Putin to Erdogan: Open to Discussion on Grain Deal

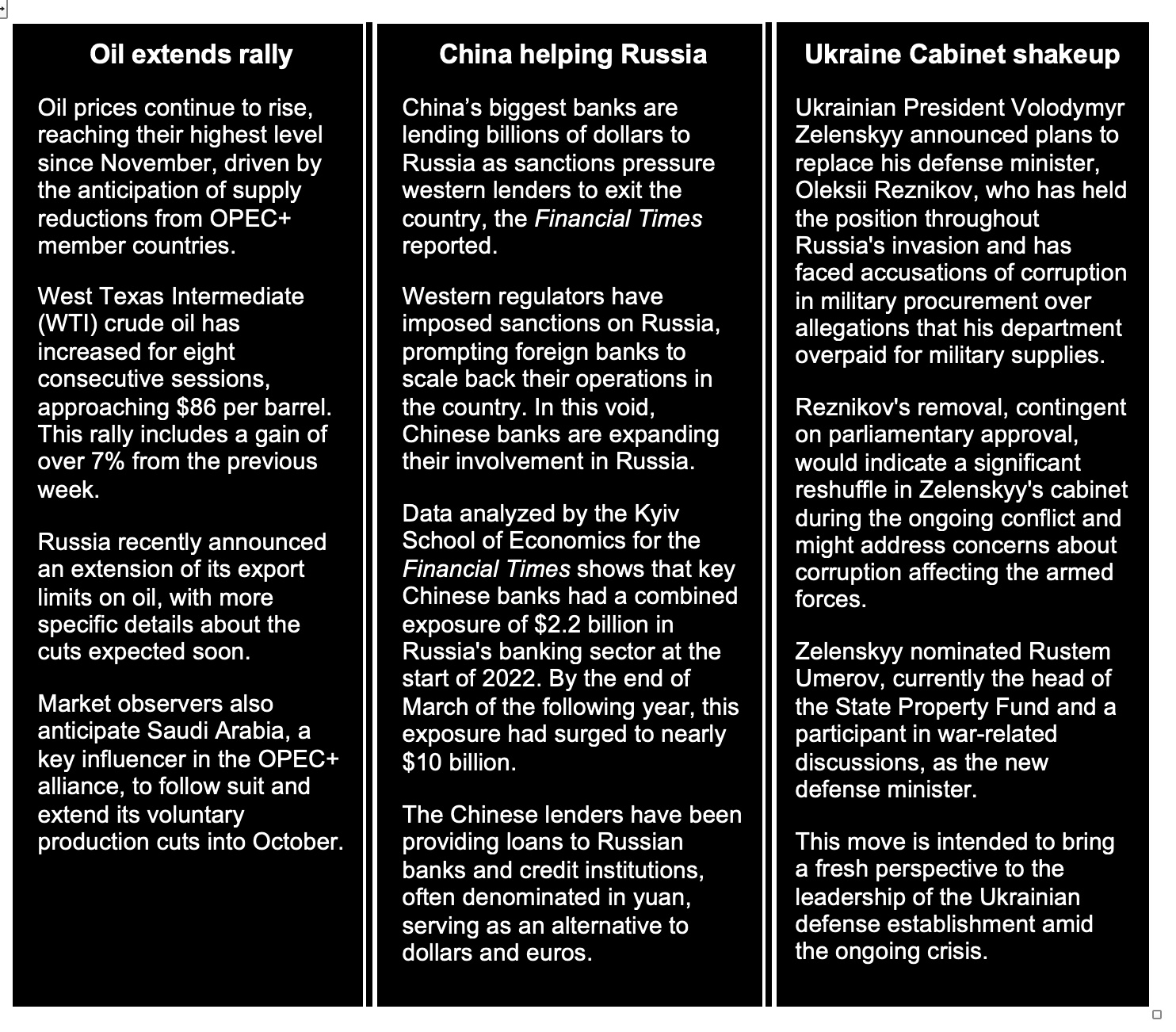

Oil continues to rally | China helping Russia | CR plan | Ukraine shakeup | Trade policy

|

Today’s Digital Newspaper |

Russia launched a drone strike on Izmail, a Ukrainian river port on the Danube. Izmail has become important for the country’s grain exports since Russia withdrew in July from a deal which allowed the export of Ukrainian food crops through the Black Sea. The latest assault lasted more than three hours, Ukrainian officials said, adding that they shot down 17 drones targeting the Izmail district, the site of a key river port, but that some evaded air defenses. “Warehouses and production buildings, agricultural machinery and equipment of industrial enterprises were damaged,” the head of the Odesa regional military administration, Oleg Kiper, said in a statement.

Turkish president Recep Tayyip Erdoğan and Russia’s Vladimir Putin met in Sochi to discuss restarting the export of grain through the Black Sea. Putin told Erdogan he was open to discussion on a grain deal. “I know you intend to raise the issue of the grain deal. We are open to negotiations on this matter,” Putin said during a televised meeting with Erdogan, who said he believes the message the leaders will send on grain at a news conference following the meeting “will be very important for developing nations in Africa.” While Russian exports of food and fertilizer are not subject to Western sanctions imposed after Russia's invasion of Ukraine, Moscow has said restrictions on payments, logistics and insurance have hindered shipments. More in Russia & Ukraine section, and we will have more updates on this topic in Tuesday’s dispatch.

Putin announced an agreement with Turkey to establish a natural gas trading hub is nearing completion.

South African President Cyril Ramaphosa said an inquiry concluded no evidence supporting American accusations that South Africa supplied weapons to Russia.

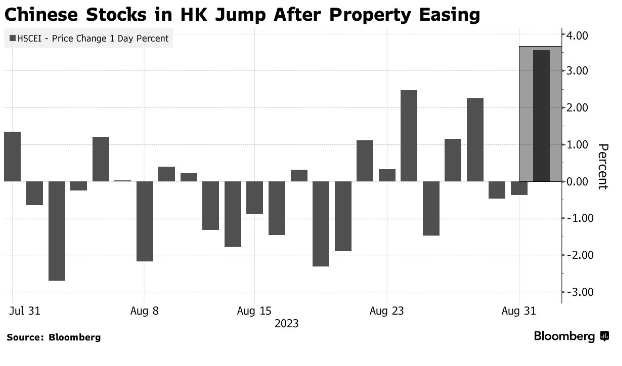

Are things starting to turn around in China? Home sales in Shanghai and Beijing, China’s two largest cities, doubled this weekend compared to the previous one. Last week China lowered the size of down payments required for a mortgage to boost the country’s ailing property sector. Meanwhile, shares in Country Garden, a struggling Chinese homebuilder, soared after it announced an agreement with some of its creditors to restructure repayments of onshore debts.

China has criticized the Biden administration's strategy toward Beijing, stating that it is "doomed to fail."

Heavy rains from Typhoon Haikui threaten rice fields in southern China, which could impact the country's rice crop, a staple grain.

The U.S. personal saving rate fell to 3.5% in July, down from 4.3% in June and 4.7% in May.

Elevated interest rates in major economies are anticipated to lead to a slowdown in global growth next year. Details in Market section.

The new BRICS-11 will account for a major share of key global inputs, according to calculations (link) by Center for Strategic and International Studies researchers Gracelin Baskaran and Ben Cahill. Details in today’s report.

The Mexican peso depreciated 1.86% against the U.S. dollar in August to end the month at 17.05 to the greenback, according to the Bank of Mexico. It was the first time this year that the peso was weaker at the end of a month than it was at the start.

Chevron, a major American energy company, initiated discussions with labor unions to prevent potential strikes at two significant liquefied natural gas (LNG) facilities in Australia.

Japan to allocate $140 million more to help fisheries after China's import ban.

Palm oil prices experienced their first decline in four sessions due to worries about rising stockpiles in Malaysia and reduced demand due to increased competition from sunflower oil.

Rains predicted for September in various parts of India are expected to mitigate crop damage and ensure sufficient food supplies after a delayed monsoon and dry August.

Malaysia is taking measures to secure rice supplies as global prices surge due to Indian export restrictions.

Egypt's state grains buyer bought about a half a million metric tons of Russian wheat in a private deal, four traders told Reuters.

The Ukrainian Grain Association (UGA) raised its grain and oilseed harvest forecast by 3.7 million tons to 80.5 million tons on better-than-expected yields helped by favorable weather.

U.S. State Dept. selected senior diplomat Mark Lambert to lead a new initiative aimed at countering China's influence globally. Meanwhile, the Senate will address Federal Reserve, NLRB, and FCC nominations this week before the House returns next week.

Trade Policy section items include:

• Brazil is sending business leaders to Cuba to rebuild trade ties.

• Ex-Treasury Secretary Lawrence Summers on U.S. trade policy.

• WTO chief criticizes rich nations for embrace of protectionism.

Mercedes-Benz introduced a nearly production-ready electric vehicle (EV) edition of its CLA sedan. This EV boasts an impressive range of approximately 750 kilometers (466 miles) on a single charge, surpassing the capabilities of Tesla's updated Model 3.

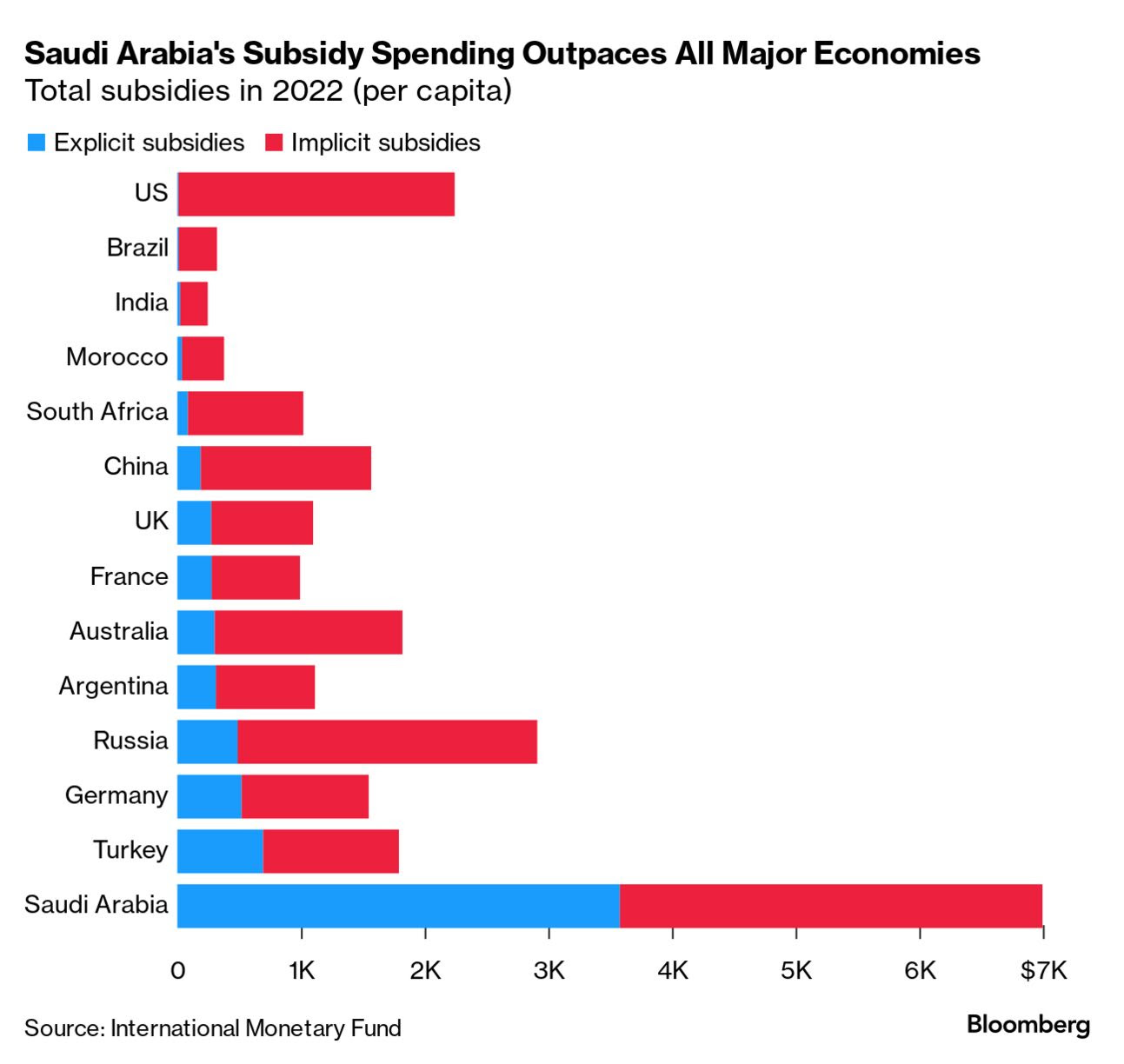

Over the last two years, Saudi Arabia's expenditure on fuel subsidies has surged, reaching the highest per capita among the Group of 20 economies.

A Wall Street Journal poll reveals that President Biden faces challenges in his re-election bid, with voters overwhelmingly believing he's too old to run again and giving him low ratings for handling the economy and other important issues. Regarding the general election, the poll suggests that Trump holds an advantage in terms of his performance in office, whereas Biden is viewed as having better personal qualities and likability. More in Politics & Elections.

Stopgap spending measure most immediate congressional issue. Details in Congress section.

A NYT article (link) looks at the summer drought of 2021 in Minnesota, which was one of the most severe in its history, causing widespread damage.

|

MARKET FOCUS |

Equities today: Global equity markets were higher on Monday, as property support measures unveiled by China lifted investors' sentiment. The Hang Seng was the top performer, led by real estate stocks after Country Garden reached a deal with creditors to extend onshore debt payments. However, Country Garden now must pay up on its dollar debt — a combined $22.5 million in two dollar note coupons within a grace period that ends Sept. 5-6. Meanwhile, the DAX and the pan-European STOXX 600 both rose about 0.6%.

U.S. equities Friday: The Dow rose 115.80 points, 0.33%, to 34,837.71. The S&P 500 was up 8.11 points, 0.18%, at 4515.77. The Nasdaq slipped 3.15 points, 0.02%, to 14,031.81.

For the week, the S&P 500 advanced 2.5%. The Dow and Nasdaq rallied 1.4% and 3.2%, respectively, each notching their best weeks since July.

Agriculture markets Friday:

- Corn: December corn futures marked a 3 1/4 cent gain on the day, settling at $4.81 1/2. That marked a 6 1/2 cent loss on the week.

- Soy complex: November soybeans closed up 1/2 cent at $13.69 1/4 and nearer the session low. For the week, November beans fell 18 1/2 cents. December soybean meal futures dropped $4.40 to $399.60 and near the session low and on the week down $15.40. December soybean oil futures rose 81 points to 63.29 cents and near mid-range. On the week, December bean oil fell 7 points.

- Wheat: December SRW futures fell 6 1/2 cents before settling at $5.95 1/2, near the session low and marking a 26 1/4-cent loss on the week. December HRW futures closed 4 1/2 cents lower at $7.22 3/4, marking a 41 3/4 cent loss on the week. December spring wheat futures fell 7 cents to $7.59 3/4, marking a 42 1/4 cent loss on the week.

- Cotton: December cotton futures rose 213 points to 89.95 cents, near the daily high and hitting a 12-month high. For the week, December cotton gained 264 points.

- Cattle: Cash cattle weakness undercut the cattle complex Friday, with nearby October futures sliding 67.5 cents to $180.15. The closing quote represented a weekly decline of $1.025.

- Hogs: Nearby October lean hog futures ended the week at $83.05, up 50 cents on the day and $3.225 higher on the week.

Quotes of note:

- China: “In key areas, Beijing remains powerful and ambitious: Its defense spending and military might continue to increase, its diplomacy is global, and it is party to economic arrangements that the United States is not. Reports of its geopolitical demise are utterly premature.” — Richard Fontaine, Chief executive officer of the Center for a New American Security in Washington.

- Prigozhin’s last words? “As the detonation sucked the air out of the aircraft’s cabin, I would wager that the last thought in the doomed dome of [Yevgeny] Prigozhin’s skull was ‘Putin!’ preceded by one of the many profanities in which the former jailbird and hotdog salesman was so fluent.” — Former British Prime Minister Boris Johnson, wagering in a Daily Mail op-ed last week that the doomed boss of Russia’s Wagner Group went down cursing Putin.

- Some large bond investors are betting that the Fed is done hiking, with BlackRock’s Jeff Rosenberg saying 2-year Treasuries are a “screaming buy.”

The U.S. personal saving rate fell to 3.5% in July, down from 4.3% in June and 4.7% in May. Immediately before the pandemic, savings rates were much higher, averaging 8.8% in 2019.

Elevated interest rates in major economies are anticipated to lead to a slowdown in global growth next year. Despite exceeding expectations in 2023, the global economy is projected to expand by 2.1% in 2024, per a collection of forecasts by Consensus Economics, compared to the expected growth of 2.4% for the current year.

The new BRICS-11 will account for a major share of key global inputs, according to calculations (link) by Center for Strategic and International Studies researchers Gracelin Baskaran and Ben Cahill:

- 42% of the world’s oil supply

- 72% of rare earth minerals, with three of the five nations with the largest reserves

- 75% of the world’s manganese

- 50% of global graphite

- 28% of nickel

Of note: “It is quite possible that a more coordinated approach” toward export restrictions to the rest of the world could now develop among the BRICS-11, the CSIS analysts wrote.

In the energy sector, the group features both major oil and gas producers as well as two of the largest importers, in China and India. So, there’s an incentive for members to set up “mechanisms to trade commodities outside the reach of the G7 financial sector,” Baskaran and Cahill wrote.

Summary of upcoming events and developments across Asia:

Monday:

- British Prime Minister Rishi Sunak will join leaders from Laos, Cambodia, and Vietnam to address the ASEAN Business & Investment Summit in Jakarta. The summit features top executives from major regional companies.

Tuesday:

- ASEAN leaders will gather in Jakarta for their second summit this year, with discussions likely to focus on regional economic integration and addressing issues such as energy transition financing, food security, and the use of local currencies.

- The ASEAN Indo-Pacific Forum, hosted by Indonesia, aims to secure funding for economic development in the region. Topics include green infrastructure, supply chain resilience, digital transformation, and sustainable financing. Japanese Prime Minister Fumio Kishida will attend the forum from Wednesday.

- Australia's monetary policy decision will be announced.

Wednesday:

- ASEAN leaders meet counterparts from China, Japan, and South Korea at the ASEAN Plus Three Summit. U.S. Vice President Kamala Harris and Chinese Premier Li Qiang represent their leaders.

- The Semicon Taiwan event, a key gathering for the semiconductor industry, features speeches from industry leaders, including Taiwan Semiconductor Manufacturing Co. Chairman Mark Liu and executives from ASE and Lam Research.

- Australia's GDP for Q2 will be released.

Thursday:

- The East Asia Summit brings together ASEAN leaders and counterparts from partner countries. Leaders will discuss regional issues, with Biden and Xi skipping the summit.

- China releases trade data for August amid pressure from slow global and domestic demand. The trade report is expected to show exports and imports contracted again in August, with figures due Saturday probably showing an increase in consumer prices, according to state media.

- Malaysia's monetary policy decision will be announced.

Friday:

- Japan's revised Q2 GDP will be published.

Weekend:

- The G20 summit will take place in New Delhi, with leaders from various countries attending. Some leaders, like President Biden, will attend while others, like Russian President Vladimir Putin, will be represented by their foreign ministers. Chinese leader Xi Jinping is skipping the meeting and Premier Li Qiang is representing Beijing instead. This marks the first time the Chinese leader will miss the landmark meeting. The announcement has dimmed hopes of a possible meeting between Xi and Biden at the ALOEC meeting in San Francisco in November. On Sunday, Biden said “I am disappointed … but I am going to get to see him.”

- The Maldives holds its presidential election, with incumbent Ibrahim Mohamed Solih facing challengers. The outcome will be significant for India and China's influence in the region.

- President Biden will visit Hanoi, Vietnam, to discuss diplomatic ties, the economy, technology, and climate with Vietnamese leaders.

Market perspectives:

• The Mexican peso depreciated 1.86% against the U.S. dollar in August to end the month at 17.05 to the greenback, according to the Bank of Mexico. It was the first time this year that the peso was weaker at the end of a month than it was at the start. Among the factors that affect U.S. sovereign credit rating, expectations that the U.S. Federal Reserve could raise interest rates (although unlikely at the Sept. 19-20 FOMC meeting) and the decision by Mexico’s Exchange Commission (Comisión de Cambios) to cut a six-year-old hedge program aimed at reducing currency volatility.

• Europe’s top copper producer Aurubis may face losses of hundreds of millions of euros after it was hit by a massive scam involving scrap metal shipments. Bloomberg has the details (link).

• Chevron, a major American energy company, initiated discussions with labor unions to prevent potential strikes at two significant liquefied natural gas (LNG) facilities in Australia. Employees had previously declined the company's proposal for enhanced wages and benefits. As the largest global exporter of LNG, Australia's two impacted projects contribute to over 5% of the world's production capacity. Concerns arise that the planned strikes, scheduled to start on Thursday, could lead to an increase in fuel prices.

• Japan to allocate $140 million more to help fisheries after China's import ban. Japanese Prime Minister Fumio Kishida said on Monday the gov’t would allocate an additional 20.7 billion yen ($141.41 million) to support the fisheries industry after China's total import ban of Japanese aquatic products.

• Palm oil prices experienced their first decline in four sessions due to worries about rising stockpiles in Malaysia and reduced demand due to increased competition from sunflower oil. Futures dropped 1.4% to 3,985 ringgit a ton in Kuala Lumpur, marking the largest daily decrease since Aug. 22. Concerns about higher prices impacting demand have prevented palm oil from sustaining gains above 4,000 ringgit since July. Factors contributing to the price decline include expectations of increased Malaysian inventories by the end of August, the narrowing price difference between palm oil and sunflower oil in key markets like India and China, and losses in Dalian vegetable oil markets.

• Rains predicted for September in various parts of India are expected to mitigate crop damage and ensure sufficient food supplies after a delayed monsoon and dry August. The food ministry's top bureaucrat, Food Secretary Sanjeev Chopra, stated in an interview with Bloomberg that India's ample grain reserves and upcoming rice harvest would prevent food security concerns. Despite recent export curbs on rice and other measures to protect the domestic market, Chopra reassured that the situation is not worrisome. Government stockpiles of rice and wheat are deemed sufficient for welfare programs, and monitoring of stockpiles by traders will prevent hoarding. Local wheat supplies are also adequate, and the decision to remove import duties is under consideration. The government is prepared to take appropriate actions if needed to address potential requirements.

• Malaysia is taking measures to secure rice supplies as global prices surge due to Indian export restrictions. The country plans to discuss the supply situation and potential actions with industry stakeholders, including the state rice importer, farmers, and the National Paddy and Rice Board. The state importer, Bernas, recently increased prices for all imported white rice by 36%, citing challenges from climate change and a weakening exchange rate, exacerbated by India's export curbs. Malaysia imports around 30% of its rice, primarily from India, Thailand, Pakistan, and Vietnam, while domestically produced rice remains price controlled. Despite sufficient supply for now, there are calls for local prices to be raised, and efforts are underway to address potential shortages.

• Egypt's state grains buyer bought about a half a million metric tons of Russian wheat in a private deal, four traders told Reuters (link), succeeding in negotiating lower prices than those offered in the more traditional tenders.

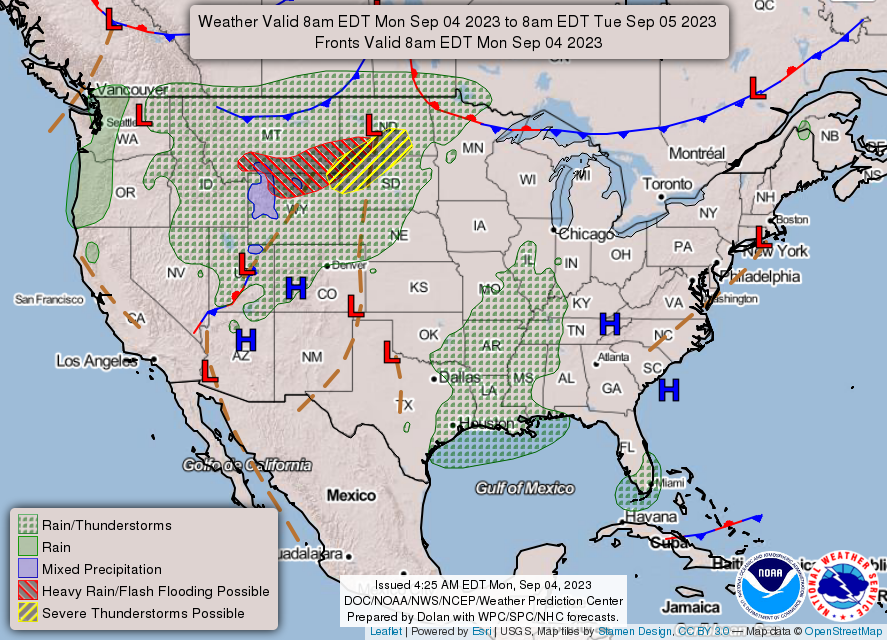

• NWS weather outlook: There is a Slight Risk of excessive rainfall over the parts of the Northern Rockies/Northern High Plains on Monday... ...There is a Slight Risk of severe thunderstorms over parts of the Northern/Central High Plains... ...There are Heat Advisories over parts of the Upper Mississippi Valley and Northeast on Monday...

|

RUSSIA/UKRAINE |

— Update on shipping in Ukraine. U.N. Secretary-General Antonio Guterres last week communicated with Russian Foreign Minister Sergey Lavrov, presenting specific suggestions to facilitate Russia's global exports and revive the Black Sea grain shipping agreement. The situation involves recent actions by the Russian military using drones to target port infrastructure in Ukrainian Danube ports, namely Izmail and Reni. These ports are crucial for Ukraine's grain exports since its seaports are currently inaccessible. Following the conclusion of the Black Sea Grain Initiative (BSGI) in July, Ukraine has continued its seaborne grain exports from Danube ports. Additionally, some grain volumes from Ukraine are being transported via barges and land routes to Romanian ports like Sulina and Constanta, where they are loaded onto bulk carriers. A recent report from Clarksons Research highlights that despite using alternative routes, Ukrainian seaborne grain exports have not reached the peak levels observed during the Black Sea Grain Initiative. In the last month, Ukraine shipped 1.1 million tonnes of grain by sea, a significant drop from the 3.5 million tonnes in May when the shipping agreement was fully operational.

Meanwhile, on Monday, Turkish President Recep Tayyip Erdogan met Russian President Vladimir Putin in the Russian resort town of Sochi, to persuade him to revive a U.N.-backed Black Sea grain deal but a barrage of Russian drone strikes on Ukrainian port facilities set a somber tone just before the talks.

What Russia wants: Russia demands an easing of its exports of food and fertilizer, which have been hit as banks, insurers and shipment companies steer clear of Russian goods, while Baltic nations have ceased handling Russian volumes through their ports. Russia also wants to reopen an ammonia pipeline that traverses Ukraine and reconnect Rosselkhozbank, a state-owned lender focused on agriculture, to the SWIFT system for international payments. Russia says it will not reopen the trade corridor unless its conditions are met.

Russia has put forward a plan suggesting the sale of 1 million tons of its grain to Turkey at a favorable price. The idea involves processing the grain in Turkey and then sending it to countries requiring it. This proposal was deliberated during a recent meeting between the foreign ministers of Russia and Turkey. Furthermore, the deal is supplemented with the possibility of financial assistance from Qatar. However, Ukraine's Foreign Ministry has raised concerns regarding any agreement that could enable Russian exports without simultaneously addressing the issue of Ukraine's maritime access. They argue that such a deal might embolden Russia to persist in its aggressive actions.

— The Ukrainian Grain Association (UGA) raised its grain and oilseed harvest forecast by 3.7 million tons to 80.5 million tons on better-than-expected yields helped by favorable weather, according to Bloomberg. This compares with 73.8 million tons of grains and oilseed harvested in 2022.

- UGA estimates wheat harvest to rise by 9% y/y to 22m tons with potential exports of 16 million tons including 4.4 million tons of carryover stock.

- Barley harvest is estimated to rise by 12% to 5.8 million tons; barley exports may be 3 million tons.

- Corn harvest is seen rising by 4% to 28 million tons and 22 million tons can be exported.

- UGA sees sunflower harvest rising by 25% y/y to 13.9 million tons; exports are seen at 0.5 million tons and 13.2 million tons will be processed in Ukraine.

- Rapeseed harvest is estimated at 4.1 million tons and exports at 4 million tons.

- Soybean harvest is estimated at 4.8 million tons and exports at 3.3 million tons.

— Russian President Vladimir Putin announced an agreement with Turkey to establish a natural gas trading hub is nearing completion. Putin and his Turkish counterpart, Recep Tayyip Erdogan, are working on the gas hub project, which aims to create a stable and balanced energy situation in the region. The hub will function as an electronic trading platform rather than a physical facility for storing large amounts of Russian fuel. The move comes as Russia seeks alternative export routes for its gas and aims to strengthen ties with Turkey in the face of strained relations with the European Union due to the conflict in Ukraine.

Of note: Putin stated that a nuclear power station being constructed in Turkey is expected to start operating in 2024.

— South African President Cyril Ramaphosa said an inquiry concluded no evidence supporting American accusations that South Africa supplied weapons to Russia. The U.S. ambassador to South Africa had alleged that a Russian ship, the Lady R, loaded arms at a naval base near Cape Town in December. However, the inquiry revealed that the ship transported weapons ordered by South Africa's own military.

|

PERSONNEL |

— U.S. State Dept. selected senior diplomat Mark Lambert to lead a new initiative aimed at countering China's influence globally. The initiative involves the Office of China Coordination, often referred to as the "China House," which was created in 2022. Lambert is set to assume the position as the head of this office. The primary objective of the "China House" is to facilitate coordination among the U.S. diplomatic staff in countering China's activities in regions extending beyond the Asia-Pacific area. Reuters first reported the news (link). Lambert was formerly the U.S. special envoy for North Korea and in 2020 established an office dedicated to blunting the rise of authoritarian influence (aka China) at the United Nations and other international institutions.

— The Senate will address Federal Reserve, NLRB, and FCC nominations this week before the House returns next week.

|

CHINA UPDATE |

— Home sales in China’s biggest cities soared over the weekend following the loosening of mortgage rules last week, local media reported.

— Chinese lenders stepped in to extend billions of dollars to Russian banks as western institutions retreated from the country during the first year of Moscow’s invasion of Ukraine, the Financial Times reports (link/paywall). The moves by four of China’s biggest banks are part of Beijing’s efforts to promote the renminbi as an alternative global currency to the dollar.

— China has criticized the Biden administration's strategy toward Beijing, stating that it is "doomed to fail." The criticism comes shortly after Commerce Secretary Gina Raimondo's visit to China to strengthen ties between the two nations. China's Ministry of State Security expressed skepticism about the U.S. focus on "competition and controlling competition," comparing it to the decades-old approach of "engagement and containment." The ministry highlighted ongoing issues such as arms sales to Taiwan, military financing, and U.S. comments about China's economy. This public assessment from the Chinese security agency reflects the challenges in improving U.S./China relations, even after diplomatic efforts.

— Heavy rains from Typhoon Haikui threaten rice fields in southern China, which could impact the country's rice crop, a staple grain. The National Meteorological Centre warns of potential flooding in provinces like Fujian, Guangdong, and southern Jiangxi, adding to the series of extreme weather events that have affected China this summer. The risk to rice production is significant as global supplies are already tight due to shipment restrictions from India and other weather-related challenges. China is the largest rice grower and importer, so any disruption in its output could further destabilize the market. The northeastern region also faces cold snaps that could affect fall grain crops, and drought in the northwest, particularly Gansu province, has already impacted corn production.

|

TRADE POLICY |

— Brazil sending business leaders to Cuba to rebuild trade ties. A delegation of more than 30 Brazilian business leaders is set to visit Havana, Cuba, as part of a four-day trade mission. This move aligns with President Luiz Inácio Lula da Silva's efforts to strengthen the relationship between Brazil and Cuba. The mission will precede Lula's own trip to Cuba, where he plans to meet with Cuba's leader, Miguel Diaz-Canel, and participate in the Group of 77 meetings, a United Nations economic summit for developing nations.

Background. Under the previous right-wing administration of Jair Bolsonaro, Brazil's ties with Cuba had deteriorated but were never completely severed. Since taking office in January, President Lula has worked to rebuild relations with both Cuba and Venezuela. This shift has created an opportunity for business leaders eager to enhance trade relations. Jorge Viana, the head of the Brazilian Trade and Investment Promotion Agency (Apex), which is leading the mission, emphasizes the importance of resuming trade relations with Central American and Caribbean countries, including Cuba.

Brazil ranks as the fourth-largest supplier of goods to Cuba, following Spain, China, and the U.S. However, the volume of Brazilian exports to Cuba in 2022 was only slightly more than half of what it had been a decade earlier.

Industries represented in the delegation include air transportation, agriculture, energy, and health. Areas with the most promising export opportunities in Cuba are food, industrial machinery, transportation equipment, and chemicals. Apex also anticipates the establishment of a commercial airline route connecting Sao Paulo and Havana.

Besides the trade mission, President Lula will travel to New York for the United Nations General Assembly. During his visit, he plans to meet with President Joe Biden, with discussions likely to encompass various international issues, including the ongoing efforts to reshape U.S. policy towards Cuba.

— Ex-Treasury Secretary Lawrence Summers on U.S. trade policy: Whereas Washington once championed free-trade deals, now its focus is on import restrictions and a “buy American” bias, he says. “Whenever anybody says they care about producers, not low prices for consumers, they are adopting a negative sum, ‘all-against-all’ vision of international economic policy” that invites challenges to the post-WWII vision the U.S. once championed, says Summers, a paid contributor to Bloomberg Television.

— WTO chief criticizes rich nations for embrace of protectionism. The head of the World Trade Organization sharply criticized western governments for embracing protectionist policies and shifting toward a power-based global trading system. “Recent unilateral protectionist measures by some developed countries coupled with a more general reticence about the multilateral trading system and the WTO is seen as cynical and hypocritical by developing countries,” WTO Director-General Ngozi Okonjo-Iweala said Monday at a conference in Berlin. “The latter feel that rich countries who have benefited immensely from the multilateral trading system to develop their economies now no longer want to compete on a level playing field and would prefer instead to shift to a power-based rather than a rules-based system,” she said.

Though Okonjo-Iweala didn’t single out any country, U.S. administrations under Presidents Joe Biden and Donald Trump have called for more domestic production in key industries and a larger focus on economic security — after more than a quarter-century of American policy fostering globalization.

|

ENERGY & CLIMATE CHANGE |

— Mercedes-Benz introduced a nearly production-ready electric vehicle (EV) edition of its CLA sedan. This EV boasts an impressive range of approximately 750 kilometers (466 miles) on a single charge, surpassing the capabilities of Tesla's updated Model 3. The announcement also includes plans for a compact electric variant of the G-Wagon. In parallel, BMW has revealed the initial prototype of its upcoming EV lineup known as the Vision Neue Klasse.

— Over the last two years, Saudi Arabia's expenditure on fuel subsidies has surged, reaching the highest per capita among the Group of 20 economies. The nation allocated approximately $7,000 per individual, accounting for around 27% of its economic output. This spending encompasses both explicit and implicit energy subsidies, as reported by the International Monetary Fund.

|

POLITICS & ELECTIONS |

— A Wall Street Journal poll (link) reveals that President Biden faces challenges in his re-election bid, with voters overwhelmingly believing he's too old to run again and giving him low ratings for handling the economy and other important issues. The poll indicates that only 39% of voters view Biden favorably, while 42% approve of how he's handling his job, compared to 57% who disapprove. In a hypothetical rematch of the 2020 election, Biden and former President Donald Trump are tied at 46% support each.

While Biden has touted his economic record and legislative achievements, 58% of voters feel the economy has worsened in the past two years, and nearly three in four believe inflation is headed in the wrong direction. Voters are divided on the direction of the job market. Biden campaign aides point to early stages in the race and public support for his federal investments in infrastructure and technology.

The poll also highlights perceptions of Biden's age, with 73% of voters considering him too old to seek a second term. However, Biden is viewed more favorably than Trump on personal characteristics such as likability and honesty. Despite these challenges, Biden aims to rally supporters around key issues like abortion rights, while Trump is facing multiple indictments.

— More info from WSJ poll. The Wall Street Journal conducted a recent survey of 1,500 American voters regarding the 2024 presidential race and economic concerns. The poll reveals that Donald Trump has strengthened his lead in the race for the Republican nomination, making a general election rematch between him and President Biden a close contest. Among GOP primary voters, 59% expressed Trump as their first choice for the nomination, marking an 11-percentage point increase from a previous poll. Notably, Trump's supporters appear steadfast, with 76% stating their commitment to their chosen candidate.

Comparatively, Trump's top rival, Florida Governor Ron DeSantis, saw a decline in support from 24% to 13% since April, with only a fraction of those voters indicating firm commitment. The poll indicates a divided GOP electorate: a sizable group firmly behind Trump and a smaller segment exploring alternative options. While voter preferences could shift before the election, a significant portion of support seems to gravitate towards Trump's most prominent opponents.

Regarding the general election, the poll suggests that Trump holds an advantage in terms of his performance in office, whereas Biden is viewed as having better personal qualities and likability. Despite the strong economy on many metrics, voters express dissatisfaction, with 58% believing that the economy has worsened over the past two years and a majority perceiving inflation negatively. The outcome of Trump's criminal trials and attention to legal issues facing Hunter Biden could also impact voter sentiment and influence the final election outcome.

|

CONGRESS |

— Stopgap spending measure most immediate congressional issue. House Minority Leader Kevin McCarthy (R-Calif.) plans to extend government funding for around four to six more weeks, possibly until November 1 or 15, sources note, aiming to bolster House Republicans' negotiating position for appropriations bills with the Senate. One potential approach is constructing a "minibus" centered on the Homeland Security funding bill. However, there's a discrepancy between McCarthy and Senate GOP leader Mitch McConnell. (R-Ky.), who prefers a short-term funding bill through the end of the year.

Senate Majority Leader Chuck Schumer wants the House to emulate the Senate's process in funding the government for the entire fiscal year, emphasizing bipartisan progress in the Senate Appropriations Committee versus the more partisan approach in the House. Schumer is expected to initiate Senate floor discussions on funding bills, potentially starting with less contentious ones.

Meanwhile, McConnell appears supportive of a supplemental spending request (Ukraine, disaster aid, WIC, etc.), which could be included in a short-term continuing resolution (CR), but its passage in the House might pose challenges.

Recall: Under the Fiscal Responsibility Act, a 1% spending cut across the board comes into effect if all 12 annual spending bills aren't passed by Jan. 1, but it is not expected to take effect until April.

|

OTHER ITEMS OF NOTE |

— NYT looks at the summer drought of 2021 in Minnesota, which was one of the most severe in its history, causing widespread damage (link). While individuals hoped for rain, large farmers turned to powerful irrigation wells to save their crops. This led to excessive groundwater usage, surpassing state permits by at least 6.1 billion gallons. A notable portion of this overuse, nearly a third, was attributed to R.D. Offutt Farms. The increased water usage benefited the company's efforts to cultivate perfect potatoes for McDonald's French fries.

This practice had detrimental consequences, affecting the environment and local communities. Watersheds dried up due to intense irrigation, trout streams warmed due to water depletion, and residential wells dried up, impacting people's daily lives. Officials even had to lower pumps to continue providing drinking water to residents in some areas. Minnesota's dependence on aquifers, particularly for water-intensive crops like potatoes, highlighted the fragility of water resources.

In a written statement, Warren Warmbold, vice president of R.D. Offutt Farms, said, “The story of 2021 was either going to be about water overages or food shortages.” Along with other farmers, he said, “we had to make difficult decisions around water use in order to save our crops and keep the food supply secure and affordable.” Warmbold also said that, over the years, R.D. Offutt had used less water than its permits allocated 97 percent of the time. “We don’t take these decisions lightly,” he wrote.

The problem of excessive groundwater use extends beyond Minnesota, as data reveals cities, industries, and farms across the U.S. are depleting aquifers at alarming rates. The article underscores the challenge of balancing agricultural needs with the protection of water resources for future generations.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |