Your Pro Farmer newsletter (October 21, 2023) is now available

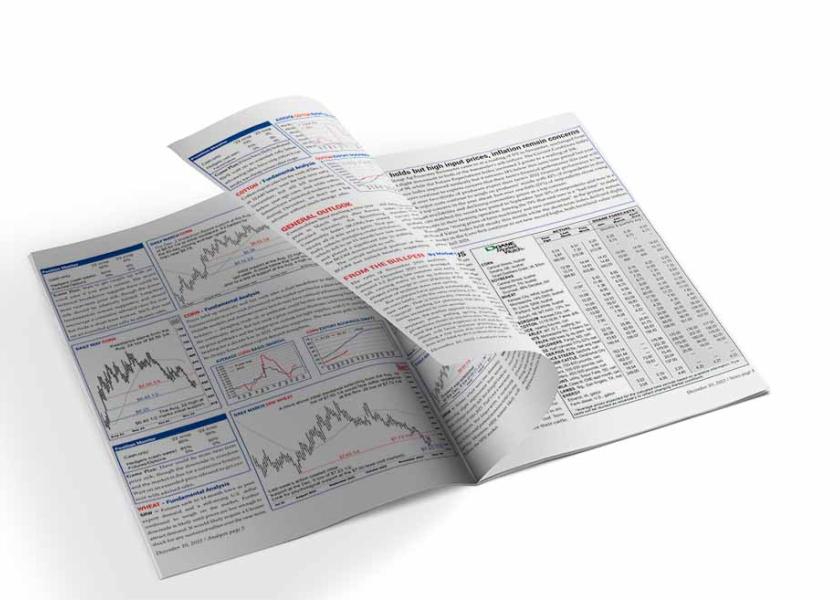

Markets are showing stronger signs seasonal lows are in place. With U.S. corn and soybean harvest progressing ahead of average, a greater focus has turned to demand. While export demand is still lagging, there have been better results recently. China is short-bought on soybeans and crush margins are robust, so Chinese buyers should show a greater appetite for U.S. soybeans. Meanwhile, U.S. soybean crush started September on a record clip. Markets are also starting to pay closer attention to weather in South America. While rains have been plentiful in southern Brazil, conditions have been dry in central areas of the country and in Argentina. That’s not a major market factor for soybeans yet – and could actually have the greatest impact on safrinha corn in Brazil. On the economic front, bond yields continue to soar, which is helping the Fed in its inflation battle. Chair Jerome Powell said the Fed will be cautious with monetary policy moving forward. In Washington, Republican dysfunction continues in the House and the farm bill could be the next victim of the directionless Congress. We cover all of these items and much more in this week’s newsletter, which you can download here.