Senate Takes Key Step to Clear Stopgap Spending Bill, but Hurdles Ahead in House

Amazon | Farm bill webinar | Crop insurance proposal | Russia short of fuel? | Bank deposits

|

Today’s Digital Newspaper |

MARKET FOCUS

- Equity markets today

- FTC and 17 U.S. states have filed a lawsuit against Amazon

- Targeting theft

- What travelers need to know for early October plans if there is a gov’t shutdown

- Canada initiates review of Bunge-Viterra merger amid concerns over competition

- Ag markets today

- Ag trade update

- NWS weather outlook

- Pro Farmer First Thing Today items

CONTINUING RESOLUTION (CR) and POSSIBLE GOV’T SHUTDOWN

- Senate clears procedural vote to keep federal agencies open until Nov. 17

- House clears rule allowing four spending measures to proceed to debate

RUSSIA & UKRAINE

- Poland and Ukraine make progress in grain import dispute resolution talks

- WSJ: Kremlin grapples with fuel shortages and oil company tensions

POLICY

- USDA launches ELRP effort for 2022 losses and Phase 2 of 2021 ELRP

- Some highlights of farm bill webinar Tuesday given by Farm Foundation

- Blumenauer proposes crop insurance reforms to save billions, target small farmers

CHINA

- China's industrial profits surge 17.2% in August, signaling economic stabilization

- China increases minimum wheat purchase price for 2024

- U.S. Ambassador's visit to Gwadar port raises geopolitical questions

- PBOC adviser: ‘No Japanification’ for Chinese economy

ENERGY & CLIMATE CHANGE

- Giant batteries provided vital support to U.S. power grid during summer heat waves

LIVESTOCK & FOOD INDUSTRY

- Food insecurity as pandemic-era benefits end, hitting SNAP recipients, food pantries

POLITICS & ELECTIONS

- Supreme Court rejected Alabama’s proposed congressional map

CONGRESS

- EPA administrator faces congressional inquiry into science and technology utilization

OTHER ITEMS OF NOTE

- Travis King: North Korea expels U.S. soldier who crossed demilitarized zone

- Today’s calendar of events

|

MARKET FOCUS |

— Equities today: Asian and European stocks were mixed to firmer overnight. U.S. Dow opened up around 60 points higher and then turned slightly lower. Investors are concerned about the Fed’s interest rate policy and the prospect of a government shutdown. All eyes are on the House, after the Senate reached a stopgap spending deal yesterday. In Asia, Japan +0.2%. Hong Kong +0.8%. China +0.2%. India +0.3%. In Europe, at midday, London -0.2%. Paris flat. Frankfurt -0.2%.

U.S. equities yesterday: All three major indices ended with sharp losses Tuesday. The Dow fell 388.00 points, 1.14%, at 33,618.88. The Nasdaq lost 207.71 points, 1.57%, at 13,063.61. The S&P 500 was down 63.91 points, 1.47%, at 4,273.53.

— The Federal Trade Commission (FTC) and 17 U.S. states have filed a lawsuit against Amazon, alleging that the e-commerce giant unlawfully exercises monopoly power in the online marketplace. The lawsuit claims that Amazon's practices artificially inflate prices, lock sellers into its platform, and harm its competitors. This legal action is seen as a significant step in the Biden administration's aggressive stance on enforcing antitrust laws. FTC Chair Lina Khan, a vocal Amazon critic, has faced challenges in persuading courts to adopt her antitrust perspectives, having previously lost cases involving Microsoft and Meta Platforms.

"The lawsuit is wrong on the facts and the law, and we look forward to making that case in court," Amazon said in a statement.

Bottom line: This is a landmark antitrust suit, as Amazon controls about 40% of the e-commerce market. It represents a pivotal moment for Khan and her agency's efforts in addressing monopolistic practices in the tech industry. Analysts say the case will hinge on how a market is defined. Amazon says it represents a tiny fraction of the retail sector if brick-and-mortar stores are included. But the FTC defines the market as “online superstores,” a narrower category of e-commerce companies.

— Targeting theft. Target will shutter nine underperforming stores in the U.S. on Oct. 21 due to increased violence and organized retail crime at the locations. The store closures are expected to have a positive impact on margins. Retail theft has been on the rise in the U.S., climbing nearly 20% last year, according to the National Retail Federation. The top five areas that were affected were Los Angeles, San Francisco/Oakland, Houston, New York and Seattle. Other retailers such as Dick’s Sporting, Lowe’s and Macy’s have also pointed to a rise in crime as a factor in reduced earnings and expect the trend to continue.

— Agriculture markets yesterday:

- Corn: December corn futures fell 1 1/2 cents at $4.79 3/4 and near mid-range.

- Soy complex: November soybeans rose 5 cents to $13.02 3/4, a high-range close. December meal rose $2.90 to $392.70, ending the session above the 10-day moving average. December soyoil gained 23 points, closing at 57.71 cents, a high-range close

- Wheat: December SRW wheat closed steady at $5.89. December HRW wheat lost 4 cents to $7.10 1/2. Prices closed near mid-ranges. December spring wheat futures fell 2 1/2 cents to $7.66 1/2.

- Cotton: December cotton rose 1 point to 88.18 cents, still a high-range close.

- Cattle: October live cattle futures fell $2.175 to $184.80 Tuesday and closed near session lows. October feeder cattle futures closed $4.95 lower to $253.875, the lowest level since Sept. 5.

- Hogs: Hog futures stabilized in the wake of recent losses, with nearby October futures edging up 10 cents to $81.625 while the deferred contracts slipped.

— Ag markets today: Corn and soybean futures firmed amid light corrective buying overnight. Wheat traded on both sides of unchanged overnight. As of 7:30 a.m. ET, corn futures were trading mostly a penny higher, soybeans were 6 to 7 cents higher, winter wheat markets were 1 to 2 cents lower and spring wheat was narrowly mixed. Front-month crude oil futures were more than $1.50 higher, and the U.S. dollar index was more than 200 points higher.

Macros drive corrective selling in cattle. Live cattle and feeders faced heavy selling pressure on Tuesday, tied largely to macroeconomic concerns as a government shutdown looms at the end of the month if lawmakers can’t agree on a short-term spending measure. While the cash cattle market is well supported by tight market-ready supplies, prices could slip this week. Plus, Choice boxed beef fell below $300.00 for the first time since May.

Pork movement surges. The pork cutout value fell 58 cents to $98.28 on Tuesday, though movement improved to 360.6 loads, signaling there is strong retailer buying under the market. But with pork supplies building seasonally, the cutout value could face heavier pressure if retailer demand doesn’t prove to be consistently strong.

— Quotes of note:

- “The FTC doesn’t have a particularly good history of bringing monopolization cases.” — Rick Rule, head of the Justice Department’s antitrust division during the Reagan administration.

- “We got the deal the members went on strike for.” — David Goodman, Writers Guild of America negotiating committee co-chair.

- “U.S. dependence on China for critical material imports required to help power America’s green transition not only remains high but, in many cases, has only increased this decade. So memo to the decouplers — curb your enthusiasm.” — A Bank of America market strategy report published Tuesday.

— What travelers need to know for early October plans if there is a gov’t shutdown. Here is what travelers should know if a U.S. government shutdown begins on Oct. 1 and impacts their travel plans (based on a Wall Street Journal article):

Impact on Flights:

- Likely yes, as TSA officers and air-traffic controllers are considered essential personnel and must report to work.

- Working without pay may lead to significant delays and longer wait times at airports, as seen in previous shutdowns.

- In past shutdowns, TSA employees and air-traffic controllers calling in sick caused air-traffic bottlenecks, leading to shutdown resolutions.

Customs and Border Protection:

- Most Customs and Border Protection employees are considered essential, so they are expected to work despite not receiving regular paychecks.

- The Department of Homeland Security may provide further guidance if a shutdown occurs.

Airline Policies:

- Airlines haven't issued specific shutdown-related travel warnings or waivers, but they typically waive change fees for most flights.

- Passengers may still need to pay the fare difference when changing flights.

Passport Applications:

- Passport operations aren't expected to be immediately affected by a government shutdown.

- However, if a passport agency is in an affected government building, operations may temporarily pause.

U.S. Embassies and Consulates Overseas:

- U.S. embassies and consulates abroad would remain operational even during a government shutdown, according to the State Department.

- Travelers should stay informed about the situation and potential updates from relevant authorities if a government shutdown occurs in early October.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro and British pound weaker. The yield on the 10-year U.S. Treasury note was weaker, trading around $4.50%, with a negative tone in global government bond yields. Crude oil futures continued to strengthen ahead of U.S. gov’t inventory data due later this morning, with U.S. crude around $91.90 per barrel and Brent around $93.50 per barrel. Gold and silver were seeing pressure ahead of Durable Goods data, with gold around $1,909 per troy ounce and silver around $23.02 per troy ounce.

— Canada initiates review of Bunge-Viterra merger amid concerns over competition. Canada's Ministry of Transport is launching a public interest assessment of the proposed merger between Bunge and Viterra, backed by Glencore. The review is set to be completed by June 2, 2024, as announced by Ministry of Transport Pablo Rodriguez. Both Bunge and Viterra have ownership interests in port terminals across Canada, making competition in the transportation sector a vital consideration. Rodriguez emphasized the importance of healthy competition in ensuring fair pricing and access for users, particularly Canadian farmers. Besides the Ministry of Transport's review, Canada's Competition Bureau is also evaluating the merger, which, if approved, would result in the creation of an agricultural company valued at approximately $34 billion. The reviews aim to address potential competition concerns in the agricultural sector.

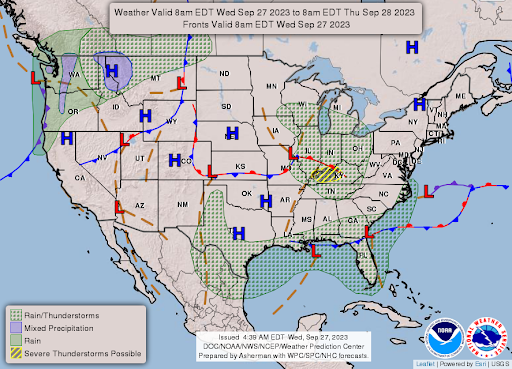

— NWS weather outlook: Severe thunderstorms and locally heavy rain possible across portions of the Ohio Valley today... ...Wet weather to continue across much of Florida and into the coastal Southeast, as well as the Pacific Northwest... ...Much above average temperatures expected to build over the central U.S. by the end of the week.

Items in Pro Farmer's First Thing Today include:

• Corn and beans firmer, wheat mixed this morning

• China will hold additional sales of sugar reserves

• Concerns with China’s Evergrande build

|

CONTINUING RESOLUTION (CR) & POSSIBLE GOV’T SHUTDOWN |

— Senate’s bipartisan stopgap funding bill, which cleared a procedural vote last night, 77-19, would keep federal agencies open until Nov. 17. The White House-endorsed bill includes around $6 billion in new economic and military aid for Ukraine, plus another $6 billion for disaster relief. There is no border security money, nor spending cuts that some House GOP lawmakers have been incessantly demanding. However, Sen. Rand Paul (R-Ky.) says he won’t give consent for speedy passage of the continuing resolution (CR). That means the Senate could potentially vote on final passage of the CR as late as Sunday, which is after government funding expires.

More on Ukraine funding: The Senate’s nearly seven-week CR provides a fraction of what President Joe Biden sought for Ukraine in the remainder of 2023. The Senate allocates $4.49 billion for the Defense Department’s effort in Ukraine, alongside $1.65 billion in additional aid for the war-torn country, money that will remain available until Sept. 30, 2025. Combined, the more than $6 billion is far less than the White House’s request for $20.6 billion in Ukraine funding. But if the plan becomes law, Congress will almost certainly pursue additional money for Ukraine later this fall.

In the House, Speaker Kevin McCarthy (R-Calif.) aims to amend the Senate's CR with HR 2, a bill related to border security from the House of Representatives. In brief:

- McCarthy wants to make changes to the Senate's CR using HR 2, which focuses on border security. This move is intended to frame the debate as being about border security issues and the deteriorating situation at the U.S./Mexico border.

- Shift in Focus: By framing the debate this way, McCarthy and House GOP leaders are attempting to divert attention away from the deep spending cuts that House Republicans are advocating for in various social programs.

- Expectation of Republican Support: The passage assumes that McCarthy and the House GOP leaders believe they can garner enough support from Republican members of Congress to pass their proposed amendments.

- Debt and Deficit Commission: McCarthy may also propose the creation of a commission to address debt and deficit-related issues.

- Challenges in Getting Votes: Potential challenges McCarthy may face hurdles in getting enough votes for his proposed amendments if there is a push within the House GOP to include spending cuts or remove funds designated for Ukraine from the CR. At least 10 House Republicans have vowed to not support any CR.

- Legislative Timeline: McCarthy's plan is to introduce his own stopgap funding bill later in the week, following votes on other appropriations measures related to Defense, Homeland Security, Agriculture, and State-Foreign Operations. It is an open the question of whether House Republicans will be successful in passing any of these measures.

The White House in a statement Tuesday night came out in support of the Senate-led proposal and urged House Republicans to stick to the parameters of a spending deal McCarthy and President Joe Biden reached earlier this year to avoid a default on the nation’s debt. The Senate has marked up its full-year funding bills to match that agreement, while House Republicans have marked up theirs to much more conservative spending figures to appease demands from the renegade Republicans.

Bottom line: McCarthy faces key challenges among House Republicans as they seek to influence the content of the Senate's CR and shape the narrative around key issues like border security, spending cuts, and aid to Ukraine. McCarthy said funding for Ukraine should be dealt with in a supplemental request and not tacked onto a stopgap bill. “I don’t quite understand, when you have all these people across the country talking about the challenges happening in America today, that people would go and say, ‘Oh, we need to do Ukraine and ignore what’s happening along our border,’” he said.

If McCarthy is unable to pass a stopgap with just Republican votes, passing the Senate’s bill appears to be the only way for him to avoid a gov’t shutdown Oct. 1, or at least keep it brief.

— The House Tuesday evening cleared a rule allowed four spending measures to proceed to debate, though that does not guarantee eventual passage on any. The four bills would fund the Departments of State, Homeland Security, Defense, and Agriculture. The vote was 216-212, with several Republicans changing their votes to "yea" from previous attempts in appreciation for GOP leaders' work to get the individual spending bills moving again. They include Arizona Reps. Andy Biggs and Eli Crane, Matt Rosendale of Montana and Dan Bishop of North Carolina. Rep. Marjorie Taylor Greene (R-Ga.) was the sole GOP "nay" vote, largely in protest over the underlying Defense and State-Foreign Operations bills' inclusion of money for Ukraine.

Key ahead: amendments, and several of them would impact ag and food policy. But the bill is going nowhere in the Senate.

|

RUSSIA/UKRAINE |

— Poland and Ukraine make progress in grain import dispute resolution talks. Poland and Ukraine are making strides in their discussions to resolve the ongoing disagreement regarding Poland's ban on Ukrainian grain imports. Polish Agriculture Minister Robert Telus stated that both sides are actively engaged in dialogue and are working to establish future mechanisms while addressing emotional aspects of the dispute. The Ukrainian Agriculture Ministry has announced that its chief, Muykola Solsky, will meet with Minister Telus in a week to discuss Ukraine's proposed license system, which aims to implement import licenses for corn, rapeseed, sunflower seed, and wheat destined for five East European countries within the European Union (EU). Additionally, Poland's Minister Telus has urged Ukraine to withdraw its complaint filed at the World Trade Organization (WTO), where Ukraine initiated a dispute settlement process against bans imposed by Poland, Hungary, and Slovakia.

— WSJ: Kremlin grapples with fuel shortages and oil company tensions as Russia faces domestic crisis. Russia, a major global oil exporter, is confronting a sudden shortage of fuel within its borders, sparking tensions between the Kremlin and the country's oil companies. This crisis has even resulted in the removal of executives from state controlled Rosneft Oil. The situation escalated when surging fuel prices, particularly in key agricultural regions, compelled the Russian government to prohibit the export of diesel and gasoline earlier this month. While this move alleviated pressures on Russian businesses, it also contributed to elevated diesel prices worldwide, potentially exacerbating the ongoing energy-price surge. Link to details via the Wall Street Journal.

|

POLICY UPDATE |

— USDA launches ELRP effort for 2022 losses and Phase 2 of 2021 ELRP. USDA initiated two relief programs: the Emergency Livestock Relief Program (ELRP) for 2022 losses stemming from drought or wildfires (link) and Phase 2 of the 2021 ELRP (link). Under the 2022 ELRP, the focus is on addressing increased supplemental feed costs due to drought or wildfire occurrences in calendar year 2022. Funds for these programs, totaling just under $495 million, were allocated from the Disaster Relief Supplemental Appropriations Act of 2023, which amounted to $3.74 billion.

For the 2022 ELRP, data from the Livestock Forage Disaster Program (LRP) will be utilized to determine payments. These payments will be calculated based on the number of animal units, with consideration given to available grazing acreage in eligible drought-affected counties. Payments will be set at 90% of the LFP payments for underserved producers and 75% for all other producers. Importantly, producers who have already received LFP payments for their losses will not need to resubmit information to receive the 2022 ELRP payments.

Regarding the 2021 ELRP Phase 2, it aims to aid eligible livestock producers who suffered losses in the value of winter forage due to qualifying drought or wildfire during the 2021 normal grazing period. This situation has been further exacerbated by continued precipitation deficits.

USDA had previously announced Phase 1 of the ELRP effort in April, which utilized 2021 LFP data to expedite payments. Phase 1 payments were calculated at 90% of the gross LFP payment for underserved farmers and ranchers, and 75% for all other producers. Phase 2 payments will be based on 20% of ELRP Phase 1 payments and will cover a percentage (ranging from 44% to 52%) of the estimated losses in the value of winter forage. Producers do not need to resubmit information for the Phase 2 payment.

Timing: Both programs, the 2022 ELRP and 2021 ELRP Phase 2, will commence implementation on September 27, 2023.

— Some highlights of farm bill webinar Tuesday given by Farm Foundation (link):

- Farm bill timing: As usual, participants noted this issue is murky. Dr. Joe Outlaw, an economist and professor with Texas A&M University, repeated what he told AgWeb last week — that it would take a couple of years to pass a farm bill, but getting a bill is possible in 2024 if lawmakers can get it done by February before many of the primary elections. “This is a terrible time to do a farm bill,” said Outlaw. His concern is not only the political strife in the Capitol but the current farm economy. Relatively high crop prices have masked a tenuous economy for farmers. “The farm safety net is all about the bad times, and frankly the bad times are coming, they just aren’t here right now,” Outlaw said.

“At this point, it will not be possible to pass a farm bill by Saturday,” said Emily Pliscott, an economist for the Democratic staff of the House Agriculture Committee.

Jonathan Coppess, a professor of agriculture law and policy at the University of Illinois, said the prospects for the farm bill are in “serious doubt,” given the far-right faction that is holding up legislation in the House. “We have an incredibly difficult political hurdle in the House and on the House floor,” Coppess said. One of the potential hurdles he said was potential roadblocks was food stamps. “We don’t know if the House will go into a third round of this fight over SNAP.” Passage of the 2014 and 2018 farm bills was delayed by unsuccessful attempts by Republicans to cut SNAP funding and to curtail eligibility.

Steven Wallander, senior economist for the Democratic staff of the Senate Ag Committee, said he hopes the Senate Ag Committee is on a timeline similar to the 2018 Farm Bill, when lawmakers rolled out legislation in the fall and passed a bill by the end of the year. “There is strong bipartisan support for getting this done, we’ve seen that with the chairwoman (Stabenow) and ranking member (Boozman) and their experiences working together. We think that strength is something we can leverage towards a finished product,” Wallander added. - Agreement that farmer safety net needs improved, but differences over method. Lawmakers and staff do not even have enough consensus on potential changes to ask for a “score” from the Congressional Budget Office — the process of seeing how much different proposals would cost over ten years. “We are all on the same page about wanting to help farmers, but there are definitely some disagreements about the best way to do that,” Pliscott said of House Agriculture Committee members.

- Reference prices: Outlaw said a 10% increase would cost more than $20 billion over 10 years, while a 20% increase would cost at least $50 billion. While several commodities are going to get “nice increases” in effective references due to escalator provisions in existing farm bill legislation, more than half of the covered commodities would not qualify, he added.

“Title I support does not reflect the reality on the ground today,” said John Newton, chief economist for Republicans on the Senate Ag panel. He said if reference prices are not dealt with now, “producers will be stuck with the same safety net for the next five years. And by the time we get to that next farm bill, some of the information that we used to establish those reference prices will be over 15 years old by that point.”

Wallander said he is looking at how the Title I commodity programs and crop insurance work together. “We are looking closely at program interactions, how programs work together or overlap. The farm safety net — that is where there are some really challenging interactions.”

“I think we’re still working with CBO to get our scores,” said Newton when asked about the budgetary impact of higher reference prices. Wallander said higher reference prices had ripple effects in the farm bill so it was a complex task to estimate costs: “It all interacts.” - $20 billion in conservation funding. Leaders of both Ag committees are interested in moving the $20 billion in climate funding into farm bill jurisdiction because it would build the farm bill baseline and make conservation programs eligible for larger funding in the future. “I will not support taking those dollars and moving it into another title,” said Sen Debbie Stabenow (D-Mich.) last week. Newton said Sen. John Boozman (R-Ark.) believed the money could be used for “meeting the conservation and local resource concerns around the country…. We’re not talking about taking the [money] and using it for reference prices.”

— Rep. Blumenauer proposes crop insurance reforms to save billions and target small farmers. Rep. Earl Blumenauer (D-Ore.) introduced a crop insurance reform bill aimed at reducing costs and better targeting support toward small and mid-sized farmers. The proposed reforms include limiting farmers to a maximum of $125,000 in premium subsidies annually and denying subsidized coverage to farmers with over $250,000 in adjusted gross income. The bill also eliminates premium subsidies for policies with the harvest price option and reduces guaranteed returns to insurance companies and USDA payments to insurers for administrative and operating costs. If implemented, these reforms could save an estimated $2.7 billion annually, significantly reducing the cost of the crop insurance program.

Outlook: The proposal is given very low odds of being part of the coming farm bill debate and/or separate legislation or an amendment to another bill. Says one farm policy analyst: “It didn’t seem possible, but the Blumenauer proposal makes the EWG proposal even worse. The ‘reform’ is a Trojan Horse because it would wipe out all of the pillars that made crop insurance what it is today. Crop insurance would be back in the 1970s barely limping along and ad hoc disaster would once again be the norm.”

|

CHINA UPDATE |

— China's industrial profits surge 17.2% in August, signaling economic stabilization after months of decline. Official data reveals that China's industrial profits experienced a 17.2% year-on-year increase in August, marking the fastest growth rate seen in over a year. This positive shift comes after five consecutive months of year-on-year declines in industrial profits. While these figures indicate a potential stabilization of China's economy, experts caution that a full recovery from its recent economic challenges is likely to be both arduous and protracted.

— China increases minimum wheat purchase price for 2024. China announced an increase in the minimum purchase price for third-grade wheat to 2,360 yuan ($323) per metric ton for the 2024 supply. This marks a slight uptick from the 2023 price of 2,340 yuan per metric ton. The National Development and Reform Commission (NDRC) revealed that a maximum of 37 million metric tons will be procured at this new minimum price.

— U.S. Ambassador's visit to Gwadar port raises geopolitical questions amid China-Pakistan Economic Corridor (CPEC) tensions. Donald Blome, the U.S. ambassador to Pakistan, recently made a visit to the Pakistani port of Gwadar, a key element of China's Belt and Road Initiative and the $50 billion China-Pakistan Economic Corridor (CPEC). This visit marked the first time a U.S. diplomat had visited Gwadar in two years. Gwadar hosts a Chinese-built and operated deep-sea port, playing a central role in CPEC. However, tensions have arisen due to Pakistan's financial challenges, resulting in delayed payments to China under the CPEC agreements. Reportedly, Islamabad is in negotiations with Beijing to reduce the costs associated with a railway project.

Bottom line: Pakistan appears to be seeking leverage in its forthcoming negotiations with China concerning CPEC projects. The visit by Ambassador Blome is seen as part of Pakistan's diplomatic strategy, attempting to maintain a delicate balance between the interests of both the United States and China in the region.

— PBOC adviser: ‘No Japanification’ for Chinese economy. China is expected to achieve economic growth of slightly more than 5% this year, an adviser to the central bank said. While some economists contend China’s economic situation could be worse than Japan’s lost decade of the 1990s, Wang Yiming, a member of the Monetary Policy Committee of the People’s Bank of China (PBOC), said: “There is no Japanification in China, we are still in the medium-to-high growth stage.” PBOC said it would step up policy adjustments and implement monetary policy in a “precise and forceful” manner to support an economy whose recovery was improving with “increasing momentum.”

|

ENERGY & CLIMATE CHANGE |

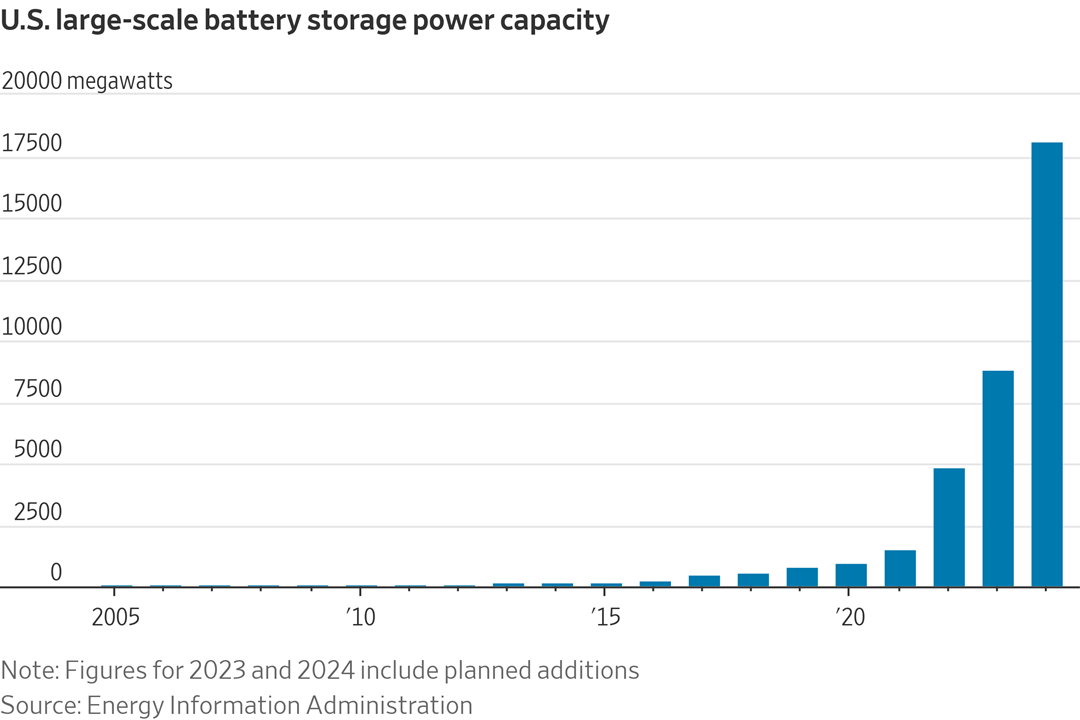

— Giant batteries provided vital support to U.S. power grid during summer heat waves. During the scorching summer months, the U.S. power grid found a crucial lifeline: giant batteries. Battery storage, although a relatively small component of the overall electrical-power mix, played a significant role in supporting the grid during heat waves, the Wall Street Journal reports (link). These batteries stepped in to fill the gap after sunset when solar generation decreased, ensuring a stable power supply as air conditioners continued to run.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

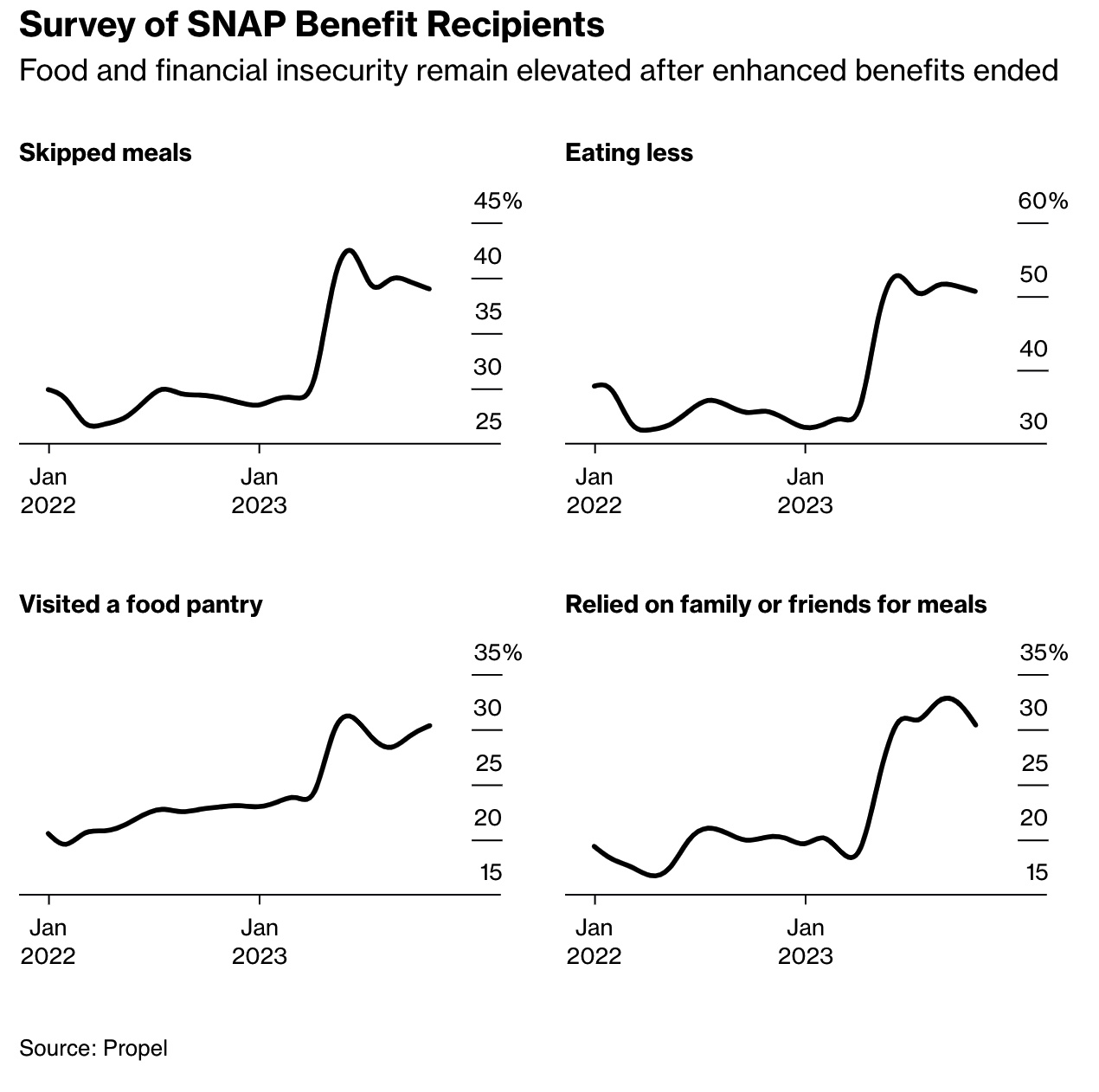

— Food insecurity persists as pandemic-era benefits cease, hitting SNAP recipients and food pantries. A recent report highlights that food insecurity remains a pressing issue even six months after the conclusion of expanded government assistance programs designed to address pandemic-related challenges. The report, released by Propel Inc., which assists in administering benefits, reveals that among households relying on the Supplemental Nutrition Assistance Program (SNAP/food stamps), 50% are experiencing food shortages, over 30% are turning to food pantries for support, and 30% are depending on friends and family for their meals and groceries.

The survey, conducted among 2,584 respondents in early September, primarily consists of individuals from households with incomes at or below the poverty line. Stubbornly high food prices coupled with the expiration of pandemic-era SNAP expansions are cited as contributing factors to the sustained demand for food assistance. This ongoing challenge is also putting significant strain on food pantries across the nation.

|

POLITICS & ELECTIONS |

— Supreme Court rejected Alabama’s proposed congressional map that would only include one majority-Black district. The U.S. Supreme Court has declined to block the enforcement of an Alabama voting rights decision issued earlier this year. In June, the court ruled that Alabama's Republican-drawn congressional map violated the Voting Rights Act by creating only one congressional district where Black voters were a majority or close to it. The lower court then ordered the creation of a second majority Black district, but when the GOP-led legislature failed to comply and instead increased the number of Black voters in one district, the lower court appointed a special master to draw a new map with two majority Black districts. Alabama appealed to the Supreme Court to postpone the new map's creation, but the justices refused, reinforcing the importance of the Voting Rights Act in preventing the dilution of Black voting power.

Bottom line: David Wasserman of the Cook Political Report with Amy Walter, says this “ensures that one of the three maps proposed by a court-appointed special master (all of which feature a second Black majority seat) will be adopted for 2024, netting Dems a seat.”

Of note: In several Southern states, such as Georgia, Louisiana, and Florida, legal battles are ongoing in the courts regarding their congressional district maps. Federal judges have determined that these maps also violated the law by disenfranchising Black voters. However, these court cases have been protracted, and there's a possibility that the upcoming congressional elections scheduled for next year may be conducted in these states using maps that a court has declared as illegally disenfranchising voters of color.

|

CONGRESS |

— EPA administrator faces congressional inquiry into agency's science and technology utilization and integrity. In a House Science, Space, and Technology Committee hearing today, EPA Administrator Michael Regan will be under scrutiny for the agency's approach to utilizing science and technology in decision-making processes. The inquiry will also delve into the EPA's commitment to scientific integrity and its measures to ensure access to the highest quality scientific information, as detailed in the panel's hearing charter.

|

OTHER ITEMS OF NOTE |

— Travis King: North Korea expels U.S. soldier who crossed demilitarized zone. North Korea has announced its decision to expel U.S. Army Private Travis King, who had crossed into North Korea from South Korea in July while touring the joint security area. According to state media KCNA, the decision to expel King was made by "the relevant organ of the DPRK" under the country's laws, and the investigation into his actions has concluded. North Korea claims that King confessed to illegally entering its territory due to dissatisfaction with alleged inhuman maltreatment and racial discrimination within the U.S. army, as well as disillusionment with what he perceived as an unequal U.S. society, a statement that is not yet confirmed by others outside North Korea, including King himself. The report does not provide details on when, where, or how King will be expelled from North Korea.

— Calendar of events today include:

Wednesday, Sept. 27

• Foreign ownership of U.S. farmland. Senate Ag Committee hearing on “Foreign Ownership in U.S. Agriculture.”

• Farm bill reform opportunities. Cato Institute briefing on “Farm Bill 2023: Opportunities for Reform.”

• Sustainable farming practices. PunchBowl News holds a discussion on “modern agriculture, focusing on sustainable farming practices and innovation.”

• GOP presidential debate. The Republican National Committee hosts the second presidential primary debate.

• Dow Jones holds 15th annual OPIS RFS, RINs, and Biofuels Forum, through Sept. 29, Chicago.

• Science technology at EPA. House Science, Space and Technology Committee hearing on “Science and Technology at the EPA.”

• USMCA Environment Committee. U.S. Trade Representative holds its virtual Third United States-Mexico-Canada Agreement Environment Committee meeting to review implementation of chapter 24 (environment) and discuss how the parties are meeting their chapter 24 obligations; receive a presentation from the Commission on Environmental Cooperation Secretariat on cooperation, and virtual public session on USMCA Chapter 24 implementation. Virtual public session will take place at 3 p.m. CT.

• Small businesses. Washington Post Live virtual discussion on “small business resilience.”

• EPA brownfields. House Energy and Commerce Environment, Manufacturing, and Critical Materials Subcommittee hearing on “Revitalizing American Communities: Ensuring the Reauthorization of EPA's Brownfields Program.”

• Broadband access. Axios holds a discussion on “Building Connections Across the Divide,” focusing on access to broadband.

• Antimicrobials. Center for Global Development virtual discussion on “Six Recommendations to Improve the Antimicrobial Market for Human Health.”

• Pandemic funds misuse. House Small Business Committee hearing on “Action Through Innovation: Private Sector Solutions to Recouping Stolen Pandemic Loan Funds.”

• Federal real estate. Senate Environment and Public Works Committee hearing on “Oversight of the General Services Administration: Examining the Federal Real Estate Portfolio.”

• U.S. Copyright Office oversight. House Judiciary Courts, Intellectual Property, and the Internet Subcommittee hearing on “Oversight of the U.S. Copyright Office.”

• SEC oversight. House Financial Services Committee hearing on “Oversight of the Securities and Exchange Commission.”

• Gas furnace and boiler regs. Consumer Product Safety Commission briefing for a notice of proposed rulemaking on a safety standard for residential gas furnaces and boilers.

• OSHA. House Education and the Workforce Protections Subcommittee hearing on “Examining the Policies and Priorities of the Occupational Safety and Health Administration.”

• GAO modernization. House Administration Modernization Subcommittee hearing on “Legislative Branch Advancement: GAO Modernization.”

• Flood insurance. Senate Banking, Housing and Urban Affairs Securities, Insurance, and Investment Subcommittee hearing on “The State of Flood Insurance in America.”

• U.S./Saudi relationship. Cato Institute briefing on “Pariah or Partner? Re-evaluating the U.S./Saudi Relationship.”

• U.S./South Africa relations. House Foreign Affairs Africa Subcommittee hearing on “The Current U.S./South Africa Bilateral Relationship.”

• The U.N. and Ukraine. Commission on Security and Cooperation in Europe hearing on “Has the United Nations Failed Ukraine and the World?”

• China influence in the U.S. Senate Select Intelligence Committee hearing on “Countering China's Malign Influence Operations in the United States.”

• AI and elections. Senate Rules and Administration Committee hearing on “AI and the Future of our Elections.”

• Economic reports. Durable Goods Orders

• Energy reports. EIA Petroleum Status Report | Weekly Ethanol Production | Genscape weekly crude inventory report | Aurora Hydrogen Conference, London | Holiday: Bahrain, Algeria, Chad, Nigeria, Guyana.

• USDA reports. ERS: Livestock and Meat Domestic Data NASS: Turkeys Raised | Peanut Stocks and Processing | Potatoes | Broiler Hatchery

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |