Middle East at War; Israel Cuts off All Supplies to Gaza Strip; 9 Americans Killed in Conflict

U.S. congressional delegation in Beijing meets with Xi | Senior spending | OPEC raises forecasts for global oil demand

|

Today’s Digital Newspaper |

MARKET FOCUS

- Gov't holiday Monday, but most markets are open

- Eruption of violence in Israel could increase flows into traditional safe-haven assets

- Oil prices edge up amid concerns over conflict spillover and Iran's potential role

- OPEC raised forecasts for global oil demand through to the middle of the century

- Sevens Report on importance of inflation data this week

- Sneak peek at IMF forecasts

- Seniors drive resilient consumer spending despite rising interest rates

- Natural gas prices in Europe surge 7% amid supply concerns

- Wall Street grapples with growing concerns over U.S. bond issuance

- Over 29,000 U.S. autoworkers on strike as union rejects Mack trucks' agreement

- Ag markets today

- Indonesia to increase rice imports to address drought-induced crop declines

- NWS weather outlook

- Pro Farmer First Thing Today items

RUSSIA & UKRAINE

- IKAR raises Russian grain crop, export forecasts

- Russian ruble slumped to a more than 18-month low against the dollar

- U.S. halts Ukraine funding amid government spending debate

CHINA

- China's economy faces threats without reform, report

- Xi meets with U.S. Senate delegation, hints at possible Apec summit attendance

- Chinese billionaire’s Texas company owes millions on unpaid bills

- Mainland China could delay complex trade probe to eve of Taiwan election

TRADE POLICY

- Mexican alcohol industry thriving in the U.S., eyes global expansion

- U.S. and U.K. to initiate trade talks, but agriculture remains a point of contention

ENERGY & CLIMATE CHANGE

- New federal tax credits for electric vehicles offer upfront discounts at dealerships

LIVESTOCK & FOOD INDUSTRY

- Major meatpacking plants in the U.S. shut down, affecting small town economies

HEALTH UPDATE

- Bristol-Myers Squibb agreed to buy Mirati Therapeutics

POLITICS & ELECTIONS

- Robert F. Kennedy, Jr. expected to launch independent campaign for White

- Iowa Dem party caucus will be held in person on Jan. 15, will release results March 5

- Amazon's Alexa spreads misinformation about 2020 election

CONGRESS

- House speaker selection process continues amid GOP candidates' pitches

- Scalise discusses speakership bid and policy priorities in Punchbowl News interview

- Jordan discusses speakership bid, key policy positions with Punchbowl News

OTHER ITEMS OF NOTE

- The Eras Tour movie arrives

- Crocs unveils its first ever cowboy boots

- Today’s calendar of events

|

MARKET FOCUS |

— Gov't holiday Monday, but most markets are open. The second Monday in October is, depending on where you live, Columbus Day or Indigenous Peoples' Day. Most markets will trade normal hours Oct. 9, but the bond market will be closed. That means USDA Crop Progress and Export Sales reports are delayed one day from their usual Monday/Thursday.

— Equities today: Asian and European stocks were mostly lower overnight. U.S. Dow is currently down about 50 points. China is open for business again after the Golden Week Holiday. During China's Golden Week, tourism spending surged by 130% compared to the previous year, totaling 753.4 billion yuan ($103 billion). However, this spending only increased by 1.5% when compared to 2019 levels, reflecting a slower recovery to pre-Covid levels. Macau and its casinos saw benefits from this tourism influx, but international travel remained below pre-pandemic levels. Additionally, the movie box office results during this period were disappointing. Hong Kong markets will remain shut this morning due to a typhoon. In Asia, Japan closed. Hong Kong closed. China -0.4%. India -0.7%. In Europe, at midday, London +0.2%. Paris -0.5%. Frankfurt -0.8%.

Tel Aviv share indices fell nearly 7% on Sunday, led by a 9% drop in banking shares, and were edging further lower on Monday. The shekel hit a near 8-year low, prompting the Bank of Israel to promise up to $30 billion in intervention to support the currency.

U.S. equities Friday: Friday's big stock market move secured weekly gains for the major indexes, with the S&P 500 snapping a four-week losing streak to finish 0.5% higher, while the Dow edged up 0.3% and the Nasdaq gained 1.6%. On Friday, the Dow ended up 288.01 points, 0.87%, at 33,407.58. The Nasdaq gained 211.51 points, 1.60%, at 13,431.34. The S&P 500 rose 50.31 points, 1.18%, at 4,308.50.

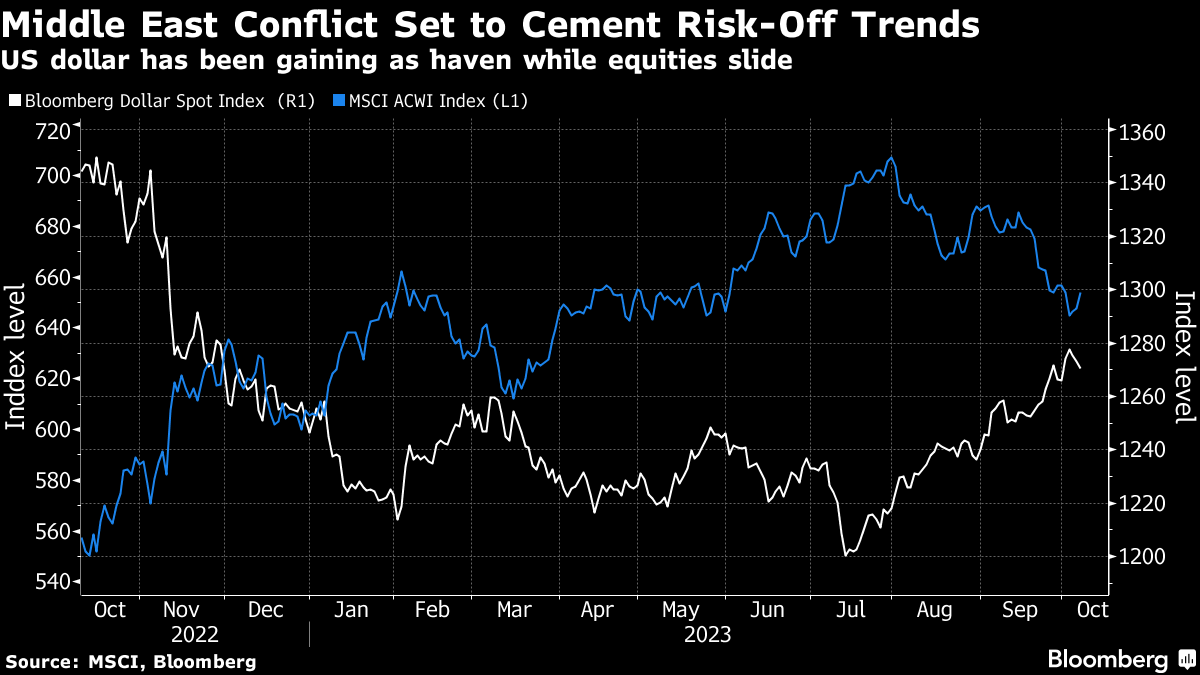

— Eruption of violence in Israel could increase flows into traditional safe-haven assets like U.S. Treasuries and other highly rated government bonds, gold and the Swiss franc, versus riskier assets like emerging markets. Oil prices could rally, too.

— Agriculture markets Friday:

- Corn: December corn futures dropped 5 1/2 cents to $4.92 but gained 15 1/4 cents on the week.

- Soy complex: November soybeans fell 14 3/4 cents to $12.66 and gave up 9 cents on the week. December meal closed $5.10 lower for the day at $372.10 and lost $9.10 week-over-week. December soyoil rose 7 cents to 55.35 cents but lost 48 cents on the week.

- Wheat: December SRW wheat futures fell 10 cents to $5.68 1/4, near the session low but gained 26 3/4 cents for the week. December HRW wheat futures lost 16 3/4 cents to $6.73 3/4, near the daily low, but for the week rose 10 cents. December spring wheat futures fell 11 cents to $7.20 1/2 but gained 11 1/4 cents on the week.

- Cotton: December cotton rose 60 points to 87.14 cents and lost 1 point on the week.

- Cattle: December live cattle futures rose $1.30 to $186.675 and nearer the session high. For the week, December live cattle lost $1.25. November feeder cattle futures rose 57 1/2 cents to $250.875 and near the daily high after hitting a 2.5-month low early on today. For the week, November feeders fell $4.025.

- Hogs: Expiring October hog futures rallied $1.425 to $82.325 Friday, while most-active December climbed $1.30 to $73.575. The latter represented a weekly gain of $1.80.

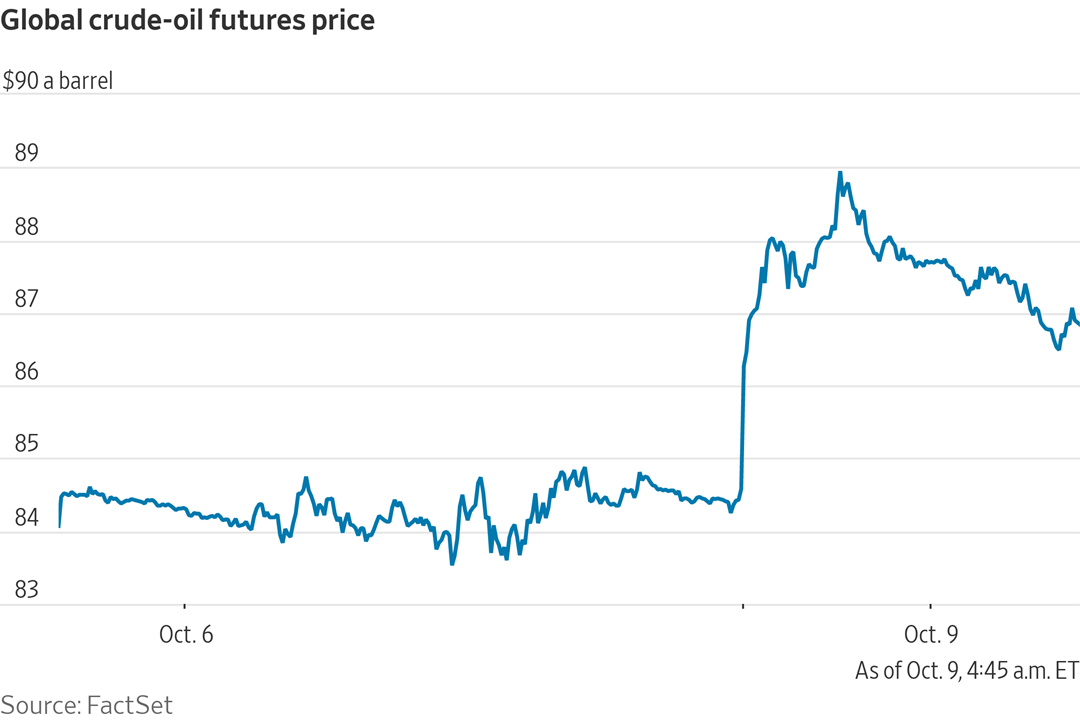

— Ag markets today: Corn, soybeans and wheat firmed overnight on support from crude oil as it responded to a major geopolitical shock over the weekend when Hamas raided Israel. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents higher, soybeans were 7 to 8 cents higher and wheat futures were 8 to 12 cents higher. Front-month crude oil futures were nearly $3.00 higher, and the U.S. dollar index was more than 400 points higher.

Choice beef back above $300. Choice boxed beef prices jumped $4.25 on Friday, climbing back above the $300.00 level after slipping below that mark earlier last week. Select beef firmed $1.01 to $275.78. One day of price action isn’t nearly enough to say the market has put in a short-term low, but it’s at least a clue the market may be finding some traction.

Cash hog fundamentals continue to weaken. The CME lean hog index is down another 67 cents to $83.03, the lowest level since June 5. The pork cutout value fell $1.76 to $93.22 on Friday amid sharp declines in primal bellies, hams and loins. That’s the lowest level for the pork cutout since Aug. 31.

— Quotes of note:

- One impact of Israeli/Hamas conflict. Helima Croft, RBC Capital Markets’ head of global commodity strategy, said the conflict puts the Saudi Arabia-Israel deal in a precarious position. With the Israeli government vowing an unprecedented response, “it is hard to envision how Saudi normalization talks can run on a parallel track.”

- “This is an enormous intelligence failure by the Israelis and the Americans,” Bruce Riedel, a former CIA officer and Middle East specialist, told NBC’s Peter Nicholas and Natasha Korecki. “I don’t see any reason to believe that either Washington or Jerusalem had any expectation this was coming.” And it raises the foreign-policy credentials of President Biden, as well as his rivals like Trump (a former president) and Haley (the former U.N. ambassador).

- Federal deficit. Goldman Sachs economists Alec Phillips and Tim Krupa estimate the federal deficit in the current fiscal year will total $1.7 trillion, and $1.9 trillion in the next fiscal year. That would total 6% of gross domestic product this fiscal year and 6.5% next year, plus interest. Meanwhile, only 2% of Americans surveyed by Gallup said they consider the federal budget deficit or debt the most important problem facing the nation. With neither likely presidential nominee focused on reducing the deficit, it isn’t clear how much will change after the 2024 election, Goldman Sachs wrote.

- Sevens Report on importance of inflation data this week. “Thursday’s CPI report was already going to be the most important economic report of this week, but Friday’s hot jobs report made CPI even more important and for one simple reason: If CPI is higher than estimates Treasury yields could spike higher and really hit stocks. Conversely, if CPI is lower than expected it’ll ease anxiety about another rate hike and higher for longer Fed, and the result could be a relief rally… The bottom line is the market needs to see CPI reinforce that disinflation is continuing and that the Fed does not need to get more aggressive.”

- Fedspeak: The Fed’s Michelle Bowman stuck to her view that rates will probably need to rise further as inflation remains “too high.” The governor reiterated that elevated energy prices may reverse some of the progress made in recent months. Lorie Logan, Philip Jefferson and Michael Barr speak today.

- Sneak peek at IMF forecasts. The ECB’s Christine Lagarde said the IMF cut its global growth forecasts, except for the U.S., ahead of that organization’s latest outlook due tomorrow. “The International Monetary Fund has revised down its growth projections worldwide, except for the United States,” Lagarde told La Tribune Dimanche in an interview, according to a transcript on the ECB’s website. It currently sees global GDP expanding 3% in both 2023 and 2024, with the U.S. growing 1.8% and 1%. In the runup to this week’s World Economic Outlook — published as part of the IMF’s annual meetings in Marrakesh — Managing Director Kristalina Georgieva highlighted Thursday that new numbers will show “the current pace of global growth remains quite weak — well below the 3.8% average in the two decades before the pandemic.” “Over the medium-term, growth prospects have weakened further,” with “stark differences in growth dynamics,” she said in a speech in Abidjan, Ivory Coast. “Stronger momentum comes from the United States,” Georgieva said. “But most advanced economies are slowing down and in China economic activity is below expectations.”

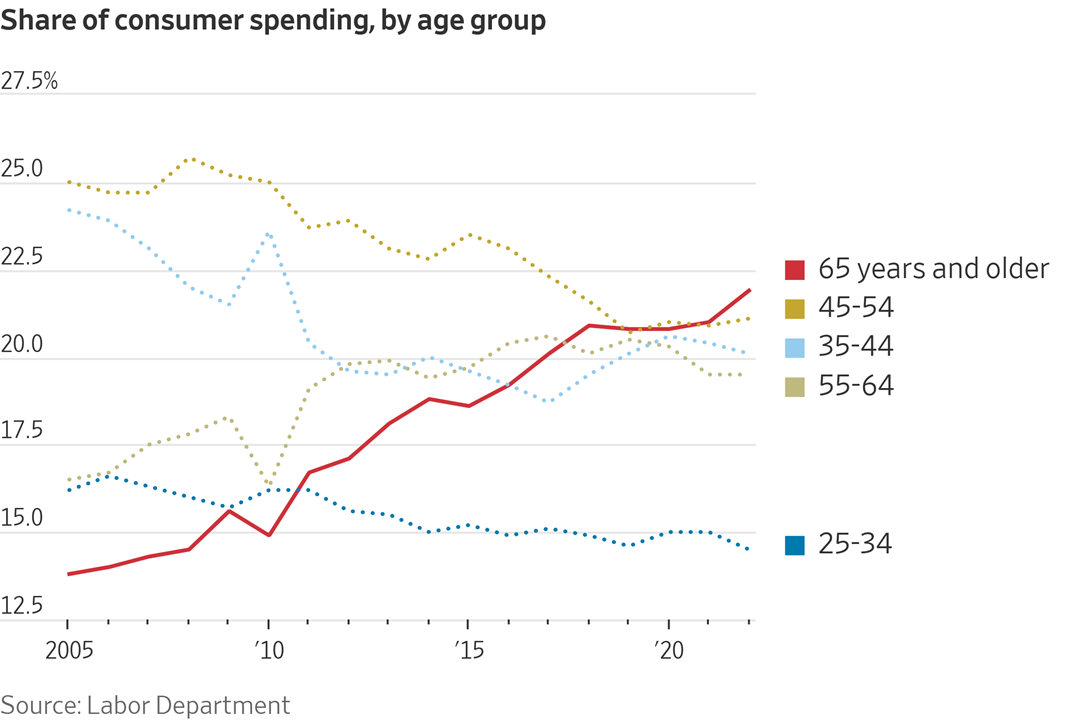

— Seniors drive resilient consumer spending despite rising interest rates. Consumer spending has remained robust, even with the Federal Reserve's interest rate hikes, largely because seniors are living longer and enjoying a higher quality of life, the Wall Street Journal reports (link). According to the Labor Department's survey of consumer expenditures, Americans aged 65 and older represented 22% of total spending in the past year, marking the highest share since records began in 1972. This percentage has risen significantly from 15% in 2010, underscoring the substantial impact of senior spending on the economy.

Market perspectives:

— Outside markets: The U.S. dollar index was higher as buying has emerged amid rising strife in the Middle East, with the euro, British pound and yen all weaker against the greenback. U.S. bond markets are closed for a holiday with a mixed-to-lower tone in global government bond yields. Crude oil futures have maintained solid advances on worries about oil supply interruptions, with U.S. crude around $86.15 per barrel and Brent around $87.95 per barrel. Gold and silver are seeing advances linked to a flight to safety, with gold around $1,862 per troy ounce and silver around $21.76 per troy ounce.

— Natural gas prices in Europe surge 7% amid supply concerns, to above €40 per megawatt-hour on Monday, following a 5.6% increase on Friday. These price hikes were driven by mounting supply concerns. Over the weekend, a gas leak in the Balticconnector offshore pipeline between Finland and Estonia caused a drop in pressure, leading to a shutdown in gas flow. Repair work is expected to take several months. Additionally, the news of workers planning to resume strikes at Chevron Corp.'s LNG facilities in Australia added further pressure on natural gas prices. Despite these challenges, factors such as mild weather forecasts for October, lower demand, ample storage levels, ongoing gas injections, and reduced industrial demand have helped maintain relatively stable prices. However, front-month gas prices in the Netherlands, Europe's benchmark, remain significantly below last year's levels, when they reached around €150 per megawatt-hour.

— Oil prices edge up amid concerns over conflict spillover and Iran's potential role. Oil prices experienced a slight increase as concerns grow about the possibility of the long-running Israeli/Hamas conflict escalating to a broader stage. The specific fears revolve around the potential impact on oil supplies if Iran is linked to the recent attacks and how it might affect U.S. efforts to strengthen ties between Saudi Arabia and Israel. Saudi officials had indicated their willingness to raise oil output next year as part of a proposed deal with Israel, which could have alleviated supply tightness caused by months of cuts from key producers like Saudi Arabia and Russia. But any direct connection to Iran's involvement could hinder the easing of sanctions on the country and impact an estimated 3% of the world's oil supply. The Wall Street Journal reported (link) that Tehran had assisted Hamas in planning the attack over several weeks. However, despite these concerns, the rise in crude oil prices has been relatively modest, with U.S. crude trading at $85.25 per barrel, approximately where it was last Wednesday, and year-on-year prices are still showing a 5% decline.

Oil traders said this weekend they were bracing for a potential “fear trade” that could push up crude oil prices short-term.

— OPEC raised forecasts for global oil demand through to the middle of the century, even as the climate crisis intensifies. Consumption will climb 16% to reach 116 million barrels a day in 2045, about 6 million a day more than previously predicted.

Details: Oil consumption will climb 16% over the next two decades to reach 116 million barrels a day in 2045, about 6 million a day more than previously predicted, the Organization of Petroleum Exporting Countries said in its World Oil Outlook. Road transportation, petrochemicals and aviation will drive the growth, it said. India represents the biggest expansion, more than doubling its consumption to almost 12 million barrels a day, followed by China, with a gain of 4 million a day, or 26%. “There has been pushback against the opinion that the world should see the back of fossil fuels, as policies and targets for other energies falter due to costs and a more nuanced understanding of the scale of the energy challenges,” OPEC Secretary-General Haitham Al Ghais said. OPEC also boosted projections for how much oil it will supply in coming years, even though most of its members — hobbled by underinvestment, operational disruptions and political instability — aren’t currently able to pump at their full production quotas. It sees OPEC liquids supply rising roughly 14% to 38.9 million barrels a day by the end of the decade, ultimately reaching 46.1 million a day in 2045.

Of note: The International Energy Agency, the world’s leading energy watchdog, predicts a peak in oil demand before 2030. Its leader called the current state the “beginning of the end” of the fossil fuel era.

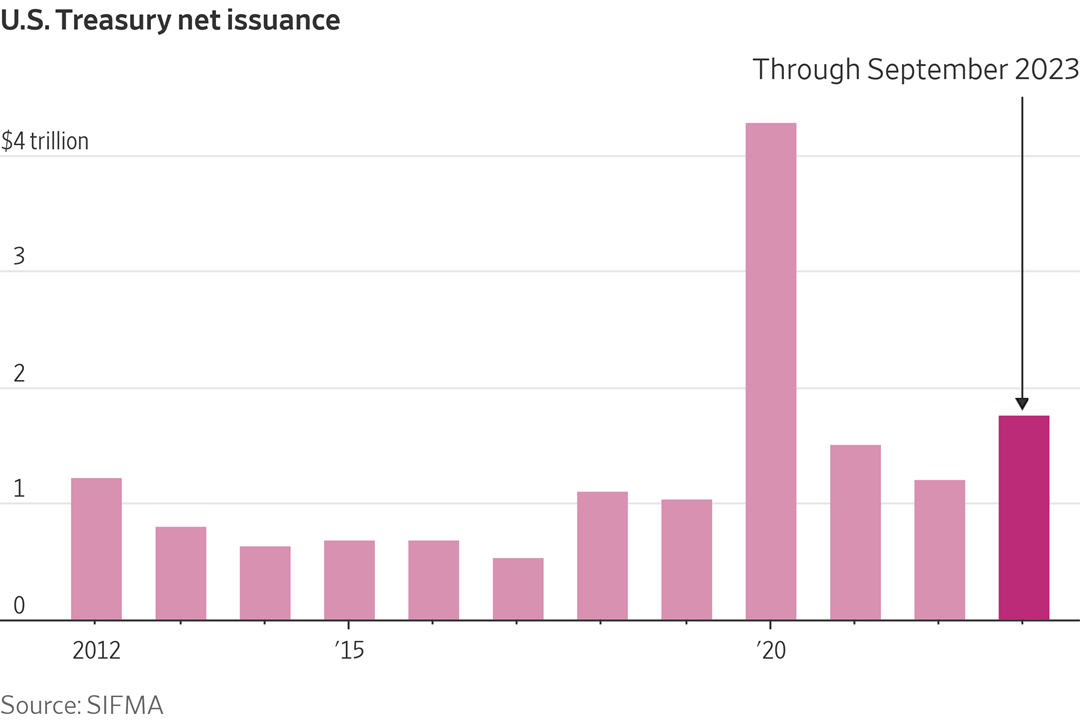

— Wall Street grapples with growing concerns over U.S. bond issuance. The recent bond market turmoil is challenging Wall Street's long-held belief that the U.S. government could easily sell an abundance of Treasuries. Historically, Wall Street and Washington have not been overly concerned about mounting deficits, relying on the assumption that America's global stature would ensure consistent demand for its debt. However, current market conditions are forcing a re-evaluation, with the possibility of higher-than-expected interest rates needed to facilitate the issuance of government debt, the Wall Street Journal reports (link). On Friday, the yield on the 10-year Treasury note briefly approached 4.9%, reflecting rising rates as bond prices declined.

Of note: Through September, a net $1.76 trillion-plus of Treasurys has been issued this year. That is higher than in any full year in the past decade, excluding 2020’s pandemic surge.

— Over 29,000 U.S. autoworkers go on strike as union rejects Mack trucks' tentative agreement. More than 29,000 U.S. autoworkers employed at assembly plants and parts distribution centers have initiated a strike, and the number is expected to rise as additional workers join the picket lines. The latest strike was prompted by the United Auto Workers' rejection of a tentative agreement with Mack Trucks (around 4,000 workers), a major manufacturer of heavy-duty vehicles in the United States. The union's demands at Mack Trucks align with those in negotiations with major automakers such as General Motors, Ford, and Stellantis, encompassing issues like improved wages, healthcare, and pension benefits.

— Indonesia to increase rice imports to address drought-induced crop declines. Indonesia is planning to boost its rice imports in 2023 by an additional 1.5 million metric tons, increasing the initial import quota of 2 million metric tons and carrying over 300,000 metric tons from the previous year's import plan. Acting Agriculture Minister Arief Prasetyo Adi stated that 600,000 metric tons of the additional rice imports have already been procured from Thailand and Vietnam and are expected to arrive by year-end. However, he did not specify the source for the remaining supplies. This move aims to address crop declines caused by drought, following the trend of several Asian nations increasing rice imports to compensate for production shortfalls or reduce domestic rice prices.

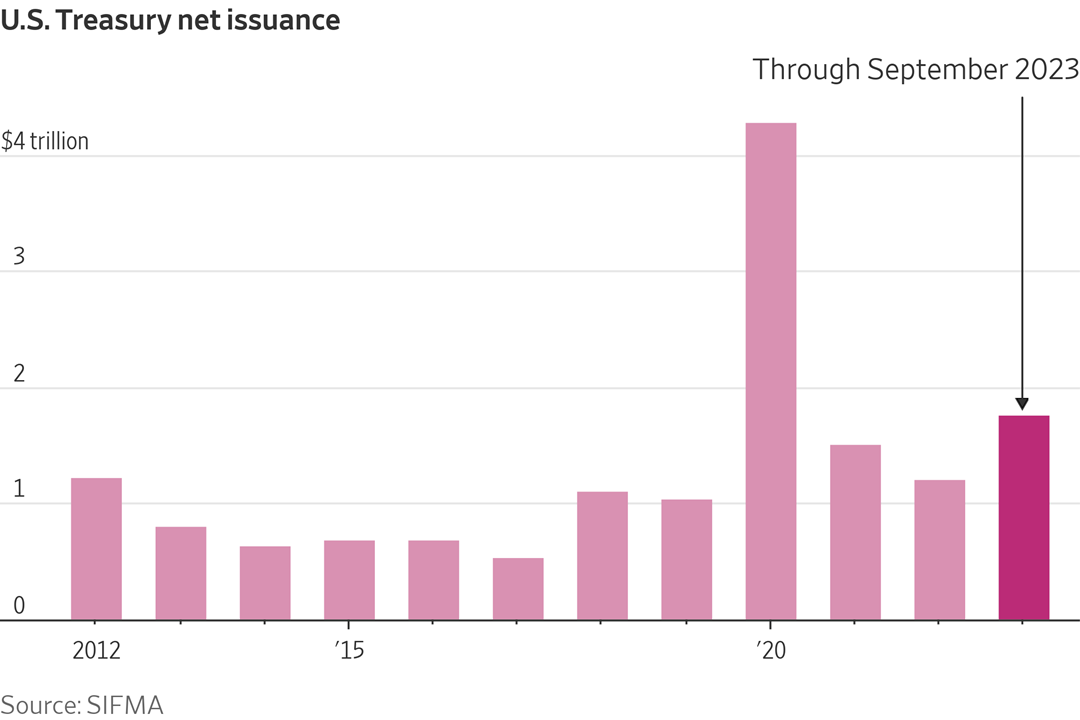

— NWS weather outlook: Colder and unsettled weather to move east from the Pacific Northwest and northern California through mid-week while above average temperatures shift from the Interior West into the Great Plains... ...Below average temperatures continue for the Great Lakes and Ohio Valley while lake effect showers persist through Tuesday... ...Surge of tropical moisture to bring an increased threat for heavy rain and flash flooding for southern Texas on Tuesday.

Items in Pro Farmer's First Thing Today include:

• Grains firmer to open the week

• Chinese property developers remain a focal point

|

RUSSIA/UKRAINE |

— IKAR raises Russian grain crop, export forecasts. IKAR agriculture consultancy raised its forecast for Russia’s grain crop this year to 141.2 MMT, up 1.2 MMT from its prior projection. The firm raised its 2023-24 grain export forecast by 500,000 MT to 64.5 MMT.

— Russian ruble slumped to a more than 18-month low against the dollar on Monday past the 102 mark, still hampered by reduced foreign currency supply and struggling to latch on to higher oil prices as the violence in Israel hurt risk appetite.

— U.S. halts Ukraine funding amid government spending debate, raising concerns about Ukraine's stability. The United States has committed approximately $113 billion in various forms of support to Ukraine, encompassing military, financial, and humanitarian assistance. However, amid a contentious debate over government spending, Congress recently passed a stopgap funding bill that excluded Ukraine funding. Russian President Vladimir Putin has expressed his belief that Ukraine would face a collapse if the West were to halt its military and economic aid. Putin argued that "the Ukrainian economy cannot exist without external support," emphasizing that cessation of such assistance would have dire consequences for Ukraine.

Bottom line: Analysts view Putin's statements as an attempt to exploit Western hesitations, potentially leading to a division among Ukraine's forces.

|

CHINA UPDATE |

— China's economy faces threats without reform, report warns. A recent report titled "Running out of road: China Pathfinder 2023 annual scorecard" by the Washington-based think tank Atlantic Council GeoEconomics Center and research organization Rhodium Group has raised concerns about China's economic stability and global position. The report highlights several key issues facing the world's second-largest economy, attributing its current economic woes to a failure in implementing necessary reforms. The challenges include a troubled property market, an aging population, declining foreign investment, rising state ownership in key industries, and unpredictable regulatory developments.

The report predicts that China's economic growth will be less than 4% in 2023, significantly lower than Beijing's official target, and calls for structural reforms, such as privatizing state assets and reforming the pension system. It also suggests that China's ambition to surpass the U.S. as the world's largest economy by the end of the 2020s is unlikely to materialize.

— Xi meets with U.S. Senate delegation, hints at possible Apec summit attendance. Chinese President Xi Jinping held a surprise meeting with a visiting U.S. Senate delegation led by Senate Majority Leader Chuck Schumer (D-N.Y.). This development is seen as a strong indication that President Xi may attend the Apec summit in San Francisco next month, where a meeting with President Joe Biden is anticipated. The visit by the U.S. congressional delegation is the first of its kind since 2019 and is aimed at fostering direct and constructive dialogue with Chinese leadership. While the meeting between Xi and Schumer doesn't guarantee a Xi/Biden meeting, it suggests both sides are working closely towards one. The senators also discussed China's stance on Israel during their visit to China.

Of note: Xi Jinping’s first meeting with U.S. congressional leaders in eight years was colored with tension after Schumer criticized China’s response to the attacks. Bloomberg reports (link).

— Chinese billionaire’s Texas company owes millions on unpaid bills. Chinese billionaire Sun Guangxin’s scuttled Texas wind farm helped spark a political movement to restrict foreign land ownership. Now 13 oil and gas outfits claim he owes them millions or was late to pay for work completed months ago. Link to details via Forbes.

— Mainland China could delay complex trade probe to eve of Taiwan election. An investigation by mainland officials into Taiwan’s trade practices could conclude right before a pivotal election — a decision that stands to further fray already strained relations. The move prompted Taipei to accuse Beijing of attempting to interfere in the vote. Link to details via the South China Morning Post.

|

TRADE POLICY |

— Mexican alcohol industry thriving in the U.S., eyes global expansion. Mexican alcohol products, including agave-based spirits like tequila and mezcal, are experiencing unprecedented popularity in the United States. The U.S. has emerged as the largest market for Mexican spirits and top beers, driven by effective marketing strategies, shifting consumer preferences, and the growing Hispanic population. Experts predict that native Mexican spirits like tequila and mezcal will surpass vodka in 2023 to become the country's fastest-growing spirits category in terms of volume. Earlier this year, Constellation Brands' Modelo Especial overtook Bud Light to become the best-selling beer in the U.S., further boosting the Mexican alcohol industry's success. Now, the sector is aiming to replicate this achievement on a global scale.

— U.S. and U.K. to initiate trade talks, but agriculture remains a point of contention. The U.S. and U.K. are preparing to commence trade talks under the banner of the U.S./U.K. Trade Partnership Forum (TPF). These talks are expected to begin this month, with the first chapters completed by early next year.

The TPF aims to address non-tariff trade barriers, economic standards, and various non-tariff issues. Unlike free trade agreements (FTAs), TPFs do not include tariff reductions and do not require approval by Congress.

Agriculture has historically been a sticking point in U.S./U.K. trade talks, and while TPFs are easier to negotiate, agriculture issues are expected to persist as a contentious topic. U.S. lawmakers have been pressing for broader FTAs, which include new market access commitments, and some have introduced legislation to extend Trade Promotion Authority for negotiating such agreements. The ag sector has also been advocating for resumption of FTA negotiations with various trade partners.

|

ENERGY & CLIMATE CHANGE |

— New federal tax credits for electric vehicles offer upfront discounts at dealerships. Starting in January, eligible electric vehicle buyers can receive a federal tax credit as an upfront discount at the dealership, instead of having to wait to claim EV credits on their federal income tax returns. It’s the latest federal move to turbocharge the shift to electric vehicles:

- 50%: The share of new vehicles the White House is pushing to have be electric by 2030.

- Up to $7,500: The credits for new EV vehicles and up to $4,000 for pre-owned vehicles, provided both the buyers and vehicles meet certain requirements.

- $53,469: The average cost of an electric car, per data from Cox Automotive.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

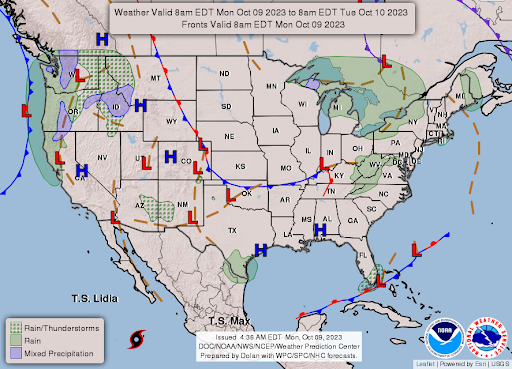

— Major meatpacking plants in the U.S. shut down due to slipping demand and rising costs, affecting small town economies. Tyson, Perdue Farms, and Smithfield Foods are shuttering their plants across the U.S. due to declining demand and persistent cost challenges. This move is causing economic concerns for small towns where these meatpacking facilities serve as significant employers, customers, and essential contributors to the local tax base, the Wall Street Journal reports (link).

Tyson is working to assist displaced workers in finding new employment opportunities and highlights its substantial annual economic impact on the communities it serves, estimated at over $27 billion.

|

HEALTH UPDATE |

— Bristol-Myers Squibb agreed to buy Mirati Therapeutics, a maker of cancer-fighting treatments, in a deal worth up to $5.8 billion.

|

POLITICS & ELECTIONS |

— Robert F. Kennedy, Jr. is expected to reveal his departure from the Democratic presidential primary to launch an independent campaign for the White House. His decision comes as he has gained more support among Republicans and has clashed with the Democratic Party, which he believes is working to undermine his candidacy. Kennedy's supporters, who tend to favor former President Trump over President Biden, have influenced his move to run as an independent. Link to New York Times article on the topic.

Democrats are concerned that additional candidates on the ballot could complicate President Biden's chances of re-election, and they are actively working to counter third-party efforts, particularly one led by the No Labels group. A recent national NBC News poll underscores these worries, showing that Trump leads Biden by a small margin in a hypothetical scenario with candidates from the Green Party, Libertarian Party, and No Labels also in the race.

— The Iowa Democratic party announced Friday that its caucus will still be held in person on Jan. 15, but that the party will release the results on March 5, conceding the first-in-the-nation position. But New Hampshire is expected to buck the Democratic Party’s plan to push its primary back. New Hampshire Democratic Party Chairman Ray Buckley acknowledged at a Democratic National Committee meeting over the weekend that Biden is not likely to be on the primary ballot as a result.

— Amazon's Alexa spreads misinformation about 2020 election. Alexa, Amazon's widely used voice assistant, has been found to spread false information regarding the 2020 election. In some instances, Alexa incorrectly stated that Joe Biden's victory was the result of massive election fraud and that Donald Trump had won Pennsylvania. These inaccuracies were brought to light by the Washington Post. Amazon responded, noting that these were isolated incidents and were promptly addressed. However, despite the reported fixes, Alexa continued to provide incorrect information about the 2020 election even after the Washington Post raised the issue with Amazon.

|

CONGRESS |

— House speaker selection process continues amid GOP candidates' pitches. The House speaker selection process has extended into its second week as pressure intensifies to reach a consensus on a candidate to assume the role. Currently, there are two candidates in contention: House Majority Leader Steve Scalise of Louisiana and Judiciary Chairman Jim Jordan of Ohio, who has received the endorsement of former President Donald Trump. Both Scalise and Jordan are expected to present their cases to their fellow GOP colleagues, with a candidate forum scheduled for Tuesday and an internal election on Wednesday. The timing of the floor vote remains uncertain.

— House Majority Leader Steve Scalise discusses speakership bid and policy priorities in Punchbowl News interview. Steve Scalise, the current House Majority Leader and a contender for the speakership, is actively working to garner support for his bid. Scalise's strong institutional advantages include an existing whip operation and previous leadership victories. He is viewed as more acceptable to moderates compared to his rival, Jim Jordan, who is known for his hardline conservative stance. However, it remains uncertain whether either candidate will secure the necessary 217 votes to become speaker.

Scalise emphasized key policy priorities in the interview with Punchbowl News:

- Funding: Scalise stressed the need for Republicans to focus on new border security policies and address the spending problem driving inflation. He expressed his intent, as Speaker, to challenge President Biden to collaborate on border security and spending issues.

- Ukraine: Scalise took a relatively firm stance against further funding for Ukraine's efforts to counter Russian occupation. He argued that President Biden has not made a compelling case for additional funding, emphasizing the need to prioritize border security, fiscal responsibility, and economic recovery.

- Motion to Vacate: Scalise acknowledged that discussions about changing the motion to vacate, a procedural rule in the House, are ongoing within the House Republican Conference. He highlighted that many members have expressed interest in addressing this issue, indicating that it will be a protracted conversation.

— Jim Jordan discusses speakership bid and key policy positions in interview with Punchbowl News. House Judiciary Committee Chair Jim Jordan (R-Ohio), a prominent contender for the speakership, provided insights into his candidacy and policy positions during an interview. Here are the key takeaways from the Punchbowl News interview:

- Approach to Speaker Election: Jordan emphasized the importance of securing support from 217 Republicans before proceeding to vote for the Speaker. He expressed the need to address the motion to vacate rule and funding issues before holding a speaker vote.

- Leadership and Communication: Jordan views the election as a choice of who can effectively lead the Republican conference, unite party members, and communicate the party's agenda to the nation.

- Working with Democrats: While known for his confrontational style, Jordan mentioned instances where he has worked with Democrats on certain issues, such as voting for a debt-ceiling increase under specific conditions.

- Government Funding: Jordan advocates using the threat of across-the-board spending cuts to pressure the Biden administration into negotiating on border security. He insists on preventing funds from being used to process or release new migrants.

- Ukraine Policy: Jordan and Scalise both express skepticism about providing additional military or economic aid to Ukraine due to unclear objectives and lack of clarity from the Biden administration. Jordan questioned the effectiveness of such funding without a defined goal.

- Fundraising: Jordan expressed readiness to raise substantial funds for House Republicans in 2024, highlighting his active involvement in grassroots fundraising efforts.

|

OTHER ITEMS OF NOTE |

— The Eras Tour movie arrives. Taylor Swift: The Eras Tour hits theaters around the world on Friday the 13th after selling a staggering $100+ million in advance tickets globally. Should Swift’s movie break the $100 million mark in North America this weekend, it would be just the sixth movie to do so in 2023, and it would surpass Miley Cyrus’s Best of Both Worlds as the highest-grossing concert film ever.

— Crocs has unveiled its first ever cowboy boots. The company announced them last week and said they will go on sale later this month. The new boots come after years of mounting demand from fans, the company said. Link to details via the Washington Post.

— Calendar of events today include:

Monday, Oct. 9

- Columbus Day. Federal gov’t offices are closed while most markets will trade normal hours during the Columbus Day holiday. The bond market is the exception as that market is closed.

- Federal Reserve. Fed Vice Chair for Supervision Michael Barr speaks on Bank Regulation at the American Bankers Association Annual Convention; Fed Vice Chair Philip Jefferson speaks on US Economic Outlook and Monetary Policy Transmission at the National Association for Business Economics (NABE) annual meeting. Dallas Fed President Lorie Logan scheduled to speak.

- IMF/World Bank preview. Atlantic Council discussion on "IMF-World Bank Big Themes Preview," as part of the 2023 annual meetings of the World Bank and International Monetary Fund.

- 2024 elections. Washington Post Live virtual discussion on what's ahead on the 2024 presidential campaign trail, part of the "Election 2024" series.

- Energy reports. Australian Financial Review Energy & Climate Summit; runs through Tuesday | Africa Oil Week, Cape Town; runs through Friday | OPEC World Oil Outlook launch | Holiday: U.S. (Columbus Day, markets open); Canada; Japan; South Korea; Taiwan.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |