Strong Soybean, Corn Sales to Open 2023-24

Oil prices & inflation | China’s ag import strategy | STB proposes rule | Crop insurance

|

Today’s Digital Newspaper |

MARKET FOCUS

- Federal Reserve reduces bond holdings by $1 trillion, tests market resilience

- Farm debt increases amid strong loan performance and margin challenges

- Market perspectives on the U.S. dollar, interest rates, and energy prices

- Strikes at Chevron's Australian facilities impact European natural gas prices

- General Motors offers substantial wage increases in new UAW contract proposal

- USDA announces daily export sale to China

- USDA reports strong soybean and corn sales for 2023-24

- U.S. beef exports slump, pork shipments remain strong

- Thailand's severe drought affects sugar production, causing global concerns

- Hurricane Lee strengthens to Category 5 as it poses potential threat to the Atlantic

- NWS weather outlook

RUSSIA & UKRAINE

- Political challenges threaten next tranche of U.S. aid to Ukraine

- Romania enhances port infrastructure to boost Ukrainian grain shipments

- Elon Musk's unveiled role in Ukraine-Russia conflict: Starlink's covert deactivation

POLICY

- Sens. Stabenow and Boozman discuss farm bill funding amid shutdown concerns

- Senate Ag Republicans urge 'meaningful enhancement' of crop subsidies/insurance

- USDA finalizes rule for MLP to compensate dairy producers affected by disasters

PERSONNEL

- Adriana Kugler first Hispanic Member of Federal Reserve Board of Governors

- White House withdraws energy nominee amid gas stove regulation dispute w/Manchin

CHINA

- India studies responses to potential Chinese invasion of Taiwan amid U.S. inquiries

- U.S. initiates investigation into advanced semiconductor chip manufactured in China

- What a grain industry veteran says about China’s strategy

ENERGY & CLIMATE CHANGE

- Corn grower leaders urge adoption of GREET model for emissions assessment

- DOE commits up to $150 million to strengthen U.S. critical mineral supply chains

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

- Kroger, Albertsons plan to sell more than 400 stores

- Induced losses in HPAI outbreak 2023 highlight gaps in federal indemnity scheme

- Global food prices decline in August, despite soaring rice prices

- Re-evaluating food expiration dates: Misunderstood practice leading to food waste

HEALTH UPDATE

- Biden admin. halts funding for DEEP VZN project amid controversy over virus hunt

POLITICS & ELECTIONS

- Republican candidates seek to qualify for second debate

- VP Harris dismisses concerns about Biden's age; prepared to assume presidency if necessary

- Nikki Haley leads Biden in hypothetical matchup: poll

- Canada reopens probe into possible foreign interference in recent elections

- CNN poll: declining confidence among Democratic voters in Biden for 2024 election

OTHER ITEMS OF NOTE

- GOP state officials push SCOTUS to limit Congress' tax power re: unrealized gains

- Cotton AWP rises for latest week

- Walmart reduces starting pay for shelf stockers and online order packers, maintains current employee pay

- Justice Kavanaugh: Supreme Court working on addressing ethics issues amid scrutiny

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly weaker overnight. U.S. stock Dow opened slightly lower and then went slightly higher. In Hong Kong, the stock exchange halted trading in both securities and derivatives markets due to a black rainstorm warning and the heaviest rainfall since 1884. In Asia, Japan -1.2%. Hong Kong closed. China -0.2%. India +0.5%. In Europe, at midday, London -0.1%. Paris flat. Frankfurt -0.3%.

U.S. equities yesterday: The Dow ended up 57.54 points, 0.17%, at 34,500.73. The Nasdaq declined 123.64 points, 0.89%, at 13,748.83. The S&P 500 lost 14.34 points, 0.32%, at 4,451.14. Apple has lost around $200 billion in market value over the past two days since reports surfaced that the Chinese government was going to widen its ban on using iPhones. The Chinese government has not verified the Wall Street Journal and Bloomberg reports, but investors are concerned that Apple’s products could be part of the growing tensions between China and the United States. Greater China, including Hong Kong and Taiwan, is Apple’s third-largest market. It accounts for 18% of total revenue and is where most Apple products are assembled.

Going into Friday’s session, the Dow and S&P 500 were down nearly 1% and 1.4%, respectively, for the week. The Nasdaq Composite has lost 2% in that time.

Agriculture markets yesterday:

- Corn: December corn rose 1/2 cent to $4.86 1/2, ending the session above the 10-day moving average for the first time since Aug. 28.

- Soy complex: November soybeans fell 16 3/4 cents to $13.59 1/2 and nearer the session low. December soybean meal dropped $3.90 to $395.30 and nearer the session low. December bean oil closed down 160 points at 60.78 cents, near the session low and hit a two-week low.

- Wheat: December SRW futures fell 9 1/4 cents to $5.99 3/4 and settled near the session low. December HRW futures fell 12 1/2 before settling at $7.76. December spring wheat futures fell 7 3/4 cents to $7.74 3/4.

- Cotton: December cotton fell 162 points to 85.38 cents, ending nearer the session low. Prices hit a two-week low.

- Cattle: October live cattle led fed cattle futures higher, rising 95 cents to $183.65, but posted a midrange close. October feeder futures jumped $2.40 to $258.875, with September feeders posting a fresh all-time high for a nearby contract at $255.95.

- Hogs: October lean hogs rallied 95 cents on the session to $82.825, though it posted a midrange settlement.

Ag markets today: Corn, soybean and wheat futures held in tight trading ranges during a quiet overnight session. As of 7:30 a.m. ET, corn futures were trading mostly 2 cents higher, soybeans were fractionally to a penny higher and wheat futures were steady to 3 cents lower. Front-month crude oil futures were around 60 cents higher, and the U.S. dollar index was trading just below unchanged.

Market quotes of note:

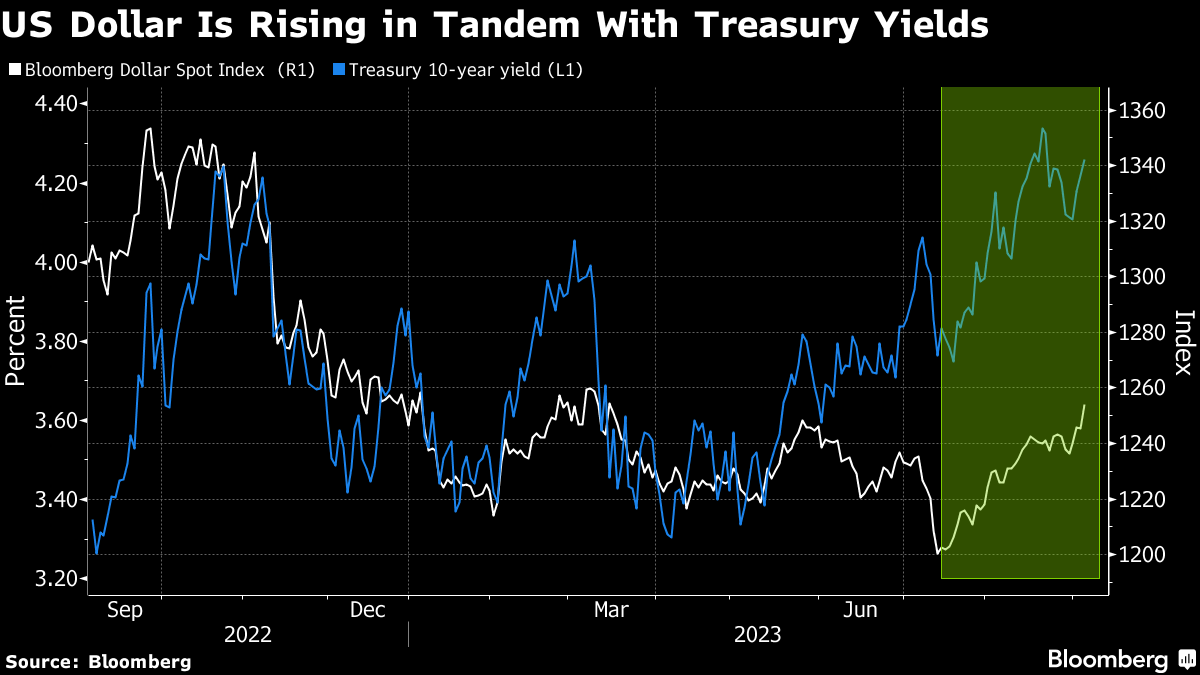

- “It does look too risky to short the dollar,” said George Boubouras, head of research at hedge fund K2 Asset Management, according to Bloomberg. “The higher-for-longer Fed funds rate theme will dominate and markets will start pricing in rate cuts in 2024 a number of times, we believe, unsuccessfully.”

- Fed watch: Fed Bank of New York President John Williams said US monetary policy is “in a good place,” but officials will need to parse through data to decide on how to proceed on interest rates. Meanwhile, Fed Bank of Dallas President Lorie Logan said that skipping an interest-rate hike at the U.S. central bank’s upcoming policy meeting may be appropriate, while also signaling rates may have to rise further to get inflation back to 2%. The typically more dovish Chicago Fed boss Austan Goolsbee said: "We are very rapidly approaching the time when our argument is not going to be about how high should the rates go; it's going to be an argument about how long do we need to keep the rates at this position." Speaking today: Federal Reserve Vice Chair for Supervision Michael Barr and San Francisco Fed President Mary Daly.

- Germany: “There’s a triple-whammy: higher energy prices, a global environment that’s not conducive to goods trade and the China shock." — Sander Tordoir, a senior economist at the Centre for European Reform in Berlin, on headwinds facing Germany's economy. The country was once Europe’s main engine of growth.

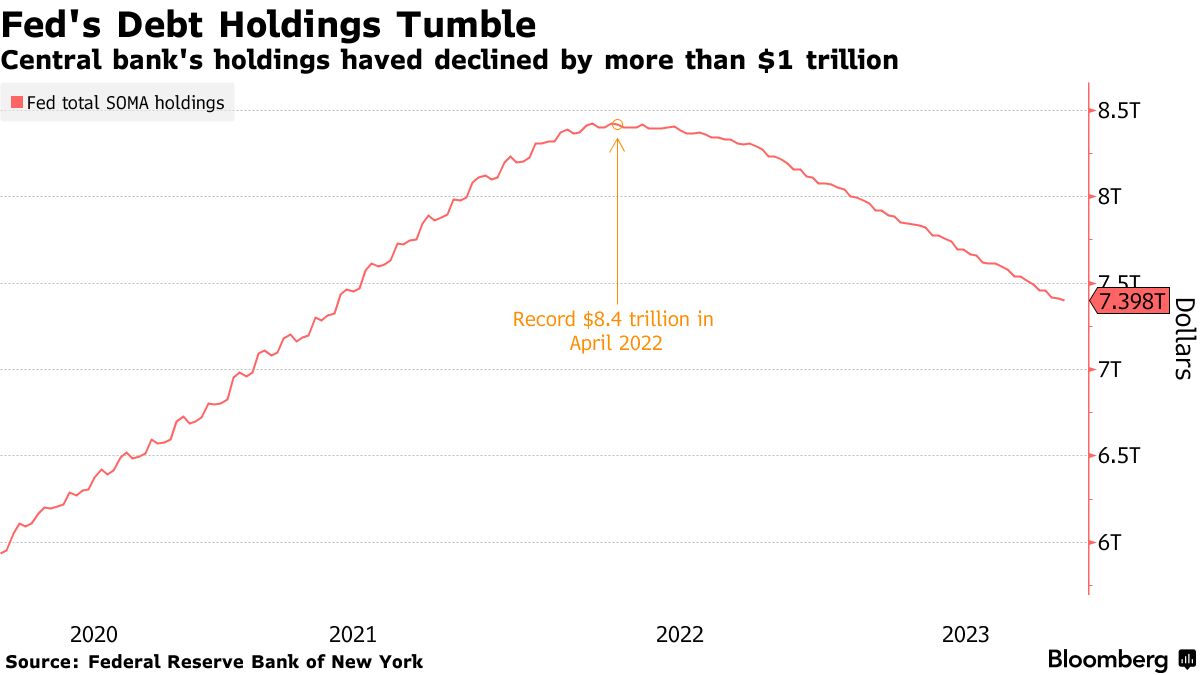

Federal Reserve quietly reduces bond holdings by $1 trillion, tests market resilience. The Federal Reserve has successfully reduced its bond holdings by approximately $1 trillion since initiating its balance sheet reduction program last year. This reduction has occurred without causing significant financial market disruptions, contrasting with previous experiences of quantitative tightening, Bloomberg reports (link). The central bank's System Open Market Account, which represents its asset portfolio, has diminished from a record high of $8.4 trillion in April the previous year to about $7.4 trillion. As part of its substantial monetary tightening measures, the Fed is allowing up to $60 billion in Treasury securities and $35 billion in mortgage-backed debt to mature each month without replacement.

Analysts note that quantitative tightening (QT) has not had a significant impact on the marketplace, unlike the turmoil experienced during the Fed's first attempt with QT in 2019. During that time, the program drained bank reserves, causing unexpected challenges. Reserves have remained relatively stable this time, with QT primarily affecting the Fed's reverse repurchase program (RRP), which money-market funds use to park cash. The RRP account has reduced to about $1.6 trillion from a peak of approximately $2.6 trillion in December.

Bottom line: As the Fed’s QT continues, a big test will be how markets absorb the Treasury’s expanding funding requirement, propelled by a widening fiscal deficit.

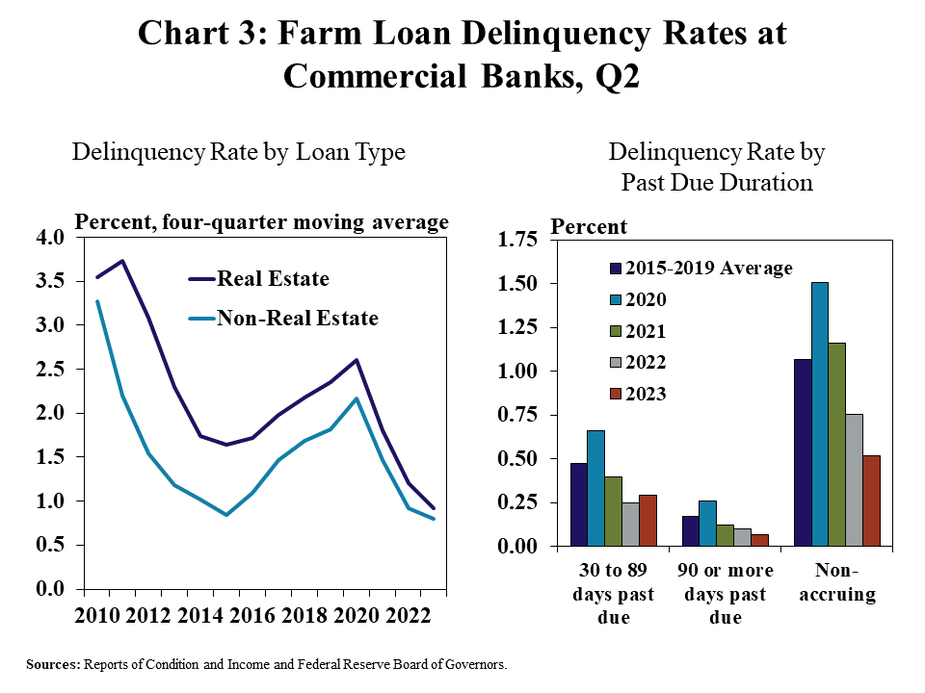

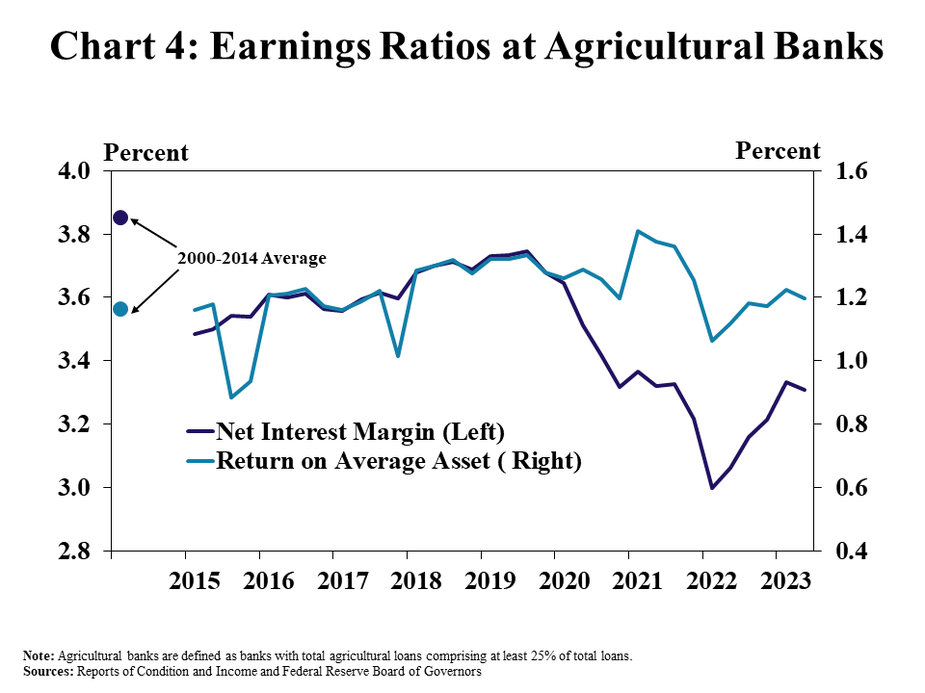

Farm debt increases amid strong loan performance and margin challenges. Farm debt continued to rise, particularly non-real estate loans, with outstanding agricultural loan balances at commercial banks increasing by about 5%, according to an ag finance update from the Kansas City Fed (link). While farm debt increased, loan performance remained strong, with delinquency rates edging lower for the third consecutive year. Agricultural banks reported higher net interest margins and returns on assets compared to the previous year but faced some softening in the last quarter due to rising funding costs.

The outlook for agricultural credit conditions remained robust, despite a recent moderation in the farm economy, the report says. While there may be some challenges, such as a slight pullback in key farm product prices and elevated expenses, farm finances remained strong overall. Rising production costs and the use of cash reserves to reduce loan levels in recent years could increase credit needs for some producers, the authors noted. Although more lenders anticipate a softening in farm income and repayment rates soon, agricultural credit conditions are expected to remain strong through 2023.

In the second quarter, faster growth in non-real estate lending contributed to steady increases in farm debt. Outstanding farm production and real estate loans at all commercial banks increased by 7% and 5% from a year ago, respectively, with agricultural banks experiencing even stronger growth. Farm debt increased from a year ago at slightly more than half of all banks, marking the largest share since 2016.

Despite the growth in farm loan balances, loan performance continued to improve. Delinquency rates reached their lowest level since 2010 for both real estate and non-real estate loans. Strong growth in loan interest over the past year helped offset higher deposit expenses and support net interest margins. However, interest margins flattened slightly in the last quarter due to a considerable rise in funding costs.

Bottom line: While there are margin challenges and potential softening in the farm economy, the agricultural credit outlook remains positive for the foreseeable future.

Market perspectives:

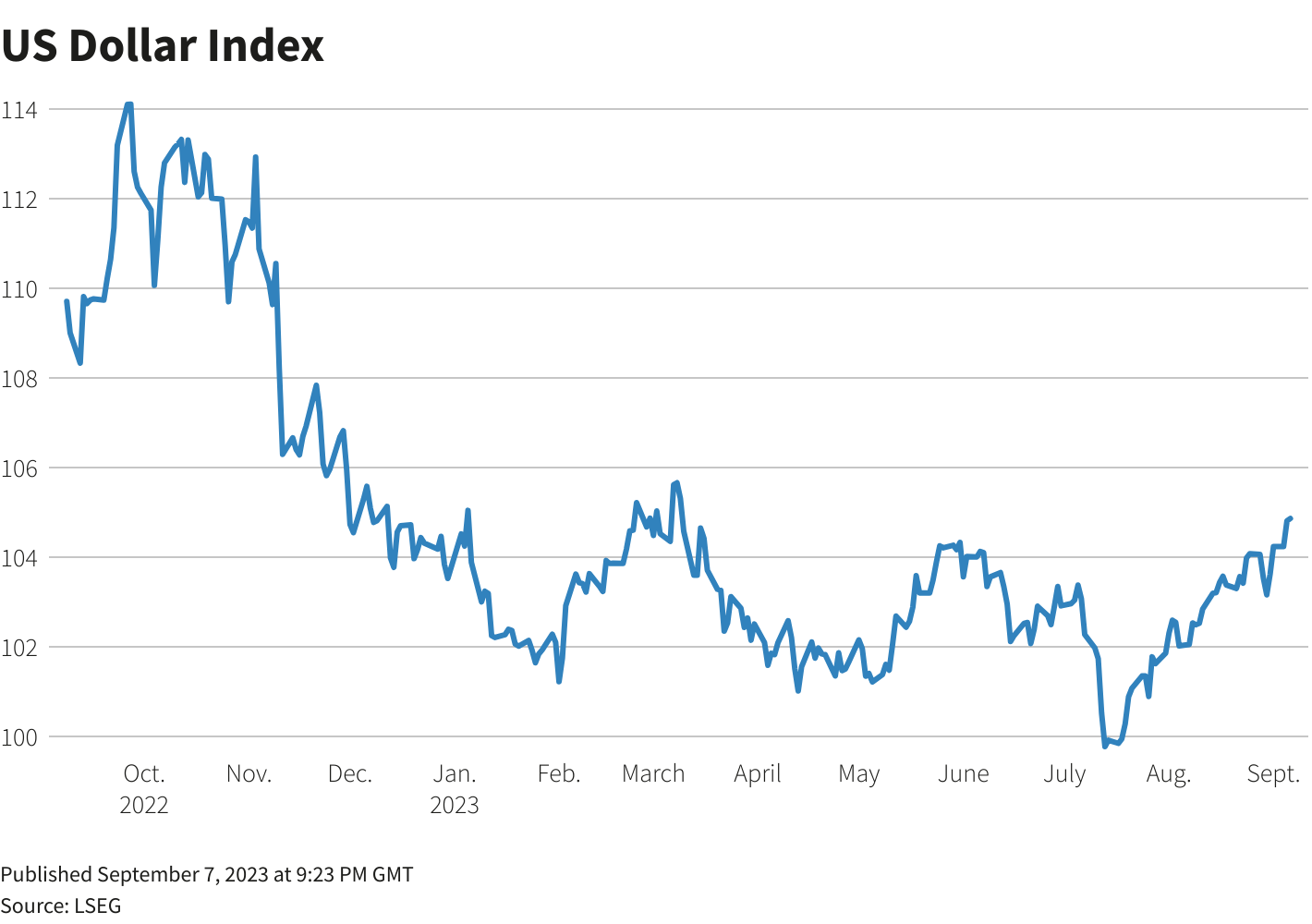

— Outside markets: The U.S. dollar index was slightly lower, with the euro, yen and British pound stronger against the greenback. The yield on the 10-year U.S. Treasury note rose, trading around 4.26%, with a mixed tone in global government bond yields. Crude oil futures were higher, with U.S. crude at around $87.45 per barrel and Brent at around $90.60 per barrel. Gold futures and silver futures were up, with gold around $1,947 per troy ounce and silver around $23.28 per troy ounce.

— "We are changing our view on the broad USD; we now see it strengthening through end-2024," HSBC strategists including Paul Mackel wrote in a note on Thursday. They reckon as the Fed's tightening stance transmits into the economy, a faltering global growth outlook will be dollar supportive.

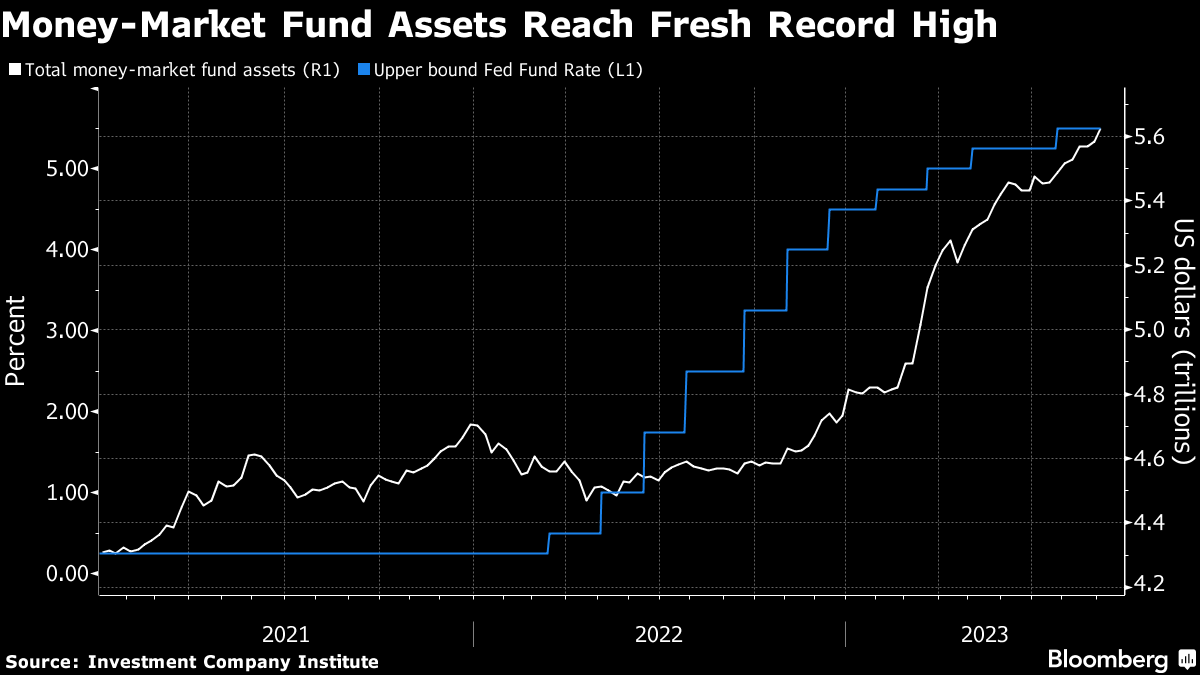

— Money-market fund assets climbed to a fresh all-time high for the second straight week as interest rates north of 5% continue to attract investors. The odds are rising for another quarter-percentage point this year, with U.S. overnight indexed swaps looking at around a 40% chance by November.

— Partial strikes at Chevron's Australian facilities trigger surge in European natural gas prices. European natural gas prices experienced a significant increase following partial strikes initiated by workers at two crucial Chevron Corp. facilities in Australia. Benchmark Dutch futures surged by up to 11%, reaching €36.20 per megawatt-hour. These strikes impact the Gorgon and Wheatstone liquefied natural gas (LNG) facilities, which collectively supplied approximately 7% of the global LNG supply in the previous year. Despite the global market appearing well-supplied now and Europe's gas stockpiles being nearly full ahead of schedule due to tepid demand, traders are not anticipating a substantial immediate impact from this dispute. However, the potential for prolonged disruptions is keeping pressure on a volatile market that has not fully recovered from last year's energy crisis. The strikes were organized by unions at Chevron's Wheatstone Platform, Wheatstone Downstream, and Gorgon facilities, as reported by Offshore Alliance in a statement.

— General Motors offers substantial wage increases in new UAW contract proposal amid tensions. General Motors presented a new contract proposal to United Auto Workers (UAW)-represented employees, suggesting significant wage increases. Under this proposal, the majority of workers could receive a 10% wage hike, while newer employees could be eligible for an impressive 56% wage increase over the four-year contract period. This proposal represents one of the most substantial four-year wage increases in decades. However, UAW President Shawn Fain has characterized the offer as "insulting." This development follows the UAW's recent filing of unfair labor practice charges against GM and Stellantis, alleging that the companies did not engage in good faith bargaining in a timely manner. These negotiations are taking place as Detroit automakers aim to prevent a potential costly strike before the expiration of union workers' contracts on Sept. 14.

GM's wage offer is slightly better than Ford's — which was rejected by the union — but it relied on lump sum payments, instead of the annual pay hikes being demanded. The union is expected to make another offer in response to Ford's proposal, while Stellantis will make a counterproposal by the end of the week.

— USDA daily export sale: 121,000 metric tons soybeans to China during the 2023-2024 marketing year.

— Strong soybean, corn sales to open 2023-24. Overall U.S. export sales of corn and soybeans were solid for 2023-24, according to Export Sales data for the week ended Aug. 31. USDA reported net sales of 949,700 metric tons of corn and 1,783,100 metric tons of soybeans for the week. Sales for 2022-23 were net reductions of 15,200 metric tons of corn and net sales of 155,600 metric tons of soybeans. Sales of 370,300 metric tons of wheat were also reported.

As for sales to China, activity for 2022-23 included net sales of 70,795 metric tons of sorghum and 141,808 metric tons of soybeans. For 2023-24, activity for China included net reductions of 4 metric tons of wheat, net sales of 76,000 metric tons of corn, 59,395 metric tons of sorghum, 735, 167 metric tons of soybeans, and 16,150 running bales of upland cotton. For 2023, net sales of 1,602 metric tons of beef and 739 metric tons of pork were reported.

— U.S. beef exports slump, pork shipments slow but remain strong. The U.S. exported 240.1 million lbs. of beef during July, the smallest monthly total since September 2020. Beef shipments declined 29.8 million lbs. (11.1%) from June and were 67.1 million lbs. (21.9%) less than July 2022. Through the first seven months of 2023, the U.S. exported 1.824 billion lbs. of beef, down 270.0 million lbs. (12.9%) from the same period last year, as shipments to the top three destinations — South Korea, Japan and China — all declined notably.

July pork exports totaled 504.7 million pounds. While that was down 79.2 million lbs. (13.6%) from June, shipments topped year-ago by 20.4 million lbs. (4.2%). Through July, the U.S. shipped 3.955 billion lbs. of pork, up 321.8 million lbs. (8.9%) from the same period last year. Of the top five destinations for U.S. pork, only Japan imported less pork than year-ago during the first seven months of 2023.

— Thailand’s severe drought sparks global concerns as sugar production plummets by 18%. Thailand, the world's second-largest sugar exporter, faces a significant setback in sugar production, with an anticipated 18% drop due to a severe drought, Bloomberg reports (link). Rangsit Hiangrat, director of Thai Sugar Millers Corp, warns of worsening extreme heat and dry conditions in the coming years. Farmers may consider shifting to cassava cultivation in hopes of better tolerating the scorching conditions. This drought threatens all crops, including sugar cane, cassava, and rice. With Thailand's crucial role in global sugar markets, this production decline intensifies pressure on already soaring sugar prices, recently reaching an 11-year high following Alvean's forecast of another year of shortages. Simultaneously, extreme heat in India contributes to the global sugar crunch, underscoring the disruptive impact of climate change on food markets.

Rangsit predicts a drop in Thailand's sugar exports from 8 million tons this year to 6 million tons next year. While overseas sales in the first seven months of 2023 have increased by 2.4% compared to the previous year, the overall outlook remains uncertain.

The drought-induced water shortages in key production regions are expected to lead to a substantial reduction in sugar cane production, plummeting from 93.9 million tons this season to 82 million tons in 2023-24.

Of note: Brazilian production may also drop briefly with heavy rains hitting major producing areas.

— Ag trade: South Korea rejected all offers on a tender to buy 45,000 MT of Canadian milling wheat.

— Hurricane Lee strengthens to Category 5 as it poses potential threat to the Atlantic. Hurricane Lee has intensified into a formidable Category 5 storm, boasting maximum sustained wind speeds of 160 mph while located over the Atlantic Ocean. Although the storm is currently situated well east of the Caribbean, it has the potential to evolve into a dangerous hurricane over the southwestern Atlantic early next week, as indicated by the National Hurricane Center. Computer models have suggested that Hurricane Lee may veer northward early next week, but the extent of its proximity to the U.S. remains uncertain. Meteorologists anticipate that a clearer picture of any potential impact on the East Coast will emerge as Hurricane Lee continues its westward trajectory in the coming days.

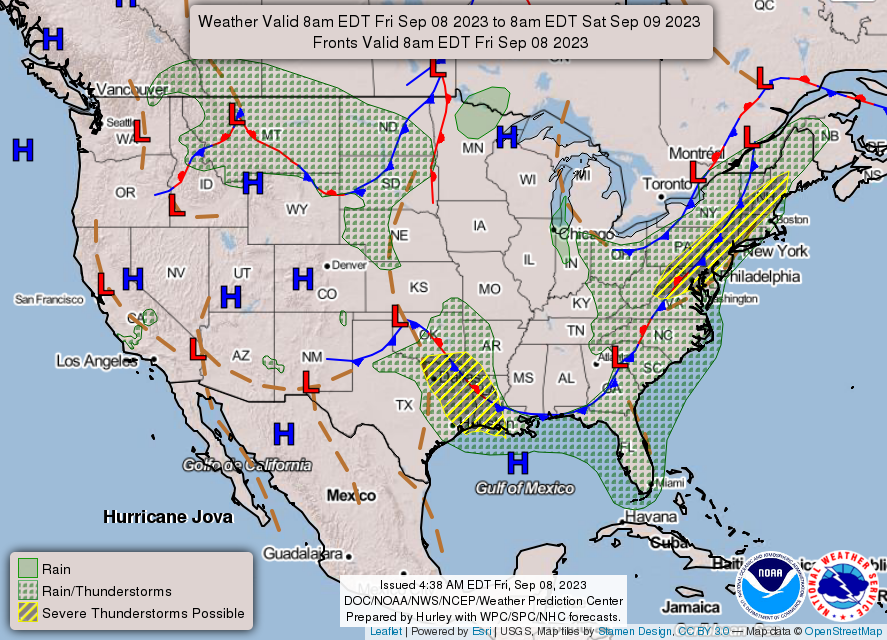

— NWS weather outlook: Severe storms possible today across portions of the Northeast, MidAtlantic, and from the Red River to the upper Texas and Louisiana coasts......Dangerous heat continues across parts of the Northeast, south-central U.S., and the Southwest...... Increasing chance for heavy rain across portions of the Southeast on Saturday.

Items in Pro Farmer's First Thing Today include:

• Quiet grain trade overnight

• Argentine crop production expected to rebound sharply amid El Niño

• Cash cattle prices firm

• Cash hog index firms

|

RUSSIA/UKRAINE |

— Political challenges threaten next tranche of U.S. aid to Ukraine. House Speaker Kevin McCarthy (R-Calif.) is considering attaching controversial immigration and asylum policies to President Joe Biden's request for $24 billion in emergency funds to aid Ukraine. This move could lead to a protracted standoff over border policies, potentially endangering crucial aid to Ukraine, as the country attempts to counter Russia's seizure of southern territories. The supplemental request includes around $4 billion for the border, but House Republicans are looking to increase that and secure some policy changes.

McCarthy's plan aims to separate Ukraine aid from a must-pass bill needed to fund the gov’t past Oct. 1, which could make it easier to pass a short-term spending bill and avoid a gov’t shutdown. However, several ultra-conservative House members oppose new relief for Ukraine, and any bill containing asylum policy changes would face opposition in the Senate, where support for aiding Ukraine is stronger. The Senate is expected to add Ukraine aid to the CR bill coming from the House, thus setting up a potential gov’t-shutdown scenario.

The specific border provisions that would be attached to Ukraine relief remain unclear. House Freedom Caucus member Chip Roy (R-Texas) insists that more funds for the border must come with asylum policy changes to hold the Biden administration accountable. This move by McCarthy puts him at odds with Senate Republicans, who are largely supportive of aiding Ukraine. Sen. Thom Tillis (R-N.C.) expressed concerns about McCarthy's plan potentially delaying Ukraine aid, which could be a strategic opportunity for Russian President Vladimir Putin. Senate Minority Leader Mitch McConnell (R-Ky.) said he will use his floor remarks in the coming days to push back on their “dubious” arguments. McConnell has voiced support for the White House’s supplemental funding request, which includes $24 billion for Ukraine.

The White House reacted negatively to McCarthy’s plan. White House spokesperson Andrew Bates: “Like Senate Republicans, Speaker McCarthy should keep his word about government funding. And he should do so in a way that acts on these pressing issues — including fentanyl, national security and disaster response — rather than break his promise and cave to the most extreme members of his conference agitating for a baseless impeachment stunt and shutdown.”

— Elon Musk's unveiled role in Ukraine-Russia conflict: Starlink's covert deactivation. Details regarding Elon Musk's involvement in the Ukraine-Russia conflict are unveiled in Walter Isaacson's upcoming biography of the entrepreneur, scheduled for release on Sept. 12. The biography reveals Musk's discreet actions to deactivate his Starlink satellite network off the coast of Crimea, effectively thwarting a hidden Ukrainian assault on the Russian navy. The book sheds light on Musk's concerns about a potential "mini-Pearl Harbor" scenario, highlighting his unintended yet influential role as a power broker, a role that did not go unnoticed by U.S. officials.

— Romania enhances port infrastructure to boost Ukrainian Shipments, targeting grain transit increase. Romania has approved a plan to upgrade road infrastructure surrounding the Black Sea port of Constanta, as part of broader investments aimed at facilitating increased shipments of Ukrainian grain. The country's transport ministry intends to utilize European Union funds for this project, which will involve repairing and reinforcing existing infrastructure, constructing new roads, access ramps, and roundabouts. Additionally, a digitized traffic management system will be implemented. Romanian authorities have expressed their goal to double the monthly transit capacity for Ukrainian grain shipments to Constanta, aiming for a capacity of 4 million metric tons soon. To achieve this, Romania has undertaken various measures, including upgrading numerous railway lines connecting the country to Ukraine. Furthermore, efforts are underway along the Danube River to accommodate more barges, which involves hiring additional pilots and enabling nighttime navigation. These infrastructure improvements signify Romania's commitment to facilitating trade and strengthening its role as a vital transit route for Ukrainian grain exports.

|

POLICY UPDATE |

— Senators Stabenow and Boozman discuss farm bill funding amid shutdown concerns. Senate Ag Committee Chairwoman Debbie Stabenow (D-Mich.) highlighted the potential $11 billion cost of a gov’t shutdown and its impact on farm bill funding. And she expressed the need to secure funding by attaching expiring farm bill programs to a continuing resolution (CR) for government funding beyond Sept. 30. Stabenow cited the Congressional Budget Office's estimate that a previous gov’t shutdown cost the economy $11 billion. She stressed the importance of using these funds for investments in farmers and rural America. Politico reported that "a couple" of programs set to expire with the 2018 Farm Bill would be included in the CR for government funding, as confirmed by Stabenow. Meanwhile, Sen. Boozman (R-Ark.), ranking member on the Senate Ag Committee, mentioned that they are financially secure until January but emphasized the importance of addressing "orphan programs" before the farm bill's expiration this month.

As for the timing of a new farm bill, lawmakers are finally going official with what veteran farm bill watchers knew before: it’s going to be later rather than sooner. While some senators had hoped they could finalize farm bill text in October, Stabenow signaled in a brief interview Thursday with Politico that the text will likely take longer to secure. Asked about November as a possibility, Stabenow told Politico: “Yeah it’s going to be a while… There’s some big questions yet to get answered,” she added of the farm bill talks.

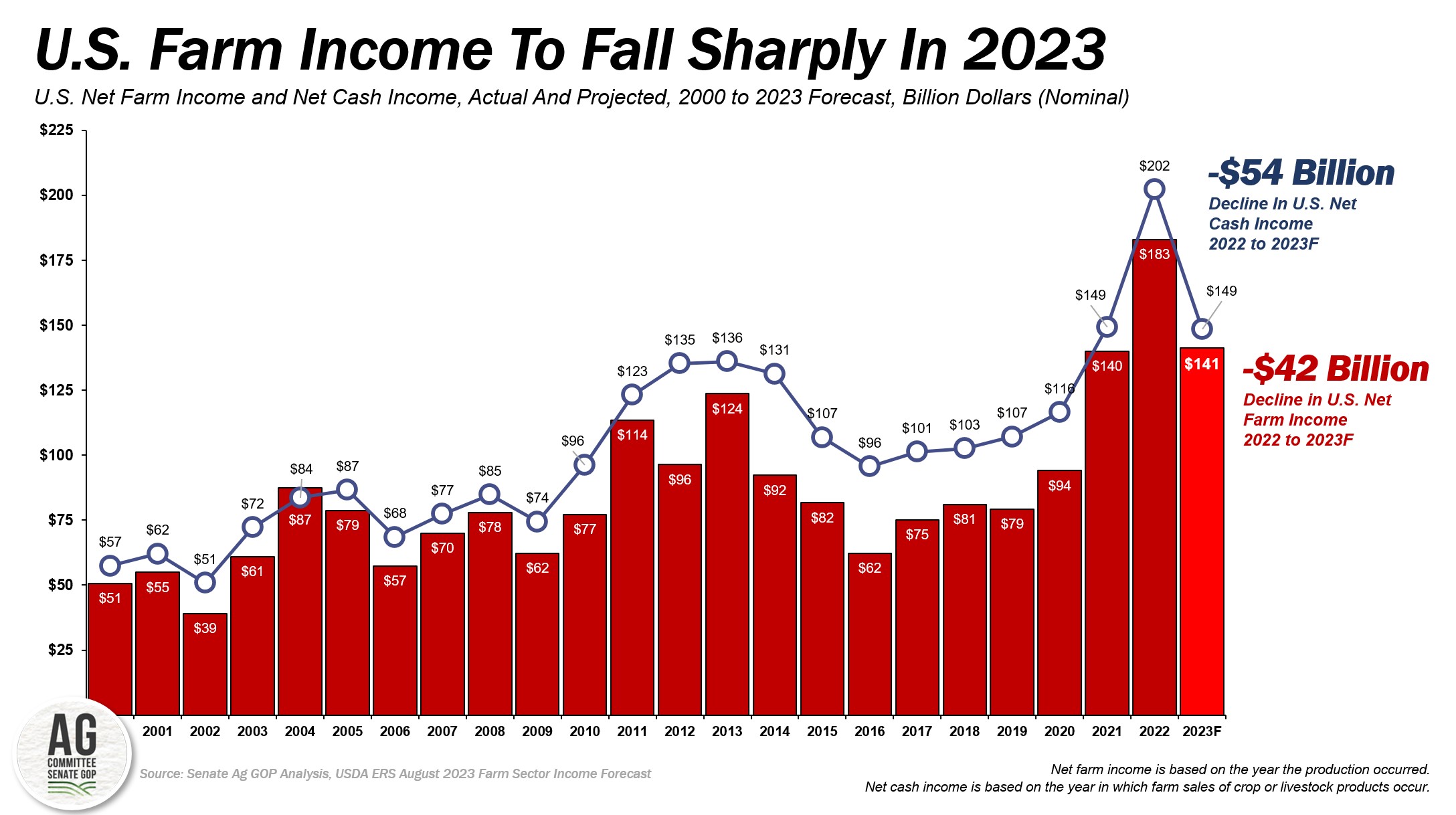

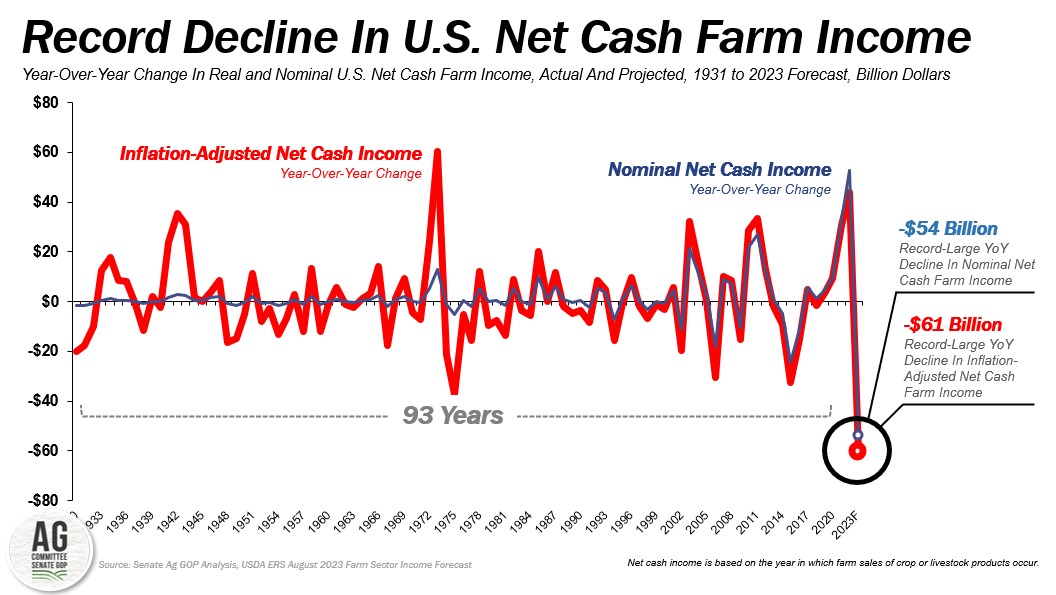

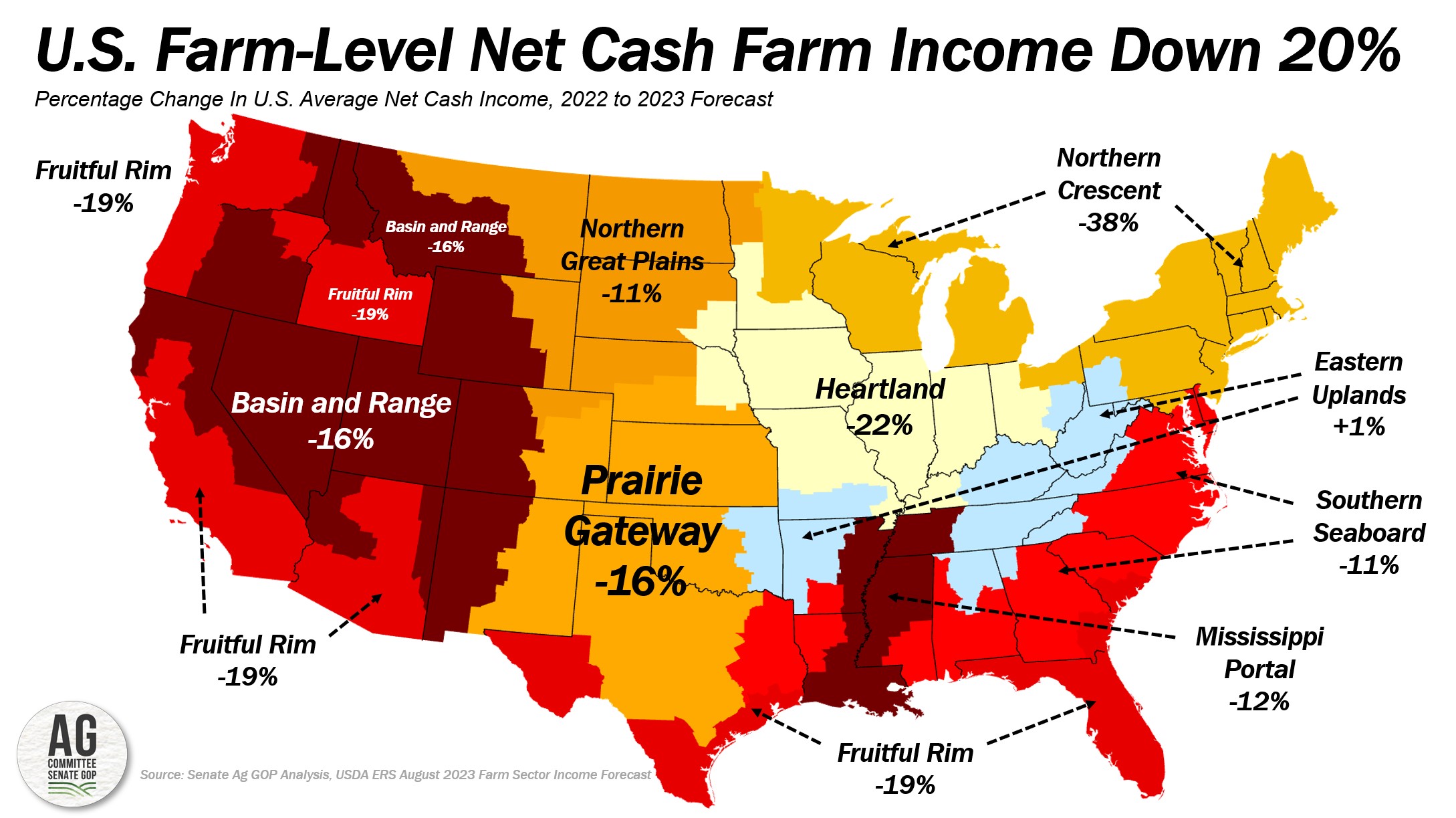

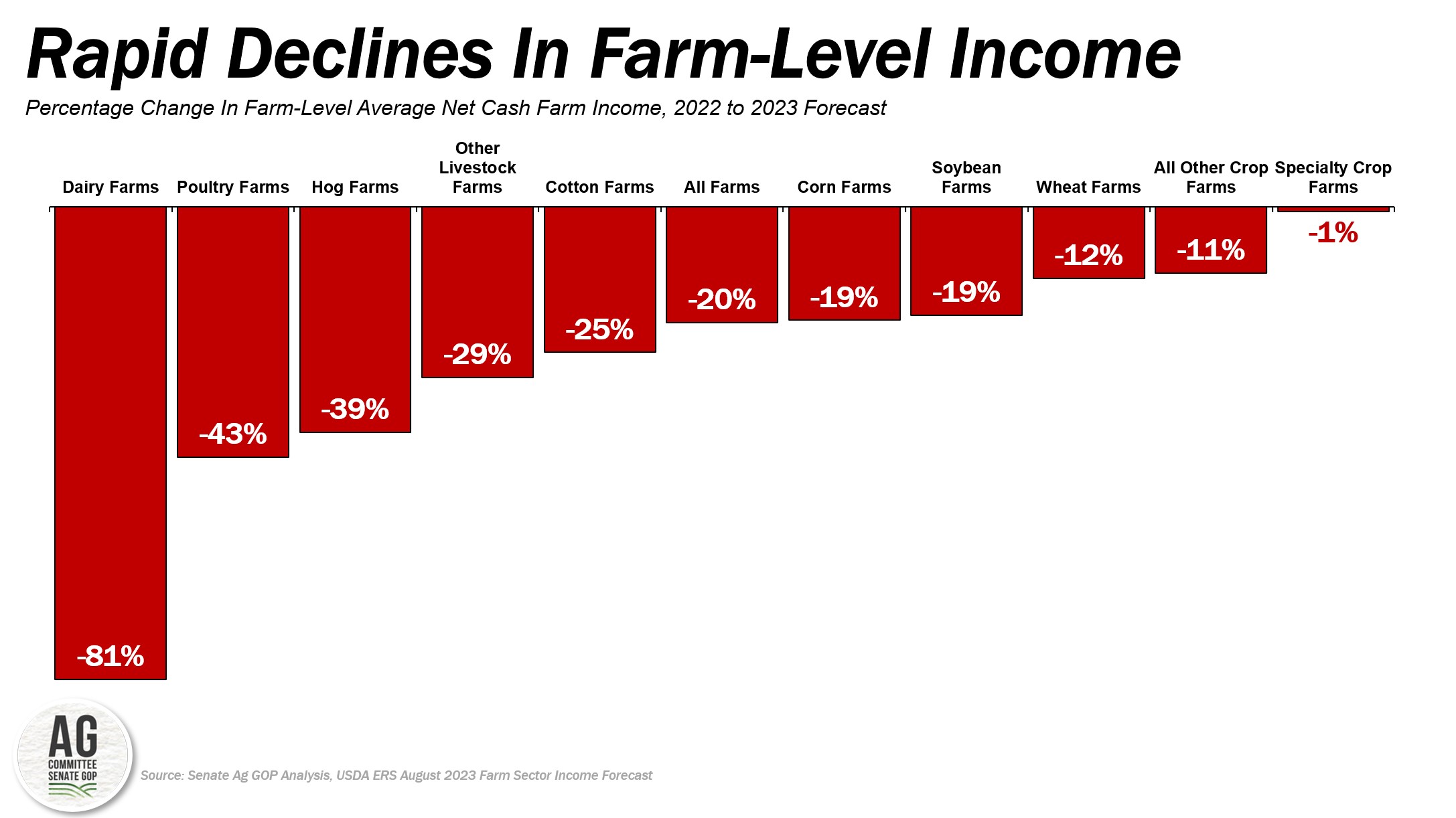

— Senate Agriculture Committee Republicans urge 'meaningful enhancement' of crop subsidies and insurance’. Republican staff members on the Senate Agriculture Committee have recommended a substantial improvement in crop subsidies and the crop insurance program due to the declining farm income in the United States. In a report (link), they cited ongoing challenges in the U.S. farm economy, including a slowdown in farm exports, weakening commodity prices, high production costs, and rising interest rates.

Farm income is expected to experience a significant decrease this year compared to the record high of 2022. Various farm groups have united in advocating for higher reference prices, a critical factor in determining subsidy payments, and an expansion of taxpayer-subsidized crop insurance.

Bottom line: The GOP staff report emphasized the need to reauthorize the farm bill and invest in substantial improvements to risk management and commodity program tools, which are vital for farmers and ranchers to navigate the volatile farm economy, both in 2024 and the future.

— USDA finalizes rule for Milk Loss Program (MLP) to compensate dairy producers affected by disasters. USDA has formally established the Milk Loss Program (MLP), designed to provide compensation to dairy producers who suffered losses due to the dumping or removal of milk without compensation resulting from disaster events. These events include droughts, wildfires, hurricanes, floods, derechos, excessive heat, winter storms, freeze (including a polar vortex), and smoke exposure that occurred during the years 2020, 2021, and 2022. Recent legislation has added tornadoes in 2022 as an eligible disaster event.

The rule, set to be published in the Federal Register on Sept. 11, also marks the beginning of the signup period, which is scheduled to conclude on Oct. 16.

The funding for MLP is derived from the fiscal year (FY) 2021 appropriations package, providing $10 billion for crop and milk losses in the calendar years 2020 and 2021. The Disaster Relief Supplemental Appropriations Act has allocated an additional $3.7 billion for disaster assistance related to similar crop losses in calendar year 2022.

Under MLP, the base period is defined as the first full month of milk production before the milk's dumping or removal due to a qualifying event. Dairy producers can file claims for each month in which milk was lost due to the disaster event. Producers affected in multiple months must submit separate applications for each period of loss.

For the years 2020, 2021, and 2022, producers have a 30-day window each year to file claims for losses. Payments will be calculated at 90% of the fair market value of normal marketings for underserved farmers and ranchers and at 75% for all other affected producers, minus any amounts previously received for milk marketed during the application's prior coverage period and any non-refundable payments received from a milk handler.

Payments will be disbursed as applications are received and approved by USDA. The total expected payouts under MLP have not been disclosed by USDA at this time.

The National Milk Producers Federation praised USDA for addressing overdue disaster relief for farmers. But the trade group urged Congress and USDA to be better prepared for future disasters. “On top of the challenges created by wild price gyrations and the COVID-19 pandemic, dairy farmers since 2020 have also faced an inadequate federal mechanism for addressing unforeseen weather catastrophes, further straining finances at a time when strains have been hard to bear,” said NMPF President Jim Mulhern. “NMPF never accepted that situation, and it’s gratifying to see a compensation plan in place from USDA that will address this backlog of disaster assistance.”

|

PERSONNEL |

— Adriana Kugler becomes first Hispanic Member of Federal Reserve Board of Governors. Adriana Kugler was confirmed by the Senate in a 53-45 vote, making her the first Hispanic policymaker on the Federal Reserve Board of Governors. Kugler, a Colombian-American economist who currently serves as the U.S. representative to the World Bank, joins the Fed at a time when the Biden administration is actively working to enhance diversity within the institution. Her confirmation follows the recent Senate confirmations of Philip Jefferson as the Fed's second Black vice chair and Lisa Cook as the first Black woman to serve on the board. Three Republicans supported her nomination – Sens. Mike Rounds (S.D.), Susan Collins (Maine) and Lisa Murkowski (Alaska). She is filling the remainder of a term left behind by Lael Brainard, a former governor and vice chair at the Fed who now works in the White House.

— White House withdraws energy nominee amid gas stove regulation dispute with Manchin. The White House pulled the nomination of Jeff Marootian for a posting at the Energy Department, bringing an end to a lengthy standoff and delivering a victory to Senator Joe Manchin. This decision comes amid a disagreement over the agency's plans to regulate gas stoves. Marootian had been nominated to serve as the assistant secretary of the Energy Department's Office of Energy Efficiency and Renewable Energy, but his nomination had been stalled since May. Sen. Joe Manchin (D-W.Va.), who chairs the Energy and Natural Resources Committee, postponed a committee vote at that time, expressing discomfort with moving forward on Marootian's nomination. Marootian had been selected to lead the Energy Department division responsible for implementing energy-efficiency rules for stoves, a move Manchin had opposed. Earlier this year, the Energy Department introduced unprecedented limits on the energy consumption of both gas stoves and electric cooktops. This decision drew criticism from the industry, with concerns that it could result in some products being removed from the market. The debate over gas stove regulations gained national attention when an official from the U.S. Consumer Product Safety Commission floated the idea of a ban, sparking outrage from Manchin and others who viewed it as government overreach. As a result of the withdrawal, Marootian will be appointed as the principal deputy assistant secretary for energy efficiency and renewable energy at the Energy Department, where he currently serves as a special advisor to Energy Secretary Jennifer Granholm.

|

CHINA UPDATE |

— India studies responses to potential Chinese invasion of Taiwan amid U.S. inquiries. Senior Indian government officials disclosed that India is actively studying possible reactions to a hypothetical Chinese invasion of Taiwan. This study was initiated following discreet inquiries from the U.S. regarding India's potential contributions in the event of a conflict. India's top military commander commissioned the study, which aims to assess various war scenarios and provide strategic options for India should a conflict erupt.

Results: While some Indian military leaders believe that strong statements may be sufficient if the war is brief, they recognize that a prolonged conflict, akin to Russia's war in Ukraine, would require more comprehensive responses. India, under Prime Minister Narendra Modi, has pursued a policy of "multi-alignment," maintaining close ties with the U.S. while refraining from participating in international sanctions against Russia. This policy faces a significant test if U.S./China relations deteriorate dramatically.

— The U.S. initiated an official investigation into an advanced semiconductor chip manufactured in China, which is incorporated into Huawei's latest smartphone. This development has ignited a discussion in Washington regarding the effectiveness of restrictions imposed on China's semiconductor industry.

— What a grain industry veteran says about China’s strategy: “China needs to control Black Sea food production. If they do, they do not have to worry as much about agricultural exports coming out of the United States.”

|

ENERGY & CLIMATE CHANGE |

— Corn grower leaders urge adoption of GREET model for emissions assessment. A group of 17 prominent leaders in the corn growing industry, including the president of the National Corn Growers Association (NCGA) and leaders from various state grower groups, have sent a letter to Treasury Secretary Janet Yellen advocating for the adoption of the GREET model for assessing greenhouse gas emissions. This model, developed by the Department of Energy (DOE), is considered the federal government's most comprehensive and up-to-date methodology for evaluating transportation lifecycle greenhouse gas emissions. It is employed globally to measure emissions in transportation.

The letter (link) emphasizes that the GREET model offers a more holistic view of environmental factors compared to other models. It accounts for on-farm carbon reduction practices, increased feedstock yields, and advancements in agricultural production methods over the past two decades. As a result, the corn growers assert that GREET is the most suitable methodology for determining tax credits for sustainable aviation fuel (SAF) under the Inflation Reduction Act (IRA).

Corn ethanol, which has proven effective in reducing greenhouse gas emissions from automobiles, is now being considered for use in aviation to achieve similar emissions reductions. The tax credit provided by the IRA is seen as crucial in expediting the adoption of ethanol in the aviation sector. The choice of emissions model for assessing greenhouse gas reductions will likely influence the decision on tax credits.

The letter cites President Biden's recent statement that farmers will lead the way in aviation biofuels and emphasizes the need for a reliable emissions assessment model to fulfill this promise. While Treasury Secretary Yellen was initially expected to make a final announcement on the tax credits in the coming month, Reuters earlier reported that the Biden administration likely will delay until December a decision on whether to make it easier for SAF made from corn-based ethanol to qualify for subsidies under the climate law.

— DOE commits up to $150 million to strengthen U.S. critical mineral supply chains. The Department of Energy (DOE) announced a substantial investment of up to $150 million to facilitate the development of cost-effective and environmentally friendly methods for producing and refining critical minerals within the United States. This funding opportunity, known as the "Critical Material Innovation, Efficiency, and Alternatives Funding Announcement," will utilize resources allocated under the Bipartisan Infrastructure Law.

The primary objective of this initiative is to accelerate the establishment of a secure and sustainable domestic supply chain for critical minerals, drawing from various sources. It will support research, development, and demonstration projects at both bench and pilot scales. The emphasis will be on projects focused on technology development, process enhancements, the creation of value-added products from critical mineral waste streams, exploration of alternatives or substitutes for scarce critical minerals, and the utilization of materials more abundant within the United States for alternative energy technologies.

Interested parties can submit their applications for this funding opportunity until Nov. 10, marking a significant step in fortifying the nation's critical mineral supply chains.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Kroger, Albertsons plan to sell more than 400 stores. Kroger and Albertsons – two of the largest supermarket chains in the country – are in talks to sell more than 400 stores to C&S Wholesale Grocers as part of their proposed $25 billion merger, according to reports from Bloomberg and Reuters. The nearly $2 billion sale includes stores in the Pacific Northwest, the Mountain states and California, Texas, Illinois and the East Coast. A deal could be announced as early as this week.

— Induced losses in HPAI outbreak 2023 highlight gaps in federal indemnity scheme. As the one-year anniversary of the highly pathogenic avian influenza (HPAI) outbreak in 2023 passed, the U.S. agricultural industry seemed relatively unaffected, notes an article by Southern Ag Today (link). However, the outbreak, triggered by wild fowl migration, left its mark, with scattered detections in commercial broilers, turkeys, and gamebird operations in the early part of the year. By May 2023, commercial flock detections had ceased, indicating the end of the outbreak for the commercial poultry sector.

USDA's Animal and Plant Health Inspection Service's (APHIS) HPAI Response Plan, also known as "The Red Book," along with other USDA policies and guidance documents, played a crucial role in coordinating and structuring the response to the outbreak. However, this outbreak exposed limitations in the current indemnification and compensation process:

- Contract Growers: Growers without ownership of the affected birds or eggs are not eligible for compensation, despite suffering complete revenue losses until production can resume after quarantine restrictions are lifted.

- Ancillary Business Operations: Businesses such as breeders supplying chicks and poults are not eligible for compensation, even though they experience revenue losses due to the cessation of production at infected or quarantined premises. This limitation arises from quarantine restrictions that affect poultry operations within the entire control zone around an infected premise, causing "induced impact" on revenue.

One state, Pennsylvania, heavily affected by the HPAI outbreak, took action by appropriating $25 million for the "Highly Pathogenic Avian Influenza Recovery Reimbursement Grant" program. Administered by the Pennsylvania Department of Agriculture, this program provides reimbursement to those directly impacted by HPAI, covering financial losses incurred due to inclusion in a control or quarantine zone.

Additionally, a federal bill called the Healthy Poultry Assistance and Indemnification Act of 2023, introduced as S 2235 by Sen. Chris Coons (D-Del.), aims to address this gap on a nationwide scale. The bill is currently under consideration in the Senate Ag Committee.

Bottom line: The effectiveness of state-level actions and the potential for a federal solution remain to be seen as the situation unfolds.

— Global food prices decline in august, despite soaring rice prices. In August, global food prices experienced a decrease, as reflected in the Food Price Index monitored by the U.N. Food and Agriculture Organization (FAO). The index dropped to 121.4 points, marking a 2.1% decline from July and a notable 24% reduction from its peak in March 2022.

This decrease can be attributed to several factors, including a 3.1% decline in the vegetable oil price index in August, following a 12.1% increase in July. Within this category, sunflower oil registered an 8% decrease, driven by weakened export demand.

Cereal prices also contributed to the decline, falling by 0.7% in August. This decline was influenced by a 3.8% drop in global wheat prices and a 3.4% decrease in coarse grain prices.

However, rice prices saw a sharp increase, with the rice price index reaching a 15-year high in August, rising by 9.8% compared to July. The FAO attributed this surge to "trade disruptions in the aftermath of a ban on Indica white rice exports by India, the world's largest rice exporter." Uncertainties surrounding the ban led some to stockpile rice, renegotiate contracts, or halt price offers.

The August decline in food prices followed a 1.3% increase in July, partly driven by uncertainties resulting from Russia's withdrawal from the Black Sea Grain Initiative. Wheat prices had risen for the first time in nine months following the termination of the grain deal.

Overall, the Food Price Index has exhibited a consistent decline over the past year, except for slight fluctuations in April and July. This trend suggests improved conditions for countries dependent on food imports, with the index consistently staying below the annual rate for 2021 over the past four months.

— Re-evaluating food expiration dates: A misunderstood practice leading to food waste. The practice of placing expiration dates on food products initially served as a means for manufacturers to communicate to retailers when to rotate their stock. Over time, these dates have evolved into what many consumers perceive as firm food-safety deadlines. However, the reality is quite different. These dates are primarily general indicators of when food is at its peak quality, with no regulatory requirements ensuring safety. This misunderstanding contributes significantly to the excessive wastage of perfectly good food in the United States. Link to more via the Wall Street Journal.

|

HEALTH UPDATE |

— Biden administration halts funding for DEEP VZN project amid controversy over virus hunt. The project aimed to discover and study 12,000 exotic pathogens in the wild. Critics expressed concerns that the project was more likely to unintentionally trigger a viral outbreak rather than prevent one. Consequently, the U.S. gov’t will shift its focus towards alternative pandemic preparedness initiatives.

|

POLITICS & ELECTIONS |

— Republican candidates seek to qualify for second debate. In the 2024 presidential primary race, several Republican candidates have successfully met the qualifications for the upcoming second debate, which will take place in three weeks. Hosted by Fox Business at the Ronald Reagan Presidential Library in Simi Valley, California, this debate features stricter requirements than the first one. Fox News anchor Dana Perino and Fox Business anchor Stuart Varney will serve as moderators.

Former President Donald Trump has qualified for the second debate but has downplayed the idea that he will appear, posting to Truth Social on Monday that he will “not be doing the debates.”

The other candidates who have already qualified are: Florida Gov. Ron DeSantis, former Vice President Mike Pence, businessperson Vivek Ramaswamy, former U.N. Ambassador Nikki Haley, Sen. Tim Scott (R-S.C.) and former New Jersey Gov. Chris Christie.

To participate in this second debate, candidates had to meet specific criteria, including having a minimum of 50,000 unique donors, with at least 200 donors from 20 states or territories. In contrast, the first debate required candidates to secure at least 40,000 unique donors to their principal presidential campaign committee, with a minimum of 200 unique donors per state or territory across more than 20 states and/or territories.

Candidates aiming to take the stage in California also had to meet additional polling requirements, polling at a minimum of 3% in two national polls or 3% in one nationwide poll and two polls from different early voting states, including Iowa, New Hampshire, South Carolina, and Nevada. All polls needed to be recognized by the Republican National Committee (RNC).

Some candidates, like conservative pundit Larry Elder, are seeking clarification from the RNC regarding which polls will be accepted. Elder's campaign believes they have met the donor requirement and is awaiting confirmation. Elder and businessman Perry Johnson previously announced their intention to sue the RNC before the first debate, claiming they met the RNC's requirements but were not included.

— VP Harris dismisses concerns about Biden's age, but says she is prepared to assume presidency if necessary. Vice President Kamala Harris responded to polling data indicating concerns among voters regarding President Biden's age as he seeks re-election. During an interview in Indonesia, Harris emphasized her firsthand experience with Biden's ability to handle the demands of the presidency. She mentioned spending significant time with the President in the Oval Office and witnessing his skill in comprehending and addressing complex issues, allowing him to make informed decisions for the nation. Harris emphasized that what truly matters to the American people is a president who delivers results, and she expressed confidence in Biden's ability to do so.

Harris acknowledged her readiness to fulfill her constitutional duty to assume the presidency should President Biden become unable to govern due to health or age-related issues. While describing this scenario as hypothetical, Harris underscored her preparedness for the role. She expressed optimism about President Biden's health, but also stressed the responsibility every vice president carries in understanding their potential to step into the presidency. Harris affirmed her commitment to this responsibility, emphasizing that she is no different from any other vice president in this regard.

— Nikki Haley leads Biden in hypothetical matchup: poll. According to a recent CNN/SSRS poll, former South Carolina governor Nikki Haley outperformed President Joe Biden in a hypothetical matchup. The poll found that 49% of voters supported Haley, while 43% backed Biden. This outcome can be attributed to Haley's strong support among White voters with college degrees, a crucial demographic in the Democratic coalition. The survey, conducted from Aug. 25 to Aug. 31, included 1,259 registered voters nationwide and was conducted following the first Republican presidential debate.

In a broader comparison, the poll revealed a tight race between former President Donald Trump and President Biden, with Trump garnering 47% support and Biden receiving 46%. Trump demonstrated more significant support among White voters, men, and individuals without a college degree, while Biden performed better among voters of color, college graduates, young people, and women.

— Canada reopens probe into possible foreign interference in recent elections. Canada has reopened an investigation to determine whether foreign countries, including China and Russia, interfered in the country's recent elections. This move comes after a prior probe initiated by Prime Minister Justin Trudeau earlier in the year was prematurely terminated following criticism from the Conservative Party. Previously, Prime Minister Trudeau had dismissed the notion that Canada's elections might have been subject to interference, asserting that the country had some of the best and most robust election processes globally.

— CNN poll indicates declining confidence among Democratic voters in President Biden for 2024 election. A recent CNN poll highlights diminishing confidence among Democratic-aligned voters regarding their support for President Joe Biden in the 2024 election. These poll findings coincide with Biden's broadly negative job ratings and widespread concerns about his age, which stands at 80 years old, potentially impacting his current level of physical and mental competence. According to the poll, a significant 67% majority of Democratic and Democratic-leaning voters express a desire for an alternative to President Biden. Additionally, 46% of registered voters believe that any Republican presidential nominee would be a better choice than Biden for the 2024 election. While it remains roughly 14 months away from the election, it is widely expected that President Biden will be the party's nominee, barring any credible challenges from other Democrats. But analysts caution that his current unpopularity may create an opportunity for former President Donald Trump to mount a return to power.

|

OTHER ITEMS OF NOTE |

— GOP state officials push Supreme Court to limit Congress' tax power re: unrealized gains. Seventeen Republican attorneys general, led by West Virginia Attorney General Patrick Morrisey, submitted an amicus brief to the U.S. Supreme Court, urging the Court to rule that Congress lacks the authority to tax unrealized gains as income. The case involves Charles and Kathleen Moore, who contest that Congress cannot tax them as shareholders of an Indian farming equipment company because they haven't realized their foreign earnings. The Supreme Court's decision on this case could have significant implications for the country's international tax framework.

The case centers on tax code Section 965, created by the 2017 Tax Cuts and Jobs Act to collect taxes on foreign earnings that might otherwise remain untaxed in the U.S. The Republican attorneys general argue that the Ninth Circuit's previous ruling on this issue undermines the traditional tax powers of states and could open the door to a federal wealth tax by treating unrealized gains as income under the Sixteenth Amendment.

In response, Senate Finance Committee Chairman Ron Wyden (D-Ore.) expressed confidence in the constitutionality of his proposed wealth tax plan but warned that a Moore victory could benefit multinational corporations and potentially allow billionaires to avoid paying their fair share of taxes. Numerous business groups and organizations have also submitted amicus briefs on this case. The U.S. government's merits brief is expected to be filed on Oct. 16.

Attorneys general from Alabama, Arkansas, Georgia, Idaho, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Montana, Ohio, Oklahoma, North Dakota, South Carolina, Texas, and Virginia are listed as additional counsel on the brief.

The case in question is Moore v. United States, and it has the potential to shape the boundaries of Congress' tax authority.

— Cotton AWP rises for latest week. The Adjusted World Price (AWP) for cotton is at 73.55 cents per pound, effective today (Sept. 8), up from 71.56 cents per pound the prior week. Meanwhile, USDA said that Special Import Quota #21 will be established Sept. 14 for the import of 55,640 bales of upland cotton, applying to cotton purchased not later than Dec. 12 and entered in the U.S. not later than March 11.

— Walmart reduces starting pay for shelf stockers and online order packers, maintains current employee pay. Walmart lowered the starting wage for employees responsible for stocking shelves and fulfilling online orders, resulting in a reduction of approximately one dollar per hour compared to previous rates. Notably, this wage cut does not affect the pay of existing employees in these roles, and some more experienced employees have even received raises. The retail giant explained that the change was implemented to ensure consistency in starting pay, regardless of whether an employee works as a cashier or a stocker. It's worth noting that Walmart had previously increased pay for personal shoppers and stockers in March 2021, a move made in response to the significant growth in e-commerce sales at that time. As the largest private employer in the U.S., Walmart's employment and compensation policies often serve as indicators for economists and industry leaders, shedding light on potential signs of inflation and shifts in the labor market.

— Justice Kavanaugh: Supreme Court working on addressing ethics issues amid scrutiny. Justice Brett Kavanaugh revealed that the Supreme Court is actively pursuing "concrete steps" to tackle ethics concerns within the high court. This development comes in the wake of multiple news reports exposing instances of justices' undisclosed luxury travel and connections with political donors. News outlets such as ProPublica and the Associated Press have highlighted issues surrounding justices' unreported trips aboard private jets, extravagant vacations, and the utilization of taxpayer-funded staff for tasks related to their book projects. Kavanaugh's remarks arrive just weeks before the commencement of the Supreme Court's new term, with critics, including congressional Democrats, urging the justices to establish a code of conduct specifically tailored to the judicial branch.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |