Central Corn Belt Farmland Values Rise 9%

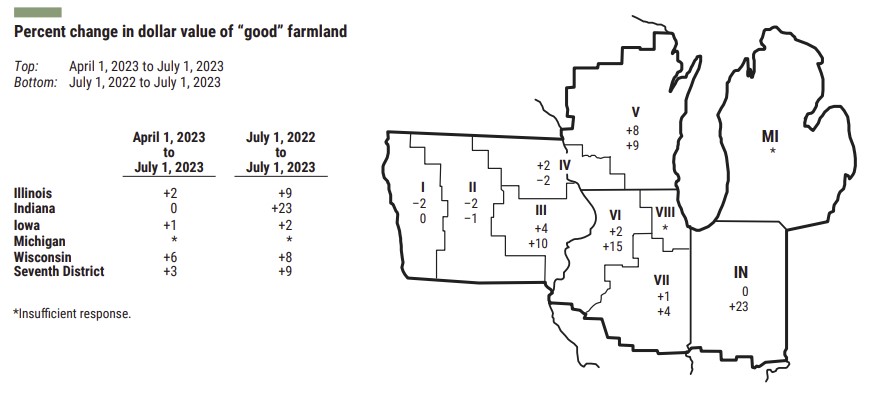

The value of Central Corn Belt farmland rose 9% in the second quarter of 2023 from a year earlier, according to a quarterly survey conducted by the Federal Reserve Bank of Chicago.

The year-over-year increase in district farmland values for the second quarter nearly matched that for the first quarter. However, the second quarter marked the first time the annual percentage gain dipped into single digits since the first quarter of 2021.

Once again, Indiana reports the largest annual increase in agricultural land values at 23%; Illinois, Iowa, and Wisconsin exhibit more modest year-over-year gains at 9%, 2% and 8%, respectively. While smaller than Indiana’s annual gain, these three states tailed off from their strong gains of previous recent quarters, comments David B. Oppedahl, who conducts the survey.

“Good” farmland values in the district rose 3% in the second quarter of 2023 relative to the first quarter. Wisconsin paces quarterly gains with a 6% surge; Illinois follows with a 2% rise; Iowa with a 1% increase and Indiana lists “no change”.

Oppedahl quotes an Iowa banker: “Low-quality land values are stronger than a year ago due to nonfarm investors. Medium-quality values are showing some weakness recently. High-quality land values are still strong.”

He further observes higher farmland values seem to reflect the strong financial conditions of the past couple of years, rather than the relatively weaker current situation. Agricultural prices were lower in June 2023 than in June 2022, yet they were still generally higher than in June 2021. The U.S. Department of Agriculture’s June index of prices received by farmers was down 5% from a year ago, but up 19%t from two years ago.

Looking ahead, 9% of survey respondents forecast higher district farmland values during the third quarter of 2023 -- 5% project lower values. The remaining 86% anticipate farmland values to be stable during July through September.

Overall, agricultural credit conditions in the second quarter of 2023 improved from a year ago yet again, although interest rates on farm loans continued to rise, he comments.

Repayment rates for non-real-estate farm loans continue to improve, but just barely. Some 12% of responding bankers note higher rates of loan repayments than a year ago versus 7% reporting lower rates. The current streak of 11 quarters with year-over-year improvements in loan repayment rates is the second longest in history. The share of farm loans with “major” or “severe” repayment problems in agricultural loan portfolios (as measured in the second quarter of every year) was 1.3% — the lowest such reading ever. In addition, renewals and extensions of non-real-estate farm loans during the April through June were lower than during the same period of a year earlier, as 5% of survey respondents report more of them and 9% cite fewer.