McCarthy Gets the Boot, First Such Ouster in U.S. History. Now What?

House GOP chaos will slow work on appropriations, farm bill, other issues

|

Today’s Digital Newspaper |

MARKET FOCUS

- USDA daily export sale: 196,607 MT of corn to Mexico. Of the total, 109,226 MT is for delivery during the 2023-2024 marketing year and 87,381 MT for 2024-2025 MY.

- Treasury yields are surging; yields on 30-year Treasuries hit 5% first time since 2007

- Fed's Bostic sees no 'urgency' to raise rates again, but cuts a long way off

- Yellen: higher-for-longer scenario of lending rates ‘by no means a given’

- Sevens Report on McCarthy’s exit: ‘We didn’t need this right now’

- Economists at Goldman Sachs called U.S. gov’t shutdown next month new base case

- Recession warning, not watch

- U.S. private job growth slows to 32-month low

- U.S. 30-year fixed mortgage rates surge to 22-year high amid rising treasury yields

- U.S. auto industry sees impressive double-digit sales growth in third quarter

- New $850 million road project to connect copper and cobalt mines in Africa

- Ag markets today

- Philippines lifts rice price cap

- Malaysia wants ASEAN rice suppliers to prioritize members

- Cost of Australian cattle sinks to lowest in about nine years, likely to drop further

- NWS weather outlook

- Pro Farmer First Thing Today items

RUSSIA & UKRAINE

- Biden reassures allies of continued U.S. support for Ukraine

- U.S. funding shortfall puts Ukraine's economic stability at risk

- More ships headed to Ukrainian ports

- Former Russian TV journalist sentenced to 8.5 years for anti-war display

POLICY

- Arizona terminates lease of Saudi company exporting state's water-intensive crops

PERSONNEL

- Whitaker faces Senate scrutiny for FAA leadership nomination

- USDA announces three new senior-level staff appointments and promotions

CHINA

- China criticizes EU's investigation into tariffs on Chinese electric vehicles

- Biden admin. targets Chinese fentanyl producers with sanctions amid opioid crisis

TRADE POLICY

- Billions of paper bills underpin $25 trillion in global cargo trade, but fraud big concern

- Biden administration plans trade talks with U.K., bypassing congressional involvement

ENERGY & CLIMATE CHANGE

- Hybrids continue to outsell EVs in the U.S.

- Effort is underway to crowdsource a map of the entire ocean floor by 2030

- RFA urges California to accelerate approval of E15 ethanol blend

- Dems urge Biden to halt new carbon pipeline permits pending updated safety regs

LIVESTOCK & FOOD INDUSTRY

- Cal-Maine Foods shares hit

- Debate over advanced pricing of Class I and II milk sparks concerns

HEALTH UPDATE

- Court tosses $223.8 million verdict against J&J in talc cancer case

- Drugmakers agree to negotiate with Medicare over prices

- More than 75,000 workers preparing for largest health care strike in U.S. history today

POLITICS & ELECTIONS

- Support for third U.S. political party up to 63%, up from 56% a year ago

- Wasserman promoted to senior editor and elections analyst of Cook Political Report

CONGRESS

- Historic vote removes Kevin McCarthy as House Speaker

- Sen. Ben Cardin (D-Md.) blocks military aid to Egypt

OTHER ITEMS OF NOTE

- Biden canceling an additional $9 billion in student-loan

- Some newly arrived migrants in NY City begin street vending, causing turf battles

- CFPB’s funding model faces Supreme Court

- NATO grapples with cyberattack; classified documents stolen and posted online

- Everyone's cell phone in the U.S. will sound off today at around 2:20 p.m. ET

- Today’s calendar of events

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed overnight. U.S. Dow opened around 35 points higher. In Asia, Japan -2.3%. Hong Kong -0.8%. China closed. India -0.4%. In Europe, at midday, London +0.1%. Paris +0.4%. Frankfurt +0.2%.

U.S. equities yesterday: All three major indices registered sizable losses as the rise in bond yields and a big boost in job openings supported the Fed narrative that rates would stay higher longer. The Dow sank 430.97 points, 1.29%, at 33,002.38, its lowest close since June and turning lower for the year. The Nasdaq fell 248.31 points, 1.87%, at 13,059.47. The S&P 500 declined 58.94 points, 1.37%, at 4,229.45, its lowest close since May.

Treasury yields surged after data showed U.S. job openings rose more than expected in August underscoring the view that interest rates will be higher for longer. The yield on the 10-year Treasury note on Tuesday was at 4.802%, its highest level since August 2007. The 30-year was at 4.936%, its highest level since September 2007.

Other markets: The yen strengthened sharply against the dollar, surging from the weakest level in a year versus the dollar amid unconfirmed speculation Tokyo acted to slow its drop. The currency jumped 2% within seconds. Gold prices declined. Oil recovered after hitting a three-week low, supported by tightening supply.

— Agriculture markets yesterday:

- Corn: December corn futures fell 1 1/4 cent at $4.87 1/2, ending nearer the session high.

- Soy complex: November soybeans fell 4 1/4 cents to $12.72 3/4, a high-range close after trading at the lowest intraday level since June 28. December meal fell $2.60 to $371.70, marking the lowest close since June 12. December soyoil fell 30 points to 57.13 cents.

- Wheat: December SRW wheat rose 3 3/4 cents to $5.68 1/2, a near mid-range close. December HRW wheat gained 6 1/2 cents to $6.83 1/4, marking a high-range close. Spring wheat rose 6 3/4 to $7.25 1/2.

- Cotton: December cotton fell 32 points to 87.43 cents, marking a mid-range close.

- Cattle: December live cattle futures fell $2.70 to $185.65, while nearby October futures dropped $2.30 to $182.125. November feeder cattle futures led the complex lower today, plunging $5.35 before settling at $250.35. Nearby October futures dove $4.725 to $248.60.

- Hogs: Pessimism about the fourth-quarter outlook undercut hog futures Tuesday, although the expiring October contract edged up 12.5 cents to $79.975. Most-active December futures fell 42.5 cents to $69.075.

— Ag markets today: Soybean futures firmed amid corrective buying overnight, while wheat declined and corn chopped around unchanged. As of 7:30 a.m. ET, corn futures were trading a penny lower, soybeans were 4 to 7 cents higher and wheat futures were mostly 5 to 9 cents lower. Front-month crude oil futures were nearly $2.00 lower, and the U.S. dollar index was 275 points lower.

Wholesale beef can’t get traction. Choice boxed beef prices dropped $3.01 to $300.07, while Select fell $1.39 to $275.39 on Tuesday. Movement improved to 130 loads, signaling there’s still solid retailer demand under the market, but packers have struggled to push prices higher. With cutting margins in the red and fresh contract cattle supplies available, packers will be reluctant to raise cash cattle bids.

Cash hog, wholesale pork prices continue to slide. The CME lean hog index is down another 29 cents to $84.55 (as of Oct. 2), sending clearer signals an extended seasonal downturn is underway. Wholesale pork prices are also declining seasonally, falling another $1.43 to $94.61 on Tuesday.

— Quotes of note:

- Fed's Bostic sees no 'urgency' to raise rates again, but cuts a long way off. With the U.S. economy slowing and inflation falling, there is no urgency for the Federal Reserve to raise its policy interest rate again, but it will likely be "a long time" before rate cuts are appropriate, Atlanta Federal Reserve president Raphael Bostic said.

- Janet Yellen, the Treasury secretary, sounded a more optimistic note, saying that the higher-for-longer scenario of lending rates was “by no means a given.”

- Sevens Report on McCarthy’s exit: “We didn’t need this right now. Markets are continuing to digest the implications of the removal of McCarthy as Speaker of the House. Yields were initially higher overnight, likely on worries of a more pronounced threat of a government shutdown next month, but have since stabilized and are only little changed in morning trade, helping support steady stock futures in the pre-market.”

- Economists at Goldman Sachs called a U.S. gov’t shutdown next month their new base case, saying in a note yesterday that “a $120 billion difference between the parties on the preferred spending level for FY 2024” is one of the big sticking points. A lengthy shutdown could dent growth, and put the country’s credit rating at risk.

- Recession warning, not watch. Jeffrey Gundlach, the billionaire investor and CEO of DoubleLine Capital, warned that the bond slump “should put everyone on recession warning, not just recession watch.”

- “I don’t see alternatives — U.S. funding is crucial for Ukraine’s survival.” —Bill Taylor, former U.S. ambassador to Ukraine.

— U.S. private job growth slows to 32-month low. Private businesses in the U.S. hired 89,000 workers in September, the lowest number since a decline was recorded in January 2021, and below market expectations of a 153,000 increase. The latest data indicates a gradual slowdown in the U.S. labor market following the Federal Reserve's aggressive policy tightening.

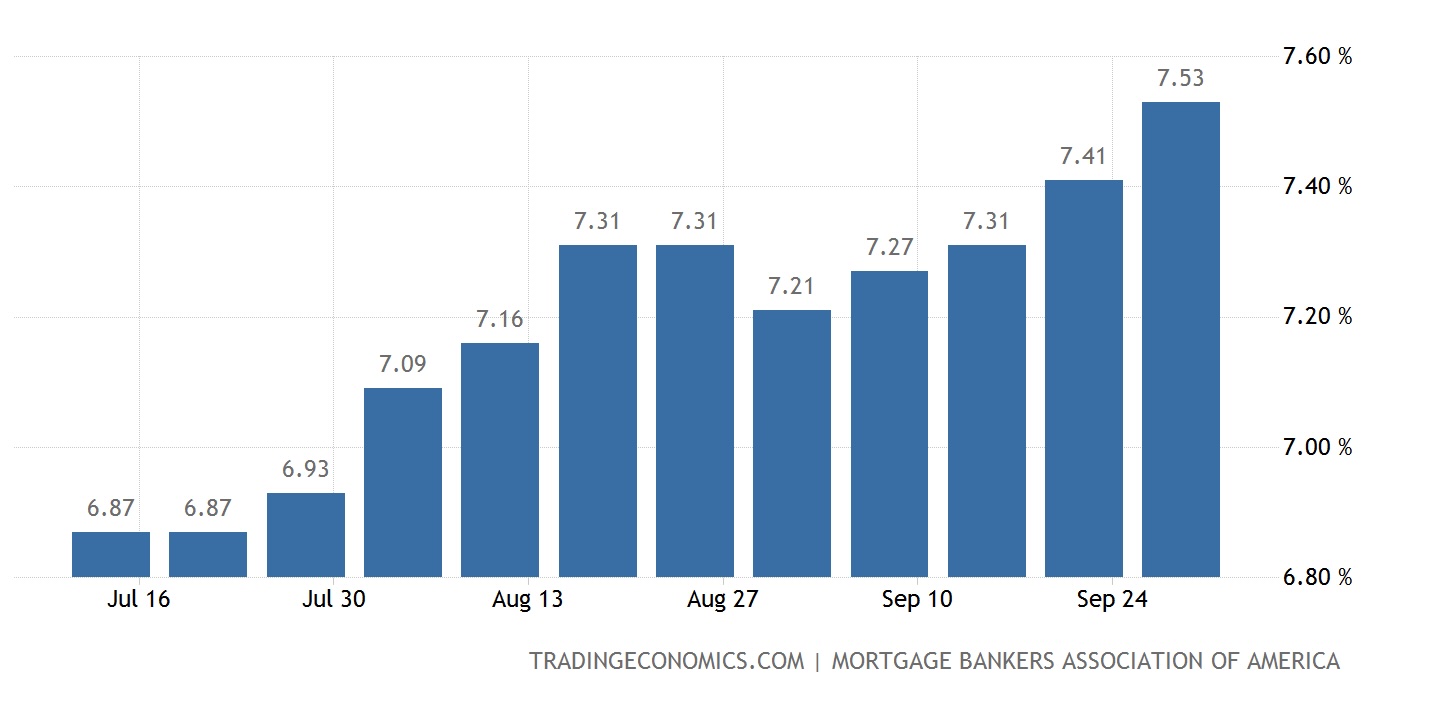

— U.S. 30-year fixed mortgage rates surge to 22-year high amid rising treasury yields. In the week ending Sept. 9, 2023, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) in the U.S. rose by 12 basis points to reach 7.53%. This marks the fourth consecutive week of rate increases, propelling borrowing costs to levels not seen since November 2000. The surge in mortgage rates can be attributed to the sharp rise in Treasury yields. Comparatively, one year ago, mortgage rates were approximately a full percentage point lower, at 6.75%.

"The rapid rise in rates pushed an increasing number of potential homebuyers out of the market," MBA's deputy chief economist said in a release. Mortgage applications for home purchases are at the lowest level since 1995.

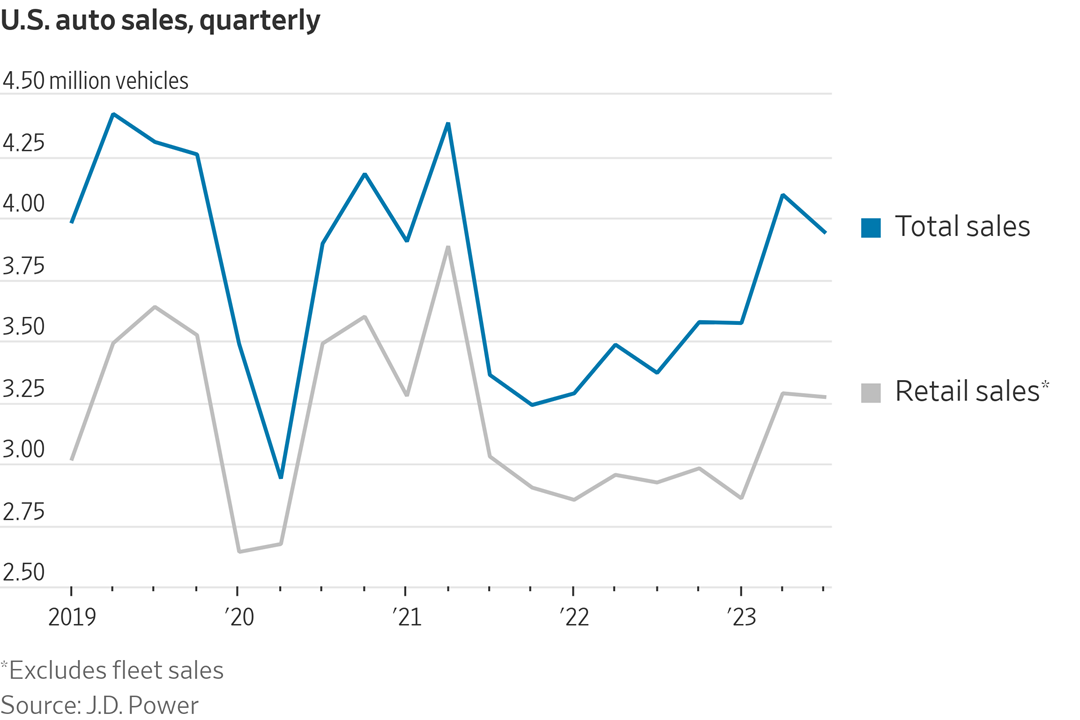

— U.S. auto industry sees impressive double-digit sales growth in third quarter despite challenges. The U.S. auto industry has witnessed robust performance in the third quarter, with automakers and consumers showing resilience in the face of higher interest rates and a prolonged United Auto Workers strike. According to data from J.D. Power, automakers sold approximately 3.9 million new vehicles during the quarter, marking a significant 17% increase compared to the same period in the previous year. Despite elevated car prices and a moderating labor market, American car buyers have continued to flock to dealerships, underlining the enduring strength of consumer demand in the automotive sector.

Of note: General Motors posted a 21.4% year-over-year jump for the third quarter, outpacing foreign rivals Toyota, Hyundai and Kia. Stellantis, which is also negotiating with the UAW, posted a slight decline, although that isn’t attributable to the strikes, just reflective of recent trends for the company. Ford is expected to post its sales figures today.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker as the euro and British pound were both firmer against the greenback. The yield on the 10-year U.S. Treasury note was trading around 4.75% with a mixed-to-lower tone in global government bond yields. Crude oil futures were under significant pressure ahead of U.S. trading and U.S. gov’t inventory data due later this morning. U.S. crude was around $87.50 per barrel while Brent slumped to around $89.25 per barrel. Gold and silver were narrowly mixed ahead of U.S. trading, with gold weaker around $1,841 per troy ounce and silver firmer around $21.38 per troy ounce.

— Yields on 30-year Treasuries hit 5% for the first time since 2007 — and some are signaling the 10-year is next.

— New $850 million road project to connect copper and cobalt mines in Africa. An $850 million road project is set to connect copper and cobalt mines in the Democratic Republic of Congo, through Zambia, to an East African port, reducing the existing journey by over 150 miles. The project, backed by GED Africa and Hungarian construction firm Duna Aszfalt, will feature a 345-meter bridge over the Luapula River. Presidents Felix Tshisekedi of Congo and Hakainde Hichilema of Zambia inaugurated the groundbreaking ceremony. Major construction will commence after the rainy season and is expected to span three years, facilitating more efficient transportation in the region. Link for details via Bloomberg.

— Philippines lifts rice price cap. Philippine President Ferdinand Marcos Jr. lifted an order capping rice prices the government imposed last month to rein in the rising cost of a national staple. The Philippines has adequate rice supplies, said Marcos, who is also the country’s ag secretary.

— Malaysia wants ASEAN rice suppliers to prioritize members. Malaysia will call on the main rice supplying nations of the Association of Southeast Asian Nations (ASEAN) to prioritize the bloc’s member countries amid concerns over rising prices and supply shortages, state news agency Bernama reported. Malaysia may hold talks with Thailand or Vietnam — the world’s second and third largest rice exporters behind India — on rice supplies, a senior ag ministry official said.

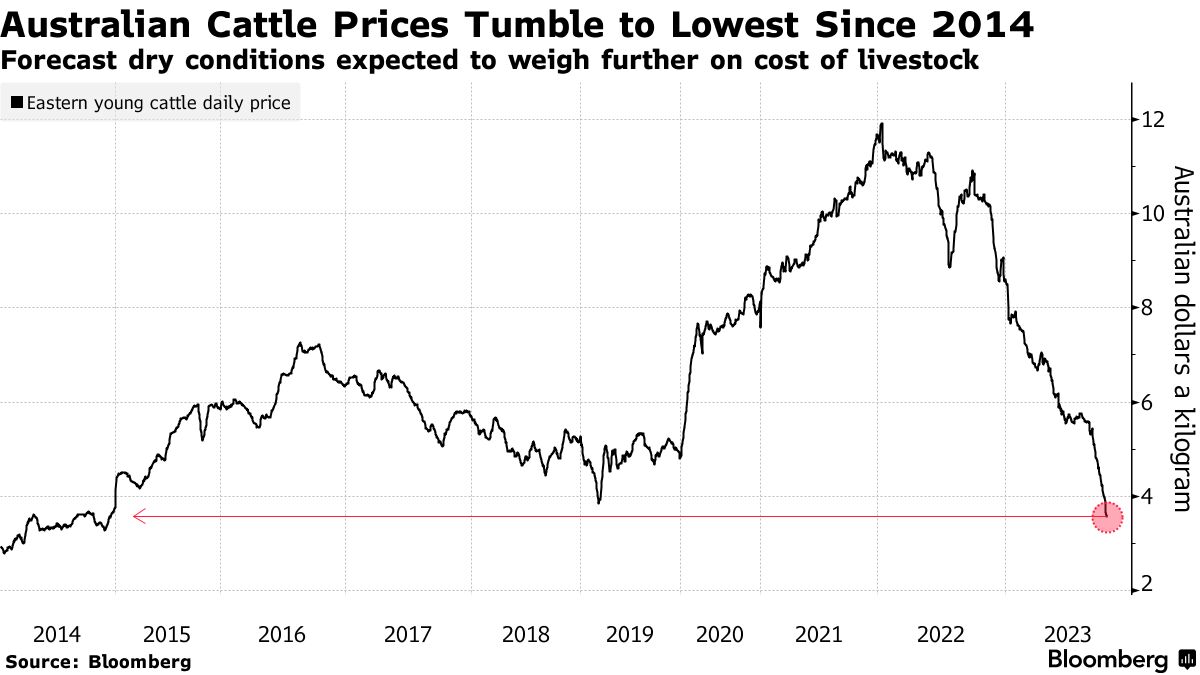

— Cost of Australian cattle has sunk to the lowest in about nine years and is likely to drop further as ranchers cull an expanded herd. The Eastern Young Cattle Indicator has fallen almost 60% this year, while livestock numbers have swelled to the highest in a decade. Link to more via Bloomberg.

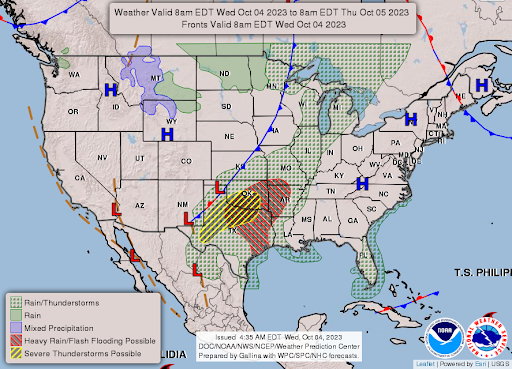

— NWS weather outlook: There is a Moderate Risk of excessive rainfall over parts of the Southern Plains/Lower Mississippi Valley on Wednesday... ...There is a Slight Risk of severe thunderstorms over parts of the Southern Plains on Wednesday... ...Temperatures will be 15 to 25 degrees above average from the Great Lakes/Ohio Valley to the Northeast.

Items in Pro Farmer's First Thing Today include:

• Varied price tone in grains overnight

• Eurozone producer prices post record decline in August

• Eurozone continues to contract

|

RUSSIA/UKRAINE |

— President Biden reassures allies of continued U.S. support for Ukraine despite funding bill omission. President Joe Biden held a telephone call with nearly a dozen foreign leaders to reaffirm the United States' commitment to supporting Ukraine amidst concerns over the omission of $6 billion in aid from a government funding bill. The White House stated that Biden assured these allies that the U.S. would stand by Ukraine in defending its sovereignty and territorial integrity.

The call included leaders such as U.K. Prime Minister Rishi Sunak, President Andrzej Duda of Poland, German Chancellor Olaf Scholz, Prime Minister Giorgia Meloni of Italy, and Canadian Prime Minister Justin Trudeau, among others. NATO Secretary General Jens Stoltenberg, European Commission President Ursula von der Leyen, and Japanese Prime Minister Fumio Kishida were also part of the conversation.

— U.S. funding shortfall puts Ukraine's economic stability at risk. Ukraine faces a critical challenge to its economic stability as the U.S. funding system, which supports Ukrainian salaries and government expenditures, is set to run dry in the coming month without a new injection of funds from Congress, according to both Ukrainian and American officials cited by the Wall Street Journal (link). This system sustains the salaries of approximately 150,000 civil servants and over half a million educators and school staff in Ukraine, while also covering various government expenses, including healthcare and housing subsidies. As officials in Washington and Kyiv grapple with the impending decline in aid, concerns mount over Ukraine's ability to maintain its government operations and keep its economy afloat.

— More ships headed to Ukrainian ports. Ukraine’s navy said 12 more cargo vessels were ready to enter its Black Sea humanitarian shipping corridor on their way to Ukrainian ports to be loaded. It was uncertain when the vessels would be loaded with grain and scheduled to set sail to their destinations.

— Former Russian TV journalist sentenced to 8.5 years for anti-war display. Marina Ovsyannikova, a former Russian state TV journalist, has been sentenced in absentia to 8.5 years in prison for her public display of a "Stop the war" placard during a broadcast following Russia's invasion of Ukraine. She was convicted of "spreading knowingly false information about the Russian Armed Forces." Ovsyannikova had escaped from house arrest in Russia a year ago and is currently residing in an undisclosed European country.

|

POLICY UPDATE |

— Arizona terminates lease of Saudi company exporting state's water-intensive crops. The Arizona State Land Department has decided to terminate the lease of Fondomonte Arizona LLC, a Saudi Arabian company that has faced criticism for exporting water-intensive crops grown in the state's Butler Valley. The company's practice of exporting alfalfa, which is water-intensive, to Saudi Arabia, where its cultivation is illegal due to water usage concerns, has raised concerns about the export of Arizona's water resources. Governor Katie Hobbs announced the termination of one lease and confirmed that the state will not renew the remaining leases when they expire in February 2024. The termination comes after the company was given notice and opportunities to address lease defaults dating back to 2016, with a recent inspection in August revealing unresolved issues spanning nearly seven years. Link for details.

|

PERSONNEL |

— Michael Whitaker faces Senate scrutiny for FAA leadership nomination amid air travel challenges. President Biden nominated Whitaker following the withdrawal of his initial choice, Phil Washington. Whitaker, a former FAA deputy administrator, enjoys broad support and a swifter confirmation process than his predecessor. Despite this, he must convince senators on how he plans to address pressing issues within the FAA, including near-miss incidents, a notification system shutdown leading to flight groundings, a shortage of air traffic controllers, and a stalled FAA reauthorization bill. In documents submitted to the committee, Whitaker outlined his strategy for tackling these challenges and disclosed a past $10 fine for a 1979 incident. He emphasized prioritizing safety, adequate staffing, compliance with standards, and continuous safety data analysis to mitigate emerging threats.

— USDA announced three new senior-level staff appointments and promotions. Tate Mitchell will join the department as chief of staff for the Office of Communications. Rudy Soto was promoted to deputy assistant secretary for the Office of Congressional Relations. Steffanie Bezruki was promoted to senior adviser for the office of the deputy secretary.

|

CHINA UPDATE |

— China criticizes EU's investigation into tariffs on Chinese electric vehicles, citing lack of evidence and short notice. The European Union has formally launched an anti-subsidies probe into electric vehicles manufactured in China, setting in motion a one-year investigation that could see provisional measures such as countervailing duties imposed in the next nine months. China has voiced its discontent with the European Union's inquiry into imposing tariffs on Chinese electric vehicles, alleging that the EU lacks substantial evidence to warrant such an investigation. The Chinese Ministry of Commerce further contends that the request for consultations was made with inadequate notice, posing a risk to China's rights in this matter.

— Biden administration targets Chinese fentanyl producers with sanctions amid opioid crisis. The United States is set to impose sanctions on 25 Chinese companies and individuals over their alleged involvement in the production and distribution of chemicals used to manufacture fentanyl, a potent and deadly opioid. This move by the Biden administration is part of its ongoing efforts to combat the importation of the drug. In response, a spokesperson for the Chinese government accused the U.S. of "scapegoating." The opioid crisis has taken a devastating toll in the U.S., with over 250,000 Americans succumbing to fentanyl overdoses since 2018.

|

TRADE POLICY |

— Billions of paper bills still underpin $25 trillion in global cargo trade, but growing vulnerability to fraud is fueling a clamor for a system upgrade, according to a Bloomberg article (link).

- Less than 2% of global trade is transacted via digital means, but that is set to change as easy to fake and frequently lost paper bills rattle an antiquated system.

- Nine of the top 10 container shipping lines — which account for over 70% of container freight — have committed to digitizing 50% of their bills of lading within five years, and 100% by 2030.

- The next challenge will be getting companies to change processes in place for hundreds of years. Few are keen to take the first steps.

— Biden administration plans trade talks with U.K., bypassing congressional involvement. The Biden administration's intention to initiate trade negotiations with the U.K., focusing on a new trade partnership without tariff adjustments, has stirred concerns on Capitol Hill, according to Politico. Senate Finance Committee Chairman Ron Wyden (R-Ore.) expressed disappointment, emphasizing that the administration's approach leaves Congress sidelined on U.S. trade policy. There are indications that the U.K. is resisting U.S. efforts to address agricultural trade barriers, potentially complicating the overall negotiations. The administration's stance has been to prioritize the enforcement of existing trade agreements and the negotiation of new trade framework deals, rather than pursuing free trade agreements (FTAs). The absence of trade promotion authority (TPA) approval further limits the possibility of FTAs with U.S. trading partners, leading to growing anxiety among agricultural interests, especially as the U.S. faces a historic trade deficit in agriculture.

|

ENERGY & CLIMATE CHANGE |

— Hybrids continue to outsell EVs in the U.S., with sales approaching 1.4 million vehicles this year, versus nearly 1.2 million full electrics, according to GlobalData, which sees hybrids controlling 9% of the American car market in 2023, while full-electrics command 8%. Americans have been slower to adopt EVs than European and Chinese consumers because of the lack of charging infrastructure as well as the higher price of EVs, even after Tesla repeatedly cut prices this year. The average price of an EV in the US in August was $59,752, compared with $45,567 for models that run on gasoline, according to researcher Edmunds.

— Effort is underway to crowdsource a map of the entire ocean floor by 2030, offering a commercial boon to the fossil-fuel, mining and shipping industries. But it’s meeting resistance from militaries reluctant to expose where their submarines hide, the BBC reports.

— RFA urges California to accelerate approval of E15 ethanol blend. The Renewable Fuels Association (RFA) is calling on the California Air Resources Board (CARB) to expedite its approval process for E15, a blend of 15% ethanol and 85% gasoline. RFA argues that CARB's delays in approving E15 are hindering potential air quality and emissions improvements. The letter from RFA highlights the benefits of E15, including reduced emissions of pollutants like particulate matter, carbon monoxide, and hydrocarbons compared to E10. RFA also emphasizes the lower carbon intensity of E15 compared to gasoline and E10. The organization urges CARB to act swiftly to approve E15, citing the potential environmental and health benefits of the fuel for California.

— Democrats urge Biden to halt new carbon pipeline permits pending updated safety regulations. Twelve Democratic members of Congress called on President Joe Biden to impose a moratorium on permitting new carbon dioxide pipelines until updated federal safety regulations are finalized. This request comes amid concerns raised by landowners along the proposed routes of major carbon capture and storage (CCS) pipeline projects in the Midwest. These landowners have expressed safety apprehensions about the pipelines. The Pipeline and Hazardous Materials Safety Administration (PHMSA) is currently working on new safety regulations for carbon pipelines, with a proposal expected in 2024. The lawmakers argue that halting federal permitting for new carbon pipelines until updated regulations are in place is essential to protect communities from construction under outdated safety standards. Environmental organizations, including Food & Water Watch and the Sierra Club, have endorsed this initiative. Link to details via Reuters.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Cal-Maine Foods shares hit. The egg producer's shares fell more than 12% in premarket trading after the company reported lackluster sales figures due to lower prices.

— Debate over advanced pricing of Class I and II milk sparks concerns about disorderly marketing. The ongoing USDA hearings to amend the Federal Milk Marketing Order system have reached their seventh week, with discussions centered on 21 submitted proposals, including those related to Class I skim milk price adjustments and advanced pricing dynamics. The American Farm Bureau Federation notes (link) that dairy industry stakeholders have raised concerns that the current use of advanced pricing, coupled with the "average-of" plus 74 cents formula, has led to disorderly marketing conditions and non-uniform pricing for dairy farmers. The Federal Milk Marketing Order system seeks to establish minimum uniform prices paid to farmers based on the value of raw milk in various dairy products, and this debate aims to address issues related to pricing equity among handlers and farmers within the system.

|

HEALTH UPDATE |

— Court tosses $223.8 million verdict against J&J in talc cancer case. A New Jersey appeals court threw out a $223.8 million verdict against Johnson & Johnson that a jury had awarded to four plaintiffs who claimed they developed cancer from being exposed to asbestos in the company's talc powder products.

— Drugmakers agree to negotiate with Medicare over prices. Ten pharmaceutical companies, including Janssen, Novartis and Novo Nordisk, will begin talks with the federal government as part of a discounted price regime introduced by the Inflation Reduction Act, even as several sue to stop it. The Congressional Budget Office projects that a breakthrough in negotiations would save taxpayers about $100 billion over a decade.

— Looming record-breaking strike: Over 75,000 Kaiser Permanente healthcare workers prepare to walk out. Kaiser Permanente, the healthcare giant, is on the brink of facing the largest strike in the history of the U.S. healthcare sector. Over 75,000 healthcare workers, represented by a coalition of employee unions, are gearing up for a potential strike as negotiations with the company have failed to reach a resolution. The looming strike has the potential to disrupt healthcare services for nearly 13 million individuals and adds to a series of prominent labor disputes in the United States, including strikes by the United Auto Workers and Hollywood actors and writers.

|

POLITICS & ELECTIONS |

— Support for third U.S. political party up to 63%, up from 56% a year ago and by one percentage point the highest in Gallup's 20-year trend. Link for details.

— David Wasserman promoted to senior editor and elections analyst of Cook Political Report (CPR). David will lead the development of key data visualizations and new product development, and will supervise and continue to contribute to the CPR’s coverage of the U.S. House of Representatives and redistricting developments for the upcoming 2024 cycle. Applications for CPR’s new House analyst are open to Oct. 17.

|

CONGRESS |

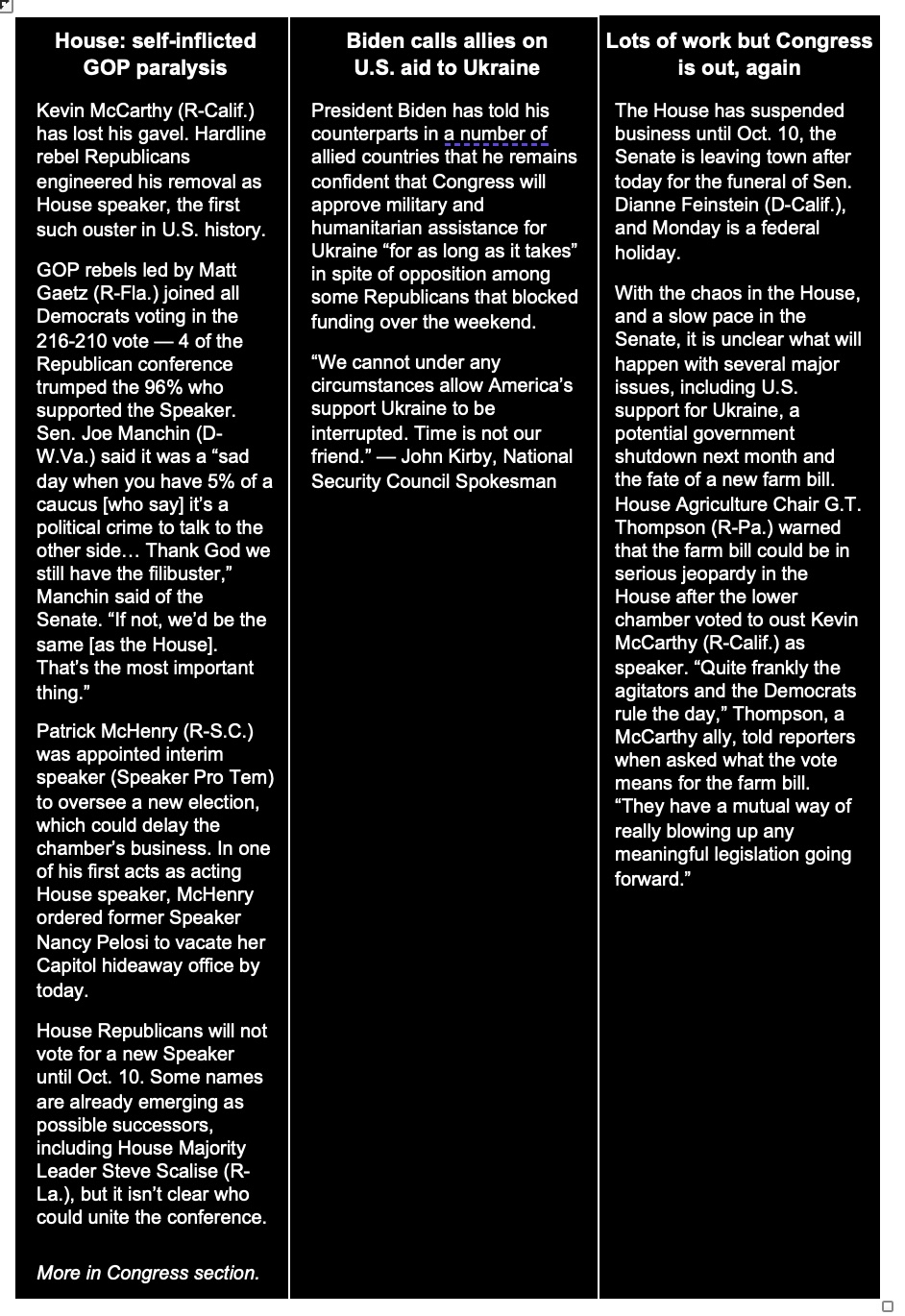

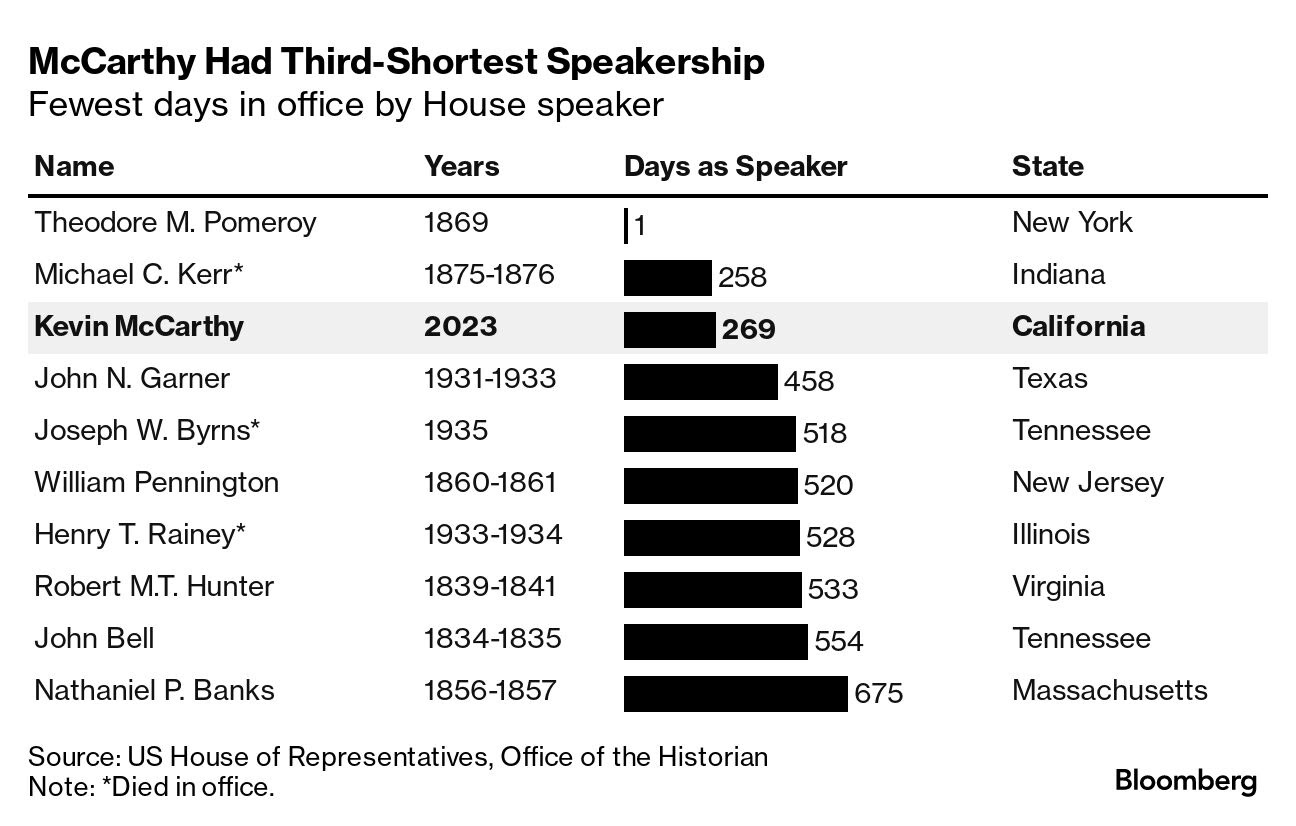

— Historic vote removes Kevin McCarthy as House Speaker. The House voted 210-216 to remove Kevin McCarthy (R-Calif.) from the position of House Speaker, 58 years old and only 269 days on the job. This marks the first time in history that a House Speaker has been removed by their colleagues and the first time a vote on ousting a speaker has occurred since 1910. Eight Republicans joined all Democrats in supporting McCarthy's removal. The decision followed a failed attempt by McCarthy and his allies to table the resolution for his removal, with 11 Republicans siding with Democrats to proceed with the vote. The House speaker is second in line to the president after the vice president.

Rebel Rep. Matt Gaetz (R-Fla.) initiated the motion to vacate the speakership, following disagreements over a short-term spending plan to avert a government shutdown. Gaetz accused McCarthy of negotiating a "secret deal" related to Ukraine funding, despite the funding being removed from the temporary budget. McCarthy had previously been elected speaker in January after a prolonged election process and multiple concessions to win over right-wing members, including changes to House rules. Gaetz’s fellow Republicans appeared to refuse to allow him to deliver his remarks from their side of the House floor, forcing him to speak from the Democratic side of the chamber. Gaetz’s effort has drawn attention to a long-running House ethics investigation against him into allegations that he engaged in sexual misconduct and illicit drug use, among other accusations.

“Think long and hard before you plunge us into chaos,” Tom Cole, an Oklahoma Republican and a McCarthy ally, told his House colleagues before the vote yesterday, “because that’s where we’re headed if we vacate the speakership.” Gaetz replied: “Chaos is Speaker McCarthy,” Gaetz replied. “Chaos is somebody who we cannot trust with their word.”

Eight Republicans voted against McCarthy: Reps. Andy Biggs (Ariz.), Ken Buck (Colo.), Tim Burchett (Tenn.), Eli Crane (R-Ariz.), Matt Gaetz (Fla.), Bob Good (Va.), Nancy Mace (S.C.) and Matt Rosendale (Mont.).

Of note: Rep. Victoria Spartz (R-Ind.) voted against McCarthy in an initial procedural vote but declined to remove him from the speaker’s chair, telling reporters before the vote, “I’m willing to give him one more chance.” Cory Mills of Florida and Warren Davidson of Ohio also backed McCarthy on the removal vote after opposing him on the procedural measure.

Democrats opted against saving the speaker. House Minority Leader Hakeem Jeffries (D-N.Y.) said it's "now the responsibility of the GOP members to end the House Republican Civil War."

The absence of a House Speaker will lead to a stall in legislative business until a replacement is elected. McCarthy said he would not run again for the job. Potential successors mentioned by Gaetz include GOP Whip Rep. Tom Emmer, 61, (R-Minn.) and Majority Leader Steve Scalise, 58 on Friday, (R-La.) — Scalise was recently diagnosed with blood cancer. This has led some Republicans to wonder if he’s physically up for the job. It’s a grueling position, but he has been trying to gauge his position among his colleagues. House Majority Whip Tom Emmer has already endorsed Scalise. Rep. Patrick McHenry (R-N.C.) has been named interim speaker. McHenry has already said he does not want the role. He chose not to run for a leadership role last year, opting instead to lead the powerful financial services committee. Rep. Elise Stefanik (R-N.Y.), the top woman in leadership, could emerge as another potential alternative. Rep. Tom Cole (R-Okla.), one of the longest serving Republicans in the House who leads the Rules Committee, is also respected by both Republicans and Democrats alike. Rep. Jim Jordan (R-Ohio) has been calling around assessing his potential support, but he may have trouble with moderates in the party.

The result plunges the House even further into crisis, with no clear sign of who — if anyone — can muster enough votes to become the next speaker. House rules do not prohibit a non-member of the legislature from being named speaker.

Bottom line: The 216-210 vote raises fresh questions about dysfunction in Washington. The vote made clear that the GOP’s rebel right wing will not tolerate leaders who compromise with President Biden and his party. Congress faces another deadline by Nov. 17 to avert a government shutdown. While farm bill deliberations and staff work can continue, the timeline of any floor action becomes murkier, and it wasn’t that clear before the latest GOP chaos. McHenry has announced his intention to hold speaker elections on Oct. 11. The House Republican majority will hold a closed-door forum on Oct. 10, where candidates can put themselves up for the job.

The slowdown in the House will also affect the Senate, Sen. Jerry Moran (R-Kansas) said. “I don’t know how the House responds to get an appropriations process done,” Moran said. “And that of course has a consequence in the Senate, where we need house bills to come over here.

— Sen. Ben Cardin (D-Md.) blocked military aid to Egypt days after Sen. Bob Menendez (D-N.J.) stepped down as Senate Foreign Relations Committee chair over allegations that he took bribes to help the Egyptian government. At issue is $235 million in foreign military financing — Egypt’s share of US funds provided to countries as either a grant or a loan to allow them to purchase defense equipment. “My hold on current funds will remain until specific human rights progress is made,” Cardin, the new chair, said in a statement.

|

OTHER ITEMS OF NOTE |

— President Joe Biden is canceling an additional $9 billion in student-loan debt, his latest action to aid borrowers after the Supreme Court blocked his debt-relief plan and as payments resume. The White House said he will detail help for 125,000 borrowers today.

— Some newly arrived migrants in New York City have begun street vending, causing turf battles with more established sellers. Link to more via the New York Times.

— CFPB’s funding model faces Supreme Court challenge. The Consumer Financial Protection Bureau (CFPB) appears to be on track to withstand a significant challenge from payday lenders who have raised concerns about the agency's funding model. In a case that could have far-reaching implications for federal agencies, Supreme Court justices expressed skepticism about the payday lenders' claims that the CFBP’s funding structure is unconstitutional. The agency, established in the aftermath of the 2008 financial crisis, is directly funded by the Federal Reserve, with critics arguing that this setup bypasses the annual budget determination by Congress. While the lower court had ruled in favor of the lenders, conservative and progressive justices seemed inclined to support the agency's funding mechanism, suggesting it had historical precedent and that Congress had the authority to delegate funding responsibilities.

Of note: "I get your point that [the CFPB's funding] is different, that it's unique, that it's odd, that they've never gone this far. But...not having gone this far is not a constitutional problem." — Supreme Court Justice Clarence Thomas.

— NATO grapples with cyberattack; classified documents stolen and posted online. NATO, the multinational defense alliance comprising 31 nations, is contending with a cyberattack affecting its unclassified websites. A hacking group stole and subsequently published strategy and research documents from the alliance, including sensitive information on topics such as hypersonic weapons, drone threats, and radioactive waste testing procedures. Although there have been no reported disruptions to NATO's missions, operations, or military deployments, the breach raises concerns about the organization's capacity to safeguard its communication networks.

— Everyone's cell phone in the U.S. will sound off today at around 2:20 p.m. ET with a message from the government. The Federal Emergency Management Agency, or FEMA, is conducting a nationwide test that will be sent to all cell phones to ensure its systems can "effectively warn the public about emergencies, particularly those on the national level."

— Calendar of events today include:

Wednesday, Oct. 4

• Federal Reserve. Fed Governor Michelle Bowman speaks on the Role of Research, Data, and Analysis in Banking Reforms at St. Louis Fed conference.

• China WTO compliance. Office of the U.S. Trade Representative virtual hearing on China's compliance with World Trade Organization commitments.

• IPEF session. U.S. Trade Representative Katherine Tai host sa virtual ministerial meeting with Indo-Pacific Economic Framework Pillar I (Trade) counterparts to review progress made so far and outline ongoing engagement on the Trade Pillar in order to advance resilience, sustainability, inclusiveness, economic growth, fairness, and competitiveness in the region.

• U.S./China report. U.S./China Economic and Security Review Commission meeting to review and edit drafts of the 2023 Annual Report to Congress; runs through Thursday.

• Workforce issues. The U.S. Chamber of Commerce Talent Forward Conference, focusing on "identifying the biggest workforce issues."

• Wildlife Service meeting. Animal and Plant Health Inspection Service (APHIS) holds a meeting of the National Wildlife Services (WS) Advisory Committee on pertinent WS operational, research, and program activities, to increase program effectiveness and ensure that WS remains an active participant in the protection of agriculture, property, natural resources, and human health and safety; runs through Thursday.

• China’s economy. Atlantic Council virtual discussion on "Running Out of Road: China Pathfinder 2023 Launch," focusing on "the trajectory of the Chinese economy."

• Development Finance Corporation oversight. Senate Foreign Relations Committee hearing on "BUILD Act Reauthorization and Development Finance Corporation Oversight."

• Russia/Ukraine situation. Henry L. Stimson Center virtual discussion on "How Doing Justice to Ukraine Can Help Win the Battle for the Future of Nuclear Security," focusing on the implications of "Russian occupation of Ukraine's Zaporizhzhia Nuclear Power Plant on nuclear security norms."

• Indo-Pacific issues. Georgetown University's Center for Australian, New Zealand and Pacific Studies discussion on "Transforming the Indo-Pacific Order: The AUKUS (Australia, United Kingdom, United States) Wager."

• Supreme Court regulations. Federalist Society for Law and Public Policy Studies' Georgetown Law Student Chapter discussion on "Ethics and Ethos: How SCOTUS Can and Should be Regulated."

• U.S./China conflict. Quincy Institute for Responsible Statecraft virtual discussion on "Is U.S./China Conflict Inevitable?"

• Korean peninsula. Senate Foreign Relations East Asia, the Pacific and International Cybersecurity Policy Subcommittee hearing on "Security on the Korean Peninsula."

• AI in entertainment, music. Federal Trade Commission virtual roundtable on the impact of the use of generative artificial intelligence on music, filmmaking, and other creative fields.

• U.S. energy. Heritage Foundation discussion on "American Energy for Prosperity."

• China economic growth. Brookings Institution discussion on Does the U.S. need to seek to limit China's economic growth in order to protect itself?"

• Economic reports. ADP Employment Report | PMI Composite Final | Factory Orders | ISM Services Index

• Energy reports. EIA Petroleum Status Report | Weekly Ethanol Production | Genscape weekly crude inventory report | OPEC+ Joint Ministerial Monitoring Committee | Holiday: China.

• USDA reports. NASS: Dairy Products | Broiler Hatchery

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |