Pilot Climate-Smart Ag Pilot Program Paying $100 an Acre

House GOP begins speaker election | ExxonMobil’s huge buy | Milk pricing differences

|

Today’s Digital Newspaper |

MARKET FOCUS

- USDA daily export sales:

— 121,000 MT soybeans to China during 2023-2024 marketing year

— 213,000 MT soybeans received in the reporting period for delivery to unknown destinations during the 2023-2024 marketing year - ExxonMobil's $59.5 billion purchase of Pioneer Natural Resources

- Sevens Report on the good, bad and ugly of tomorrow’s Consumer Price Index report

- Bulging federal budget deficit

- Rising bond yields may alter Fed outlook

- Fedspeak

- Satellite imagery reveals changing planting dates in U.S. Corn Belt over two decades

- Oil markets equipped to handle Middle East turmoil with spare production capacity

- Canadian union resolves GM strike with tentative contract

- Indonesia to introduce Crude Palm Oil (CPO) futures exchange

- India mulls 33% increase in cash support for small farmers ahead of elections

- India plans to extend duty on parboiled rice exports

- Low water levels on Miss. River could be positive for spot N. American trucking rates

- Ag markets today

- Ag trade update

- $1 billion+ weather disasters on the rise

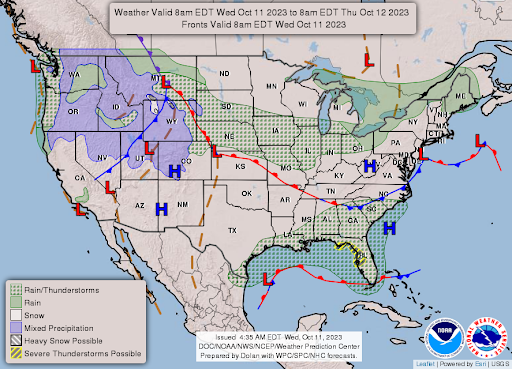

- NWS weather outlook

- Pro Farmer First Thing Today items

ISRAEL/HAMAS CONFLICT

- Biden announces increased military assistance to Israel

- Boeing accelerated deliveries of 1,000 smart bombs to Israel

- Secretary of State Antony Blinken plans to leave for Israel

- Anti-tank missile strikes Israeli military post near Lebanese border amid rising tensions

- Founding member of Hamas killed in Israeli air strike in Gaza

RUSSIA & UKRAINE

- Ukraine keeps winter wheat plantings forecast unchanged

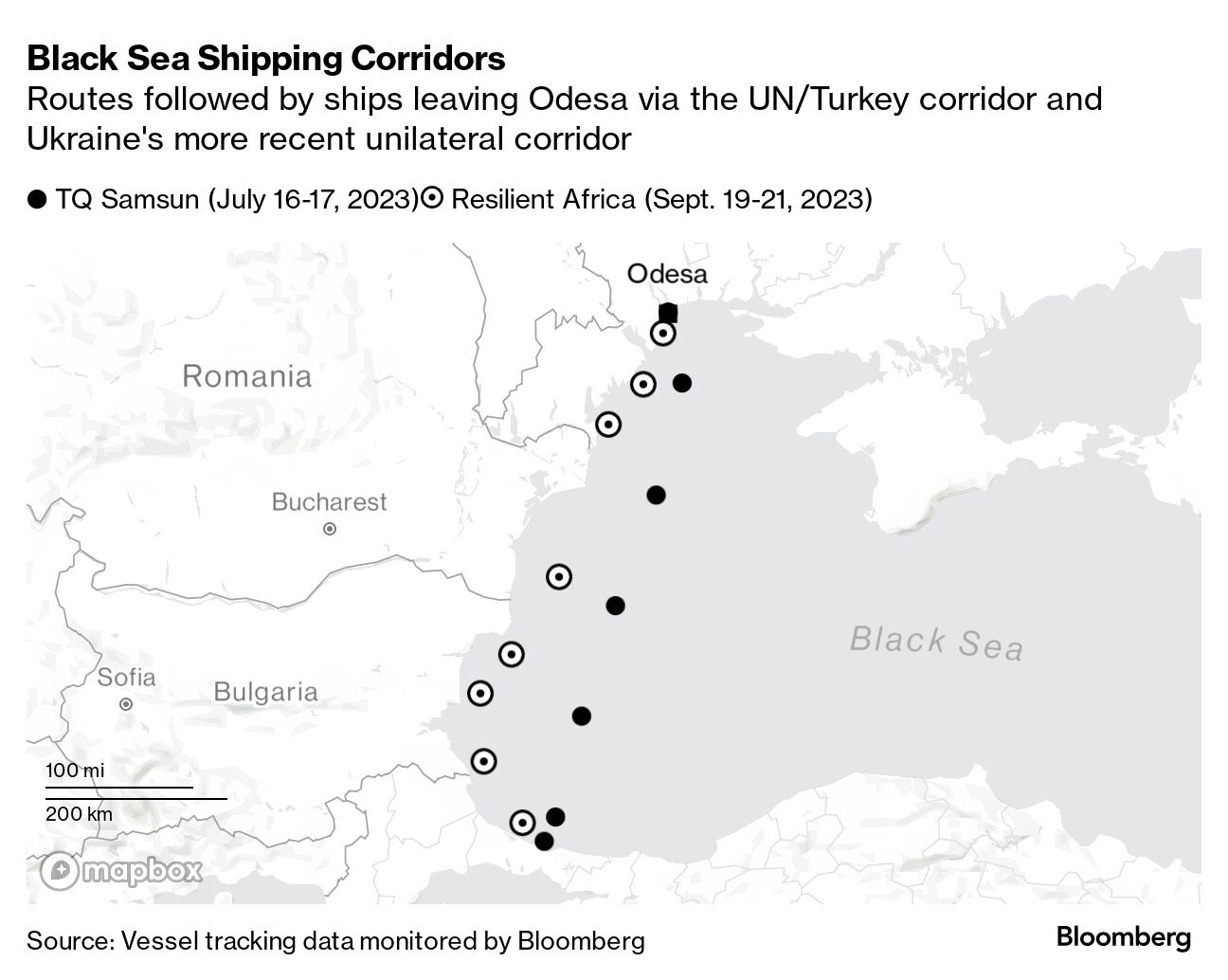

- Direct shipments to European and Asian buyers via new Black Sea shipping corridor

POLICY

- FarmDoc looks at 2023 U.S. corn and soybean crop insurance payments

- Dairy industry remains divided on milk pricing reform amid public hearing

CHINA

- Trade activity starts to increase for China and Taiwan

ENERGY & CLIMATE CHANGE

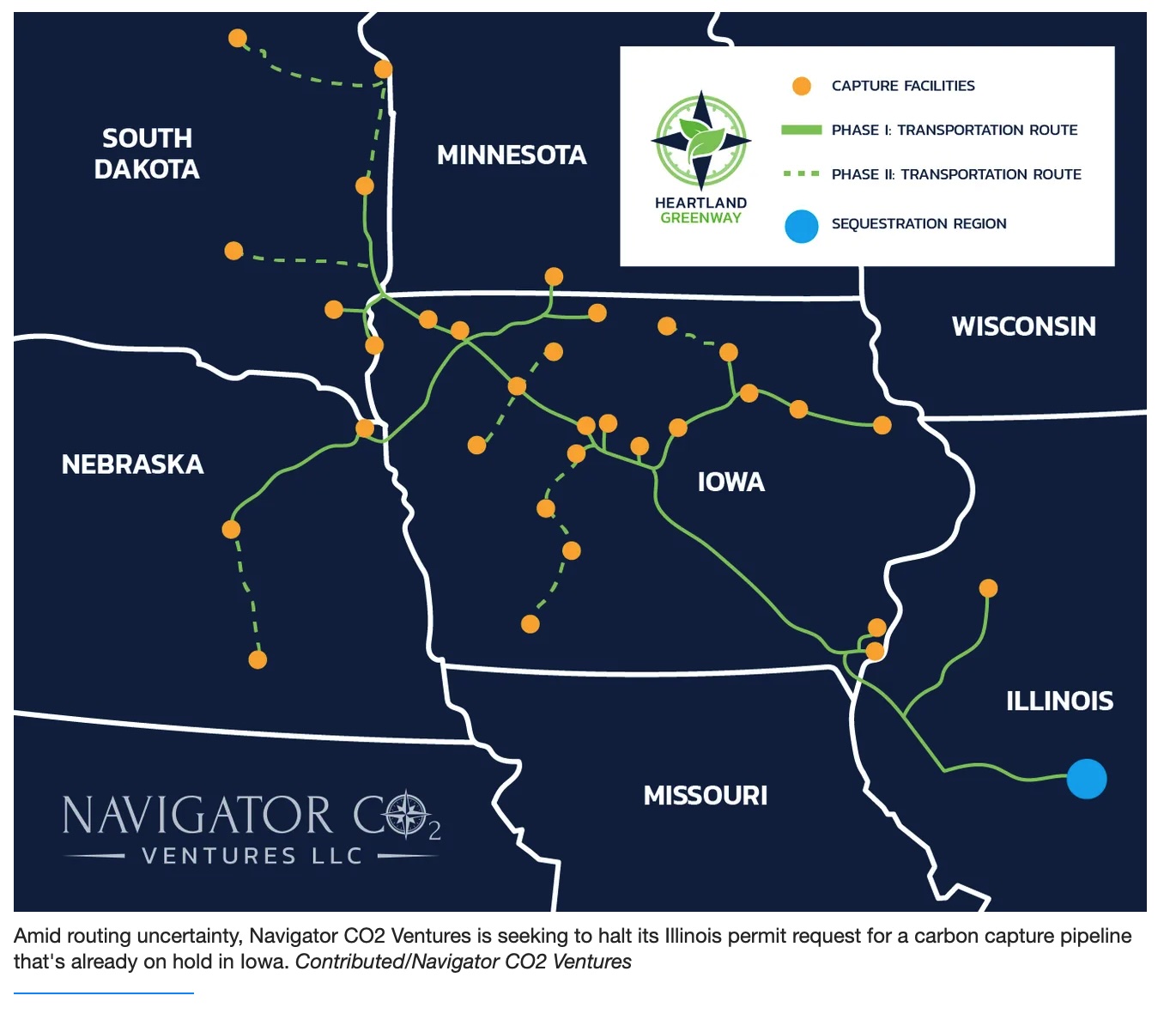

- Navigator CO2 Ventures withdraws pipeline application amid uncertainty

- Virginia Tech $80 million grant to fund program paying $100 an acre

LIVESTOCK & FOOD INDUSTRY

- EFSA urges bird flu vaccination for vulnerable poultry in high-risk areas

- Genus develops gene-edited pigs resistant to costly swine disease

CONGRESS

- Rep. Santos faces 10 new federal charges, refuses to resign

OTHER ITEMS OF NOTE

- Today’s calendar of events

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed to higher overnight. U.S. Dow opened around 75 points higher. In Asia, Japan +0.6%. Hong Kong +1.3%. China +0.1%. India +0.6%. In Europe, at midday, London +0.1%. Paris -0.5%. Frankfurt +0.1%.

U.S. equities yesterday: The Dow closed up 134.65 points, 0.40%, at 33,739.30. The Nasdaq gained 78.60 points, 0.58%, at 13,562.84. The S&P 500 was up 22.58 points, 0.52%, at 4,358.24.

— ExxonMobil's $59.5 billion purchase of Pioneer Natural Resources set to trigger consolidation in U.S. shale oil industry. ExxonMobil has entered into a monumental $59.5 billion deal to acquire Pioneer Natural Resources, marking a significant move that is expected to initiate a wave of consolidation within the U.S. shale oil sector. In this all-stock transaction, ExxonMobil values Pioneer at $253 per share, securing a dominant position for the major oil company in the prolific Permian Basin, situated in western Texas and New Mexico. The Permian Basin has played a pivotal role in elevating the U.S. to its status as the world's largest oil and gas producer.

Perspective: This acquisition represents ExxonMobil's largest purchase since its formation through the merger of Exxon and Mobil in 1999. It also marks the first substantial acquisition under the leadership of Darren Woods, who has been at the helm of Exxon since 2017.

Exxon, headquartered in Houston, had been actively seeking acquisition opportunities, bolstered by a substantial cash reserve accumulated over the past year. The surge in oil prices resulting from Russia's invasion of Ukraine propelled Exxon's profits to record levels. The acquisition is the second in recent months for Exxon after it scooped up Denbury Resources for almost $5 billion in an all-stock deal in July.

— Agriculture markets yesterday:

- Corn: December corn futures fell 2 3/4 cents to $4.85 1/2 and ended the session below the 10-day moving average.

- Soy complex: November soybeans rose 7 1/4 cents to $12.71 1/2 after trading at the lowest level since June 15. December meal rose $2.90 to $377.50, closing near the session high. December soyoil fell 70 points to 53.23 cents, a mid-range close after trading at the lowest level since June 22.

- Wheat: December SRW wheat closed down 14 1/4 cents at $5.58 1/2 and near the session low. December HRW wheat fell 14 3/4 cents to $6.71 1/4, while December spring wheat futures fell 7 1/2 cents to $7.23 1/2.

- Cotton: December cotton plunged 151 points to 85.45 cents, marking the lowest close since Sept. 7.

- Cattle: December live cattle futures fell 35 cents to end the session at $185.00, while nearby October futures rallied 20 cents to $182.575. November feeder cattle futures rose 70 cents to $250.35, while expiring October futures rose $1.05 to $247.95.

- Hogs: Expiring October hog ended Tuesday having slipped 2.5 cents to $81.95, while most-active December fell $1.05 to $71.425.

— Ag markets today: Corn, soybeans and wheat held in tight trading ranges during a quiet two-sided overnight session. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny higher, soybeans were steady to 2 cents higher and wheat futures were steady to 3 cents lower. Front-month crude oil futures were modestly weaker, while the U.S. dollar index was trading just above unchanged.

Movement soars as beef prices drop. Packers have struggled to push wholesale beef prices higher, with Choice anchored near $300.00 and Select holding near $275.00. But sharp losses in wholesale prices on Tuesday signaled there’s still strong demand under the market on price pullbacks. With Choice down $2.36 and Select $1.35 lower, packers moved a strong 217 loads of product on the day.

Cash hogs showing signs of stabilizing. The CME lean hog index is down another 20 cents to $82.26 (as of Oct. 9). Remember, the index is a two-day weighted average. The single-day average for Monday at $82.31 topped Friday’s single-day figure at $82.22, signaling the cash market may be stabilizing.

— Quotes of note:

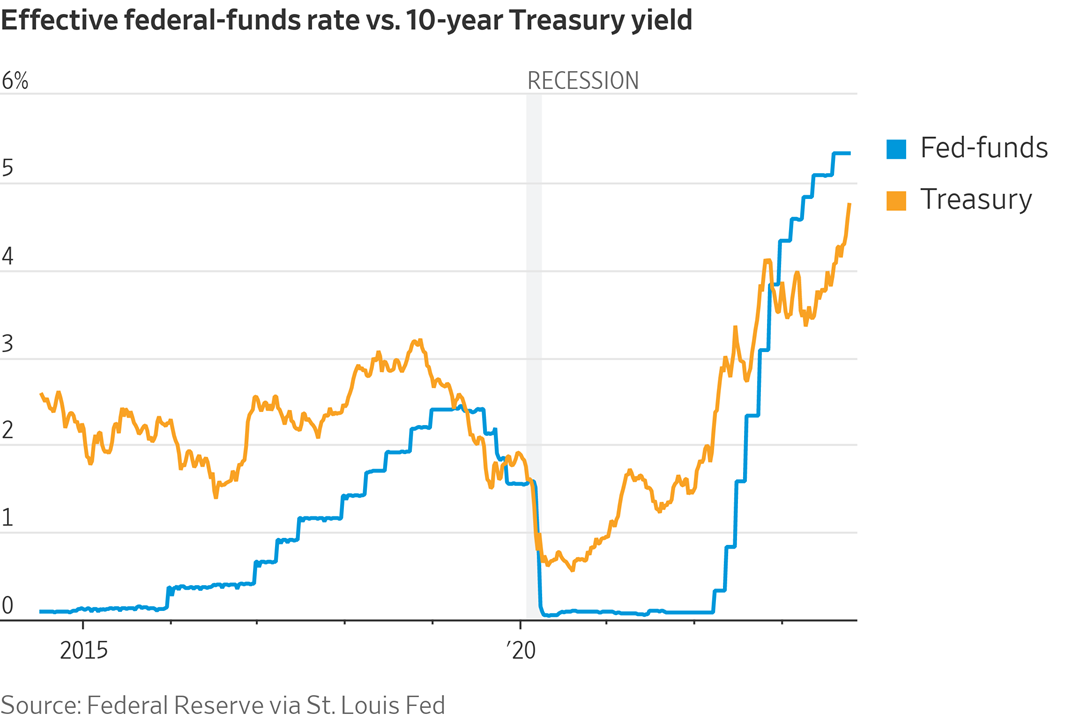

- Fedspeak: San Francisco Fed President Mary Daly reiterated a recent rise in bond yields may mean the Fed “doesn’t have to do as much.” But Michelle Bowman disagreed, saying rates may need to increase further and stay higher for longer. Minneapolis Fed President Neel Kashkari called the recent jump in the 10-year Treasury yield "perplexing," but noted that the odds of a soft landing looked "favorable." Atlanta Fed President Raphael Bostic also doesn't expect any more rate hikes, while Fed Governor Christopher Waller stressed that the central bank would "stay on the job" to reach its inflation target. More insight may come when minutes of the September meeting are published later today.

- MGM Resorts chose not to pay a ransom to hackers because they didn’t ask for money until well after it discovered the cyberattack. CEO Bill Hornbuckle said he’d love to claim they declared “we’re not paying these bastards. The reality is because we caught this so early and we were on them.”

- Sevens Report on the good, bad and ugly of tomorrow’s Consumer Price Index report.

— A “Good” CPI Re-port: Core CPI < 0.3%, 4.1% y/y. Likely Market Reaction: “A potentially strong rally. A continued drop in Core CPI will help to calm concerns that inflation is bouncing back and that should trigger a solid drop in Treasury yields and a rally in stocks.”

— A “Bad” CPI Report: Core CPI 0.3% m/m, 4.1%-4.3% y/y. Likely Market Reaction: Disappointment. “A reading in this range would reflect a decline in Core CPI, but one that’s less than expected. As such, these “sticky” core inflation readings would help to partially confirm fears that disinflation (the decline in inflation) may be stalling and since that’s been one of the reasons stocks have pulled back since late July, we’d expect modest selling pressure on stocks.”

— An “Ugly” CPI Report: Core CPI > 0.3% m/m, 4.3% y/y. Likely Market Reaction: A solid selloff. “A hotter-than-expected CPI report would increase concerns that inflation is bouncing back, and as a result we’d see Treasury yields surge higher (likely more than 15 bps across the yield curve). That rise in yields would, in turn, pressure stocks the same way it’s done since early August.”

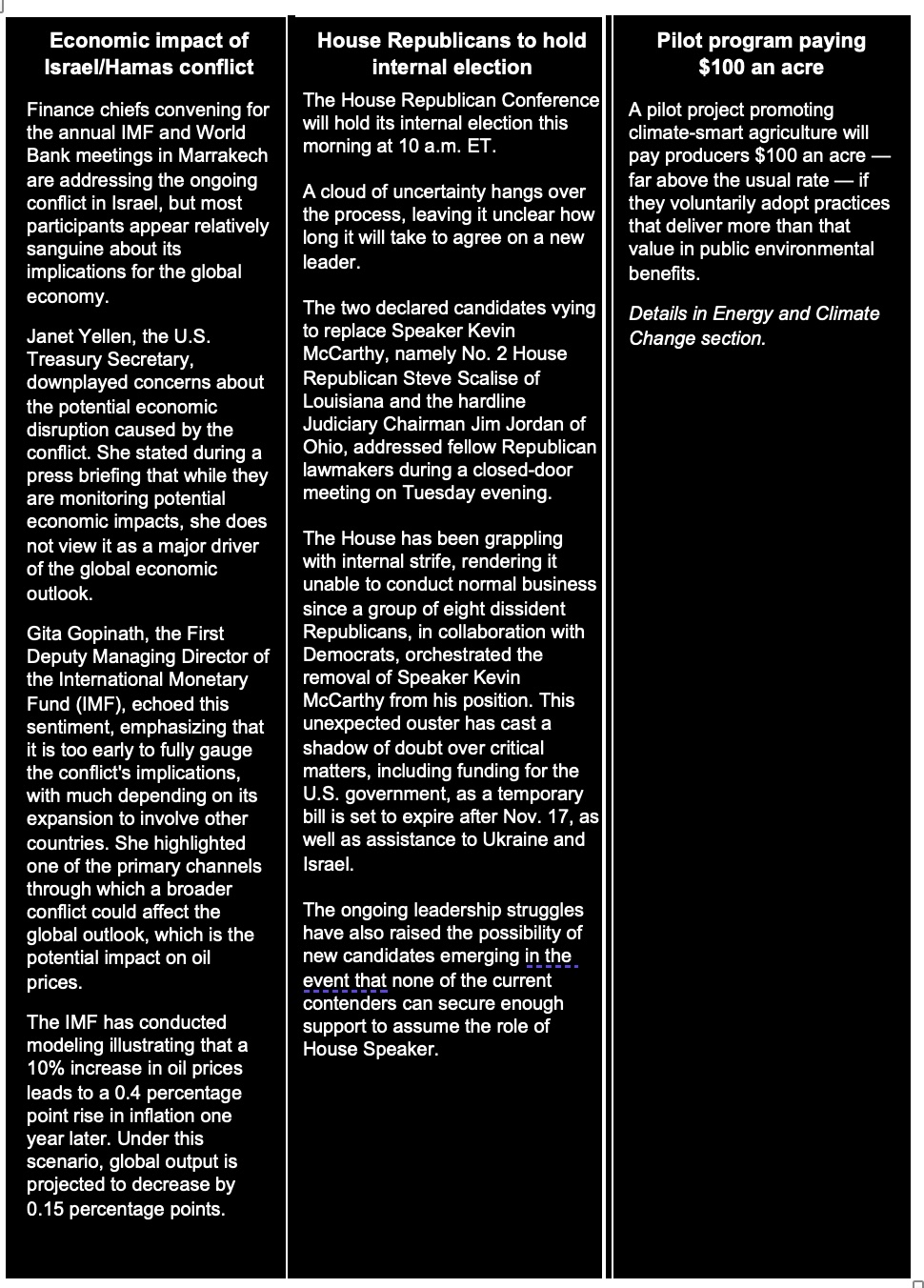

— Bulging federal budget deficit. The Congressional Budget Office (CBO) released its final Monthly Budget Review of Fiscal Year (FY) 2023, finding that the budget deficit totaled $1.7 trillion in fiscal year (FY) 2023 and $166 billion in September. After adjusting for the enactment and reversal of President Biden’s student debt cancellation plan and timing shifts, the deficit more than doubled between FY 2022 and 2023, from $0.9 trillion to $2 trillion. At the same time, interest rates on U.S. Treasury securities have been surging, with the rate on the ten-year Treasury note closing above 4.7% last week — levels not seen since 2007.

— Rising bond yields may alter Fed outlook. Federal Reserve officials have suggested that their trajectory of raising short-term interest rates might come to an anticlimactic conclusion if long-term rates persist at their recent elevated levels and if inflation continues to abate, the Wall Street Journal reports (link). In July, the Fed elevated its benchmark federal-funds rate to a 22-year high. During their last meeting, officials chose to maintain rates at their current level, with indications that they were inclined to increase rates during one of their remaining two meetings in the year. The surge in long-term Treasury yields commenced following the Fed's rate hike in July and gathered momentum after the September Fed meeting, altering the dynamics of the central bank's rate-hiking cycle.

— Satellite imagery reveals changing planting dates in U.S. Corn Belt over two decades. A study led by NASA Harvest's Jill Deines has utilized satellite imagery to track the changing planting dates for maize and soybean fields in the U.S. Corn Belt over the past two decades. This research generated field-scale planting date maps from 2000 to 2020 for 12 major agricultural states. Link.

Understanding these changes in planting dates is critical for farmers' decision-making, as it impacts growing time, risk of frost damage, and energy costs. Moreover, it has implications for carbon cycles, water use, and agricultural modeling.

The study's dataset, with 30-meter spatial resolution, provides valuable insights for various applications, including agricultural management, environmental studies, and crop production simulations. The research also found correlations between planting dates, rainfall, soil productivity, and optimal planting windows, shedding light on real-world limitations faced by farmers and directing future research.

Key Points:

- Satellite imagery was used to analyze changing planting dates for maize and soybean fields in the U.S. Corn Belt from 2000 to 2020.

- The research aids farmers' decision-making and has implications for carbon cycles, water use, and agricultural modeling.

- Findings reveal correlations between planting dates, rainfall, soil productivity, and optimal planting windows.

- Crop simulation studies suggest that optimal planting dates could shift earlier in the future under realistic climate scenarios.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly weaker ahead of U.S. wholesale inflation figures despite the euro and Swiss franc being lower against the U.S. currency. The yield on the 10-year U.S. Treasury note was weaker, around 4.58%, with a mostly lower tone in global government bond yields. Crude oil futures were lower, with U.S. crude around $85.25 per barrel and Brent around $87 per barrel. Gold and silver futures were higher ahead of the PPI-FD update, with gold around $1,886 per troy ounce and silver around $22.21 per troy ounce.

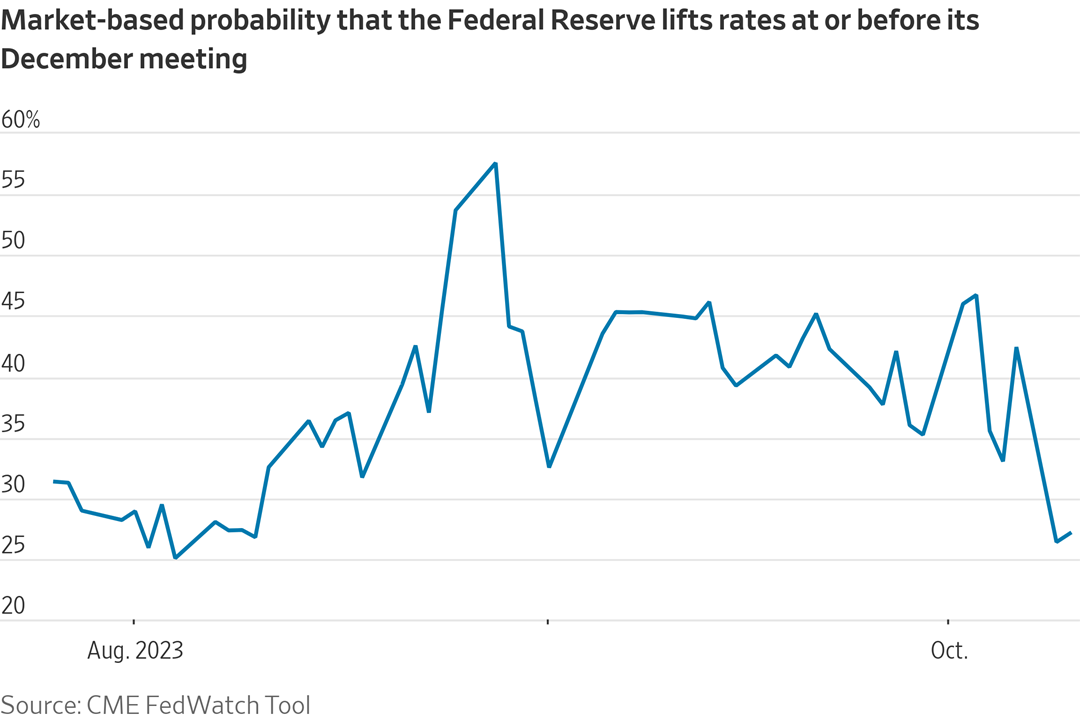

— Global oil markets better equipped to handle Middle East turmoil with healthy spare production capacity. Global oil markets are currently facing increased risk due to instability in the Middle East. However, there is a notable difference in the market's resilience compared to previous crises, thanks to healthy spare production capacity. Despite reduced output earlier this year, Saudi Arabia and its OPEC+ partners have some of the largest production buffers in over a decade, excluding the Covid-19 pandemic period when demand plummeted due to lockdowns. This substantial spare capacity has played a pivotal role in stabilizing crude oil prices, particularly following a recent surge in response to hostilities involving the Palestinian militant group Hamas and Israel.

S

— Canadian union resolves GM strike with tentative contract, avoiding further disruption to U.S. operations. Members of the Unifor union in Canada successfully concluded their strike against General Motors (GM) following the achievement of a tentative agreement. The strike, which lasted for 13 hours, came to an end as union members returned to work on Tuesday afternoon, as confirmed by the union. This resolution averts the potential for additional disruptions to GM's operations in the United States, where targeted strikes by the United Auto Workers (UAW) have previously been deployed against GM, Ford, and Stellantis. In Canada, the strike affected three facilities, including a production factor for Silverado pickups, an engine factory, and a parts distribution center.

In the U.S., the UAW had over 25,000 workers on strike across five assembly facilities and 38 parts distribution centers. However, last Friday, the UAW refrained from expanding its strike against the three automakers, indicating progress in negotiations with these companies.

— USDA daily export sales:

• 121,000 MT soybeans to China during 2023-2024 marketing year

• 213,000 MT soybeans received in the reporting period for delivery to unknown destinations during the 2023-2024 marketing year.

— Indonesia to introduce Crude Palm Oil (CPO) futures exchange to establish pricing reference, but participation remains optional. Indonesia is set to inaugurate a Crude Palm Oil (CPO) futures exchange on Friday, aimed at establishing a reference price for CPO in the country. However, the trading platform will not impose mandatory participation for all CPO exports, according to Didid Noordiatmoko, the head of the regulator BAPPEBTI, in an interview with Reuters. The launch of the futures exchange, managed by the Indonesia Commodity and Derivatives Exchange, is envisioned to provide a benchmark for CPO pricing in Indonesia, enabling data collection and the formulation of more effective industry policies. Transactions within this exchange will be denominated in Indonesia's rupiah currency. Didid mentioned that initial trading activity might be limited as training for participants will follow the launch. Currently, there are 12 companies listed on the exchange. However, it's worth noting that the response to this initiative has been described as "lukewarm," with the Indonesia Palm Oil Association and other stakeholders expressing reservations about mandatory participation.

— India mulls 33% increase in cash support for small farmers ahead of elections. The Indian government is contemplating a plan to boost direct cash support to small farmers by one-third, potentially increasing the annual direct cash transfer to 8,000 rupees ($96) from the current 6,000 rupees. This initiative is seen as an effort by Prime Minister Narendra Modi's ruling party to consolidate support from a crucial voting bloc in preparation for upcoming elections. If the proposal is approved, it would cost the government an additional 200 billion rupees, supplementing the 600 billion rupees allocated for the program in the current fiscal year, ending in March 2024. Finance Ministry spokesperson Nanu Bhasin declined to comment on the matter. The proposal also includes discussions about relaxing eligibility rules to encompass more farmers under the direct cash transfer program. However, final decisions on these matters have not yet been made. The government is also taking other steps to support lower-income households, including extending a free grains program into the following year and contemplating subsidized loans for small urban housing. In a recent development, the cabinet approved increased subsidies for liquefied petroleum gas used for cooking. Link to details via Bloomberg.

— India plans to extend duty on parboiled rice exports. India is planning to extend a 20% duty on exports of parboiled rice until March 2024, a government official told Reuters. The duty that was imposed in August was originally set to expire Oct. 15.

— Ag trade update: South Korea purchased 202,000 MT of corn in two separate tenders — two cargoes expected to be sourced from South America or South Africa and one cargo of optional origin. Thailand purchased 60,000 MT of optional origin feed wheat. Japan tendered to buy 60,000 MT of feed wheat and 20,000 MT of feed barley.

— Low water levels on the Mississippi River could be incrementally positive for spot North American trucking rates, as some freight might be diverted to the trucking market, Bloomberg Intelligence says.

— $1 billion+ weather disasters on the rise. With more than two months left in the year, the U.S. has already faced a record number of disasters costing $1 billion or more in 2023 — a total of 24 such events.

— NWS weather outlook: Colder and unsettled weather to move east from the western U.S. into portions of the northern Plains and Upper Midwest while above average temperatures shift into parts of the central/southern Plains and Ohio Valley... ...Increased threat for heavy rain and flash flooding for portions of Nebraska/South Dakota into the Upper Midwest and along the east-central Gulf Coast into northern Florida... ...Severe thunderstorms possible across parts of the central Plains today and Thursday.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• Crop progress report highlights

• France raises wheat export forecast

• Eurozone consumers see inflation holding above ECB target for years

|

ISRAEL/HAMAS CONFLICT |

— President Biden announces increased military assistance to Israel amid Hamas attacks; will ask Congress for more aid. In response to the recent surprise attack by Palestinian militant group Hamas, President Joe Biden declared a surge in military assistance to Israel. During a press briefing at the White House on Tuesday, Biden revealed that this aid package includes ammunition and interceptors to replenish Israel's "Iron Dome" anti-missile systems. He also expressed his intention to urgently request Congress to fund the national security requirements of critical partners, potentially including Ukraine. President Biden emphasized the importance of ensuring that Israel does not deplete its essential defense assets, which are crucial for protecting its cities and citizens.

Biden condemned the Hamas assault as an "act of sheer evil" that reminded him of the worst atrocities committed by ISIS. He reaffirmed Israel's right and duty to defend itself, stating that every nation in the world shares this responsibility. Biden said he has directed his team to share intelligence and military experts to consult and advise Israelis.

Biden warned other governments not to step into the conflict in hopes of taking advantage of the situation. “I have one word: Don’t.”

President Biden revealed that at least 14 U.S. citizens have lost their lives in the attacks, and Americans are among those being held hostage by Hamas. “As president I have no higher priority than the safety of Americans being held hostage around the world,” Biden said.

— Boeing accelerated deliveries of 1,000 smart bombs to Israel as the country steps up retaliation against Hamas, industry and defense officials said. The 250-pound Small Diameter Bombs were flown from an Air Force base in the U.S. by Israeli Air Force transport, according to reports.

— Secretary of State Antony J. Blinken plans to leave for Israel from Washington on Wednesday and arrive on Thursday, said Matthew Miller, the State Department spokesman. The secretary plans to meet with senior Israeli officials. “Our support for Israel is unwavering,” Miller said, adding that Blinken will carry “a message of solidarity and support.”

— Escalating conflict: Anti-tank missile strikes Israeli military post near Lebanese border amid rising tensions in the region. In a volatile turn of events, an anti-tank missile fired from Lebanon struck an Israeli military post near the border, intensifying the already heightened tensions in the region. Investors rushed to seek safe-haven assets like U.S. Treasuries in response to the escalating conflict. Adding to the complexity of the situation, Hezbollah, an Iran-funded group operating from Lebanon, has expressed solidarity with Hamas and launched several rockets at Israel. The specter of a ground invasion of Gaza looms as Israeli Prime Minister Benjamin Netanyahu vowed that their actions in the days to come would have far-reaching repercussions. However, such an invasion would be fraught with challenges, given Gaza's densely populated areas, intricate underground tunnel network, and the inherent risks it poses to potential hostages.

— Founding member of Hamas killed in Israeli air strike in Gaza. Abd al-Fattah Dukhan, a founding member of Hamas, was killed in an Israeli air strike in Gaza. Two other senior Hamas leaders, Zachariah Abu Ma’amar and Jawad Abu Shamala, were also killed in separate airstrikes.

|

RUSSIA/UKRAINE |

— Ukraine keeps winter wheat plantings forecast unchanged. A senior Ukrainian ag ministry official said he still expects the country to plant 4.4 million hectares to winter wheat. As of Oct. 9, 3.7 million hectares had been planted to the crop. Last week, Ukraine’s ag minister warned not all intended winter wheat acres would likely be seeded.

— Ukraine's commodities resume direct shipments to European and Asian buyers via new Black Sea shipping corridor. Ukraine's commodities have resumed their journey to traditional buyers across Europe and Asia through the country's newly established shipping corridor in the Black Sea. Ship-tracking data compiled by Bloomberg reveals (link) that three ships are currently en route to Spain, while one each is bound for the Netherlands, Egypt, and Singapore. Ships that recently departed from Ukraine's Black Sea ports have already reached destinations including Romania, Israel, Italy, and Bulgaria, transporting various cargoes such as grain and metals. This development marks a significant milestone in Ukraine's efforts to reestablish its role as a key supplier of commodities to global markets.

|

POLICY UPDATE |

— FarmDoc: 2023 U.S. corn and soybean harvest faces yield variability, possible crop insurance payments amid low harvest prices. The 2023 U.S. corn and soybean harvest is underway, providing farmers with a clearer picture of crop yields after a growing season marked by extended periods of dry weather in the Corn Belt. Reports indicate significant variability, with some farmers experiencing yields below expectations, while others are pleasantly surprised by better-than-anticipated yields given the challenging conditions.

October is the crucial period for determining the harvest price for revenue insurance products. Presently, harvest futures prices for corn and soybeans are trading below the projected prices used to establish crop insurance guarantees.

For corn, December futures settlement prices have averaged $4.90 through October 9th, compared to the projected price of $5.91 set in February. This places the harvest price at 83% of the projected price.

Meanwhile, for soybeans, November futures have averaged $12.72 through the same period, compared to the projected price of $13.76, putting the harvest price at 92% of the projected price.

Bottom line according to FarmDoc: With harvest prices below the projected prices and the potential for poor yields, there could be substantial crop revenue insurance payments for 2023. The article provides detailed scenarios and a payment calculator for both corn and soybeans to assess potential payment outcomes. It's noted that the harvest prices for these crops may continue to fluctuate throughout the October discovery period. Link for details.

— Dairy industry remains divided on milk pricing reform amid public hearing. National Milk Producers Federation (NMPF) officials express hope for including additional milk pricing provisions in the upcoming farm bill, as discussions continue during the ongoing public hearing to update Federal Milk Marketing Orders (FMMOs). The hearing, taking place over six weeks in Carmel, Indiana, involves testimony and discussions on 22 milk pricing reform proposals from various dairy and agriculture sector groups.

Of note:

- NMPF and the International Dairy Foods Association (IDFA) are at odds over milk pricing reform during a public hearing to update Federal Milk Marketing Orders (FMMOs).

- NMPF supports shifting back to a formula based on the "higher of" rates paid for Class III and Class IV milk, while IDFA proposes a hybrid approach to the Class I Mover.

- The split between producers and processors persists, with processors opposing anything that would lower producer prices.

- NMPF aims to balance price changes for the benefit of U.S. dairy farmers, but also recognizes the importance of risk management.

- The farm bill's impact on make allowances is being considered, with efforts to require USDA to conduct mandatory plant cost studies every two years.

- The Dairy Margin Coverage (DMC) safety net program is set to lapse at the end of the year, but it's unlikely that Congress will fail to act before this happens.

|

CHINA UPDATE |

— Trade activity starts to increase for China and Taiwan. Of note:

- China’s new-energy passenger car exports more than doubled last month, as the nation’s growing clout in the global auto market comes under pressure from Europe and the U.S.

- Taiwan’s exports in September unexpectedly grew for the first time in more than a year, adding to signs that global trade is recovering.

|

ENERGY & CLIMATE CHANGE |

— Navigator CO2 Ventures withdraws pipeline application amid uncertainty, raising questions about carbon capture projects' future. Navigator CO2 Ventures has taken the step of voluntarily withdrawing its application for a section of its carbon capture pipeline in Illinois, citing the need to reevaluate the $3.5 billion project's route, according to the Des Moines Register (link). The move comes amid increasing uncertainty surrounding the future of carbon capture pipelines, with Navigator being one of three companies proposing pipelines with routes across Iowa, where regulatory challenges have arisen in other states.

Navigator, headquartered in Omaha, Nebraska, had already received permission to suspend its pursuit of a permit in Iowa pending a decision on its application with the Illinois Commerce Commission. Illinois is a crucial state for the project, as it is where the pipeline would sequester liquefied carbon dioxide emissions from ethanol and agricultural industrial plants deep underground.

In a motion filed, Navigator expressed its desire to withdraw its Illinois application without prejudice, with the intention to reconsider the permitting process "if appropriate" once a comprehensive evaluation is completed. The motion requests the suspension of upcoming procedural schedules and hearings until the Commerce Commission reaches a decision on the request.

While Navigator did not directly address the project's future, the company stated that its actions align with recent filings in neighboring jurisdictions. The company will take the necessary time to reassess the project's route and application, which also includes proposed sections in South Dakota, Nebraska, and Minnesota.

Background. The proposed carbon capture pipelines by companies like Navigator, Summit Carbon Solutions, and Wolf Carbon Solutions are seen as critical to reducing ethanol's carbon footprint and sustaining the industry. They could also qualify for significant federal tax credits aimed at incentivizing lower carbon emissions to combat global warming.

Navigator's withdrawal in Illinois follows previous difficulties in South and North Dakota, where regulators rejected permit requests from Navigator and Summit for pipeline construction. North Dakota regulators have indicated a willingness to reconsider Summit's application after route adjustments to address concerns from residents and stakeholders.

In Iowa, where a hearing on Summit's permit application has been ongoing since August, pipeline opponents have raised concerns about the potential use of eminent domain to obtain easements from landowners unwilling to negotiate voluntary agreements and the impact of construction on farmland and underground drainage tiles.

Bottom line: The decision by Navigator to withdraw its Illinois application adds to the growing challenges and uncertainties surrounding carbon capture pipeline projects across multiple states. Opponents of these projects continue to voice their concerns about their environmental and property rights impact, emphasizing their opposition to the development of such pipelines.

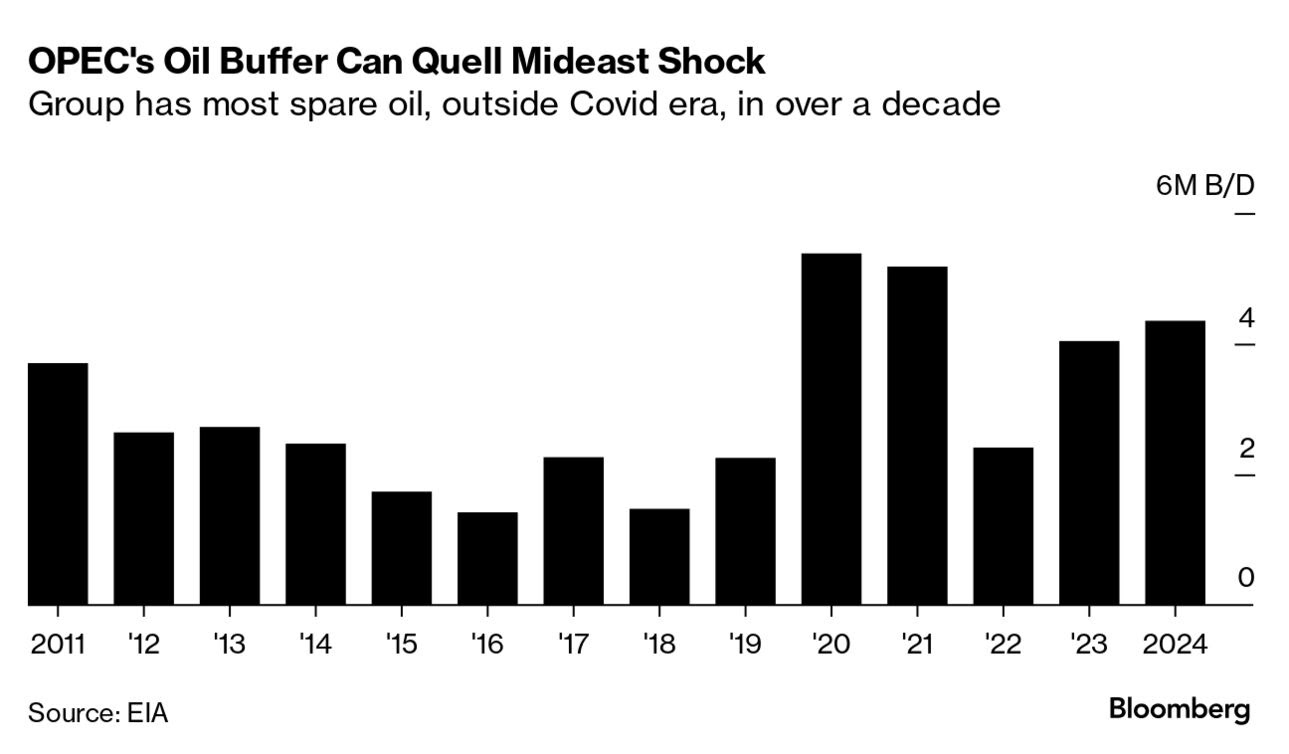

— Virginia Tech receives record $80 million grant to fund Climate-Smart Agriculture program paying $100 an acre. Virginia Tech has been awarded an $80 million grant from USDA to initiate the Alliance to Advance Climate-Smart Agriculture, a program aimed at encouraging farmers to adopt climate-smart practices that reduce greenhouse gas emissions. Link for more info.

The College of Agriculture and Life Sciences at Virginia Tech will distribute over $57 million of the grant to farmers as part of a pilot program to test the feasibility of this initiative on a national scale. The program will initially run for three years in Virginia, Arkansas, Minnesota, and North Dakota, with the potential to reduce agricultural emissions by 55% and total U.S. emissions by 8% after a decade if expanded nationally.

Farmers will be paid $100 per acre or animal unit for voluntarily implementing climate-smart practices, which is expected to improve both environmental outcomes and their bottom lines. The program will initially involve 4,500 agricultural operations, representing up to 500,000 acres, and if scaled up nationally, up to 80% of agricultural producers could enroll. This initiative aims to combat climate change while boosting agricultural productivity to meet the growing global food demand.

Key Points:

- Virginia Tech has received a record $80 million grant from the USDA for the Alliance to Advance Climate-Smart Agriculture.

- The pilot program will operate in Virginia, Arkansas, Minnesota, and North Dakota to test the feasibility of a national rollout.

- The program pays farmers $100 per acre or animal unit for implementing climate-smart practices, potentially reducing agricultural emissions by 55% and total U.S. emissions by 8% after a decade if scaled up nationally.

- At least 40% of participants will be underserved and small producers.

- The initiative aims to improve environmental outcomes and increase sustainability in agriculture while helping to feed a growing global population.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— EFSA recommends preventative bird flu vaccination for vulnerable poultry in high-risk areas to control avian influenza. The European Food Safety Agency (EFSA)issued a recommendation endorsing the preventative vaccination of susceptible poultry against avian influenza in regions with a high risk of human-to-bird transmission, as detailed in a scientific opinion posted on its website. EFSA emphasizes that preventative vaccination represents the optimal strategy for minimizing the number of outbreaks and the duration of epidemics, particularly in high-risk transmission areas.

France recently made headlines as the first European Union (EU) country to initiate a nationwide vaccination effort against avian influenza. According to EFSA's recommendation, when an outbreak occurs, protective vaccination should be carried out within a 3-kilometer (19-mile) radius of the outbreak's location in high-risk transmission areas. However, EFSA underscores that vaccination should be viewed as a complementary measure rather than a replacement for other preventive and control measures, including bird infection monitoring, early detection, biosecurity, and an integrated disease control approach.

Avian influenza vaccination has been met with reluctance by many countries grappling with outbreaks, as it can lead to trade restrictions. Currently, testing cannot differentiate between vaccinated birds and those infected with the virus. EFSA's role, in response to a request from the European Commission, is to provide an overview of existing vaccines and various vaccination efforts. Another opinion from EFSA, addressing surveillance and risk mitigation in vaccinated areas and farms, is anticipated in March 2024.

— Genus develops gene-edited pigs resistant to costly swine disease; awaits FDA approval for commercial sale. Animal genetics company Genus has utilized gene editing techniques to develop pigs resistant to porcine reproductive and respiratory syndrome (PRRS), a costly viral disease affecting hogs. Colombia has granted approval for the sale of these gene-edited pigs. Genus, based in Britain, anticipates a decision from the FDA in the first half of 2024, after which it plans to launch the pigs globally in a phased manner, contingent on receiving the necessary regulatory approvals.

These pigs mark the first instance of gene-edited pigs being commercially sold. Genus emphasizes a responsible and transparent approach to this development, working closely with stakeholders in the animal protein value chain.

More market access pushed. Besides the United States, Genus has sought regulatory approval for these pigs in countries such as Canada, China, Japan, Mexico, Brazil, and others.

PRRS imposes significant economic costs on the hog industry in the U.S. and Europe, amounting to an estimated $2 billion annually, according to Genus. To create pigs resistant to PRRS, Genus scientists employed gene editing to remove a specific segment of swine DNA responsible for encoding a protein used by the virus to enter pig cells.

This achievement follows the FDA's approval of a genetically modified pig for both food and human therapeutics in late 2020, which prevents the production of a sugar causing allergic reactions in some individuals. TFDA has also given the green light to fast-growing genetically modified AquAdvantage salmon in 2015 and gene-edited "slick" cattle with short hair, potentially better suited to tolerate hot weather, in 2022.

|

CONGRESS |

— Rep. Santos faces 10 new federal charges, refuses to resign despite ongoing legal woes. Rep. George Santos (R-N.Y.) is grappling with a fresh set of legal troubles as he faces 10 new federal charges, which include accusations of stealing donors' identities and racking up fraudulent credit card charges. This comes in addition to the 13 existing counts lodged against him, covering alleged offenses such as wire fraud, money laundering, theft of public funds, and providing false information to the U.S. House. Despite the mounting legal pressure, the Republican lawmaker has reiterated his refusal to step down from his congressional post. Santos was part of a cohort of newly elected New York Republicans who played a crucial role in securing a narrow House majority for the party in the 2022 midterms. The fate of individuals like Santos will be pivotal in determining whether the Republican Party can retain that majority in the upcoming 2024 elections.

|

OTHER ITEMS OF NOTE |

— Calendar of events today include:

Wednesday, Oct. 11:

- Federal Reserve. Fed Governor Michelle Bowman speaks on Financial Stability in Uncertain Times in Marrakech, Morocco; Fed Governor Christopher Waller participates in a fireside chat in Utah; Atlanta Fed President Raphael Bostic scheduled to speak.

- World Bank/IMF related events. The Atlantic Council holds a virtual discussion on "Decoding the IMF's World Economic Outlook," as part of the 2023 annual meetings of the World Bank and International Monetary Fund.

- IRA and climate progress. The Brookings Institution holds a discussion on "One Year Later: The Inflation Reduction Act and Climate Progress." White House Senior Adviser for Clean Energy Innovation and Implementation John Podesta delivers remarks.

- Rural energy issues. The United States Energy Association (USEA) holds a virtual discussion on "Mini Grid Operations in Rural Communities: Challenges and Opportunities."

- U.S. energy infrastructure. The American Council on Renewable Energy (ACORE) holds a Grid Forum on "Powering Up Our Nation's Infrastructure." Allison Clements, commissioner of the Federal Energy Regulatory Commission, Deputy Energy Secretary David Turk deliver remarks.

- Challenges for the next House Speaker. The Bipartisan Policy Center (BPC) holds a virtual discussion on "New Speaker, Same Congress: The Path Ahead for Governing in The House."

- EIA energy outlook. The Center for Strategic and International Studies (CSIS) holds a discussion on "U.S. Energy Information Administration's (EIA) International Energy Outlook 2023."

- China/U.S. de-risking. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "Chinese Assessments of US De-risking Efforts," focusing on U.S. and European Commission trade and investment policies toward China.

- Farm Credit meeting. Farm Credit System Insurance Corporation (FCSIC) holds a meeting of the board of directors.

- Rural broadband. The Fiber Broadband Association and NTCA virtual discussion on "Internet for All - Getting BEAD (Broadband Equity, Access, and Deployment) Right, Now: An Overview of FBA and NTCA's Playbook 3.0 on BEAD Implementation."

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |