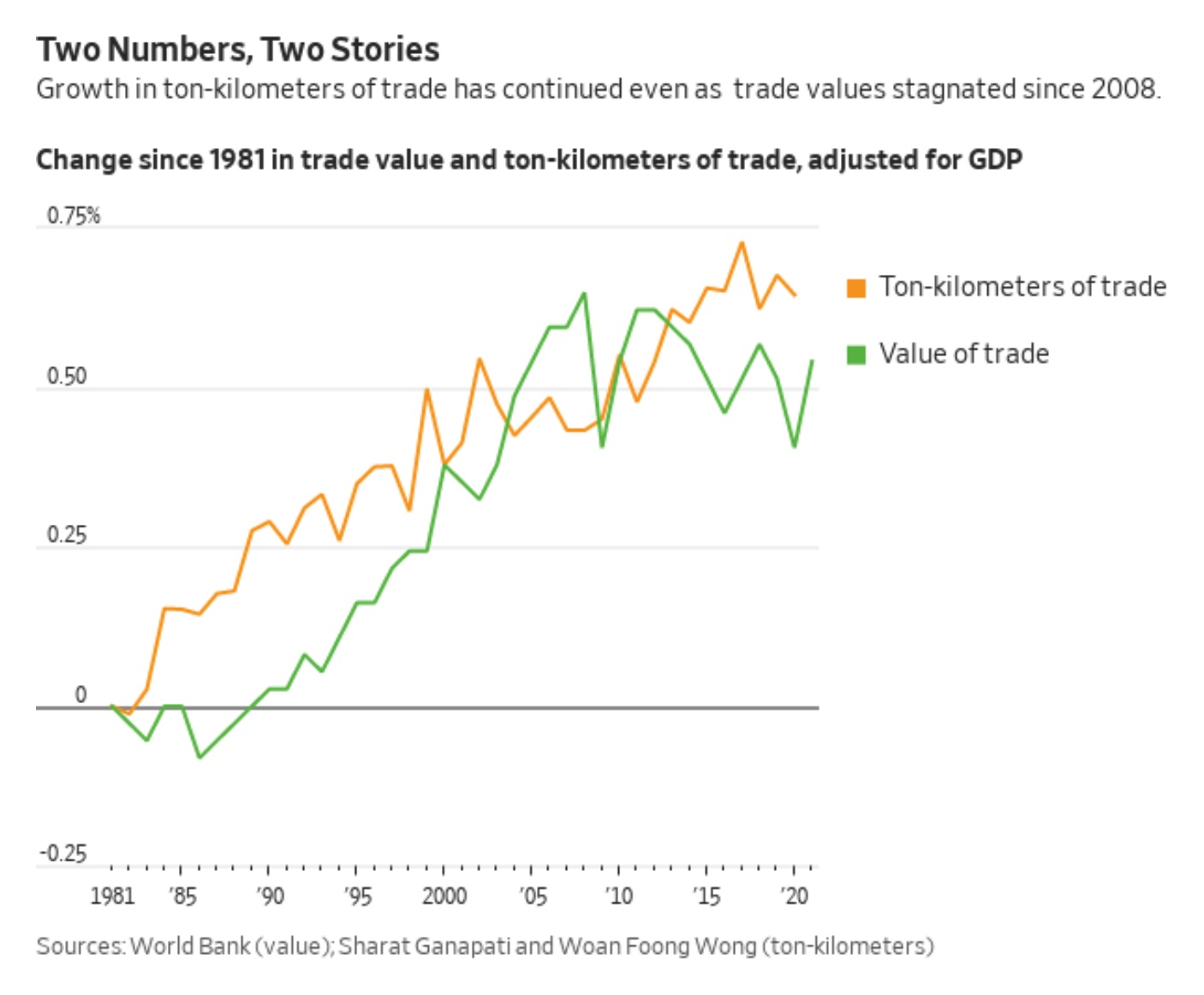

— Is global trade really in decline? Depends on what you are using to calculate the answer. A Wall Street Journal item (link) notes that two conflicting sets of data provide differing perspectives on the state of globalization:

- Traditional Metrics: The article notes that over the past 15 years, there has been a consensus that globalization has been in decline. One commonly used metric to support this view is the ratio of trade (the dollar value of exports and imports) to global gross domestic product (GDP). This ratio reached its peak in 2008 but has not recovered since, leading many to believe that globalization has stagnated or reversed.

- New Metric: The article introduces a new metric, the "ton-kilometer," which measures the total distance traveled by freight multiplied by its total weight. This metric indicates that more goods are being transported over longer distances than ever before, seemingly contradicting the idea of globalization decline. According to this metric, ton-kilometers of trade increased by 49% from 2008 to 2019, outpacing global GDP growth.

Bottom line: The article suggests that the apparent contradiction between these two sets of data can be resolved by considering that the value of trade might be decreasing because items being shipped are becoming cheaper per ton. This could occur due to falling prices per ton, a shift in the mix of traded goods towards lower-cost items, or both. For example, raw materials like lithium have become important in various industries and are cheaper per ton compared to high-value consumer goods like iPhones. The article also highlights that a significant portion of global trade involves bulk goods like agricultural products, natural resources, or refined petroleum, which have lower prices per ton. Additionally, international trade in services, which includes cross-border financial services, telecommunications, and intellectual property, has continued to rise. The conclusion is that while traditional trade metrics may suggest a decline in globalization, alternative measures such as ton-kilometers and the persistence of global supply chains indicate that globalization might be more resilient than previously thought.

|

ENERGY & CLIMATE CHANGE |

— EPA defends its decision to modify the renewable fuel standards (RFS) program against objections from some fuel refiners. Key points:

- EPA's Defense: EPA on Friday (Nov. 3) argued before the D.C. Circuit that its decision to make changes to the renewable fuel standards program was based on the Clean Air Act and that it "reasonably set and fully explained the 2022 volume requirements for total renewable fuel and advanced biofuel" within the authority granted by the statute.

- Clean Air Act Authority: EPA contends it has the discretion to set annual standards for renewable fuel volume targets, which fuel refiners and importers must follow to reduce greenhouse gas emissions. They argue that they considered both the program's implementation and statutory factors while making their decisions.

- Changes Made: EPA's final rule, effective from Aug. 30, 2022, modified the 2021 and 2022 volume targets for different types of renewable fuels and established the 2022 volume target for biomass-based diesel. It also changed volume requirements for 2020, established annual percentage standards for obligated parties in 2020, 2021, and 2022.

- Refiners' Objections: Refineries and biofuel groups argued that EPA's rule did not align with federal statute requirements. They claimed that EPA increased renewable fuel requirements for 2022 to unreasonably high levels and disregarded statutory criteria.

- Small Refinery Exemptions: The dispute also involved hypothetical future small refinery exemptions, with refiners contending that EPA wrongly reallocated them to nonexempt obligated parties.

- Cellulosic Biofuel Volume: The biofuel petitioners argued that EPA set the required cellulosic biofuel volumes too low due to a misinterpretation of the cellulosic waiver provision, which is one of the types of renewable fuels regulated by EPA.

- Compliance with Standards: Obligated parties can meet fuel standards by retiring credits, known as renewable identification numbers (RINs), which they acquire through blending renewable fuels or purchasing them from third parties.

- Waivers for Cellulosic Biofuel: EPA can reduce or waive the required cellulosic volume if the projected volume of cellulosic biofuel production for a year is less than the statutory requirement. Biofuel groups claimed that EPA failed to include carryover cellulosic RINs in its waiver decisions.

- RIN Lifespan: EPA disagreed with refiners' suggestions that RINs from 2015 or 2016 could be used for compliance, stating that such an approach would be inconsistent with the statute's provision that RINs have a 12-month lifespan.

- Supplemental Obligation: EPA imposed supplemental obligations in response to a 2017 court opinion, which raised questions about the fairness of subjecting obligated parties that were not in the market in 2016 to these obligations. EPA argued that it felt compelled to take action to address the court's remand, and any approach it considered would have imposed some burden on obligated parties.

Bottom line: EPA defended its actions in modifying renewable fuel standards against claims from industry groups that the changes do not comply with federal law. The case involves complex legal interpretations and disagreements over the interpretation of the Clean Air Act and its requirements.

— Virgin Atlantic gets U.K. approval for 100% SAF in transatlantic flight. Virgin Atlantic received approval from the U.K. government for a transatlantic flight from London to New York, scheduled for Nov. 28, powered entirely by sustainable aviation fuel (SAF). However, the airline still needs regulatory approval for the flight from U.S. and Canadian authorities. The U.K.'s approval came after a series of technical reviews conducted by Britain's Civil Aviation Authority (CAA), which included successful ground testing of the jet engines that will be used on the flight.

Virgin Atlantic is committed to using 10% SAF by 2030 but acknowledges the need for government support to establish a sustainable aviation fuel industry in the U.K. Currently, only 0.5% of aviation fuel used in 2021 was SAF, and it remains relatively expensive, with SAF costing between three to five times more than conventional jet fuel, as reported by Reuters.

— Saudi Arabia looks to China to help build up its renewables industry. Saudi Arabia will be counting on partnerships with Chinese companies to help the Gulf country build up a renewable energy industry of its own, according to an executive at its sovereign wealth fund. Link to more via Caixin.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Tyson Foods issued a recall for approximately 29,819 pounds of fully cooked, breaded, shaped chicken patty products due to potential contamination with extraneous materials, specifically pieces of metal. The recall was initiated after the firm received consumer complaints reporting the presence of small metal pieces in the chicken patty product. These products, which are shaped like dinosaurs, were produced on Sept. 5 and distributed to various states, including Alabama, California, Illinois, Kentucky, Michigan, Ohio, Tennessee, Virginia, and Wisconsin for further distribution at the retail level. Consumers who have purchased these products are advised to either discard them or return them to the place of purchase. It's important to note that there has been one reported minor injury associated with the consumption of the contaminated product. This recall serves as a precautionary measure to ensure the safety of consumers and prevent any further incidents of contamination.

— Burger King does not have immediate plans to expand its plant-based menu offerings in the United States. According to Restaurant Brands CEO Josh Kobza, plant-based options are not currently a significant focus for the company. However, he did acknowledge that there is stable demand for such products. Kobza also mentioned that plant-based options are more popular and in higher demand internationally, particularly in western Europe. This decision from Burger King comes amid challenges faced by producers of plant-based meat substitutes. Companies like Beyond Meat have provided pessimistic outlooks, and Archer-Daniels-Midland has warned of ongoing softness in demand and inventory reductions in the plant-based protein market, which is expected to persist into 2024. Despite these challenges, the company believes that there is a steady demand for plant-based options, but they are not currently a primary focus for Burger King in the U.S. market.

— USDA to reconvene hearing on milk marketing orders. USDA announced that it will reconvene a national public hearing in Carmel, Indiana, to consider and take evidence on proposals to amend the pricing formulas in the 11 Federal Milk Marketing Orders (FMMOs). The hearing will reconvene Nov. 27, according to a notice in the Federal Register (link).

— The New York City Council passed a bill that will mandate chain restaurants to display warnings for items with high sugar content, including sugary drinks and snacks. This requirement will be implemented in phases, commencing in June 2025. This initiative aims to increase public awareness about the sugar content in menu items and promote healthier food choices among consumers dining at chain restaurants in the city. Link for more.

|

HEALTH UPDATE |

— Chinese scientists claim anti-ageing breakthrough with spinal cord discovery. Researchers find protein at ‘toxic’ levels surrounding motor neurons of older monkeys and test whether vitamin C really makes a difference. Link to details via the South China Morning Post.

|

POLITICS & ELECTIONS |

— David Axelrod, the former Obama adviser, is openly wondering whether Biden should run for re-election. While conceding that it’s late for Democrats to change candidates, he wrote of Biden, “What he needs to decide is whether that is wise; whether it’s in HIS best interest or the country’s?”

|

OTHER ITEMS OF NOTE |

— American Banking Association holds Agricultural Bankers Conference, through Wednesday, Oklahoma City. Link for details and speakers.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |