House GOP Leadership Saga Continues, with Jordan Latest Nominee

U.S./EU trade issue decision looming | Putin goes to Beijing | More U.S. sanctions on China

Washington Focus

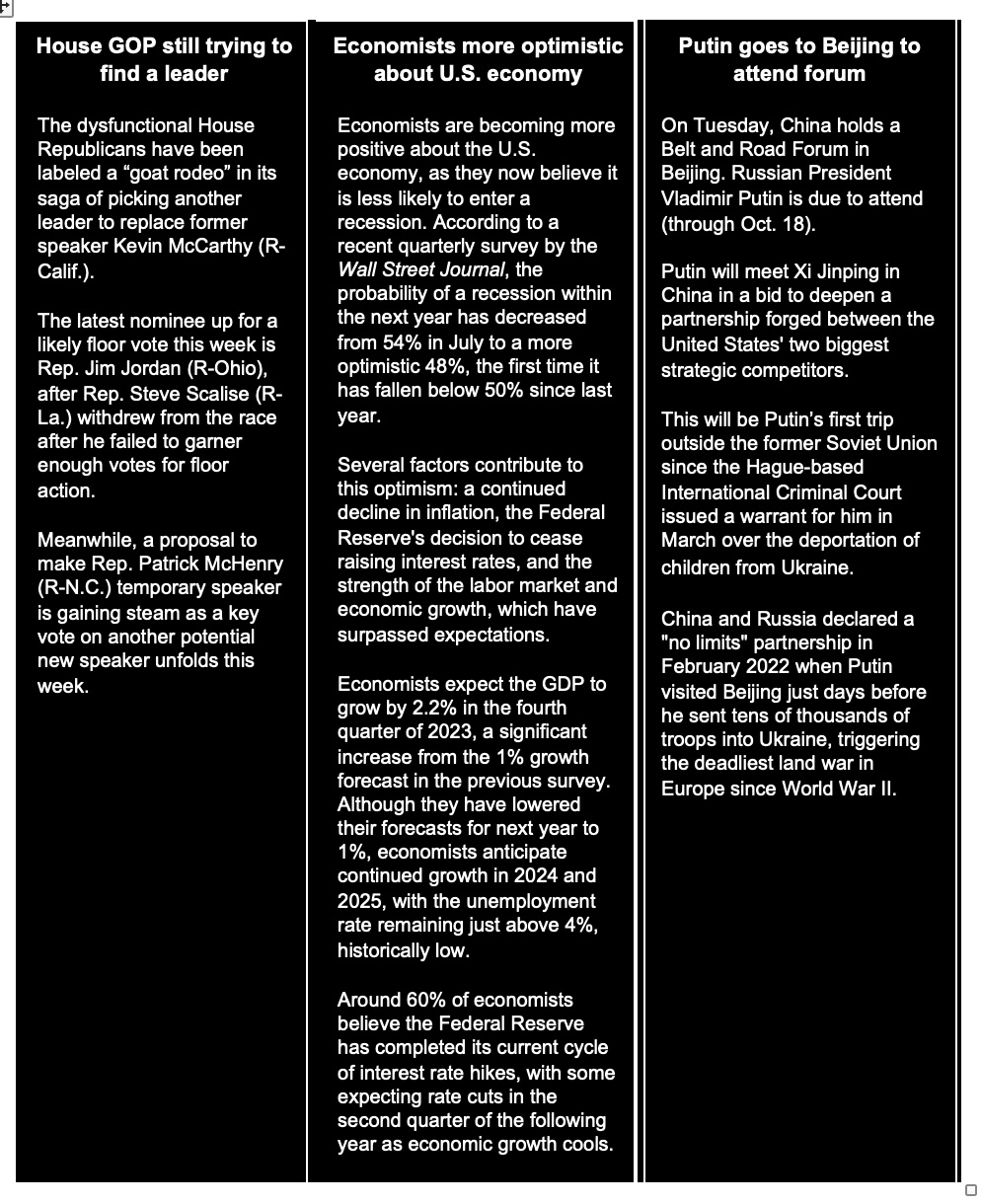

The House is reconvening at 6 pm ET on Monday without a speaker since Oct. 3 and a proposal to make Rep. Patrick McHenry (R-N.C.) temporary speaker is gaining steam as a key vote on another potential new speaker unfolds this week.

Rep. Jim Jordan (R-Ohio) won the most recent speaker nomination on Friday 124-81 over Rep. Austin Scott (R-Ga.). Jordan, chairman of the Judiciary Committee, previously lost to Rep. Steve Scalise 113-99, who backed out of the running due to a lack of votes to win a simple majority on the House floor. A simple majority is currently 217 due to vacancies.

Big hill for Jordan. The conference on Friday held a closed-door test vote to gauge how much support Jordan would have from Republican members on the House floor. The final tally was 152-55 so he still needs to pick up 65 votes to win, no small task. For perspective, eventual House Speaker Kevin McCarthy (R-Calif.) had 188 votes secured before coming to the House floor in January. He was elected after 15 rounds and removed on Oct. 3 after Rep. Matt Gaetz (R-Fla.) introduced a motion to vacate the chair that passed the full House with Democrat votes and 8 rebel Republican votes. "I think he’s got the votes, but we’ll see," McCarthy said on Friday before lawmakers left for the weekend.

Rep. Thomas Massie (R-Ky.), a Jordan ally, said he expects a floor vote this week so that members can lay out where they stand before finally supporting a speaker. Massie projected that “we go to the floor” when Jordan has closer to 180 votes. ”Which isn't to 217 yet, but I believe what's going to happen is – people in the first round may vote for McCarthy, they may vote for Scalise, Donald Trump may get a vote,” Massie said. “But after everybody gets that out of their system, you know, fulfills their commitments … by the second or third round, I think we're going to be over 200."

Jordan and his supporters have initiated a right-wing pressure campaign within the GOP. Their goal is to rally the party's base voters against any Republican lawmakers perceived as obstacles to Jordan's election as Speaker of the House. Reports note that lawmakers and activists close to Jordan have turned to social media and the airwaves to publicly criticize fellow Republicans whom they believe are impeding his path to victory. They are also encouraging voters to pressure these lawmakers into backing Jordan. Some of Jordan's backers have even shared the phone numbers of mainstream GOP lawmakers they view as holdouts, urging their followers to flood the Capitol switchboard with calls demanding support for Jordan or risk backlash from conservative voters in upcoming primary elections.

If Jordan doesn’t get 217 votes, other Republican candidates center on Rep. Kevin Hern (R-Okla.), the chair of the conservative Republican Study Committee, and House Majority Whip Tom Emmer (R-Minn.) along with Rep. Mike Johnson (R-La.), the vice chairman of the House Republican conference.

There is interest among some of the House GOP conference to make Speaker Pro Tempore McHenry the speaker at least temporary but constitutional questions about such a move linger. Some moderate Democrats offered on Friday to back McHenry as a temporary speaker with all the powers of the office if the GOP cannot soon choose a permanent speaker. But if Democrats help achieve that, they made clear it wouldn’t be for free. On Friday, Democratic leaders of the bipartisan Problem Solvers Caucus sent a letter to McHenry proposing that his powers be expanded to allow him to bring a narrow set of legislation up for a vote, with his authority limited to 15-day increments. The bills would cover foreign aid to Ukraine and Israel, extending through Jan. 11 a continuing resolution that is funding the government, and committee and floor consideration of the eight fiscal year 2024 appropriations bills that haven’t yet cleared the House.

Bottom line: Until Republicans can unite around a speaker candidate, the House is poised to remain unable to conduct business, including the next steps for any new farm bill yet this year. Some label what’s happening in the GOP House a goat rodeo.

— On the trade policy front, the Wall Street Journal reports (link) that U.S. and Europe are at odds over Trump-era tariffs, straining trans-Atlantic relations. Former President Donald Trump imposed tariffs on U.S. steel and aluminum imports in 2018, sparking tensions with U.S. allies and retaliatory measures. While the U.S. and EU aim to make progress during an upcoming summit, reaching a final agreement is uncertain, the WSJ article notes, potentially extending the tariff dispute into the next presidential election. This issue has significant implications for U.S./EU ties, climate goals, and geopolitics.

The Biden administration initially allowed European steel and aluminum imports into the U.S. without tariffs, as long as import volumes remained below historical levels, signaling an attempt to reset the relationship after tense years under the Trump administration. This move also led the EU to suspend its retaliatory tariffs on various U.S. products. However, economic tensions flared up again, driven by provisions linked to clean-technology subsidies in the U.S. Inflation Reduction Act (Climate Bill). This resulted in some European companies considering shifting investments to the U.S. Some European politicians also accused the U.S. of taking advantage of European energy shortages related to the Ukraine conflict by charging high prices for liquefied natural gas, raising industrial costs.

In the current negotiations, the U.S. is seeking EU tariffs on Chinese steel, which it believes contributes to global oversupply and harms U.S. producers. Simultaneously, the U.S. is hesitant to completely remove tariffs on European metals and instead seeks commitments from the EU to impose tariffs on Chinese steel in exchange for maintaining the suspension of tariffs on European imports.

The EU's position is that it seeks a definitive end to U.S. tariffs and insists that any trade measures must comply with World Trade Organization rules.

EU officials have expressed willingness to pursue an anti-subsidy investigation into steel originating from non-market economies, but they have resisted Washington's push for specific actions against Chinese products, citing WTO rules. The WSJ article says the EU is reportedly planning to announce such an investigation targeting steel during the upcoming summit (Friday, Oct. 20), potentially using it as leverage in negotiations with the United States.

Bottom line: The outcome of the negotiations will not only impact trade relations but also have broader geopolitical implications.

— The Biden administration is planning to announce new controls on artificial intelligence chips and equipment that can be sold to China, administration officials told Axios (link). The new restrictions, likely to be announced early this week, will broaden a White House effort to prevent China from gaining a military advantage in artificial intelligence.

The controls will also limit the export of equipment used to produce advanced semiconductors, bringing the U.S. into line with regulations imposed by Japan and the Netherlands.

— Monday, Oct. 16, is World Food Day at the United Nations. This year’s focus is on water.

— Louisiana Republicans reclaim governor's mansion with Jeff Landry's decisive win. In a significant political shift, Republicans have reclaimed the governor's seat in Louisiana as state Attorney General Jeff Landry emerged victorious in a competitive race featuring 14 candidates. The election utilized a "jungle primary" system where all contenders, regardless of party, competed against each other. Landry secured over 50% of the vote, triumphing over fellow Republicans, Democrats, and Independents. Had no candidate crossed the 50% threshold, the top two finishers would have faced a runoff election in November. This victory marks the end of an eight-year Democratic tenure in the state's highest office, with incumbent John Bel Edwards, a Democrat, reaching his term limit at the end of the year. Landry, who has held the position of state attorney general since 2016, positions himself as an advocate for conservative family values. He notably enforced Louisiana's trigger law, effectively banning most abortions, following the Supreme Court's decision to eliminate the constitutional right to abortion in June 2022. Throughout his campaign, Landry emphasized his support for Second Amendment rights and touted his reputation as a tough-on-crime attorney general. His candidacy received endorsements from former President Donald Trump, who is seeking the 2024 Republican presidential nomination, and U.S. Rep. Steve Scalise, a prominent Republican figure. Trump's past successes in Louisiana's presidential races in 2016 and 2020 likely contributed to Landry's strong support in the election.

Economic Reports for the Week

Federal Reserve speakers, including chairman Jerome Powell, are out in force this week so Fed watchers will be listening carefully to any hints of future interest rate decisions ahead.

Monday, Oct. 16

- Empire State Manufacturing Index: October's Empire State index is expected to fall into modest contraction, to minus 5.0 after September's plus 1.9 which was the third positive score in four months.

- Federal Reserve speakers: Patrick Harker

Tuesday, Oct. 17

- Retail Sales: September sales are expected to rise 0.3% versus August's higher-than-expected 0.6% rise that followed July's gain of 0.5% which was also higher than expected.

- Industrial Production: After rising 0.4% in August, industrial production is expected to slow to no change in September. Manufacturing output is expected to fall 0.1%. Capacity utilization is expected to edge lower to 79.6% following August's higher-than-expected 79.7% rate.

- Business inventories in August are expected to rise 0.3% following no change in July.

- Housing Market Index: Forecasters expect the housing market index to hold unchanged at a very weak 45 in October after falling by a steep and unexpected 5 points in September.

- Albertsons may provide an update on the proposed takeover of its business by Kroger when it publishes earnings. In September the two supermarket chains unveiled a plan to sell a combined 413 stores to satisfy competition regulators. The merger was announced a year ago, and remains on track to close in early 2024.

- Federal Reserve speakers: John Williams | Michelle Bowman | Tom Barkin

Wednesday, Oct. 18

- MBA Mortgage Applications

- Housing Starts and Permits: After falling very sharply from 1.447 million in July to 1.283 million in August, housing starts in September are expected to rebound to a 1.394 million annual rate. Permits, which by contrast jumped to 1.543 million in August from 1.443 million, are expected to swing lower to 1.450 million.

- Beige Book

- Treasury International Capital

- Investors will closely watch Tesla’s earnings. The carmaker’s deliveries and production figures fell short of expectations in the third quarter, and it has since cut the prices of its Model 3 compact sedan and Model Y SUV to boost sales.

- In China, GDP figures for the third quarter are released along with data on industrial production and retail sales. Analysts expect China’s GDP to drop below 5%, after rising to 6.3% in the second quarter.

- Federal Reserve speakers: Christopher Waller | John Williams | Michelle Bowman | Patrick Harker | Lisa Cook

Thursday, Oct. 19

- Jobless claims for the Oct. 15 week are expected to come in at 214,000 versus 209,000 in the prior week. Claims have moved lower in recent weeks toward historic lows.

- Philadelphia Fed Manufacturing Index: Swinging wildly into the plus column at 12 in August then swinging wildly into the negative column to minus 13.5 in September. the Philadelphia Fed manufacturing index in October is expected to improve to minus 6.8.

- Existing Home Sales: After August's 4.04 million annual rate, existing home sales in September are expected to decrease to a 3.90 million rate. The National Association of Realtors described August sales as stable, balanced between the effects of high mortgage rates and strength in the labor market.

- Leading Indicators: Down by 0.4% in August, the index of leading economic indicators in September is expected to extend its long streak of decline with another 0.4% dip. This index has long been signaling a pending recession.

- Fed Balance Sheet

- Money Supply

- Federal Reserve speakers: Philip Jefferson | Jerome Powell | Austan Goolsbee | Michael Barr | Raphael Bostic | Patrick Harker

Friday, Oct. 20

- Federal Reserve: Patrick Harker | Loretta Mester

- In Japan, publication of September’s inflation figure will add to the speculation about when the Bank of Japan will end its long period of ultra-loose monetary policy and start raising interest rates. Annual core inflation was 3.1% in August, the 17th month in a row that it has been above the central bank’s target rate.

Key USDA & international Ag & Energy Reports and Events

The monthly International Grains Council report comes Thursday (link).

Monday, Oct. 16

Ag reports and events:

- Export Inspections

- Crop Progress

- Cotton and Wool Outlook

- Oil Crops Outlook

- Dairy Monthly Tables

- Feed Outlook

- Rice Outlook

- Wheat Outlook

- Turkey Hatchery

- Malaysia Oct 1-15 palm oil exports

- Holiday: Argentina, Colombia

Energy reports and events:

- Japan Power Week, Tokyo (through Oct. 19)

- African Energy Week, Cape Town (through Oct. 20)

- EU environment ministers meeting, Luxembourg. Issues include COP28 negotiating position

- U.S. Energy Information Administration’s Winter Fuels Outlook webinar

Tuesday, Oct. 17

Ag reports and events:

- Feed Grains: Yearbook Tables

- EU weekly grain, oilseed import and export data

- Argus Fertilizer Europe Conference, day 1

Energy reports and events:

- API weekly U.S. oil inventory report

- Japan Power Week (day two)

- Energy Intelligence Forum 2023 (through Oct. 19), London

- EU energy ministers meeting, Luxembourg

- WTI November options expire

Wednesday, Oct. 18

Ag reports and events:

- Broiler Hatchery

- Fruit and Tree Nuts Data

- Vegetables and Pulses Data

- Livestock, Dairy, and Poultry Outlook

- Sugar and Sweeteners Outlook

- China’s 2nd batch of September trade data, including agricultural imports

- China’s 3Q pork output and inventory levels

- Argus Fertilizer Europe Conference, day 2

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- China’s industrial production for September including coal, gas and power generation, crude oil and refining

- China’s second batch of September trade data, including LNG and pipeline gas imports; oil products trade breakdown

- Japan Power Week (day 3)

- Enagas H2Med hydrogen corridor presentation, Berlin

- Energy U.K. annual conference

- Oxford Institute for Energy Studies annual Gas Day, Oxford

- Qatar Fuel 3Q results

Thursday, Oct. 19

Ag reports and events:

- Weekly Export Sales

- Food Expenditure Series

- U.S. Bioenergy Statistics

- Livestock Slaughter

- Milk Production

- IGC monthly grains report

- Port of Rouen data on French grain exports

- Argus Fertilizer Europe Conference, day 3

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- China winter gas summit hosted by Chongqing Petroleum and Gas Exchange in Beijing

- Japan Power Week (last day)

- Singapore onshore oil-product stockpile weekly data

Friday, Oct. 20

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Cotton Ginnings

- Cattle on Feed

- Chickens and Eggs

- China’s 3rd batch of September trade data/country breakdowns for commodities

- Malaysia’s Oct. 1-20 palm oil exports

- Grain Industry Association of Western Australia’s (GIWA) monthly report

- FranceAgriMer’s weekly crop condition report

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- China’s third batch of September trade data, including country breakdowns for energy and commodities

- Shanghai exchange weekly commodities inventory

- Energy conference (through Oct. 22), Xiamen, China

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |