ERP for 2022 Is Own Disaster as Experts Agree USDA Takes Wrong Track

FOMC | Panama Canal | Aid for Israel, Ukraine | EVs | Russia boosts oil exports

|

Today’s Digital Newspaper |

MARKET FOCUS

- Fed holds rates steady but that’s not the biggest development

- Sevens Report on what the Fed decision means for markets

- Jamie Dimon: Texas risks undermining its business-friendly reputation

- South Korea's exports rebound with 5.1% year-on-year growth in October

- Bank of England maintains key interest rate at 15-year high of 5.25%

- IRS: Increased retirement savings limits for 2024 401(k)s and IRAs

- Russia appears to shift away from supply cuts, while Saudi Arabia bears burden

- Guyana's record oil discoveries transform nation into energy powerhouse

- Ag markets today

- Sorghum, soybeans and cotton main export sales to China in most recent week

- StoneX raises corn crop estimate, trims soybean forecast

- Panama Canal officials will cut available slots for ship transits by half this winter

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Senate GOP to combine border & immigration proposal with aid for Ukraine, Israel

- CBO finds House GOP IRS budget cuts attached to Israel aid bill increases deficit

- Stopgap spending measure being discussed to avoid gov’t shutdown

- Both chambers complete action on fiscal year (FY) 2024 appropriations measures

- House has now passed half its spending bills

- Senators passed their first three government-funding bills

- Disaster aid bill fails in Senate, blocking block grant relief authority for Vilsack

ISRAEL/HAMAS CONFLICT

- First evacuees leave Gaza

RUSSIA & UKRAINE

- Ukraine accuses Russia of interfering in Black Sea grain corridor

POLICY

- Is ERP for 2022 as bad as it sounds?

- Biden unveils rural revival plans in Minnesota to address farm decline

- How did Democrats lose control of state agriculture policy?

CHINA

- Record Chinese soybean imports expected this year

- U.S. ag delegation visiting China to talk trade

- China strengthens capital management rules for banks

- China struggles to convince Li mourners of reason for death

- China faces surging coal glut as prices decline, winter demand uncertain

TRADE POLICY

- Mexico’s moment: The biggest U.S. trading partner is no longer China

ENERGY & CLIMATE CHANGE

- EVs make up 1 in 5 cars in California

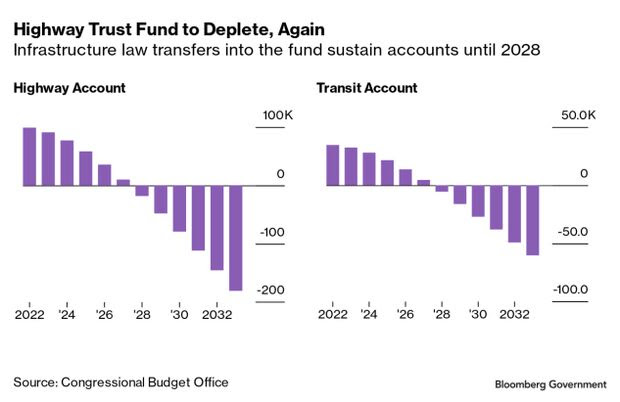

- Highway Trust Fund faces depletion amidst improved gas mileage and EV transition

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- USDA publishes final rule on organic livestock and poultry standards

HEALTH UPDATE

- Ozempic sales up 58% as drugmaker Novo Nordisk nets record profits

POLITICS & ELECTIONS

- House Appropriations Chair Kay Granger (R-Texas) announces retirement

- Rep. Ken Buck (R-Colo.) announces he is not running for re-election next fall

- Rep. George Santos avoids his second expulsion; vote fell short of two-thirds needed

OTHER ITEMS OF NOTE

- Another Roundup loss

- The Texas Rangers won their first World Series

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed to firmer overnight. U.S. Dow opened up nearly 200 points higher. In Asia, Japan +1.1%. Hong Kong +0.8%. China -0.5%. India +0.8%. In Europe, at midday, London +1.3%. Paris +1.8%. Frankfurt +1.7%.

U.S. equities yesterday: The Dow ended up 221.71 points, 0.67%, at 33,274.58. The Nasdaq rose 210.23 points, 1064%, at 13,061.47. The S&P 500 gained 44.06 points, 1.05%, at 4,237.86.

— Agriculture markets yesterday:

- Corn: December corn fell 3 3/4 cents to $4.75, the lowest close since Sept. 18.

- Soy complex: January soybeans rose 4 1/2 cents to $13.15 and near mid-range. December soybean meal fell 60 cents to $430.40 and nearer the session high. December bean oil lost 152 points at 49.90 cents, near the session low and hit a five-month low.

- Wheat: December SRW futures rose 5 1/2 cents to $5.61 3/4, settling nearer the session high. December HRW futures rallied 10 3/4 cents before closing at $6.40, near session highs. December spring wheat futures fell 1/4 cents to $7.09.

- Cotton: December cotton fell 178 points to 79.44 cents and near the session low. Prices hit a 3.5-month low.

- Cattle: December live cattle futures edged up 7.5 cents to $183.625. Meanwhile, expiring November feeder futures climbed 87.5 cents to $238.575, while most-active January gained 82.5 cents to $238.025.

- Hogs: December lean hog futures fell $1.575 to $70.15, settling near the session low.

— Ag markets today: Soybeans traded sharply higher overnight, while corn and most wheat contracts posted milder gains. As of 7:30 a.m. ET, corn futures were trading a penny higher, soybeans were mostly 10 to 11 cents higher, SRW wheat was fractionally lower to a penny higher, HRW wheat was fractionally to 1 cent higher and HRS wheat was 1 to 2 cents higher. Front-month crude oil futures were $1.25 higher, and the U.S. dollar index was nearly 800 points lower.

Packers cut wholesale beef prices to spur movement. Wholesale beef prices fell $3.00 for Choice and 95 cents for Select on Wednesday, though movement was strong at 136 loads. While there’s still solid retailer demand on price pullbacks, packers have struggled to push Choice beef above $309.00 and Select above $280.00.

Hog futures rally halted. Lean hog futures finished sharply lower and posted bearish reversals on Wednesday as the recent corrective buying ran out of steam. Traders also widened the discount December futures hold to the cash index, which is down another 19 cents to $76.94 as of Oct. 31, after actively tightening it over the past week-plus.

— Quotes of note:

- Fedspeak. Federal Reserve Chair Jerome Powell hinted the U.S. central bank may now be finished with the most aggressive tightening cycle in four decades, a dovish pivot that has been cheered by global markets. “The question we’re asking is: Should we hike more?” Powell told reporters yesterday after the Fed held off on raising interest rates for a second consecutive policy meeting. “Slowing down is giving us, I think, a better sense of how much more we need to do, if we need to do more.”

- Jamie Dimon said Texas risks undermining its business-friendly reputation with laws designed to punish Wall Street banks for policies that limit work with the gun and fossil fuel industries. “Texas is a wonderful, welcoming place” for business, the longtime JPMorgan Chase & Co. chief executive officer said Wednesday. “The government’s done a magnificent job and that’s why you have the growth, why unemployment is so low, why people are moving companies and jobs here… I think it’s a mistake to damage it even a little way,” said Dimon. Link for more.

- Sevens Report on what the Fed decision means for markets: “As long as the ‘Three Pillars’ of the rally were in place (soft landing, disinflation, Fed almost done) then the chances of a material drop in stocks was slim. And despite the short-term risks from geopolitics and the spike higher in yields, I have maintained that opinion and will do so until one (or more) of those pillars is destroyed. In the very short term, headlines will likely keep volatility elevated and earnings season is creating a valuation risk. And for the S&P 500 to trade above 4,300 we will need positive geopolitical and domestic politics headlines. But beyond the short term, I still view this market broadly as a ‘hold’ as the net impact of the Fed meeting (and all of this week’s news so far) is to imply that the S&P 500 should remain largely rangebound between 4,350ish on the high end and 4,200ish on the low end, until such time as those ‘Three Pillars’ are either no longer needed or are destroyed.”

- “The advantage I have is that I speak the language of the customer.” — Pat Shanahan, a former Boeing executive who is interim CEO of troubled Boeing supplier Spirit AeroSystems.

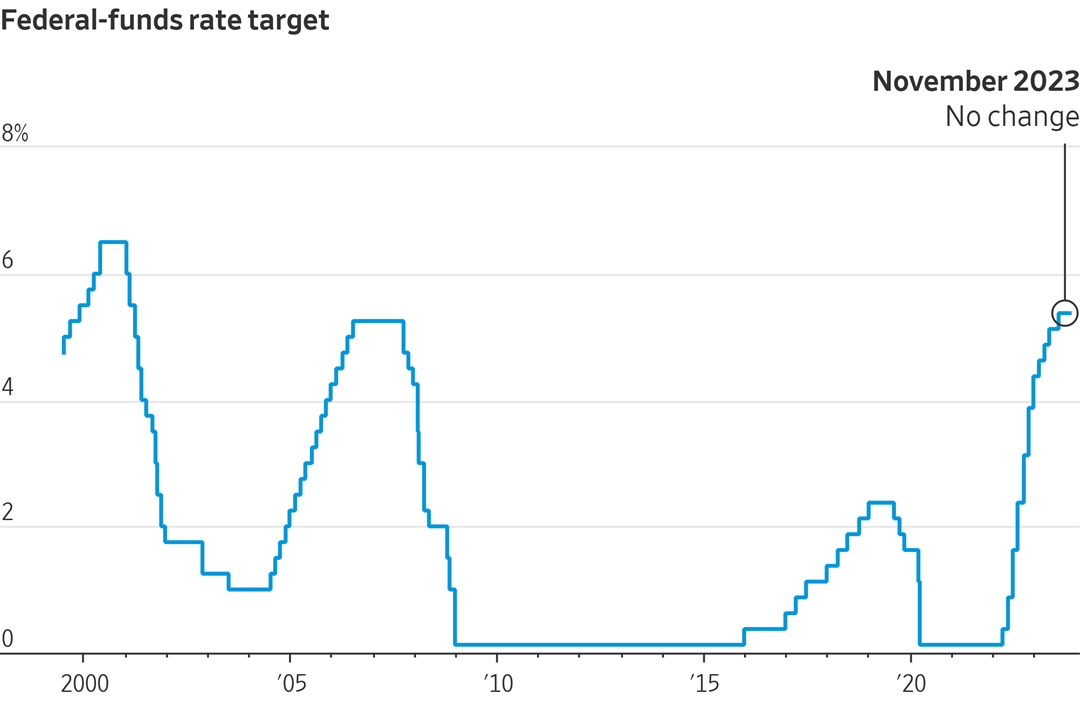

— Fed holds rates steady, leaves door open for future rate hike; focus on inflation and uncertainty remains. Highlights of the FOMC decision and Fed Chair Jerome Powell’s presser:

- The Federal Reserve on Wednesday as expected opted to maintain its current monetary policy with the target range for the Fed funds rate at 5.25% to 5.5%.

- Fed Chairman Jerome Powell emphasized rate decisions are made on a meeting-by-meeting basis.

- The focus remains on higher bond yields and whether they can combat inflation effectively.

- The U.S. economy was described as "strong" in the post-meeting statement, with a continued emphasis on elevated inflation.

- The Fed is unsure if current rates are sufficiently restrictive to address inflation concerns.

- Powell dismissed the idea of rate cuts and suggested the Fed is uncertain about the level of restrictiveness.

- Fed staff is closely monitoring rising bond rates.

- Powell avoided providing specific numbers regarding the impact of bond rates on rate hikes.

- The Fed's "dot plot" forecasts are viewed as less accurate over time.

- No consideration of changing the pace of balance sheet runoff.

- The Fed remains committed to addressing inflation concerns.

- Fed staff has not reintroduced the possibility of a recession in their outlook.

Bottom line: Overall, the Fed faces uncertainties regarding rate hikes, the level of restrictiveness, and how long rates will be maintained at current levels.

Market impact: The futures market has slashed the odds for an interest-rate increase at next month’s meeting to roughly one in four — down from the 40 percent level before yesterday’s Fed decision to hold rates unchanged, according to Bloomberg. That optimism has seen investors pour back into stocks and bonds.

— South Korea's exports rebound with 5.1% year-on-year growth in October; U.S. demand surges while China slump eases. In October, South Korea experienced a 5.1% year-on-year increase in exports, reaching a total of $55 billion. This marks the first positive growth in over a year. Notably, exports to the U.S. saw a significant surge of 17.3%, while exports to China decreased by 9.5%, the smallest decline observed in the past 13 months. South Korea, known for its role as a major supplier of semiconductors and electronic components, serves as a crucial indicator of global demand trends.

— Bank of England maintains key interest rate at 15-year high of 5.25% amid inflation and economic slowdown concerns. The Bank of England (BoE) decided to keep its key Bank Rate unchanged at 5.25% for the second consecutive meeting, aligning with market expectations. This decision comes as BoE policymakers continue to evaluate the impact of persistent high inflation and indications of an economic deceleration. Notably, three policymakers voted in favor of a rate hike during this meeting, compared to four who supported such a move in the September meeting.

— IRS announces increased retirement savings limits for 2024, allowing higher contributions to 401(k)s and IRAs. The IRS has unveiled new contribution limits for retirement accounts in 2024, granting retirement savers the opportunity to set aside more money. Specifically, the employee contribution limit for 401(k) plans will rise to $23,000 in 2024, up from the previous limit of $22,500 in 2023. Meanwhile, catch-up contributions for individuals aged 50 and above for 401(k) plans will remain at $7,500.

In addition to 401(k)s, investors will have the opportunity to increase their savings in Individual Retirement Accounts (IRAs). The annual contribution limit for IRAs will be $7,000 in 2024, an increase from $6,500 in 2023. Catch-up contributions for IRAs will continue to be capped at $1,000.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, amid mild strength in the euro and British pound against the greenback. The yield on the 10-year U.S. Treasury has fallen, trading around 4.69%, with a negative tone in global government bond yields. Crude oil futures continued to advance, with U.S. crude around $81.55 per barrel and Brent around $85.75 per barrel. Gold and silver futures were registering gains ahead of economic updates, with gold around $1,995 per troy ounce and silver around $23.16 per troy ounce.

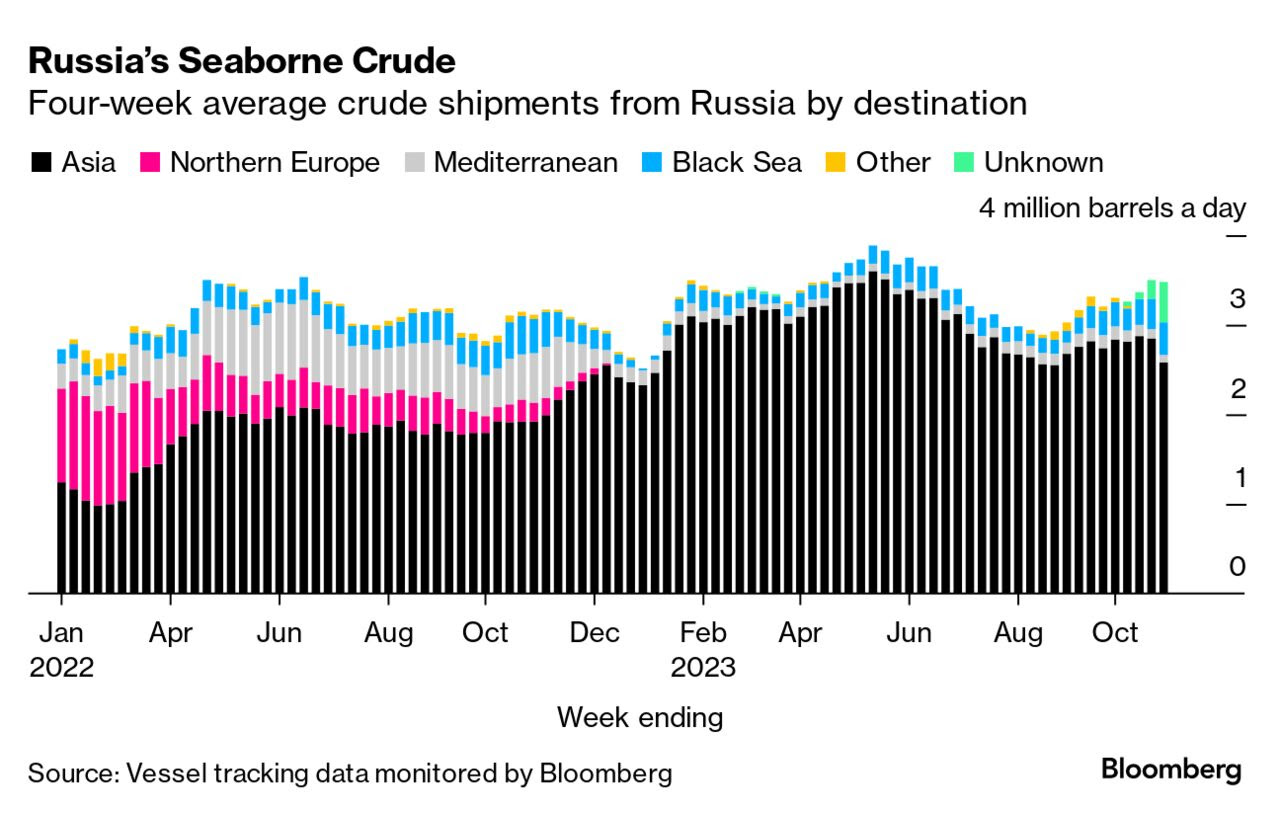

— Russia appears to shift away from supply cuts, while Saudi Arabia bears burden to balance oil market. Russia seems to be scaling back its commitment to support oil prices through supply cuts alongside its OPEC+ partner, Saudi Arabia. Despite reaffirming their cooperation in the oil market, Russian crude exports are on the rise, according to a Bloomberg investigation. In the summer, Saudi Arabia and Russia announced unilateral output reductions in addition to their OPEC+ commitments. Russia initially pledged to cut exports by 500,000 barrels per day in August, later reducing it to 300,000 barrels per day in September, with an extension through the end of the year. The reduction was based on the average level of overseas shipments in May and June.

While Russia initially complied, its commitment has not matched Saudi Arabia's determination. Saudi Arabia has significantly reduced oil production by nearly 1.5 million barrels per day since April, resulting in reduced exports. In contrast, Russia's seaborne crude exports in October were down by only 70,000 barrels per day from the May-June average, compared to a 250,000-barrel-per-day reduction in September.

There is no indication that the burden of Russia's export reduction has fallen on direct pipeline flows, primarily to China, either through East Siberia or Kazakhstan. These pipeline flows have remained stable.

Russia's reluctance to cut exports aligns with its need for oil revenue, especially in the face of declining natural gas exports and the financial demands of its activities in Ukraine. The potential for further increases in Russia's oil exports exists, as seaborne crude shipments are still around 580,000 barrels per day below their peak.

Meanwhile, Saudi Arabia continues to shoulder the responsibility of balancing the oil market at a price level it deems acceptable. However, this unilateral approach is taking a toll on the kingdom's economy. In the third quarter, Saudi Arabia experienced its largest economic contraction since 2020, with GDP falling by 4.5% year-on-year, primarily due to a 17% decline in the oil sector. The kingdom also posted a substantial budget deficit of $9.5 billion in the third quarter.

Of note: The upcoming meeting of OPEC+ oil ministers on Nov. 26 may witness calls for greater burden-sharing among members, including Russia, to address the growing challenges in the oil market.

— Guyana's record oil discoveries transform nation into energy powerhouse, sparking wealth and concerns. Guyana has emerged as a global energy powerhouse thanks to a remarkable series of oil discoveries since 2015. Exxon Mobil and its partners have uncovered over 11 billion barrels of oil off the coast of Guyana, leading to substantial investments and propelling one of South America's most impoverished nations into the world's fastest-growing economy, as reported by the International Monetary Fund. While this newfound wealth has brought prosperity, it has also raised concerns among some locals who fear that their country may be increasingly reliant on Exxon, potentially diminishing their national sovereignty, the Wall Street Journal reports (link).

— StoneX raises corn crop estimate, trims soybean forecast. Commodity brokerage StoneX raised its estimate of U.S. 2023 corn production to 15.302 billion bu. on a yield of 175.7 bu. per acre. Those figures are up from the firm’s October forecasts of 15.282 billion bu. and 175.5 bu. per acre. For soybeans, StoneX lowered its production forecast to 4.162 billion bu. on a yield of 50.3 bu. per acre, down from 4.175 billion bu. and 50.4 bu. per acre last month.

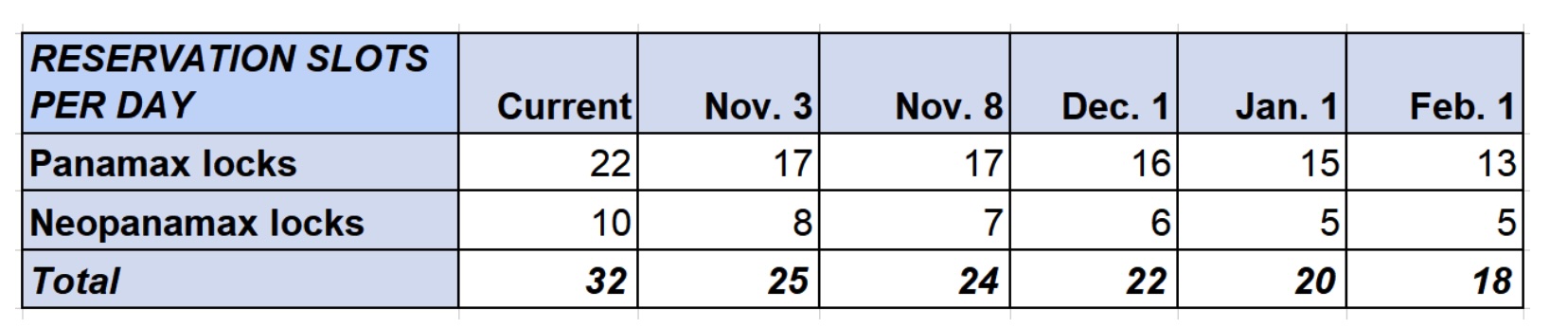

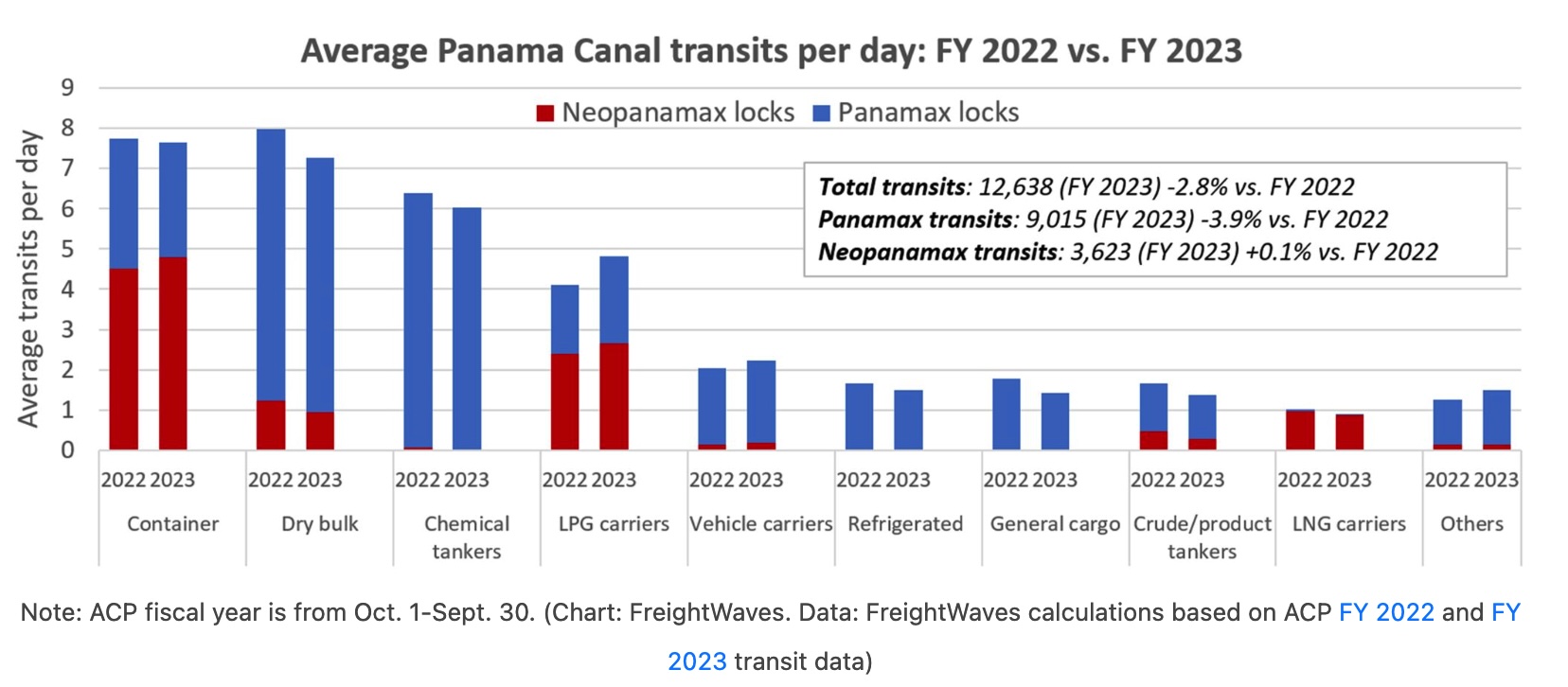

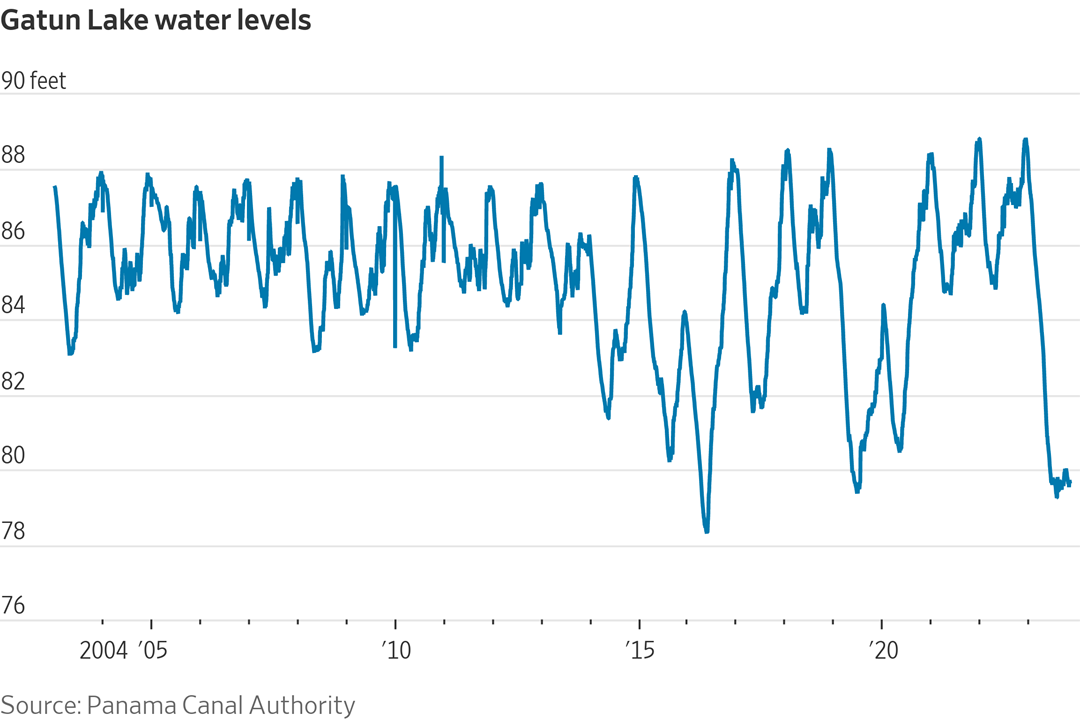

— Panama Canal to reduce daily ship transits by half this winter amid severe drought. Officials at the Panama Canal announced a significant reduction in available slots for ship transits this winter, cutting them in half due to an ongoing and extreme drought. The decision follows the driest October on record for the Panama Canal, as well as a prolonged period of elevated temperatures and limited rainfall, which have led to a significant drop in the water level of Gatun Lake, the artificial reservoir that supplies water to the canal's locks. The Panama Canal plays a crucial role in global seaborne trade, handling approximately 7% of all such trade activities. Link for more via the WSJ.

Of note: The latest changes come after Panama experienced its driest October on record, extending a monthslong spell of warmer temperatures and low rainfall. The canal administration said daily reservation slots will be cut to 25 this month, 22 in December, 20 in January and 18 in February. Last month the canal had 32 daily transits. The waterway can normally handle an average of 40 transits a day. Authorities say about 98 vessels are waiting to cross at both sides of the canal. Containerships that have fixed schedules and booked slots months in advance aren’t facing serious delays, but crude and gas tankers calling on short notice can be trapped for weeks.

More details: Around 70% of vessels using the Panama Canal require a draft of 44 feet, which is the current limit, down from 50 feet at the beginning this year. If the draft is lowered further, most ships won’t be able to transit with full loads. “We will commit to 44 feet for the foreseeable future. If adjustments are required in order to maintain 44 feet, those adjustments will be on the number of transits per day,” Panama Canal Authority (ACP) Administrator Richarte Vasquez said six weeks ago. Those adjustments are now required. The ACP had previously reduced daily transit reservation slots from 36 to 32. On Tuesday, it announced that reservation slots will be limited to 25 as of Friday, 24 starting Nov. 8 and 22 on Dec. 1. The number of reservation slots will fall to 20 on Jan. 1, 2024, then 18 starting Feb. 1.

— Ag trade update: South Korea purchased 133,000 MT of corn from unspecified sources. Japan purchased 113,506 MT of milling wheat in its weekly tender, including 45,776 MT U.S., 34,950 MT Canadian and 32,780 MT Australian.

— NWS weather outlook: Record cold subfreezing temperatures this morning across much of the South before a gradual warm up by this weekend... ...Wet weather pattern in place across the Pacific Northwest as several rounds of moderate to locally heavy rain impact the region.

NWS

Items in Pro Farmer's First Thing Today include:

• Mostly firmer grain price action overnight

• Eurozone manufacturing continues to contract

• Indonesia to continue palm oil domestic market obligation policy into 2024

• Japan compiles $113 billion package to cushion inflation

|

CONGRESS |

— Senate Republicans plan to combine border and immigration proposal with aid for Ukraine, Israel, and Indo-Pacific. The GOP's focus on border measures aims to garner enough support from conservatives to overcome opposition to additional Ukraine aid. Senators from both parties are looking to pass a comprehensive bill that addresses President Joe Biden's foreign aid requests along with border measures. While House Republican leaders are considering passing Israel aid separately, they have not ruled out the possibility of including it in a combined Ukraine-border bill.

— CBO finds House Republicans' IRS budget cuts attached to Israel aid bill would increase the deficit by $12.5 billion. The Congressional Budget Office (CBO) determined that House Republicans' proposal to link IRS budget cuts to an Israel aid bill does not constitute a genuine offset. According to the CBO's analysis, this move would contribute to increasing the deficit by approximately $12.5 billion, as the reduction in revenue would exceed the amount saved through spending cuts.

— Stopgap spending measure being discussed to avoid gov’t shutdown. Sen. Chris Murphy (D-Conn.), Chair of the Senate Appropriations Homeland Security Subcommittee, expressed openness to Republican suggestions but stressed the necessity of a limited proposal to meet the Nov. 17 funding deadline. Meanwhile, House Speaker Mike Johnson (R-La.) suggested a continuing resolution through Jan. 15 in a meeting with Republican senators, indicating a potential path to avoid a government shutdown. Johnson expressed confidence in his standalone $14.3 billion Israel aid bill passing and emphasized that combining Ukraine aid with Israel aid might face hurdles in the House.

— Both chambers complete action on fiscal year (FY) 2024 appropriations measures:

- Senators voted 82-15 to pass its three-bill funding package covering Agriculture-FDA, Military Construction-VA, and Transportation-HUD bills. It’s the chamber’s first passed package of FY 2024 bills.

- House members voted 214-197 to pass their Legislative Branch appropriations bill. It’s the sixth annual spending bill they’ve passed so far this year.

— Disaster aid bill fails in Senate, blocking block grant relief authority for USDA Secretary Vilsack. A bill, previously passed by the House, which aimed to grant USDA Secretary Tom Vilsack the authority to utilize block grants for providing relief to farmers in states affected by disasters through the Emergency Relief Program, failed in the Senate with a vote of 43-53. This legislation was intended to expedite the processing of relief payments to farmers, particularly those in Florida who had suffered damages from multiple hurricanes. Despite its potential benefits, the bill faced opposition in the Senate. Sen. Rick Scott (R-Fla.) expressed his determination to continue pushing for the bill, emphasizing its importance in delivering much-needed disaster aid to farmers across the country.

Opponents contended it could hinder the aid application process currently underway at USDA. Some noted the Biden administration already possessed the authority, under existing law, to allocate funding to states through block grants, rendering the bill counterproductive and unnecessary.

|

ISRAEL/HAMAS CONFLICT |

— First evacuees leave Gaza. After weeks of waiting, hundreds of people, including foreigners, aid workers, and critically injured Palestinians, were allowed to leave Gaza. This was made possible through a negotiated deal involving Israel, Egypt, the U.S., Qatar, and Hamas, allowing certain categories of people to leave the besieged territory. The Rafah crossing to Egypt served as the sole escape route and entry point for relief supplies. The United Nations agency for Palestinians expressed concerns about running out of essential supplies, highlighting the urgent need for a cease-fire to enable sufficient aid delivery.

|

RUSSIA/UKRAINE |

— Ukraine accuses Russia of interfering in Black Sea grain corridor with aerial provocations. Ukraine lodged accusations against Russia, alleging interference in the established grain corridor within the Black Sea. Ukrainian officials reported on Wednesday that Russian warplanes had dropped "explosive objects" into the Black Sea on three separate occasions within the past 24 hours. Despite these actions, Ukraine's southern military command confirmed that the shipping corridor remained operational. The Ukraine military expressed concern over Russian tactical aviation activities and their potential impact on civilian shipping routes in the Black Sea. Nevertheless, they emphasized that the navigation corridor continued to operate under the supervision of the defense forces.

|

POLICY UPDATE |

— Is ERP for 2022 as bad as it sounds?

It’s a self-imposed disaster. Congress provided roughly $3.2 billion to address natural disasters that occurred during the 2022 calendar year for crop losses and an additional $470 million for livestock losses which has already been programmed. USDA elected to follow a two-track system like the previous ERP phases for 2020 and 2021 but with some serious and harmful deviations, according to ag consulting firm Combest-Sell. Track 1 will utilize existing crop insurance data to send pre-filled applications to eligible producers, just as Phase I had done in the previous program. Track 2 will attempt to utilize Schedule F tax records to aid on a revenue-based approach, akin to the approach under Phase 2 in the prior program.

There are some major, harmful departures from previous disaster programs that are deeply concerning, according to Combest-Sell. It says USDA has established a “progressive” payment factor to fit total payments within budget that will severely restrict assistance to full time farm and ranch families. This “progressive” factor cuts deepest on those who faced the largest losses. Customarily, when a factor is required to fit payments within budget, one uniform factor is applied. But in this case the factor looks more like a payment limitation rewarding smaller losses and punishing larger losses.

For example, a farmer with a calculated loss of $100,000 in 2020 would have received $75,000, plus a refund of some portion of the crop insurance premium paid for the farm so as not to punish producers for buying insurance. For 2022, the same farmer with a $100,000 calculated loss will receive $11,250 after applying the progressive factor and the limitations on premium refunds. “This is a backdoor pay limit that violates the intent of Congress and the plain letter of the law,” says the consulting firm. “Congress explicitly required the ERP for 2022 to employ the same payment limitations as the previous program.”

— President Biden unveils rural revival plans in Minnesota to address farm decline and boost local economies. President Biden on Wednesday outlined his strategy to rejuvenate rural communities in response to decades of declining farm numbers and the hollowing out of rural areas. Speaking from a farm in southern Minnesota, Biden emphasized his commitment to diversifying farm income and promoting local food production and marketing as essential steps to revive rural America. Link to video of address.

Key initiatives mentioned in his 20-minute speech include a $1 billion plan to expand independent meat processing capacity, substantial funding for climate mitigation in agriculture, and efforts to address the market power of large seed, chemical, and farm equipment companies. Biden reiterated his belief that farmers can both profit and combat climate change, even though many farmers remain skeptical about climate-related measures.

USDA Secretary Tom Vilsack highlighted climate-smart practices such as cover cropping and reduced tillage as opportunities for farmers to earn income by sequestering carbon in the soil. Vilsack also emphasized the potential for local marketing and processing to boost revenue for rural communities and transform agricultural waste into valuable products.

Biden's plan aims to enable farmers to diversify their income streams and reduce their dependence on commodity markets and large corporations. The president noted that farm numbers have decreased by 400,000 since the 1980s, leading to reduced business activity in small towns across rural America. He expressed concern that many young people in rural areas are questioning their ability to stay due to limited opportunities, despite receiving an education.

— How did Democrats lose control of state agriculture policy? A New York Times article (link) notes Democrats once dominated statewide elections for the influential post of agriculture commissioner. Now they’re hoping to win just one.

|

CHINA UPDATE |

— Sorghum, soybeans and cotton main export sales to China in most recent week. U.S. export sales activity for China the week ended Oct. 26 for 2023-24 included net sales of 311,485 metric tons of sorghum, 976,841 metric tons of soybeans, and 323,950 running bales of upland cotton. No sales activity was reported for corn or wheat and no sales for 2024-25 were reported. For 2024, net sales of 6,615 metric tons of beef and 1,423 metric tons of pork were reported.

— Record Chinese soybean imports expected this year. China’s soybean imports are likely to stay high through the fourth quarter, taking 2023 purchases to a record 105 MMT, but lackluster demand from hog farms is seen reducing purchases in early 2024, according to Reuters. Brazilian soybean supplies shipped to China are expected to be stronger than normal in the fourth quarter, reducing demand for U.S. supplies. China will import around 26 MMT of soybeans during the last three months of the year, with around 45% of the cargoes arriving from Brazil, based on the forecasts of four trading sources.

— U.S. ag delegation visiting China to talk trade. Dozens of U.S. agriculture industry representatives gathered in Beijing on Thursday to meet Chinese counterparts amid growing U.S. efforts to bolster trade between the two countries. A delegation from 11 groups including the U.S. Soybean Export Council, U.S. Grains Council and U.S. Wheat Associates is visiting a week after Chinese grain buyers signed non-binding agreements to buy billions of dollars’ worth of commodities, mostly soybeans, the first such signing since 2017. The delegation will travel to Shanghai for next week’s annual China International Import Expo, where USDA is hosting a pavilion for the first time since the event started in 2018. Link to more via Reuters.

— China strengthens capital management rules for banks. China’s financial regulator is beefing up capital rules for banks to combat financial risks, the National Financial Regulatory Administration said. The move, which will come into effect on Jan. 1, aims to help banks improve risk management and better serve the economy. The rules establish a differentiated capital supervision system that imposes higher capital requirements on larger banks and those with the higher proportion of overseas businesses. Banks will also need to set aside higher loss provisions for non-credit assets. They will be given a grace period of two years before they must be fully compliant with the new provisioning requirements, the regulator said. It also specified risk control measures for banks’ exposure to mortgage lending based on property type and source of repayment.

— China struggles to convince Li mourners of reason for death. As China prepared to cremate former Premier Li Keqiang on Thursday, skepticism among some residents of his hometown over the official account of his death showed a lack of trust in the ruling Communist Party. Link to more via Bloomberg.

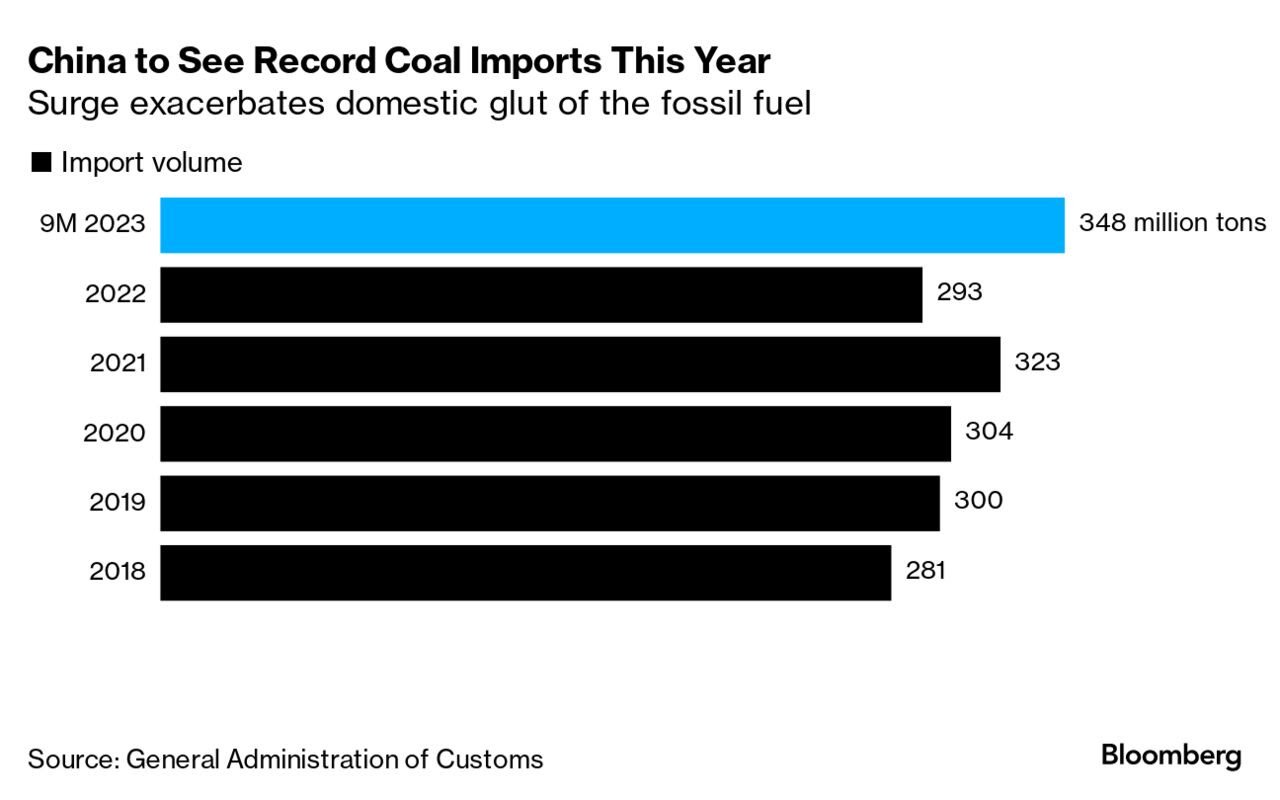

— China faces surging coal glut as prices decline, winter demand uncertain. China is grappling with an escalating surplus of coal, driven by a combination of strong domestic production and surging imports, Bloomberg reports (link). This surplus threatens to outpace the anticipated rise in winter demand, and as a result, prices for coal, a fundamental energy source, are under significant pressure. Analysts are cautioning that the forthcoming winter-heating season, set to begin later this month, may not be sufficient to offset the relatively modest industrial demand. This situation marks a stark contrast from two years ago when coal shortages led to widespread power cuts, negatively impacting both businesses and households.

Of note: China may soon hit peak coal. In a major turning point for the world, China’s fossil fuel use is projected to decline starting in 2025. Link to Foreign Policy article.

|

TRADE POLICY |

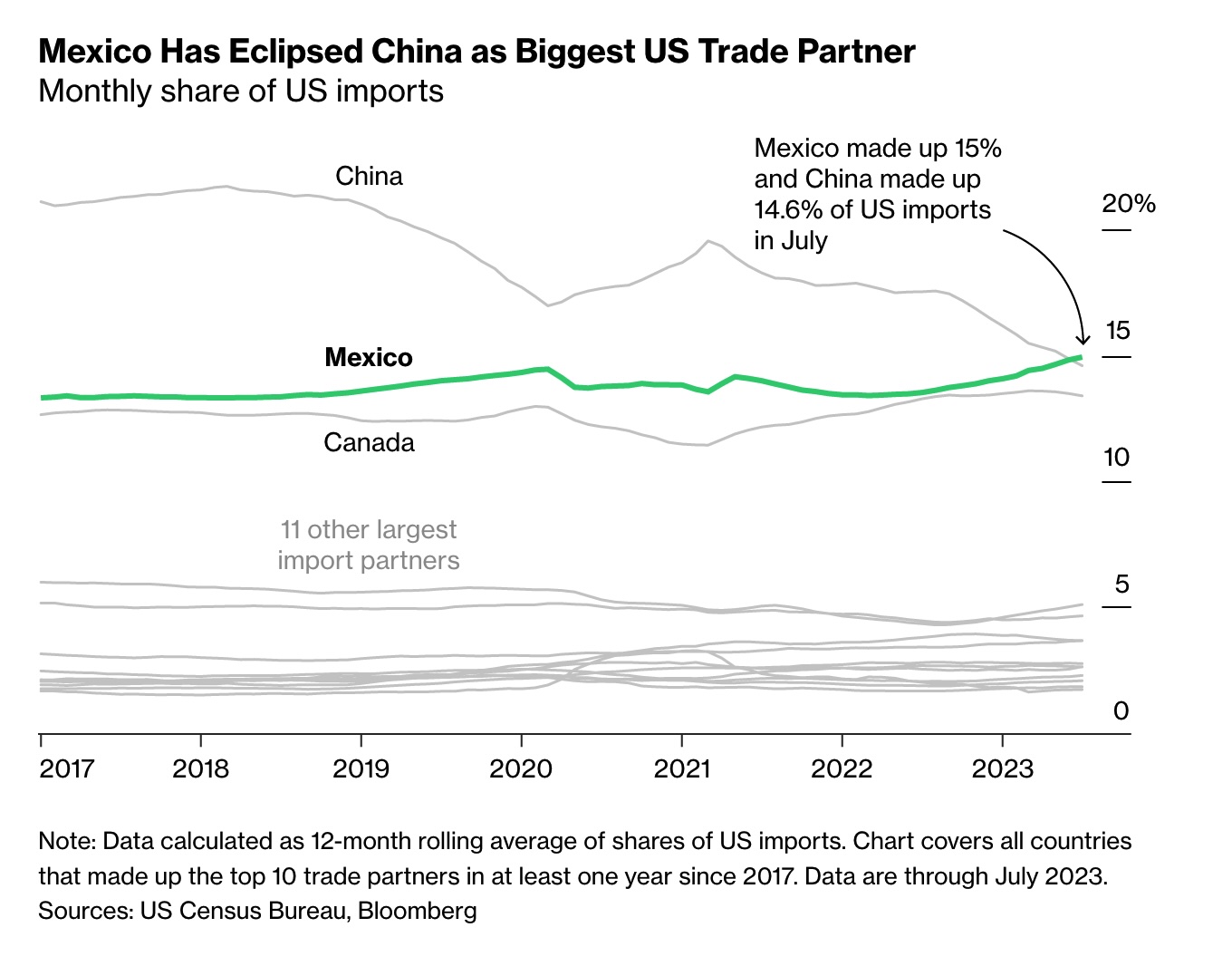

— Mexico’s moment: The biggest U.S. trading partner is no longer China. Billions of dollars are pouring into America’s southern neighbor, but a Bloomberg Businessweek article (link) asks, “Will it seize or squander the opportunity?”

|

ENERGY & CLIMATE CHANGE |

— Highway Trust Fund faces depletion amidst improved gas mileage and EV transition; alternative tax solution lacks adequate time for testing. The Highway Trust Fund, which serves as the primary source of funding for road repairs in the United States, is facing a shrinking balance due to factors such as improved gas mileage in vehicles and the rapid transition to electric vehicles (EVs). The federal gas tax rate, unchanged since 1993, has contributed to this issue. According to the Congressional Budget Office (CBO), the fund is projected to run out of money by 2028. Unfortunately, the proposed alternative plan to maintain the fund's solvency does not provide sufficient time for testing an alternative tax system before Congress formulates its next road funding bill.

Two years ago, President Biden's infrastructure law allocated funds to explore a national per-mile tax as an alternative to the traditional gasoline tax, which would collect revenue based on how far vehicles travel rather than the amount of fuel they consume. However, progress on implementing this program has been slow, and it is expected to take too long to test as an alternative to the gas tax.

Timeline. The entire process, including establishing an advisory board, conducting public outreach, and running a pilot program, is estimated to require about seven and a half years to complete. This timeline extends beyond the scheduled reauthorization of the surface transportation law in 2026.

Reality hits. Both Democratic and Republican lawmakers now acknowledge that the current funding system for road infrastructure is unsustainable. The declining number of vehicles contributing to the Highway Trust Fund or paying user fees for road usage has had a detrimental impact on the fund, according to House Transportation and Infrastructure Chair Sam Graves (R-Mo.).

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA publishes final rule on organic livestock and poultry standards, effective Jan. 2, 2024, with gradual implementation for some operations until 2029. USDA's Agricultural Marketing Service (AMS) released its final rule on organic livestock and poultry standards, slated to go into effect primarily on Jan. 2, 2024, though certain operations may have until 2029 for full implementation. The rule includes guidelines for space requirements for poultry and other provisions. According to the AMS, the costs associated with complying with this rule are expected to outweigh the benefits for producers who adhere to the new standards. USDA has taken into consideration extensive public comments, with 94% of respondents supporting the provisions the agency was preparing to implement. USDA aims to ensure that organically produced foods adhere to a transparent and consistent standard, maintain consumer confidence in USDA organic products, align with outdoor access expectations, and promote interstate commerce in organic products.

|

HEALTH UPDATE |

— Ozempic sales up 58% as drugmaker Novo Nordisk nets record profits. Danish pharmaceutical giant Novo Nordisk reported the most robust quarterly profits and sales in its history Thursday, as Europe’s largest public company rides the surge in popularity of its weight loss and diabetes drugs to blockbuster results. Novo Nordisk primarily produces diabetes medications, including the injectable GLP-1 semaglutide drugs Wegovy and Ozempic, which have become particularly popular in the U.S. recently for their efficacy in promoting weight loss. Ozempic and Wegovy brought in $4.8 billion of sales during the third quarter, and the drugs account for 52% of Novo Nordisk’s $23.6 billion of total revenue through 2023’s first nine months, up from a 36% share during the same period last year. Overall, Novo Nordisk reported $8.4 billion of total revenue and $3.2 billion of net income during the third quarter, topping respective analyst estimates of $8.2 billion and $3.1 billion, according to FactSet.

|

POLITICS & ELECTIONS |

— House Appropriations Chair Kay Granger announces retirement, setting the stage for a successor race. Granger (R-Texas) said she will not seek re-election and will retire at the end of her term. This announcement will trigger a competition to determine her successor. Among potential candidates, Rep. Tom Cole, who chairs the Rules Committee and the Transportation-HUD Subcommittee and previously served as the full committee's vice chair, appears to be a prominent figure. Reps. Robert Aderholt and Mike Simpson, both of whom vied for the top GOP position on the committee in 2019 following the retirement of former Chair Rodney Frelinghuysen, are also expected to be contenders in the race for the chairmanship.

— Rep. Ken Buck (R-Colo.) also announced he was not running for re-election next fall. In announcing his decision, moderate lawmaker Buck levied criticism at other Republicans for continuing to embrace a narrative that the 2020 elections were stolen. Buck also predicted there would be other Republicans who will soon announce they will not run again in 2024.

— George Santos avoids expulsion in House vote. House lawmakers rejected an effort to expel Rep. George Santos (R- N.Y.), who made a series of bold fabrications in running for office and faces federal fraud charges related to his 2022 campaign. The vote was 179 in favor of expulsion to 213 against, well short of the two-thirds threshold needed to remove a lawmaker from office. Some 19 lawmakers voted present and nearly two dozen more were absent. House Speaker Mike Johnson (R-La.) suggested that the effort was premature, saying Santos’s issues should first play out in the legal system. “That’s what our system of justice is for,” he said on Fox News. “He’s not convicted. He’s charged. And so, if we’re going to expel people from Congress just because they’re charged with a crime, then — or accused, that’s a problem.”

Separately, the House was also considering efforts to censure Reps. Rashida Tlaib (D-Mich.) and Marjorie Taylor Greene (R-Ga.). Republicans led by Greene allege Tlaib has made antisemitic remarks, while Rep. Becca Balint (D-Vt.) proposed to censure Greene over her own purported antisemitic comments and other inflammatory statements. Lawmakers voted to table, or kill, the proposal to censure Tlaib in a 222-186 vote. Twenty-three Republicans sided with Democrats. The resolution to censure Greene didn’t get a vote on Wednesday night.

|

OTHER ITEMS OF NOTE |

— Another Roundup loss. A California jury awarded $332 million in damages to Michael Dennis, a former land surveyor, who said decades of using Roundup weedkiller gave him cancer — the third courthouse defeat in a row for Roundup maker Bayer. Link to details via Bloomberg.

— The Texas Rangers won their first World Series with a 5-0 victory over the Diamondbacks in Game 5. Shortstop Corey Seager was series MVP for the second time (joins legends Sandy Koufax, Bob Gibson and Reggie Jackson as the only two-time winners). Bruce Bochy came out of retirement to manage the team this season after winning three rings with the Giants a decade ago. One observer noted ir took Texas a little while to become champions of baseball — 10,033 games, to be precise. The team dates to 1961 when they were the Washington Senators. The observer adds: “Just to give you an idea of how long the Rangers' journey has been, when the team started, bread sold for 21 cents a pound, a dozen eggs cost 57 cents and the cost of a gallon of regular gas? 31 cents.”

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |