House GOP Looking at CCC for Possible Extra Funding for New Farm Bill

Biden’s trade policy suffers setback as NPPC says India continues to hinder pork trade

|

Today’s Digital Newspaper |

MARKET FOCUS

- Central banks have loaded up on more gold than previously thought this year

- BOJ loosens grip on bond yields

- Eurozone inflation eased to a two-year low as the bloc’s economy shrank

- BP stock falls as third-quarter earnings miss analyst predictions

- U.S. Treasury lowered its federal borrowing estimate for the current quarter

- U.S. commercial real estate lending reaching historically low levels

- Lenders presenting option to potential home buyers faced with 8% mortgage rate

- Ag markets today

- USDA daily export sale: 239,492 MT soybeans to Mexico during 2023-2024 MY

- India’s cotton production could fall 7.5%

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONGRESS

- Senate Dems plan vote to authorize subpoenas in probe into Supreme Court ethics

- House Republicans’ $14.3 billion plan for Israel

ISRAEL/HAMAS CONFLICT

- Israel struck more targets in Lebanon & Syria, steps up ground operations in Gaza

- Netanyahu rejects calls for a cease-fire, saying, “This is a time for war.”

RUSSIA & UKRAINE

- Update on Ukraine plantings

- Ukrainian railways witness over 50% surge in railcar grain movements to Odesa ports

- McConnell optimistic House Speaker Johnson will back more U.S. aid to Ukraine

POLICY

- ERP payments increase as USDA launches 2022 relief effort

- House aggies keeping their additional farm bill funding ideas quiet, but…

- Producers embrace USDA's LRP program as adoption surges to 5.2 million head

CHINA

- China's official NBS Manufacturing PMI for October unexpectedly drops

TRADE POLICY

- U.S. revokes AGOA benefits for four countries over eligibility concerns

- NPPC: U.S. pork exports still being stymied by India

ENERGY & CLIMATE CHANGE

- DOE invests $1.3 billion in six-state transmission line projects to bolster electric grid

- Dems urge SEC to complete climate reporting rules, including Scope 3 emissions

LIVESTOCK, NUTRITION & FOOD INDUSTRY

- McDonald's to raise prices in California as minimum wage hits $20 per hour

POLITICS & ELECTIONS

- Rep. Earl Blumenauer will not seek re-election

- Prosecuting Attorney Bell drops bid to unseat Sen. Josh Hawley (R-Mo.) next year

OTHER ITEMS OF NOTE

- Biden to launch a two-week "investing in rural America" campaign

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed overnight. U.S. Dow is currently down around 100 points. In Asia, Japan +0.5%. Hong Kong -1.7%. China -0.1%. India -0.4%. In Europe, at midday, London +0.6%. Paris +1%. Frankfurt +0.5%.

U.S. equities yesterday: All three major indices notched solid gains to open the week, with the Dow up 511.37 points, 1.5%, at 32,928.96. The Nasdaq was up 146.47 points, 1.16%, at 12,789.48. The S&P 500 gained 49.45 points, 1.20%, at 4,166.82.

— BP stock falls as third-quarter earnings miss analyst predictions. BP's stock faced a decline following its third-quarter earnings report, which fell short of analyst forecasts. The oil company reported an adjusted net income of $3.29 billion for the quarter, notably below Wall Street's expectation of $4.05 billion. This earnings gap was attributed to lower oil prices and underwhelming performance in gas trading

In a related development, Saudi Arabia announced a 4.5% decrease in its Gross Domestic Product (GDP) compared to the previous year, citing the reduction in oil production as a contributing factor.

— Agriculture markets yesterday:

- Corn: December corn fell 2 1/2 cents to $4.78 1/4, closing near the session low.

- Soy complex: Unable to hold onto overnight gains, November soybeans fell 14 1/2 cents to $12.82 3/4, closing near the session low. December meal futures led the soybean complex lower, falling $15.9 to $426.50, while December soyoil futures rose 12 points to 53.39 cents.

- Wheat: December SRW wheat closed down 9 cents at $5.66 and near the session low. December HRW wheat closed up 2 cents at $6.45, near mid-range and hit a more-than-two-year low early on. Spring wheat futures slipped 2 cents to $7.17 3/4.

- Cotton: December cotton dove 147 points to 82.91 cents and closed below the 100-day moving average.

- Cattle: December live cattle gained $1.025 at $183.25 and near mid-range. November feeder cattle closed up 77 1/2 cents at $237.675 and nearer the session low.

- Hogs: Lean hog futures rallied 70 cents before closing at $71.175, near the mid-point of today’s session.

— Ag markets today: Corn, soybeans and wheat held in tight trading ranges in light trade overnight. As of 7:30 a.m. ET, corn futures were trading steady to fractionally higher, soybeans were 1 to 2 cents lower and wheat futures were 4 to 7 cents lower. Front-month crude oil futures were around 60 cents higher, and the U.S. dollar index was about 100 points lower.

Beef prices firm but movement slows. Wholesale beef prices firmed $1.71 for Choice and 77 cents for Select on Monday, though movement totaled only 59 loads. Choice cutout at $309.28 was the highest since mid-September. Despite the recent price strength in wholesale beef, packer cutting margins remain in the red.

Pork margins continue to strengthen. The CME lean hog index is down another 44 cents to $77.51 (as of Oct. 27). The pork cutout value firmed $1.46 on Monday, rising for a second straight day. Given the persistent decline in cash hog prices and recent uptick in the pork cutout value, packer cutting margins are solidly in the black.

— Quotes of note:

- Ford in tough spot. “We have to identify efficiencies. We have to increase productivity. It is a record contract.” — Ford Chief Financial Officer John Lawler. Ford executives are already talking about the need to offset the higher expenses in this latest deal. The automaker has said the UAW contract would add $850 to $900 per vehicle in additional costs. The tentative agreements, to be voted on in the coming weeks, include a 25% general wage increase over four years, which with cost-of-living increases would boost the top pay for production workers to about $42 an hour.

- AI warning: “One thing is clear: To realize the promise of AI and avoid the risks, we need to govern this technology…There’s no way around it. It must be governed.” — President Biden on Monday at a reception held in the White House East Room. Biden issued a new executive order aimed at reining in the risks of artificial intelligence.

U.S. Treasury lowered its federal borrowing estimate for the current quarter on higher revenue expectations, although this would still be a record amount compared to prior fourth quarters. It expects to borrow $776 billion during Q4, $76 billion lower than its previous forecast, and $816 billion during Q1 2024 — also a record for that period.

— Eurozone inflation rate drops to 2.9%, hitting over 2-year low. In October, the Euro Area's inflation rate slid to 2.9% year-on-year, marking its lowest level since July 2021. This figure fell slightly below the market consensus of 3.1%, as per a preliminary estimate. Additionally, the core inflation rate, which excludes volatile food and energy prices, also saw a decrease, reaching 4.2%, its lowest point since July 2022.

— Eurozone economy contracts in Q3 2023, raising concerns amid global challenges. Preliminary estimates reveal that the Eurozone economy experienced a 0.1% quarter-on-quarter contraction in the third quarter of 2023, falling short of market expectations for a stable reading. This downturn follows an upwardly revised 0.2% expansion in the second quarter and marks the first contraction since mid-2020, primarily attributed to the lingering impact of the Covid-19 pandemic.

Among the major economies within the Eurozone, Germany saw its GDP shrink by 0.1%, while Italy stagnated, and France and Spain managed modest growth of 0.1% and 0.3%, respectively. On an annual basis, the Euro Area's economy advanced by a mere 0.1%, falling below forecasts of 0.2%.

The European Central Bank (ECB) anticipates sluggish growth for the Eurozone in 2023, with a projected rate of just 0.7%. This subdued outlook is attributed to tightening financing conditions, high prices weighing on domestic demand, muted foreign demand, and ongoing contractions in the industrial sector, particularly in Germany. The forecast suggests a gradual recovery, with GDP growth expected to reach 1% in 2024 and 1.5% in 2025.

— Bank of Japan keeps rates unchanged; revises inflation forecasts upwards. The Bank of Japan (BoJ) maintained its key short-term interest rate at -0.1% and the 10-year bond yields at around 0%, aligning with market expectations. Additionally, the central bank made notable changes by redefining 1.0% as a loose "upper bound" rather than a rigid cap, abandoning its pledge to defend this level. This shift came after the long-term interest rate was capped at 1% in July, an increase from the previous cap of 0.5%.

In a quarterly outlook report, the BoJ raised its inflation forecasts for fiscal year (FY) 2023 and 2024 to 2.8% from 1.3% and 1.2%, respectively, surpassing its 2% target. However, for FY 2025, the Consumer Price Index (CPI) is expected to ease to 1.7% due to the diminishing impact of high oil prices and past increases in import prices. The central bank expressed optimism about Japan's economy, foreseeing a continued moderate recovery driven by pent-up demand. Still, it acknowledged the downside risks posed by a slowing global economic recovery. The BoJ reiterated its readiness to implement additional easing measures if necessary.

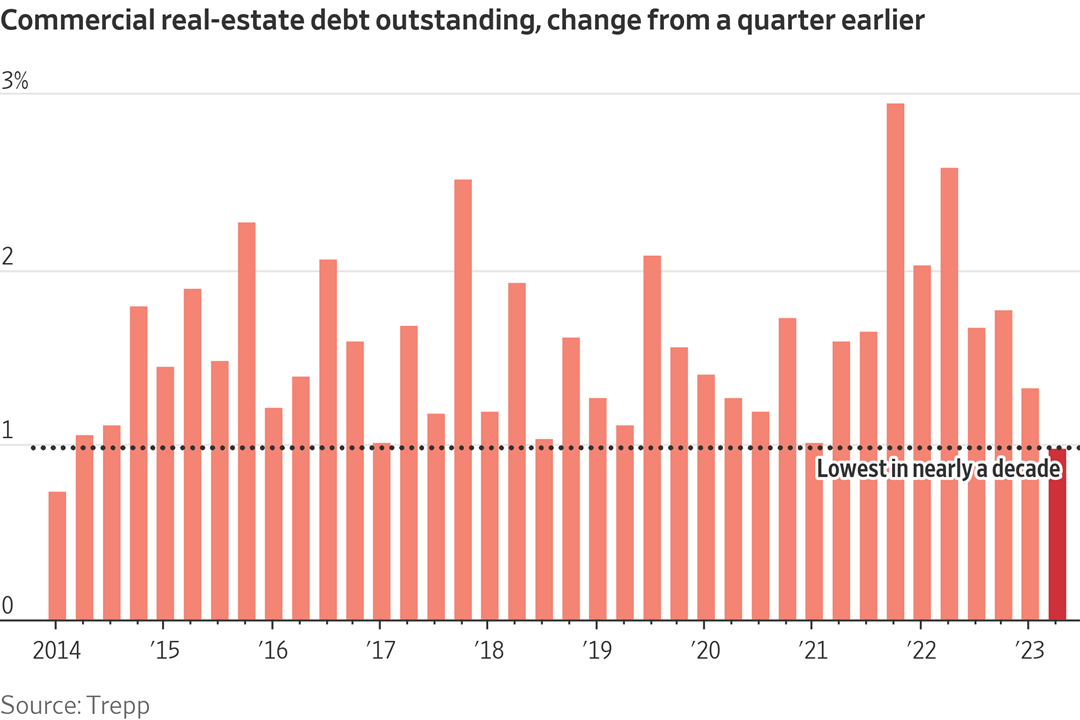

— U.S. commercial real estate lending is experiencing a significant decline, reaching historically low levels. This reduction in funding poses several risks, including an increased likelihood of defaults on expiring debt and a notable drop in new construction projects for various property types like warehouses and apartments. The trend of diminishing lending activity began in the first half of 2022 when the Federal Reserve initiated interest rate hikes and concerns about a potential recession grew. However, the situation has worsened as creditors have become increasingly hesitant to issue new loans, primarily due to the substantial rise in Treasury bond yields since early August.

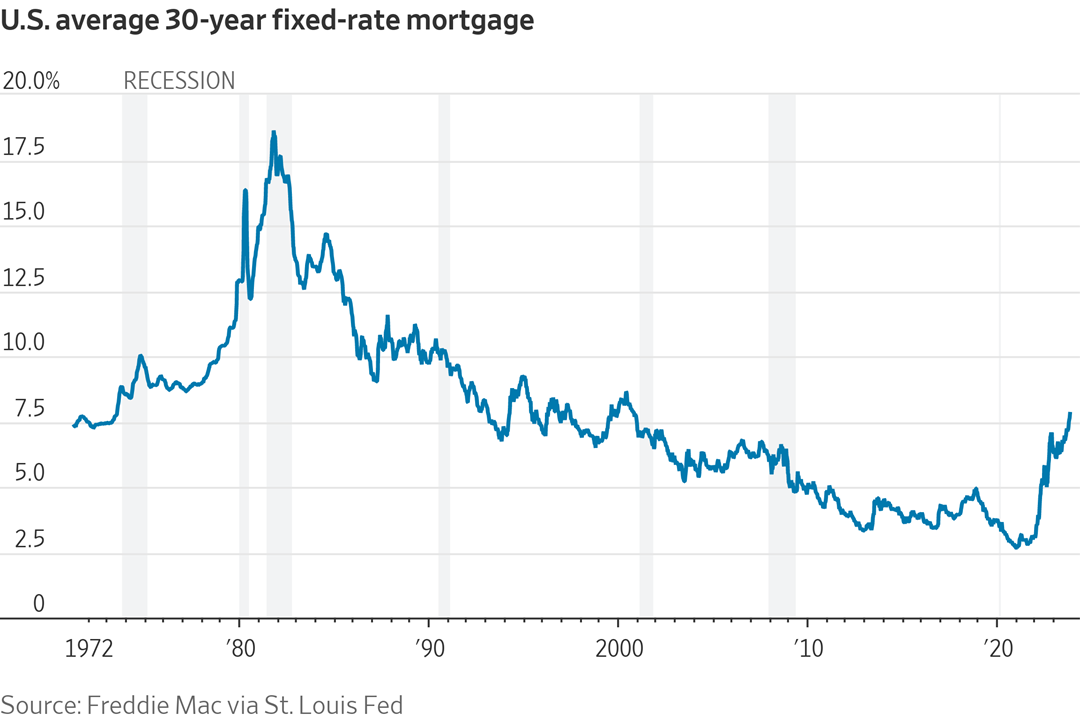

— Lenders are presenting an option to potential home buyers faced with the prospect of an 8% mortgage rate: Buy a home now, and they promise a free refinancing opportunity later. This offer arises as the mortgage market has faced a significant downturn due to the Federal Reserve's actions to curb inflation by raising interest rates to levels not seen in two decades. However, experts caution that while these offers may seem tempting, they may not necessarily result in long-term savings for buyers, according to the Wall Street Journal (link).

Market perspectives:

— Outside markets: The U.S. dollar index was weaker with the euro, yen and British pound all firmer against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 4.81%, with a mostly lower tone in global government bond yields. Crude oil futures were higher, with U.S. crude around $83.10 per barrel and Brent around $87.10 per barrel. Gold and silver were narrowly mixed, with gold firmer around $2,008 per troy ounce and silver weaker around $23.32 per troy ounce.

— Central bank buying boosts gold demand, according to Q3 World Gold Council report. The World Gold Council's Q3 Gold Demand Trends report indicates continued support for gold as central bank purchases maintain a historic pace, driving quarterly gold demand (excluding OTC) to 1,147 tons, surpassing the five-year average by 8%. Central banks recorded the third strongest quarter of net buying, reaching 337 tons, although it fell short of the Q3 2022 record. Year-to-date demand for central bank purchases reached 800 tons, marking a new record. This strong trend in central bank buying is expected to continue for the remainder of the year.

Investment demand reached 157 tons during the quarter, marking a 56% increase year-on-year, albeit weaker compared to the five-year average. Bar and coin investment in Europe declined in Q3, but overall demand stood at 296t, above the five-year average. Gold ETFs experienced outflows in Q3, primarily due to concerns about high-interest rates. However, OTC investment remained strong, totaling 120 tons in the third quarter, driven by high net worth demand in Turkey and stock building in other markets.

Despite elevated gold prices, jewelry demand remained resilient, although it softened slightly, decreasing by 2% year-on-year to 516t, largely due to consumers facing cost-of-living pressures in various global markets.

Total gold supply increased by 6% year-on-year in Q3, with mine production reaching a year-to-date record of 2,744t. Recycling also rose by 8% year-on-year to 289t, supported by consistently high gold prices.

Of note: Louise Street, Senior Markets Analyst at the World Gold Council, highlighted the resilience of gold demand, particularly in the face of high-interest rates and a strong U.S. dollar, and expressed optimism that geopolitical tensions and continued central bank buying could drive gold demand even higher in the future.

Gold futures settled above $2,000 a troy ounce on Monday, a sign that investors remain on edge about the Israel-Hamas war even as oil prices ease.

— USDA daily export sale: 239,492 MT soybeans to Mexico during 2023-2024 MY

— Ag trade update: South Korea purchased 132,000 MT of corn and 55,000 MT of feed wheat – all optional origin. Japan is seeking 113,506 MT of milling wheat in its weekly tender.

— India’s cotton production could fall 7.5%. India’s cotton production in 2023-24 is likely to fall 7.5% from a year earlier to 29.5 million bales on lower planted area and as El Niño weather hit productivity, according to the Cotton Association of India. The trade body said India’s cotton imports could rise to 2.2 million bales in 2023-24, up from 1.25 million bales last year.

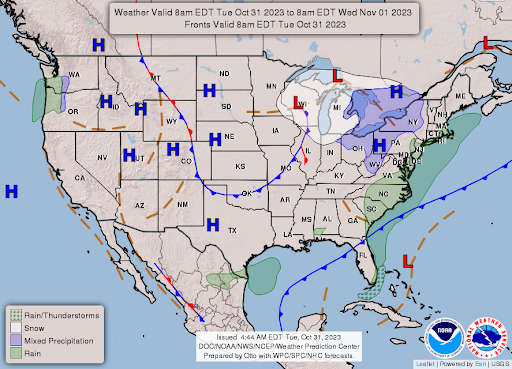

— NWS weather outlook: Crisp autumn airmass to lead to a shivering Halloween throughout much of the central and eastern United States... ...Snow showers to swing across the Great Lakes and parts of the Midwest... ...Atmospheric River ushers in wet weather to the Pacific Northwest by midweek.

Items in Pro Farmer's First Thing Today include:

• Lightly traded overnight grain session

• Consultant cuts Brazilian crop forecasts

• HRW CCI rating below average; SRW above average

• Crop progress report highlights

|

CONGRESS |

— Senate Democrats plan a vote to authorize subpoenas in their probe into Supreme Court ethics. The proposed witnesses would include Harlan Crow, whose gifts to Justice Clarence Thomas ignited an outcry. Judiciary Committee Chair Dick Durbin (D-Ill.) and Sheldon Whitehouse (D-R.I.) announced last night the panel would hold votes on authorizing subpoenas of Crow as well as of Leonard Leo, a conservative legal activist. They said Leo had refused to cooperate with the committee’s investigation, and that Crow has offered partial cooperation, which the Democrats said was inadequate.

Republicans also have suggested the Supreme Court should adopt its own ethics rules, but they have called Democratic scrutiny of the court an effort to discredit its conservative rulings.

— House Republicans’ $14.3 billion plan for Israel, which breaks with the Biden administration by separating it from Ukraine and Taiwan aid, also left out humanitarian assistance for civilians in Gaza that the White House had requested. Speaker Mike Johnson (R-La.) told reporters he expects a House vote on the measure Thursday. The bill’s unusual reliance on IRS cuts to pay for Israel aid has already angered some Democrats, who say it sets a dangerous precedent for funding emergencies. The Israeli measure isn’t likely to pass the Senate without changes, potentially bogging down the funding.

|

ISRAEL/HAMAS CONFLICT |

— Israeli Prime Minister, Benjamin Netanyahu said there will be no pause in the fighting in Gaza, as he believes it is a time for war. This decision comes despite calls from UN agencies for a humanitarian ceasefire to allow aid deliveries to the trapped civilians in Gaza. Netanyahu expressed that Israel will not surrender to Hamas or terrorists. As Israel continues its ground operations, UNICEF's chief has warned of a potential catastrophe in Gaza due to a lack of clean water. The World Health Organization has reported that hundreds have been killed in attacks on healthcare facilities, and the UN has raised concerns about the deteriorating civil order, with people breaking into warehouses to obtain essential supplies.

|

RUSSIA/UKRAINE |

— As of Oct. 30, Ukraine has planted approximately 5.34 million hectares of winter crops, according to data from the Ukrainian Agriculture Ministry. This planting includes 3.73 million hectares of winter wheat, accounting for approximately 85.7% of the expected area of 4.36 million hectares. Additionally, the total planting area comprises 1.14 million hectares of winter rapeseed and 402,600 hectares of winter barley.

— Ukrainian railways witness over 50% surge in railcar grain movements to Odesa ports. In the latest week, this number surged to 4,032, representing a more than 50% rise from the previous week's figure of 2,676. According to Reuters, officials attribute this notable increase in rail movement to the establishment of a humanitarian corridor by Ukraine.

— McConnell optimistic House Speaker Johnson will back more U.S. aid to Ukraine. In an interview Monday (link), Senate Minority Leader Mitch McConnell (R-Ky.) stressed his support for tying aid for Ukraine and Israel together in a much larger emergency-funding package that also would include funding for Taiwan and U.S. border security. The House is moving this week to advance a funding bill that provides $14.3 billion to help Israel to fight Hamas but no money for Kyiv in the war against Russia.

|

POLICY UPDATE |

— ERP payments increase as USDA launches 2022 relief effort. Emergency Relief Program (ERP) payments, intended to cover losses for 2020 and 2021, are on the rise, even though USDA previously stated that all eligible payments were disbursed by Sept. 30. According to USDA data, total ERP payments reached $8.22 billion as of Oct. 29, up slightly from the previous week's $8.19 billion. Phase 2 ERP payments also increased to $767.99 million, benefiting 10,012 recipients, compared to $742.99 million distributed to 9,968 recipients the previous week.

Simultaneously, USDA is launching the ERP effort for 2022 (link), which will operate in two tracks. ERP 2022 Track 1 aims to assist producers affected by wildfires, droughts, hurricanes, winter storms, and other eligible disasters that occurred during calendar year 2022. This track will utilize existing Federal Crop Insurance or Noninsured Crop Disaster Assistance Program (NAP) data submitted to FSA.

ERP 2022 Track 2 introduces a revenue-based certification program, designed to aid producers who experienced revenue losses in 2022 due to disaster events when compared to revenue in a benchmark year. FSA has described Track 2 as an "alternative method to establish revenue."

The total ERP funding for 2022 stands at $3.7 billion, with approximately $500 million allocated for livestock producers.

— House aggies are keeping their additional farm bill funding ideas quiet, but… sources signal billions of dollars could come from tapping funds from the Commodity Credit Corporation that the Congressional Budget Office scores for administration use.

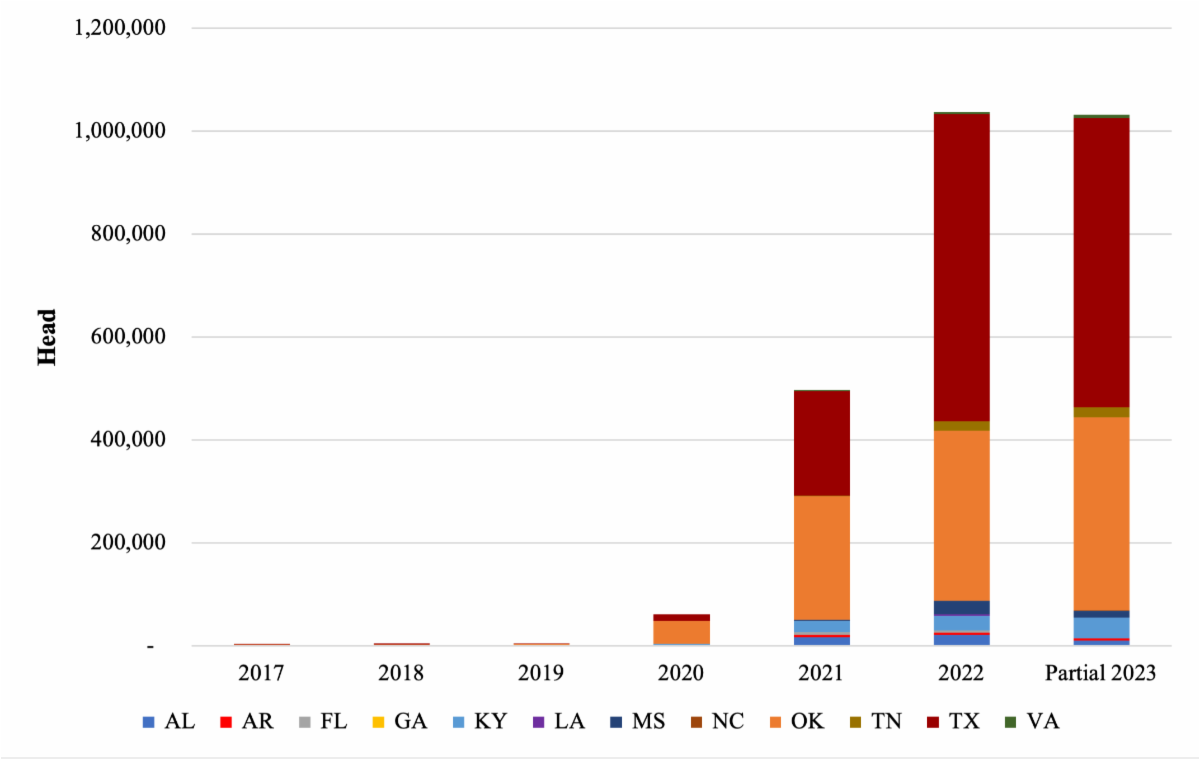

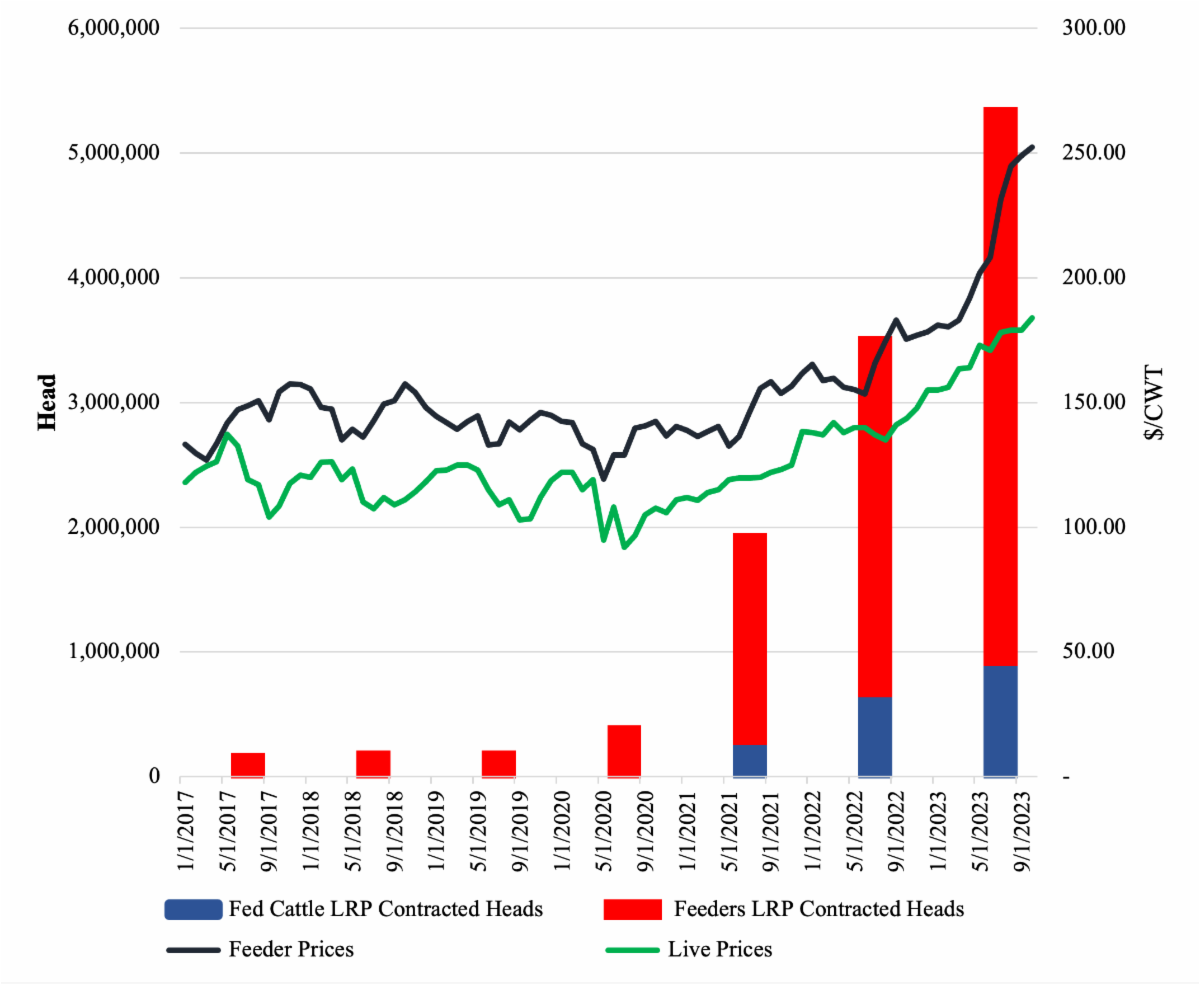

— Producers embrace USDA's Livestock Risk Protection Program as adoption surges to 5.2 million head. Producers in the U.S., particularly in the Southern States, are increasingly embracing the Livestock Risk Protection Program (LRP), a program aimed at safeguarding ranchers against declining cattle prices, according to an item released by Southern Ag Today (link). LRP adoption has seen significant growth, with the number of cattle head covered surging from 71,000 in 2017 to 5.2 million by October 2023. In 2022, ranchers insured 3.4 million head, compared to 1.8 million in 2021. Notably, the Southern region has played a substantial role in driving this increased usage, with Texas and Oklahoma insuring 56% and 34% of the total, respectively.

Reason behind the big growth: The surge in LRP adoption has coincided with higher subsidy levels and program modifications. These changes have reduced producers' premium payments and allowed for deferred payments until the endorsement period's conclusion, providing ranchers with valuable cash-flow advantages. Additionally, LRP does not impose a minimum cattle quantity for insurance, making it accessible to cow-calf or stocker producers with even a few head.

As cattle prices have risen, the importance of implementing robust price risk management plans has become evident. LRP serves as a tool to minimize financial losses, secure profit margins, and mitigate business risks, especially in the face of increased investments. The growing adoption of LRP reflects an expanding community of ranchers incorporating risk management strategies into their operations.

|

CHINA UPDATE |

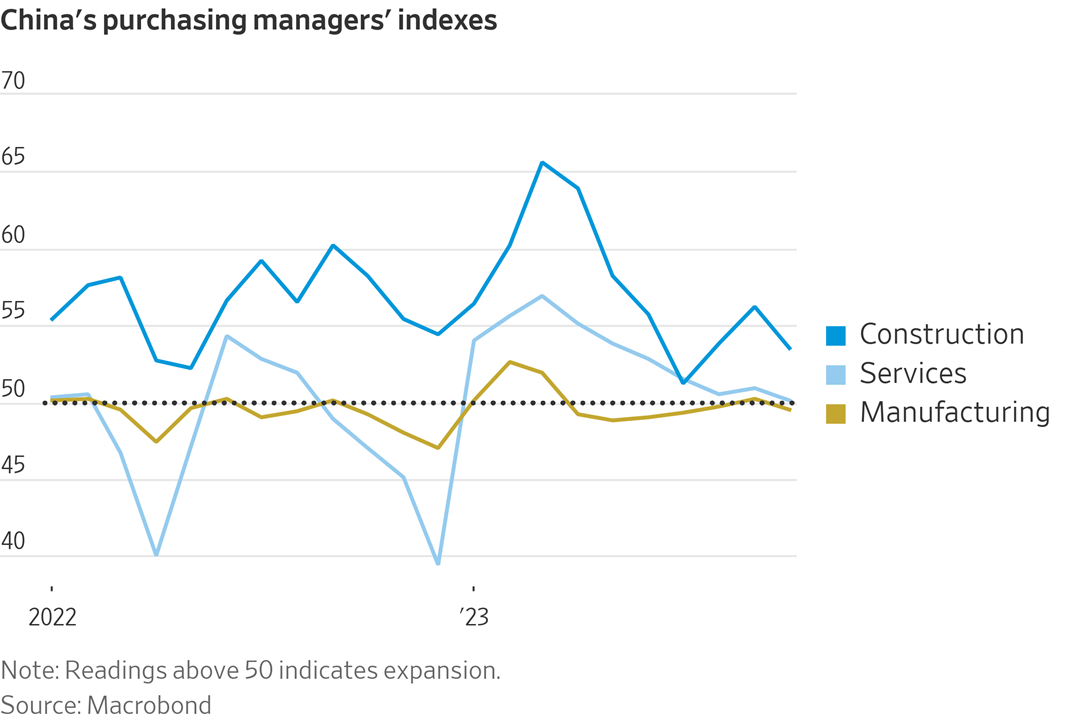

— China's official NBS Manufacturing PMI for October unexpectedly dropped to 49.5 from September's 50.2, falling below market expectations of 50.2. This decline underscores the fragility of the nation's economic recovery, indicating a need for additional government support measures. Several key indicators showed concerning trends: new orders contracted (49.5 vs. September's 50.5), foreign sales declined more rapidly (46.8 vs. 47.8), and there were milder increases in output (50.9 vs. 52.7). Employment continued to decrease (48.0 vs. 48.1), and buying levels shrank for the first time in three months (49.8 vs. 50.7). Delivery times shortened but at the slowest pace since February (50.2 vs. 50.8). On the cost side, input price inflation reached a three-month low (52.6 vs. 59.4), while output prices decreased for the first time in three months (47.7 vs. 53.5). Lastly, there was a slight improvement in business confidence (55.6 vs. 55.5). These figures suggest a challenging economic environment in China, demanding government intervention to bolster recovery prospects.

|

TRADE POLICY |

— U.S. revokes AGOA benefits for four countries over eligibility concerns. The Biden administration decided to revoke trade benefits under the Africa Growth and Opportunity Act (AGOA) for four countries: the Central African Republic, Gabon, Niger, and Uganda. This action is being taken because these countries have not met the eligibility requirements for AGOA benefits. The suspension of these benefits will take effect on Jan. 1.

Notably, South Africa has not lost its AGOA benefits, and U.S. Trade Representative, Katherine Tai, is scheduled to attend an AGOA Forum in South Africa this week.

Of note: The Biden administration has indicated that the four countries facing the loss of benefits could potentially retain them if they take measures to address the concerns raised by the U.S. The U.S. has previously halted AGOA benefits for other countries like Mauritania and Ethiopia, with no indication of these benefits being reinstated at this point.

— NPPC: U.S. pork exports still being stymied by India. The National Pork Producers Council (NPPC) raised concerns that U.S. pork exports are still being hindered by India, despite India agreeing to permit U.S. pork imports nearly two years ago. According to NPPC, India introduced a new export certificate with additional attestations in late September 2022, which were not negotiated with U.S. regulatory authorities. Consequently, pork exports to India have been nearly non-existent since access was initially granted.

The opening of India's market to U.S. pork was a significant development, with the U.S. pork industry considering the Indo-Pacific region a top destination for exports. However, it seems that non-tariff barriers are still impeding the entry of U.S. pork into India.

NPPC urged the U.S. government to continue working with the Indian government to resolve this issue and facilitate greater access for U.S. pork in India.

|

ENERGY & CLIMATE CHANGE |

— DOE invests $1.3 billion in six-state transmission line projects to bolster electric grid. The Department of Energy (DOE) has unveiled plans to fund three transmission line projects spanning six states, aimed at strengthening the electric grid to accommodate the administration's renewable energy goals. This $1.3 billion initiative is set to add 3.5 gigawatts of electricity capacity to the grid. Notable projects include the Cross-Tie Transmission Line connecting Nevada and Utah, the Southline Transmission Project spanning from Arizona to New Mexico, and the Twin States Clean Energy Link linking New Hampshire and Vermont to Canada. The funding for these endeavors is derived from the Infrastructure Law, which allocates approximately $20 billion for grid enhancements.

— Democrats urge SEC to complete climate reporting rules, including Scope 3 emissions. Democrats, including House Financial Services Ranking Member Maxine Waters (D-Calif.), continue to advocate for the Securities and Exchange Commission (SEC) to finalize its climate reporting rule. They are pressing the SEC to include Scope 3 emissions in the final plan, citing California's decision to require such reporting, encompassing emissions from supply chains and indirect sources starting in 2027. However, the inclusion of Scope 3 emissions has faced criticism, with concerns that it could impose reporting burdens on numerous industries, such as agriculture, supplying products to publicly traded companies. SEC Chairman Gary Gensler has sought to address these concerns as the agency aims to complete the rule by the end of the year, in line with administration plans. Democratic Senators have also recently called for a swift finalization of the rule.

|

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— McDonald's to raise prices in California as minimum wage hits $20 per hour. McDonald's is set to follow in the footsteps of Chipotle by increasing its prices in California, a response to the state's rising minimum wage for fast-food workers, which is reaching $20 an hour. This wage hike poses challenges for franchisees. McDonald's CEO Chris Kempczinski acknowledged that franchisee cash flow in California would be negatively impacted in the short term. While the exact price increases from McDonald's remain unclear, Kempczinski mentioned that the company would also implement cost-cutting measures. Chipotle, which has already raised prices on four occasions since June 2021, has similar plans for price hikes. In California, Chipotle anticipates price increases in the "mid-to-high single-digit" percentage range.

|

POLITICS & ELECTIONS |

— Rep. Earl Blumenauer will not seek re-election, he announced yesterday. The Oregon Democrat has been in Congress for 27 years and is a member of the Ways and Means Committee.

— St. Louis County Prosecuting Attorney Wesley Bell (D) announced Monday he will drop his bid to unseat Sen. Josh Hawley (R-Mo.) next year, and instead will launch a primary challenge to Rep. Cori Bush (D-Mo.). Bell’s move comes as Bush has taken criticism for her response to the Hamas attack on Israel, including her call in a social media post to end “U.S. government support for Israeli military occupation and apartheid.” The St. Louis Post-Dispatch reports (link) the primary “will pit two veterans of the Ferguson unrest in 2014 against each other: Bush was an activist who helped lead protests; and Bell was elected to the Ferguson City Council in 2015. Bush campaign manager Devon Moody, in a statement, called it “disheartening” that Bell would abandon his bid to become Missouri’s first Black senator and “instead decided to target Missouri’s first Black congresswoman.”

|

OTHER ITEMS OF NOTE |

— Biden to launch a two-week "investing in rural America" campaign, beginning at a farm in southern Minnesota, to draw attention to significant federal investments in rural development and agricultural projects. This move comes as rural voters have increasingly leaned toward the Republican party.

The White House announced that six cabinet secretaries and seven senior officials will travel across the nation during these two weeks to highlight how federal investments, including those in climate-smart agriculture, are contributing to increased revenue for farms, economic development in rural communities, and enhanced opportunities nationwide.

USDA Secretary Tom Vilsack, who will join President Biden at the Minnesota farm, emphasized the administration's commitment to providing tools and support for rural Americans to find opportunities in their hometowns. This initiative coincides with the one-year countdown to the Nov. 5, 2024, general elections.

While some administration officials will speak in swing states, most will not. For instance, Energy Secretary Jennifer Granholm will discuss clean energy in rural communities in Arizona, and USDA Deputy Secretary Xochitl Torres Small will address rural economic opportunities in Michigan and Wisconsin.

A White House fact sheet (link) on the campaign highlights various initiatives, including funding to expand local meat processing capacity, pilot projects for climate-smart farm products and markets, and a fund to stimulate domestic fertilizer production. The 2021 infrastructure law allocated substantial funds for rural areas, particularly in ensuring universal access to high-speed internet. Additionally, the 2022 climate, health care, and tax law provided $9.7 billion to assist rural electric cooperatives in adopting clean energy systems, marking the largest federal investment in rural electrification since the New Deal, according to USDA.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |