Mandatory Base Acre Update Still Being Pushed by S.D. Lawmakers, Others

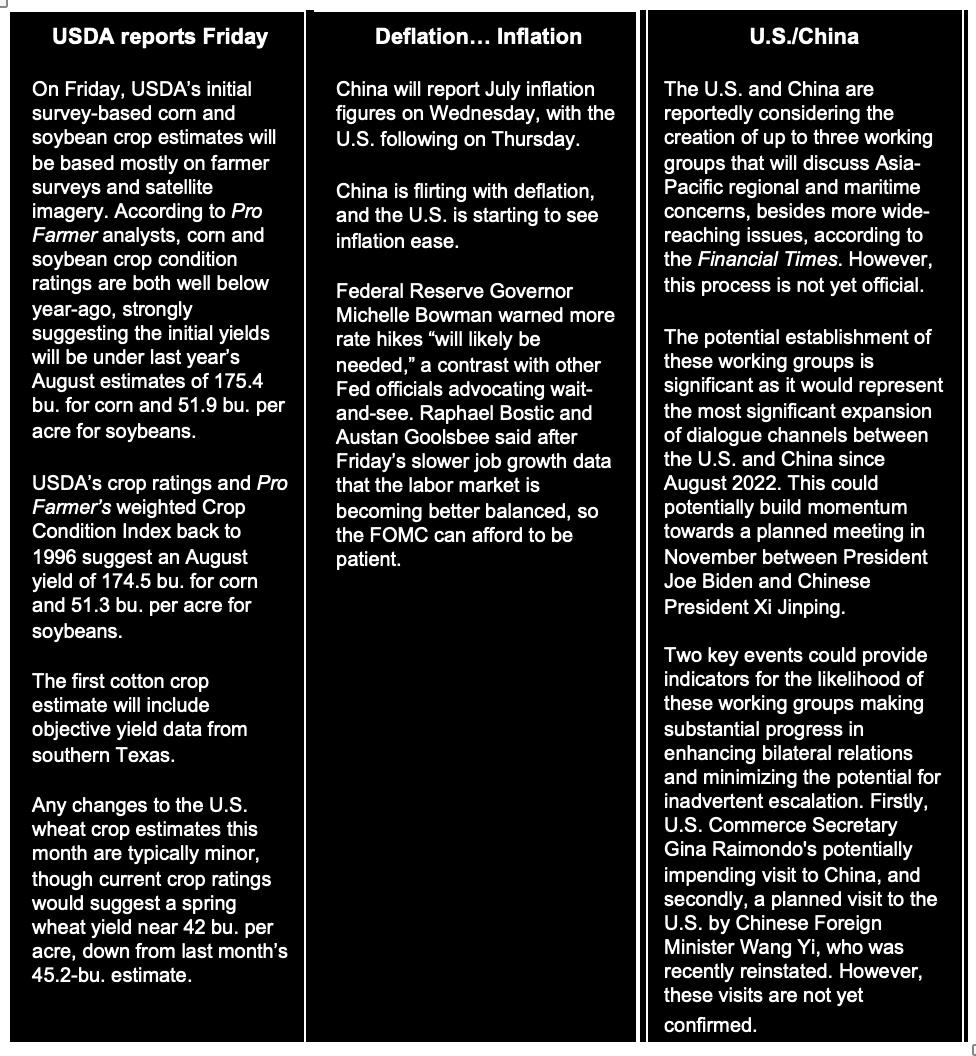

USDA reports Friday | Inflation reports from U.S., China | Ukraine hits Russian oil tanker

Washington Focus

Both chambers may be on their long summer recess, but the wheels are still turning relative to getting a new farm bill together, with staff and some lawmaker work continuing.

By far the biggest potential change is the push led by some South Dakota lawmakers and groups for a mandatory base acreage update, despite opposition from the ranking member on the Senate Ag panel, Sen. John Boozman (R-Ark.), who tried to deep-six the issue with a minority staff report last week. But the oxygen tent is clearly evident for the topic. It means more potential taxpayer money to more than a few producers.

Why not a voluntary base update? Because according to some forecasts, that would mean an additional 45 million base acres. Too expensive even for a deficit-happy Congress, and a baseline that the Congressional Budget Office (CBO) already scores at $1.51 trillion over ten years. (For perspective, the U.S.’ current annual deficit is around $1.4 trillion just for this year.)

A mandatory base update, according to some forecasts, would mean 20 million fewer base acres. It’s obvious some regions and crops would be favored, and others disfavored under the mandatory approach.

In the coming weeks and months, the arguments for and against will flow. Why pay on grass acres when young and beginning farmers have little to no base acres? Some say that is a fair question, but it is a tangent of the overall issue. But in the complex world of farm policy, few lawmakers, especially new ones, can’t see nuances.

Those pushing for a mandatory update say too many farmers are getting payments on acres they do not plant… grass acres, etc.

What about World Trade Organization (WTO) concerns of the U.S. being challenged for basing payments on relatively current plantings and thus potentially market distortive? One frequently gets a laugh when asking that question as many discount the workings of the WTO. “Besides,” one source said, “this would be a one-time mandatory update.” Others may laugh at that assessment holding up. Another argument one hears from some is that some features of the U.S. crop insurance program may have some WTO concerns if challenged. That is a topic for another day.

The mandatory update may not show up in any forthcoming farm bill drafts when lawmakers return, or shortly before they exhaust their six weeks off. But that would not mean this is a dead issue. The debate will come when the bill is marked up. Could be some interesting discussions then.

On the surface, this is a Midwest/Plains states win, and southern states lose. But as with anything, it depends on actual farmer plantings. Also, some efforts will likely be taken to boost reference prices and supports for some crops over others (say rice and peanuts for example). That could win over a few southern lawmakers and make a committee vote more than interesting.

Ukraine's drone attacks on shipping are threatening Russia's commodity exports. This could result in much higher insurance and shipping costs.

In addition, these attacks pose new risks to the international energy and agricultural markets. A concrete example happened on Saturday, when a sea drone struck a Russian-flagged oil tanker. This event occurred shortly after an assault on a landing ship outside Novorossiysk, a Russian port. Link to Bloomberg article.

The Ukraine attacks — the most serious strikes on the Russian Navy since last year — coincided with a new directive from Ukraine’s maritime authority warning that six Russian Black Sea ports would be considered “war risk” areas until further notice. Link to New York Times article.

The Federal Reserve is continuing its inflation watch and will likely focus on union requests. The latest one comes from the United Auto Workers (UAW) union, which is urging Detroit-based car manufacturers for a notable 40% salary increase spread over four years, alongside improved worker benefits. These requests were made in preliminary proposals during contract negotiations with General Motors, Ford, and Stellantis, all confidential due to ongoing discussions. The present labor agreement concludes on Sept. 14. These UAW proposals were initially reported by the Wall Street Journal.

UAW also wants to institute cost-of-living allowances, boost pensions, and secure enhanced provisions for temporary staff.

UAW president Shawn Fain justified the proposed pay increases given that the company CEOs have received an average of 40% salary increases since 2019.

Fain is pushing for an elimination of employment tiers, which often result in temporary and newly employed workers receiving lower wages. Current UAW workers earn roughly $18 per hour, increasing to a maximum of $32 per hour, while temporary staff earn less than $17 per hour. Fain is calling for "double-digit pay raises" for all types of workers.

Fain also wants to re-establish a cost-of-living allowance to safeguard against inflation, a provision UAW workers conceded during the financial crisis.

Seaboard recently commented on the ongoing legal battle over the housing of sows with Prop 12 and Massachusetts Question 3 and how that will affect the company. Seaboard Corporation is a diverse multinational agribusiness and transportation conglomerate with integrated operations in several industries. In the U.S., its primary businesses include pork production and processing and ocean transportation. Internationally, Seaboard is primarily engaged in commodity merchandising, grain processing, sugar production, and electric power generation.

“Diversity of standards for housing sows requires each producer to implement separate record keeping to track compliant animals through the growing process to the processing plant, and finished products from the processing plant to third party purchasers,” the company said. “The enactment of more stringent standards can impair the value of existing assets, increase the cost of production and distribution, lower the value of non-compliant products and/or disrupt the market for pork which could result in a reduction in the sales prices of pork products.”

Seaboard noted that the volume of pork that would fall under the new laws in California and Massachusetts accounted for approximately 5% of direct sales for the year ended Dec. 31, 2022.

Link to L.A. Times article on Proposition 12.

Politics and elections.

- Link to excerpts from the Wall Street Journal’s Aug. 1 editorial board meeting with former New Jersey governor and GOP presidential candidate Chris Christie. Link to WSJ article.

- A New York Times/Siena College poll Friday showed a somewhat closer race in Iowa, which opens the GOP nominating contest with caucuses on Jan. 15. Former President Donald Trump's lead in the Hawkeye State is 44%-20%, according to the survey.

Monday, August 7

• President Joe Biden welcomes the Houston Astros to the White House to celebrate their 2022 World Series victory.

• Federal Reserve. Fed Governor Michelle Bowman delivers opening remarks at the “Fed Listens” session sponsored by the Atlanta Fed.

• Deterring China. Hudson Institute discussion on "A Requiem for Dominance: New U.S. Strategies to Deter Aggression," focusing on China.

• Marking U.S. embassy bombings in Kenya, Tanzania. Secretary of State Antony Blinken delivers remarks at the commemoration of the 25th anniversary of the U.S. embassy bombings in Kenya and Tanzania.

• Offshore wind and decarbonizing East Asia. Atlantic Council's Global Energy Center virtual discussion on "Leveraging Offshore Wind to Decarbonize East Asia."

• Venezuela elections. Wilson Center's Latin America Program virtual discussion on "Venezuela's election and the changing strategies of the democratic opposition."

• Carbon-free energy challenges. Washington Post Live virtual discussion on "The Challenges of Carbon-free Energy."

Tuesday, August 8

• Housing issues. Bipartisan Policy Center discussion on topics including the unique features of the "Ginnie Mae" mortgage securities model and opportunities for the organization "to expand homeownership opportunities for underserved people and communities."

• PFAS in drinking water. Environmental Protection Agency virtual meeting of the National Drinking Water Advisory Council for an update on a final National Primary Drinking Water Regulation (NPDWR) for per- and polyfluoroalkyl substances (PFAS).

• GOP future. Washington Post Live virtual discussion on "The Future of the Republican Party."

• Gig economy. Aspen Institute virtual discussion on "Good Work in the Gig Economy: Building a Sustainable App-based Economy."

• Artemis II mission. National Aeronautics and Space Administration (NASA) holds a news conference to provide mission preparations and crew training updates for Artemis II, which will "send a crew of four astronauts on a journey around the Moon and bring them back safely, paving the way for future long-term human exploration missions to the lunar surface, and eventually Mars."

• Border issues. House Judiciary House Judiciary Committee Crime and Federal Government Surveillance Subcommittee; and House Oversight and Accountability Committee National Security, the Border, and Foreign Affairs Subcommittee joint field hearing in Sierra Vista, Arizona, on "Biden's Border Crisis and its Effect on American Communities."

Wednesday, August 9

• War in Ukraine. Washington Post Live virtual discussion on "Putin and the War in Ukraine."

• Nuclear panel. Department of Energy meeting of the Nuclear Energy Advisory Committee.

• Bank failures. Peterson Institute for International Economics virtual discussion "Can supervisory reform prevent repeat bank failures in the U.S.?"

• U.S./Arab cooperation. National Council on U.S./Arab Relations virtual conference on "The Road to 2050: An Assessment of Arab Regional Possibilities and the Future of U.S. Cooperation.” Runs through Thursday.

• Government cloud security. Government Executive Media Group virtual discussion on "The Road to FedRAMP: Achieving Code to Cloud Security for the U.S. Government."

Thursday, August 10

• Beginning and small farmers/ranchers. Farm Credit Administration meeting for the Annual Report on the Farm Credit System's Young, Beginning, and Small Farmers and Ranchers Mission Performance

• Hurricane Ian. House Oversight and Accountability Government Operations and the Federal Workforce Subcommittee field hearing on "Weathering the Storm: Oversight of the Federal Response and Recovery Efforts in Southwestern Florida following Hurricane Ian."

• China and the Middle East. Arab Center virtual discussion on "China's Growing Role in the Middle East: Regional Geopolitics and U.S. Policy."

• U.S./Arab relations. Final day of the National Council on U.S./Arab Relations virtual conference on "The Road to 2050: An Assessment of Arab Regional Possibilities and the Future of U.S. Cooperation.”

• Economic matters. National Economists Club discussion with Isabella Weber, assistant professor of economics at the University of Massachusetts at Amherst.

• Chronic Wasting Disease. USDA’s Animal and Plant Health Inspection Service virtual meeting of the Chronic Wasting Disease Herd Certification Program.

Friday, August 11

• Wildfire management. House Natural Resources Federal Lands Subcommittee virtual hearing on "Conservation in a Crown Jewel: A Discussion About Wildfires and Forest Management."

Economic Reports for the Week

Thursday brings the Consumer Price Index, followed by Friday’s Producer Price Index.

Monday, Aug. 7

- Consumer credit is expected to increase $14.1 billion in June versus a smaller-than-expected increase of $7.3 billion in May.

- Earnings: Tyson Foods, Lucid Group, Skyworks Solutions, Paramount Global, and Palantir Technologies

Tuesday, Aug. 8

- NFIB Small Business Optimism Index: The small business optimism index has been below, and often deeply below, the historical average of 98 for 18 months in a row. July's consensus is 91.5 versus 91.0 in June.

- International Trade in Goods and Services: A deficit of $65.4 billion is expected in June for total goods and services trade which would compare with a $69.0 billion deficit in May. Advance data on the goods side of June's report showed a $4.0 billion narrowing in the deficit.

- Earnings: Eli Lilly, United Parcel Service, Coupang, Li Auto, and Datadog.

Wednesday, Aug. 9

- MBA Mortgage Applications

- Earnings: Disney, Trade Desk, Roblox, Wynn Resorts, and Brookfield Asset Management.

Thursday, Aug. 10

- Jobless claims for the August 5 week are expected to come in at 230,000 versus 227,000 in the prior week which was 6,000 higher than expected.

- Bureau of Labor Statistics (BLS) releases the Consumer Price Index for July. Consensus estimate is for the CPI to rise 3.3% year over year and the core CPI, which excludes volatile food and energy prices, to increase 4.8%. This compares with gains of 3.0% and 4.8%, respectively, in June. The CPI is at its lowest level since March of 2021.

- Fed Balance Sheet

- Money Supply

- Earnings: Alibaba, U.S. Foods, and Ralph Lauren.

Friday, Aug. 11

- University of Michigan releases its Consumer Sentiment Index for August. In July, consumers’ expectations of the year-ahead inflation were 3.4%. Inflation expectations remain well anchored, despite the four-decade high CPI reading reached last summer.

- BLS releases the Producer Price Index for July. Expectations are for the PPI to increase 0.7% from a year earlier, six-tenths of a percentage point more than in June. The core PPI is seen rising 2.5%, after a 2.4% gain in June.

- Earnings: Spectrum Brands and Soho House.

Key USDA & international Ag & Energy Reports and Events

USDA on Friday releases its updated supply and demand estimates.

Monday, Aug. 7

Ag reports and events:

- Export Inspections

- Crop Progress

Energy reports and events:

- Earnings: Saudi Aramco; Kosmos Energy

- Holiday: Australia; Canada; Colombia

Tuesday, Aug. 8

Ag reports and events:

- China’s first batch of July trade data, including soybean, edible oil, rubber and meat & offal imports

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- China’s first batch of July trade data, including oil, gas and coal imports; oil products imports & exports

- EIA monthly Short-Term Energy Outlook, or STEO

- Earnings: Glencore; Duke Energy; Ecopetrol

Wednesday, Aug. 9

Ag reports and events:

- Broiler Hatchery

- Livestock and Meat International Trade Data

- Rosario Board of Trade monthly Argentina crop report

- Holiday: Singapore

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- Earnings: E.On

Thursday, Aug. 10

Ag reports and events:

- Weekly Export Sales

- Meat Price Spreads

- U.S. Agricultural Trade Data Update

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Malaysian Palm Oil Board’s monthly data for output, exports and stockpiles

- Port of Rouen data on French grain exports

- Sugar production and cane crush data from Brazil’s Unica (tentative)

- Malaysia’s Aug. 1-10 palm oil exports

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- OPEC publishes monthly Oil Market Report

- ICE gasoil August futures expire

- Earnings: Eneos; RWE

Friday, Aug. 11

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- WASDE

- Crop Production

- World Agricultural Production

- Cotton: World Markets and Trade

- Grains: World Markets and Trade

- Oilseeds: World Markets and Trade

- Cotton Ginnings

- China’s agriculture ministry (CASDE) monthly supply and demand report

- FranceAgriMer’s weekly crop condition report

- Holiday: Japan

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- IEA monthly Oil Market Report

- ICE Futures Europe weekly commitment of traders report

- Earnings: EnBW

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |