Fed Chair Powell to Speak Friday at Economic Policy Symposium in Jackson Hole, Wyoming

Key ag sector focus is Pro Farmer Crop Tour Aug. 21-24

Washington Focus

Lawmakers continue their long summer recess, but politics is still in play with this week’s first GOP presidential candidate debate in Milwaukee, Wisconsin.

The first GOP primary debate is Aug. 23 in Milwaukee and the second is scheduled for Sept. 27 at the Reagan Library in California.

Latest poll results. Florida Gov. Ron DeSantis (R) and conservative entrepreneur Vivek Ramaswamy are tied for second place in the Republican presidential field in a new poll. An Emerson College poll showed DeSantis and Ramaswamy tied at 10% each, trailing former President Trump, who leads with 56%. DeSantis kept his position in second place from previous polls, but he registered a big drop from the 21% he had in June. Ramaswamy rose from just 2% then.

Former President Donald Trump reportedly has decided to skip the upcoming Republican debate and is considering alternative options, including the possibility of being interviewed by Tucker Carlson. Trump, citing his strong poll numbers and his record as president, implied that he might not participate in the debate. While his aides acknowledge that he could change his mind, Trump has signaled interest in being interviewed by the former Fox News host, although the timing is yet to be confirmed. One potential timing is on the same night as the Fox debate.

Aides had previously discussed the idea of Trump organizing his own event in Milwaukee, the site of the debate. Trump's campaign has not formally informed the Republican National Committee of his plans, and Fox News, which is hosting the debate, has not provided an immediate response.

Tucker Carlson, who was previously with Fox News, launched his online show on a platform called X (formerly known as Twitter) after leaving Fox News in April. He remains under contract with Fox News but is exploring the possibility of starting a new media company using the X platform.

The annual gathering of global central bankers for an economic policy symposium in Jackson Hole, Wyoming, gets underway Aug. 24.

On Friday, Federal Reserve Chair Jerome Powell is scheduled to speak on the economic outlook before the 2023 Jackson Hole Economic Symposium hosted by the Federal Reserve Bank of Kansas City, in Moran, Wyoming. The symposium will begin on Wednesday and conclude on Friday.

On Monday, President Joe Biden and First Lady Dr. Jill Biden will survey wildfire damage that destroyed the historic Hawaiian town of Lahaina. The president will meet with survivors, emergency responders and local officials. The wildfire that wiped out Lahaina is the nation’s deadliest in over a century, killing at least 111 people. The search for remains is far from over.

On the international front, Ukrainian ground forces are making consistent progress in their operations. Recently, they successfully liberated the village of Urozhaine situated on the border between the Zaporizhia and Donetsk provinces. They are also advancing towards gaining control of Robotyne, located in the Zaporizhia province. Meanwhile, Russia has escalated its attacks on Ukrainian targets, even targeting locations up to 1,000km behind the front lines. This has included striking a military airfield and causing significant damage to civilian infrastructure.

Ukrainian officials believe that Russia is particularly concerned about Ukraine's "deep battle" campaign, which involves targeting enemy forces further behind their lines. Of specific concern to Russia are British- and French-made Storm Shadow/SCALP cruise missiles, which have the capability to neutralize logistics hubs and command centers. Russia aims to eliminate the aircraft responsible for launching these missiles and incapacitate their runways. This effort is expected to intensify if the German chancellor, Olaf Scholz, decides to provide Ukraine with Taurus missiles due to domestic pressures. Taurus missiles would be capable of reaching important targets in Crimea, including the Sevastopol naval base and the already-damaged Kerch bridge, connecting the peninsula to Russia.

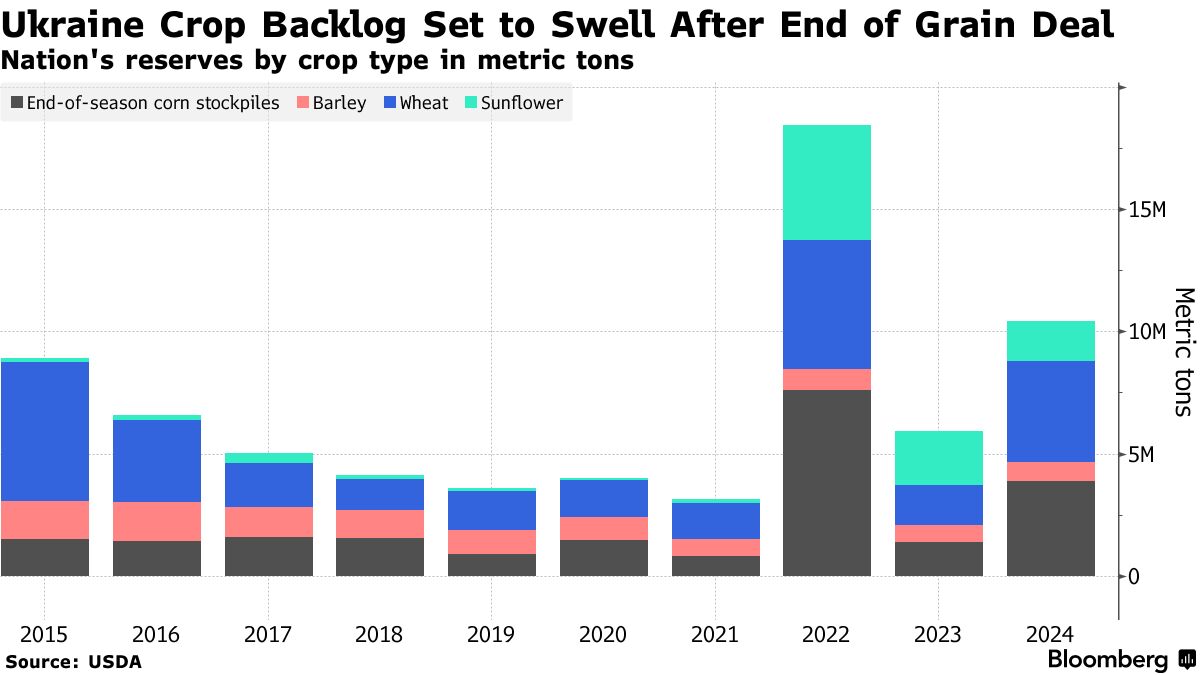

The Kremlin’s efforts to paralyze Ukrainian food shipments are succeeding, with a third of the country’s crop exports wiped out since its Black Sea ports were effectively blocked last month, Bloomberg reports (link). Ukraine was only able to export 3.2 million tons of grains, vegetable oils and meals in the four weeks through August 15, down from 4.4 and 4.8 million tons in May and June when the Black Sea deal was still in place, according to estimates from analyst UkrAgroConsult. Crop stockpiles are now expected to swell through next year as better-than-expected harvests face fewer routes to market.

Economic Reports for the Week

The Federal Reserve Bank of Kansas City will host its 2023 Economic Policy Symposium from Thursday through Saturday. This year's topic will be "Structural Shifts in the Global Economy." Fed chair Jerome Powell is scheduled to address the conference on Friday.

Tuesday, Aug. 22

- Federal Reserve Bank of Philadelphia issues Non-manufacturing Business Outlook Survey for August.

- A report from the National Association of Realtors is expected to show existing home sales likely fell in July to a seasonally adjusted annual rate of 4.15 million units, from 4.16 million units in June.

- Federal Reserve Bank of Richmond President Thomas Barkin speaks at Business@Breakfast: 2023 Economic Forecast update at the Danville Chamber of Commerce.

- Federal Reserve Bank of Chicago President Austan Goolsbee participates in the event "Fed Listens: Joining the Labor Force After Covid — A Discussion on Youth Employment," hosted by the Federal Reserve Bank of Chicago.

Wednesday, Aug. 23

- MBA Mortgage Applications

- S&P Global flash PMIs. The August reading for S&P Global manufacturing flash PMI likely came at 49.4, up from 49.0 in July. The services PMI flash likely remained unchanged at 52.3 in August.

- New home sales likely rose to a seasonally adjusted annual rate of 706,000 units in July, from 697,000 million units in June.

- Statistics Canada releases the country's retail sales data. Retail sales in May rose by 0.2% from April.

Thursday, Aug. 24

- Jobless Claims is expected to show initial claims for state unemployment benefits likely rose 1,000 to a seasonally adjusted 240,000 for the week ended Aug. 19, from 239,000 reported in the previous week.

- Commerce Department report is expected to show a 4% drop in orders for durable goods in July, compared with a rise of 4.6% reported in June. Orders for durable goods, excluding transportation, likely fell 0.2% in July from 0.5% in the previous month.

- Fed Balance Sheet

- Money Supply

Friday, Aug. 25

- University of Michigan's report on the overall index of consumer sentiment for August is expected to show a final reading of 71.1, a slight decline from the 71.2 recorded the previous month.

- Federal Reserve Chair Jerome Powell speaks on the economic outlook before the 2023 Jackson Hole Economic Symposium hosted by the Federal Reserve Bank of Kansas City.

Key USDA & international Ag & Energy Reports and Events

Focus this week will be on weather and results from the Pro Farmer Crop Tour as we scout fields across seven Corn Belt states Aug. 21-24. This marks the 31st year of the Pro Farmer Crop Tour. Because USDA no longer collects objective yield samples in August, this will be the industry’s first broad look at field data from across the Corn Belt. The objective of Crop Tour is to find a representative sample of yield potential across the seven Corn Belt states from the more than 1,600 samples each of corn and soybeans.

Monday, Aug. 21

Ag reports and events:

- Export Inspections

- Crop Progress

- Chickens and Eggs

- Milk Production

Tuesday, Aug. 22

Energy reports and events:

- API weekly U.S. oil inventory report

Wednesday, Aug. 23

Ag reports and events:

- Broiler Hatchery

- Rice Stocks

- Cold Storage

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

Thursday, Aug. 24

Ag reports and events:

- Weekly Export Sales

- Livestock Slaughter

- Poultry Slaughter

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

Friday, Aug. 25

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Food Price Outlook

- Cash Rents — County

- Mushrooms

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |