China Announces More Measures to Woo Investors, But Gets Muted Response

Ukrainian farmers fret | Raimondo in China | Biden vs Trump trade policy

|

Today’s Digital Newspaper |

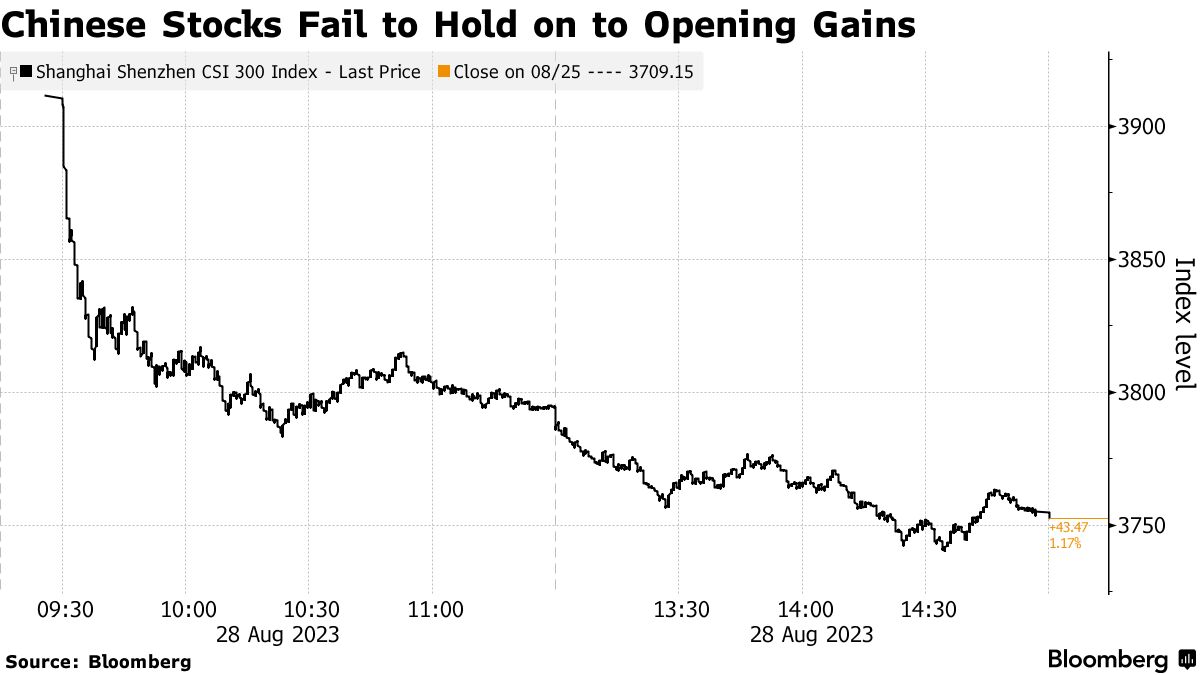

China’s measures to support the market include halving the stamp duty on stock trading, slowing the pace of new offerings, and approving the launch of 37 retail funds to invest in stocks. All of which followed Friday's steps to support housing. Stocks gained but pared most of the gains. At one time the strength was the second-biggest daily gain this year. After opening 5.5% higher on several support measures announced over the weekend, the CSI 300 Index of mainland stocks pared its advance to close just 1.2% higher. Foreign funds accelerated their selling through the day, poised to take this month’s outflows to the biggest on record.

Data released over the weekend showed profits at China's industrial firms fell for the seventh straight month in July. Profits earned by China's industrial firms fell by 15.5% from a year earlier in the first seven months of 2023 amid weakening economic recovery, feeble demand, and persisting margin pressures. The decrease followed a 16.8% slump in the prior period and a 4% fall in 2022, with profits shrinking in both state-owned firms and the private sector.

Concerns rise that China might resort to boosting exports to stimulate its economic growth once more. Analysts say this approach could be effective due to the significant weakness of the Chinese currency, the renminbi, against the U.S. dollar. More in China section.

U.S. Commerce Secretary Gina Raimondo arrived in Beijing with a dual mandate: sell more American goods and services to China and try to convince China’s leaders that the policies she’s in charge of aren’t meant to hobble their economy. If Raimondo seals the deal on a restart of deliveries for the 737 Max airliner, that would go some way to boosting both Boeing’s bottom line and American exports.

Terry Gou, the founder of Foxconn, the world’s largest contract manufacturer, said he would contest Taiwan’s presidential election in January 2024 as an independent candidate. Gou stepped down as the head of Foxconn in 2019 to pursue a career in politics, but failed to win the nomination from the opposition Kuomintang party in the last election.

The status of the Wagner Group hangs in uncertainty. Moscow has verified the death of Yevgeny Prigozhin, the head of the Russian paramilitary organization, who was involved in an unsuccessful mutiny in June. His demise in a recent plane crash raises questions about the future of this previously feared military entity. The Wagner Group, which is active in over 10 nations and holds valuable business interests in Africa, might potentially be integrated into the Russian armed forces, though specifics remain unclear.

A Trump return to the world stage could spark a global trade war, some fear. The candidate has threatened to impose fresh tariffs on all goods imported into the United States. More in Trade Policy section.

Jay Powell, chair of the Federal Reserve, warned that inflation remains too high and suggested that further interest rate increases might be considered if inflationary pressures persist. The Markets section includes key points made during his Friday speech at the Federal Reserve's annual economic symposium in Jackson Hole, Wyoming.

Christine Lagarde, head of the European Central Bank (ECB), has raised concerns about the recent disruptions in the global economy potentially leading to lasting changes that could keep inflation higher than normal.

The drought-induced challenges faced by the Panama Canal have caused disruptions in shipping, negatively impacting government bonds and raising broader economic concerns.

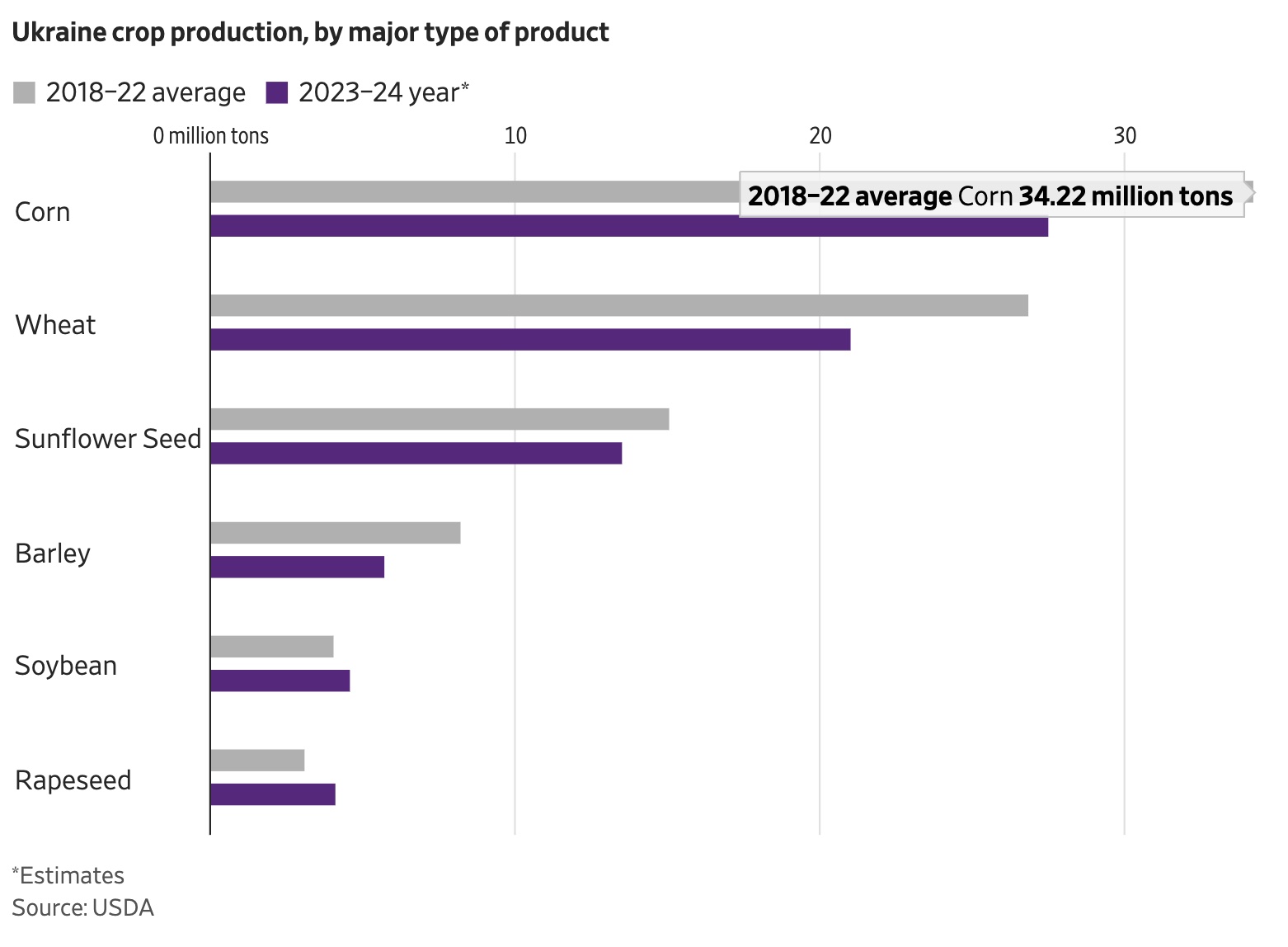

Russia's actions to obstruct Ukraine's grain exports, including withdrawing from an international agreement and attacking port facilities, have severely impacted Ukrainian farmers, according to a detailed Wall Street Journal article (link). Highlights in Russia & Ukraine section.

Ukrainian authorities are engaging in conversations with both commodity traders and global insurance companies to establish a government-supported initiative that facilitates ship travel to the country's ports. This move comes as they search for alternative commercial routes following the collapse of the Black Sea Grain Initiative. The emerging plan involves Ukraine's government assuming the initial losses in the event of a grain ship being damaged. This arrangement is expected to encourage more insurance companies to offer coverage to ships servicing Ukrainian ports, thereby leading to reduced insurance premiums. Although a few insurers do provide coverage for this route, the costs are currently extremely high.

G7 leaders acknowledge the war in Ukraine could be prolonged, and they are committed to supporting Ukraine for as long as necessary to prevent Russia from winning.

USDA needs to finalize the 2020-2021 ERP Phase 2 first (provides additional 2020 revenue to be considered for PARP) before they can calculate a payment factor for PARP. More in Policy section.

USDA’s Farm Service Agency (FSA) is updating the Livestock Indemnity Program (LIP) payment rate to support livestock producers in the Midwest who have lost cattle to the extreme heat and humidity experienced this summer. Details in Policy section.

Two storms threaten to batter the East Coast. Franklin became a major hurricane today, potentially causing life-threatening rip currents and swells in the eastern United States. Idalia is forecast to become a Category 2 hurricane by the time it hits Florida tomorrow, possibly leading to evacuations along its path.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly higher in overnight trading. U.S. stock indexes are pointed to slightly higher openings.

U.S. equities Friday: The Dow rose 0.7% but was still down 0.4% on the week. That marked the second straight week of declines for the index after a stellar July. The S&P 500 also rose 0.7%. With a 0.8% weekly gain, the market benchmark snapped a three-week losing streak. The also halted a three-week losing streak with a gain of 2.3% on the week, capped off with a 0.9% gain Friday.

Agriculture markets Friday:

- Corn: Futures saw some slight volatility ahead of the Crop Tour results which came after the close, with December futures ultimately closing 1/4 cent lower at $4.88 marking a 5-cent loss on the week.

- Soy complex: November soybeans rallied 16 cents to $13.87 3/4 and gained 34 1/2 cents on the week, while September meal futures rose 10 cents to $422.80, a $18.90 increase week-over-week. September soyoil rose 119 points to 66.73 cents but faded 156 points on the week.

- Wheat: December SRW wheat futures closed down 10 cents at $6.21 3/4 , nearer the session low and closing at a technically bearish weekly low close. For the week, December SRW lost 17 1/4 cents. December HRW wheat rose 2 cents to $7.64 1/2 and near mid-range. For the week December HRW rose 3 3/4 cents. December spring wheat futures rose 2 3/4 cents on the session to $8.02, marking a 15 3/4 cent loss on the week.

- Cotton: Futures continued the week’s rally, rising 122 points before settling at 87.31 cents, marking a 3.69-cent rise on the week.

- Cattle: Expiring August live cattle futures ended Friday having risen 82.5 cents to $180.675, while most-active October futures added 45 cents to $181.175, marking a $3.05 gain on the week. August feeder futures jumped $1.125 to $274.625, while the October contract gained 72.5 cents to $253.975, which marked a $3.275 gain on the week. The cash cattle markets firmed in light trading as the week passed, with the five-market average for the Monday-Thursday period reaching $185.33, up 29 cents from the prior week’s full-week mean.

- Hogs: October lean hog futures fell 65 cents to $79.825, nearer the daily low and on the week down $2.30.

Ag markets today: Corn and soybean futures were supported overnight by crop concerns amid expectations for a poor finish to the growing season, while wheat futures slumped. As of 7:30 a.m. ET, corn futures were trading 4 cents higher, soybeans were 9 to 12 cents higher, SRW wheat was 3 to 4 cents lower, HRW wheat was 9 to 10 cents lower and HRS wheat was around a penny lower. Front-month crude oil futures were modestly lower, while the U.S. dollar index was trading just above unchanged.

Market quotes of note:

- BOJ chief: Strategy backed by below-target inflation. Kazuo Ueda, the Governor of the Bank of Japan (BOJ), highlighted that the pace of price growth in the country is still below the central bank's target. This explanation sheds light on why the bank is persisting with its current approach to monetary policy. Ueda shared his perspective during a panel discussion at the annual symposium held by the Federal Reserve in Jackson Hole, Wyoming. He emphasized that the underlying inflation rate is slightly lower than the desired 2% target. This disparity is the main reason behind the bank's decision to maintain its existing strategy of monetary easing. In terms of numbers, the annual inflation rate, which is calculated by excluding volatile components like fresh food, stood at 3.1% in July. Ueda mentioned that this rate is projected to decrease as the year progresses, approaching the end of the year. Ueda also commented on Japan's economic growth earlier in the year, attributing it partly to the easing of pandemic-related restrictions. This indicates that some of the economic expansion experienced by the country was a result of the relaxation of measures implemented to combat the pandemic.

- China equities: “The open today was a bit too strong, and that level of hype understandably leads to some people walking away from the table,” said Lin Menghan, a fund manager at Shanghai Xiejie Asset Management Co., according to Bloomberg. “The measures overall addressed the issues of outflow and dilution of funds in the market, rather than where the fresh liquidity will come from.”

- U.S. trade policy: “We are in the midst of a long-term shift in U.S. trade policy toward a set of policies that are more pragmatic, more concerned about workers, more concerned about wages and more concerned about our national security,” said Stephen Vaughn, who served as general counsel in the office of the U.S. Trade Representative in the Trump administration, according to the Washington Post (link).

Jay Powell, chair of the Federal Reserve, warned that inflation remains too high and suggested that further interest rate increases might be considered if inflationary pressures persist. Key points made during his Friday speech at the Federal Reserve's annual economic symposium in Jackson Hole, Wyoming:

- Powell indicated the Fed's readiness to maintain a "restrictive" policy to bring inflation down to the 2% target.

- Powell mentioned that although inflation has decreased from its peak, it still remains too high.

- The Fed is prepared to raise rates further if deemed appropriate and intends to hold policy at a restrictive level until confident that inflation is moving sustainably toward the objective.

- Powell emphasized proceeding carefully as the Fed navigates the final stages of its campaign to counter decades-worst inflation.

- Powell expressed concerns about both tightening monetary policy too little and raising rates too high, potentially harming the economy.

- While opinions vary on the necessity of more rate increases, officials agree that achieving the inflation target will take time, implying the need for tight monetary policy.

- The central bank is expected to skip another rate increase at its September policy meeting, and the timing of rate cuts is anticipated to be in 2024.

- Until recently, a prevailing belief among market participants was that Fed had completed its series of rate hikes, with the benchmark federal funds rate resting within a range of 5.25-5.5%. However, recent economic data has indicated a different scenario. The labor market appears to remain tight, and consumer spending continues to show signs of relative health. These signals have prompted a reconsideration of the assumption that the Fed's rate increases were finished.

Link to WSJ Heard on the Street column, “Despite What Powell Says, the Fed Is Likely Done.”

Link to Bloomberg article, “Powell Has Bond Traders Right Where He Wants Them: Full of Doubt.”

Christine Lagarde, head of the European Central Bank (ECB), has raised concerns about the recent disruptions in the global economy potentially leading to lasting changes that could keep inflation higher than normal. Speaking at the Federal Reserve's annual conference in Jackson Hole, Lagarde highlighted the need for central bankers to be vigilant about volatility in relative prices causing medium-term inflation through wage-price dynamics.

She mentioned the possibility of global supply becoming less elastic, reduced global competition, and increased pass-through of cost increases by firms due to larger and more frequent shocks like energy and geopolitical shocks. This could complicate the role of monetary policymakers in addressing inflation and economic stability.

Lagarde also touched on the ECB's potential policy direction, stating that rates need to be set at "sufficiently restrictive levels for as long as necessary" to bring inflation back to the target in a timely manner. She mentioned the complexities brought about by factors like the German economy's recent struggles and the diverse shocks affecting the global economy, including the Covid-19 pandemic and geopolitical events. While Eurozone inflation has decreased from its peak, recent business surveys indicate a potential economic downturn, leading investors to speculate on the ECB's rate decisions. Lagarde acknowledged the need for clarity, flexibility, and humility in addressing the uncertainties.

She also noted the unique challenges Europe faces, such as its dependence on Russian oil and its proximity to the conflict in Ukraine, which contribute to different inflation dynamics compared to the U.S. Despite the current inflation situation, Lagarde expressed confidence that inflation numbers would look different by the end of the year.

Market perspectives:

• The drought-induced challenges faced by the Panama Canal have caused disruptions in shipping, negatively impacting government bonds and raising broader economic concerns. The Panama Canal is a crucial component of the Panamanian economy, contributing approximately 25% of the government's revenue and serving as a major source of income for the country. However, recent challenges have emerged due to a severe drought, causing water levels in the canal to drop significantly. This situation has led to a backlog of container ships waiting to pass through the canal, which has prompted concern among traders on Wall Street.

Of note: The canal authority has restricted the number of ships that can cross to about 32 and forced those that are allowed to enter to reduce their drafts, meaning they take less cargo. Typically about 38 vessels navigate it daily, according to the canal authority. Despite these efforts, the decrease in shipping traffic is expected to impact the canal's revenues by around $200 million, affecting its overall contribution to the national Treasury.

Addressing the issue presents challenges. One measure being considered is diverting rivers into Gatun Lake, the primary water source for the canal's locks, to mitigate the water shortage. However, the situation is complex and multi-faceted, involving factors such as erratic rainfall and the looming threat of an El Niño weather pattern.

The impact of the drought and resulting shipping delays has been felt in the financial markets, Bloomberg reports (link). Panamanian government bonds have experienced a decline in value, making them some of the poorest performers in Latin America. Over the past month, these bonds have lost 3.3% in value, a figure roughly twice the average decrease seen in government bonds across the region. The decline in government bond values is not only linked to the drought but also influenced by broader market trends, including a downturn in US Treasuries and global debt securities. Additionally, factors such as upcoming elections and contractual renewals for major mining operations have contributed to uncertainty about Panama's economic outlook. While Panama is rated as investment grade, concerns about corruption and its reputation as a tax evasion haven have lingered. The upcoming presidential election and the potential for increased spending during the campaign further contribute to market unease.

• Ag demand: South Korea purchased 55,000 MT of optional origin feed wheat.

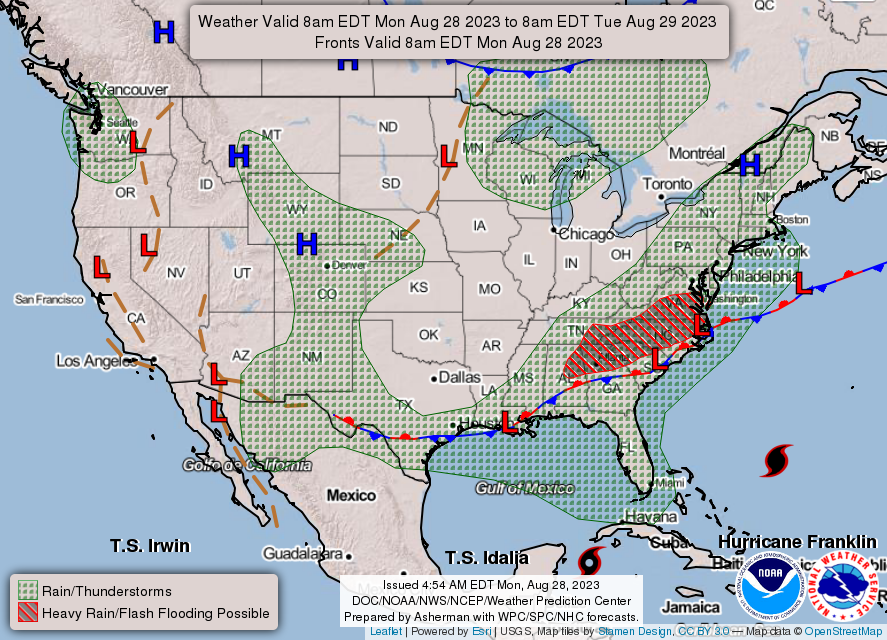

• Tropical Storm Idalia is anticipated to intensify into a Category 2 hurricane as it approaches the Gulf Coast of Florida by Tuesday. Meteorologists predict that it will develop into a notably impactful hurricane. The expected wind speeds could reach up to 100 miles per hour, as reported by Jamie Rhome, the deputy director of the National Hurricane Center, during an update on Sunday evening. Considering the severity of the situation, evacuations might become necessary either later today or tomorrow, as stated by Rhome. He emphasized that the potential risks associated with the storm will extend beyond the projected path, commonly represented as a cone on forecast maps. He urged people not to solely rely on the cone's path to assess the threat. Originating on Sunday, Idalia also poses a risk of bringing substantial rainfall to areas such as Georgia and the Carolinas, according to forecasts.

• NWS weather outlook: Tropical Storm Idalia to impact much of Florida and the Southeast Coast this week... ...Scattered showers and thunderstorms likely across the Central/Southern High Plains, Southeast and the Mid-Atlantic today... ...Pacific Northwest begins to cool down while Southwest experiences above normal temperatures.

|

RUSSIA/UKRAINE |

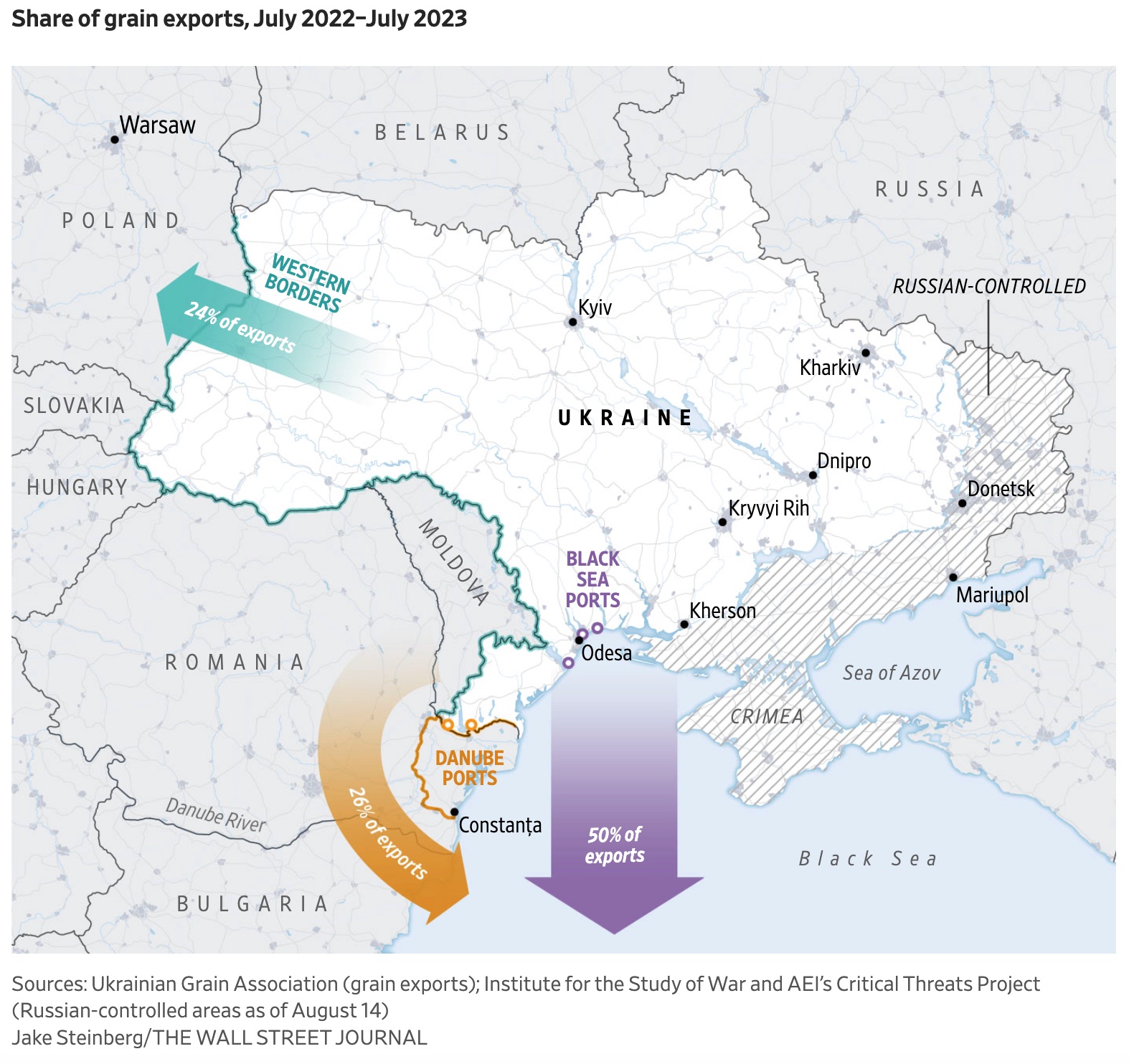

— Ukraine’s farmers detail cost of grain deal’s collapse. Russia's actions to obstruct Ukraine's grain exports, including withdrawing from an international agreement and attacking port facilities, have severely impacted Ukrainian farmers, according to a detailed Wall Street Journal article (link). Highlights:

- Around three-quarters of Ukraine's grain exports have been hindered due to these actions.

- Ukrainian farmers are facing difficulties in selling their grains, leading to increased transport costs and decreased income.

- The collapse of the Black Sea agreement caused global grain prices to rise, but in Ukraine, prices fell due to excess supplies trapped in the country.

- Ukrainian farmers are now paid less for their wheat compared to before the collapse, causing financial strain.

- The restrictions on exports might lead to difficulties in financing the next crop planting, potentially limiting grain production in one of the world's major grain suppliers.

- Some farmers are already reducing their winter wheat planting or shifting to more lucrative crops like sunflowers.

- The war and port disruptions have forced Ukraine to rely on alternative export routes, leading to higher transportation costs.

- Exporting through land or the Danube River is costlier compared to the Black Sea route.

- Farmers are concerned about profitability, with rising logistics costs and elevated fertilizer and chemical prices.

- The challenge of land mines in previously occupied areas further complicates farming.

- The situation's impact on Ukrainian farmers could have broader economic consequences, given the significance of agriculture in the country's exports.

— G7 leaders acknowledge the war in Ukraine could be prolonged, and they are committed to supporting Ukraine for as long as necessary to prevent Russia from winning. Prime Minister Justin Trudeau of Canada mentioned that conversations within G7 and NATO have prepared them for a potential lengthy conflict against Russia's aggression in Ukraine. Trudeau made these comments during an interview about Canada's Arctic interests on the sidelines of a global environmental assembly, according to Bloomberg (link).

— Kremlin plays down significance of second vessel passing through Ukraine’s Black Sea corridor. The passage of a second ship from Ukraine along a temporary Black Sea corridor has nothing to do with the prospects for a new grain deal involving Russia, Kremlin spokesman Dmitry Peskov said. A vessel carrying steel products to Africa left Ukraine’s port of Odesa on Sunday through a temporary Black Sea corridor, the second ship to do so since Russia withdrew from the Black Sea export deal. Peskov reiterated the prospects of reviving the grain deal would depend on whether the West delivered on promises it gave Moscow regarding Russia’s grain and fertilizer exports.

|

POLICY UPDATE |

— Pandemic Assistance Revenue Program (PARP) update. USDA needs to finalize the 2020-2021 ERP Phase 2 first (provides additional 2020 revenue to be considered for PARP) before they can calculate a payment factor for PARP. Sources say the CBA in the rule was a high estimate (doesn’t include other revenue factors that would decrease the overall demand) and to stress, that was an estimate. It is unclear what USDA received regarding claims under PARP. Some sources estimate that final payment factors for PARP will be determined this fall (likely in October). Link for background info on program.

— USDA’s Farm Service Agency (FSA) is updating the Livestock Indemnity Program (LIP) payment rate to support livestock producers in the Midwest who have lost cattle to the extreme heat and humidity experienced this summer. To help indemnify ranchers to reflect a trend towards higher cattle weights in feedlots, the 2023 LIP payment rate for beef calves over 800 pounds will increase from $1244 per head to $1618, an increase of $374. LIP provides benefits to livestock owners and some contract growers for livestock deaths exceeding normal mortality from eligible adverse weather events, certain predation losses and reduced sales prices due to injury from an eligible loss. Indemnity payments are made at a rate of 75% of the prior year’s average fair market value of the livestock. The updated LIP payment rate is effective immediately and will be applied retroactively starting Jan.1, 2023, for all eligible causes of loss including excessive heat, tornado, winter storms, and other qualifying adverse weather. Producers who have already received LIP payments for 2023 losses will receive an additional payment, if applicable, commensurate with this updated rate. For details on eligibility and payment rates, review the LIP fact sheet (link).

|

CHINA UPDATE |

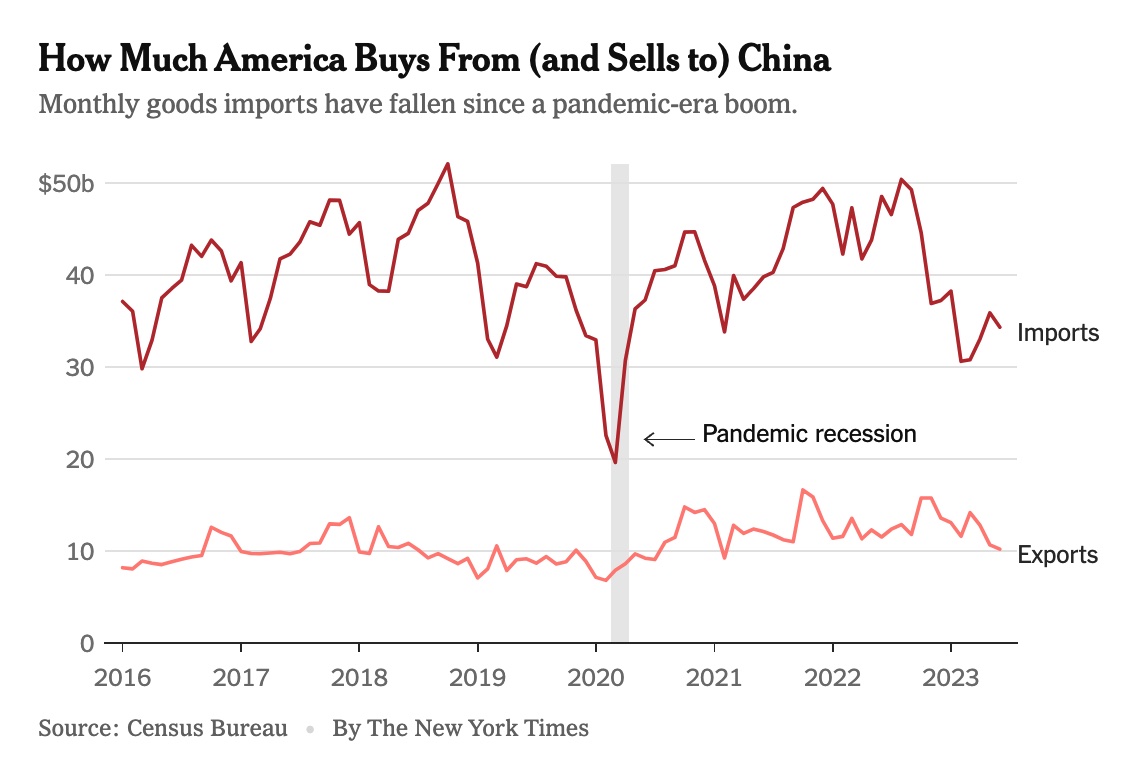

— Concerns rise that China might resort to boosting exports to stimulate its economic growth once more. Analysts say this approach could be effective due to the significant weakness of the Chinese currency, the renminbi, against the U.S. dollar. Additionally, by assembling Chinese components in other nations such as Vietnam and Mexico, it's feasible to sidestep tariffs on most products, according to an article (link) in the New York Times.

China’s dour economic news has also caught the attention of the Economist magazine, which has featured it the past two weeks:

— China’s industrial profits drop persists as economy weakens. In July, the rate of decline in China's industrial profits showed some improvement, but concerns about the sluggish economic rebound and the potential for deflation still linger over the sector. According to data released Sunday by the National Bureau of Statistics, profits for the sector dropped by 6.7% compared to the same period the previous year. This is a slight improvement from June, which saw a larger decrease of 8.3%. Looking at the cumulative figures for the first seven months of 2023, profits have declined by 15.5%. This is a moderation from the 16.8% decline observed during the same period in the previous year.

The performance of industrial production in July could have been influenced by heavy rainfall and severe flooding in certain regions of the country. Earlier data released this month indicated that industrial output grew by 3.7% year-on-year, falling short of expectations.

— Foxconn founder Terry Gou said he will run as an independent in Taiwan’s presidential election in January. or his bid to become official, he will need to secure the signatures of around 290,000 voters. “Over the past seven years, I’ve witnessed Taiwan go from being prosperous to being on the brink of falling off a cliff in many aspects, including the economy, national defense and foreign affairs,” he said. “If we don’t pull back now, it will be too late to save Taiwan from falling. We have to take down the Democratic Progressive Party.”

Gou’s announcement puts him in direct competition with Hou Yu-ih of the opposition Kuomintang for votes from Taiwanese who support closer ties between Taiwan and China. He will also face Vice President Lai Ching-te, the ruling DPP candidate who champions Taiwan’s status as an independent country.

— U.S. Commerce Secretary Gina Raimondo emphasized the significance of maintaining stable economic relations between the world's largest economies during her visit to Beijing. Her goal is to strengthen business ties between the U.S. and China during her trip.

During a meeting with her Chinese counterpart Wang Wentao, Raimondo stated that the U.S. desires "healthy competition" and has no intention of impeding China's economic advancement. She stressed the importance of having a stable economic relationship that benefits both nations and aligns with global expectations. Raimondo acknowledged that the relationship between the two countries is complex and challenging, but progress could be made through direct, open, and practical communication.

Raimondo's is the fourth high-profile U.S. official to visit China in recent months. Her role at the Commerce Department includes promoting U.S. trade abroad and addressing practices that the U.S. views as unfair or harmful to national security.

Although no high-ranking Chinese officials have visited the U.S.amid these exchanges, Wang expressed China's readiness to collaborate with the U.S. to enhance trade and create a favorable policy environment for businesses from both countries. Raimondo also highlighted that despite differences in national security matters, substantial portions of trade between the two nations should remain unaffected, allowing for opportunities of cooperation.

Climate change emerged as an area of potential collaboration, as Raimondo mentioned. Climate envoy John Kerry's negotiations with his Chinese counterpart in July showcased a willingness to communicate on this issue, despite limited concrete actions.

Raimondo's visit might also facilitate Boeing's re-entry into the Chinese market with its 737 Max jets, a crucial move for Boeing's financial recovery after the challenges posed by Covid-19 and the global grounding of the Max plane. Rival Airbus has gained traction in China, while Boeing has faced setbacks in its largest overseas market.

|

TRADE POLICY |

— How Biden’s trade policy would differ should former President Donald Trump win another term. In a recent interview, Trump has pledged to implement extensive new tariffs, outlining his intention to impose a universal 10% tariff on imports entering the United States. He articulated this during a conversation with Fox Business, emphasizing that foreign companies that flood the U.S. market with their goods should automatically be subjected to a 10% tax. Trump expressed his preference for a consistent 10% tariff rate across the board.

Economists cautioned that Trump's proposal carries the potential to trigger a worldwide trade conflict and drive up costs for American consumers.

The White House responded critically to Trump's statements, asserting that President Biden vehemently opposes this plan. Though Biden has retained some Trump policies, he places greater emphasis on working with allies.

Of note: Biden maintained much of Trump’s tough policies toward Beijing. Tariffs remained in place. Restrictions on Chinese technology companies have expanded, including a U.S. ban on sales of advanced semiconductors and chip-making equipment to China last year.

Ahead: The next few months will bring deadlines for key features of the Biden trade policy: an effort with Europe to remake the global steel market; negotiations toward an Indo-Pacific Economic Framework (IPEF); and deciding what to do about tariffs on U.S. imports from China.

Bottom line: U.S. Trade Representative Katherine Tai, the U.S. has blamed traditional trade deals for fueling inequality, hastening the exodus of U.S. manufacturing jobs and creating an excessive reliance on China for critical goods. She has vowed that the administration will deliver “a new story on trade.”

|

HEALTH UPDATE |

— This week, the U.S. gov’t is set to unveil a list of 10 medications that Medicare will be authorized to negotiate prices for. This move could lead to substantial cost savings for taxpayers and a reduction in profits for pharmaceutical companies. Analysts predict that drugs like J&J's Xarelto, a blood thinner, and Eli Lilly's Jardiance for diabetes management are likely candidates to be included in this list.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |