China's Economic Challenges Having Widespread Impacts

Black Sea incidents accelerate | Biden wants credit for IRA | SAF | Warning to shippers

|

In Today’s Digital Newspaper |

USDA daily export sale: 416,000 metric tons soybeans to unknown destinations, 2023-24 marketing year.

China's economic challenges are having widespread impacts. As a significant growth driver, China's economy is facing multiple issues, including a decline in trade, reduced consumer spending, increased regulatory pressure on the private sector, and economic restrictions imposed by the United States. The country's domestic property market is now causing concerns, particularly following the failure of debt payments by Country Garden, one of China's largest developers. Shares in Country Garden, one of China’s biggest property developers, plunged by 16% to a record low. The slump was triggered by an announcement over the weekend that the company would suspend trading in some of its bonds. Last week it was reported that the firm was restructuring its debts after missing international bond payments. Country Garden’s woes will add to the growing concerns about China’s economy. More in China section.

Up next for China: Tomorrow, Beijing is set to release data on retail sales, industrial production and property investment. Meanwhile, a China watcher sums up the current economic situation… see China section.

Shares of U.S. Steel experienced a significant surge, rising nearly 30% in premarket trading. This increase followed the company's decision to reject a takeover proposal worth $7.3 billion from Cleveland-Cliffs. Instead, U.S. Steel announced its intention to assess various strategic options. Cleveland-Cliffs made its takeover bid public, and had it been successful, the merger would have resulted in the formation of one of the largest steel producers globally. More in Markets section.

In Ukraine, another series of Russian drones and missiles hit the critical port city of Odesa, injuring at least three people. Ukrainian officials claimed they’ve seen “some success” in their ongoing counteroffensive measures, but the campaign has been slower than expected and progress has been limited by widespread Russian-laid minefields. More in Russia & Ukraine section.

Meanwhile, Russia's ruble hit a 17-month low against the dollar today, highlighting the growing squeeze on Russia's economy from Western sanctions as Moscow's war in Ukraine takes a heavy toll.

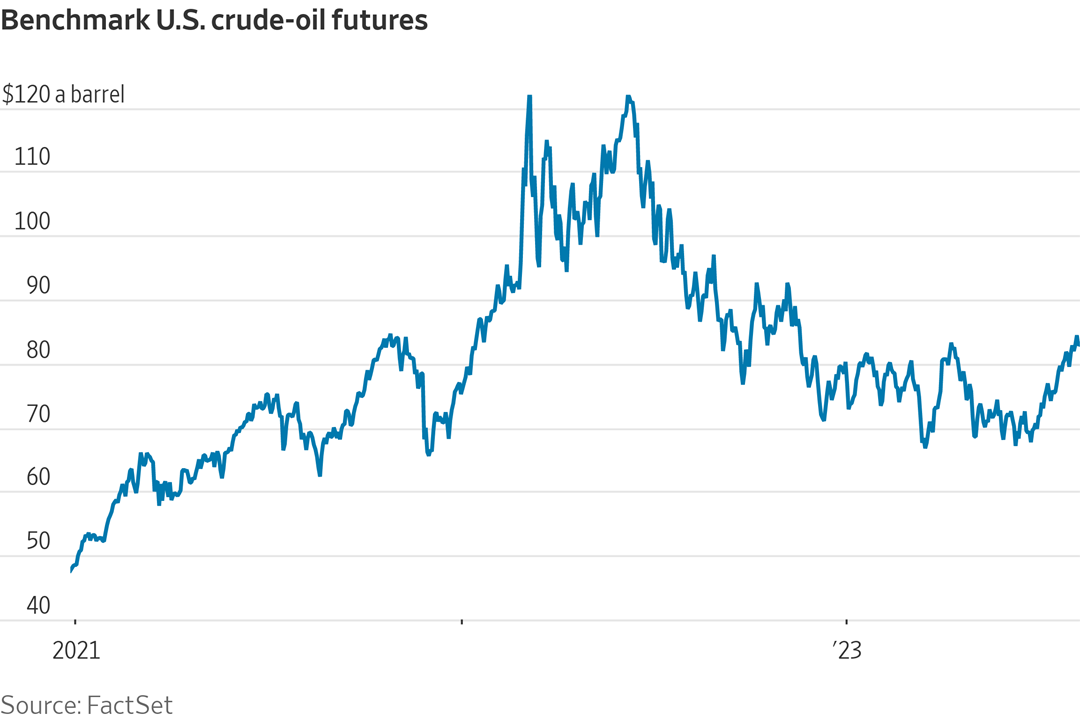

U.S. inflation is on the rise again via higher energy and food prices. See Markets section for details.

American ports are behind Asia and Europe facilities in automating. Reason: Labor unions.

The Panama Canal's operations are being impacted by drought conditions.

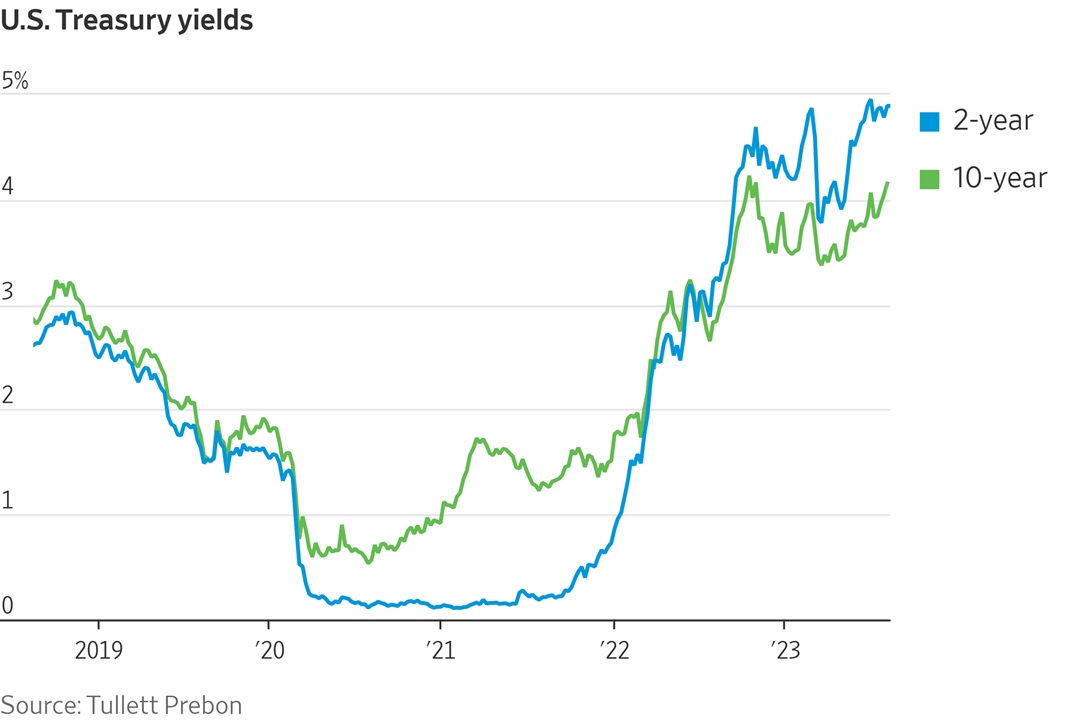

Despite a growing number of analysts pulling back prior recession forecasts, the yield curve is suggesting otherwise. More below.

U.S. airlines are helping farmers seek subsidies for corn as jet fuel. More in Energy & Climate Change section.

Supermarkets and restaurants are engaged in an intensified battle for the spending of American consumers' limited food budgets. More in Food section.

The death toll from wildfires in Hawaii rose to at least 93. It is the deadliest natural disaster since it became an American state in 1959. Josh Green, Hawaii’s governor, promised to investigate the response to the fires. Many residents have complained that emergency-warning systems never sounded. President Joe Biden said he was “looking into” visiting Hawaii in the coming days.

Former President Donald Trump may be facing his fourth indictment in the coming days. Atlanta-area prosecutor Fani Willis, a Democrat, is expected to seek charges against more than a dozen individuals when her team presents its case before a grand jury this week.

|

MARKET FOCUS |

Equities today: The Dow opened slightly higher but is shifting between losses and gains early, but is currently down around 80 points. Investors are looking ahead to earnings from major retailers, as well as retail sales data from July, which is set to be released Tuesday morning. In Asia, Japan -1.2%. Hong Kong -1.4%. China -0.3%. India +0.1%. In Europe, at midday, London -0.4%. Paris +0.2%. Frankfurt +0.4%.

U.S. equities Friday: The Dow ended higher with the Nasdaq and S&P 500 lower, echoing their weekly result. For the week, the Dow was up 0.6% while the Nasdaq fell 1.9% and the S&P 500 was 0.3% lower. On Friday, the Dow rose 105.25 points, 0.30%, at 35,281.05. The Nasdaq declined 93.14 points, 0.68%, at 13,644.85. The S&P 500 lost 4.78 points, 0.11%, at 4,464.05.

Agriculture markets Friday:

- Corn: December futures saw volatile action following Friday’s USDA reports, but ultimately fell 9 cents before settling at $4.87 1/4, marking a 10-cent loss on the week.

- Soy complex: November soybeans fell 10 3/4 cents to $13.07 1/2, a 25 3/4-cent loss on the week, while soymeal fell $4.70 to $410.30, and $12.30 week-over-week. Meanwhile, September soyoil fell 5 points to 64.13 cents, marking a weekly loss of 126 points.

- Wheat: December SRW wheat futures fell 10 cents to $6.53 3/4 and hit a four-week low. For the week, December SRW lost 6 1/2 cents. December HRW wheat lost 13 1/4 cents to $7.66 and hit a nine-week low. On the week, December HRW fell 3 1/4 cents. December spring wheat fell 3 cents to $8.30 1/4, a 7 1/2 cent loss on the week.

- Cotton: December cotton rose 174 points to 87.89 cents, after trading the highest level in nearly a year earlier in the session. December futures gained 360 points on the week.

- Cattle: Bears apparently remain skeptical about the short-term cattle outlook, with the expiring August live cattle futures falling 72.5 cents to $180.375 despite sustained cash strength. Most-active October cattle dropped $1.20 to $181.325 on the day, with the closing price marking a weekly decline of $1.575. October feeder futures slid 45 cents to end the week at $252.875, which represented a weekly drop of $2.55.

- Hogs: October lean hog futures rose $1.00 to $81.325 and nearer the session high after hitting a five-week low early on. For the week, October hogs lost $1.75.

Ag markets today: Soybeans recouped Friday’s losses during overnight trade. Corn and wheat failed to sustain early buyer interest overnight and were lower this morning. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents lower, soybeans were 11 to 13 cents higher, winter wheat markets were 4 to 7 cents lower and spring wheat was 2 to 3 cents lower. Front-month crude oil futures were modestly weaker, while the U.S. dollar index is trading just above unchanged.

Market quotes of note:

- No to automation. “It’s time we put companies out of business that push automation.” — International Longshoremen’s Association President Harold Daggett.

- “China could retaliate by cutting off access to commodity chips. I think it is a likely outcome,” Julie Samuels, president of trade group Tech:NYC, tells the Wall Street Journal. It's a move that could hit consumers and IT leaders alike with higher prices.

- China’s economy. “The anticipated economic rebound following the end of zero-Covid restrictions has yet to fully materialize.” —Howard Ungerleider, chief financial officer at chemical company Dow.

- No ‘cage match’? “If Elon ever gets serious about a real date and official event, he knows how to reach me. Otherwise, time to move on.” — Mark Zuckerberg. The CEO of Meta signaled that his much-discussed “cage match” showdown against Elon Musk won’t happen as he grows tired of his fellow billionaire’s excuses and delays.

U.S. inflation on the rise again. Inflation saw a decline in July, maintaining a downward trajectory. However, experts are warning that forthcoming months may bring some instability due to rising prices in energy and food items. In July, the consumer price index rose by 0.2% compared to the previous month, a substantial drop from the 1.2% increase in June 2022 and the average increase of 0.5% seen in 2022. If moderate monthly readings persist, inflation could align with the Federal Reserve's target of 2% annually by late 2023 or early 2024.

However, a notable force that was pulling down inflation is now shifting direction: gasoline prices. Gasoline prices have increased by 30 cents per gallon in comparison to the previous month. As energy and food prices show signs of moving upward, there is a possibility that they could contribute to upward pressure on inflation ahead.

Meanwhile, producer prices for foods gained 0.5% in July from June, the most since November. Russia's withdrawal from a deal that allowed Ukraine to export grain through the Black Sea, rising transportation costs and inclement weather could drive prices even higher.

Recession watch. Despite growing confidence on Wall Street that the U.S. can steer clear of a recession, a prominent market indicator continues to emit potentially pessimistic signals. The situation centers around the inversion of the yield curve, where yields on longer-term U.S. Treasuries persistently fall below those of shorter-term bonds. Historically, this phenomenon has been recognized as a precursor to economic downturns. A WSJ article (link) delves into the implications and insights that can be gleaned from this signal, analyzing what the current state of the yield curve might be indicating.

American ports are behind Asia and Europe facilities in automating. The pandemic-induced port bottlenecks have highlighted a significant reality about U.S. supply chains: American ports are trailing behind their Asian and European counterparts in terms of automation adoption, the Wall Street Journal reports (link). While automation has provided a degree of stability to Southern California ports during disruptions caused by the pandemic, the deployment of robots on docks in U.S. container terminals remains a distant prospect. This is occurring even as the pressure intensifies to enhance distribution speed.

Although automation has proven beneficial in mitigating disruptions at Southern California ports, there are notable challenges hindering its widespread adoption across American ports. Space constraints pose a significant hurdle, making it difficult to implement automated systems effectively. Additionally, the financial equation of achieving a worthwhile return on substantial investments is complex, discouraging rapid automation progress. However, the most prominent challenge is the vehement resistance from organized labor groups.

Dockworker unions have taken a firm stance against the expansion of automation, asserting that human-run ports are equally efficient as robotic operations. This organized opposition is a major roadblock for the adoption of automation in U.S. ports. The strong stance from these unions has led some to question whether automation, often seen as a potential solution to supply chain challenges, might not be the all-encompassing remedy that many industry executives had hoped for.

Market perspectives:

• Outside markets: The U.S. dollar index was firmer with the euro and British pound weaker against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.18%, with a mostly higher tone in global government bond yields. Crude oil futures were lower, with U.S. crude around $82.20 per barrel and Brent around $85.90 per barrel. Gold and silver were mixed, with gold weaker around $1,941 per troy ounce and silver slightly higher around $22.75 per troy ounce.

• United States Steel Corp. rejected a takeover offer from rival Cleveland-Cliffs Inc. that promised to create one of the world’s biggest steelmakers and will review its strategic options instead. U.S. Steel is still entertaining offers after rejecting the takeover, sending shares up 22% premarket, and invited Cliffs — whose stock melted 6% in response — to participate in its review process. The developments come after U.S. Steel posted a 20% drop in Q2 sales, hurt by lower average realized prices, though CEO David Burritt said he "couldn't be more bullish" on the sector thanks to the Inflation Reduction Act/Climate Bill.

• The Panama Canal's operations are being impacted by drought conditions. The organization responsible for managing the canal has decided to restrict both the quantity of ships passing through each day and the amount of cargo they can carry. This measure is being taken due to a decrease in the water supply caused by the ongoing drought. The limitation on ship traffic and cargo capacity is a response to the reduced water levels and highlights the challenges posed by water scarcity on the canal's operations. Link to more via Reuters.

• Ag trade: Iran tendered to buy up to 180,000 MT of corn that can be sourced from Brazil, Europe, Russia, Ukraine or other Black Sea countries and 120,000 MT of soymeal that can be sourced from Brazil, Argentina or India.

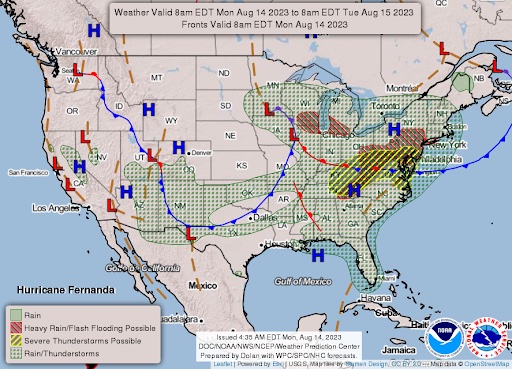

• NWS weather outlook: Flash flooding and severe thunderstorms possible for the Great Lakes/Ohio Valley/Mid-Atlantic Monday, lingering along the coast into Tuesday... ...Portions of the South to see a brief reprieve from the heat mid-week as a heat wave intensifies across the Pacific Northwest into the Northern Rockies... ...Monsoonal showers continue across the Four Corners region with some locally heavy downpours possible.

Items in Pro Farmer's First Thing Today include:

• Beans firmer, corn and wheat weaker this morning

• Favorable U.S. weather before heat builds

• Russia fires warning shots at civilian ship headed to Ukrainian port

• Limited demand for China rice sales, cotton sales continue

• Bigger cattle showlist expected this week

• Cash hog fundamentals weaken

|

RUSSIA/UKRAINE |

— Ukraine said it has started registering cargo ships for the humanitarian corridor in the Black Sea they announced August 10 to allow cargo ships trapped at Ukrainian ports to move. “Registration is now open, and the coordinator is already working," Interfax Ukraine quoted Ukrainian Navy spokesman Dmytro Pletenchuk as saying, according to a report from Reuters. Industry sources told Reuters that no ships had yet moved through the corridor.

— Russia’s navy opened fire on a cargo vessel in the Black Sea to force it to stop for checks, the defense ministry said, in the first such confirmed incident since Moscow withdrew from a key grain export deal in July. The dry freight vessel Sukru Okan, flying the Palau flag, was en route to Ukraine's Izmail port when the Russian naval patrol ship Vasiliy Bykov encountered it in the southwestern part of the Black Sea. The Russian navy instructed the vessel to halt for inspection, and when there was no response from the Sukru Okan's operators, they opened fire, according to Russia's ministry. Upon the vessel's eventual stop, a group of Russian soldiers boarded it via helicopter for inspection. Following this, the vessel was allowed to continue its journey to Ukraine. The specifics of the cargo on board, if any, were not detailed by the ministry.

— Ukraine targeted the only bridge linking Crimea to the Russian mainland on Saturday, stepping up a campaign to isolate the peninsula that was annexed by Moscow in 2014. Sergei Aksyonov, the head of Crimea installed by Russia, reported that Ukrainian missiles were shot down over the Kerch Strait early on Saturday. Later, he mentioned that another missile had been intercepted in the same area. Russia's Defense Ministry stated that Ukrainian forces had attempted to target a bridge using a modified surface-to-air missile. The bridge remained undamaged, with Aksyonov adding that a temporary smokescreen was placed over it to obscure it from potential attacks. Ukrainian officials did not comment on these reported strikes.

Reports note that Ukraine's objective seems to be undermining Russia's position in the territory and complicating Moscow's support for its forces occupying southern Ukraine. As the prospects for a direct front-line breakthrough fade, Ukraine is utilizing longer-range missiles supplied by Western allies to strike behind enemy lines, focusing on areas in and around Crimea.

Recent long-range missile attacks have targeted bridges connecting Crimea to Russian-occupied territory in southern Ukraine. The aim is to disrupt supply routes and make life and military operations in the Russian-controlled area difficult. The strategy is to weaken Russian defenses, create delays, and force the occupying forces to negotiate or withdraw, or even potentially enable a Ukrainian invasion to retake Crimea.

Limited progress. While Ukrainian forces have managed to retake some territory, their progress has been hindered by Russian minefields, fortified positions, and air power. The Crimean Peninsula, despite its small size, holds significant strategic and symbolic importance. But Ukraine's use of long-range missiles has affected Moscow's logistics routes along the land bridge connecting Russia to newly claimed territories. The deployment of U.S.-supplied artillery within striking range has disrupted these routes, pushing Russia to rely more on connections across a swampy isthmus between the land bridge and Crimea.

In response to the missile strikes, Ukrainian forces targeted key supply routes between Crimea and occupied southern Ukraine, including the Chonhar Bridge. This bridge is crucial for Russian logistics between Dzhankoi and the front line in the Zaporizhzhia region. The strikes have caused disruptions and delays for Russian logistics, impacting their war efforts.

— Ukraine grain shipments running ahead of year-ago. Since July 1, Ukraine has shipped 3.12 MMT of grains, 470,000 MT (17.7%) ahead of the same period last year. The grain exports included 1.48 MMT of corn, 1.25 MMT of wheat and 385,000 MT of barley.

— Russia plans no grain purchases for state reserves this year. Russia’s agriculture ministry said it is not planning to buy grain for its intervention fund in 2023, state news agency RIA reported.

— The Russian ruble has experienced a significant decline, reaching a 17-month low of 100 against the U.S. dollar. Throughout this year, it has lost approximately 25% of its value. This downward trend has been propelled by worsening foreign trade circumstances and a rise in military expenditures, which have contributed to its recent accelerated depreciation. The currency was already under pressure due to Western sanctions and European nations' efforts to reduce their reliance on Russian energy resources. This confluence of factors has led to the ruble's notable depreciation and economic challenges for Russia.

|

CHINA UPDATE |

— China resumes booking cargoes of Australian barley. Following the removal of tariffs by China on Australian barley earlier this month, China has initiated the booking of cargoes of Australian barley. Traders have already secured bookings for a minimum of four shipments of Australian grain, scheduled for shipping between September and October. The decision to eliminate import tariffs on August 5 was attributed to changes in the Chinese market and was seen as a positive step towards improving trade relations between the two countries.

Background. Prior to the imposition of significant tariffs exceeding 80% in May 2020, China served as Australia's primary export market for barley. This tariff imposition had a negative impact on various trade commodities, including coal and wine, which consequently strained bilateral relations. Consequently, Australia redirected its barley exports towards other countries such as Saudi Arabia, Japan, and Vietnam.

Australian barley shipments intended for animal feed in China are currently quoted at a price range of $280 to $300 per ton. In comparison, domestically produced corn in China is priced at nearly $400 per ton. This price discrepancy grants Australian supplies a competitive advantage. The value of this trade was substantial for Australia, Bloomberg reports, amounting to about A$1.5 billion ($970 million) in the 2017-18 period. However, the imposition of tariffs eventually caused this market to dwindle to zero. As a result, China shifted its barley purchases to other countries including France, Canada, and Argentina.

— More dour economic news out of China. Country Garden Holdings, China’s largest privately held property developer, is in financial trouble. The firm is reportedly seeking to delay payment on a private onshore bond for the first time. Meanwhile, two Chinese listed companies said over the weekend they had not received payment on maturing investment products from Zhongrong International Trust Co., one of China’s leading integrated financial service providers. Chinese asset management firm Zhongzhi Enterprise Group Co., a financial giant in China, has an ownership stake in Zhongrong. Concerns are building with the health of China’s economy, real estate sector and financial markets.

— Trivium China: ‘This is getting serious.’ China is demonstrating a significant commitment to attracting foreign investment with the recent release of comprehensive guidelines by the State Council, according to China watcher Trivium China. It says these guidelines, issued on Sunday, consist of 24 measures that aim to enhance the business environment for foreign investors and multinational corporations. The level of clarity and detail in these guidelines is noteworthy, the group says, marking a departure from previous high-level documents that were relatively vague and not fully implemented.

In contrast, earlier high-level documents in August 2017, June 2018, and November 2019, despite their issuance, did not yield substantial results, the China watcher notes. Additionally, a fourth task list in August 2020 was released by the State Council's general office and had limited authority. However, the guidelines themselves are just one part of the equation. The true impact on the business environment, Trivium China believes, will depend on how effectively both central and local government agencies execute these measures. The speed at which these agencies release implementing measures will provide insights into the government's seriousness about these efforts.

Upshot: Comparing the government's recent response to improving the business environment for private businesses, which was met with remarkable speed from government ministries, similar efficiency in implementing these foreign investment guidelines is expected. Concludes Trivium China: This development suggests a proactive approach by the Chinese government to create a more attractive environment for foreign investors.

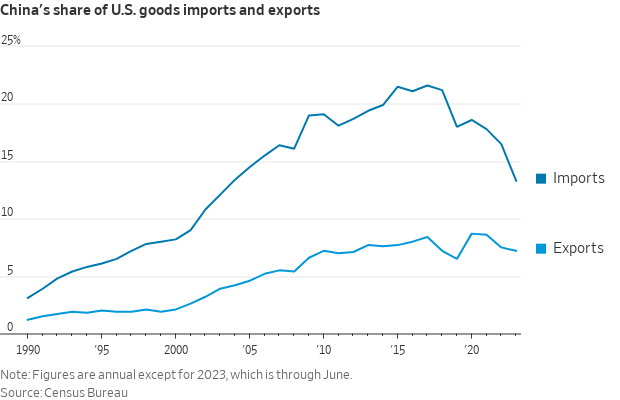

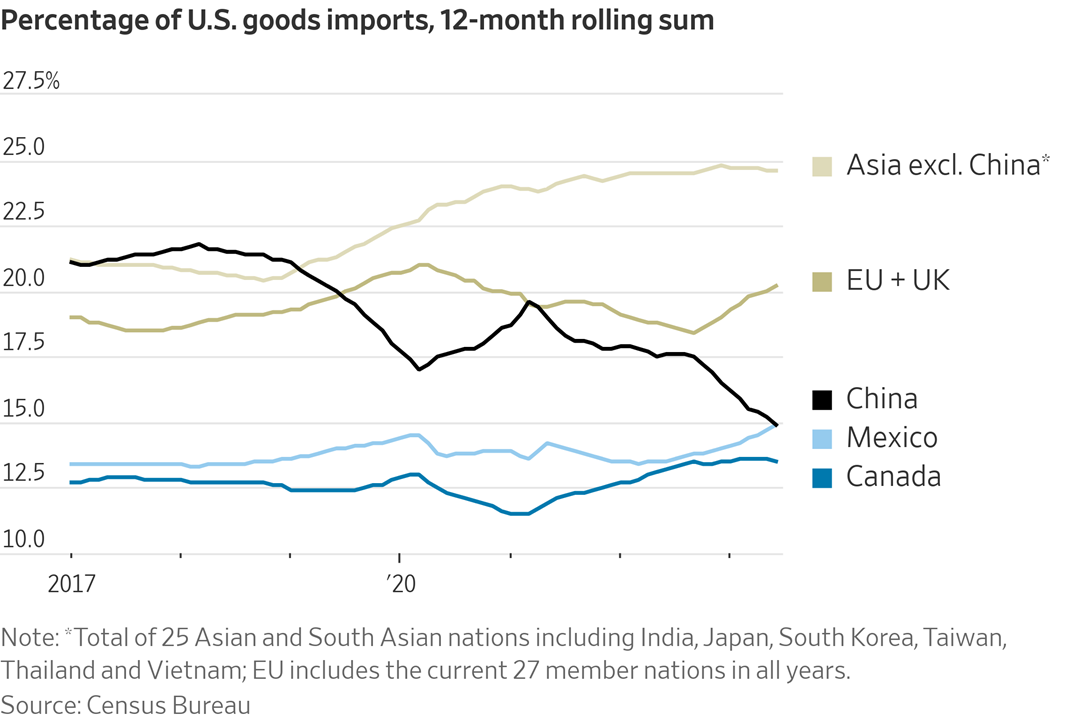

— Trade connections between the U.S. and China are weakening as their confrontational relationship intensifies. This escalating tension is causing trade ties to erode between the two largest global economies. Notably, the percentage of U.S. imports originating from China is now at its lowest point in two decades. Instead of relying heavily on Chinese goods, buyers are diversifying their sources and turning to countries such as Mexico, Europe, and other parts of Asia for a range of products, spanning from semiconductors and smartphones to clothing.

Facts and figures. During the first half of this year, China's contribution to U.S. goods imports stood at 13.3%, marking the lowest level since it was 12.1% in 2003 for the entire year, according to a WSJ review (link). In contrast, a collection of 25 other Asian nations, including countries like India, Thailand, and Vietnam, now collectively account for nearly a quarter of U.S. imports. Mexico and Canada have surpassed China, emerging as the United States' largest trade partners.

Upshot: This shift in trade dynamics has significant implications, not only for trans-Pacific maritime trade but also for the allocation of shipping capacity along these routes. As trade patterns evolve and diversify, the balance of shipping routes and cargo volumes may experience notable changes.

|

ENERGY & CLIMATE CHANGE |

— U.S. airlines are helping farmers seek subsidies for corn as jet fuel. The U.S. biofuels industry is facing a changing landscape due to evolving enviro concerns and the growth of electric vehicles. The industry confronts declining demand as electric cars gain traction. To stay relevant and meet the aviation industry’s goal of net-zero emissions by 2050, biofuel refiners and airlines are teaming up to promote the use of ethanol in sustainable aviation fuel… SAF. However, their efforts face opposition from environmental groups that argue refining corn into biofuels has limited climate benefits.

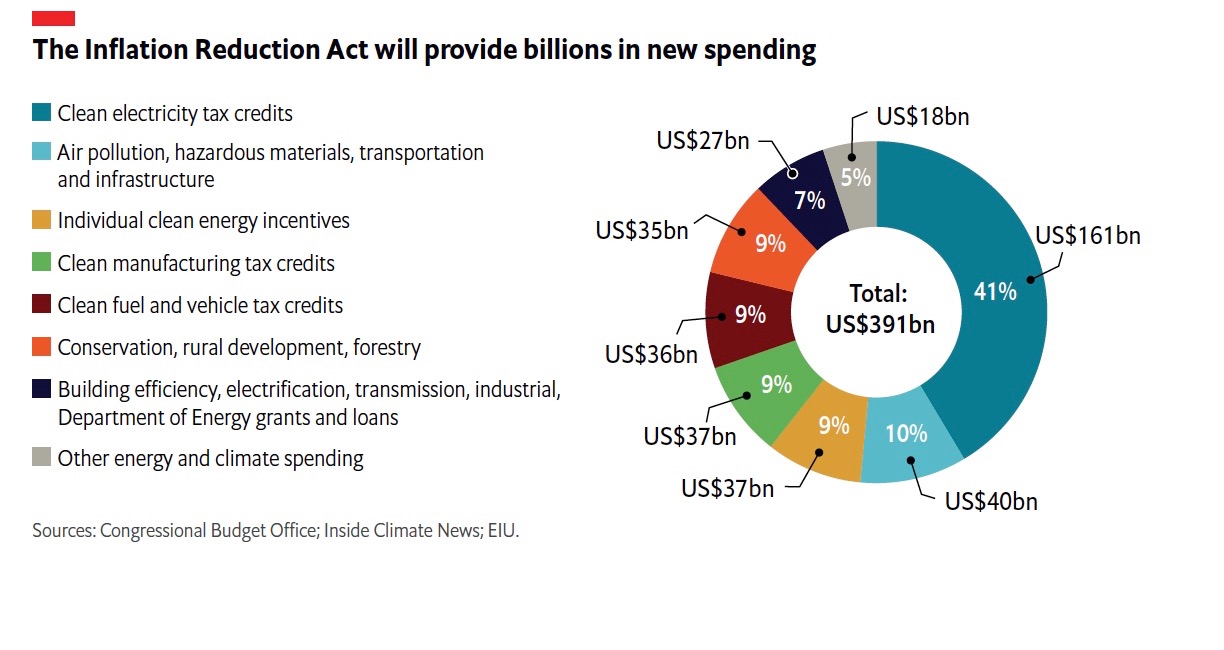

The push hinges on tax credits established in the Inflation Reduction Act… Climate Bill… signed by President Joe Biden. These tax credits, which encourage the use of more eco-friendly fuels, could make or break the prospects of corn ethanol as a sustainable aviation fuel. Airlines, biofuel refiners and oil companies are lobbying for more generous tax credits for ethanol-based fuels that reduce emissions.

The debate: metrics used to measure emissions reductions. Airlines and proponents of ethanol prefer the Greet model, while environmentalists advocate for the Corsia standard, which penalizes fuels more for changes in land use linked to crop planting. Critics argue that supporting ethanol could deter investment in more advanced, less carbon-intensive alternatives, and thus prolong reliance on older, less efficient fuels.

The Biden administration is divided over which emissions analysis model to endorse, with efforts to reconcile the two perspectives ongoing. If tax credits are extended to ethanol, despite its lower emissions reduction compared to alternatives, it could significantly expand the supply of sustainable aviation fuel, making it more accessible and affordable for airlines. This move could help airlines meet emissions targets while avoiding higher costs that come with investing in newer, more expensive sustainable fuels.

— The Energy Department plans to allocate $1.2 billion for the advancement of two commercial-scale direct-air carbon capture facilities, which will be located in Texas and Louisiana. The primary objective of this initiative is to catalyze the establishment of a comprehensive network of carbon capture sites across the United States. The funding aims to accelerate the development of these facilities, which are designed to capture carbon dioxide directly from the atmosphere. This step signifies a significant commitment to carbon capture technology and aligns with broader efforts to mitigate greenhouse gas emissions. Link for details.

— Can Biden cash in on the IRA? On the anniversary Wednesday of the signing of the Inflation Reduction Act (IRA), President Biden's initiative to turn the U.S. into a hub for green investment and clean energy, there is growing debate over whether he can capitalize on this effort. This transformation, aimed at reducing carbon emissions, involves boosting the electric vehicle sector, as well as investments in solar, wind, and hydrogen energy. Originally estimated to cost $391 billion over a decade, the plan's expenses are now projected to exceed $1.2 trillion due to unexpected popularity among consumers and businesses, creating substantial global demand for credits and subsidies, according to the New York Times (link).

Surprisingly, despite Republican lawmakers not supporting the act, a significant portion of the spending is occurring in GOP-led Southern states. These regions have attracted commitments from car companies, electric-vehicle battery manufacturers, and solar firms to establish production facilities.

The act's positive impact is already evident, with $132 billion in new clean energy projects announced since its signing, leading to the creation of 86,000 new jobs, according to Bank of America. The bank anticipates even greater economic gains in the coming year.

However, despite these positive developments, President Biden's approval ratings remain lackluster. In response, the White House has been emphasizing "Bidenomics" as a central theme in its re-election messaging, highlighting the president's efforts to promote both the economy and climate action. Jennifer Granholm, the energy secretary, even embarked on a caravan of electric vehicles in the Southeast to showcase Biden's achievements in these areas.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

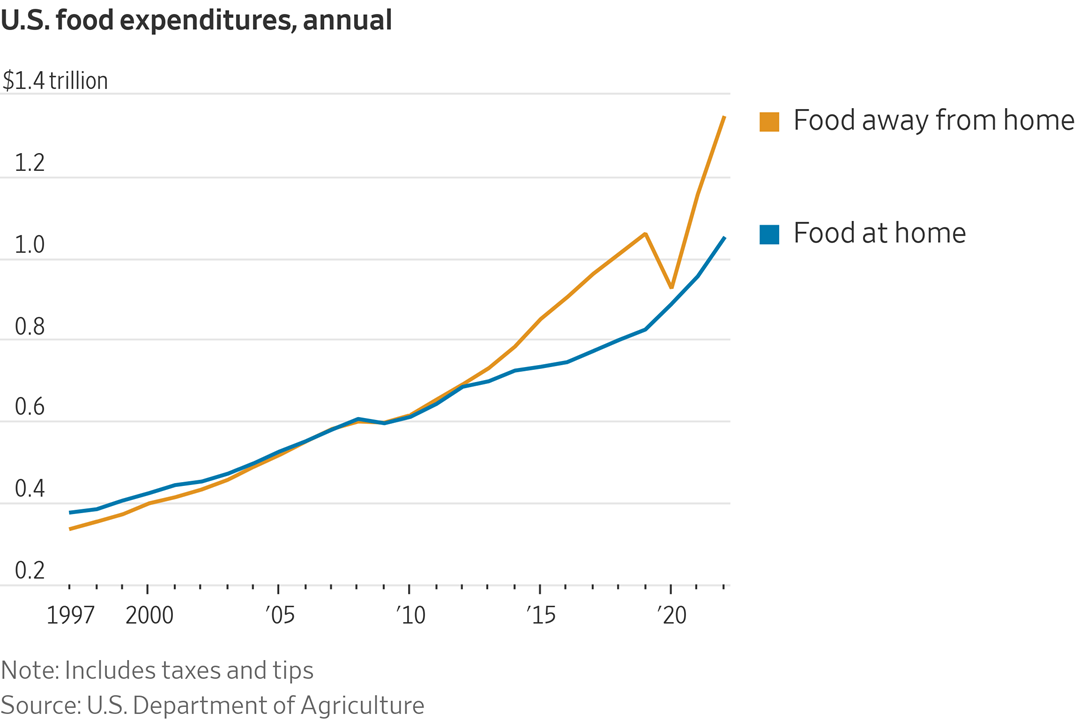

— Supermarkets and restaurants are engaged in an intensified battle for the spending of American consumers' limited food budgets. In response to escalating food prices, grocery chains are making strategic moves, such as enhancing their prepared meal offerings in delis and buffets, expanding menu options, and providing increased discounts, the Wall Street Journal reports (link). Their aim is to attract diners away from traditional restaurants. Concurrently, restaurants are adopting countermeasures, including introducing new and unique menu items that they believe would be challenging for individuals to replicate at home. This contest between the two sectors underscores their efforts to capture consumers' preferences and spending amid evolving economic conditions and changing culinary trends.

|

POLITICS & ELECTIONS |

— Former President Donald Trump is poised to confront fresh legal hurdles. Prosecutors in Georgia will likely share their findings with a grand jury today as part of an investigation into his efforts, along with his associates, to invalidate the election results in the state during November 2020. There is a possibility that a determination on whether to indict Trump could be made later this week. This development adds to the legal challenges that Trump is currently facing.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |