GOP Push for Immigration/Border Policy Changes Impacting Key Legislation

2018 Farm Bill extension | USDA reports | NYT poll: Trump over Biden in key states

Washington Focus

The ongoing debate over immigration and border policies is having a major impact on congressional discussions about gov’t spending and emergency aid packages.

Republicans are pushing for changes in immigration policies aimed at deterring illegal border crossings. They want to address border security issues and make it more difficult for migrants to enter the U.S. without proper documentation.

Democrats, including President Joe Biden, emphasize the need to allocate $13.6 billion to manage the increasing number of migrant arrivals. They argue that this funding is essential to address the current challenges at the border.

The debate over immigration is causing tensions in Congress, particularly as it relates to funding for Ukraine and other foreign aid initiatives. There is a risk that disagreements over immigration policies could lead to delays or the derailment of government spending and aid packages.

Democrats are facing pressure to compromise on immigration, with House Speaker Mike Johnson (R-La.) pledging to link a substantial border package to aid for Ukraine. Senate Republicans are also seeking to incorporate policy changes in emergency funding discussions.

Some Republicans are advocating for bipartisan efforts to address border security. They are proposing changes to asylum policies, including raising the bar for "credible fear" claims and reinstating the "Remain in Mexico" policy for asylum-seekers.

Key Democrats are opposed to Republican demands on immigration policy changes. They doubt the possibility of reaching a workable middle ground during time-sensitive funding negotiations.

But some Democratic lawmakers, such as Sen. Mark Kelly (D-Ariz.), express a willingness to address border security issues but reject "draconian" policy ideas that could harm migrants. They seek more humane solutions. Senate Homeland Security Committee Chairman Gary Peters (D-Mich.) urged colleagues to focus on measures that already have bipartisan support, such as increasing the number of Border Patrol agents and Customs and Border Protection officers, which align with President Biden's request. House Minority Leader Hakeem Jeffries (D-N.Y. indicated a willingness to consider any bipartisan border proposal put forward by the Senate.

— Latest stopgap spending measure ends Nov. 17; forget about ‘laddered’ CR. You don’t have to know much if anything about the “development” last week among some House Republicans about a “laddered” stopgap spending bill (continuing resolution/CR), setting staggered deadlines for individual appropriations bills. It simply won’t happen.

So, what will happen to avoid a government shutdown? Talks about a limited CR went late into the night on Saturday. No official decisions, yet. But House Speaker Mike Johnson (R-La.) has previously indicated he will push for a CR until Jan. 15, giving lawmakers more time to work on fiscal year 2024 appropriations bills. “The reason I look a little haggard this morning is because I was up late last night,” Johnson said on Fox News Sunday. “We worked through the weekend on a stopgap measure. We recognize that we may not get all the appropriations bills done by this deadline of Nov. 17, but we are going to continue in good faith.”

— Perspective on the interest costs of the U.S. federal debt comes from Dr. Vince Malanga, president of LaSalle Economic: “The Treasury is currently spending nearly $9 billion per day on debt service, and this will continue rising going forward. The Fed Chair refuses to admonish the Congress and administration for not addressing the deficit, but it is going to have to be addressed before all control is lost.”

— Farm bill extension coming for a host of reasons. Analysts say the 2018 Farm Bill will likely be extended for one year for a host of reasons, including: Limited time remaining this year, and competing work, including a continuing resolution, appropriations bills, supplementals, NDAA, FISA, FAA. Add in policy and funding disagreements and you conclude something Congress all too frequently chooses: Kick the can down the road.

The latest top House member to call for a one-year extension is House Ag Committee Ranking Member David Scott (D-Ga.). “While we continue the bipartisan effort on the House Agriculture Committee to craft a new farm bill, the extremism and cynicism that has taken hold of the broader House Republican Conference makes a five-year farm bill reauthorization by the year's end increasingly unlikely. Therefore, I am calling on my colleagues to support a one-year extension of the 2018 Farm Bill. A one-year extension is the responsible thing to do. It allows our farmers, ranchers, and foresters to operate with an element of certainty while we continue working on a bipartisan five-year farm bill. Agriculture Committee Democrats remain committed to passing a strong, effective, and bipartisan farm bill as quickly as we can. However, we refuse to subject our Nation’s farmers, ranchers, foresters, and families to an artificially rushed and haphazard farm bill simply because House Republicans faced a leadership crisis and have created uncertainty regarding any bipartisan legislation being able to pass on the House Floor.”

— Key House GOP member: ‘Futile’ to bring up agriculture spending bill again. Rep. Andy Harris (R-Md.), chair of the subcommittee responsible for crafting the House GOP's annual Agriculture funding bill, says he has doubts about the bill's chances of passage soon. House Republicans had aimed to pass all their remaining annual government funding bills before a looming Nov. 17 deadline to avoid a government shutdown. However, the Agriculture funding bill has proven to be a stumbling block.

Background. The House GOP previously failed to pass the Agriculture funding bill earlier in the year. One major point of contention in the bill is a provision related to limiting access to the abortion pill known as mifepristone. Some members of the Republican party are divided on this issue, with some insisting on keeping the provision in the bill, while others are demanding its removal. Rep. Harris acknowledges that the division over the mifepristone provision makes it difficult to find a resolution within the party. Consequently, he believes the House may have to proceed to conference with the Senate based on the current state of the bill.

House Speaker Mike Johnson (R-La.) initially proposed a "working group to address member concerns" with the bill to address its problems. However, Rep. Harris remains skeptical about the bill's chances, even if some spending issues are addressed. Harris points out that there is limited time for legislative action, as Congress faces a pressing deadline to prevent a government shutdown. He suggests that going to conference with the Senate is the practical way forward, given the delays and divisions.

Conference trouble ahead: Johnson continues moving spending bills through the House along party lines, at levels that violate the bipartisan budget deal enacted this year. In the Senate a package of spending bills passed this past week on a broadly bipartisan vote of 82-15.

— The Biden administration expressed support for "humanitarian pauses" in Gaza to allow expanded aid to reach the region. Secretary of State Antony Blinken mentioned this support and indicated that the Israeli government had agreed to discuss how such a humanitarian pause could be implemented. Blinken made it clear that he rejected the idea of a cease-fire, which Israeli Prime Minister Benjamin Netanyahu has refused unless it includes the return of hostages held by Hamas.

Blinken's remarks came after he met with Middle Eastern leaders in Amman and spent a day in Tel Aviv. He spoke to reporters alongside the foreign ministers of Jordan and Egypt.

Blinken on Sunday made an unannounced visit to the West Bank to meet with the president of the Palestinian Authority, Mahmoud Abbas. Blinken worked to assure Palestinian leaders that the U.S. is committed to helping Palestinian civilians and was met with a demand for an immediate cease.

Blinken also made an unannounced visit yesterday to Baghdad, showing support for Iraq’s prime minister, Mohammed Shia Al-Sudani, and sending a message to Iran about the Biden administration’s commitment to defending its personnel.

As President Biden cited progress in achieving a break in the fighting, Iran says the U.S. will be "hit hard" if it doesn’t secure a cease-fire.

— The Asia-Pacific Economic Cooperation (APEC) regional economic forum kicks off Saturday in San Francisco. The 21 APEC Member Economies account for nearly 40% of the global population, nearly 50% of global trade, and more than 60% of U.S. goods exports.

President Joe Biden is expected to meet with Chinese President Xi Jinping on the sidelines of the APEC meeting.

Of note: On Monday, Xi and premier Li Chiang will meet the Australian prime minister at the end of the latter’s three-day state visit to the country

— Ukrainian President Volodymyr Zelenskyy has invited former President Trump to visit Ukraine's war zone, challenging Trump's claims that he could quickly end the conflict with Russia. Zelensky made these comments during an interview on NBC's Meet the Press. Trump had previously asserted that he could resolve the Ukraine-Russia war within 24 hours if he were in office. Zelensky responded by stating that Trump is welcome to visit Ukraine, but he would need just 24 minutes, not 24 hours, to explain to Trump that ending the war is not as simple as Trump believes.

Zelensky also expressed skepticism about Trump's ability to bring peace to the region, emphasizing that it can't be negotiated with Russian President Vladimir Putin, even if Trump were to try. He suggested that if Trump is not willing to give up Ukrainian territory or compromise on Ukraine's independence, he would not be able to achieve peace.

When asked if he thought Trump would support Ukraine in its war if he were to win the 2024 presidential election, Zelensky admitted uncertainty, stating that it depends on the opinion of the American people and society.

Meanwhile, Russian forces targeted Ukraine with their biggest drone attack in weeks, amid fears of another winter air campaign against the country’s energy grid.

— Several elections taking place Tuesday could have implications for the 2024 political landscape. Tuesday’s contests will stress test how much Biden’s low approval ratings actually hurt Democrats at the ballot box.

- In Kentucky, traditionally a Republican stronghold in presidential races (Donald Trump carried the state by 26 percentage points in 2020) Democratic Governor Andy Beshear is seeking to win against GOP Attorney General Daniel Cameron. President Joe Biden is very unpopular in the state.

- In Mississippi, another solidly Republican state, Republican Governor Tate Reeves, who has faced scandals during his term, is defending his position against Democrat Brandon Presley.

- Virginia is holding elections for all 140 seats in its state House and Senate. Currently, Democrats control the Senate, while Republicans control the House — Republicans currently control the House of Delegates, 50 to 46. Meanwhile, Democrats hold a majority in the Senate, 22 to 18. There are four open seats up for grabs in the Senate and five in the House. There’s roughly a dozen-and-a-half battleground seats between the state House and Senate. Republican Governor Glenn Youngkin is aggressively campaigning to gain full control of the state to implement his agenda. A strong Republican performance in Virginia could raise concerns for Democrats about the 2024 elections and spark discussions about Youngkin potentially entering the presidential race or being the GOP front-runner later.

- In Ohio, there is a referendum on whether to enshrine abortion rights in the state constitution. A preliminary test in August indicated support for the referendum.

— The third Republican presidential primary debate will be held Wednesday in Miami with a smaller number of candidates (five) on the stage. Former Vice President Mike Pence suspended his campaign for president late last month amid lagging poll numbers and financial challenges, vowing to help elect “principled Republican leaders” moving forward. Trump is not taking part in the debate, echoing his no-show status during the first two debates.

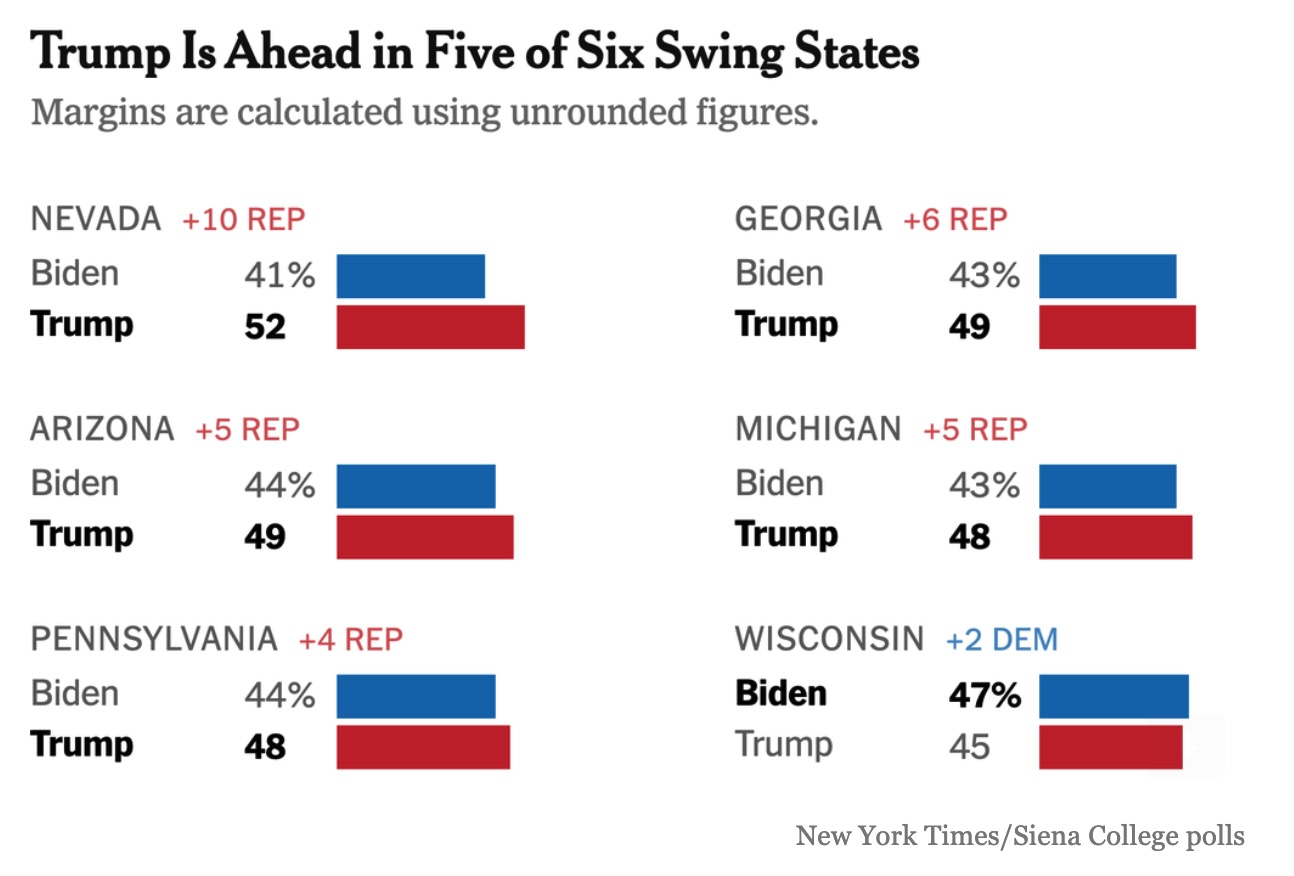

— Trump is ahead of Biden in five of six battleground states via a New York Times/Siena College poll. The poll (link) shows Trump leads at least by four percentage points among registered voters in Pennsylvania, Michigan, Arizona, Georgia and Nevada. Biden leads narrowly in Wisconsin. Of note: Trump saw unprecedented gains among young, Black and Latino voters.

Impact: The Wall Street Journal, in commentary on the poll (link), wrote: “Those are awful numbers for an incumbent and would add up to more than 300 votes in the Electoral College. Numbers like that could help the GOP pick up Senate seats in Michigan, Pennsylvania and Arizona.” The commentary concludes: “In 2020 Mr. Biden won as the Democrat most likely to beat Mr. Trump, and he did. But he now risks squandering that legacy by losing to Mr. Trump in a rematch. Mr. Biden surely doesn’t want to go down in history as the Democrat who overstayed his welcome and restored Donald Trump to power.”

The NYT writes: “The striking results seem to be more a reflection of Biden’s weakness than Trump’s strength. Trump is just as unpopular as he was when he lost the election three years ago, if not slightly more so.”

Some 71% of registered voters in the battlegrounds agree with the statement that Biden is “just too old to be an effective president,” up from around 30% in the run-up to the last election. That includes 51% of Democrats. Only 39% say the same about Trump.

Of concern to Biden: Nearly half of registered voters (49%) in the battleground states say there’s “almost no chance” they’ll support him, an indication of the depth of their dissatisfaction.

Other concerns:

- Nearly two-thirds (62%) say he doesn't have the mental sharpness to be president (44% say the same about Trump).

- A generic Democratic candidate would lead Trump by 8 points (48%-40%). Even Vice President Kamala Harris would perform slightly better than Biden, losing to Trump by 3 points (47%-44%).

Of note: Iowa Gov. Kim Reynolds will endorse Florida Gov. Ron DeSantis at a Des Moines rally tomorrow night, the Des Moines Register reports (link).

Wild card scenario: It’s been rumored for weeks now as some speculate Biden could drop out of the race around March, not wanting to be a lame-duck president by getting out even earlier.

Events of note this week include:

Monday:

- Crop insurance reform. The R Street Institute holds a discussion on "Environmental Benefits of Crop Insurance Reform."

- Global Markets panel. CFTC Global Markets holds a meeting of the Global Markets Advisory Committee.

- U.S./China issues in Congress. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "What's Next for U.S./China Relations: The View from Congress."

- APEC summit. Brookings Institution and the Stanford Center for International Security and Cooperation virtual discussion on "Assessing U.S./China Interaction at APEC (Asia-Pacific Economic Cooperation)."

Tuesday:

- Gene editing. Farm Foundation virtual forum on "Innovation in Gene Editing and Plant Breeding: A Look at Scientific Advancement and Consumer Perspectives in Food and Agriculture."

- IRA components. Treasury Secretary Janet Yellen and IRS Commissioner Danny Werfel deliver remarks on "goals for the 2024 Filing Season and new improvements taxpayers will see thanks to Inflation Reduction Act resources."

- New carbon economy. Politico's E&E News hosts a virtual discussion on "The New Carbon Economy."

Wednesday:

- Federal Reserve. Fed Governor Jerome Powell delivers opening remarks at an event in Washington, DC. For other Federal Reserve speakers during the week, check the Economic Calendar.

- Sustainable aviation. The Meridian International Center holds a discussion on "How Sustainable Aviation Will Take Off," part of the "Diplocraft" series.

- Ukraine situation. Senate Foreign Relations Committee hearing on "U.S. National Security Interests in Ukraine."

- 2024 elections. CQ Roll Call and FiscalNote webinar on "Election 2024: What You Need to Know, One Year Out."

Thursday:

- Federal Reserve. Fed Governor Jerome Powell takes part in a Policy Panel Discussion in Washington, DC.

- U.S. trade policy. Washington International Trade Association virtual discussion on "new paradigms in U.S. trade policy and its implications for the U.S. and the world."

- Biden/Xi meeting. Foreign Policy discussion on "East Meets West: Unpacking U.S./China relations in the lead up to the Biden-Xi Meeting at APEC (Asia-Pacific Economic Cooperation)."

- Global issues. International Monetary Fund (IMF) 24th Jacques Polak Annual Research Conference on "Global Interdependence.” Federal Reserve Board Chairman Jerome Powell; IMF First Deputy Managing Director Gita Gopinath; and Amir Yaron, governor of the Bank of Israel, participate in a discussion on "Monetary Policy Challenges in a Global Economy.”

- Off-year elections. Brookings Institution discussion on "What do the 2023 off-year elections mean for 2024?"

Friday:

- Global issues. Final day of the IMF 24th Jacques Polak Annual Research Conference on "Global Interdependence.”

Economic Reports and Events for the Week

The economics calendar features Federal Reserve consumer credit data for September on Tuesday and the University of Michigan's Consumer Sentiment index for November on Friday.

Federal Reserve Chairman Jerome Powell will speak at a panel at the IMF's annual research conference. European Central Bank President Christine Lagarde, Bank of Japan Governor Kazuo Ueda and Bank of England Governor Andrew Bailey will also speak.

Monday, November 6

- Federal Reserve speaker: Governor Lisa D. Cook

Tuesday, November 7

- International Trade in Goods and Services: A deficit of $60.3 billion is expected in September for total goods and services trade which would compare with a $58.3 billion deficit in August. Advance data on the goods side of September's report showed a $1.2 billion deepening in the deficit.

- Consumer credit is expected to increase $10.0 billion in September versus an unexpected decline of $15.6 billion in August.

- Federal Reserve speakers: Jeffrey Schmid | John Williams | Lorie Logan | Vice Chair for Supervision Michael S. Barr | Governor Christopher J. Waller

- Japan Foreign Minister Yoko Kamikawa hosts her G7 counterparts in Tokyo

- China’s merchandise trade balance is estimated to be posted with annual contraction expected again for both imports and exports.

Wednesday, November 8

- MBA Mortgage Applications

- Wholesale Inventories (Preliminary): The second estimate for September wholesale inventories is for no change which would match the first estimate.

- Federal Reserve speaker: John Williams | Governor Lisa D. Cook | Chair Jerome Powell | ice Chair for Supervision Michael S. Barr | Vice Chair Philip N. Jefferson

Thursday, November 9

- Jobless claims for the Nov. 4 week are expected to come in at 220,000 versus 217,000 in the prior week.

- Federal Reserve speakers: Raphael Bostic | Thomas Barkin | Kathleen O'Neill Paese | Chair Jerome Powell

- Fed Balance Sheet

- Money Supply

- China: Annual contraction is expected for both Chinese consumer prices and producer prices.

Friday, November 10

- Consumer sentiment in the first indication for November, which in October fell more than 4 points to 63.8, is expected to slip slightly further to 63.5.

- Treasury Statement

- Federal Reserve speakers: Lorie Logan | Raphael Bostic

Key USDA & international Ag & Energy Reports and Events

USDA’s monthly batch of reports, including Crop Production and WASDE, will be released Thursday. The week will also see China’s first batch of October trade data and a three-day grain conference in Geneva.

Early release of USDA long-term baseline tables comes Nov. 7. Before you ask: What is released this week will not change when the final report comes out next year. Link to USDA release.

More major energy companies will report earnings during the week, including Aramco on Tuesday. Major industry conferences include the Argus European Crude Conference in London.

Monday, November 6

Ag reports and events:

- Export Inspections

- Crop Progress

- Malaysia’s Nov. 1-5 palm oil exports

Energy reports and events:

- Earnings: Kosmos Energy 3Q; Diamondback Energy 3Q

- Holidays: Colombia; Panama; Russia; Venezuela

Tuesday, November 7

Ag reports and events:

- Purdue Agriculture Sentiment

- China’s 1st batch of October trade data, including soybean, edible oil, rubber and meat & offal imports

- EU weekly grain, oilseed import and export data

- MPOB International Palm Oil Congress, Kuala Lumpur, day 1

- Global Grain Geneva conference, day 1

Energy reports and events:

- API weekly U.S. oil inventory report

- EIA monthly STEO

- China releases first batch of October trade data, including oil, gas and coal imports; oil products imports and exports

- Green Fuels Import Conference, Berlin

- Argus European Crude Conference, London (through Nov. 8)

- Dallas and Kansas City Fed 2023 Energy & Economy Conference, Oklahoma City

- Earnings: Engie 3Q; Aramco; Devon Energy; Enel; Occidental

Wednesday, November 8

Ag reports and events:

- Broiler Hatchery

- Livestock and Meat International Trade Data

- MPOB International Palm Oil Congress, Kuala Lumpur, day 2

- Global Grain Geneva conference, day 2

Energy reports and events:

- Note: EIA is not publishing its weekly U.S. oil inventory report due to a system upgrade; publication resumes on Nov. 15. The Weekly Petroleum Status Report, Ethanol Production and Natural Gas Storage reports will not be released but will be published with two weeks of data on the regular release days the following week.

- Genscape weekly crude inventory report for Europe’s ARA region

- Earnings: Saras; EON; Vestas; TC Energy

- Holiday: Azerbaijan

Thursday, November 9

Ag reports and events:

- Weekly Export Sales

- Cotton Ginnings

- WASDE

- Crop Production

- Cotton: World Markets and Trade

- Grains: World Markets and Trade

- Oilseeds: World Markets and Trade

- World Agricultural Production

- U.S. Agricultural Trade Data Update

- Peanut Prices

- China’s agriculture ministry (CASDE) monthly supply and demand report

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Port of Rouen data on French grain exports

- MPOB International Palm Oil Congress, Kuala Lumpur, day 3

- Global Grain Geneva conference, day 3

- Holiday: Pakistan

Energy reports and events:

- Insights Global weekly oil product inventories in Europe’s ARA region

- European Gas Strategy conference, London

- Earnings: Verbio; DNO ASA; Wood Group; Petrobras; National Grid

- Holiday: Azerbaijan

Friday, November 10

Ag reports and events:

- Holiday: U.S. gov’t to observe Veterans Day (Nov. 11). Not a market holiday.

- Malaysian Palm Oil Board’s monthly report on stockpiles, production and exports

- CFTC commitments of traders weekly report

- FranceAgriMer’s weekly crop condition report

- Malaysia’s Nov. 1-10 palm oil exports

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- Earnings: Mol

- Holiday: Panama

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |