Financial Times: Ukraine Nears Deal to Insure Grain Ships

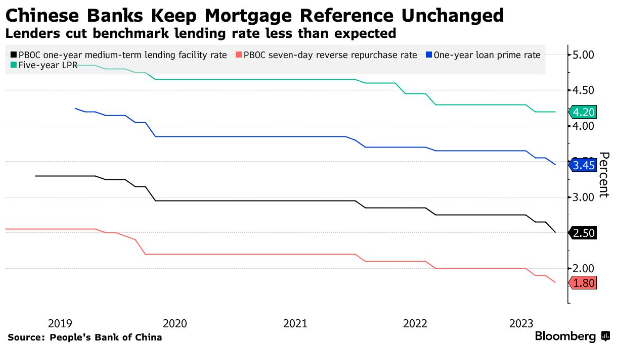

China’s banks made modest tweaks to their lending rates

|

Today’s Digital Newspaper |

Abbreviated dispatch today as I am at a Minnesota Ag Leadership conference.

— China’s banks made modest tweaks to their lending rates. The People's Bank of China cut its 1-year loan prime rate (LPR) by 10bps to a record low of 3.45% while unexpectedly holding steady the 5-year rate at 4.2% (most economists had predicted a 15 basis-point cut). Monday’s move came after a surprising reduction in both short-term loan rates and the medium-term rate by the central bank last week, as it seeks to strike a balance between helping the economy and stemming further falls in the yuan.

Market impact: The Hang Seng declined, headed for its lowest close since November, and Goldman cut its China stock targets on contagion risk from the property slump.

— Chinese leader Xi Jinping is embarking on a trip to South Africa with the aim of strengthening China's influence among developing and emerging nations. This comes as relations with the U.S. are strained and China faces economic challenges domestically. Xi's three-day state visit includes a summit with leaders from the BRICS emerging economies, which comprise Brazil, Russia, India, China, and South Africa. These countries collectively represent over 40% of the global population and share a desire for a more multipolar world and greater influence in global affairs. Xi's visit coincides with President Joe Biden's meetings with leaders from Japan and South Korea, a move aimed at countering China's rising influence. This indicates the increasing strategic relevance of BRICS for China.

— European natural gas prices surged by over 10% on Monday, continuing a trend of increases over the past three weeks. Dutch TTF futures reached nearly €40 per megawatt-hour, marking a two-month high. This rise was driven by concerns of low supply, triggered by potential strikes in Australia's export plants operated by Woodside Energy Group. If no agreement is reached with unions, workers might begin striking, adding to the possibility of supply disruptions alongside last week's announcement of potential strikes in Chevron's plants. Such disruptions could lead to competition between top European gas consumers and Asian nations for LNG imports, causing a global rise in gas benchmarks. However, the increase in prices was limited by reports of ample inventories. Fuel reserves are reportedly more than 90% full, a record high for this time of year and surpassing the EU's storage level target set for November 1. Notably, Germany, Italy, Spain, and the Netherlands have exceeded the target, while French inventories lag at 84%.

— Confidence is growing that the Fed will achieve a soft landing for the U.S. economy, according to a NABE poll. Almost 70% of economists are at least somewhat optimistic inflation can come down to the 2% target without spurring a recession. That marks a big reversal in sentiment since NABE’s March survey, which showed a similar share indicating they were skeptical of avoiding a downturn. The July 28-Aug. 7 survey included responses from 167 NABE members. Link for details.

— Cargill is currently experimenting with 123-foot-tall rigid "sails" as a more environmentally friendly option to power large fleets of ships. In a recent trial, a chartered bulk carrier successfully completed its inaugural journey from Shanghai to Singapore with two WindWings, designed by BAR Technologies. These innovative sails have the potential to reduce the ship's fuel consumption by approximately 20%. If the results are positive, Cargill plans to equip up to 10 additional vessels with these sails.

— Question 3 update. On Sept. 6, pork producers will present their case in front of Senior Judge William Young of the U.S. District Court for the District of Massachusetts regarding the state law regulating sow confinement requirements. This lawsuit was brought by Triumph Foods and other plaintiffs. The hearing comes after the implementation of the Act to Prevent Cruelty to Farm Animals, also known as Question 3, which goes into effect on Aug. 23. Question 3 will make it illegal to sell uncooked whole pork meat that doesn't adhere to the state's sow housing standards and will also prohibit the transshipment of such pork through Massachusetts. Some exceptions are permitted over the next six months during the law's rollout.

— FT: Ukraine nears deal to insure grain ships. Ukraine plans to create a safe corridor for its vessels travelling through the Black Sea, as it nears a deal with global insurers to cover the grain ships under threat from Russia, the Financial Times reports. Oleksandr Gryban, Ukraine’s deputy economy minister, told the Financial Times that the deal was “currently being pursued and actively discussed” between the relevant ministries, as well as local banks and international insurance groups including Lloyd’s of London. The scheme could be put in place as early as next month, with as many as five to 30 ships covered to travel through what he described as the “danger spot” of Ukrainian waters. Russia withdrew from a U.N.-brokered grain deal last month and had warned it would consider any civilian vessel leaving Ukraine’s ports as military targets. But under the cover of Ukrainian onshore defense systems, a German/Chinese-owned cargo ship managed to make the first commercial journey out of Odesa since Moscow’s threat.

— Several major mining companies in the western world are venturing into fertilizer production, driven by the expectation of sustained growth in demand due to the increasing global population and price rises and uncertainty following Russia’s invasion of Ukraine. BHP, the world's largest mining company, is in the process of constructing a $5.7 billion Jansen potash mine in Canada. This project marks BHP's most significant new venture in terms of capital expenditure in the past decade. Another substantial project is Anglo American's $6.1 billion Woodsmith mine in northern England. This mine will produce a unique potassium-rich fertilizer called polyhalite starting from 2027.

— Farm bill update. House Ag Chair G.T. Thompson (R-Pa.), speaking at a Minnesota Ag Leadership conference last night, reiterated that a farm bill draft would come in September, followed by a panel markup a week or two later. As for a House floor vote, Thompson said that depends on leadership scheduling. “But if we can get time, we can get it done in a week,” he told the gathering. As for the bill itself, Thompson said it must be “very effective.” The Ag Chair will also be traveling to Illinois this week.

— Russia’s Luna-25 spacecraft destroyed as it crashes into moon. Russia's crew-less spacecraft, Luna-25, aimed at marking the nation's re-entry to the moon after nearly half a century, crashed during its landing attempt near the moon's south pole. The spacecraft entered an uncontrolled orbit and ultimately "ceased to exist" upon impact with the moon's surface, according to Russia's space agency. In contrast, India's Chandrayaan-3 spacecraft is currently orbiting the moon and is anticipated to make a landing near the moon's pole in the coming days.

— President Joe Biden travels today to Maui to meet with first responders, survivors, and federal, state and local officials to see "the impacts of the wildfires and the devastating loss of life and land that has occurred on the island, as well as discuss the next steps in the recovery effort."

— Former President Donald Trump has officially stated that he will not participate in the upcoming Republican presidential primary debate in Milwaukee and hinted that he might also skip other debates. Trump made this announcement on Truth Social, stating that he believes the public is aware of his successful presidency, and therefore, he will not be partaking in the debates. It's uncertain whether he plans to abstain from all debates during the election cycle. The Republican National Committee requires candidates to sign a loyalty pledge to support the eventual nominee as a prerequisite for participating in the debates. Trump has declined to sign this pledge. Recent reports suggest that he has opted to do an interview with former Fox News host Tucker Carlson instead of participating in the Milwaukee debate. This interview has already been recorded and will be released online at the same time as the debate.

— Kroger & sushi. Kroger has achieved the remarkable status of being the top seller of sushi in the United States. As the largest operator of grocery stores in the nation, Kroger manages to sell a staggering quantity of over 40 million pieces of sushi each year. This accomplishment has played a significant role in transforming the combination of raw fish and rice into a widely embraced staple among American consumers. Sushi's popularity is a crucial element in Kroger's broader plan to extend its reach beyond conventional grocery offerings, aiming to capture a portion of the funds that individuals allocate for dining out and restaurant experiences.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |