Hurricane Idalia Gains Category 1 Status, Heading Towards Florida's Gulf Coast

U.S./China talks to improve relations | Trump’s trade proposal analyzed | Gas prices rise

|

Today’s Digital Newspaper |

Abbreviated dispatch today as I am doing several speeches throughout Iowa as part of Iowa Soybean Assn. meetings.

— Equities: Asian and European stock markets were mostly higher in overnight trading. U.S. stock indexes are pointed to slightly higher openings.

— Outside markets: The U.S. dollar index slightly firmer. Nymex crude oil futures prices are firmer and trading around $80.75 a barrel. The benchmark U.S. Treasury 10-year note is presently around 4.2%.

— WTI crude futures maintained a stable position around $80 per barrel on Tuesday, with little significant market movement. Investors are awaiting upcoming economic reports from both the U.S. and China to gain insights into the future energy demand of these top global oil consumers. The U.S. Federal Reserve's statement regarding the potential for more interest rate hikes if inflation persists is still being considered by investors, influencing their assessment of monetary policy trends. In China, Sinopec, the largest refiner in the country, has indicated that second-half domestic product demand growth will likely be slower than in the first half. From a supply perspective, the ongoing output reductions from Saudi Arabia and Russia within the OPEC+ alliance are contributing to the support of oil prices. However, there are speculations that the U.S. might consider easing sanctions on Iran and Venezuela, which is causing some downward pressure on prices.

Meanwhile, workers at two Chevron liquefied natural gas facilities in Australia plan stoppages next week, putting European gas traders on edge and sending prices higher amid worries about potential supply interruptions.

— Gasoline prices in the U.S. have been steadily rising in recent weeks, reaching their highest point of the year. This increase is evoking memories of last summer's record-high gasoline prices, creating a sense of déjà vu among consumers. The average price for a gallon of regular gasoline is approximately $3.82 nationally, which is around 60 cents higher than the price at the beginning of the year. This data comes from energy-data provider OPIS.

The surge in oil prices has the potential to complicate the Federal Reserve's efforts to maintain inflation at 2%, the Wall Street Journal reports (link). These rising prices are already having an impact on small-business owners, who are facing challenges such as delaying upgrades, experiencing workforce attrition due to increased commuting costs, and passing on higher costs to customers. This situation highlights the interconnectedness of energy prices, inflation, and their effects on various sectors of the economy.

— China's economic prospects continue to remain bleak, with no indications of improvement. According to a survey by Bloomberg, economists have revised down their GDP growth forecast for this year to 5.1%, from a previous estimate of 5.2%. The economic analysis firm Continuum is even more pessimistic, predicting a smaller expansion of 4.9%. Furthermore, Morgan Stanley has expressed skepticism about the lasting effectiveness of Beijing's efforts to bolster the stock market, suggesting that these attempts will have limited long-term impacts on the overall economic situation.

— China is poised to cut interest rates on existing mortgages for the first time since the global financial crisis, while its biggest banks are also considering lowering deposit rates for at least the third time in a year.

— Gina Raimondo, the U.S. Commerce Secretary, initiated a three-day summit in China focused on improving engagement between the two nations. This follows a trend of high-level Biden administration officials visiting Beijing recently to ease tensions between the world's two largest economies. Raimondo, alongside Chinese Commerce Minister Wang Wentao, engaged in over four hours of discussions centered around practical solutions to enhance commercial communication and collaboration. Raimondo emphasized responsible management of the economic partnership, stating that communication should not be confused with compromise. Both countries share significant annual trade, but challenges have arisen due to escalating tensions. To address these concerns, Raimondo and Wang established two working groups — one focused on commercial issues and another on export controls. These groups, comprising government officials and business representatives, are aimed at enhancing bilateral information exchanges and meeting regularly to foster collaboration. Raimondo and Wang have also committed to annual meetings to promote ongoing dialogue.

— Ukrainian forces have successfully broken through the initial line of Russian fortifications in the southeastern part of Ukraine. They are now engaged in battles to expand this breach, as confirmed by Ukraine's defense chief. This development could provide Kyiv with a strategic advantage, as subsequent barriers in the region might be less fortified. The US-based Institute for the Study of War suggests that this initial breach could potentially enable Ukrainian forces to face weaker defenses in their efforts to advance further.

— In July 2023, Japan experienced an unexpected rise in its unemployment rate, which reached 2.7%, compared to 2.5% in June. This increase was contrary to what market experts had predicted — they anticipated no change. The July rate marked the highest level of unemployment in a four-month period. The number of individuals without jobs increased by 110,000, totaling 1.84 million in July compared to the previous month. Simultaneously, the total employment figure decreased by 100,000 to reach 67.45 million.

— Japan issued a threat to report China to the World Trade Organization (WTO) in response to China's ban on the import of Japanese seafood. China's decision to impose this ban came after Japan commenced the release of wastewater from the Fukushima nuclear plant into the nearby ocean. The Fukushima plant was devastated by a tsunami in 2011. Despite concerns, Japan and the United Nations assert that the ocean release is safe, with Japan stating that water tests have not indicated any presence of radioactivity.

— The retail industry is grappling with a surge in store-related crimes, ranging from minor shoplifting to more organized large-scale theft. The consequences of this trend are evident across various retail establishments. Nordstrom, a prominent retailer, recently closed its San Francisco department store after three decades due to the escalating crime situation. Consequently, Westfield, a mall operator, announced relinquishing control of the property, citing deteriorating operating conditions in downtown San Francisco leading to decreased sales, occupancy, and foot traffic. On a larger scale, major retailers like Target are witnessing a decline in sales due to theft, with warnings of potential losses of up to half a billion dollars this year. Similarly, Dick's Sporting Goods attributed its unexpectedly weak earnings to theft and the resultant damaged inventory. The prevalence of retail theft is significantly affecting the industry, influencing store closures, revenue losses, and overall business operations.

— If former President Donald Trump's proposal to implement a 10% tariff on nearly all imports were to be realized, it would come at a significant cost to the American economy, a nonpartisan analysis from the Tax Foundation reveals. This move would result in an annual burden of $300 billion on U.S. consumers, lead to a loss of around 550,000 American jobs, and diminish economic growth by 0.7%. Should other nations respond with retaliatory tariffs on U.S. goods, the potential economic impact could be even more severe. The Tax Foundation's assessment suggests that such a trade war scenario would further curtail growth by 0.4% and eliminate an additional 322,000 jobs. Trump's proposal, if enacted, would extend the scope of tariffs he implemented during his presidency, focusing on steel, aluminum, and other goods. He outlined this plan, emphasizing a "universal baseline tariff," which he believes should be imposed automatically on products entering the U.S. market.

The Tax Foundation, while generally advocating for lower taxes, warns that Trump's proposed tariffs could amount to a significant tax increase comparable to those proposed by President Biden. However, the Trump campaign counters these assertions, asserting that tariffs enacted during his presidency did not lead to substantial inflation and dismissing the analysis as a product of a "globalist Washington think tank."

— The El Niño weather phenomenon is poised to impact global food prices, exacerbating the effects of India's rice export ban and Russia's withdrawal from the Black Sea grain deal, according to the Financial Times (link/paywall). Expected to start in September, El Niño will bring extreme heat to parts of South Asia and Central America, as well as heavy rainfall to the Andes. This event typically disrupts crop cycles, adding strain to food output and prices, especially after India halted non-basmati white rice exports and Russia affected Ukrainian grain terminals. These three shocks could lead to higher inflation expectations in emerging markets, where food constitutes a larger portion of consumer spending compared to developed economies. As a result, central banks in these countries might need to maintain higher interest rates for longer, potentially leading to market volatility. The moves by India and Russia are already affecting global food prices, as seen in the United Nations' FAO food price index. In Europe, a colder winter caused by El Niño could lead to increased demand for liquefied natural gas.

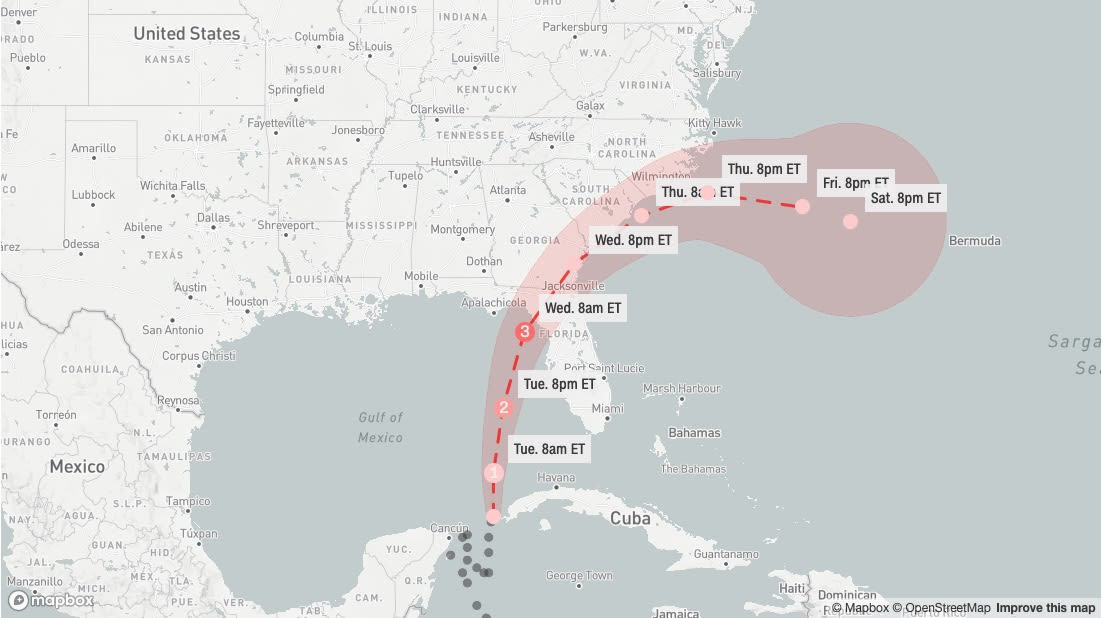

— Hurricane Idalia has gained Category 1 status and is currently heading towards Florida's Gulf Coast, prompting preparations and evacuations. The storm is expected to bring dangerous winds, potentially life-threatening storm surges, and heavy rainfall to the region. The hurricane's strength is being fueled by exceptionally warm waters in the Gulf, resulting in maximum sustained winds of 75 mph. While some areas like Tampa Bay might not experience a direct landfall, experts are emphasizing the significant threat of storm surge. This surge involves a rapid increase in water levels that can push inland along rivers and streams, leading to flooding. Coastal communities and low-lying regions in several counties along the Gulf of Mexico have started evacuations in response to the approaching storm. More evacuations are anticipated. Governor Ron DeSantis issued an emergency order covering 46 out of 67 counties in the state. The impact of Hurricane Idalia is set to affect travel plans, with airports, airlines, cruise lines, and theme parks announcing operational changes due to the storm.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |