Senate Returns This Week, House Next Week: Lengthy Agenda Including Farm Bill

Appropriations bills | Continuing resolution | Disaster aid | Air traffic control | G20 confab

Washington Focus

The U.S. Senate will return Tuesday followed by the House on Sept. 12. The key question is will there be a difference between lawmakers on recess and when they are back to work: Will they get agreement on some must-pass, sensitive issues?

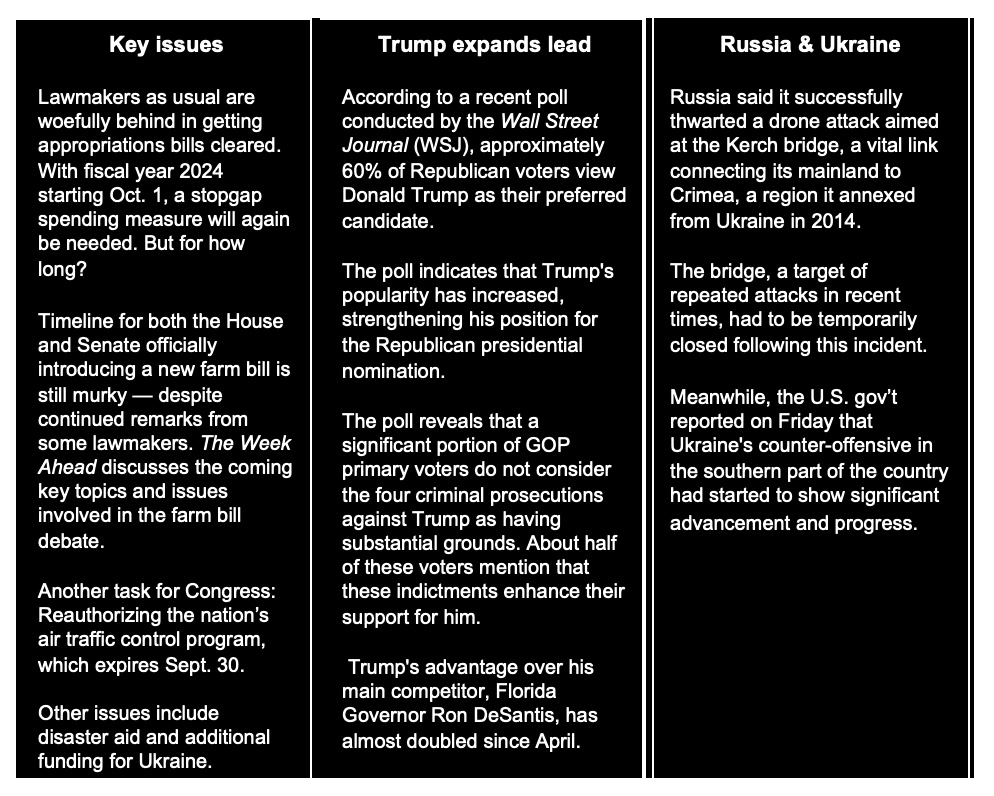

Is a gov’t shutdown really a possibility? Fiscal year (FY) 2024 begins Oct. 1. There are 12 appropriations bills that first must pass each chamber. The House has cleared only one, with none for the Senate, even though the upper chamber has passed 12 of them through the Appropriations panel.

A continuing resolution (CR) will be needed to avoid a gov’t shut down. But as most know, nothing is easy in this Congress.

The impasse between different factions of the Republican Party and the Biden administration, along with congressional Democrats, is rooted in deep and unresolved disagreements over spending priorities. Republicans controlling the House, particularly the far-right wing, have differing views from the Biden administration and Senate Republicans, led by Sen. Mitch McConnell (R-Ky.), who align more closely with the Biden administration on certain issues such as U.S. aid to Ukraine.

McConnell has historically played a pivotal role in negotiating spending deals between congressional Republicans and Democratic presidents, but it's uncertain if he can continue doing so. The current deadlock emerged from an agreement reached in May between House Speaker Kevin McCarthy (R-Calif.) and White House negotiators to raise the debt ceiling. This agreement set spending levels for the upcoming years while preserving Biden's domestic spending plans.

But there is still a big hurdle ahead. Despite Congress approving the debt ceiling deal, House Freedom Caucus members and allies have sought to undermine or overturn it. They've blocked some spending bills, including the FY 2024 Ag spending measure, and insisted on lower spending levels than agreed upon — and they also pushed some aggressive amendments that most farm-state lawmakers oppose. They've also proposed adding measures, like abortion bans, that the White House opposes.

McConnell attributes the impasse to the House's departure from the agreed-upon spending levels. He suggested a short-term spending measure might be necessary, likely lasting until December. But as expected, some conservative House members are against this idea.

While gov’t shutdowns are unpopular, some on the GOP right see them as leverage for spending cuts. This divides the Republican caucus; far-right members represent staunchly conservative districts that might support a shutdown temporarily, while others are in competitive districts that favor avoiding a shutdown.

McCarthy faces a dilemma like May’s debt ceiling deal: should he accept a deal with Democratic support, possibly alienating his party's right wing, or block a deal and risk a shutdown, which could affect his speakership or the majority's reelection chances?

Feather in the CR cap? External events, like Hurricane Idalia's damage in Florida, might influence the situation. Such events have prompted Congress to pass disaster relief funds as part of stopgap spending measures, potentially providing a path forward.

Bottom line: The weeks ahead will see various lawmakers spinning their positions with no clear conclusion at this juncture.

What about the new farm bill? With Congress returning from their long summer recess, it is unclear whether either chamber will officially release farm bill language this month. Various lawmakers have already said they want to wait to see how the funding issues unfold before starting the debate on a new farm bill.

But if there is a CR that goes into December, leaders from both political parties will want to clear a major bill to show they can accomplish things. One of those signature issues could be the farm bill.

Farm bill timeline: The real deadline is at the end of the year and not at the end of September when some farm bill provisions expire. That means lawmakers may wait a while before extending the current farm bill. If that occurs, pay attention to the length of the extension request. If it is only for a few months, that means lawmakers believe there is a chance to complete a new farm bill. If it is a one-year or longer extension, the issue has been punted. Also, when language of any new farm bill is officially unveiled is important. Reason: Key lawmakers have indicated they would want a committee markup of the bill in a week to two weeks after introducing the omnibus measure. And whenever that process starts, lawmakers from both the House and Senate would likely have some assurance from their leaders that the bill would be voted on in the full House and Senate.

Keys to the eventual farm bill debate include:

- Chairman’s mark: This is where some initial farm bill surprises could surface. This is voted on up or down with no amendments. So pay close attention.

- Farm bill markup in committee: Some sensitive farm bill issues will not likely be part of the measure introduced in both chambers, but these could and likely will surface during markup where panel votes will take place.

- Floor amendments: This is when some things attacking farm bill programs surface, so lawmakers are aware of the need to garner the votes to defeat them. Some positive amendments are possible.

U.S. Commerce Secretary Gina Raimondo characterized her recent trip to China as having achieved significant progress, but she emphasized that trust cannot be established unless Beijing takes concrete actions, particularly in areas like implementing more predictable regulations. In an interview on CBS's Face the Nation, Raimondo highlighted her stance since returning from the four-day visit, during which she held meetings with senior Chinese officials. The trip was part of the Biden administration's efforts to ease tensions between the world's two largest economies.

During Raimondo's visit, formal communication channels were re-established between Washington and Beijing, which had been severed due to deteriorating relations over the years. These restored channels include a working group focusing on commercial matters and an "information exchange" related to export control enforcement. The two sides also agreed to engage in discussions regarding trade secrets.

Raimondo expressed optimism about the progress made but cautioned against using the term "trust" to describe the situation. She stated that tangible actions need to be observed before trust can be built between the two nations.

Regarding Chinese investment in the U.S., including in areas like farmland, Raimondo acknowledged that not all investments from China pose a threat to national security, but many do.

Sept. 4: Russian President Vladimir Putin and Turkish President Recep Tayyip Erdogan are set to meet in the Black Sea resort town of Sochi to discuss the Ukraine grain export deal that the Kremlin declined to renew last month.

Sept. 5: 78th session of the United Nations General Assembly opens.

Sept. 5: The ASEAN Business Summit begins in Jakarta. World leaders due to address the gathering of Pacific nations include Japanese prime minister Fumio Kishida, Philippine president Ferdinand Marcos Jr and U.K. premier Rishi Sunak.

Sept. 9-10: Leaders of Group of 20 nations will hold their annual summit in New Delhi, including President Joe Biden, but not (for the first time at this geopolitical club’s gathering) his Chinese counterpart Xi Jinping.

Sept. 10: President Biden will make a stop in Vietnam on his way back from the G20 meeting.

Bill Richardson, a two-term Democratic governor of New Mexico and a US ambassador to the United Nations who dedicated his post-political career to working to free Americans detained overseas, has died. He was 75. The Richardson Center for Global Engagement, which he founded and led, said in a statement Saturday that he died in his sleep at his home in Chatham.

Economic Reports for the Week

Despite it being shortened due to the holiday, several significant economic events are coming this week. These events include the release of data on factory orders, initial jobless claims, and consumer credit. These releases will draw attention to the actions of the Federal Reserve, and this focus will likely intensify as various members of the Federal Open Market Committee (FOMC) are scheduled to deliver speeches. Additionally, the Fed's Beige Book for September is set to be published, and analysts will dissect its contents to gain insights into the economic situation.

The CME FedWatch tool (link), which tracks market expectations, indicates a low probability of 6% for a 0.25% increase in interest rates at the next Fed meeting planned for Sept. 19-20. However, trading in the fed funds futures contract suggests that there is a slightly higher likelihood of just under 35% for an interest rate hike of either 0.25% or 0.50% before or at the Oct. 31-Nov. 1 meeting.

Monday, Sept. 4

- Holiday: U.S. and Canadian markets closed for Labor Day holiday.

Tuesday, Sept. 5

- Motor vehicle sales: Unit vehicle sales in August are expected to edge higher to a 15.6 million annual rate from 15.7 million in the prior two months.

- Factory orders are expected to fall 2.6% in July versus June's 2.3% rise. Durable goods orders for July, which have already been released and are one of two major components of this report, fell back 5.2% on the month.

- Earnings include Zscaler, HealthEquity, and Asana.

Wednesday, Sept. 6

- MBA Mortgage Applications

- International trade: A deficit of $68.0 billion is expected in July for total goods and services trade which would compare with a $65.5 billion deficit in June. Advance data on the goods side of July's report showed a $2.4 billion widening in the deficit.

- PMI Composite Final: No change at the mid-month's 51.0, the slowest pace since February, is the call for the PMI service's August final.

- ISM services are expected to hold nearly steady in August at 52.4 versus 52.7 in July which was 3 tenths below expectations and 1.2 points below June.

- Beige Book: This book is produced roughly two weeks before the monetary policy meetings of the Federal Open Market Committee. On each occasion, a different Fed district bank compiles anecdotal evidence on economic conditions from each of the 12 Federal Reserve districts.

- Federal Reserve: Susan Collins speaks.

- Earnings include UiPath, GameStop, American Eagle Outfitters, and C3.ai.

Thursday, Sept. 7

- Jobless Claims for the Sept. 2 week are expected to come in at 238,000 after falling 4,000 to 228,000 in the prior week.

- Productivity and costs: The second estimate for second-quarter nonfarm productivity is expected to rise 3.6% versus 3.7% annual expansion in the first estimate. Unit labor costs, which in the first estimate for the second quarter rose 1.6%, are expected to rise at a 1.7% rate in the second estimate.

- Fed Balance Sheet

- Money Supply

- Federal Reserve speakers: John Williams and Raphael Bostic.

- Earnings include DocuSign, Guidewire Software, Smartsheet, and Planet Labs.

Friday, Sept. 8

- The second estimate for July wholesale inventories is expected to fall 0.1%, unchanged from the first estimate.

- Consumer credit is expected to increase $18.0 billion in July versus $17.9 billion in June.

- Earnings include Kroger and Rent the Runway.

Key USDA & international Ag & Energy Reports and Events

The United Nations’ monthly food price index will be released Friday, the day when Statistics Canada will also publish its data on reserves of crops such as wheat and soybeans. On Wednesday, Brazil’s Conab issues production, area and yield data for corn and soybeans.

The energy market could experience significant movement following the disclosure of details about Russia's new agreement with the OPEC+ group, which involves cutting oil supply to the market. This development could potentially impact global oil prices and have wider implications for the energy sector. Gas traders are also closely watching whether a labor dispute in Australia will lead to work stoppages on Thursday.

Tuesday, Sept. 5

Ag reports and events:

- Export Inspections

- Crop Progress

- Dairy Products

- Purdue agriculture sentiment

- Australia’s Abares releases quarterly report

- East Malaysia Palm and Lauric Oils conference, Sarawak, day 2

- Malaysia’s Sept. 1-5 palm oil exports

- EU weekly grain, oilseed import and export data

Energy reports and events:

- Barclays CEO Energy-Power Conference, New York (through Sept. 7); speakers include Halliburton Co. CEO Jeffrey Miller, Woodside Energy Group Ltd. CFO Graham Tiver

- APPEC oil and energy conference, Singapore, day 2

- Gastech conference, Singapore (through Sept. 8)

Wednesday, Sept. 6

Ag reports and events:

- Broiler Hatchery

- Brazil’s Conab issues production, area and yield data for corn and soybeans

Energy reports and events:

- API weekly U.S. oil inventory report

- APPEC oil and energy conference, final day

- Barclays CEO Energy-Power Conference, day 2; speakers include CEOs of Schlumberger Ltd. and Kinder Morgan Inc.

- Gastech conference, day 2

Thursday, Sept. 7

Ag reports and events:

- Livestock and Meat International Trade Data

- Port of Rouen data on French grain exports

- Holiday: Brazil

Energy reports and events:

- Unions at two of Chevron Corp.’s LNG export plants in Australia may stop work if there isn’t an agreement on pay and conditions

- EIA natural gas storage change

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Insights Global weekly oil product inventories in Europe’s ARA region

- Barclays CEO Energy-Power Conference, final day; speakers include Hess Corp. CEO John Hess

- Gastech conference, day 3

- China first batch of August trade data, including oil and gas imports

- Holiday: Brazil, Iraq

Friday, Sept. 8

Ag reports and events:

- Weekly Export Sales

- U.S. Agricultural Trade Data Update

- CFTC Commitments of Traders report

- Peanut Prices

- FAO food price index and monthly grains report

- StatsCanada stockpile data for soybeans, wheat, barley and canola

- FranceAgriMer’s weekly crop condition report

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- Gastech conference, final day

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |