U.S. Economy Added 187,000 Jobs in July, Less than Expected; Relief Rally for Equities

Oil production cuts, prices rise | Ukraine attacks Russian port | Baseless reason for base update

|

In Today’s Digital Newspaper |

The U.S. economy created 187,000 jobs in July of 2023, below market expectations of 200,000 and following a downwardly revised 185,000 in June. Job gains occurred in health care, social assistance, financial activities, and wholesale trade. Meanwhile, the unemployment rate edged down to 3.5%.

The unemployment rate in Canada edged higher to 5.5% in July of 2023 from 5.4% in the previous month, aligned with market expectations, marking the third consecutive increase to levels last seen in January 2022 to reflect some softening in the Canadian labor market.

The crude oil market is on track to mark its sixth successive weekly increase. This trend follows Saudi Arabia's announcement regarding the extension of its self-imposed cut in oil production by an additional 1 million barrels per day (bbl/day) for yet another month. Moreover, Saudi Arabia indicated the potential to either extend this reduction further or even deepen the cut. (See details below.) This is alongside voluntary reductions made by some members of the Organization of the Petroleum Exporting Countries (OPEC). Simultaneously, Russia has confirmed its commitment to continuing the reduction in its crude supply until September. These developments are fueling concerns about the availability of oil supplies. Nevertheless, despite ongoing apprehensions, there is no anticipation for any policy shifts in the short-term. An OPEC+ panel meeting is scheduled for today, at which such policy changes could theoretically be discussed.

The average rate for a 30-year mortgage rose to a three-week high of 6.9% from 6.81% last week.

U.S. sailors and Marines are in training for a possible mission to board merchant ships in the Strait of Hormuz to counter Iranian aggression.

Biden will host the leaders of Japan and South Korea for a summit at Camp David on Aug. 18.

China will scrap import tariffs on Australian barley from Aug. 5 in the latest sign of improving ties between the two countries. The commerce ministry said it’s no longer necessary to continue imposing anti-dumping and anti-subsidy tariffs on Australian barley following changes in the Chinese market. More details in China section.

The U.S. has rejected Mexico's proposal to jointly research the health effects of genetically modified (GM) corn, according to Reuters and Mexico media. More in Trade Policy section.

Russia said on Friday it needed actions, not promises, from the U.S. to meet the conditions it has set for a return to the Black Sea grain deal. More in Russia & Ukraine section, including updates on Ukraine’s attack on a Russian port.

The White House is refereeing an internal gov’t debate over whether USDA or the Food and Drug Administration should regulate genetically modified meat and fish, the Wall Street Journal reports. The industry favors USDA, while consumer and environmental groups want the FDA in charge. Details in Food section.

Global food prices registered an increase in July. The Food and Agriculture Organization (FAO) World Food Price Index rose in July to 123.9, up 1.5 points (1.3%) from June, marking only the second rise in the index in the last several months. The FPI had been declining since its peak in March 2022.

Shipping giant Maersk lowered its estimate for global container trade, seeing no major signs of a recovery this year.

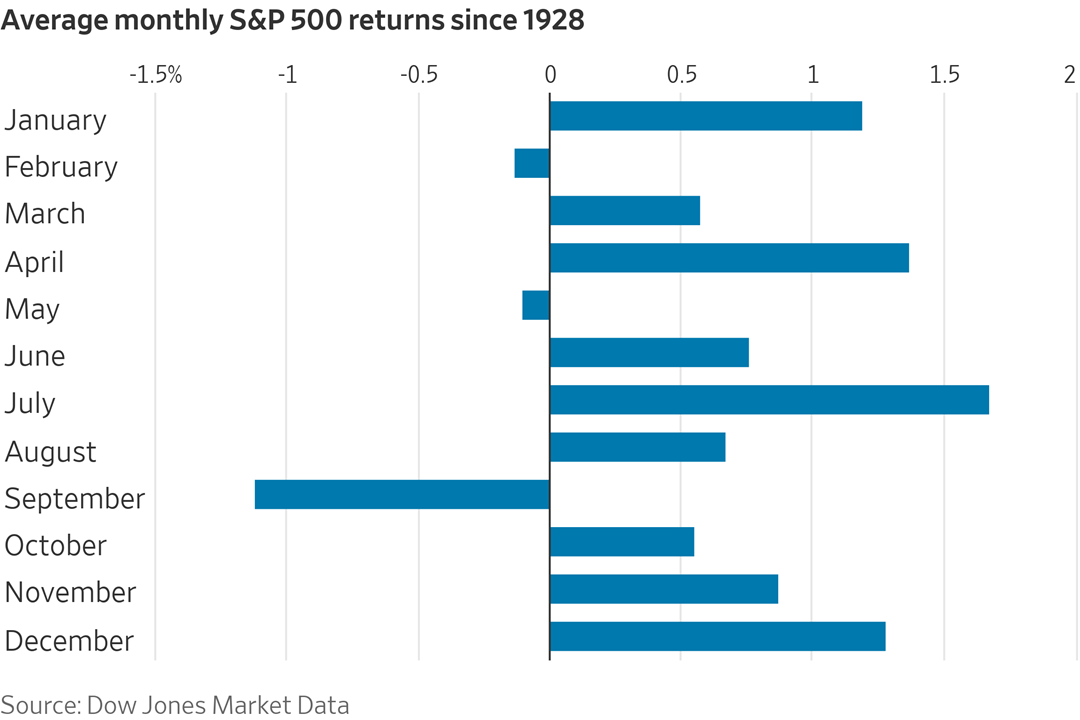

Airlines and hotels are seeing a surge in bookings for international trips — as well as rising prices. International airfare is up roughly 10% from last year and 26% from 2019, according to fare-tracking company Hopper. Meanwhile, domestic airfare is falling and so are prices. More in Markets section.

A seemingly annual farm bill push for updating base acres is here again. But this time some are pushing for a mandatory update. Ask a southern crop producer about that and it’s easy to see why GOP farm-state lawmakers and staff on the Senate Ag panel issued a report concluding Congress should focus on measures that benefit all farms, not “hand-picking winners and losers.” But some type of voluntary base acres update is possible whenever the new farm bill is completed, at least for new and beginning farmers.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mixed in overnight trading. U.S. stock indexes are pointed to slightly higher openings in what some analysts dub a “relief rally” following the U.S. jobs reports earlier this morning. In Asia, Japan flat. Hong Kong +0.8%. China +0.2%. India +0.7%. In Europe, at midday, London -0.3%. Paris +0.2%. Frankfurt -0.3%.

U.S. equities yesterday: All three major indices ended in negative territory despite spending time in positive territory. The Dow ended down 66.63 points, 0.19%, at 35,215.89. The Nasdaq declined 13.73 points, 0.10%, at 13,959.28. The S&P 500 lost 11.50 points, 0.25%, at 4,501.89.

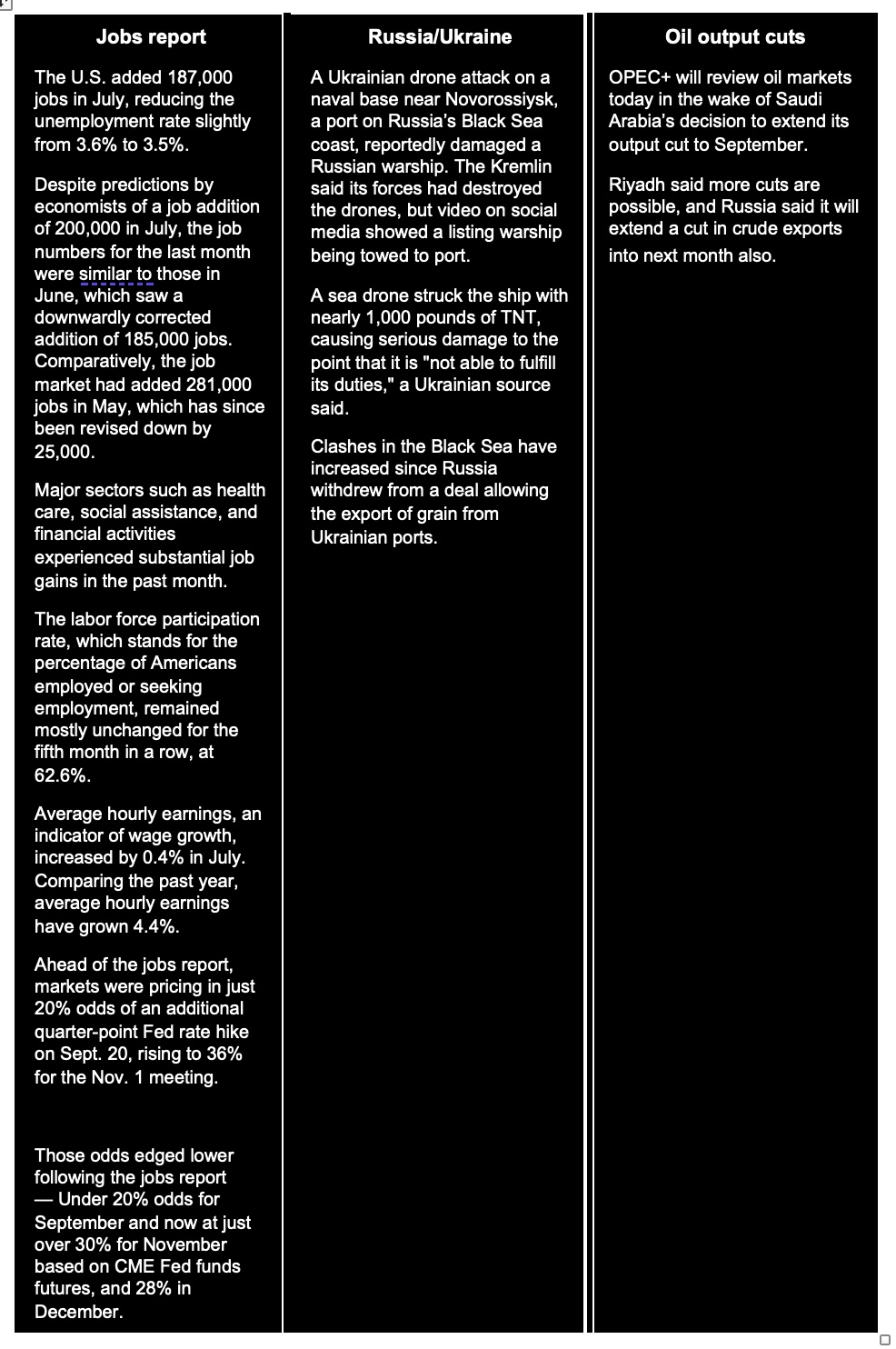

September traditionally sees the worst performance for U.S. stocks, which has some investors worried this year, particularly given the strong market gains thus far. The S&P 500 has performed exceptionally well with a year-to-date return of 17%, including a 3.1% increase across all 11 sectors in July. The Cboe Volatility Index, an indicator of market fear, has been far below its historical average, reflecting a sense of calm in the markets.

However, history suggests that optimism might face a setback. According to Jay Hatfield, CEO of Infrastructure Capital Advisors, since 1928, the S&P 500 has averaged a loss of 1.1% in September. This consistent downturn is not due to a few singularly poor years but is a recurrent event nicknamed the "September effect.” The causes behind this phenomenon are unclear, but one explanation posits September is typically a quiet month in terms of market-pushing news like major corporate earnings.

Agriculture markets yesterday:

- Corn: December corn futures fell under pressure despite early session strength, settling 7 cents lower at $4.93 1/2.

- Soy complex: November soybeans rose 4 cents to $13.25 1/4 but ended nearer the session low. September soymeal rose $3.20 to $427.10, while September soyoil fell 62 points to 64.04 cents.

- Wheat: December SRW wheat fell 12 1/4 cents to $6.55, nearer the session low and hit a three-week low. December HRW wheat dropped 19 cents to $7.82. Prices closed near the session low and hit a six-week low.

- Cotton: December cotton rose 11 points to 84.70 cents after trading the lowest level since July 21.

- Cattle: October live cattle rose 80 cents to $181.30. October feeder cattle gained $1.575 to $253.425. Prices closed near their session highs.

- Hogs: Hog futures dropped despite cash and wholesale market firmness. Expiring August futures slid $1.675 to $101.00, while most-active October dove $2.825 to $82.05.

Ag markets today: Corn, soybeans and wheat traded sharply higher overnight amid rising geopolitical tensions after Ukraine attacked a major Russian Black Sea port. As of 7:30 a.m. ET, corn futures were trading 10 to 12 cents higher, soybeans were 13 to 17 cents higher, SRW wheat futures were 14 to 19 cents higher, HRW wheat was 9 to 10 cents higher and HRS wheat was 6 to 8 cents higher. Front-month crude oil futures and the U.S. dollar index were both modestly higher.

Market quotes of note:

- Soft landing. Federal Reserve Bank of Richmond President Thomas Barkin said the greater-than-expected easing in inflation in June may be an indication that the U.S. economy can have a “soft landing,” returning to price stability without a damaging recession.

- Shipping grounded. Shipping giant Maersk, a bellwether for the world economy, lowered its estimate for global container trade. It now predicts a slump of up to 4% this year as weak demand hampers economic activity. It sees growth returning in 2024.

- Impact of rising pork prices. “They’re probably thinking twice about featuring a new bacon cheeseburger, bacon chicken sandwich or Baconator, or whatever.” — Brian Earnest of agricultural lender CoBank, on restaurants’ responses to rising pork prices.

On tap today:

• Economic reports. Employment

• Energy reports. OPEC+ Joint Ministerial Monitoring Committee online review of oil markets | ICE weekly Commitments of Traders report for Brent, gasoil | Baker-Hughes Rig Count | CFTC Commitments of Traders | Earnings: Mol; Enbridge.

• USDA reports. NASS: Cash Rents - State | Land Values | Dairy Products | Peanut Prices

U.S. travelers are shunning the U.S. for Europe. More Americans are choosing to travel to Europe instead of opting for domestic travel, impacting different airlines differently. This trend has led to a 2% decrease in the number of passengers on domestic flights compared to July 2019, as reported by Airlines for America, a trade association representing many significant airlines. Meanwhile, the number of transatlantic passengers has increased by 14%. This shift is noticeable in the airline ticket pricing trends. Domestic fares have dropped by 11% since last year and remain below their 2019 levels. In contrast, international fares have surged by 11% from last year and have increased by a significant 28% compared to 2019.

ECB: Underlying inflation has peaked. Underlying inflation in the Eurozone has probably peaked, pointing to slower growth in other prices too, the European Central Bank said. ECB noted most of the around 10 indexes of underlying inflation is gauges were now “showing signs of easing” and the latest reading for July was “broadly in line” with its own expectations.

Market perspectives:

• Outside markets: The U.S. dollar index was firmer, with the euro and British pound weaker against the greenback. The yield on the 10-year U.S. Treasury note was higher ahead of the jobs report, trading around 4.19%, with a mostly higher tone in global government bond yields. Crude oil futures were higher, with U.S. crude around $81.85 per barrel and Brent around $85.45 per barrel. Gold and silver were weaker prior to the jobs update, with gold around $1,965 per troy ounce and silver around $23.44 per troy ounce. ·

• Saudi Arabia signaled it could deepen cuts to oil production, extending its voluntary supply restrictions with Russia for another month. This decision could escalate tensions with the U.S., which prefers lower prices to bolster the economy and constrain Russian revenues, especially with elections on the horizon. Saudi Arabia plans to maintain its 1 million barrels per day (b/d) cut, referred to as the "Saudi lollipop," until the end of September, and Russia will decrease oil exports by 300,000 b/d next month. Further cuts could possibly follow later this year.

Russia is also planning a smaller cut next month, following a reduction of 500,000 b/d in August.

Saudi Arabia is attempting to transform its economy through a significant investment program funded by high crude revenues. Russia also desires higher prices to fund its war in Ukraine after losing a significant portion of its gas export revenues to Europe due to supply cuts last year.

Saudi's reduction in output is additional to a voluntary 500,000 b/d cut announced in April. Consequently, Saudi Arabia's oil output will be at 9 million b/d until the end of September, which is 25% lower than its maximum capacity of 12 million b/d.

• This summer has seen an unusual increase in gas prices, diverging from the typical decline observed during this time of the year, the WSJ reports (link). Wholesale gasoline costs have surged more than 12% since July 3, nearing nine-month highs. The inflated prices can be predominantly attributed to cuts in Russian and Saudi crude oil production, as well as renewed optimism about the robustness of the fuel-dependent U.S. economy.

Adverse weather conditions have also played a significant role in the price surge. The extreme heat has complicated fuel production, slowing down the necessary cooling processes involved in refining crude.

Energy traders have been playing their part by purchasing futures contracts. They speculate that the upcoming hurricane season might disrupt refinery operations, triggering a scramble for supplies, which could further raise prices. Therefore, a combination of geopolitical issues, weather conditions, and market speculation is pushing gas prices higher this summer.

• Fertilizer exports are encountering a significant holdup due to disturbances at two North American ports, according to Nutrien Ltd., a leading supplier. These interruptions stem from a dockworkers strike at the Port of Vancouver in early July, along with a shutdown at a potash-handling facility in Portland's port. The situation has led to logistical issues affecting crop nutrient shipments, compelling the Canadian company to cut back its operations and reduce its annual earnings forecast. Bloomberg reports the obstacles at these ports have resulted in "numerous loaded trains" stationed in Western Canada that must be managed, according to Chief Commercial Officer Mark Thompson. He also predicted the conditions might improve by the end of August, on the condition no new hindrances emerge. Thompson has confirmed a "meaningful backlog" exists.

• Vietnam looking to boost rice exports. Vietnam’s trade minister said a surge in global rice prices offered an opportunity to increase exports but stressed the need to ensure domestic food security. He called on the country’s rice exporters to honor export contracts signed before the recent price surge to maintain demand and seek to sign new contracts based on “current market conditions.” Vietnam, the world’s third largest rice exporter after India and Thailand, is expected to export 7.8 MMT of rice in 2023-24, up from 7.1 MMT last year.

• Ag trade: Algeria purchased around 40,000 MT of corn expected to be sourced from Brazil or Argentina.

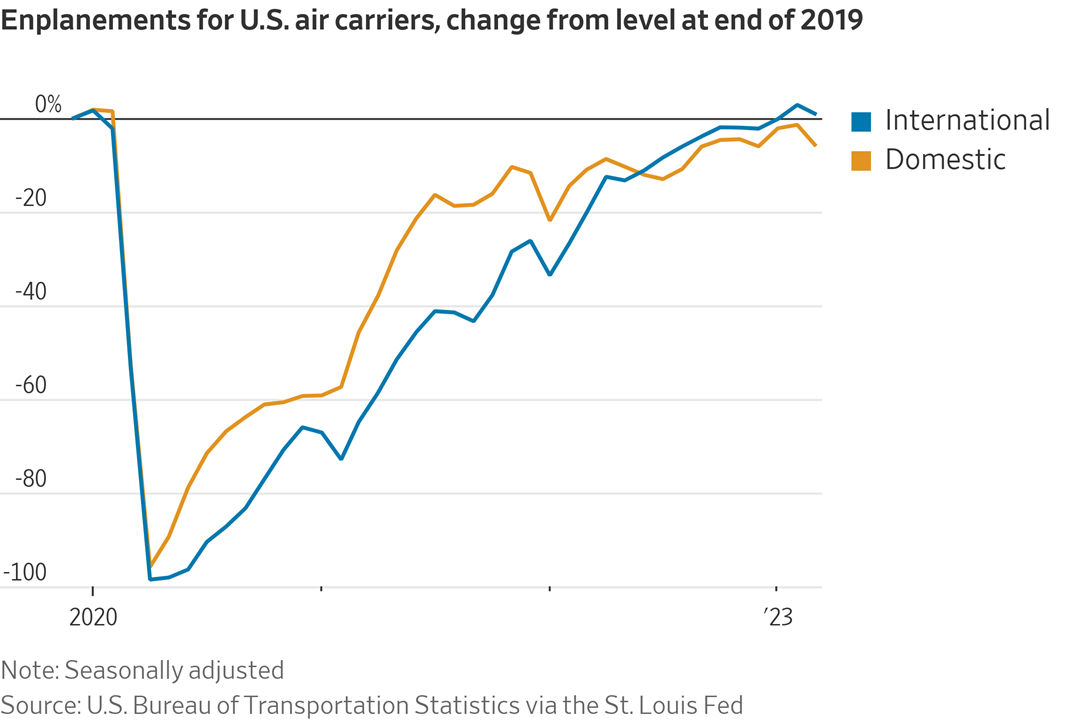

• NWS weather outlook: Persistent heat will continue to affect the Desert Southwest, Southern Plains and Lower Mississippi Valley into the weekend... ...Elevated potential for flash flooding across the Northern High Plains today, expanding eastward through the Dakotas into Minnesota for Saturday... ...Stormy conditions expected for portions of the central to southeastern U.S. through Saturday.

Items in Pro Farmer's First Thing Today include:

• Grains post strong corrective gains overnight

• Chinese flooding moves into northeast grain belt

• France raises wheat crop estimate

• Slow developing cash cattle trade

• Pessimistic hog futures discounts

|

RUSSIA/UKRAINE |

— Russia early Friday accused Ukraine of employing sea drones to launch an attack on its Black Sea navy base situated in the port city of Novorossiysk. Marking a first in the 18-month-long conflict, a commercial Russian port has been targeted. Novorossiysk, a significant location for the Black Sea harbor and Russian exports, houses shipbuilding yards, a naval base, and an oil terminal. It is also geographically located close to Crimea. The attack seems to have briefly disrupted shipping, as per a Caspian Pipeline Consortium statement, which operates an oil terminal in the port. It confirms that maritime traffic was temporarily suspended following the repulsion of the sea drone attack. The company later clarifies that there was no damage to their facilities and loaded tankers will be moved post-lift of the ban.

— Russia wants actions, not words, to resume Black Sea grain deal. Russia said on Friday it needed actions, not promises, from the U.S. to meet the conditions it has set for a return to the Black Sea grain deal. “If they want to contribute to fulfilling the part of the grain deal that is due to Russia, the Americans must fulfil it, not promise that they will think about it,” Kremlin spokesman Dmitry Peskov said. “As soon as this is done, this deal will immediately be renewed.” The comments came after U.S. Secretary of State Antony Blinken on Thursday said the U.S. would make sure everyone including Russia would be able to export food products safely in the event of a resumption of the Black Sea grain deal.

|

POLICY UPDATE |

— Very little is new when it comes to U.S. farm policy. An example is the recent debate regarding updating base acres. Senate Agriculture Committee Republicans and staff released an analysis earlier this week (link) regarding the push by some for a mandatory base acre update. But the GOP analysis correctly argues it would complicate the passage of the next Farm Bill and unfairly disadvantage some farmers. Key is a mandatory approach pushed by some, something farmers and ranchers rarely like.

Base acres track the crops planted across U.S. farmland to determine farm safety net program payments such as Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC). They were last updated in 2002. Payments are determined by these base acre crops rather than the currently planted crops to ward off oversupplying certain crops for increased payouts and getting in trouble with the World Trade Organization (WTO).

Proponents of mandating base acreage updating, like U.S. corn growers, argue it would reflect their recent planting trends, potentially leading to higher program payments.

But the Senate GOP analysis suggests the proposed update could have negative consequences for most farmers, decreasing payments for those growing crops like rice, cotton, and peanuts prevalent in the South, while favoring farmers in the High Plains and Midwest regions.

Facts and figures show why the mandatory approach is dead in the water. The new analysis estimates that 16 states in the High Plains and Midwest could see higher farm safety net program payments of about $1.1 billion due to a mandatory update. Conversely, it projects losses of approximately $3.0 billion in payments in another 34 states, mainly in the South.

Veteran farm policy analysts are not surprised about the findings, having done such analysis before via prior farm bill debates.

Bottom line: A potential alternative to mandatory updates is to permit voluntary ones, allowing farmers to choose whether to update their base acres according to more recent plantings. But this could increase overall farm safety net program spending. The latest analysis concludes by suggesting that Congress should focus on measures that provide overall benefits to farmers, instead of “hand-picking winners and losers in agriculture.”

Upshot: Some type of voluntary update is possible whenever the new farm bill is completed. This is especially the case for new and beginning farmers.

Of note: FarmDoc just released an item about this topic (link). It notes: “There is also little that is new about this issue arising in a farm bill debate, nor about the challenges presented by the base acres puzzle.” Both the GOP analysis and FarmDoc have colorful charts and tables. They keep economists busy. The best line on base acres came from Dr. Bart Fischer of Texas A&M during a Farm Journal webinar when he said researching base acres is like “looking into a Black Hole….”

|

CHINA UPDATE |

— Chinese investment through mergers and acquisitions in the U.S. has reached a 17-year low, standing at merely $221 million since the start of 2023. This drop in dealmaking activity is mainly due to increasing tensions between the U.S. and China, including a trade war focused on semiconductors. The dwindling investment has resulted in a substantial decrease in Chinese outbound mergers and acquisitions, with totals falling from $212 billion in 2016 to just $54 billion in 2019.

— Two U.S. Navy sailors were arrested for sharing sensitive military information with China. According to prosecutors in California, the men received thousands of dollars to reveal details about defense equipment and operations. A senior FBI official criticized China’s espionage efforts, saying it would “stop at nothing to attack” America.

— Biden urged to curb U.S. purchases of China stocks and bonds. President Joe Biden should restrict stocks and bonds in his upcoming executive order aimed at limiting U.S. investments in China, according to Rep. Mike Gallagher (R-Wis.), the chair of the House Select Committee on the Chinese Communist Party. “Both private investments, such as venture capital and private equity funding and limited partners in those funds, and public market investments, including U.S. holdings of PRC stocks and bonds and trading of investment funds that include PRC companies, should be addressed,” Gallagher wrote Thursday.

— The PBOC said it will step up monetary support for the economy, joining the NDRC and Finance Ministry with measures to shore up growth. China is also expected to accelerate plans to combat local government debt risks, including via debt swaps and restructurings, the China Securities Journal reported.

— China announced plans to eliminate import tariffs on Australian barley starting on Aug. 5, a sign of improving trading relations between the two countries, attributed to changes in China's local barley market. Previously, China applied tariffs of over 80% on Australian barley in May 2020, alleging price manipulation in the Chinese market by Australian exporters. This occurred during strained bilateral relations following calls from then-Prime Minister Scott Morrison for a probe into the origins of Covid-19. China also restricted imports of other Australian commodities such as wine and lobsters during this period.

With the change in Australian leadership to the Labor government in May 2022, relations and communication between Canberra and Beijing have seen a significant improvement.

The Australian government hopes to repeat the barley process to have China lift its duties on Australian wine as well.

Background. In April, China began a review into the barley tariffs that lasted for three months. As part of this agreement, Canberra agreed to suspend its case against China at the World Trade Organization (WTO). The review was due by next week after Beijing requested a one-month extension in July.

Facts and figures. Australian barley exports to China were worth about A$1.2 billion ($790 million) annually between 2014–15 and 2018–19, per Canberra government estimates. According to Bloomberg, even with the tariff lift, Australian barley exporters will not be quick to return to the Chinese market, as many have discovered new markets in countries such as Saudi Arabia, Japan, Vietnam, Kuwait, and Mexico. Risk premiums may initially be necessary for resuming trade with China, according to Rabobank agricultural analyst Dennis Voznesenski.

— China regulator approves rural commercial banks in Henan, Liaoning. China’s National Financial Regulatory Administration (NFRA) said it had approved the setting up of rural commercial banks in Liaoning and Henan provinces as part a push to reform the country’s rural credit system. The new bank in Liaoning is being created through the merger of dozens of local rural credit unions and an existing rural commercial bank, NFRA said. It did not offer details of the new rural lender in Henan.

|

TRADE POLICY |

— Update on U.S./Mexico GMO corn dispute. The U.S. has rejected Mexico's proposal to jointly research the health effects of genetically modified (GM) corn, according to Reuters (link) and Mexico media. This development comes amid increasing tensions caused by Mexico's imminent ban on some GM imports. The potential impact on corn exports from the U.S. to Mexico, which average $5 billion annually, is significant.

Mexico's move to decrease dependence on GM corn imports and focus more on national food self-sufficiency has caused friction between the two countries. The Mexican government is encouraging farmers to grow more native corn and other staple crops, supported by steep tariffs on imported corn types.

The two countries failed to reach an agreement during a meeting with USDA Secretary Tom Vilsack, according to Mexico's Deputy Agriculture Minister, Victor Suárez,. Suárez criticized the U.S.'s refusal to agree to impact studies on animal and human health, insinuating that the U.S. treats its scientific claims as infallible – more ideology than science. “They did not want to establish a period in which the two parties agree to carry out impact studies on animal health and human health,” Suárez said. “Their science is the word of God. That is not science, that is ideology.”

As the tensions intensify, it appears that the nations are moving closer to a formal trade dispute over Mexico's decision to stop importing GM corn for human consumption by 2024, with plans to eventually also cut down on GM corn imports for animal feed. Mexico believes that GM corn negatively impacts native biodiversity and could have potential implications on human health.

Mexico is one of the top three importers of U.S. corn worldwide, purchasing around $5 billion worth of corn annually, primarily GM yellow corn for animal feed. The U.S, however, argues that Mexico's GM ban breaches the U.S.-Mexico-Canada Trade Agreement (USMCA) and could harm U.S. farmers.

Mexico suggests the immediate impact on trade will be minimal because the country is self-reliant in producing non-GM white corn, a staple food ingredient. They have also proposed to expedite the ban on GM corn in tortillas, potentially applying within two months.

USMCA trade dispute consultations continue, and Canada also announced its intention to join the dispute process. Mexican Economy Minister, Raquel Buenrostro, has met with U.S. and Canadian trade representatives, however, they reached no resolution on Mexico's GM corn ban.

If the dispute is not resolved within 75 days from the consultation’s start (Aug. 16), the U.S. can elevate the matter to a dispute settlement panel. If the panel rules against Mexico, the country could be forced to modify its policy or incur substantial tariffs. Yet, Mexico remains resolute, with Suarez confidently proclaiming, according to Reuters, “If they establish the panel, we will defend ourselves. And if we defend ourselves, we think we are going to win.”

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Future regulation of genetically modified bacon, steak, and fish is the subject of a debate in Washington, with the White House deciding whether it should fall under the jurisdiction of the Food and Drug Administration (FDA) or the Agriculture Department (USDA), according to the Wall Street Journal (link).

Food companies favor gene-edited cattle and fish since they can grow larger and more quickly and are more adaptable to environmental changes and disease. These companies want USDA oversight due to its speed and cost-effectiveness compared to the FDA.

However, consumer and environmental groups prefer FDA regulation due to its expertise in complex scientific matters and concerns over potential collusion between the USDA and the industry.

FDA has primarily controlled the sector so far, approving five products and tagging 45 genetically modified animals as low risk. The market for these animals is forecasted to rise from $4.2 billion in 2020 to $6.4 billion by 2027.

Companies argue that as this technology matures and genetically engineered animals become more common, oversight should shift to the USDA, which already governs gene-edited plants. They find the FDA’s oversight process to be long and costly.

FDA and its supporters insist that the agency already has the necessary legal authority and expertise to mitigate possible dangers. They argue for careful supervision, citing the instance of genetically engineered cows which unexpectedly carried antibiotic-resistant genes. Those advocating for the FDA claim the agency is trying to be more efficient and has drafted guidelines awaiting White House approval. They also express concern about the USDA’s closeness to the industry, thereby affecting proper regulation.

USDA has tried to win oversight before, the WSJ article notes, with the Trump administration planning to hand over this sector's regulation, but without success. The Biden administration's recent budget proposal, however, favors USDA with budget allocated for the development of expertise to regulate gene-edited animals.

— The FAO Food Price Index rose to 123.9 in July 2023, marking its first increase in three months, from an upwardly revised 122.4 in June, the lowest it had been since April 2021. This increase was mainly due to a surge in vegetable oil prices by 12.1%, the first rise after eight months of stability or decrease. This was fueled by higher global prices across various oil types including sunflower, palm, soy, and rapeseed oil.

However, not all food prices followed the same trend. Sugar prices decreased by 3.9% due to the successful progression of the 2023-24 sugarcane harvest in Brazil and favorable weather conditions improving soil moisture across most sugarcane growing regions in India.

Similarly, cereal prices declined by 0.5% because of a 4.8% decrease in international coarse grain prices. The dairy cost also dipped slightly by 0.4%, marking the seventh consecutive month of decline. The downward trend in dairy costs was primarily due to lower prices for skim milk powder and butter, driven by quiet market activity in Europe over the summer holidays and expected low import demand in the future due to market volatility.

Meat prices dipped by 0.3%.

|

POLITICS & ELECTIONS |

— A new CNN poll (link) shows more voters have confidence in House Republicans to deal with the problems facing the country than President Biden. The poll question: “Generally speaking, do you have more confidence in (President Biden) or in (the Republicans in Congress) to deal with the major issues facing the country today?” 45% said Biden and 54% said Republicans in Congress.

— Rep. Dan Bishop (R-N.C.), a member of the House Freedom Caucus, announced that he’s running for attorney general (AG) of the Tarheel State and won’t seek re-election to the House. The current AG, Democrat Josh Stein, is running for governor.

|

OTHER ITEMS OF NOTE |

— An appeals court permitted the Biden administration to continue using a contentious asylum policy for the time being. This policy is under scrutiny because it largely prevents migrants who have travelled through another country from applying for asylum in the U.S., a significant shift from longstanding practices. This policy and a similar one from the Trump era have faced opposition from those close to Biden, Democrats, and immigration advocates. Although a judge obstructed this policy last week, he suspended this decision for 14 days to allow for a potential appeal. The 9th U.S. Circuit Court of Appeals extended this temporary hold on the judge's ruling on Thursday and pledged to prioritize their review of the case.

Meanwhile, the president of Mexico criticized Texas for using floating barriers on the Rio Grande river, declaring the state's border enforcement strategies as "inhumane."

— Cotton AWP rises back above 70 cents. The Adjusted World Price (AWP) for cotton rose to 70.19 cents per pound, effective today (Aug. 4), up from 69.74 cents per pound the prior week. This marks the first time the AWP has been above 70 cents since the week of March 10, 2023, when it was 71.95 cents. Meanwhile, USDA announced that Special Import Quota #16 for upland cotton will be established Aug. 10 for 58,062 bales of upland cotton, applying to supplies purchased not later than Nov. 7 and entered into the U.S. not later than Feb. 5, 2024.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |