Fed’s Preferred Price Gauge Ticked Higher as Inflation Fight Gets Tougher

Brazil bests U.S. on corn exports | Idalia impacts on crops | Is Fed overdoing it on rate hikes?

|

Today’s Digital Newspaper |

The Federal Reserve's preferred measure of inflation exhibited a slight increase on a yearly basis in July, underscoring the ongoing challenge of addressing inflation. The core Personal Consumption Expenditures (PCE) price index, a reading that excludes the more volatile costs of food and energy, demonstrated an annual price growth of 4.2% in July, slightly up from the 4.1% rate recorded in June. However, when considering monthly changes, price growth remained relatively steady. This data comes from the latest release by the Bureau of Economic Analysis on Thursday. Economists surveyed by FactSet had predicted that the core PCE would reach 4.2% in July, with a monthly increase of 0.2%.

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, has cautioned against excessively tightening monetary policy, emphasizing the need to avoid negative impacts on the U.S. labor market.

In response to a series of bank failures earlier this year, regulators are taking stronger measures to enhance supervision over regional banks. The Federal Reserve has discreetly demanded that these regional lenders bolster their liquidity planning.

Shares of Visa and Mastercard rose to record prices as the credit card giants could soon increase merchant fees, according to a Wall Street Journal report. The higher fees will force merchants to shell out $502 million more per year, payments consulting firm CMSPI estimated, and one analyst warned the change could drive businesses to push non-credit card payments like cash, Venmo and the Federal Reserve’s new FedNow payment system.

New overtime rules could make millions more eligible. Under a Biden administration proposal, employees who make around $55,000 or less a year would qualify by default for time-and-a-half pay if they work more than 40 hours a week. That would extend eligibility to 3.6 million new workers, the Labor Department said. The current threshold is $35,568 a year.

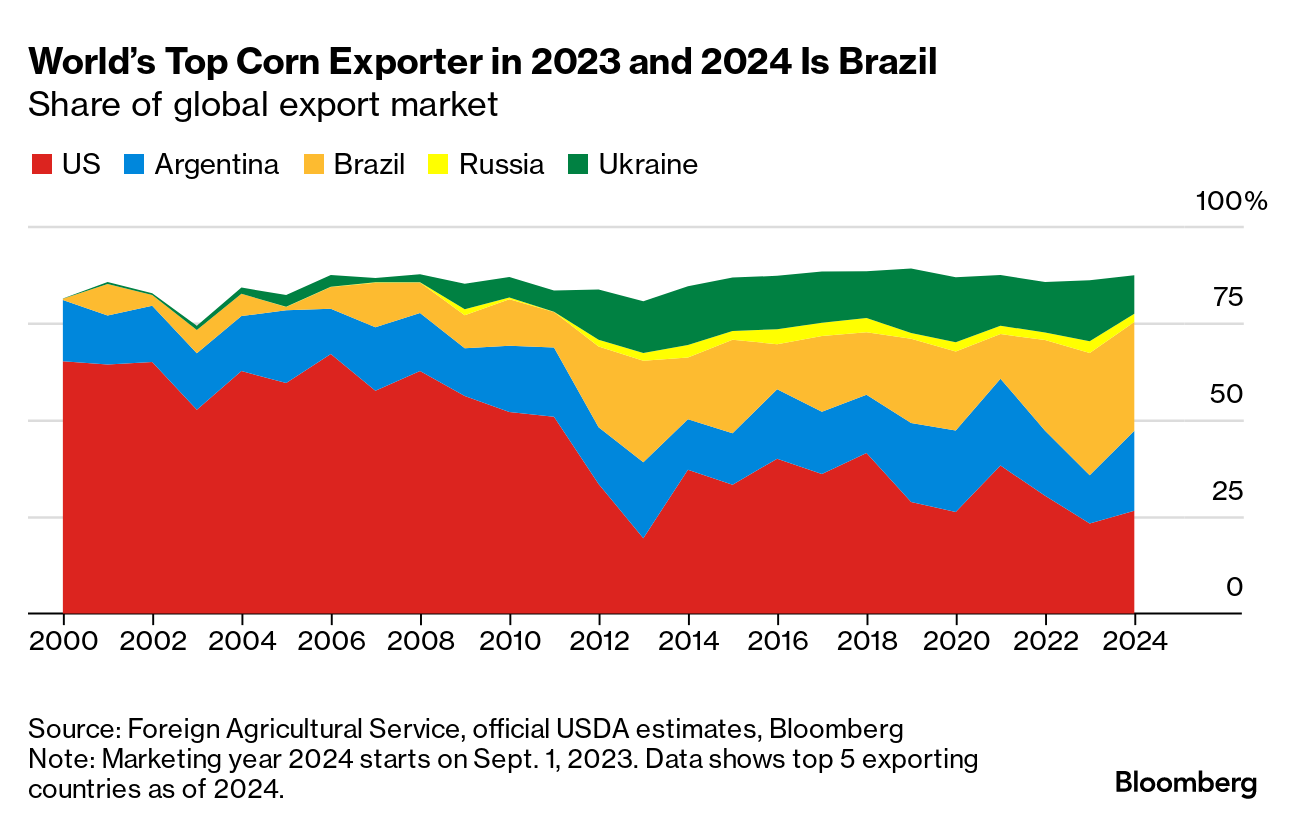

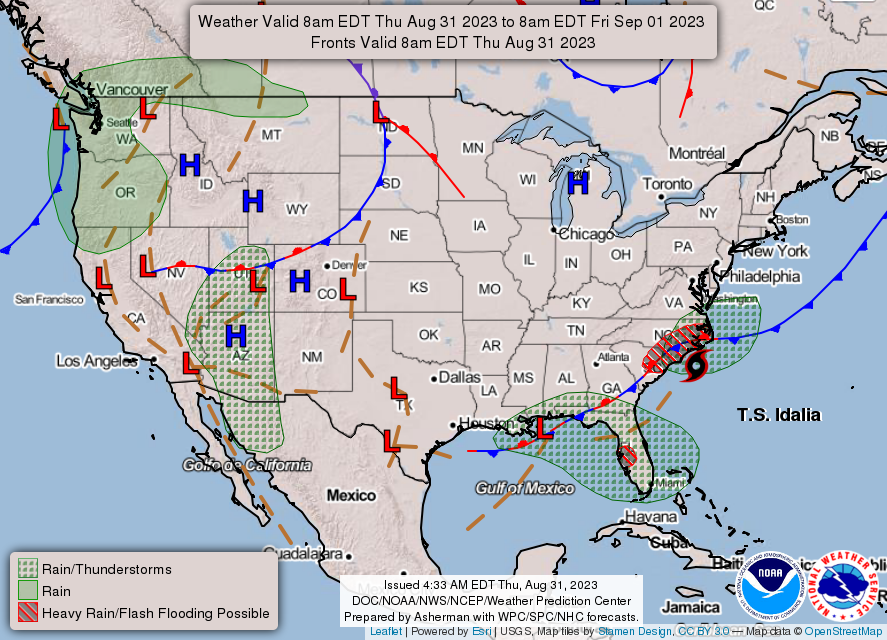

Initial impact of Idalia on crops: Some lodging of cotton and corn may have occurred, although much of the corn crop had already been harvested from the most negatively impacted areas in Florida and Georgia. The most concentrated area of cotton is produced northwest of where the greatest wind occurred, which should have also helped to spare much of that crop from damage. More in Markets section.

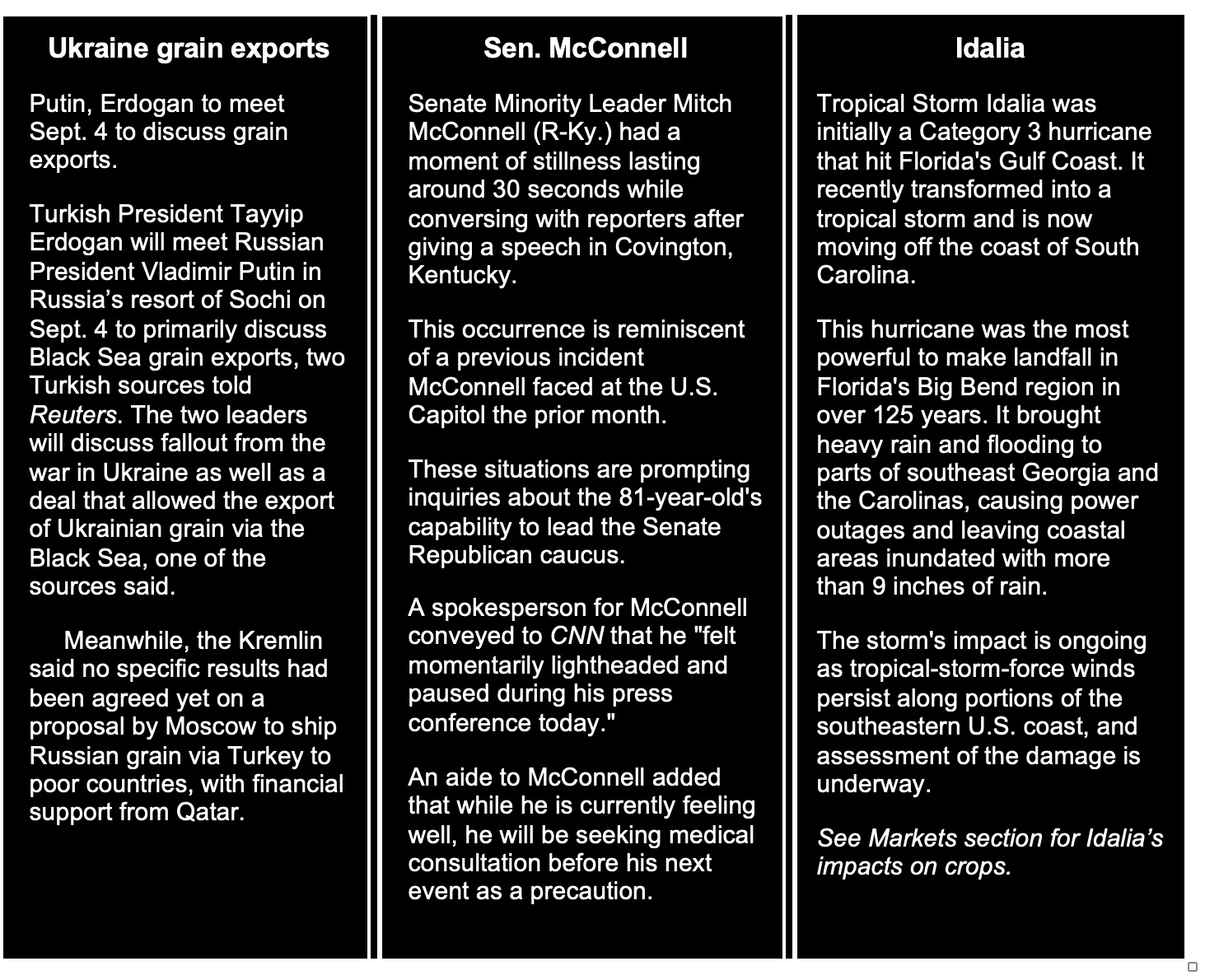

The U.S. lost its corn-exporting crown to Brazil and may never get it back, Bloomberg reports. Brazil shipped more of the staple overseas in the 2023 season, and is on track to do it again next year.

Economists think it could be 2024 Q2 or later that the U.S. will start to rebuild the cattle herd, and as a result, consolidation could shake-up the industry, and further consolidation within meat processing could hit all protein sectors.

AAA reports that the average expense for owning and operating a new vehicle has risen to $12,182 for Americans. This reflects an approximately 14% year-over-year increase.

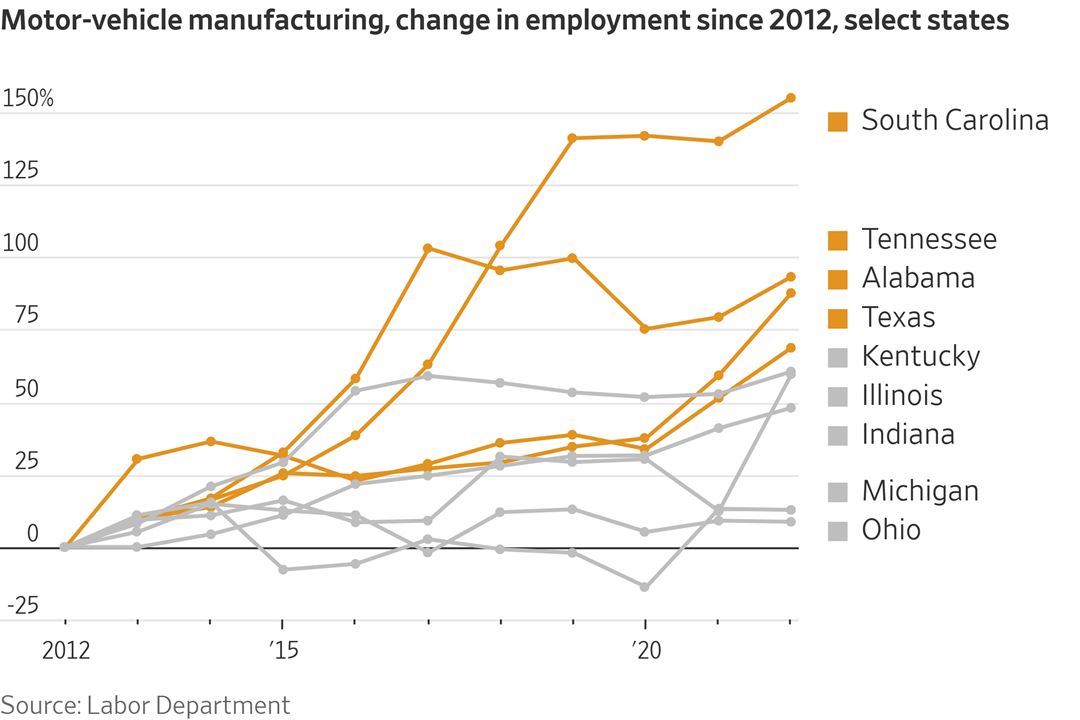

Electric vehicle (EV) revolution is causing a transformation in rural towns across the American South as the U.S. auto industry relocates and invests heavily in states like Georgia, Kentucky, and Tennessee, the Wall Street Journal reports. More below.

Russian crude oil products, including diesel and kerosene, are flooding into Europe, Politico reports. This has led Ukraine to request stricter sanctions against Russia.

China section items of note include:

• China's official Purchasing Managers' Index (PMI) for manufacturing has shown an unexpected increase, driven by a notable rise in production and an improvement in new orders.

• The U.S. has granted $80 million in military aid to Taiwan, marking the first instance of such aid being provided under the Foreign Military Financing program, typically reserved for sovereign nations.

• China is running out of arable land to produce the high-protein food demanded by its wealthier population, Caixin Global reports, as official statistics show a downward trend in grain consumption and growth in meat, dairy and seafood.

• Reuters: Xi to skip G20 summit.

Shell Plc has recently terminated what was once the world's largest corporate initiative aimed at creating carbon offsets. Details in Energy & Climate Change section.

In a letter to the DEA, the Department of Health and Human Services recommended reclassifying marijuana to a lower-risk drug after President Joe Biden asked the department last year to review how marijuana is scheduled under federal law. Marijuana is currently a Schedule I drug, the same designation as substances like heroin and ecstasy, with no accepted medical use and a high potential for abuse.

|

MARKET FOCUS |

Equities today: Asian stock markets were mixed and European stock markets mostly up in overnight trading. U.S. stock indexes are pointed to narrowly mixed openings. In Asia, Japan +0.7%. Hong Kong -0.5%. China -0.6%. India -0.4%. In Europe, at midday, London +0.1%. Paris -0.1%. Frankfurt +0.6%.

U.S. equities yesterday: The Dow rose 38 points, or 0.1%. The S&P 500 increased 0.4%. The Nasdaq gained 0.5%.

Agriculture markets yesterday:

- Corn: December corn futures fell 6 cents before settling at $4.80 3/4, near the session low.

- Soy complex: November soybeans fell 5 3/4 cents to $13.86 3/4 and nearer the session low. December soybean meal dipped $1.70 to $410.20 and near mid-range. December bean oil lost 70 points to 62.63 cents and near the session low.

- Wheat: December SRW futures rallied 6 1/2 cents before settling at $6.07 and nearer the session high. December HRS futures closed 2 1/2 cents higher at $7.31 3/4. December spring wheat futures saw relative weakness and closed 6 1/4 cents lower at $7.79 1/2.

- Cotton: December cotton closed up 99 points at 87.88 cents and nearer the session high.

- Cattle: Expiring August futures, which go off the board at noon today, tumbled $2.20 to $178.80 Wednesday, while most-active October fell $1.425 to $180.05. August feeders, which also expire at noon today, slid 65 cents to $250.05. October feeder futures dropped $1.525 to $255.225.

- Hogs: Despite sustained cash and wholesale pork weakness, hog futures turned sharply higher Wednesday. Nearby October soared $2.875 to $83.60.

Ag markets today: Corn and soybeans posted two-sided trade overnight, while winter wheat futures were unable to build on yesterday’s corrective gains and spring wheat faced followthrough selling. As of 7:30 a.m. ET, corn futures were trading steady to a penny higher, soybeans were fractionally higher, SRW wheat was 5 to 8 cents lower, HRW wheat was mostly a dime lower and HRS wheat was mostly a nickel lower. Front-month crude oil futures were around 70 cents lower, and the U.S. dollar index was nearly 400 points higher.

Market quotes of note:

- Is the Fed overdoing rate hikes? Raphael Bostic, President of the Federal Reserve Bank of Atlanta, has cautioned against excessively tightening monetary policy, emphasizing the need to avoid negative impacts on the U.S. labor market. Speaking at an event in South Africa, he noted that current U.S. monetary policy is suitably restrictive. Bostic advocated for a cautious and patient approach, suggesting that the existing restrictive policy should be allowed to affect the economy, to prevent the potential of excessive tightening and its associated unnecessary economic consequences.

- “What Russia is doing is running an opaque, improvised supply chain.” — A senior official in Washington, on Moscow’s production of drones in defiance of Western sanctions.

- Grain market update from grain trader and analyst Richard Crow: The weather forecast has limited differences. The major forecast is for heat next week and dry weather. Around Sept. 5 to 7, showers are possible across the central corn belt. The question in the market is what the U.S. crops are doing. The discussion is for a low 170 corn yield and a bean yield under 50. Limited harvest is available to give any support to the yields. The markets have not been able to hold rallies. Producers have been good sellers of beans in the $14 area. The Mississippi River continues to be a potential problem. The low water levels will slow the movement of grain by water. PNW becomes an alternative and shipment by rail to the gulf. Interior cash values are likely to suffer.”

Assessing Idalia’s impact on crops. Hurricane Idalia, which has been downgraded to a tropical storm and is moving off the Carolina coast, left behind flooding rains and high winds. World Weather Inc. says, “Some lodging of cotton and corn may have occurred, although much of the corn crop had already been harvested from the most negatively impacted areas in Florida and Georgia. The most concentrated area of cotton is produced northwest of where the greatest wind occurred, which should have also helped to spare much of that crop from damage. Much of the rainfall that occurred in cotton areas of Georgia, Alabama and Florida was welcome because of the recent bouts of heat and moisture stress that was impacting the crop. Not only was that the case for cotton, but also for peanuts and soybeans. Since most of the cotton is produced northwest of where the greatest rain fell flooding was minimal in key production areas and mostly the moisture will prove to be highly beneficial.”

The cost of owning a vehicle has surged significantly in 2023. AAA reports that the average expense for owning and operating a new vehicle has risen to $12,182 for Americans. This reflects an approximately 14% year-over-year increase, largely influenced by higher sales prices, enhanced depreciation post-purchase, and declining used car prices. Moreover, maintenance and insurance costs have gone up, particularly due to higher prices for replacement parts, labor, and various other factors.

Fed takes actions on regional banks. In response to a series of bank failures earlier this year, regulators are taking stronger measures to enhance supervision over regional banks. The Federal Reserve has discreetly demanded that these regional lenders bolster their liquidity planning. Specifically, the Federal Reserve has issued confidential warnings to banks with assets ranging from $100 billion to $250 billion. This group includes institutions like Citizens Financial, Fifth Third Bancorp, and M&T Bank. The warnings cover a broad range of aspects, spanning from the banks' capital and liquidity levels to their technological capabilities and compliance practices.

The Biden administration has presented a proposal to expand eligibility for overtime pay at a rate of one and a half times the regular wage for an additional 3.6 million workers. The update involves raising the income threshold required for eligibility to approximately $55,000. This is a significant change from the current threshold, which was established in 2020 and applies to workers earning up to $35,568 annually. Acting Labor Secretary Julie Su highlighted that numerous individuals have been working extended hours without receiving extra compensation. The new regulation is anticipated to impose a cost of $1.2 billion on employers during the initial year of implementation. However, it is also expected to contribute to an increase of $1.2 billion in total wages, according to estimates provided by the Labor Department.

Visa and Mastercard intend to raise the fees that merchants are charged when customers make credit or debit card payments, both in-store and online, starting from October, the Wall Street Journal reports. This move could result in an additional annual increase of approximately $502 million in fees, as projected by consulting company CMSPI. In 2022, U.S. merchants paid a record-breaking $160.7 billion in swipe fees, marking a 17% rise from the preceding year, as reported by the Nilson Report. Merchants often respond to these costs by adjusting prices or offering discounts to customers who pay with cash, checks, or debit cards. CMSPI indicated in a recent blog post that digital merchants should brace for an additional $154 million in costs due to a digital services fee planned by Visa, as well as around $82 million from an updated billing structure by Mastercard. Visa, Mastercard, and major banks argue that these fees are essential to cover the costs of innovation and fraud prevention.

Electric vehicle (EV) revolution is causing a transformation in rural towns across the American South as the U.S. auto industry relocates and invests heavily in states like Georgia, Kentucky, and Tennessee, the Wall Street Journal reports (link). This relocation is generating both excitement and unease in these rural communities, as they prepare for an influx of new workers and residents. While the shift of the auto industry's geographic footprint has been gradually unfolding over several decades, it has accelerated notably in recent years due to the growing focus on electric vehicles. With more than $110 billion in EV-related investments announced by auto companies in the U.S. since 2018, approximately half of these funds are designated for Southern states.

Market perspectives:

• Outside markets: The U.S. dollar index was higher. Nymex crude oil futures prices are slightly firmer and trading around $82.00 a barrel. The benchmark U.S. Treasury 10-year note is presently around 4.1%.

• The U.S. lost its corn-exporting crown to Brazil and may never get it back, Bloomberg reports (link). Brazil shipped more of the staple overseas in the 2023 season, and is on track to do it again next year. America’s corn industry has, until now, never before spent two back-to-back years in second place.

• Economists think it could be 2024 Q2 or later that the U.S. will start to rebuild the cattle herd, and as a result, consolidation could shake-up the industry, and further consolidation within meat processing could hit all protein sectors. Link for details.

• Ag trade: South Korea purchased 203,000 MT of corn from two separate tenders with all of the supplies expected to be sourced from South America or South Africa. Egypt purchased 240,000 MT of wheat from Tuesday’s tender – 120,000 MT each from France and Romania.

• NWS weather outlook: Tropical Storm Idalia will continue to impact the Carolina Coast today... ....Heat wave to expand in coverage across the Northern/Central Plains and Upper Midwest through Labor Day weekend... ...Flash Flooding concerns for the Southwest and Florida's northern Gulf Coast through Saturday.

Items in Pro Farmer's First Thing Today include:

• Corn and beans choppy, wheat lower overnight

• French wheat quality declines but still above average

• Eurozone inflation unexpectedly holds steady in August

• Slow developing cash cattle negotiations

• Seasonal cash hog weakness picking up steam

|

RUSSIA/UKRAINE |

— Russian crude oil products, including diesel and kerosene, are flooding into Europe, Politico reports (link). This has led Ukraine to request stricter sanctions against Russia. Oleg Ustenko, an economic adviser to Ukrainian President Volodymyr Zelenskyy, has urged the EU, the U.K., and the U.S. to address a "loophole" that permits countries like India, China, and Turkey to refine Russian crude purchased from Moscow's state energy companies into various petroleum products and then sell them without limitations. The G7 established a price cap of $60 per barrel for Russian crude in December, allowing sales below this price point. The goal was to economically pressure Russia while maintaining the functioning of oil markets. However, this has resulted in countries like India buying inexpensive Russian crude, refining it locally for a refining margin, and subsequently selling the refined products to other nations.

|

CHINA UPDATE |

— China's official Purchasing Managers' Index (PMI) for manufacturing has shown an unexpected increase, driven by a notable rise in production and an improvement in new orders. This suggests that the downward trend in factory activity might be reversing. However, the PMI value still indicates a contraction in the manufacturing sector.

— The U.S. has granted $80 million in military aid to Taiwan, marking the first instance of such aid being provided under the Foreign Military Financing program, typically reserved for sovereign nations. This decision holds potential to provoke China, as the country asserts territorial authority over Taiwan. The U.S. justified this move as necessary to assist Taiwan in maintaining a satisfactory self-defense capability.

— China is running out of arable land to produce the high-protein food demanded by its wealthier population, Caixin Global reports (link), as official statistics show a downward trend in grain consumption and growth in meat, dairy and seafood.

— Reuters: Xi to skip G20 summit. Chinese President Xi Jinping is likely to skip a summit of G20 leaders in India next week, sources familiar with the matter in India and China told Reuters. Premier Li Qiang is expected to represent Beijing at the Sept. 9-10 meeting in New Delhi. Li is also likely to attend a summit of East and Southeast Asian leaders in Jakarta, Indonesia on Sept 5-7, according to a report from Kyodo. The summit in India had been viewed as a venue at which Xi may meet with President Joe Biden, as the two superpowers seek to stabilize relations soured by a range of trade and geopolitical tensions.

|

ENERGY & CLIMATE CHANGE |

— Shell Plc has recently terminated what was once the world's largest corporate initiative aimed at creating carbon offsets. Carbon offsets are environmental projects intended to counterbalance the warming impacts of CO2 emissions. Initially, Shell had pledged to invest up to $100 million annually to develop a portfolio of carbon credits, aligning with its goal to achieve net-zero emissions by 2050. The decision to discontinue this initiative signifies a shift in CEO Wael Sawan's commitment towards the oil and gas sector, which remains the primary profit generator for Shell. This move also acknowledges the impracticality of the previous objectives, as a limited number of projects met the company's standards for quality.

|

HEALTH UPDATE |

— A high-ranking official at the Department of Health and Human Services has advocated for loosening restrictions on marijuana. This involves reclassifying it as a Schedule III substance, a recommendation conveyed in a letter to the Drug Enforcement Administration (DEA). Currently categorized as a Schedule I controlled substance, which is reserved for the most dangerous drugs like heroin and LSD, marijuana's status is now under review by the DEA. This review was prompted in part by President Joe Biden's call last year to reevaluate marijuana's federal classification. The recent recommendation by HHS is an initial step in this process. The next stage involves the DEA holding the authority to decide on potential changes to marijuana's scheduling. If any adjustments are proposed, they would undergo a rulemaking procedure that includes a public comment period before any final scheduling changes are implemented.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |