China Suspends Urea Exports Amid Surging Domestic Prices

Farm bill and CCC Charter Act | S.D. regulators deny Navigator's CO2 pipeline application

|

Today’s Digital Newspaper |

MARKETS

- U.S. trade gap below forecasts in July 2023

- U.S. ag trade deficit hits record high in July 2023

- Fed set to double U.S. economic growth forecast

- Beige Book: Modest economic growth

- Fed watch in high gear with several officials speaking today

- Record number of Americans over 80 still working

- Eurozone's second quarter growth falls short of expectations

- Middle East sovereign-wealth funds: The global ATM for investments

- Efforts to protect currencies: Japan and China

- Airlines face soaring jet fuel prices

- StoneX lowers U.S. corn and soybean crop forecasts

- Orange juice futures hit unprecedented peak

- Ag trade: Iran purchases Brazilian corn

- Hurricane Lee gaining strength in Atlantic, potential Caribbean threat

- NWS weather outlook

- Items in Pro Farmer’s First Thing Today

RUSSIA & UKRAINE

- Russia: Deal 'in principle' to move grain to Africa

- Deadly Russian missile attack strikes Ukraine's Kostiantynivka market

- Ukraine turns to Croatian ports for grain exports amid Russian backlash

- Lloyd's in talks with U.N. regarding new Black Sea grain insurance coverage

- Russia targets pro-Ukraine sentiments in Crimea crackdown

POLICY

- Biden administration to launch national vehicle-mileage fee testing

NOMINATIONS

- Philip Jefferson confirmed as Vice Chair of Federal Reserve

- Fed Governor Lisa Cook cleared by Senate for another 14-year term

CHINA

- China exports, imports fall less than expected

- China soybean imports slow a little in August but remain strong

- China's meat imports slowed

- China suspends urea exports amid surging domestic prices

- China's Belt and Road initiative faces challenges as loans sour and investments wane

- Australian PM to visit China as progress in trade relations emerges

- House panel to discuss geopolitical scenarios with Wall Street

- Arrests made as individuals damage section of China's Great Wall for shortcut

TRADE POLICY

- Vilsack urged to make investments in trade promotion and food assistance

- Biden admin. seeks affidavits from energy firms in trade dispute with Mexico

- U.S. & EU negotiate tariffs on excess steel prod., resolving Trump-Era trade conflict

- Global goods trade faces shallow recession, predicts Oxford Economics

ENERGY & CLIMATE CHANGE

- Biden to block oil drilling across millions of acres of Arctic Alaska

- Biden administration to delay SAF subsidy guidance until December

- African leaders demand wealthier nations invest in clean energy

- Japan PM, China premier spar over Fukushima water release

- Renewable energy sector grapples with end-of-life challenges

- Modi urges wealthy nations to ease climate expectations

- Microsoft commits to large-scale carbon removal through innovative approach

- South Dakota regulators deny Navigator's CO2 pipeline application

LIVESTOCK & FOOD INDUSTRY

- Pork industry grapples with whiplash of shifting regulations

- ASF detected in Sweden

HEALTH

- Health insurance costs to surge in 2024, possibly largest increase in over a decade

- Covid-19 hospitalizations surge in the U.S. after months of decline

POLITICS & ELECTIONS

- Former Stewart aide Celeste Maloy wins Utah primary for his seat

- Google implements policy requiring transparency in AI-generated political ads

CONGRESS

- Sen. Mitch McConnell provides no new information on his health or retirement plans

- Three Senate spending bills on tap next week

OTHER ITEMS OF NOTE

- Pentagon plans to deploy thousands of drones by 2025

- Federal judge orders removal of Texas river barriers targeting migrants

|

MARKET FOCUS |

Equities today: The Dow opened up around 50 points higher. In Asia, Japan -0.7%. Hong Kong -1.3%. China -1.1%. India +0.6%. In Europe, at midday, London +0.3%. Paris +0.3%. Frankfurt +0.1%.

U.S. equities yesterday: The Dow ended down 198.78 points, 0.57%, at 34,443.19. The Nasdaq declined 148.48 points, 1.06%, at 13,872.47. The S&P 500 declined 31.35 points, 0.70%, at 4,465.48. Stocks fell Wednesday amid worries that the Federal Reserve might not be done hiking interest rates. Meanwhile, Treasury yields jumped and the yield on the 2-year Treasury note traded above the 5% level. The rate hike concerns came as recent readings on both the services and manufacturing sectors of the U.S. economy indicate prices are moving in the wrong direction.

Agriculture markets yesterday:

- Corn: December corn fell 1/4 cent to $4.85 3/4, ending near the session low.

- Soy complex: November soybeans rallied 11 1/4 cents before closing at $13.76 1/4. December soybean meal futures closed $1.60 higher at $399.2 but ended nearer the session low. December soyoil futures fell 43 points to 62.38 cents.

- Wheat: December SRW wheat rose 9 3/4 to $6.09, a mid-range close, while December HRW wheat rose 25 cents to $7.49 1/2, above the 10-day moving average. December spring wheat rose 20 1/4 cents to $7.82 1/2, a high-range close.

- Cotton: December cotton futures fell 176 cents points, closing at 87.00 cents.

- Cattle: Nearby October live cattle futures soared $2.75 to $182.70 Wednesday, while October feeder futures jumped $2.175 to $256.475.

- Hogs: Anticipation of sustained cash weakness seemed to depress hog futures again Wednesday, with the nearby October contract tumbling $1.30 to $81.875.

Ag markets today: Corn, soybeans and wheat held in tight trading ranges during a quiet, two-sided overnight session. As of 7:30 a.m. ET, corn futures were trading fractionally higher, soybeans were 4 to 5 cents lower and wheat futures were narrowly mixed. Front-month crude oil futures were 50 cents lower, and the U.S. dollar index was around 125 points higher.

Quotes of note:

- Fed’s Collins: Patience needed and further tightening possible. Federal Reserve Bank of Boston President Susan Collins said policymakers will need to be patient as they assess economic data to figure out their next steps and that further tightening may still be required, based on what the trends show. “This phase of our policy cycle requires patience, and holistic data assessment, while we stay the course,” Collins said Wednesday in remarks prepared for an event with business leaders in Boston. “And while we may be near, or even at, the peak for policy rates, further tightening could be warranted, depending on the incoming data.”

- “Trump’s great mistake is his belief that trade is a zero-sum exercise. But countries and companies trade because they see a mutual advantage. When American consumers buy clothing and Scotch on a global market, while American producers sell soybeans and Boeing jets, the magic is that both sides benefit.” — WSJ editorial (link).

- “Now, everybody wants to go to the Middle East—it’s like the gold rush in the U.S. once upon a time.” —Peter Jädersten, founder of fundraising advisory firm Jade Advisors.

- “Until our work is done, we’re still at risk.” — Wells Fargo Chief Executive Charlie Scharf at a conference in May, about what he perceived to be regulators’ increased willingness to take drastic action when banks aren’t meeting their expectations.

— U.S. trade gap below forecasts. In July 2023, the U.S. experienced a trade deficit of $65 billion, which was slightly narrower than anticipated, especially when compared to the revised June figure of $63.7 billion (originally estimated higher). Market expectations had projected a larger gap of $68 billion. Here's a breakdown of key points from the trade report:

Exports:

- Exports increased by 1.6% to reach a four-month high of $251.7 billion.

- Leading the rise in exports were categories such as passenger cars, trucks, buses, and special purpose vehicles.

- Other significant contributors to export growth included nonmonetary gold, crude oil, pharmaceutical preparations, travel services, and transport-related goods.

- However, exports of gem diamonds experienced a decline during this period.

Imports:

- Imports rose by 1.7% to $316.7 billion in July.

- Key drivers of import growth included items like cell phones, other household goods, pharmaceutical preparations, semiconductors, computers, crude oil, and travel-related products.

- Conversely, there was a decrease in imports of finished metal shapes, iron and steel mill products, nonmonetary gold, and transport-related goods.

Bilateral Trade Balances:

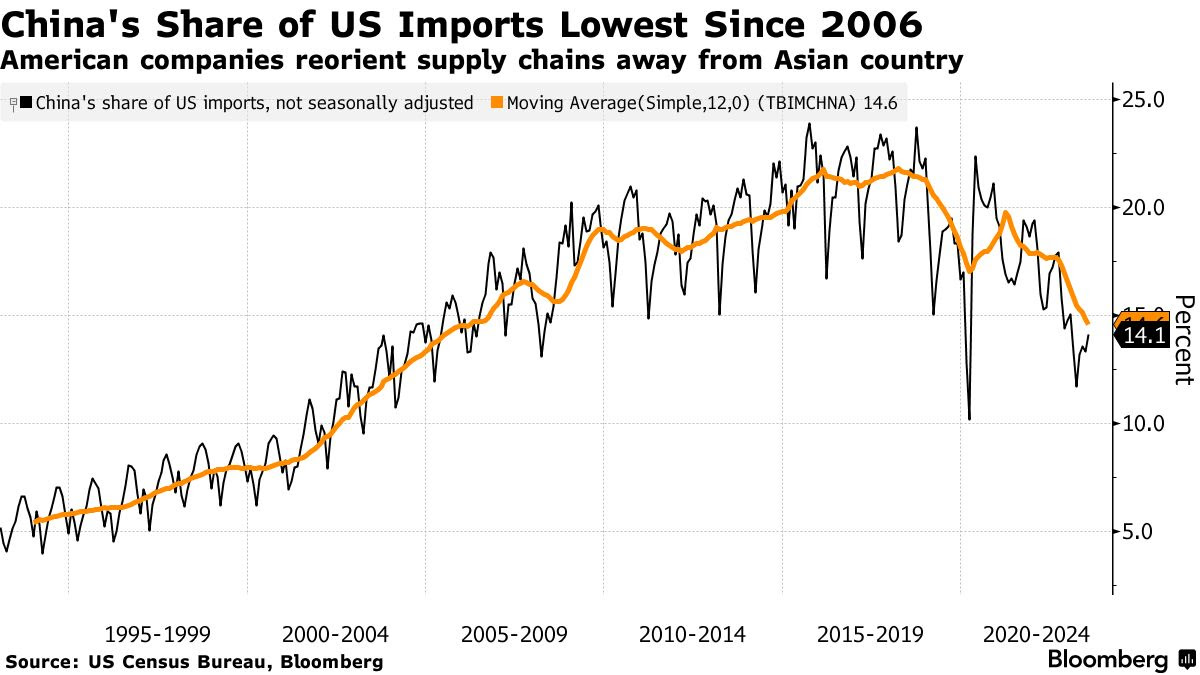

- The trade deficit with China expanded by $1.2 billion, reaching $24.0 billion.

- In contrast, the surplus with Hong Kong decreased by $1.0 billion, down to $1.5 billion.

- The trade balance with the United Kingdom shifted from a deficit of $0.8 billion in June to a surplus of $0.5 billion in July.

Bottom line: These figures indicate that the U.S. trade deficit in July was influenced by both increased exports and imports. The positive growth in exports of various goods was partially offset by rising imports, particularly in sectors like electronics, pharmaceuticals, and energy-related products. Additionally, the trade dynamics with specific countries like China, Hong Kong, and the U.K. played a role in shaping the overall trade balance.

— U.S. ag trade deficit hits record high in July 2023, raising concerns for upcoming fiscal year. In July, the U.S. experienced another record monthly trade deficit in its agricultural sector, with ag exports declining to $12.17 billion, marking a 5% decrease from the previous month. In contrast, ag imports amounted to $15.75 billion, which was a 1.4% drop from June. This resulted in a monthly trade deficit of $3.58 billion, setting a new record for the highest deficit in a single month.

For fiscal year (FY) 2023, cumulative agricultural exports reached $153.54 billion, while imports totaled $163.93 billion, leading to a cumulative trade deficit of $10.39 billion. The July export figures were the lowest since September 2021 when they were at $12.0 billion.

USDA has forecasted that FY 2023 will see agricultural exports of $177.5 billion and imports of $196.5 billion. To meet this projection, exports would need to amount to only $11.98 billion for August and September, while imports should reach $16.29 billion. This forecast implies a record trade deficit of $19.0 billion for FY 2023 and would be the third deficit in the last five fiscal years.

Looking ahead to FY 2024, USDA's initial forecast, issued in August, anticipates a decrease in exports to $172.0 billion and a rise in imports to $199.5 billion, which would set a new record. This projection would result in a record trade gap of $27.5 billion for FY 2024.

— Fed set to double its U.S. economic growth forecast after strong data. The Federal Reserve is expected to double its projection for U.S. economic growth in 2023 due to recent strong economic data, Bloomberg reports (link). Several economic reports, including those related to consumer spending and residential investment, have surpassed expectations. The Atlanta Fed's unofficial estimate suggests an annualized expansion of 5.6% in the third quarter. This turnaround from earlier predictions may lead the Fed to revise its interest-rate cut estimates for 2024.

Consumer spending in June and July has been robust, indicating a strong third quarter for GDP growth. If GDP growth exceeds 3.2%, it would be the strongest quarter since 2021. This contrasts with China's outlook, which has been downgraded due to a property crisis.

The Fed's previous projection in mid-June suggested GDP growth of just 1% in 2023. The upcoming projections are expected to show growth between 1.8% and 2%, with a possible downward revision of the unemployment rate. This growth upgrade may also lead to a reduction in the projected interest-rate cuts for next year.

While the Atlanta Fed tracker may be volatile and subject to revision, it reflects a general increase in optimism over the past few months. Despite this optimism, the central bank is likely to keep its benchmark interest rate unchanged at the September meeting.

Factors like rising gasoline prices, student loan payments resuming, and the possibility of a government shutdown could create headwinds for growth in the fourth quarter. Additionally, the impact of aggressive rate hikes and tighter credit conditions may begin to affect the economy.

Bottom line: Strong economic data is expected to lead the Fed to revise its economic growth projections, possibly reducing the projected interest-rate cuts for 2024. However, headwinds and uncertainties in the fourth quarter could temper economic growth.

— Beige Book: Modest economic growth. The Fed’s Beige Book highlighting economic conditions in the 12 districts noted economic growth was generally modest in July and August. Agriculture conditions were “somewhat mixed,” but reports of drought and higher input costs were widespread. Districts specifically noting agriculture included:

Atlanta: “Agricultural conditions were little changed since the previous report. Demand for cattle was strong. Egg supply increased, but the supply of hens remained lower than normal. The supply of chickens continued to exceed demand, although there was some improvement in the market. There continued to be excess supply of milk in the market. Many row crops were expected to have a strong harvest. Demand for cotton remained weak, leading some growers to exit the cotton market.”

Chicago: “District farm income expectations for 2023 remained much lower than 2022 levels. However, reduced costs for some inputs, particularly fertilizers, boosted net income prospects for 2024. Drought concerns lessened overall, although hot weather toward the end of the period impaired development of a wide swath of Midwest crops. Corn, soybean, and wheat prices were down. Still, there were reports of a slowdown in exports as prices offered by other producers were more favorable on world markets. Hog prices moved down after hitting a seasonal peak. Prices for dairy products rose from low levels, and egg prices crept up a bit. Cattle prices increased once again, remaining one of the few agricultural prices above the levels of a year ago. Farmland prices were still higher than a year ago.”

St. Louis: “District agricultural conditions have been mixed since our previous report. Despite record-breaking heat and heat-dome-induced thunderstorms across the District, the percent of cotton and rice rated fair or better stayed stable throughout the reporting period, with cotton returning to 2021 rating levels after a moderate dip in 2022. Corn and soybean ratings both decreased more significantly during the summer months, sustaining their fall below 2020-2021 levels the previous year. District contacts described feeling the effects of extreme weather and increased interest rates in the form of higher input costs. On net, contacts indicated a slight decline in dollar value sales and an increase in inventories.”

Minneapolis: “District agricultural conditions weakened slightly. More than a third of respondents to a survey of agricultural credit conditions reported that farm incomes decreased in the second quarter from a year earlier. Several contacts noted that while commodity prices were still favorable, they were retreating to levels that could be below break-even for some producers given high input costs. Drought conditions improved recently but remained a concern, especially in eastern portions of the region. District oil and gas drilling activity decreased slightly since the previous report; however, contacts reported that oil production increased recently.”

Kansas City: “The farm economy in the Tenth District remained strong, but conditions softened alongside lower agricultural commodity prices and persistent drought. Volatility in markets for major crops was elevated amid heightened uncertainty about supply and demand conditions. Through mid-August, prices for corn and wheat were about 10% lower than the beginning of the month and soybean prices also dropped slightly. In the livestock sector, cattle prices remained strong and continued to support profit opportunities, despite considerable cost pressures. Large areas of the region continued to be heavily impacted by drought that could reduce crop revenues and limit availability of feed for livestock operations. District contacts continued to highlight input costs, interest rates and thinner margins as other key concerns. Lenders indicated that credit conditions remained sound with support from strong farm finances.”

Dallas: “A significant portion of the district entered (or reentered) drought over the past six weeks due to meager rainfall and soaring temperatures. Pasture conditions deteriorated, and the weather had an adverse effect on row crops. A majority of the Texas cotton crop was rated in poor to very poor condition, and abandonment is expected to be high this year. Cattle prices rose further over the reporting period, driven by tight supply and solid demand for beef.”

San Francisco: “Conditions in the agriculture and resource-related sectors remained largely unchanged during the reporting period. Domestic retail and food services demand for agricultural products was stable, with strength noted particularly for fruits and vegetables. A contact from Arizona reported challenges with limited availability of produce for retail outlets. Exports of some products, such as grain and hay, reportedly fell, resulting in increased domestic supply levels and lower domestic prices. Major fish stocks were stable. Though yields for some crops remained low due to the wet winter, contacts reported high volumes of crops carried over from the prior harvest and strong projections for this year's perennial crop yields in California and Washington. Production input costs remained elevated with upward movement for some costs, such as packaging and energy.”

— Fed watch in high gear with several officials speaking today. Investors are closely monitoring various speeches by Federal Reserve officials, hoping to gain insights into the central bank's upcoming monetary policy decisions. Here is an overview of some key appearances:

- Philadelphia Fed President Patrick Harker is expected to discuss "The Future of Fintech" at the Seventh Annual Fintech Conference hosted by the Federal Reserve Bank of Philadelphia in Philadelphia, Pennsylvania.

- Federal Reserve Bank of Chicago President Austin Goolsbee will deliver welcome remarks at the Fourth Annual Career Pathways in Economics and Related Fields Conference in Chicago.

- New York Fed President John Williams is set to participate in a moderated discussion at the Bloomberg Market Forum in New York.

- Atlanta Fed President Raphael Bostic will provide insights into the economic outlook during a moderated conversation hosted by Broward College in Davie, Florida. Additionally, Bostic will speak on economic mobility before the Prosperity Partnership/Greater Fort Lauderdale Alliance Foundation dinner in Fort Lauderdale, Florida.

- Federal Reserve Board Governor Michelle Bowman is expected to participate in a panel discussion titled "The Future of Money and Consumer Protection" at the hybrid Federal Reserve Bank of Philadelphia Seventh Annual Fintech Conference in Philadelphia, Pennsylvania.

- Dallas Fed President Lorie Logan will address monetary policy and the economy at the Dallas Business Club in Dallas, Texas.

Of note: Investors will be attentive to these speeches for any hints or guidance on the Federal Reserve's stance on monetary policy, which can have significant implications for financial markets and investment strategies.

— Oldies but goodies. Last year, 650,000 Americans over 80 were still working, up 18% from the previous decade, according to data from the Census Bureau. There will be twice as many 75-year-old+ workers in 2030 than in 2020, due in part to the aging baby boomer generation, the Bureau of Labor Statistics estimates.

— Eurozone's second quarter growth falls short of expectations. The Eurozone's economy experienced minimal growth in the second quarter, with a Gross Domestic Product (GDP) increase of just 0.1% for the period ending on June 30. This growth figure fell short of expectations and was influenced by export challenges resulting from a global economic slowdown, particularly in China and other regions. The report is noteworthy as it precedes a decision by the European Central Bank next week on whether to implement another interest rate hike.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro, yen, and British pound all weaker against the greenback. The yield on the 10-year U.S. Treasury note was weaker, around 4.27%, with a mixed tone in global government bond yields. Crude oil futures remained under pressure ahead of U.S. gov’t inventory data that is delayed a day by the Monday U.S. holiday. U.S. crude was around $87 per barrel while Brent was around $90.15 per barrel. Gold and silver were mixed, with gold firmer around $1,945 per troy ounce and silver lower around $23.31 per troy ounce.

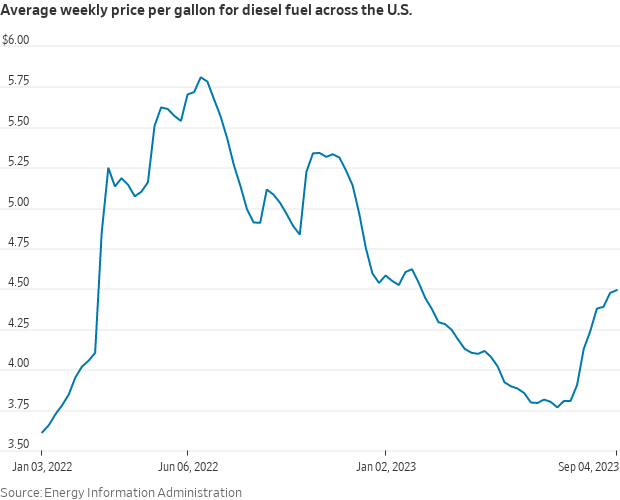

— Global oil-production cuts drive diesel price surge in the U.S. and Europe. Diesel prices in the United States and Europe have surged by over 40% since May, coinciding with unexpected production cuts by Saudi Arabia and some OPEC allies, the Wall Street Journal notes (link). This increase has outpaced the growth in futures prices for Brent crude and West Texas Intermediate, the two major oil benchmarks, which have risen by only 13% to 14% over the same period. The rise in diesel prices is impacting pump prices and trucking costs in the U.S. and other Western countries. This trend is due to the fact that heavier oil, like that produced by Saudi Arabia, is better suited for diesel production, whereas lighter U.S. crude is more commonly used to produce gasoline.

In the U.S., average diesel prices have increased by over 72 cents per gallon since early July, reaching their highest levels since February. These developments highlight the ripple effects of global oil-production cuts on fuel prices and transportation costs.

— Middle East sovereign-wealth funds: The global ATM for investments. Middle East monarchies are experiencing a surge in wealth thanks to an energy boom, transforming their sovereign-wealth funds into a sought-after financial resource for private equity, venture capital, and real estate funds facing challenges in raising capital from other sources, the Wall Street Journal reports (link). Recent notable deals include an Abu Dhabi fund's acquisition of investment manager Fortress for over $2 billion and a Saudi fund's $700 million purchase of Standard Chartered's aviation unit. This trend is expected to intensify, with an upcoming investment conference in Riyadh next month poised to attract a multitude of investors seeking opportunities. The region's sovereign-wealth funds have emerged as influential players in the global investment landscape, reflecting their newfound financial strength.

Of note: Oil-rich Saudi Arabia is eyeing another potential source of wealth: metals in the desert. Crown Prince Mohammed bin Salman wants to turn the kingdom into a hub for resources such as copper, but mining giants are yet to back him.

— Chinese and Japanese authorities are intensifying their efforts to protect their respective currencies from the surging U.S. dollar, which poses a risk of increasing inflationary pressures. Japan issued a strong warning against rapid declines in the yen, with its top currency official expressing readiness to take action in response to speculative market movements. In parallel, China's central bank has provided its most forceful guidance ever through its daily reference rate for the yuan. This action comes as the yuan, a managed currency, weakened to a level not seen since 2007.

Facts and figures. Both the Japanese yen and the Chinese yuan have been facing pressure due to the general strength of the U.S. dollar over the past several months. The yen has depreciated by almost 8% against the U.S. dollar since mid-July, while the yuan has fallen by over 6% since May. This decline in the value of their currencies is concerning for these countries as it can contribute to rising inflationary pressures.

— Airlines face soaring jet fuel prices amid busy travel season. Major airlines have issued warnings regarding the significant spike in jet fuel prices, which is adding to their expenses during the peak summer travel season. Since early July, jet fuel prices have surged by approximately 30%, raising concerns about how airlines will absorb these costs, especially considering that fares have declined compared to last year.

The impact of these rising fuel prices is being felt across the industry. Southwest Airlines has revised its unit revenue outlook for the current quarter, while Alaska Airlines anticipates that higher fuel prices will impact its pretax margin for the same period. United Airlines, while maintaining its revenue forecast, now expects fuel prices to reach as high as $3.05 per gallon for the quarter, surpassing its previous estimate of no more than $2.80 per gallon made in July.

— StoneX lowers U.S. corn, soybean crop forecasts. Commodity brokerage firm StoneX estimates the U.S. corn crop at 15.102 billion bu. on an average yield of 175 bu. per acre. That would be down from the firm’s August forecasts of 15.274 billion bu. and a yield of 177 bu. per acre. In August, USDA estimated the corn crop at 15.111 billion bu. on a yield of 175.1 bu. per acre. StoneX estimates the U.S. soybean crop at 4.144 billion bu. on a yield of 50.1 bu. per acre. That would be down from its August forecasts of 4.173 billion bu. and 50.5 bu. per acre. In August, USDA estimated the soybean crop at 4.205 billion bu. on a yield of 50.9 bu. per acre. StoneX says the estimates are for USDA’s final production number and assume USDA’s harvested acreage.

— Orange juice futures hit an unprecedented peak at $3.50 per pound in early September, driven by concerns over diminished production and inventories following the landfall of Hurricane Idalia in the U.S. on August 30. Key points include:

1. Hurricane Impact: Hurricane Idalia posed a significant threat to orange juice production in Florida, a state that contributes more than 90% of the total orange juice output in the United States. Florida's orange juice industry has already been grappling with persistent challenges such as greening disease and previous hurricane events.

2. Declining Production: The reduced crop production stemming from these ongoing issues has resulted in a sharp 46.5% decline in orange juice production for the 2022-23 period when compared to the previous year. This decline reflects a worrying trend in the industry's output.

3. Hurricane Idalia Exacerbates Concerns: Analysts anticipate that the detrimental effects of Hurricane Idalia may exacerbate the situation by further hampering orange juice production in Florida. The hurricane's impact on the industry's output is seen as a potential continuation of the declining trend.

4. International Factors: Beyond the U.S., Brazil, the world's leading citrus grower, is also grappling with supply challenges due to adverse weather conditions, particularly rainfall. These conditions have further contributed to the global tightening of orange juice supply.

5. Soaring Prices: The culmination of these factors has translated into a substantial surge in orange juice prices throughout the year. Prices have surged by nearly 70% in 2023, reflecting the growing concerns about supply shortages and the impact of adverse weather events on production.

— Ag trade: Iran purchased an undisclosed amount of Brazilian corn from a tender for up to 180,000 MT. South Korea purchased 57,000 MT of optional origin feed wheat.

— Hurricane Lee gaining strength in Atlantic, potential Caribbean threat. Hurricane Lee, currently a Category 1 storm in the Atlantic, is poised to undergo rapid intensification as it approaches the Caribbean in the coming days. Forecasts indicate that it could elevate to near Category 5 strength by early Friday. Presently, Lee has maximum sustained winds of 80 mph and is located approximately 1,000 miles east of the northern Leeward Islands. While there's growing confidence that the storm's center will pass north of the Leeward Islands, the Virgin Islands, and Puerto Rico, it's expected that the swells generated by Hurricane Lee will create life-threatening surf and rip current conditions in the region. The potential impact on the U.S. mainland remains uncertain at this stage.

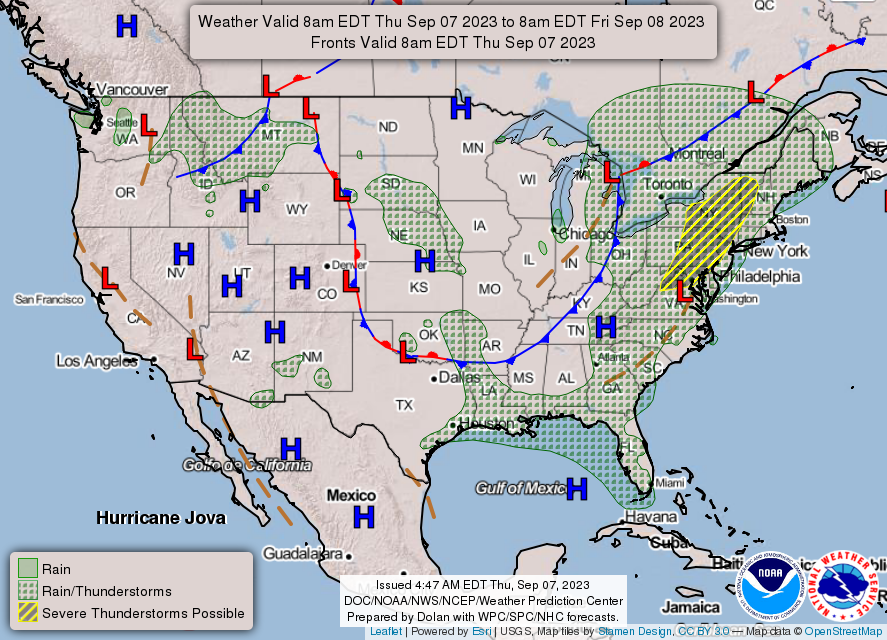

— NWS weather outlook: On Thursday, there is a Slight Risk of severe thunderstorms over parts of the Northeast and Mid-Atlantic/Central Appalachians......There are Heat Advisories and Excessive Heat Warnings over parts of the Southern Plains/Lower Mississippi Valley and Heat Advisories over the Northeast on Thursday......Air Quality Alerts over parts of the Central Plains, Upper Mississippi Valley, and Maine on Thursday.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight grain trade

• Russia continues attacks on Ukrainian Danube port

• Export sales data pushed back to Friday

• Varied cash cattle opinions

• Cash hog decline slows

|

RUSSIA/UKRAINE |

— Russia: Deal 'in principle' to move grain to Africa. Moscow said Turkey had agreed “in principle” to handle 1 MMT of grain that Russia plans to send to Africa at a discounted price with financial support from Qatar. “All agreements in principle have been reached. We expect that in the near future we will enter into working contacts with all parties to work out all the technical aspects of the scheme for such deliveries,” Deputy Foreign Minister Alexander Grushko said, according to Interfax news. Turkey would handle onward export of the Russian grain but details of its full role were not clear.

— Deadly Russian missile attack strikes Ukraine's Kostiantynivka market. A devastating Russian missile attack in the eastern town of Kostiantynivka on Wednesday resulted in the deadliest incident of its kind in months, claiming the lives of at least 17 people and leaving numerous others injured. Ukrainian President Volodymyr Zelenskyy decried the strike as an act of "utter inhumanity." While Russian missile attacks on civilian areas are unfortunately not uncommon, the scale of casualties in this attack stands out. Earlier this year, a missile strike on an apartment block in the city of Uman in April led to the loss of 23 lives, including children, while a similar incident in Dnipro in January claimed the lives of 40 people. The area affected by Wednesday's attack is situated near the front lines around Bakhmut and is often densely populated with military personnel.

President Zelenskyy characterized this Russian assault as "the brazenness of wickedness" and "the audacity of evil," underscoring the severity of the situation in Ukraine.

— Ukraine turns to Croatian ports for grain exports amid Russian backlash. Ukraine has shifted its grain export strategy, utilizing Croatian sea ports as an alternative after Russia withdrew from the Black Sea Grain Initiative. First Deputy Prime Minister Yulia Svyrydenko revealed that Ukrainian grain exports have already been channeled through Croatian ports. While specific export quantities were not disclosed, Svyrydenko expressed gratitude for this newfound trade route, acknowledging its niche status but noting its growing popularity. Svyrydenko suggested that this move could play a significant role in future bilateral trade with Croatia, particularly after the resolution of the ongoing conflict with Russia. This shift in trade routes reflects Ukraine's efforts to adapt to changing geopolitical dynamics and ensure the continued export of its agricultural products.

— Lloyd’s in talks with U.N. regarding new Black Sea grain insurance coverage. Lloyd’s of London is in talks with the United Nations over providing insurance cover for Ukrainian grain shipments if a new Black Sea corridor deal can be reached, its CEO John Neal told Reuters. “Are we happy and able to continue to provide insurances if a corridor can be re-operated and can be re-established? The answer to that is yes,” Neal said. “We are in active discussions with the U.N. about how that might happen,” Neal said, adding those conversations included the possibility that cover may need to be structured differently than before. “Absent U.N. intervention and U.N. clearance, we would not sanction the insurance,” he said.

— Russia targets pro-Ukraine sentiments in Crimea crackdown. In response to renewed optimism among Crimeans about the possibility of returning to Ukrainian governance amid the Ukraine conflict, Russian occupation authorities have launched a crackdown on residents expressing pro-Ukraine sentiments. Individuals are being detained on charges of resistance, ranging from playing Ukrainian songs in public to sabotaging railway tracks. Notably, a significant portion of those detained are ethnic Russians who oppose their country's militaristic autocracy and advocate for a return to a democratic Ukraine. This crackdown highlights the challenges faced by residents of Crimea who hold pro-Ukraine views in the current political climate.

|

POLICY UPDATE |

— Biden administration to launch national vehicle-mileage fee testing; facing lawmaker pressure and delay. The Biden administration intends to initiate testing for a national vehicle-mileage fee by inviting members to participate in an advisory board before the end of September. This move follows a missed deadline and pressure from lawmakers.

The administration has fallen behind on a directive from the 2021 infrastructure law, which required the establishment of an alternative funding advisory board within 90 days to recommend methods for piloting a national miles-traveled fee. Shailen Bhatt, the head of the Federal Highway Administration, anticipates filing a charter, with his agency subsequently seeking board members by the end of this month, according to a recent letter obtained by Bloomberg Government.

This development is in response to concerns raised by Sen. Tom Carper (D-Del.) and Rep. Sam Graves (R-Mo.), who chair committees overseeing highways. They expressed worries about delays hampering the acquisition of data necessary for Congress to make funding decisions in the next multiyear policy bill. The growing importance of highway funding solvency and the increase in electric vehicles on the road have heightened interest in exploring alternatives to the gas tax.

|

PERSONNEL |

— Philip Jefferson was confirmed as the vice chair of the Federal Reserve with a strong 88-10 vote in the Senate. This makes him the second Black person to hold this important position. He will also continue his separate term as a governor, which extends until 2036. Jefferson has consistently supported every interest-rate decision made by the Federal Reserve, including last year's aggressive rate hikes followed by a slowdown in increases. He indicated a probable pause in rate hikes before the Fed's decision to keep rates steady in June.

Fed Governor Lisa Cook was cleared by the Senate for another 14-year term. Next up is Adriana Kugler for the governor position previously held by Lael Brainard, who now advises President Biden on economic matters. Kugler face more contentious votes, with only one Republican on the panel supporting their nominations.

|

CHINA UPDATE |

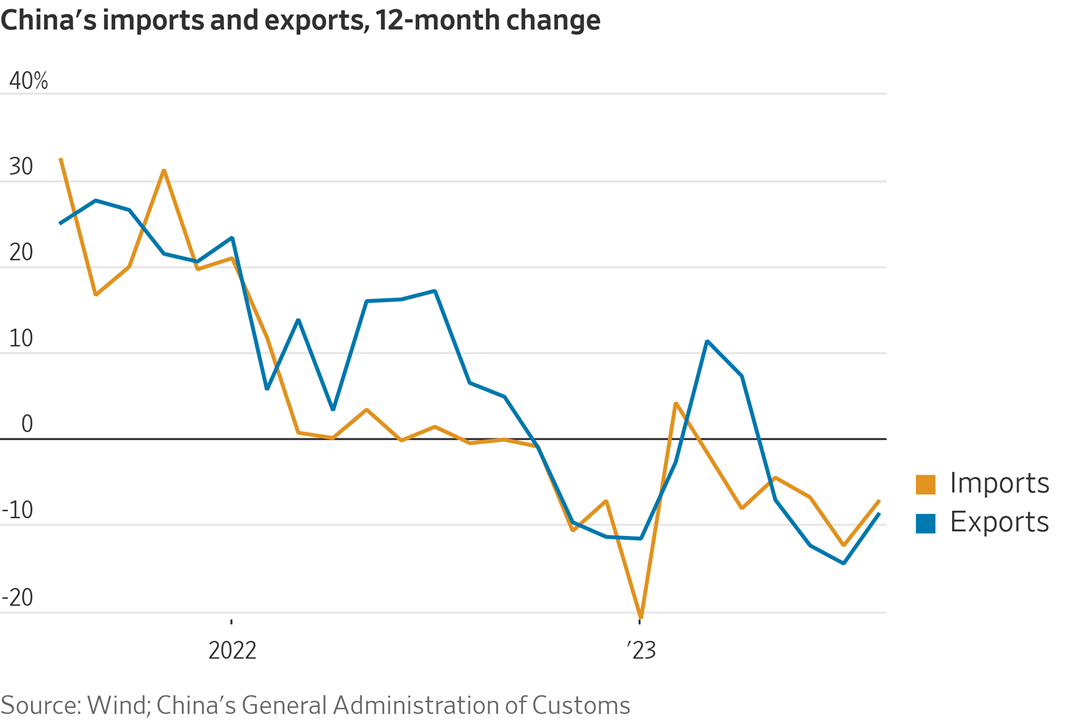

— China exports, imports fall less than expected. In August 2023, China experienced a decline in both its exports and imports. Exports dropped by 8.8% compared to the same month the previous year, marking the fourth consecutive month of such declines. Imports were down by 7.3%, making it the seventh time this year that they had decreased.

Both the decrease in exports and imports were less severe than initially estimated. Despite this, the Chinese economy is currently facing a significant challenge in achieving its 2023 growth target of approximately 5%. Several factors are contributing to this risk, including a deepening property market downturn, reduced consumer spending, and ongoing pressure on the manufacturing sector. These issues collectively pose a threat to China's economic growth prospects for the year 2023.

Exports to the U.S. and European Union — both among China's major trading partners -- led the decline, tumbling 17.4% and 10.5%, respectively, while shipments to Southeast Asian countries fell 3.6%.

Imports from these regions also contracted, notably influenced by a 16.7% fall from Japan, caused in part by a ban on seafood following the release of treated water from the crippled Fukushima Daiichi nuclear power plant.

China-ally Russia was one of the few countries that recorded trade growth with an uptick of 63.2% in exports and 13.3% in imports.

“Looking ahead, we expect exports to decline over the coming months before bottoming out toward the end of the year,” Julian Evans-Pritchard of Capital Economics said in a report.

Of note: China’s car industry is booming, with exports quadrupling in just three years, and shipyards struggling to build fleets fast enough to move vehicles overseas. Trade policy analysts note that China has a 25% import tariff on electric vehicles from some other countries.

— China soybean imports slow a little in August but remain strong. China imported 9.36 MMT of soybeans during August, down 3.8% from July but up 30.5% from last year. Through the first eight months of this year, China imported 71.65 MMT of soybeans, up 17.9% from the same period last year.

— China’s meat imports slowed. China imported 627,000 MT of meat during August, down 7.7% from July and 4.6% less than last year. Through the first eight months of 2023, China imported 5.11 MMT of meat, up 7.4% from the same period last year.

— China suspends urea exports amid surging domestic prices. China has instructed some fertilizer producers to suspend exports of urea due to a sharp increase in domestic prices. This move is expected to limit the supply of urea and raise costs for farmers in key importing countries like India, Bloomberg reports (link).

Several major Chinese fertilizer manufacturers have stopped entering into new export agreements starting this month in response to a government directive. The suspension currently applies exclusively to urea, according to insiders who requested anonymity as they are not authorized to speak to the media.

Urea futures on the Zhengzhou Commodity Exchange saw a nearly 50% surge in prices over a seven-week period from mid-June to the end of July, although they have since experienced fluctuations. Prices recently fell by nearly 6%, ending a two-day gain streak.

Chen Li, an analyst with Huatai Futures in Guangdong, attributed the rise in urea prices to low Chinese inventories and increased exports. She noted that the demand for fertilizers in crops such as soybeans and corn in the first half of the year likely rose due to heightened top-dressing demand following extreme weather conditions.

China, the world's largest producer and consumer of urea, plays a crucial role in global urea supply. Any significant reduction in exports from China could tighten supplies and lead to higher global prices. Key importers of Chinese urea include India, South Korea, Myanmar, and Australia.

Impacts: In response to the news, shares of Chinese urea producers, including state-owned China BlueChemical Ltd. and Sinofert Holdings Ltd., declined in Hong Kong. On the Shanghai exchange, Cangzhou Dahua Co. experienced its most substantial drop in nearly two weeks, and Shandong Hualu Hengsheng Chemical Co. slid by 1.4%.

The Ministry of Commerce and the National Development and Reform Commission in China have not yet provided comments in response to the situation. Notably, CNAMPGC Holding Co. had already announced its intention to reduce fertilizer exports in a bid to secure supplies and maintain stable prices. These developments introduce an additional layer of volatility to the global agriculture market, which has been impacted by extreme weather conditions in growing regions, export restrictions imposed by India, and Russia's conflict in Ukraine.

— China's Belt and Road initiative faces challenges as loans sour and investments wane. China's ambitious Belt and Road Initiative, launched a decade ago to expand trade and global influence, is encountering headwinds. The initiative, designed to boost infrastructure development worldwide, is losing momentum due to a domestic economic slowdown and a surge in loan defaults, partly driven by the impact of Covid-19, according to Nikkei Asia (link/paywall). Chinese President Xi Jinping is now advocating for greater profitability in Belt and Road projects.

The dilemma: While the initiative initially strengthened China's trade ties and international standing, countries involved are increasingly facing trade deficits and concerns about access to the Chinese market. Additionally, Chinese conditions on financing have led to problems, with countries wary of falling into a "debt trap." Covid-19 prompted China to reassess its approach, with a significant increase in bad loans.

Despite China's efforts to assist Belt and Road countries, new investments have declined, partly due to China's own economic slowdown. The country is exploring more sustainable economic assistance avenues, emphasizing profitability in future projects. However, the success of these efforts remains uncertain, with potential consequences for China's global influence.

— Australian PM to visit China as progress in trade relations emerges. Australian Prime Minister Anthony Albanese and Chinese Premier Li Qiang have signaled progress in restoring "unimpeded trade" between their nations. During a regional summit in Indonesia, Albanese expressed optimism about the positive strides made in resuming trade and emphasized the importance of ongoing progress. He also highlighted the significance of dialogue, acknowledging that Australia's views may not always align with China's. Premier Li welcomed Albanese's planned visit to China later in the year, marking the 50th anniversary of Prime Minister Whitlam's historic visit in 1973, which signifies a major step in stabilizing bilateral ties.

— House Committee on China Competition to discuss geopolitical scenarios with Wall Street. The panel is set to hold a series of discussions in New York next week. Led by Chairman Mike Gallagher, a Republican from Wisconsin, and Raja Krishnamoorthi, a Democrat from Illinois, the delegation will engage with prominent figures in Wall Street, including leaders from banks, hedge funds, and venture capital firms. One notable agenda item is a tabletop exercise, where retired military generals and financial experts will simulate the geopolitical and business consequences of a hypothetical Chinese invasion of Taiwan.

Attendees at these discussions are expected to include executives from Apollo Global Management and Centerview Partners. Additionally, the itinerary includes a luncheon hosted by Josh Wolfe of Lux Capital and a "field hearing" at the Council on Foreign Relations think tank. This hearing will feature Jay Clayton, former chair of the U.S. Securities and Exchange Commission (SEC), and will focus on the potential threat to U.S. financial stability posed by the Chinese Communist Party.

Chairman Gallagher has expressed concerns that "millions of Americans have become financial backers of the CCP without knowing it" through their investment portfolios. The committee previously launched an investigation into asset manager BlackRock and finance giant MSCI, alleging that their funds were investing in Chinese companies deemed national security threats or involved in human rights abuses.

Krishnamoorthi emphasized the importance of understanding how CCP policies impact Americans' savings and investments, as well as the role Congress should play in safeguarding American investors and national security.

— Arrests made as individuals damage section of China's Great Wall for shortcut. Chinese authorities arrested two individuals for allegedly causing significant damage to a section of the Great Wall of China, all to create a shortcut for their work near the world heritage site. The suspects, a 38-year-old man and a 55-year-old woman, widened an existing cavity in the wall to allow their excavator to pass through, resulting in what officials describe as "irreversible damage" to the structural integrity and safety of this iconic landmark.

The Great Wall, which dates back to 220 BCE/BC (Before the Common Era) and was later extended during various periods, served as a defensive barrier against invasions from northern nomadic nations and groups. It was designated a UNESCO World Heritage Site in 1987 due to its historical and cultural significance.

In response to such incidents and to protect the historic site from unruly tourists, the Chinese government has implemented regulations and penalties. These include blacklisting tourists displaying "disciplinary behaviors" and subjecting them to administrative penalties. In some cases, tourists have been banned from visiting the Great Wall for disregarding safety signs and venturing onto sections in need of restoration.

|

TRADE POLICY |

— Vilsack urged to make investments in trade promotion and food assistance. Sens. Debbie Stabenow (D-Mich.) and John Boozman (R-Ark.) are urging USDA to use its authorities under the Commodity Credit Corporation (CCC) Charter Act to support opportunities for American farmers. In a letter (link/pdf) to USDA Secretary Tom Vilsack, the two highlight the need to invest in trade promotion and in-kind international food assistance, both of which support American farmers and producers.

Comments: Use of the CCC Charter Act could be one of the “creative” ways farm-state lawmakers have signaled could come via funding issues for a new farm bill.

— Reuters: Biden administration seeks affidavits from energy companies in escalating trade dispute with Mexico. The Biden administration has requested that U.S. energy companies provide affidavits detailing how Mexico's protectionist policies have disrupted their investments, Reuters reports (link). This move indicates the U.S. Trade Representative's (USTR) intention to escalate a trade dispute with Mexico under the United States-Mexico-Canada Agreement (USMCA). Mexico's actions, including rolling back reforms designed to open its power and oil markets to foreign competition, have sparked this dispute.

U.S. energy and power companies, such as Chevron and Marathon Petroleum, have complained about difficulties obtaining permits and facing decisions favoring state oil company Petroleos Mexicanos (Pemex) and the national power utility Comision Federal de Electricidad (CFE) in Mexico.

If talks on the issue continue to stall, the U.S. is likely to seek a dispute panel before the end of the year, and the affidavits will be used as evidence in the panel request. If the panel rules against Mexico and corrective action is not taken, Washington could potentially impose substantial tariffs on Mexican goods.

This escalation adds strain to trade relations between the U.S. and Mexico, despite their growing economic integration. Previously, the USTR requested a USMCA dispute settlement panel regarding Mexico's restrictions on genetically modified corn imports. Mexico is now a significant buyer of U.S. GM corn for livestock feed, and the U.S. argues that banning GMO corn for human and animal consumption violates Mexico's obligations under the trade pact.

Mexican President Andres Manuel Lopez Obrador's stance on energy and corn issues poses a significant challenge to resolving these disputes, as he considers them essential to Mexico's national identity.

Both the USTR and Mexico's Economy Ministry declined to comment on the matter. The Biden administration has been cautious about escalating energy trade tensions with Mexico, as it has sought Mexico's cooperation on immigration and drug trafficking. However, the current lack of progress in talks has led to this potential escalation, carrying political risks for President Biden in his reelection bid in 2024.

Mexico recently became the largest U.S. goods trading partner in the first half of 2023, with a total trade value of $396.6 billion, driven by increased automotive production and supply chain shifts. This trade surplus is on track to more than double from 2017 levels.

Seeking a dispute settlement panel would signal a shift from negotiations to litigation, as outlined in the USMCA's dispute settlement rules. A panel of experts would be convened within 30 days to review the case, with the initial report due 150 days after its formation. Past panels have ruled both in favor of and against the U.S. in various trade disputes under the USMCA.

Of note: The report comes after Mexico’s economy minister, Raquel Buenrostro, told the news service in late-August that the U.S., Mexico and Canada were in discussions regarding wording an agreement that settles the issue without the use of a USMCA dispute settlement panel.

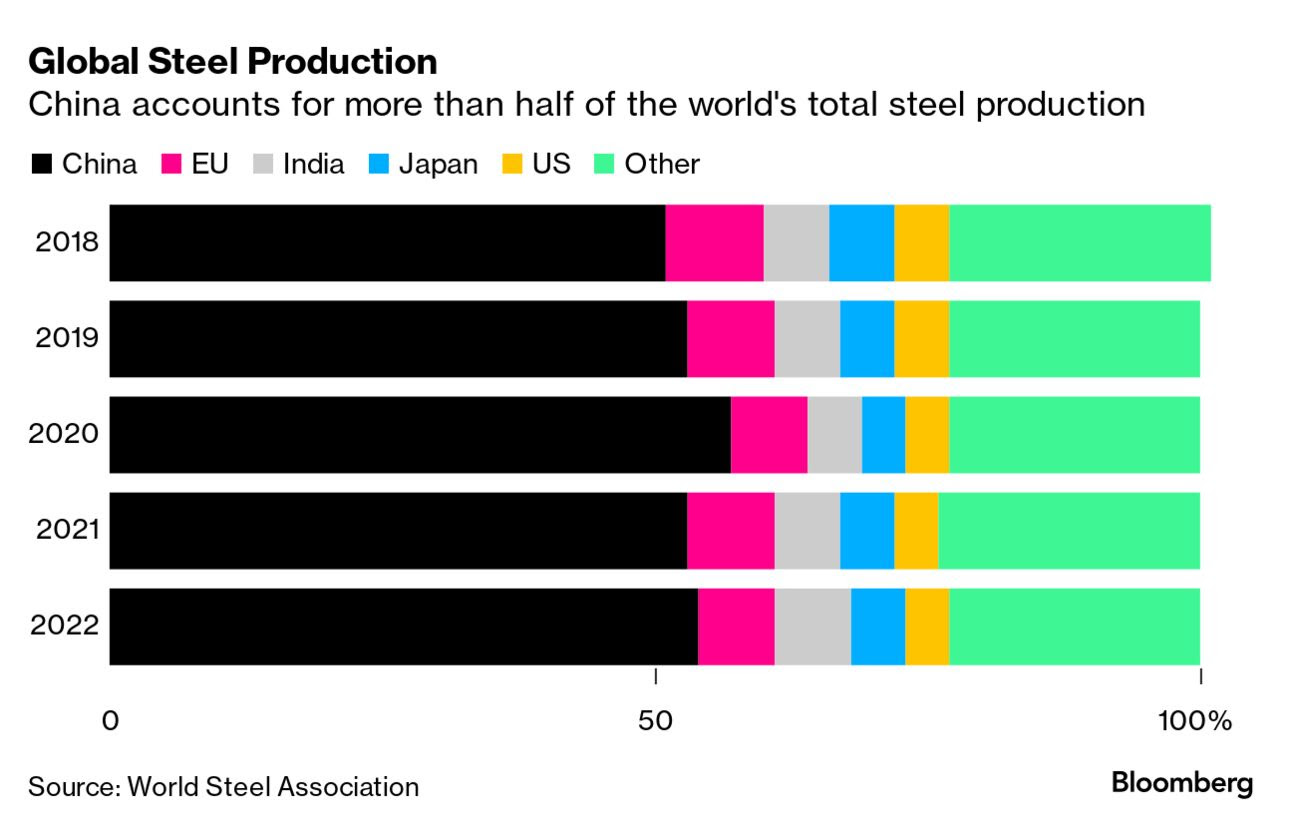

— U.S. and EU negotiate tariffs on excess steel production, resolving Trump-Era trade conflict. The United States and the European Union are in the process of negotiating an agreement that would impose fresh tariffs on excessive steel production originating from China and other nations. This move aims to put an end to a trade dispute that originated during the Trump administration. The tariffs will primarily target imports that benefit from non-market practices. The discussions are ongoing, and both sides are working towards resolving a conflict that began when former President Donald Trump imposed tariffs on metal imports from Europe, citing national security concerns. The proposed agreement represents an effort to find a mutually beneficial solution to the trade tensions that have persisted between the U.S. and the EU.

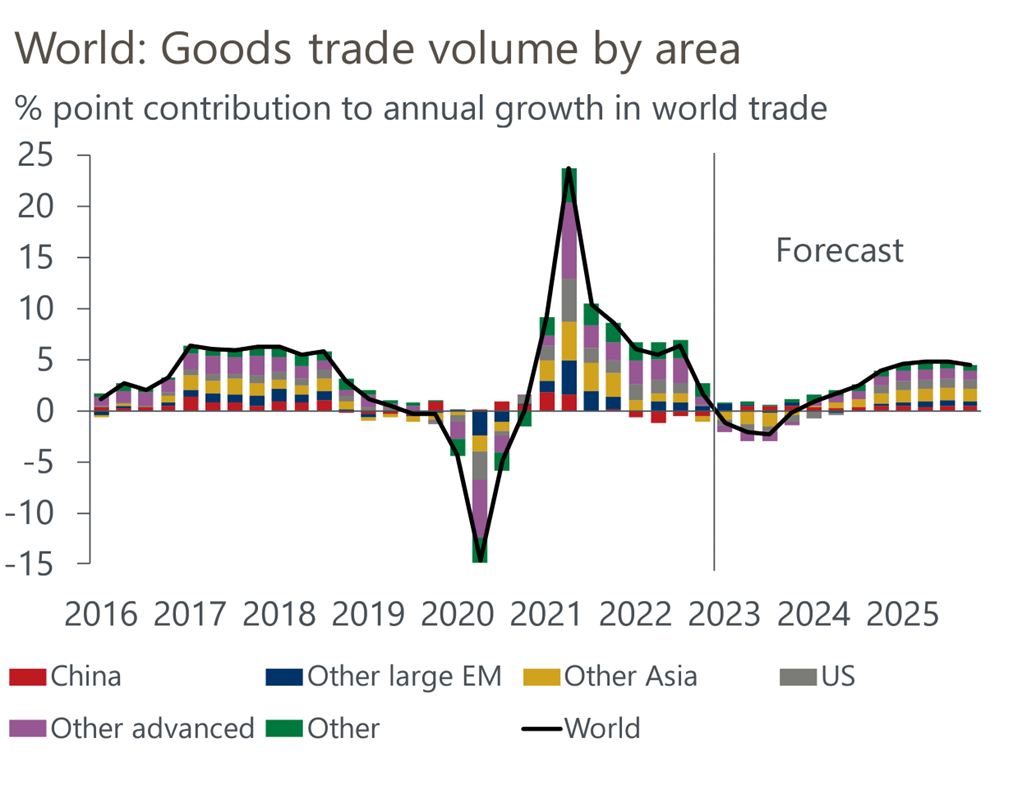

— Global goods trade faces shallow recession, predicts Oxford Economics. Oxford Economics has announced that global goods trade volumes declined at an approximate annual rate of 2% in the last quarter. The organization's leading indicators have also indicated the possibility of further weakness ahead, followed by a modest upturn at the end of 2023 and into early 2024.

Oxford Economics anticipates a "shallow trade recession," projecting a 1.5% drop in trade volumes for this year before a 2.3% rebound in the following year. However, this outlook is less optimistic than a recent forecast made by the World Trade Organization. The analysis suggests that the global goods trade faces challenges in the near term but could see a gradual recovery in the coming years.

|

ENERGY & CLIMATE CHANGE |

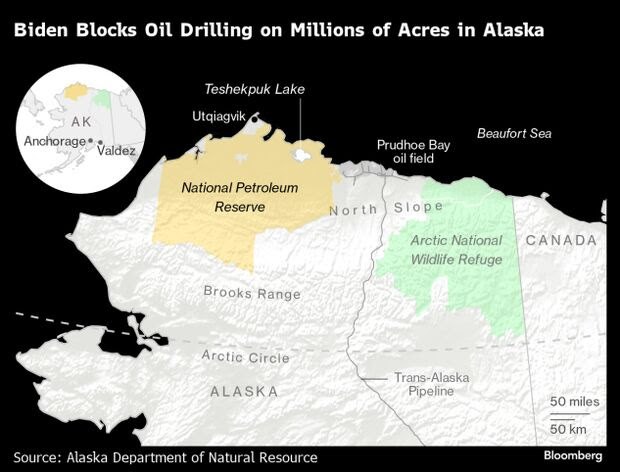

— Biden to block oil drilling across millions of acres of Arctic Alaska. President Joe Biden has taken significant steps to prevent oil drilling in vast areas of Arctic Alaska. Key points:

- Protecting Arctic Alaska: President Biden's administration is focusing on safeguarding the Arctic region in Alaska from oil drilling. This is important for preserving the natural environment, wildlife, and addressing climate change concerns.

- Stronger Protections: The administration is proposing stronger protections for public lands in this region. This means implementing measures to ensure that these areas are not open to oil and gas development.

- Lease Cancellations: As part of this effort, the government is canceling leases for oil and gas development. These leases would have allowed companies to explore and extract resources in the affected areas.

- Sizeable Conservation Effort: One of the significant actions is the proposal for a permanent ban on oil and gas development across 10.6 million acres of the National Petroleum Reserve-Alaska. This area is the largest expanse of public land in the United States.

Bottom line: This action is seen as a response to concerns raised earlier when the administration approved the Willow oil drilling project. By announcing a permanent ban on drilling in a much larger area, the administration is attempting to balance environmental conservation with energy needs.

— Reuters: Biden administration to delay SAF subsidy guidance until December. President Joe Biden’s administration likely will delay until December a decision on whether to make it easier for sustainable aviation fuel (SAF) made from corn-based ethanol to qualify for subsidies under the climate law, two sources familiar with the discussions told Reuters. At issue is a requirement in last year’s Inflation Reduction Act (Climate Bill) that SAF producers seeking tax credits must demonstrate with an approved scientific model their fuel generates 50% less greenhouse gas emissions over its lifecycle than petroleum fuel. Ethanol producers have asked the administration to adopt a model (GREET) that would enable ethanol-based SAF to qualify while environmentalists want standards that would favor inputs like those used in cooking oil and animal fat. A decision was expected sometime this month, though the administration has been divided.

— Leaders from various African nations recently concluded Africa's first climate summit in Nairobi, Kenya, with a strong call for a fundamental overhaul of how wealthier nations engage with the continent in the context of climate change. In their declaration, these African leaders emphasized Africa's potential for leadership in clean energy and environmental conservation. However, they also underlined a critical prerequisite for this transformation: industrialized countries, which bear significant responsibility for climate-altering pollution, must facilitate access to their wealth by making substantial investments in Africa.

The core issue is the lack of financing from multinational lending institutions for clean energy initiatives in many African countries. These institutions often perceive these nations as too risky for investment in such projects. This financial divide between wealthier and poorer nations regarding clean energy is a central point of contention that is expected to feature prominently at the upcoming U.N. climate summit scheduled for November in Dubai.

Bottom line: Africa's leaders are demanding a shift in global dynamics, asserting their readiness to take the lead in clean energy and environmental efforts. To realize this vision, they insist that industrialized nations must provide critical investments to help Africa combat climate change effectively. The debate over equitable financing for clean energy projects is poised to remain a pivotal issue in international climate discussions.

— Japan PM, China premier spar over Fukushima water release. At the ASEAN+3 summit in Jakarta, Japanese Prime Minister Fumio Kishida defended the release of wastewater from the Fukushima Daiichi nuclear plant into the Pacific Ocean, asserting its safety from a scientific standpoint. However, Chinese Premier Li Qiang disagreed with Kishida's assertion, holding Japan responsible for releasing what he referred to as "nuclear-contaminated water." The exchange highlights ongoing tensions and differing perspectives between Japan and China regarding the Fukushima nuclear plant's environmental impact.

— Renewable energy sector grapples with end-of-life challenges. As wind and solar energy projects continue to proliferate across the U.S., many states are confronting the critical issue of how to responsibly decommission or repower these projects when they reach the end of their operational life. In the absence of federal guidelines, a report from the law firm Lewis Roca reveals that over two-thirds of U.S. states have established requirements for decommissioning or renewing wind and solar projects at the end of their initial life cycles. However, these guidelines vary significantly from state to state, with some emphasizing upfront coverage of decommissioning costs and others outlining specific end-of-life standards for these renewable energy initiatives.

— Modi urges wealthy nations to ease climate expectations. Prime Minister of India, Narendra Modi, expressed in an editorial carried by several Indian outlets as well as international dailies including in Britain and Japan that the G20 Summit of affluent nations should adopt a more supportive approach in assisting developing countries grappling with climate change. Modi stressed that such support should be accompanied by tangible actions related to financing and the transfer of technology.

— Microsoft commits to large-scale carbon removal through innovative approach. Microsoft has taken a significant step towards carbon removal by agreeing to purchase carbon credits from the startup Heirloom Carbon. Heirloom Carbon employs a unique method involving crushed-up limestone to absorb carbon from the atmosphere. This collaboration aims to remove up to 315,000 metric tons of carbon dioxide over the course of a decade.

The commitment translates to an investment of at least $200 million based on current market prices, marking one of the most substantial purchases of carbon-removal credits to date. This effort will help offset emissions equivalent to those of approximately 70,000 gasoline-powered cars annually, contributing to Microsoft's ongoing efforts to achieve carbon neutrality.

— South Dakota regulators deny Navigator's CO2 pipeline application. The South Dakota Public Utilities Commission has unanimously denied Navigator Heartland Greenway, LLC's application to construct its carbon capture pipeline system, known as the Heartland Greenway System pipeline. Additionally, the commission rejected Navigator's request to use federal law to bypass local ordinances that set restrictive setback distances for the project. Link to details via the Sioux Falls Argus Leader.

PUC Chairperson Kristie Fiegen cited Navigator's failure to meet the burden of proof outlined in South Dakota Codified Law 49-41B-22. The law outlines four standards that a proposed project must meet, including compliance with applicable laws and rules, no threat of serious harm to the environment or local conditions, no substantial impairment to the health, safety, or welfare of inhabitants, and no undue interference with future municipal development.

Navigator's lack of timely responses to staff questions and objections to administrative tasks, such as notifying landowners about routes and public input meetings, raised concerns about the company's ability to comply with applicable laws and rules.

Background. Navigator's $3.2 billion pipeline system would have crossed approximately 111.9 miles of eastern South Dakota farmland, connecting to ethanol plants and a Valero Renewable Fuels plant. The project aimed to transport carbon dioxide (CO2) for sequestration and associated financial benefits, making it one of the largest pipeline systems in the U.S.

Despite the denial, Navigator retains the option to reapply for a permit under South Dakota law. Navigator officials argued that they had operated in good faith with South Dakota farmers and deferred to landowners' opposition to the pipeline for land surveys. In contrast to rival Summit Carbon Solutions, Navigator had not filed eminent domain lawsuits against landowners.

Navigator's motion to preempt county ordinances by citing federal laws was also denied, with the commission finding that Navigator's project did not fall within the energy conversion and transmission facilities covered by South Dakota Codified Law 49-41B-1.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Pork industry grapples with whiplash of shifting regulations. A New York Times article (link) on Proposition 12 followed Pederson's Natural Farms. It initially expected a prosperous period when California enforced a law banning certain pork products made from pigs raised in small gestation pens. The company received a surge in orders from California grocery stores and restaurants seeking compliant bacon and pork chops. However, California regulators delayed full enforcement of the law (Proposition 12) to the following year, leading to canceled orders and industry confusion. The pork industry, including Midwest pig farmers and major processors, has been disrupted by changing regulations. Congressional legislation may further complicate the situation.

Also, Pederson's faced a supply challenge when one of its pig suppliers received a better offer from a larger company, potentially impacting the company's sales.

Hog producers are grappling with low hog prices and high feed costs, causing losses. Some retailers in California are raising prices to cover the higher costs incurred by complying with the state's stricter standards. Shortages and higher prices for bacon and pork chops are possible due to some farmers choosing not to sell in California.

Making the necessary changes for California compliance is expensive for pig farmers, and the economic benefits are uncertain. The future of the pork industry in California remains unclear, with questions about supply and pricing.

The pork industry has been fighting Proposition 12, and recent legislative acts seek to limit state-level agricultural regulations.

Bottom line: The U.S. pork industry is navigating regulatory changes in California, with uncertainties surrounding compliance costs, supply, and pricing.

— ASF detected in Sweden. A dead wild boar in Sweden has tested positive for African swine fever (ASF), Sweden’s Veterinary Institute said, the first such case in the country. “At present, we do not know how the infection got in, but it is a long jump from the nearest infected area in Europe, and we therefore assume that it has happened through humans and not wild boar,” Sweden’s Veterinary Institute said.

|

HEALTH UPDATE |

— Health insurance costs set to surge in 2024, potentially largest increase in over a decade. The cost of employer health coverage is projected to experience a substantial increase in 2024, with estimates suggesting a surge of approximately 6.5%. This potential hike would mark the most significant annual rise in over a decade, as reported by major benefits consulting firms Mercer and Willis Towers Watson, who exclusively shared their survey results with the Wall Street Journal (link).

Several factors contribute to this faster cost growth, including hospitals facing higher labor expenses and increased demand for new and costly medications. Therefore, employees are likely to bear a greater portion of their coverage expenses from their paychecks, while many employers are expected to absorb the majority of the cost increase. This development underscores the ongoing challenges associated with managing healthcare expenses in the United States.

— Covid-19 hospitalizations surge in the U.S. after months of decline. Hospitalizations due to Covid-19 are on the rise in many parts of the U.S. for the first time this year. New hospitalizations have increased by approximately 16% in the U.S. over the past week, according to data from the Centers for Disease Control and Prevention (CDC). This marks a significant shift in the trend, as hospitalizations and deaths had been consistently declining week after week since January, before the summer surge began.

The recent increase in hospitalizations coincides with the return of students to school and the anticipation of updated booster shots becoming available at pharmacies this fall. Pfizer, Moderna, and Novavax are expected to release updated shots later this month. However, it's worth noting that these booster shots were designed several months ago to target the XBB.1.5 variant, which is no longer the dominant strain.

|

POLITICS & ELECTIONS |

— Former Stewart aide Celeste Maloy wins Utah primary for his seat. Former House aide Celeste Maloy has emerged victorious in the special Republican primary for Utah's 2nd District, a seat currently held by her former boss, Rep. Chris Stewart, who is set to resign next week. Maloy initially held a lead of approximately 1,400 votes in a three-way race during Tuesday night's primary. However, the Associated Press decided to wait for the results of additional mail-in ballots, which could be counted if received by Sept. 19. The AP ultimately called the race on Wednesday at 7:54 p.m., with Maloy leading by over 2,400 votes. She secured 38% of the vote, while former state legislator Becky Edwards had 35%, and former state Republican Party chairman Bruce Hough had 27%. Edwards, a critic of former President Donald Trump, conceded the race. Maloy faces legal challenges to remove her from the ballot due to her lack of active Utah voter registration as a Republican at the time of filing. Maloy, hailing from rural southern Utah, drew strong support from the rural areas of the district, while Edwards performed well in more urban regions, including Salt Lake City. Maloy, with an agricultural bachelor's degree from Southern Utah University and a law degree from Brigham Young University, spent a significant part of her career dealing with public lands policy and litigation before joining Capitol Hill.

In the upcoming special general election on Nov. 21, Maloy will face Democratic candidate state Sen. Kathleen Reibe, who won the Democratic convention in June without a primary, as well as five independent candidates. The Republican nominee is expected to have a significant advantage, given that Trump won the district by 17 percentage points over Joe Biden in the 2020 presidential election.

— Google implements policy requiring transparency in AI-generated political ads. Google has unveiled a new policy that will compel political advertisers to prominently disclose the use of AI-generated material in their advertisements. This measure aims to enhance transparency and combat the dissemination of inauthentic content. The policy is set to take effect in mid-November, a year ahead of the U.S. presidential and congressional elections.

This announcement precedes a scheduled meeting in Washington, D.C., where Senate Majority Leader Chuck Schumer (D-N.Y.) will convene discussions on AI regulation with top tech executives, including Alphabet CEO Sundar Pichai and Meta CEO Mark Zuckerberg.

Meanwhile, in Europe, similar efforts are underway, as online platforms have been urged to label AI-generated content to ensure transparency and authenticity.

|

CONGRESS |

— Sen. Mitch McConnell (R-Ky.) during a press conference indicated he has no additional information to provide regarding his health. He previously released a doctor's letter addressing concerns about his health. When questioned about potential retirement plans, he stated his intention to complete his term as leader.

— Three Senate spending bills on tap next week. Senate Majority Leader Chuck Schumer (D-N.Y.) said he would file cloture today (Thursday) on the motion to proceed to the first minibus appropriations bill. This sets up an initial procedural vote on Monday. The minibus will include three funding bills: Transportation, Housing and Urban Development; Agriculture; and MilCon-VA.

|

OTHER ITEMS OF NOTE |

— The Pentagon has ambitious plans to deploy thousands of drones through air, sea, and possibly land by 2025. Deputy Defense Secretary Kathleen Hicks shared this information in prepared remarks at a defense industry event. The initiative, known as the "Replicator" drone program, aims to showcase overwhelming U.S. military strength and counterbalance China's numerical advantage in weapon systems.

Hicks emphasized that the Replicator program represents a significant shift in U.S. military innovation towards using small, intelligent, cost-effective, and numerous platforms. The primary goal is deterrence, with the intention of avoiding conflicts through a robust show of military capability.

Of note: Drones have become increasingly important in defense operations, including their recent use in the conflict in Ukraine, primarily due to their ability to be deployed in large numbers. The Replicator program's objective is to have systems that can be used and even lost in combat on a scale of multiple thousands, further enhancing the U.S. military's capabilities.

— Federal judge orders removal of Texas river barriers targeting migrants. A federal judge has issued an order mandating the removal of floating barriers placed by Texas in the Rio Grande to deter migrants. The judge also prohibited the state from adding additional buoys to the river. These buoys have been a contentious immigration issue, drawing criticism from Democrats and the Justice Department, who consider them an illegal security initiative. Even Mexico's president has labeled them "inhumane."

Meanwhile, recent data reveals that over 60,000 migrant children have crossed the perilous Darien Gap this year. This treacherous stretch of mountainous rainforest connects South and Central America and serves as a crucial 66-mile route for migrants aiming to reach the United States and Canada. It is widely recognized as one of the most hazardous journeys on Earth. In 2023, nearly 250,000 individuals made this perilous crossing, driven by economic and humanitarian crises.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |