House Republicans Face Uphill Battle: Free-for-All Speaker Race and Internal Struggles Complicate Legislative Agenda

Lack of clarity on tariff removal timelines impedes U.S./EU steel trade accord

Washington Focus

House Republicans on Friday thwarted Rep. Jim Jordan's (R-Ohio) push for the speakership, culminating in a closed-door vote of 86-112 against him. This move cleared the way for nine members to enter the race, with House Majority Whip Tom Emmer (R-Minn.) dubbed an early favorite but right-wing outlets and allies of former president Donald Trump are urging Republicans not to elect Emmer, who voted to certify the results of the 2020 election for Joe Biden.

A candidate had to reveal their intentions by Sunday and a forum is scheduled for Monday with a vote on Tuesday to select the party's third nominee since Speaker Kevin McCarthy's (R-Calif.) removal earlier in the month. In order to win the nomination, a candidate needs to garner a majority of the support in the House Republican Conference.

Nine Republican candidates have officially declared to run for speaker: Emmer (Minn.), 62; Republican Conference Vice Chair Mike Johnson (La.), 51; RSC Chair Kevin Hern (Okla.), 61; Reps. Byron Donalds (Fla.), 44; Austin Scott (Ga.), 53; Jack Bergman (Mich.), 76; Pete Sessions (Texas), 68; Gary Palmer (Ala.), 69; and Dan Meuser (Pa.) 59, have all alerted House Republican Conference Chair Elise Stefanik they will run. Link to a New York Times article for more info on each candidate. Link to Washington Post profiles.

Emmer has already locked up an endorsement from McCarthy. "He sets himself, head and shoulders, above all those others who want to run," McCarthy said on NBC’s Meet the Press. "We need to get him elected this week, and move on, and bring not just the party together, but focus on what this country needs most." McCarthy added: “This is embarrassing for the Republican Party. It’s embarrassing for the nation, and we need to look at one another and solve the problem.” Asked if he would rule out running for speaker again: “I don’t need the title. I’m going to help in any way I can.” McCarthy then went after Rep. Matt Gaetz (R-Fla.). “You've got to understand why we were here. Eight Republicans, led by Gaetz, have created this chaos by joining every single Democrat and voting to shut down one branch of government,” the former speaker added.

“It’s so sad,” said Rep. Andy Kim, Democrat of New Jersey. “Everyone just feels so frustrated that the Republican majority is just incapable of governing this chamber.”

Rep. Michael McCaul (R-Texas) told ABC's This Week: “I have to say, and it’s my 10th term in Congress, this is probably one of the most embarrassing things I’ve seen because, if we don’t have a speaker of the House, we can’t govern. And every day that goes by, we’re essentially shut down as a government. We have very important issues right now, war and peace, adding “I want a speaker in the chair so we can move forward and govern.”

Bottom line: Republicans need to move quickly (for them), particularly considering the Biden administration’s request for new funding for the conflicts in Ukraine and the Middle East and a fast-approaching Nov. 17 deadline for deciding on how to fund the federal government. But the first task is to find someone who could unify the GOP conference.

— Biden asks Congress for $106 billion emergency aid package: Israel, Ukraine, and border security at the forefront. In a significant move, the Biden administration on Friday called upon Congress to approve a substantial $106 billion emergency aid package, aimed at providing crucial support to Israel, Ukraine, bolstering border security, and addressing humanitarian needs. The proposed allocation comprises $61.4 billion for Ukraine, with a focus on supplying Department of Defense equipment, replenishing weapon stocks, and sustaining military assistance. Additionally, $14.3 billion is earmarked for Israel, while $9.15 billion is designated for humanitarian aid in Ukraine, Israel, and Gaza.

This funding request has ignited skepticism among Republicans, raising the stakes by linking Ukraine's support to bolstering Israel's defense system.

— Senate Minority Leader Mitch McConnell (R-Ky.) on President Joe Biden’s around $100 billion supplemental funding request, on Fox News Sunday: “I think neither side has done a very good job of dealing with the deficit. However, you have to respond to conditions that actually exist that are a threat to the United States. The Iranians are a threat to us as well. And so, this is an emergency. It’s an emergency that we step up and deal with this axis of evil — China, Russia, Iran — because it’s an immediate threat to the United States.” Biden’s request to Congress included $61 billion for Ukraine, $14 billion for Israel, $14 billion to beef up border operations, $10 billion in humanitarian aid and $2 billion for Indo-Pacific security assistance. Some Senate Republicans say border policy changes are needed besides just funding for border protection/operations.

On some Republicans not supporting Ukraine funding: “There are some differences of opinion among Republican senators about this. I don’t view this about whether we give Biden credit or not. This is a question of whether it’s a serious threat to the United States. If the Russians aren’t defeated, they will go into a NATO country next.”

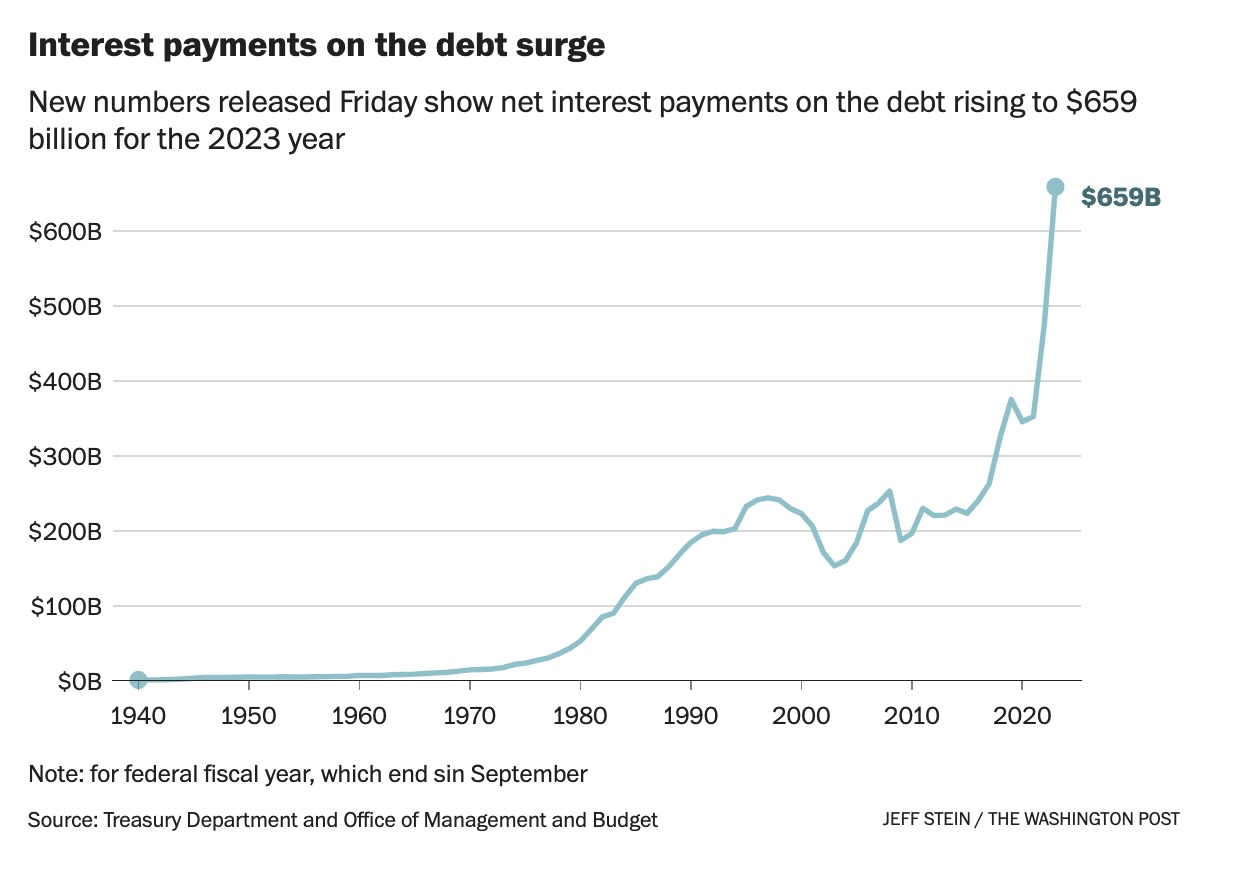

— U.S. budget deficit doubles to $1.7 trillion in 2023 amid economic challenges. The United States' federal budget deficit for the 2023 fiscal year (FY) effectively doubled due to various economic challenges, including declining tax revenue, rising interest rates, and the continued demand for pandemic relief benefits. According to the latest Treasury Department figures, the deficit reached $1.7 trillion in 2023, up from $1.37 trillion in 2022, with a significant part of this increase attributed to accounting changes related to a student-loan forgiveness program. When excluding these effects, the deficit rose from about $1 trillion in 2022 to $2 trillion in 2023.

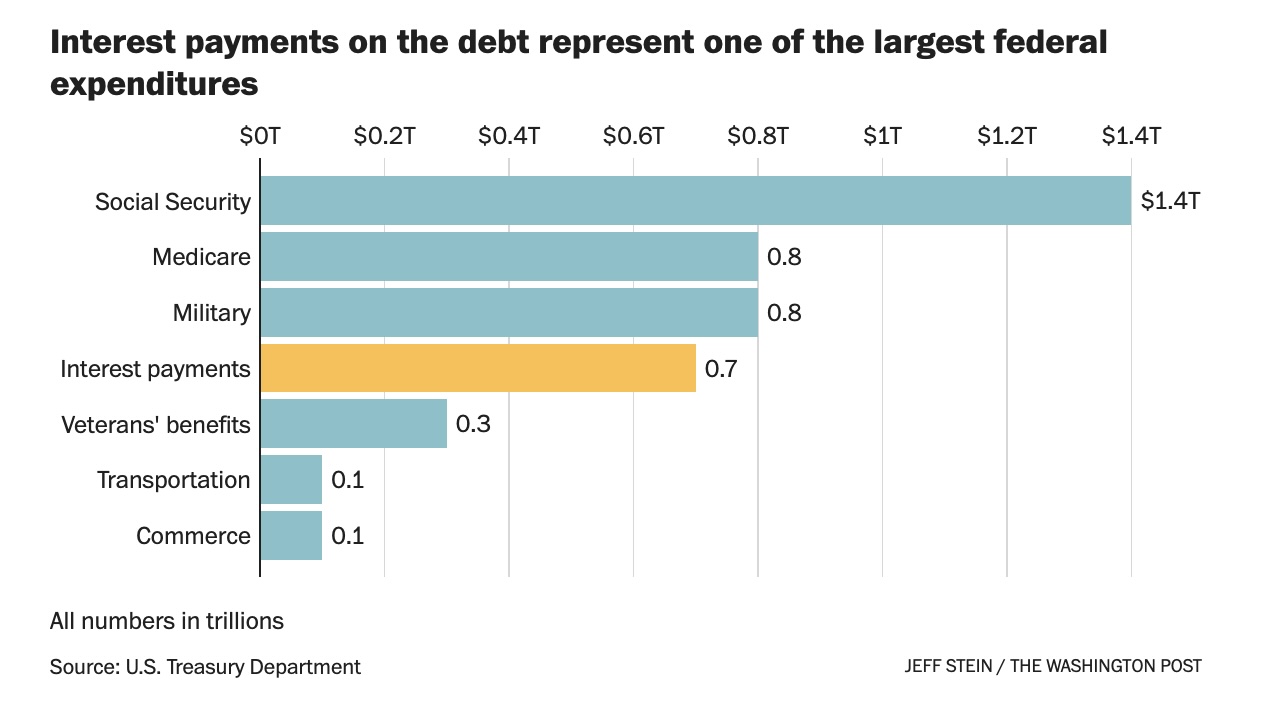

Of note: The U.S. gov’t spent $659 billion this year paying off the interest on its debt, according to the Treasury report, as the nation’s widening fiscal imbalance and the Federal Reserve’s rate hikes dramatically raised the federal cost of borrowing. This year’s sum was almost twice as much as two years ago. The government spent $476 billion paying off the interest on its debt last year and $352 billion doing so in 2021.

Despite concerns about the fiscal trajectory, lawmakers have struggled to agree on meaningful spending cuts or tax increases. The national debt has exceeded $33 trillion, with projections indicating that interest on the debt could become the nation's largest expenditure within the next few decades. Within three years, if interest rates remain elevated, payments on the debt could become the second-largest federal program — behind only Social Security, which provides pensions for tens of millions of seniors, analysts say. Depending on future rates, interest payments on the debt could reach $2 trillion per year by the end of the decade, consuming close to 3% of all federal tax revenue. That number would be lower if interest rates fall.

Treasury Secretary Janet Yellen emphasized the administration's focus on economic growth and proposed measures to reduce future deficits, including raising taxes on high earners and corporations. However, experts warn that the current borrowing path may be unsustainable, especially if interest rates remain high for an extended period.

— Senate Republicans, Manchin introduce legislation to block EPA's tailpipe emissions rules. Senate Finance Committee Ranking Member Mike Crapo (R-Idaho) and Sen. Pete Ricketts (R-Neb.), along with a coalition of 25 Senate Republicans, have introduced the "Choice in Automobile Retail Sales Act" (CARS) to thwart the implementation of the EPA's ambitious tailpipe emissions rules. This legislation, introduced as a companion to a House bill by Rep. Tim Walberg (R-Mich.), aims to strike down the EPA's proposal, which seeks to make a significant portion of new vehicles electric by 2032.

The CARS Act, which is co-sponsored by Sen. Joe Manchin (D-W.Va.) also seeks to prohibit regulations that mandate specific technologies or limit the availability of vehicles based on their engine type.

Industry groups, including the American Petroleum Institute and the National Automotive Dealers Association, have voiced their support for the bill, arguing that the EPA rules are too aggressive and unattainable in the proposed timeframe.

— On Monday, North Carolina's GOP-controlled state legislature is expected to vote on new congressional district maps that could put at risk as many as four Democratic-held seats in the U.S. House — a move that could help determine which party gains the upper hand in the chamber after the 2024 elections. Democratic Gov. Roy Cooper does not have veto power over redistricting legislation in North Carolina.

— On the trade policy front:

- Lack of clarity on tariff removal timelines impedes U.S./EU steel trade accord. The failure to reach a steel trade agreement between the U.S. and the European Union (EU) late last week can be attributed, in part, to the U.S.’ reluctance to clarify when it would lift punitive trade measures, according to Valdis Dombrovskis, an executive vice president at the European Commission. The dispute centers on the removal of Section 232 tariffs and tariff-rate quotas imposed by the U.S. on more than $6 billion of EU steel and aluminum exports in 2018. Dombrovskis expressed disappointment in the absence of a clear timeline from the U.S., and without a resolution, tariffs could be reinstated on EU/U.S. exports by year-end. Negotiations were part of the Global Arrangement on Sustainable Steel and Aluminum (GSA) talks aimed at addressing global excess capacity and carbon emissions in the steel industry. Key issues include the removal of tariffs and tariff-rate quotas, compatibility with international trade rules, and coordination on issues like China's non-market practices.

- On Monday, the U.S. International Trade Commission is expected to decide whether to ban imports of Apple Watches based on allegations that they infringe patents belonging to medtech company Masimo. An ITC judge preliminarily ruled for Masimo in January.

- Australia will suspend its case at the WTO over China’s tariffs on wine imports ahead of Prime Minister Anthony Albanese’s first trip to the country next month. China will undertake a review of its wine tariffs that’s expected to take five months and during that period, Australia will suspend its WTO dispute over China’s actions.

— Argentina's ruling party candidate, Sergio Massa, leads in presidential election, forcing runoff with libertarian economist, Javier Milei. In the first round of Argentina's presidential election, Sergio Massa, the candidate from the ruling Peronist party, secured the most votes, defying expectations that libertarian economist Javier Milei would emerge victorious. Massa garnered 36.3% of the votes, while Milei received 30.1%, setting the stage for a runoff on Nov. 19. The establishment conservative candidate, Patricia Bullrich, received 23.8% of the votes.

Massa, the country's Economy Minister, faced a challenging economic climate marked by high inflation, a depreciating currency, and rising poverty levels. In response, he introduced measures like eliminating income tax for most Argentines and providing cash bonuses in an effort to gain support.

Javier Milei campaigned on a platform to upend the political establishment and promised to replace the Argentine peso with the U.S. dollar, close the central bank, and cut government spending. His unconventional proposals garnered significant attention but also raised concerns about their potential impact on ordinary citizens.

The country faces hyperinflation risks due to extensive money printing, and Massa's recent measures, such as eliminating sales tax on groceries and providing cash bonuses, may exacerbate the fiscal deficit. Analysts warn of the potential for further economic instability and depreciation of the peso in the lead-up to the runoff.

— Some key events and hearings this week include:

Monday Oct. 23:

- OECD report. Atlantic Council virtual discussion on "A Bold Agenda for the 2024 NATO Summit in Washington."

- China challenges. George Washington University Elliott School of International Affairs discussion on "Congress and Biden's Initial Success in Countering China's Challenges."

Tuesday, Oct. 24:

- WRDA: House Transportation and Infrastructure subcommittee hearing, “Water Resources Development Acts: Status of Past Provisions and Future Needs.”

- SEC agenda. House Financial Services Capital Markets Subcommittee hearing on "Examining the SEC's Agenda: Unintended Consequences for US Capital Markets and Investors."

- Trade issues. Commerce Secretary Gina Raimondo addresses the U.S. Chamber of Commerce and the Association of American Chambers of Commerce in Latin America and the Caribbean 56th annual meeting and "Forecast on Latin America and the Caribbean" Conference.

- U.S./EU summit and decarbonization. Atlantic Council virtual discussion on "After the EU/U.S. Summit: What's Next for International Cooperation on Industrial Decarbonization?"

- DOL overtime rule. House Education and the Workforce Protections Subcommittee hearing on "Bad for Business: DOL's Proposed Overtime Rule."

Wednesday, Oct. 25:

- President Joe Biden hosts Australian prime minister Anthony Albanese at the White House. The event will be Biden's fourth state dinner since taking office. In June, he welcomed India's Prime Minister Narendra Modi to the White House.

- WTO at a crossroads. Peterson Institute for International Economics virtual discussion on "World Trade Organization (WTO) at a Crossroads: The Geopolitical Threat to 75 Years of Multilateral Trade Cooperation."

- Trade policy. Washington International Trade Association virtual discussion with Stephen Lande, president of Manchester Trade, on "Six Decades of Trade Policymaking."

- Climate change and supply chains. Senate Budget Committee hearing on "Bottlenecks and Backlogs: How Climate Change Threatens Supply Chains."

- Biden Black Sea policy. Senate Foreign Relations Europe and Regional Security Cooperation Subcommittee hearing on "Assessing the Department of State's Strategy for Security in the Black Sea Region."

Saturday, Oct. 28:

- Japan: G7 trade ministers meeting in Osaka, attended by ministers of the member nations.

Economic Reports and Key Events for the Week

On Friday, the Bureau of Labor Statistics releases the personal-consumption expenditures price index for September. The Federal Reserve's preferred inflation measure — core PCE, which excludes food and energy prices — is forecast to be up 3.7% from a year earlier, slower than August's 3.9%.

As for the Federal Reserve, members will be in a blackout period ahead of the next FOMC meeting Oct. 31-Nov. 1.

Monday, Oct. 23

- Chicago Fed National Activity Index: The national activity index is expected to rise to plus 0.05 in September versus a lower-than-expected minus 0.16 in August.

- ECB’s Monetary Policy Committee members are expected to vote to hold rates steady at 4.75%.

- China: Chung Yeung Festival. Financial markets closed.

- Tim Wentworth becomes chief executive of Walgreens Boots Alliance. The pharmacy group’s former CEO abruptly stepped down last month.

- Earnings: Results: Philips Q3, UniCredit Q3

Tuesday, Oct. 24

- PMI Composite Flash: Services have held in the 50 column the last eight reports but have been noticeably slowing with the consensus for October at 49.4 versus September's 50.1. Manufacturing, at 49.8 in September, is expected to edge lower to 49.5 in August.

- Richmond Fed Manufacturing Index

- Earnings: Anglo American Q3 production report, Alphabet Q3, Archer-Daniels-Midland Q3, ASM International Q3, Barclays Q3, Brown & Brown Q3, Bunzl Q3 trading statement, Coca-Cola Company Q3, Corning Q3, Dow Q3, General Electric Q3, General Motors Q3, Halliburton Q3, Hermès Q3, Hydro Q3, Kering Q3, Kimberly-Clark Q3, Michelin Q3, Microsoft Q1, Novartis Q3, Puma Q3, Randstad Q3, Shimano Q3, Snap Q3, Spotify Q3, 3M Q3, Travis Perkins Q3 trading update, Verizon Communications Q3, Visa Q4, Zegna Q3

Wednesday, Oct. 25

- MBA Mortgage Applications

- New home sales fell sharply from 739,000 in July to a 675,000 annual rate in August with forecasters for September calling for a slight rebound to 685,000 despite the steep surge in interest rates.

- State Street Investor Confidence Index

- Canada interest rate decision

- Earnings: Akzo Nobel Q3, Alfa-Laval Q3, Asos FY, Boeing Q3, Carrefour Q3, Cazoo Q3, Chubb Q3, Dassault Systèmes Q3, Deutsche Bank Q3, Fresnillo Q3 production report, Heineken Q3, Hilton Worldwide Holdings Q3, IBM Q3, Lloyds Banking Group Q3 management statement, Mattel Q3, Meta Q3, Moody’s Q3, Porsche Q3, Reckitt Benckiser Q3, RWS FY trading statement, Santander Q3, SEB Q3, UMC Q3, Western Union Q3, Wyndham Hotels & Resorts Q3

Thursday, Oct. 26

- Jobless claims for the Oct. 21 week are expected to come in at 206,000 versus 198,000 in the prior week.

- Durable Goods Orders: Forecasters see durable goods orders rising 1.0% in October following September's 0.1% increase. Ex-transportation orders are seen up 0.2%.

- Third-quarter GDP, supported by consumer spending, is expected to accelerate sharply to 4.1% annualized growth versus second-quarter growth of 2.1%.

- International Trade in Goods [Advance]: The U.S. goods deficit (Census basis) is expected to hold steady at $85.4 billion in September after narrowing by $6.3 billion in August to $84.6 billion.

- Retail Inventories (Advance)

- Wholesale Inventories (Advance): Wholesale inventories are expected to increase 0.1% in the advance report for September that would follow a 0.1% dip in August.

- Pending home sales in September, which in August fell 7.1%, are expected to rebound a slight 0.2%.

- Fed Balance Sheet

- Money Supply

- EU: European Central Bank monthly interest rate decision

- Earnings: Accor Q3, Amazon.com Q3, Bank of Ireland Q3 trading update, Bloomsbury Publishing H1, BNP Paribas Q3, Bristol Myers Squibb Q3, Capital One Q3, Comcast Q3, Danone Q3, Ford Motor Company Q3, Fujitsu H1, Harley-Davidson Q3, Hasbro Q3, Heathrow Q3, HelloFresh Q3, Hershey Q3, SK Hynix Q3, Inchcape Q3 trading statement, Intel Q3, Juniper Networks Q3, Kerry Group Q3, Mastercard Q3, Mercedes-Benz Q3, Merck Q3, Northrop Grumman Q3, Reliance Steel & Aluminum Q3, Royal Caribbean Q3, Sodexo FY, Southwest Airlines Q3, Standard Chartered Q3, STMicroelectronics Q3, Unilever Q3, United Parcel Service Q3, Universal Health Services Q3, Universal Music Group Q3, Vinci Q3, Volkswagen Q3, Volvo Q3, Whirlpool Q3, Willis Towers Watson Q3, WPP Q3 trading update

Friday, Oct. 27

- Personal Income & Outlays. Personal income is expected to rise 0.4% in September with consumption expenditures expected to increase 0.5%. These would compare with August's 0.4% creases for both. Inflation readings for September are expected at monthly increases of 0.3% both overall and for the core (versus August's increases of 0.4% and 0.1%). Annual rates are expected at 3.4% overall and 3.7% for the core (versus August's 3.5% and 3.9%).

- Consumer sentiment is expected to end October at 63.0, unchanged from the mid-month flash and more than 5 points lower than September.

- Russia: interest rate decision

- Earnings: Air France-KLM Q3, Aker BP Q3, Aon Q3, AutoNation Q3, Chevron Q3, Colgate-Palmolive Q3, Danske Bank Q3, Electrolux Q3, Eni Q3, EquinorQ3, ExxonMobil Q3, Holcim Q3, Hitachi Q2, IAG Q3, NatWest Group Q3, Nomura Q2, Rémy Cointreau H1, Stanley Black & Decker Q3, T Rowe Price Q3

Key USDA & international Ag & Energy Reports and Events

With China reportedly short bought on soybean imports from both Brazil and the United States, trade news will be monitored closely. Meanwhile, USDA on Wednesday issues another food price outlook.

On the energy front, Tuesday brings the IEA World Energy Outlook report.

Monday, Oct. 23

Ag reports and events:

- Export Inspections

- Crop Progress

- MARS monthly report on EU crop conditions

- Sugar production and cane crush data from Brazil’s Unica (tentative)

- Indonesia’s ICDX to start CPO trading

- Holiday: Hong Kong, Libya, New Zealand, Thailand

Energy reports and events:

- Singapore International Energy Week (through Oct. 27)

Tuesday, Oct. 24

Ag reports and events:

- EU weekly grain, oilseed import and export data

- Holiday: India, Bangladesh

Energy reports and events:

- API weekly U.S. oil inventory report

- International Energy Agency publishes its World Energy Outlook

- Singapore International Energy Week (day 2)

- Future Investment Initiative, Riyadh (through Oct. 26)

- European biogas conference, Brussels (through Oct. 25)

- European Commission to publish its wind energy plans, Brussels

- Earnings: CNOOC 3Q; Halliburton 3Q; NextEra Energy 3Q

Wednesday, Oct. 25

Ag reports and events:

- Broiler Hatchery

- Food Price Outlook

- Food Security in the U.S.

- Food Security in the United States

- Household Food Security in the United States in 2022

- Statistical Supplement to Household Food Security in the United States in 2022

- Rice Stocks

- Cold Storage

- Poultry Slaughter

- Malaysia Oct 1-25 palm oil exports

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- Singapore International Energy Week (day 3)

- Future Investment Initiative, Riyadh (second day)

- European biogas conference, Brussels (2nd day)

- Earnings: Hess 3Q; Baker Hughes 3Q

- Holiday: Kazakhstan

Thursday, Oct. 26

Ag reports and events:

- Weekly Export Sales

- Tree Nuts: World Markets and Trade

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Singapore onshore oil-product stockpile weekly data

- Singapore International Energy Week (day 4)

- Future Investment Initiative, Riyadh (last day)

- Brent December options expire

- Nymex gasoline November options expire

- Nymex heating oil November options expire

- Earnings: China Oilfield Services 3Q; Repsol 3Q; TotalEnergies 3Q; Valero 3Q

Friday, Oct. 27

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Peanut Stocks and Processing

- Livestock and Meat Domestic Data

- FranceAgriMer’s weekly crop condition report

- Holiday: Chile

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- Singapore International Energy Week (last day)

- European Climate Stocktake

- ICE Futures Europe weekly commitment of traders report

- Earnings: Eni 3Q; Equinor 3Q; Aker BP 3Q; Imperial Oil 3Q; Exxon Mobil 3Q; Chevron 3Q; Xcel Energy 3Q

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |