FT: Russia Pushing Plan to Supply Africa with Its Own Grain and Cut Ukraine Out of Global Markets

Possibility of a nationwide UPS strike is rising | Hurdle for year-round E15 legislative proposal

|

In Today’s Digital Newspaper |

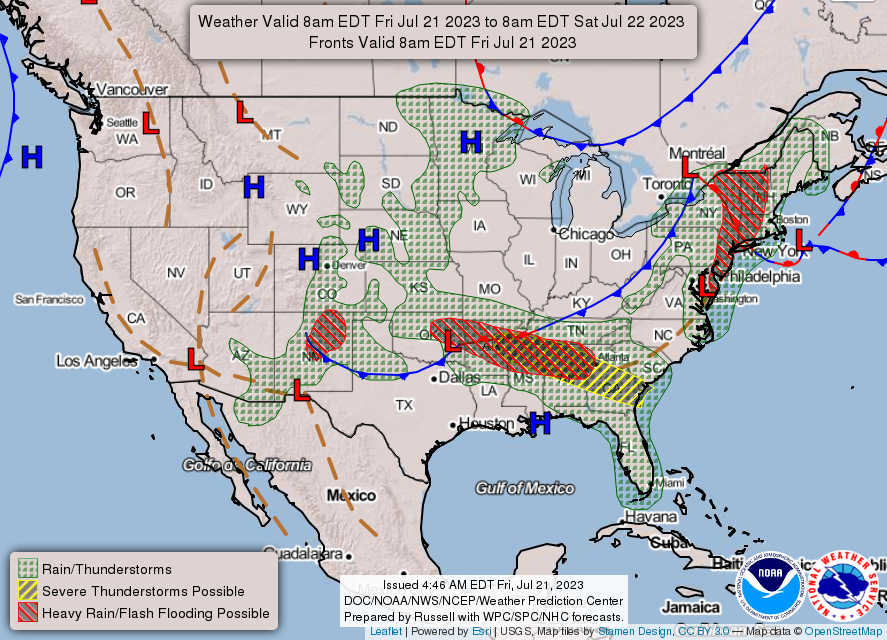

U.S. airlines continued to cancel or significantly delay flights in parts of the United States on Thursday. This writer experienced first-hand a major delay getting out of Atlanta due to storms there and in the region. While the Delta plane eventually arrived at Dulles Airport, it was 3 a.m. ET.

Russia’s navy conducted a live fire exercise at a training range in the Black Sea, escalating the war’s risk to global food markets. Wheat headed for a weekly gain of about 8% as the tensions added to concern about extreme weather. More on this topic in Russia & Ukraine section.

Russia is pushing a plan to supply Africa with its own grain and cut Ukraine out of global markets, after withdrawing from a U.N.-backed deal this week, the Financial Times reports. Details in Russia & Ukraine section.

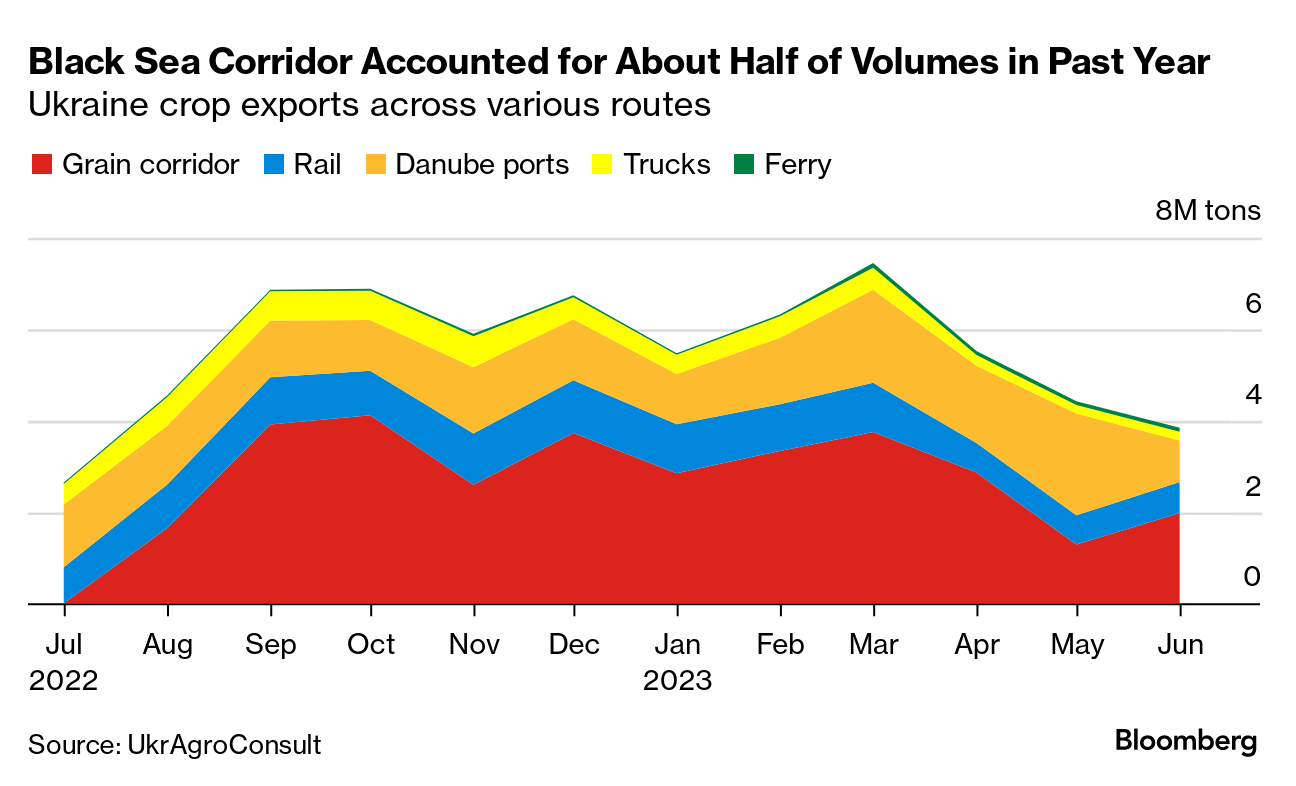

Crops from the breadbasket nation of Ukraine are sent around the world, including to poor countries in Africa and Asia, and the Black Sea grain deal has been crucial for that. There are alternative river, rail and road routes via the European Union — which Ukraine has already been using — but they’re more costly and simply can’t handle all the volumes.

Chinese, U.S. and Russian ag officials could soon meet. Details in Russia & Ukraine section.

Ukraine's central bank is preparing to seize control of Sense Bank, previously known as Alfa Bank-Ukraine, which is currently under the control of two Russian business tycoons, Mikhail Fridman and Petr Aven.

The situation with Russia's economy is quite complex, reflecting several contributing factors that are pushing it into a precarious situation. Details below.

India put restrictions on rice exports yesterday (see Market section). Grain trader and analyst Richard Crow says: “Wheat demand typically increases when this happens. The 2007-08 wheat market started with India’s restriction of rice exports. Key: Will India become a wheat importer? The rumor is they bought some wheat from Russia on a gov’t-to-gov’t trade.”

Japanese inflation seen as peaking. More in Markets section.

Organic milk producers are seeking recognition from USDA that their product is distinct from traditional milk in accordance with federal law.

Where heat waves lead, food inflation will follow. Record temperatures in the U.S., Europe offer a preview of harsh conditions farmers will likely face as the climate changes, the Wall Street Journal reports.

Chinese President Xi Jinping recently met with former U.S. National Security Advisor Henry Kissinger, signaling Beijing's desire for improved U.S./China relations. More in China section.

The Biden administration moved yesterday to raise royalties and other fees for companies developing oil and gas on public lands, changes it said were needed to ensure a fairer return to the taxpayer and discourage speculators. More in Energy section.

President Joe Biden is setting up a working group to study ways to avoid future brinkmanship over the U.S. debt limit, months after the nation was taken to the edge of default. More in Policy section.

Two senators pushing a legislative deal to get year-round E15 face a big hurdle. See Energy section for more.

When supermarkets were first introduced, they were a disruptive concept, putting general stores, butchers, greengrocers and bakeries out of business. Is it now their turn to fade away? See Food section below.

The biggest challenge for President Biden in 2024 isn’t if a third-party candidate is on the ballot, Amy Walter writes — it's if Donald Trump is not. But Charlie Cook writes: “Unless either former President Trump or President Biden have an adverse health event forcing them to terminate their campaign, we are going to have a Trump-Biden rematch, whether the parties or the public prefer it or not. Of course, a 2024 matchup may have some different angles than four years ago. For one thing, former Harvard and Princeton professor Cornel West (now affiliated with the Union Theological Seminary) is seeking both the People’s Party and the Green Party nominations.” Meanwhile, the Cook Political Report with Amy Walter has moved three House 2024 races in Democrats’ favor and two toward the GOP.

Bill introduced on foreign ownership of U.S. farmland. See Congress section.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mixed in quieter overnight trading. U.S. Dow opened around 85 points higher and then moved slightly lower. In Asia, Japan -0.5%. Hong Kong +0.8%. China -0.1%. India -1.3%. In Europe, at midday, London +0.1%. Paris +0.3%. Frankfurt -0.4%.

U.S. equities yesterday: The Dow rose about 160 points, 0.5%, to clinch its longest winning streak since September 2017. The S&P 500 declined 0.7%. The tech-heavy Nasdaq pulled back 2.1%. The Dow outperformed the Nasdaq by the widest one-day percentage-point margin since March 2021.

With about 15% of companies in the S&P 500 having reported fourth-quarter results, 74% have topped analysts’ consensus earnings estimates, according to FactSet. That is below the five-year average of 77%. The stakes get higher next week as some of the biggest tech companies in the U.S. are set to report earnings, including Alphabet, Microsoft and Meta Platforms.

Agriculture markets yesterday:

- Corn: December corn futures saw early gains before falling 6 3/4 cents to settle at $5.46 1/4, nearer the session low.

- Soy complex: November soybeans fell 4 cents to $14.04 3/4, a low-range close, while August meal futures lost $3.30, closing at $440.59. August soyoil rose 159 points to 67.64 cents, marking the highest close since Nov. 4.

- Wheat: December SRW wheat rose 3/4 cent to $7.46 1/4, near mid-range and hit a three-week high early on. December HRW wheat gained 8 1/4 cents to $8.80 3/4, near mid-range and hit an eight-month high. December spring wheat rose 5 3/4 cents to $9.11 3/4.

- Cotton: December cotton rose 56 points to 84.31 cents, the highest close since early March.

- Cattle: August live cattle fell $1.00 to $180.325 and nearer the session low after hitting a fresh all-time high of $182.975 early on. August feeder cattle dropped $1.70 to $245.10 and nearer the session low.

- Hogs: August hog futures led the deferred contracts sharply higher Thursday, posting a $2.70 jump to $100.625.

Ag markets today: Corn, soybeans and wheat fell under pressure overnight as the U.S. dollar index continues its recent rebound. As of 7:30 a.m. ET, corn futures were trading 10 to 12 cents lower, soybeans were 7 to 16 cents lower, SRW wheat was nearly 20 cents lower, HRW wheat was 27 to 28 cents lower and HRS wheat was 13 to 15 cents lower. Front-month crude oil futures were pressuring the highs from the past two weeks.

Market quotes of note:

- Japanese CPI accelerated to 3.3% in June, but prices excluding energy showed inflation pressures easing. A former top finance ministry official said it would be “a major surprise” if the BOJ tweaked yield curve control at next week’s meeting, but that a move could come in September.

- Housing costs. "To adjust to changing market conditions and higher mortgage rates over the past year, we increased our use of incentives and reduced the sizes of our homes to provide better affordability to homebuyers." — Michael J. Murray, co-chief operating officer at homebuilder D.R. Horton, on an earnings call yesterday.

- On its own, a UPS walkout could add up to 0.2 percentage point to the annual inflation rate, said Greg Valliere, chief US policy strategist for asset manager AGF Investments Inc. The measure fell to 3% in June.

Japanese inflation seen as peaking. Japan’s core inflation remains above their 2% target as CPI came in at an expected 3.3% in an overnight report. The Bank of Japan is meeting next week and is expected to update their inflation forecast but leave rates unchanged. Japan has had relatively loose monetary policy over the last few years unlike many of its Western counterparts, leaving rates in negative territory despite inflation.

Market perspectives:

• Outside markets: The U.S. dollar index was higher, with the euro and British pound both weaker against the greenback. The yield on the 10-year U.S. Treasury note fell, trading around 3.83%, with a mixed-to-negative tone in global government bond yields. Crude oil futures continue to move higher, with U.S. crude around $76.75 per barrel and Brent around $80.75 per barrel. Gold futures were down, and silver was up, with gold around $1,969 per troy ounce and silver around $25.07 per troy ounce.

• Oil headed for a fourth weekly gain amid tentative signs that global markets are tightening. Russia is paring crude exports while China has stepped up efforts to boost its flagging economic recovery.

• The possibility of a nationwide UPS strike is rising, as union negotiations with the company remain unresolved. The union represents 340,000 UPS workers, and a strike has been set for August 1 if no deal is reached. To try to prevent a strike, both parties have agreed to resume negotiations next week. If the strike goes ahead, it would be the most significant labor disruption in over 50 years, which could have significant repercussions for the U.S. economy. UPS is responsible for delivering a quarter of all packages across the nation, underscoring the broad impact such a strike could have.

“We’re going to get the best contract,” union President Sean O’Brien told Teamster members July 16. “This is the largest collective-bargaining agreement in the entire labor movement. So you all will set the tone on the direction of organized labor moving forward.” The talks to renew the five-year contract will resume next week after they stalled July 5. Then, the Teamsters rejected UPS’s offer for part-time wage increases, which O’Brien called “crumbs.” He has said that part-time wages need to start at more than $20 an hour. Currently, about 100,000 workers employed on this basis make less than that, O’Brien has said.

• Ag trade: Taiwan tenders for 108,000 MT of U.S. origin wheat.

• Where heat waves lead, food inflation will follow. Record temperatures in the U.S., Europe offer a preview of harsh conditions farmers will likely face as the climate changes, the Wall Street Journal reports (link). The long-term impact of global warming on agriculture will be mixed, with some farmers benefiting from longer, warmer growing seasons. But new weather patterns could upend today’s key food-producing regions. “When weather extremes start to kick in, places that have been breadbaskets for hundreds of years may fail,” according to Tim Lenton, professor of earth system science at University of Exeter.

• NWS weather outlook: Flash Flooding and Severe Weather threats across parts of the East Coast, Lower Mississippi Valley and Southern Plains today... ...Lengthy & dangerous heat wave to continue across the Southern tier and in the West... ...Cooler and more comfortable temperatures spread across Great Plains and Midwest.

Items in Pro Farmer's First Thing Today include:

• Sellers have the advantage in grains overnight

• Ukraine warns ships heading to Russia

• Key cattle reports out this afternoon

• Seasonal rise in lean hog index slows

|

RUSSIA/UKRAINE |

— U.S. cluster bombs have been deployed by Ukraine in its counter-offensive against Russia, according to the White House. John Kirby, the national-security spokesman, said Ukrainian forces have been using the controversial weapons “effectively.” Earlier Russia attacked Ukrainian ports for a fourth consecutive night. The Kremlin has declared that all ships bound for Ukraine will be considered “potential carriers of military cargo.” Ukraine responded with a similar threat for vessels heading to Russia.

— Ukraine's central bank is preparing to seize control of Sense Bank, previously known as Alfa Bank-Ukraine, which is currently under the control of two Russian business tycoons, Mikhail Fridman and Petr Aven, the WSJ reports (link). This move is seen as a bid to limit Moscow's sway over Ukraine, particularly in the financial sector. The nationalization of Sense Bank is just one part of a wider strategy aimed at curtailing Russian influence over the Ukrainian economy. This step appears especially significant for Fridman and Aven, who are presently under sanctions imposed by the European Union and the United Kingdom. The decision poses a challenge for these sanctioned individuals who might have been seeking secure financial refuges.

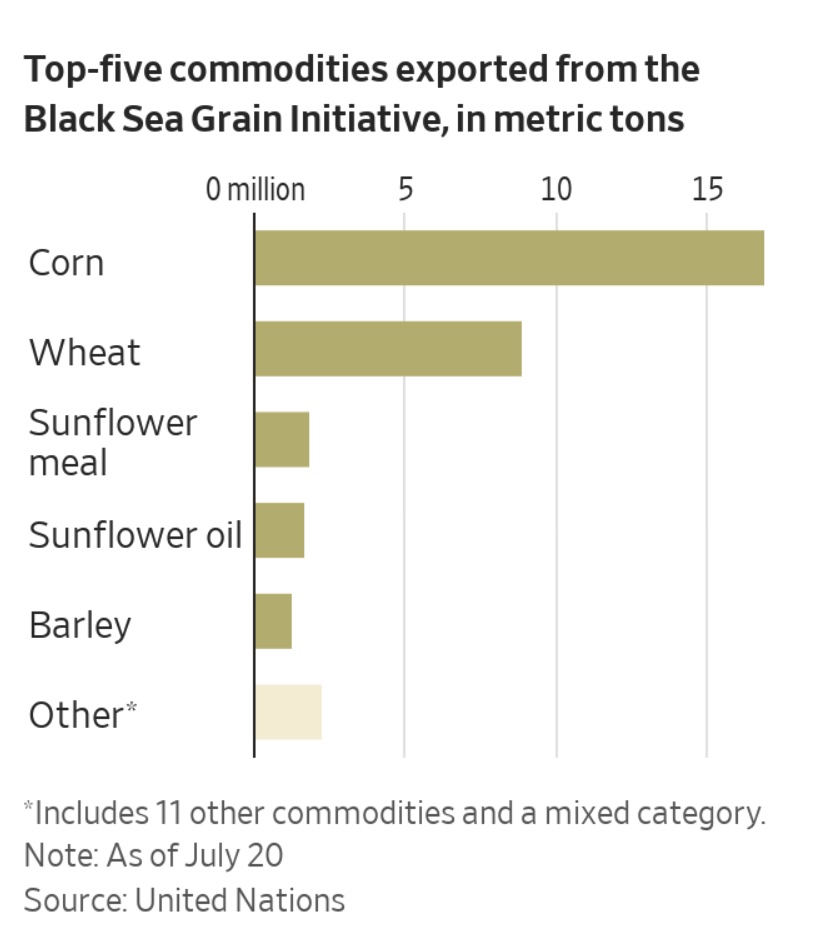

— Chinese, U.S. and Russian ag officials could soon meet. The U.S. invited Tang Renjian, China's agriculture minister, to the 2023 APEC food security ministerial meeting in Seattle, scheduled for Aug. 3. This information was confirmed by the Biden administration and reported by Politico. The meeting is expected to focus on Russia's withdrawal from the Black Sea Grain Initiative.

China’s role. This action has been of particular concern because China, as Russia's ally and the leading recipient of grain shipments from Ukraine under the agreement, could potentially influence Russia to re-enter the deal.

The meeting also gives U.S. officials an opportunity to engage directly with China and Russia, who has also been invited as an APEC member.

Since Russia's exit from the deal, tensions in the Black Sea have escalated due to an increase in Russian missile attacks on crucial Ukrainian ports. Russia has also issued threats to commercial ships heading towards the region, leading to sharp increases in global wheat prices. This situation has significantly affected global grain markets, particularly China, which previously received about 25% of Ukraine's grain export under the deal, as per UN statistics.

It's unclear at this stage whether Minister Tang will attend the Seattle conference. China's embassy in the U.S. hasn't provided a response regarding this invitation.

USDA Secretary Tom Vilsack will be attending the conference.

Russia may consider rejoining the grain deal if it can secure additional concessions, such as reinstating Russia's state-run agricultural bank into the global financial payments system, SWIFT. This move by Russia has implications for all APEC member countries since their economies are integrated with global grain markets.

Of note: Link to Wall Street Journal article on why Russia killed the Ukraine grain deal.

— Russia is pushing a plan to supply Africa with its own grain and cut Ukraine out of global markets, after withdrawing from a U.N.-backed deal this week, the Financial Times reports (link/paywall). Russian President Vladimir Putin suggested a plan where Qatar foots the bill for Moscow to send its grain to Turkey, which in turn would distribute it to "countries in need” This plan, however, has not yet been agreed upon by either Qatar or Turkey, or raised on a formal level.

The proposed initiative comes after Russia withdrew from a U.N.-backed deal supporting Ukraine. This initiative from Russia may be unsettling for Kyiv and its western backers as it would solidify Russia's naval blockade of Ukraine's Black Sea ports, a significant economic channel for Ukraine.

Russia first brought up the prospect of distributing its grain to Africa last year, shortly after briefly withdrawing from the Black Sea agreement, which had allowed for the export of 33 million tons of Ukrainian grain. In the draft memorandum of the offer, Russia intended to send up to 1 million tons of grain to Turkey on preferential terms for onward delivery to Africa, with Qatar covering all costs.

Timeline. Following Russia's latest withdrawal from the grain deal, it is anticipated that Russia will press for its proposal at the forthcoming summit with African leaders in St Petersburg and during Putin's visit to Turkey in August.

Analysts say Russia's motive for this indirect grain deal can be interpreted as an effort to display its power and to further pressure Kyiv, mostly by exporting grain from areas of Ukraine presently under Russian military control. They are packaging it as an altruistic move aimed at providing free grain for poorer countries to rally support globally and especially against western sanctions. However, there has been criticism and disappointment with the exit from the Black Sea agreement, particularly from African countries facing rising food costs since Russia's large-scale invasion of Ukraine. Kenya reacted negatively, calling the Russian move a "stab in the back" hurting countries in its particular region. The controversy around the grain issue is putting pressuring on African leaders, with some even facing U.S. advice to criticize Russia on the matter and refrain from attending the upcoming St Petersburg summit. This Financial Times article says the situation presents a dilemma for certain African nations as they often seek assistance from both the U.S. and Russia for their economic and security issues.

— The situation with Russia's economy is quite complex, reflecting several contributing factors that are pushing it into a precarious situation. The decision undertaken by the nation's central bank to increase its key interest rate is particularly significant, signaling that the economy could be at an inflection point. The changes in Russia's economy are mostly due to the impact of recent geopolitical events, coupled with internal pressures. Given that the nation survived Western sanctions and even avoided deeper recession primarily due to increased oil and gas revenues, and state handouts and redirection of trade to Asia, its future economic growth could be potentially uncertain, the Wall Street Journal reports (link).

In the near term, emergent pressures such as labor shortages, a weakened ruble due to the failed mutiny by the Wagner mercenary group, increasing wages, and a surge in state spending in response to the ongoing conflict in Ukraine have stoked inflationary pressures, leading to an unexpected rise in interest rates. There is also the issue of a growing deficit due to war costs, which has forced the government to implement spending cuts, putting further strain on the country's economy.

Inflation, despite currently appearing relatively low, is another concern. With an increase from the 2.5% rate in May to 3.25% year-over-year in June, economists are predicting a sharp rise in consumer prices in the future.

Additionally, Russia is facing a negative growth rate, where its potential growth rate is lower than before the invasion of Crimea. This could further compound the issue, as resources are siphoned off to the ongoing conflict in Ukraine, impacting the growth rate and pushing it below 1%, according to some economists.

Another worrying trend is the escalating debt Russia is accumulating. Deputy finance minister Irina Okladnikova acknowledged this reality, stating that they "will increase our debt, this is a hopeless situation." With spending growing, particularly to support the military bloc, the debt burden is rising.

The weak performance of the ruble, the deterioration in trade, and a labor shortage — intensified by a significant exodus of workers due to war — also add to the pressures mounting on the Russian economy. All these factors are boosting inflation and could potentially trigger price increase in coming months.

The decreased revenues from oil due to fall in crude prices and heavy discounts caused by Western sanctions and the reduced surplus from the current account are evident signs of a struggle within Russia's economy.

Bottom line: Over the longer term, the persisting impact of sanctions, the increasing international isolation, and the severe labor shortage are poised to negatively affect Russia's growth prospects, analysts say. Despite having weathered the sanctions better than expected so far, future optimism might be unwarranted considering the overall picture.

|

POLICY UPDATE |

— Organic milk producers are seeking recognition from USDA that their product is distinct from traditional milk in accordance with federal law. They are specifically asking for an exemption from Federal Milk Marketing Orders (FMMO). These orders mandate that all milk producers contribute to an industry-wide fund, designed to support conventional farmers in attaining the minimum prices set out by regulatory schemes. This plea was voiced in a letter to Secretary Vilsack on July 13, brought to attention by Politico. The organic dairy farmers emphasized the need for consideration of an organic exemption in any forthcoming federal order hearing, citing the current system as untenable for their industry.

Adam Warthesen, representing Organic Valley, explained that this change would add minimal costs to conventional producers — three cents per hundredweight — but could result in substantial savings for the organic dairy industry, amounting to millions.

The letter highlighted the fact that organic dairy is already exempted from programs like the commodity checkoff; this program extracts fees from farmers to fund research and promotion of a particular commodity.

An expected federal hearing on dairy industry issues is set to commence before the end of July. Such hearings, which typically run for six to eight weeks, can lead to sweeping changes that impact farmers' and milk processors' earnings. This hearing will be the first in 17 years and has already led to divisions amongst the largest dairy co-operations and key industry trade groups in the nation.

— President Biden established a team tasked with exploring ways of preventing future predicaments regarding the U.S. debt ceiling, following the country nearly defaulting on its debt two months ago. The team consists exclusively of administrative officials with no Republican representatives. It will be headed by White House Counsel Stuart Delery and National Economic Council Director Lael Brainard. No specific deadlines have been set for this working group to complete its task, nor is there a designated date for its first meeting.

— Several major tech companies, including Microsoft, Amazon, Google, and Meta, have agreed on measures to secure artificial intelligence (AI), the White House announced. The deal is part of an initiative to mitigate the risk of misinformation and other AI-related risks. A crucial aspect of their commitment includes the development of watermarks that would enable users to distinguish AI-generated content. The tech giants also have voluntarily agreed to test AI systems for their safety and capabilities prior to public release, invest in research into societal risks posed by AI, and allow external audits to identify potential system vulnerabilities. The leaders of these companies are scheduled to meet with President Biden today.

|

CHINA UPDATE |

— Rain in China brings corn relief. Recent rainfall in northeast China has relieved drought stress and helped improve soil moisture, according to an agricultural ministry official. The area hit by drought covered 1.33 million hectares (3.29 million acres), an area roughly the size of Connecticut. China is the world’s second largest corn producer, and a large portion of the crop comes from the northeast region.

— Chinese President Xi Jinping recently met with former U.S. National Security Advisor Henry Kissinger, signaling Beijing's desire for improved U.S./China relations. The meeting happened amid other U.S. officials' unsuccessful attempts to secure a meeting with Xi, notably U.S. Climate Envoy John Kerry and Treasury Secretary Janet Yellen. However, it's worth noting that Kissinger's visit was planned prior to their visits.

Xi emphasized that the U.S./China relationship is at a critical point, hoping that visionary Americans could help redirect it back to a path of productivity and mutual benefit. He sees Kissinger as a symbol of past successful U.S./China relations, when both nations bridged significant ideological differences. Trivium China says Kissinger reciprocated this sentiment, assuring that he will continue making efforts to foster mutual understanding between the two countries. However, the China watcher says it seems unlikely that the current Biden administration would mimic the past approach of overlooking differences, since China is now viewed by many American policymakers as a significant strategic competitor, akin to the role the Soviet Union once played.

|

TRADE POLICY |

— India banned exports of non-basmati white rice to ensure “adequate availability” and “allay the rise in prices” in its domestic market. The announcement is expected to drive up global rice prices, which are already near ten-year highs. India's export ban is expected to push food inflation even higher as it accounts for more than 40% of global rice exports. While the ban may ease domestic prices, international rates are expected to scale higher, as the onset of the El Niño weather pattern threatens to tighten supplies. Rice futures are nearing $16 per hundredweight count in July, the highest level since the end of May. Meanwhile, wheat prices increased by more than 10% this week after Russia announced it would withdraw from the deal that allowed Ukraine to export grains from its ports.

|

ENERGY & CLIMATE CHANGE |

— Biden administration officials proposed a new rule to increase the cost of drilling on public lands. This change comes as an effort from the Interior Department to avoid taxpayers shouldering the cost of cleaning up oil and gas wells and to implement reforms from the Inflation Reduction Act. The rule has been proposed by the Bureau of Land Management (BLM). The draft rule entails hiking the required bond amounts to prevent passing the burden of future clean-ups onto taxpayers. It will also incorporate fee increases established in last year's Democrats-led climate, tax, and healthcare bill.

As part of the specific changes:

- Royalties on extracted oil would rise from 12.5% to 16.67%.

- Fees for renting land not being produced on would increase during the lease term - with rates going from $1.50 to $2 per acre up to $3 per acre in the first two years, $5 per acre for the subsequent six years, and $15 per acre after this period.

- Minimum lease bids would also rise from $2 per acre to $10 per acre.

The rule also proposes targeting oil and gas development on public lands with pre-existing infrastructure or considerable potential for oil and gas production, provided these are not near significant wildlife habitats or cultural sites.

BLM Director Tracy Stone-Manning expressed that these changes represent progress in tackling climate change by ensuring fairness for taxpayers, given these lands are government-owned. She stated that these modifications are another step towards transitioning to a clean energy economy.

— Challenge for bill to trade SREs for year-round E15. A bill unveiled this week would permit nationwide sales of E15 throughout the year, in return for considerations given to small refineries. This initiative, led by Sens. Deb Fischer (R-Neb.) and Shelley Moore Capito (R-W.Va.), the top Republican on the Senate Environment and Public Works Committee, seeks to address E15-related concerns via legislation. The bill offers relief to smaller refineries that have been strained by the expenses associated with adhering to the Renewable Fuel Standard. But without the support of the Chairman of the Senate Environment and Public Works Committee, Tom Carper (D-Del.), the bill faces a major hurdle. Carper said his priority is to shield small refineries and their workers.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

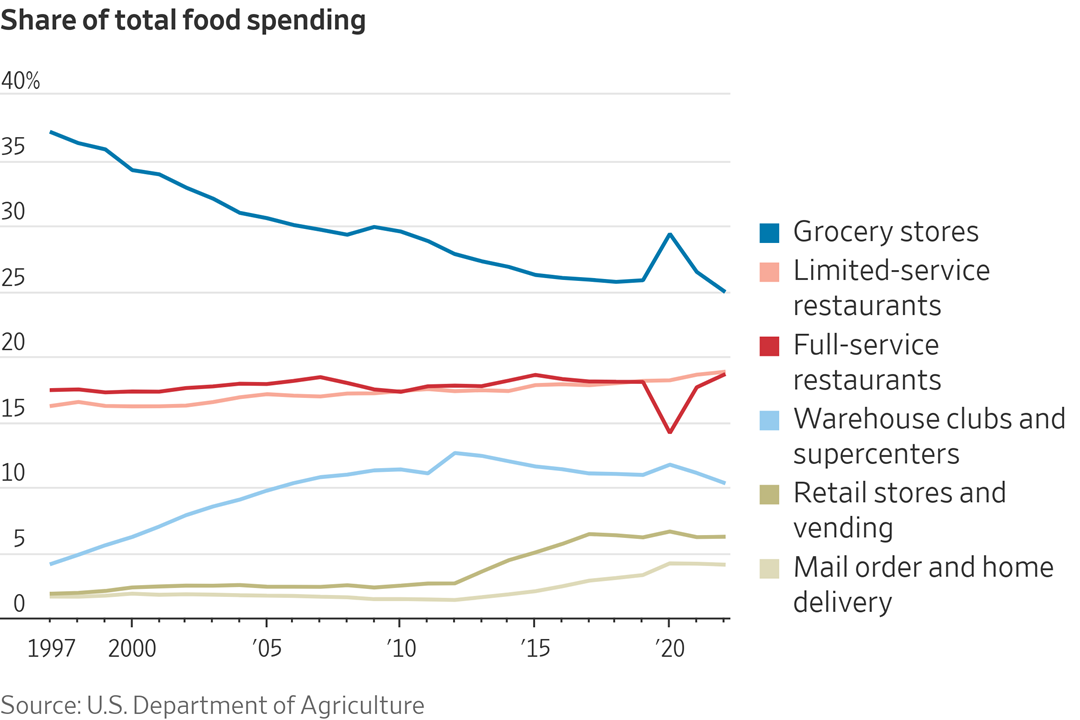

— Food fight. When supermarkets were first introduced, they were a disruptive concept, putting general stores, butchers, greengrocers and bakeries out of business. Is it now their turn to fade away? A Wall Street Journal article (link) looks at how Costco, Walmart, Aldi and Amazon are all chipping away at the supermarket’s once-dominant position selling Americans their food.

|

HEALTH UPDATE |

— E-cigarettes. The Centers for Disease Control and Prevention (CDC) reported that over 10% of young adults in the U.S. regularly use e-cigarettes. Although traditional cigarette use has reached a historic low, the usage of e-cigarettes is on the rise. From 2020 to 2022, monthly e-cigarette sales soared to 22.7 million devices sold, fueled by the introduction of more brands, specifically those offering disposable e-cigarette products, and an increase in fruit and candy-flavored options attractive to younger consumers. This report comes shortly after the American Heart Association cautioned about the risks of heart and lung diseases associated with e-cigarettes. Dr. Joanna Cohen, director of the Institute for Global Tobacco Control at Johns Hopkins University, emphasized that e-cigarettes should only be used by individuals trying to quit smoking traditional cigarettes.

|

POLITICS & ELECTIONS |

— The biggest challenge for President Biden in 2024 isn’t if a third-party candidate is on the ballot, Amy Walter writes — it's if Donald Trump is not. But Charlie Cook writes: “Unless either former President Trump or President Biden have an adverse health event forcing them to terminate their campaign, we are going to have a Trump-Biden rematch, whether the parties or the public prefer it or not. Of course, a 2024 matchup may have some different angles than four years ago. For one thing, former Harvard and Princeton professor Cornel West (now affiliated with the Union Theological Seminary) is seeking both the People’s Party and the Green Party nominations.”

— The Cook Political Report with Amy Walter has moved three House 2024 races in Democrats’ favor and two toward the GOP.

|

CONGRESS |

— Bill introduced on foreign ownership of U.S. farmland. Sens. Chuck Grassley (R-Iowa) and Tammy Baldwin (D-Wis.) introduced a new bipartisan bill, the Farmland Security Act of 2023, seeking to further boost transparency in foreign ownership of U.S. farmland. The legislation builds upon measures introduced by the same senators in the Farmland Security Act of 2022 and amendments to the 1978 Agricultural Foreign Investment Disclosure Act. This bill would require greater transparency for foreign purchases of U.S. ag land, impose stronger penalties for reporting non-compliance, and mandate USDA to audit a minimum of 10% of foreign agricultural land ownership reports annually. The issue of foreign ownership is increasingly important as nearly half of U.S. ag land is owned by individuals aged 65 and over, and approximately 100 million acres are expected to change hands over the next decade due to retirement.

The measure necessitates a transition to a digital filing system and a public database on foreign ownership for researching ownership trends. It also requires the USDA to report on foreign investment impacts. The bill further emphasizes transparency, complete and accurate data collection, and greater understanding of foreign ownership.

The new legislation introduces stricter penalties for non-compliant foreign owners or "shell companies" by removing the current fee cap of 25% of land valuation, imposing a 100% land valuation fee for non-reporting shell companies unless corrected within 60 days of notification. It authorizes $2 million annually for administration as amended in the Agricultural Foreign Investment Disclosure Act.

Other stipulations include USDA research into foreign ownership of agricultural production capacity and foreign participation in U.S. agriculture, along with investigations into the use of "shell companies". State and county-level staff would also be trained to identify non-reporting foreign-owned farmland.

— Presidential candidate Robert F. Kennedy Jr. defended himself during a contentious House hearing, which was convened by Republicans. Representing a prominent American political family, Kennedy Jr., who is challenging Biden and has upset Democratic leaders, appeared before a House panel on censorship. During the hearing, Kennedy claimed that both social media platforms and members of his own party have made attempts to silence him. He defended himself against accusations of antisemitism, and his appearance was labeled a Republican stunt by Democrats. Appearing before the Select Subcommittee on the Weaponization of the Federal Government, Kennedy Jr. stated, "I am being censored here…through smears, through misinterpretations of what I’ve said, through lies, through association."

|

OTHER ITEMS OF NOTE |

— Cotton AWP rises. The Adjusted World Price (AWP) for cotton is at 66.18 cents per pound, effective today (July 21), up from 64.94 cents per pound the prior week. Meanwhile, USDA announced that Special Import Quota #14 would be established July 27 for 39,606 bales of upland cotton, applying to supplies purchased not later than Oct. 24 and entered into the U.S. not later than Jan. 22, 2024.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |