Economists Continue to Roll Back Odds of U.S. Recession

Global trade finance gap reached unprecedented $2.5 trillion last year

|

Today’s Digital Newspaper |

USDA daily export sale: 251,000 metric tons soybeans to unknown destinations during 2023-2024 marketing year.

China’s biggest property developer, Country Garden, avoided default with a last-minute interest payment. But it has billions more to repay within the next year.

China’s weather bureau warns of crop impacts from heavy rains. Meanwhile, China has introduced stricter rules concerning commodities trading by state-owned enterprises (SOEs) to address potential risks in the world's largest raw materials market, More in China section.

North Korean leader Kim Jong-un is planning to travel to Russia this month to meet with President Vladimir Putin to discuss the possibility of supplying Russia with more weaponry for its war in Ukraine and other military cooperation, the New York Times reports. It would be a rare trip outside his country.

A growing number of economists/traders believe the Fed will likely maintain a cautious approach to interest rate adjustments.

The scarcity of homes available for sale in the U.S. has led to a surge in home prices, reaching their highest point since October.

The issue of providing high-speed internet access to all Americans is hampered by its high cost. Example: In cases like laying fiber-optic cable across Nebraska's Winnebago Tribe reservation, the average cost of connecting each household and workplace is around $53,000.

The Philippines is contemplating a reduction in tariffs on rice imports to control rising domestic prices.

Russian President Vladimir Putin has been consistent on one thing: Russian demand must be met before restarting the Ukraine grain deal. More in Russia & Ukraine section and a special report filed on this previously (link).

Congress has a lot on his agenda. We discuss in the Congress section and in reports filed over the weekend (link) and Monday (link).

The global trade finance gap reached an unprecedented $2.5 trillion last year due to increased economic uncertainties that strained banks' capacity to provide financing, reports the Asian Development Bank. More in Trade Policy section.

First lady Jill Biden again tested positive for Covid, but President Biden did not.

After Hurricane Idalia struck Florida recently, there is a growing debate about whether federal funds should be used to rebuild infrastructure that is prone to frequent flooding. Details below.

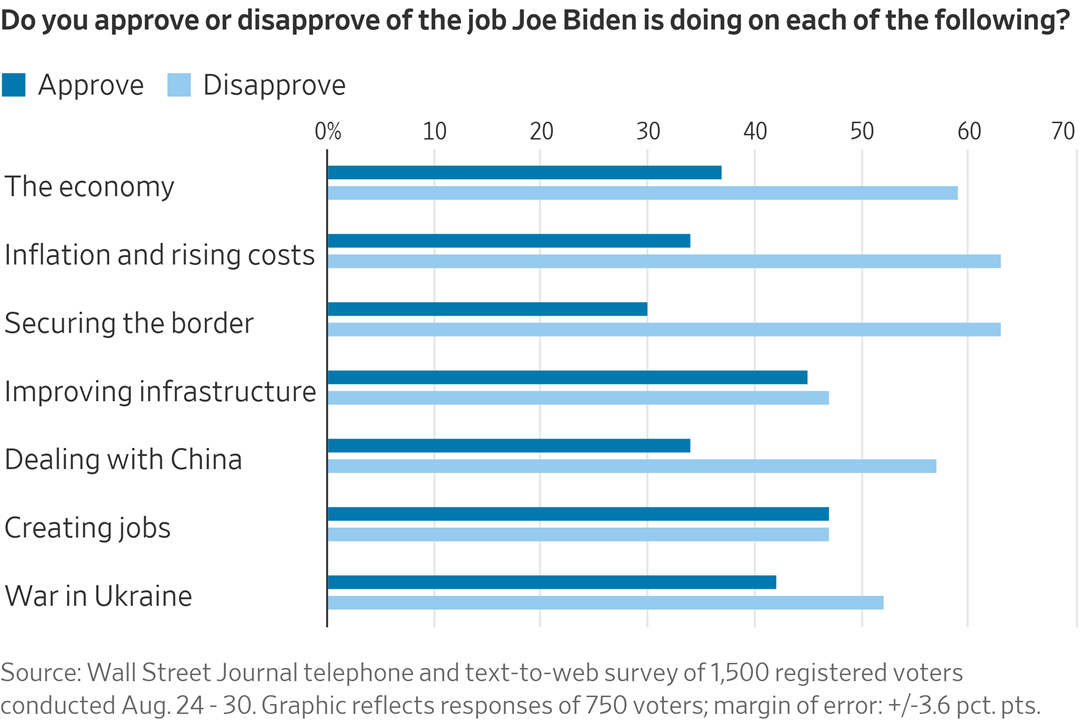

WSJ poll: Biden’s age, economic worries endanger re-election in 2024. Details in Politics & Elections.

|

MARKET FOCUS |

Equities today: Asian stock markets were mostly lower in overnight trading. U.S. Dow opened slightly higher. In Asia, Japan +0.3%. Hong Kong -2.1%. China -0.7%. India +0.2%. In Europe, at midday, London +0.1%. Paris -0.4%. Frankfurt -0.3%.

Ag markets today: Corn, soybeans and wheat held in relatively tight ranges in two-sided trade overnight. As of 6:30 a.m. ET, corn futures were trading steady to fractionally higher, soybeans were mostly 6 cents lower, SRW wheat was 4 to 5 cents higher, HRW wheat was 1 to 3 cents higher and HRS wheat was mostly a nickel higher. Front-month crude oil futures were modestly weaker, while the U.S. dollar index was around 475 points higher.

Quotes of note:

- Federal Reserve action ahead. According to TS Lombard's Steven Blitz, if the current patterns in the U.S. labor market persist, the Federal Reserve (Fed) is likely to maintain interest rates steady in both September and November. Blitz draws attention to specific sectors that are actively hiring to fill positions that were created during the pandemic. These sectors include health, accommodations and food services, and retail. He points out that the growth in hiring, excluding the sectors focused on backfilling positions, indicates a trend that resembles what is often seen before a recession. Blitz suggests that despite this trend, there is still potential for employment to recover, especially as backfilling jobs contribute to supporting the overall economy. He predicts that the Fed will not raise interest rates soon, but they also won't decrease rates. He indicates that rate cuts typically happen only when the unemployment rate drops below 4%, and he speculates that the Fed might wait until the unemployment rate is around 4.5% before considering rate cuts. In essence, Blitz's analysis suggests that the Fed will likely maintain a cautious approach to interest rate adjustments, closely monitoring employment data and economic indicators before making any significant policy changes.

- Where to for equities, according to the Sevens Report: “There are no Fed officials scheduled to speak today however the Treasury will hold auctions for 3-Month, 6-Month, and 52-Week Bills late this morning and the results of those auctions could shed light on the market’s latest outlook for Fed policy plans in the months ahead. Weak demand leading to a rise in short duration yields would be viewed as hawkish and that has the potential to put additional pressure on equity markets and other risk assets today.”

- Goldman Sachs now sees less of a chance the U.S. will slide into recession as cooling inflation and a still-resilient labor market suggest the Federal Reserve may not need to raise interest rates further. The bank now sees the probability of a U.S. recession at 15%, down from 20% previously. Reasons for the change: “First, real disposable income looks set to reaccelerate in 2024 on the back of continued solid job growth and rising real wages,” says Jan Hatzius, chief economist at Goldman. “Second, we still strongly disagree with the notion that a growing drag from the ‘long and variable lags’ of monetary policy will push the economy toward recession.”

Why the U.S. economy keeps defying predictions of recession. According to WSJ writers Nick Timiraos and Chip Cutter (link), inflation-adjusted or “real” incomes are rising, Covid-19-related shortages created enormous pent-up demand that has been less sensitive to higher rates, and government polices showered the economy with cash and allowed many businesses and consumers to lock in low borrowing costs.

The scarcity of homes available for sale in the U.S. has led to a surge in home prices, reaching their highest point since October. Redfin, a real estate brokerage, attributes this trend to homeowners' reluctance to give up their comparatively low mortgage rates. The substantial year-over-year price increase is also influenced by the fact that prices experienced a notable decline during the same period last year, mainly due to rising mortgage rates which discouraged potential buyers. The limited housing inventory has resulted in heightened competition for desirable properties, leading to a 5% year-over-year increase in the median home-sale price, which reached $380,000 during the four-week period ending on Aug. 27. Among the 50 most populous metropolitan areas, Miami, Florida, observed the most significant year-over-year surge in home prices, with the median home-sale price rising by 17% compared to a year ago.

The issue of providing high-speed internet access to all Americans is hampered by its high cost. Government officials at both state and federal levels are facing challenges in determining when the expense of establishing new broadband connections becomes too excessive. In cases like laying fiber-optic cable across Nebraska's Winnebago Tribe reservation, the average cost of connecting each household and workplace is around $53,000. This amount is even greater than the assessed value of some of the homes being connected. Supporters of broadband initiatives argue that a straightforward per-location cost assessment fails to account for the broader, long-term advantages that improved internet access can bring to rural areas. Link to details via the Wall Street Journal.

Market perspectives:

• Outside markets: The U.S. dollar index against the most traded currencies hit its highest level since May, spurred by news of another swoon in Chinese service sector growth to eight-month lows last month. The Australian dollar skidded close to its lowest levels of the year, meantime, as the Reserve Bank of Australia left interest rates on hold for the third month in a row at the last meeting chaired by Governor Philip Lowe. The yield on the 10-year U.S. Treasury note was higher, trading around 4.23%, with a higher tone in global government bond yields. Crude oil futures are under modest pressure, with U.S. crude around $85.25 per barrel and Brent around $88.35 per barrel. Gold and silver were lower, with gold around $1,956 per troy ounce and silver around $23.97 per troy ounce.

• The Philippines is contemplating a reduction in tariffs on rice imports to control rising domestic prices. Economic Planning Secretary Arsenio Balisacan indicated that the country is considering this measure to counter the impact of increasing global prices and alleviate the burden on consumers and households. He mentioned that the tariff reduction would be temporary and carefully planned. The Philippines is also focusing on accelerating recovery efforts in regions affected by typhoons. This move aligns with the actions taken by various countries worldwide to address the surge in rice prices caused by weather-related factors that have limited rice output in certain regions.

• Ag trade: Iran tendered to buy up to 180,000 MT of corn that can be sourced from Brazil, the Black Sea region or other areas of Europe and 120,000 MT of soymeal to be sourced from Brazil, Argentina or India. Egypt’s state grains buyer GASC purchased 480,000 MT of Russian wheat in a private deal on Friday but made no purchases in direct talks with trading houses on Monday.

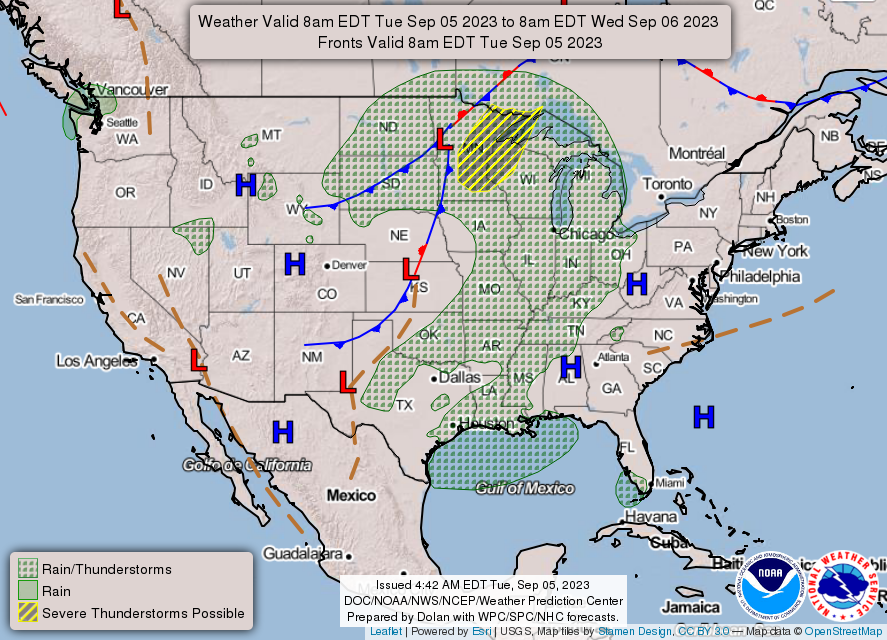

• NWS weather outlook: There is a Slight Risk of severe thunderstorms over parts of the Upper Mississippi Valley/Upper Great Lakes on Tuesday... ...There are Heat Advisories over parts of the Northeast and Mid-Atlantic on Tuesday... ...Air Quality Alerts over parts of the Northern High Plains on Tuesday.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight trade in grains to start the week

• Temps moderate, but conditions stay mostly dry

• Australia cuts wheat production forecast

• Looking for stabilization in cash cattle market

• Cash hog market continues seasonal decline

|

RUSSIA/UKRAINE |

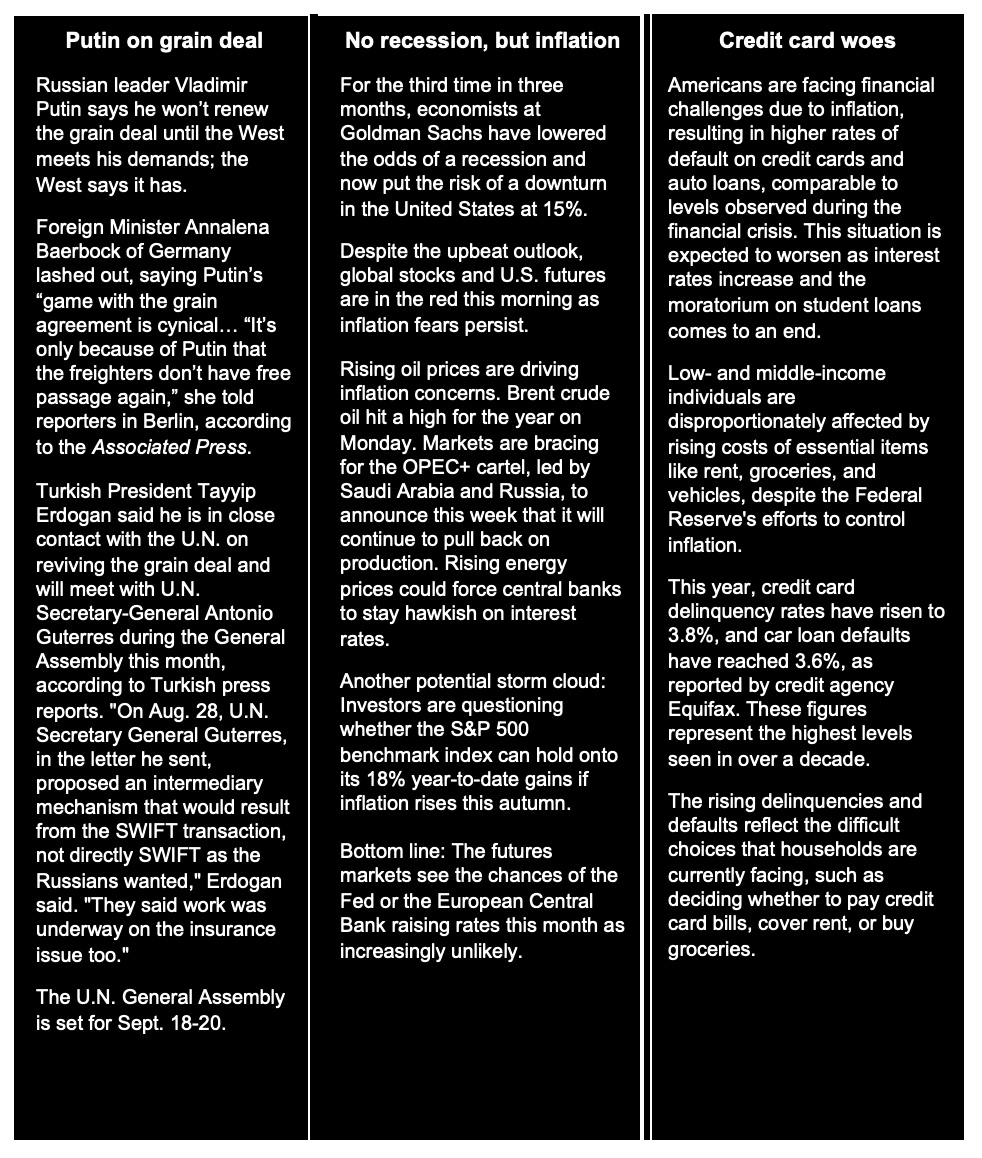

— President Vladimir Putin announced that Russia will not rejoin the grain deal allowing Ukrainian grain exports until the West fulfills its demands to facilitate Russian agricultural exports. “We are not against this deal; we are ready to immediately return to it as soon as the promises made to us are fulfilled. That’s all,” Putin said at a joint press conference after a meeting with his Turkish counterpart Recep Tayyip Erdogan in the Russian Black Sea resort of Sochi on Monday. “So far no obligations toward Russia have been fulfilled,” Putin said.

The decision comes after Russia withdrew from the U.N.-brokered grain deal, which guaranteed the safety of Ukraine's Black Sea grain exports, and launched attacks on Ukrainian grain-export facilities.

Russia's withdrawal from the deal was partially motivated by concerns about hampered food and fertilizer exports due to international sanctions.

The U.S. has been working with Turkey and Ukraine to explore alternative export routes for Ukrainian grain, including using the Danube River to ship grain to nearby ports in Romania. Turkey maintains connections with both Russia and Ukraine, serving as a trading partner and logistical hub for Russian trade, while also supporting Ukraine's ambitions to join NATO.

Turkey’s Erdogan was more upbeat. "As Turkey, we believe that we will reach a solution that will meet the expectations in a short time," Erdogan said in the Black Sea resort of Sochi after his first face to face meeting with Putin since 2022. Erdogan said that Russia's expectations were well-known to all and that the shortcomings should be eliminated, adding that Turkey and the United Nations had worked on a new package of suggestions to ease Russian concerns.

Putin said Western claims that Russia had stoked a food crisis by suspending participation in the grain deal were incorrect as prices did not rise on its exit from the deal. "There is no physical shortage of food," Putin said. "The West continues to block the supply of grain and fertilizers from the Russian Federation to world markets," Putin said, adding that the West had "cheated" Russia over the deal because rich countries got more than 70% of the grain exported under the deal.

Putin said that a plan to supply up to 1 million tonnes of Russian grain to Turkey at reduced prices for subsequent processing at Turkish plants and shipping to countries most in need was not an alternative to the grain deal. He also said Russia was close to a deal with six African countries over a plan to supply Burkina Faso, Zimbabwe, Mali, Somalia, the Central

The two presidents also discussed topics like Russia's gas exports to Turkey and increasing trade in local currencies, aligning with Russia's efforts to reduce its economic dependence on the West.

Bottom line: One of Moscow's main demands is for the Russian Agricultural Bank to be reconnected to the SWIFT international payments system. The EU cut it off in June 2022 as part of sweeping sanctions imposed in response to the invasion. Despite the discontinuation of the Black Sea Grain Initiative, Russia continues to achieve record wheat exports, and its fertilizer exports are rebounding to levels seen before the conflict. Notably, Russia recently secured an agreement to ship 1 million tons of grain to African countries through Turkey, where the grains will be processed into flour. This arrangement highlights a shift from traditional methods, as state grain buyers like Egypt are opting for private transactions instead of conventional tenders. Although Ukrainian grain can still reach the market without a new deal, elevated transportation costs are impacting profit margins, potentially resulting in reduced planting and supplies in the future.

— Kim Jong-un, the leader of North Korea, is planning to travel to Russia this month to meet with President Vladimir Putin for discussions on potential military cooperation, including supplying Russia with weaponry for its war in Ukraine, the New York Times reported (link). The meeting is set to take place in Vladivostok on the Pacific Coast of Russia, where both leaders are expected to attend the Eastern Economic Forum from Sept. 10 to 13.

Kim Jong-un is also seeking advanced technology for satellites and nuclear-powered submarines from Russia, while Putin aims to acquire artillery shells and antitank missiles from North Korea. The leaders' discussions on military cooperation have been described as "actively advancing."

The visit is expected to mark an unusual departure for Kim Jong-un from North Korea.

While officials in the White House have confirmed intelligence about the planned meeting, the details have not been declassified. A delegation of North Korean officials had previously visited Russia as a preliminary step, indicating the seriousness of Kim Jong-un's potential visit. The idea for the meeting originated from Russian Defense Minister Sergei K. Shoigu's visit to North Korea, during which Kim presented options for military cooperation and invited Putin to visit North Korea. The strengthening of ties between Russia and North Korea is seen as advantageous for both countries amid their limited number of allies and shared tensions with the United States.

Of note: Russia's Defense Minister Sergei Shoigu also confirmed that Moscow is considering joint naval exercises with China and North Korea, in what would be a first for the regime in Pyongyang.

China and Iran, other countries of concern regarding military cooperation with Russia, have also been addressed by U.S. officials, who have warned against providing lethal aid to Russia. While China has supplied dual-use technology and components, it has not yet provided drones or heavy weaponry to the Russian military. Iran, on the other hand, has supplied drones and is assisting in building a drone factory for Russia, but warnings from the U.S. have led to a reconsideration of providing ballistic missiles to Russia.

|

CHINA UPDATE |

— In August, the growth of China's service sector experienced a decline, reaching its slowest pace in 8 months. The Caixin China General Service Purchasing Managers' Index (PMI) dropped from 51.9 in July to 51.8. This decrease was unexpected, as market projections had anticipated a higher value of 53.6. This reduction in the PMI suggests a weaker expansion in service-related activities compared to previous months.

The primary factor contributing to this decline was a decrease in demand for services. New orders experienced a slowdown, indicating that the rate of acquiring new business was not as robust as before. Additionally, export sales also decreased, marking the first instance of such a decline since December of the previous year. This reduction in export sales might be indicative of challenges in international markets or a decrease in demand from foreign customers.

Furthermore, sentiment within the service sector was negatively affected, reaching its lowest level in 9 months. This implies that businesses in the service industry were less optimistic about future prospects and economic conditions. The combination of weakened demand, slowed new order growth, and declining export sales likely contributed to this subdued sentiment among service sector professionals.

— Chinese property firm Country Garden has successfully made interest payments totaling $22.5 million on two U.S.-dollar bonds just in time before the end of a grace period. The company had previously missed coupon payments on these bonds on Aug. 6, which initiated a 30-day window for them to fulfill their financial obligations before entering a state of default. By meeting this payment deadline, Country Garden has temporarily averted the risk of defaulting on these bonds.

— China’s weather bureau warns of crop impacts from heavy rains. Rainfall in eastern Heilongjiang is expected to be 20% to 50% higher than normal in September, the China Meteorological Administration said. Heavy late-season rains could slow crop maturation and harvesting, especially after two typhoons hammered the region in August. Heavy rains from Typhoon Haikui threaten rice fields in southern China, which could impact the country's rice crop. An official with the National Climate Center also said up to 50% more rainfall than normal is possible in northwestern Xinjiang, which could reduce the quality of cotton and slow harvesting.

— China has introduced stricter rules concerning commodities trading by state-owned enterprises (SOEs) to address potential risks in the world's largest raw materials market, Bloomberg reports (link). The Chinese government is seeking feedback from leading state-run energy, metals, and food companies regarding draft regulations aimed at preventing fraud and curbing what officials view as wasteful financial activities. The proposed rules would apply to major Chinese industrial groups under central government control, such as Sinopec and China Minmetals Corp.

These regulations would prohibit SOEs from engaging in commodity trades unrelated to their core businesses or not linked to actual physical shipments. The rules would also disallow closed-loop trading, where related entities trade with each other and book multiple profits from the same cargo. The aim is to reshape a sector that has experienced high-profile fraud cases and curb trading practices that divert profits away from productive areas of the economy.

While these proposals focus on central SOEs, they do not cover provincial-level SOEs or the private sector, where similar trading activities are still prevalent. The proposed rules have surprised experts with their stringent nature. The State-Owned Assets Supervision and Administration Committee, which oversees central SOEs, has not yet commented on the matter.

Bottom line: The move comes in response to various global commodities trading scandals and aims to establish stronger connections between trades and the underlying physical materials. The draft rules have also specified penalties for non-compliant trades and have received attention from several central SOEs during discussions.

|

TRADE POLICY |

— The global trade finance gap reached an unprecedented $2.5 trillion last year due to increased economic uncertainties that strained banks' capacity to provide financing, reports the Asian Development Bank (ADB). The trade finance gap represents the disparity between financing requests and approvals for supporting imports and exports. It expanded by 47% from $1.7 trillion in 2020, driven by factors such as higher interest rates, diminishing economic prospects, inflation, and geopolitical instability. The ADB's 2023 Trade Finance Gaps, Growth, and Jobs Survey, published on Tuesday (link), highlights this significant growth in the gap.

What it means: The expansion of this gap hampers the potential of trade to contribute to crucial human and economic development through job creation and growth. The ADB's Director General for Private Sector Operations, Suzanne Gaboury, emphasized the importance of trade financing in global trade, stating that approximately 80% of trade relies on some form of financing.

|

HEALTH UPDATE |

— Jill Biden, the first lady of the U.S., has tested positive for Covid-19, as announced by the White House on Monday night. She is currently experiencing only mild symptoms and will stay at the family residence in Rehoboth Beach, Delaware, where she and President Biden spent part of their weekend. President Biden tested negative for the virus following the first lady's diagnosis. He returned to the White House on Monday evening. President Biden will continue to undergo regular testing throughout the week and will be closely monitored for any potential signs of infection.

|

POLITICS & ELECTIONS |

— WSJ poll (link): Biden’s age, economic worries endanger re-election in 2024. Voters overwhelmingly think President Biden is too old to run for re-election and give him low marks for handling the economy and other issues, according to a new Wall Street Journal poll that offers a stark warning to the 80-year-old incumbent ahead of the 2024 contest. The negative views of Biden’s age and performance in office help explain why only 39% of voters hold a favorable view of the president.

|

CONGRESS |

— The key remains the same re: stopgap funding measure to avoid a gov’t shutdown Oct. 1: whether some of the most hard-right members of the House Freedom Caucus will back down from their policy demands that include border security provisions, an overhaul of the Justice Department and FBI’s budget and an end to “woke” policies at the Defense Department in exchange for supporting a Continuing Resolution (CR) to give lawmakers more time to complete work on the 12 appropriations measures. The House has passed only one of its 12 funding measures, while the Senate has approved none (the Senate’s Appropriations panel has cleared all 12 spending bills).

The CR will likely include an additional funding request by the White House, including $24 billion for the war in Ukraine, $16 billion for disaster aid, $1.4 billion for the Women, Infants and Children food assistance program and more than $1 billion for refugee assistance.

There is a distinct risk that Congress won't meet its year-end target for passing spending bills, which could trigger automatic 1% spending cuts for domestic spending, including the Pentagon but not Social Security and Medicare.

— Sen. Mitch McConnell (R-Ky.) is facing new concerns regarding his health and ability to lead the GOP (Republican Party) conference. This comes after he experienced another public freeze-up incident in Covington, Kentucky, last week, which is the second such incident in slightly over a month. McConnell's team attributed the episode to a momentary feeling of lightheadedness, which was a similar explanation provided after the previous freeze-up incident. The attending physician at the Capitol cleared McConnell, who is 81 years old, to continue with his schedule. The situation is expected to become more significant as the Senate returns to session, shining a spotlight on McConnell's ability to effectively fulfill his role as the longtime leader of the Senate Republicans.

|

OTHER ITEMS OF NOTE |

— After Hurricane Idalia struck Florida recently, there is a growing debate about whether federal funds should be used to rebuild infrastructure that is prone to frequent flooding. Meteorologists warn that the Atlantic hurricane season is not yet at its peak, and the historically warm Gulf of Mexico could contribute to the development of more powerful and deadly storms. Adding to the challenges, many insurance companies are withdrawing from certain Gulf states, leaving homeowners and businesses with greater risk and fewer options to finance their recovery efforts. This situation makes it difficult to implement rebuilding measures that would create more resilient structures capable of withstanding future hurricanes. While experts suggest raising and reinforcing homes as a viable option, achieving this without a robust insurance market poses a significant hurdle.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |