Most Substantial Monthly U.S. Ag Trade Deficit on Record

Deflation comes to China | Russian ports stuffed with wheat | Mass. Question 3 agreement

|

Today’s Digital Newspaper |

Abbreviated report today as I am en route back to Washington, D.C.

— Varied grain price tone overnight. Soybeans traded higher overnight, while wheat faced pressure and corn was caught in the middle. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny higher, soybeans were 8 to 9 cents higher, SRW wheat was mostly 8 cents lower, while HRW and HRS wheat were mostly 4 cents lower. Front-month crude oil futures were more than $1.00 higher, and the U.S. dollar index was modestly lower.

— Overnight ag demand news. South Korea passed on a tender to buy up to 140,000 MT of optional origin corn. Japan tendered to buy 60,000 MT of feed wheat and 20,000 MT of feed barley. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat. Algeria tendered to buy up to 80,000 MT of corn to be sourced from Argentina.

— In Asia, rice prices have dramatically increased and reached their highest level in nearly 15 years due to growing concerns over global supplies. Dry weather conditions in Thailand are predicted to impact rice production negatively. In addition to this, India, which is a major exporter of rice, has imposed bans on certain rice exports. A significant increase is highlighted in the cost of Thai white rice (5% broken), a typical reference point in Asia, which has escalated to $648 per ton. Link to more via Bloomberg.

— India plans to distribute 2.5 million metric tons (MMT) of rice and 5 MMT of wheat to domestic bulk consumers to stabilize the rising prices of these grains, according to India's Food Secretary, Sanjeev Chopra. Despite the challenges of food price inflation and impacted production due to weather conditions, India supposedly has sufficient stocks of both rice and wheat. The Indian government has put some export restrictions in place to ensure adequate domestic supplies. Recent statistics also support this claim, indicating that the country currently possesses more than the required amount of these grains in stock.

— Equities: Asian and European stock markets were mixed to firmer in overnight trading. U.S. stock indexes are pointed to firmer openings. China’s economy slipped into deflation for the first time in more than two years, as prices fell in July (details below). In Asia, Japan -0.4%. Hong Kong +0.2%. China -0.5%. India +0.2%. In Europe, at midday, London +0.8%. Paris +1.2%. Frankfurt +1.1%.

On Tuesday, the Dow closed down 158.64 points, 0.45%, at 35,314.49. The Nasdaq fell 110.07 points, 0.79%, at 13,884.32. The S&P 500 was down 19.06 points, 0.42%, at 4,499.38.

— Outside markets: The U.S. dollar index was weaker, with the euro, yen and Swiss franc firmer against the greenback. The yield on the 10-year U.S. Treasury note was trading around unchanged at 4.03%, with a mixed tone in global government bond yields. Crude oil futures were higher ahead of U.S. gov’t inventory data due later this morning, with U.S. crude around $83.85 per barrel and Brent around $87 per barrel. Gold and silver were weaker, with gold around $1,958 per troy ounce and silver around $22.79 per troy ounce.

— Fed watch: Philadelphia Fed President Patrick Harker, who is a voter in the rate-setting Federal Open Market Committee this year, has indicated in his latest comments that the Federal Reserve may have reached a point where they could hold steady with increasing interest rates. He did, however, caution that this trajectory could change depending on future data. Harker believes that the monetary policy actions already done should be given time to play out. He also added that he doesn't see any rate cuts in the foreseeable future. The Fed has hiked rates 11 times since March 2022, leading to the highest level for interest rates in over 22 years.

— Settlement clarifies new regs to Massachusetts Question 3. A federal judge on Monday approved a compromise joint motion (link) between state regulators and industry groups, who had challenged the voter-approved law, that allows enforcement of most pork-related regulations to begin Aug. 24. Products that pass through Massachusetts on their way to final sale destinations in other states, however, will not immediately be subject to the new requirements. Link for details.

As part of the deal, Attorney General Andrea Campbell’s office and the Massachusetts Department of Agricultural Resources (MDAR) will not enforce any new restrictions on “transshipped” pork meat for at least six months. In that span, MDAR will work on a regulatory carveout explicitly exempting products that traverse the Bay State but are neither produced nor sold in the state.

“We’re going to finally see implementation. We just want to make sure that the plaintiffs in the case are not going to continue to work to undermine proper implementation,” said Wayne Pacelle, president of the Animal Wellness Action group and an architect of the Massachusetts ballot question. “I think our concerns now go to whether the people in the retail industry are going to honor the spirit and the letter of the law.”

The drafted regulations (link) require pigs to have enough space to lie down, stand up, turn around freely and fully extend their limbs. Massachusetts businesses cannot sell any whole pork meat derived from animals denied that space, regardless of where they were raised, slaughtered, and butchered. The prohibition does not extend to “combination food products” that use pork as an ingredient such as hot dogs.

Of note: Almost all of the pork sold in Massachusetts comes from other states. According to statistics cited in one lawsuit challenging the pig welfare law, Massachusetts residents consumed about 356 million pounds of retail pork in 2022, only about 1.9 million pounds of which was produced within its borders.

Background. The Restaurant Law Center, four state associations, the National Pork Producers Council (NPPC), and the Massachusetts Attorney General’s Office reached a settlement providing clarity and new regulations to Massachusetts Question 3 (Q3).

The terms of the settlement state the Q3 regulations won't apply to whole pork meat that's already in the supply chain as of Aug. 23, nor will they apply to whole pork meat that was raised and sold to an out-of-state consumer. Also, if pork destined for out-of-state restaurants passes through distribution centers in Massachusetts, it will not be subject to Q3, even if a sale occurs in the state. The outcome allows impacted stakeholders more time to avoid supply disruptions.

Q3 was put into law in 2016, setting a ban on the sale of pork from establishments not meeting state's confinement standards. The pork industry was given two years to adapt to these regulations. However, the effective date for Q3 was delayed to August 2022 due to amendments to the law. The Restaurant Law Center and NPPC initially contested the constitutionality of Q3 in court in August 2022. The adjudication was put off until 30 days after the verdict on California's Proposition 12 — a comparable animal confinement state law — was reached. In May, when the U.S. Supreme Court validated Prop 12’s constitutionality, the case stay period was extended to Aug. 23.

Of note: With the recent settlement, issues not covered by the Supreme Court decision, particularly transshipment through Massachusetts, have been resolved. This is important because allowing a state to dictate what products are sold or consumed elsewhere could significantly impact the national supply chain.

A request has been made to a federal court judge to approve this settlement agreement.

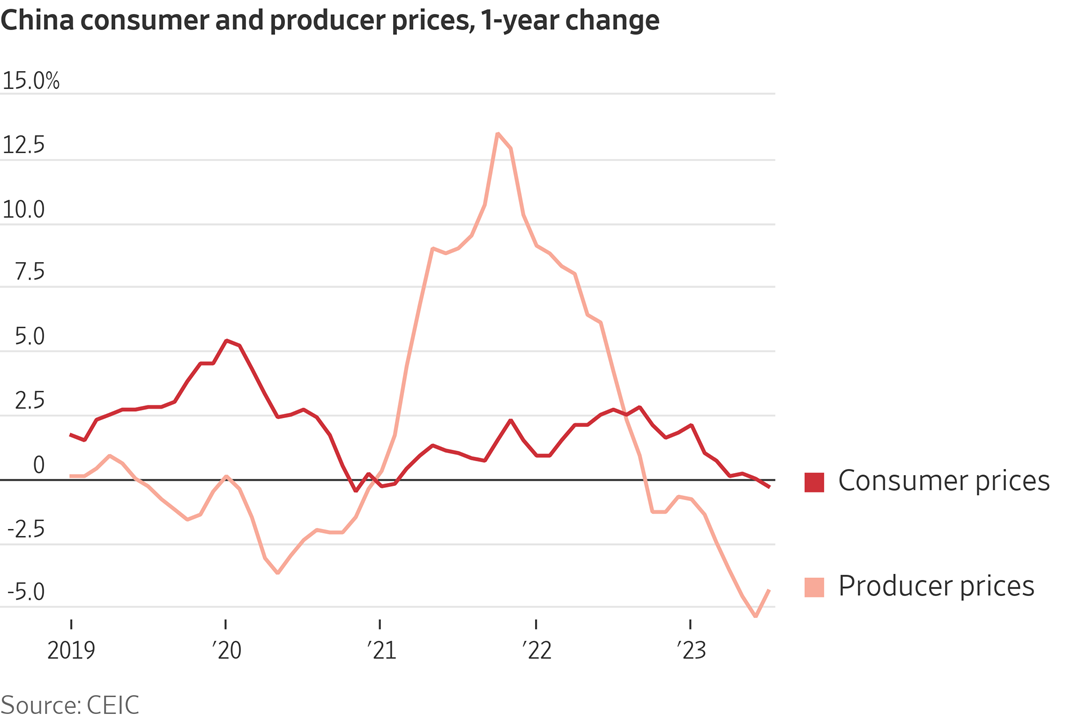

— In July, China saw a decrease in both consumer and producer prices for the first time since November 2020. This signifies a deflationary pressure due to decreasing demand. The Consumer Price Index (CPI) dropped by 0.3% compared to the previous year, while the Producer Price Index (PPI) went down by 4.4% for a tenth month in a row. According to Robin Xing from Morgan Stanley, China is undoubtedly experiencing deflation. The duration of this economic situation, however, is still uncertain.

Details: The cost of food fell 1.7%, after rising in the prior 15 months amid a plunge in pork prices. Meantime, factory gate prices extended their falls for the 10th straight month.

Of note: Domestic spending has slowed amid a faltering economic recovery after the pandemic. China also suffered a worse-than-expected drop in exports, which fell by 14.5% year on year in dollar terms in July, the biggest decline since February 2020.

— China warns of crop, animal disease outbreaks in flood-hit areas. Northern China warned of crop and animal diseases breaking out as flood waters retreated from rural areas. Local authorities must step up measures to prevent and control major disease outbreaks caused by dead animals, pests and insects, Ag Minister Tang Renjian said. He noted, “Agricultural and rural departments at all levels should accurately assess the disaster situation of farmers, help the affected farmers solve practical difficulties, and prevent disaster-caused poverty or return to poverty.”

— In China, it’s cheaper to buy EVs than gasoline cars. Bloomberg reports (link) that seven of the 10 best-selling cars in China in June were EVs. Tesla’s Model Y crossover SUV has comfortably outsold every competitor since February, while BYD Co.’s Dolphin hatchback has already overtaken established competitors just months after deliveries began. EVs’ exemption from China’s 10% vehicle purchase have benefitted the sector.

— U.S. to ban some investments in China. The U.S. government is planning to impose restrictions on private-equity and venture-capital investments into certain Chinese tech companies, according to a new executive order that will be issued today by President Biden's administration. This step represents an escalation in the U.S. strategy to hinder Beijing from advancing military-grade technology. The forthcoming executive order is predicted to include prohibitions on direct investments in three specific technological sectors: semiconductors, quantum computing, and artificial intelligence.

— In a major move for America's rural electric cooperatives, $10 billion in federal grants for clean energy projects have become available. From July 31, cooperatives can submit letters of intent to the "Empowering Rural America" grant program, which is worth $9.7 billion and for specific renewable energy initiatives. Furthermore, an additional $1 billion became available through a similar scheme, PACE, in late June. USDA will oversee the distribution of the funds. The grants, classified into three categories based on the size of the cooperatives, are competitive, so timelines are tight. The deadline for submitting letters of intent is Sept. 15, and missing it means forfeiting the opportunity to enter the formal application process.

— U.S. oil production is set to increase more rapidly than previously projected this year, largely due to better-than-anticipated well productivity and rising crude prices, according to the latest forecast by the U.S. Energy Information Administration (EIA). This increased U.S. output will contribute additional supplies to a market that has been strained due to Saudi Arabia's decision to reduce its oil production.

Details: Oil production in the U.S. is set to reach a record 12.8 million barrels a day in 2023, up from the projected 12.6 million barrels. In 2022, the U.S. averaged approximately 11.9 million barrels per day. This production surge will help to satisfy the extant demand as the Organization of Petroleum Exporting Countries (OPEC), led by Saudi Arabia, has significantly reduced its output in order to stabilize oil prices.

Global oil production is also expected to see a rise next year. The EIA projects that the world's output will reach 103 million barrels per day in 2024, 1.7 million barrels per day more than this year. Over 70% of the increase will be contributed by non-OPEC countries, with the U.S., Brazil, Canada, Guyana, and Norway taking the lead. U.S. production is expected to peak at 13.1 million barrels per day next year.

Despite the surge in production, the consumption of refined products in the U.S. will be less than formerly anticipated, according to the EIA. A slowdown in the U.S. air travel boom is expected to lower jet fuel usage by 4% in the third quarter, compared to previous forecasts. Predicted gasoline and diesel consumption rates have also been decreased for the third quarter and entire year.

Bottom line: Even with these adjustments, the EIA's projection for total oil demand in the U.S. has increased due to the growing usage of natural gas liquids.

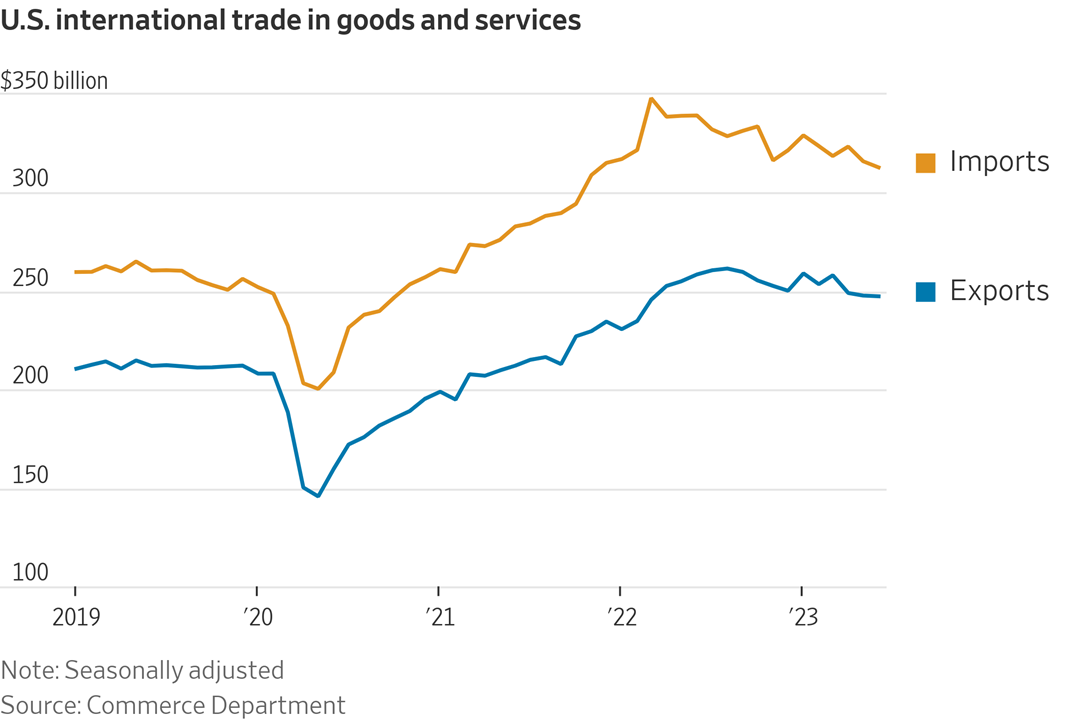

— In June, U.S. agricultural exports and imports both fell significantly, resulting in the most substantial monthly trade deficit on record. Agricultural exports dropped more than 8% to $12.80 billion, the lowest monthly shipment value since September 2021, while imports fell almost 6% to $15.96 billion. This decrease resulted in a monthly deficit of $3.16 billion.

For fiscal year (FY) 2023, U.S. agricultural exports have now reached a total of $141.37 billion, an average of $15.71 billion per month, while imports total $148.19 billion, with a monthly average of $16.47 billion. Consequently, the current deficit stands at $6.8 billion.

USDA projects U.S. agricultural exports will hit $181 billion, against imports of a record $198 billion, thereby resulting in a trade deficit of $17 billion. To meet this forecast, agricultural exports need to average $9.95 billion per month in the July-September period, while imports must average $12.45 billion. But because U.S. ag exports have not fallen below $10 billion since April 2016, when they were $9.91 billion, it appears USDA's export forecast might be underestimated. Unless import strength persists over the next three months, their import forecast could possibly be overstated.

— U.S. trade with the rest of the world fell in June as imports slid to their lowest level in 19 months, the latest sign that high interest rates are cooling economic activity. Imports fell 1% in June from the prior month to a seasonally adjusted $313 billion, the lowest since November 2021, the Commerce Department said. Exports declined 0.1%, and the overall trade deficit narrowed 4.1%.

— The U.S. is aware that Ukraine's counteroffensive is not progressing as initially anticipated, according to a White House official. A CNN report pointed to a growing concern among Western officials regarding the ability of Ukraine's forces to recapture significant territories. National Security Council spokesperson John Kirby noted that though progress is being made, it's gradual, entails difficulties, but they continue to strive. Ukrainian President Volodymyr Zelenskyy also acknowledged in a video on Tuesday that the counteroffensive has been challenging and is probably moving slower than expected. Despite this, Kirby reassured that the U.S. would continue supporting Kyiv with military aid, including mine-clearing equipment, ammunition, and advanced rocket systems.

Of note: The Biden administration on Thursday is expected to ask Congress for additional aid for Ukraine. This will likely be part of a package that includes funding for U.S. disaster aid.

— Antarctic ice levels are at record lows, prompting an urgent call for policy action to curb the burning of fossil fuels, as depicted in a study published on Tuesday in the journal Frontiers in Environmental Science. The study (link) states that it is "virtually certain" that if carbon emissions continue at their current pace, the magnitude and frequency of extreme weather events will increase. This situation underscores the urgent need for concerted efforts to reduce greenhouse gas emissions, primarily originating from fossil fuels, to mitigate their impact on the climate, especially in sensitive regions like Antarctica.

— Australia to resume barley exports to China. The Australian government announced that CBH Group and Emerald Grain Australia, two of its major grain exporters, have been given the green light to resume barley exports to China. This follows the recent move by China to lift tariffs on Australian barley shipments. The announcement, made jointly by the Australian ministries of trade and agriculture, did not specify when the first post-tariff removal exports would occur. This development comes after China eliminated anti-dumping and anti-subsidy duties on Australian barley on Aug. 5.

— Russia is grappling with overflowing grain ports following two bumper harvests, risking disruption to global grain trade in light of potential military escalation in the Black Sea, Bloomberg reports (link). Despite record exports of 4.4 million tons of wheat in July, 60% above average, port capacity is stretched to the limit, according to consultant SovEcon. Storage problems are particularly acute at terminals on the Azov Sea, which have stopped accepting grain.

The situation could escalate if political tensions in the Black Sea between Russia and Ukraine worsen, which would further slow the flow of Russian grain — a key player in global food supplies. This is concerning as Russia, the world's top wheat shipper, moves most of its grain through the Black Sea. Russian wheat supplies, the largest in 30 years, have been slow to move due to bottlenecks from handling excessive amounts of grain.

Smaller ports on the Azov Sea are experiencing more congestion than the primary Black Sea grain port of Novorossiysk. Navigation through the Kerch Strait, a critical route for vessels from Azov Sea ports, has been restricted due to safety concerns following an attack on the Kerch bridge.

Of note: Escalating tensions could significantly affect global grain trade. Ukraine retaliated against Russia's attempts to hinder Ukrainian grain exports by attacking a Russian oil tanker and has warned of potential further attacks. Persistent backup in the ports could cause storage problems for Russian grain growers and force them to store more grain at farms, potentially mixing different varieties of wheat. Despite high exports, there's still substantial grain surplus, and a second wave of harvest is anticipated in southern Russia.

— Turkey seeks ‘expanded’ Black Sea grain deal. Turkish President Recep Tayyip Erdogan said he aims to revive the Black Sea grain deal with an “expanded scope,” calling on western countries to help turn the initiative into the basis for peace between Russia and Ukraine. Erdogan said contacts to restart the initiative “with an expanded scope” are ongoing but a solution depends on western countries “fulfilling their promises,” he added, without specifying which commitments had been broken.

— Top South American leaders convened in Brazil recently to deliberate the future of the Amazon rainforest. Brazil's President, Luiz Inácio Lula da Silva, made a commitment to counteract the economic "plundering" in the forest region and rectify the environmental harm instigated by his predecessor, Jair Bolsonaro. An alliance to safeguard the Amazon was formed during this summit, signifying a collaborative effort to protect this vital ecosystem. However, the members fell short of setting a coordinated target date to halt deforestation, highlighting some of the challenges in establishing unified policies.

— The Republican National Committee has picked Fox Business to host the second GOP presidential primary debate, which is set to be held next month at the Ronald Reagan Presidential Foundation and Institute in Simi Valley, Calif. The decision means that Fox networks will televise the first two debates.

— In Ohio, a proposal aiming to increase the difficulty of amending the state's constitution was turned down by voters. The plan entailed a necessity for Ohio's citizenry to gather signatures evenly from all counties within the state to propose a constitutional change. Additionally, it would have raised the minimum requirement for such proposals to pass a vote, up to 60% from the current 50%. The rejection of this proposal is considered a setback for Republicans, as it precedes a consequential referendum on the issue of incorporating abortion rights into the Ohio constitution, slated for a vote in November. If the abortion measure is approved by voters later this year, the amendment would override Ohio's 2019 law that bans abortion after six weeks of pregnancy without exceptions for rape or incest.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |