Dockworkers on Canada’s West Coast on Strike Again; Major U.S. Trucking Firm May Strike

Farm bill update | Gore on climate change | U.S./Taiwan trade deal | Court rules on SREs

|

In Today’s Digital Newspaper |

Dockworkers on Canada’s west coast are on strike again after a contract reached last week was rejected by the union, setting up more paralysis of trade out of west coast ports. In the U.S., workers at a major trucking company may strike as soon as next week. Details below.

The Justice Department and the Federal Trade Commission have unveiled their new guidelines concerning mergers. Details in Markets section.

In the first half of 2023, the U.S. witnessed a significant decrease in homeowners' activity mainly due to high mortgage rates.

Growing global demand for energy is expected to dampen this year amid ongoing fallout from economic downturns and the energy crisis triggered by Russia’s invasion of Ukraine, the International Energy Agency said Wednesday. But it’s set to bounce back next year, supported by efforts to electrify energy systems: depending on weather conditions, the agency said 2024 “could well become the first year in which more electricity is generated worldwide from renewables than from coal.”

Western oil sanctions have had a contrasting impact on Russia, Iran, and Venezuela this year.

The D.C. Circuit Court of Appeals upheld the regulation regarding compliance and reporting deadlines for Renewable Fuel Standard (RFS) on Tuesday. Details in Energy section.

New York Times writer David Gelles writes, “With extreme weather convulsing much of the globe, we decided to check in with Al Gore, who has been warning us about climate change for years now.” More in Energy & Climate Change section.

Several farm bill updates are in the Policy section. They both signal a likely short-term extension.

Competition is the word today at the White House, and USDA is doing its part in unveiling several initiatives.

All sides continue to spin their positions regarding the suspended Black Sea Grain Pact. Details in Russia & Ukraine section.

Chinese President Xi Jinping announced that China will take its own approach to decrease carbon emissions rather than following the strategies of other countries. Meanwhile, China’s fiscal revenue growth slowed in June, signaling broadening economic pressures. More in China section.

The Senate has approved a preliminary trade agreement with Taiwan, clearing its path to President Biden's desk for final approval. More in Trade Policy section.

A group of House lawmakers, led by Rep. Tony Gonzales (R-Texas), have introduced a draft bill intending to revise seasonal work visa programs to address labor shortages. More in Congress section.

This week, the Biden administration suspended funding for the Wuhan research lab following a monthslong review that revealed some safety concerns. The virus was first identified in Wuhan, China, but researchers have denied that the lab was related to the outbreak. To complicate matters, China has blocked international scientists from freely exploring all hypotheses for how the virus emerged — hampering research that could have potentially shone a light on the outbreak's origin.

The U.N.’s weather agency warned that heatwaves — like those scorching large parts of America, Asia and Europe — are becoming more frequent and intense. In Europe alerts for high temperatures remained in place in Italy, Spain and several regions of the Balkans. Wildfires raged for a third day in Greece. On Tuesday Phoenix, Arizona, endured a 19th consecutive day of temperatures above 43°C — a record among big American cities.

North Korea recently launched two missiles into waters near its east coast.

|

MARKET FOCUS |

Equities today: Asian and European stock markets were mostly higher in overnight trading. U.S. stock indexes are pointed toward slightly higher openings. In Asia, Japan +1.2%. Hong Kong -0.3%. China flat. India +0.5%. In Europe, at midday, London +1.6%. Paris +0.4%. Frankfurt +0.1%.

U.S. equities yesterday: U.S. stock indices finished the day with solid advances after opening in negative territory. The Dow ended up 366.58 points, 1.06%, at 34,951.93. The Nasdaq gained 108.69 points, 0.76%, at 14,353.64. The S&P 500 was up 32.19 points, 0.71%, at 4,554.98.

Goldman Sachs missed expectations in its second-quarter earnings. The company posted earnings of $3.08 a share, lower than the Refinitiv forecast of $3.18 per share. Goldman also reported revenue of $10.9 billion, which was more than the expected $10.84 billion.

Bank of America Corp., Morgan Stanley, JPMorgan Chase & Co. and Citigroup Inc. all beat analysts’ expectations for equity-underwriting revenue in the second quarter, with all but Citigroup earning more than they did a year earlier from that business. The biggest banks — again except for Citigroup — also surpassed estimates for debt underwriting.

The Justice Department and the Federal Trade Commission have unveiled their new guidelines concerning mergers. Despite a track record of failing to block transactions in court, regulators maintain an assertive stance. The updated guidelines extend the scope of evaluations for deals and stress on the understanding of the regulators' progressive views on trustbusting through footnotes about case law.

These guidelines, historically introduced by regulators under various administrations and not bound by law, present new strategies formulated by Lina Khan of F.T.C. and Jonathan Kanter of the Justice Department. They argue for adaptability to the current business landscape, emphasizing that present legitimations do not effectively cater to this era.

The guidelines consider the consolidation of market power by dominant platforms and the cumulative effect of multiple deals, which might impact the private equity industry. The regulators are also considering the effect of transactions on employees besides consumers.

The Biden administration also declared the launch of a new enforcement group to monitor and control price gouging in the food and agricultural markets, as part of their fight against business consolidation.

Analysts say the challenge now is whether the regulators can align the courts with their perspective, given the history of court decisions not always favoring their stance on deal-making. The guidelines will enter a 60-day comment period, following which the agencies will attempt to persuade the courts to agree with their interpretation of precedent.

Meanwhile, deal makers must decide which battles they are willing to engage in.

Agriculture markets yesterday:

- Corn: December corn futures gained 28 1/2 cents to $5.34 1/2, near the session high and hitting a three-week high.

- Soy complex: November soybeans rose 17 1/4 cents to $13.95 1/4, after reaching the highest level since Dec. 30. August meal rose $8.30 to $442.70, while August soyoil fell 71 points to 64.05 cents.

- Wheat: December SRW wheat rose 16 3/4 cents at $6.90 1/2. December HRW wheat gained 12 1/4 cents at $8.32 1/4. Prices closed nearer their session highs today. December spring wheat rose 3/4 cent to $8.86 1/2.

- Cotton: December cotton rose 12 points to 82.25 cents after reaching as high as 83.00 cents.

- Cattle: August live cattle rallied $1.15 to a contract-high close at $181.275. August feeder cattle succumbed to grain market strength, falling $1.25 to $248.00.

- Hogs: August hog futures rebounded from Monday’s big losses, climbing $1.50 to $96.275, whereas deferred contracts were mixed.

Ag markets today: Corn, soybeans and wheat sharply extended Tuesday’s gains during the overnight session amid concerns with U.S. weather and Black Sea grain supplies. As of 7:30 a.m. ET, corn futures were trading 15 to 16 cents higher, soybeans were 15 to 18 cents higher, winter wheat futures were 15 to 22 cents higher and spring wheat was 10 to 12 cents higher. Front-month crude oil futures were tethered near unchanged, and the U.S. dollar index was around 350 points higher.

Market quotes of note:

- Russia’s termination of the Black Sea Grain Pact this week means that it will no longer guarantee safe passage through the waterway. Ukraine is calling on other nations to help facilitate shipments from three of its deep-sea ports, which were covered by the agreement. The U.S. said shipping escorts are not an option, and, according to Bloomberg, insurance broker Marsh on Tuesday suspended its program for grain exports from Ukraine, underscoring the challenges ahead. “No sane owners will call there uninsured,” said Vasilis Mouyis, joint managing director of Greece-based Doric Shipbrokers SA, which had previously sent vessels through the shipping passage. Without the protection of the safe corridor “the Ukraine trade is dead.”

- JPMorgan has warned that European general retailers may face challenges due to an anticipated drop in clothing prices in 2024. The bank posits that this potential price deflation might significantly impact the sector soon. Sellers might face troubles meeting sales forecasts if there aren't accompanying increases in sales volumes. In addition, reduced clothing prices could lead to shrinking profit margins, especially if operating costs remain high — a likely scenario considering the trend of increasing minimum wages. JPMorgan's preliminary analysis suggests clothing prices might fall by roughly 6% in 2024. Such a change could particularly affect retailers like H&M and Marks & Spencer, both rated "under-weight," along with ABF and Asos, rated "neutral," especially when their growth is based on margin recovery, according to JPMorgan analyst Georgina Johanan.

- Red flag on Yellow. “We believe it would be extremely difficult for Yellow to recover from a full-blown strike given its precarious financial status.” — A TD Cowen analyst report on Yellow. Yellow is facing a new risk to its business as the trucker's labor concerns and financial troubles converge. The Teamsters union is threatening a walkout after the debt-laden operator missed a payment due this month to the Central States pension fund and said it is looking to defer another payment in August.

U.K.'s inflation rate dropped more than anticipated to its lowest level in over a year, suggesting that rising interest rates may be mitigating the country's severe wage-price spiral, the worst among the Group of Seven nations. According to the Office for National Statistics, the Consumer Prices Index (CPI) in June was 7.9% higher than the previous year, marking a significant decrease from the 8.7% reported in May. Following the announcement, the British pound weakened, and investors reduced their expectations of further significant increases in interest rates. Barclays strategist Emmanuel Cau expressed that the weaker-than-expected inflation is arguably a relief and should boost sentiment on domestic and rate plays. He suggested that because investors have generally been bearish on the U.K. and underexposed, short covering could be potent.

Market impacts: The pound slumped after U.K. inflation slowed to the weakest level in more than a year, prompting traders to pare bets for a 50-bp BOE hike next month. The reverse happened in the euro area, where core prices picked up more than expected.

Eurozone inflation eases in June. Consumer inflation in the Eurozone slowed to 5.5% from year-ago last month, down from a 6.1% rise the previous month. Core inflation, which excludes prices of energy and unprocessed food, eased to 6.8% versus 6.9% a month earlier. But an even narrower measure, which also excludes alcohol and tobacco products, rose to 5.5% from 5.3% in May.

In the first half of 2023, the U.S. witnessed a significant decrease in homeowners' activity mainly due to high mortgage rates. Redfin, a real estate brokerage firm, reported that the rate of home turnover during the first six months of this year was the lowest in at least a decade. A mere 14 out of every 1,000 U.S. homes changed hands, marking a downturn from 19 in the same period of 2019, prior to the Covid-19 pandemic. Taylor Marr from Redfin suggests bringing mortgage rates closer to 5% to stimulate activity in this sector. The rate adjustment is projected to provide some relief by reducing monthly payments and increasing available inventory. Moreover, other suggested measures to increase turnover include building additional housing, implementing zoning reforms, and offering tax break subsidies.

Market perspectives:

• Outside markets: The U.S. dollar index was firmer, with the euro and British pound both weaker against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 3.74%, while there was a lower tone in global government bond yields. Crude oil futures were higher ahead of U.S. gov’t data due later this morning, with U.S. crude around $76.20 per barrel and Brent around $80.30 per barrel. Gold and silver futures were slightly higher, with gold around $1,981 per troy ounce and silver around $25.36 per troy ounce.

• The Japanese yen, which has been underperforming against major currencies for a considerable part of this year, seems to be on a recovery path, having increased by over 4% against the U.S. dollar since the beginning of July. For much of the year, the yen depreciated nearly 5% against the U.S. dollar and even more against the euro, the British pound, and the Swiss franc. However, its fortunes seem to be changing. The key driver behind this shift appears to be expectations surrounding interest rates. The Bank of Japan's longstanding adherence to a loose monetary policy sharply contrasts with the U.S. Federal Reserve's historical wave of rate hikes in the past 16 months. However, speculations are rife that both central banks might alter their current stances soon, which might further bolster the yen.

• Western oil sanctions have had a contrasting impact on Russia, Iran, and Venezuela this year, according to Bloomberg Opinion's Javier Blas. Despite damaging Russia's oil market, these sanctions have benefited Iran and Venezuela. Iran's oil production has reached a five-year high, spawning significant effects. Firstly, it has relaxed global energy markets, decreasing prices and thereby enabling the Group of Seven to impose a price cap on Russia. Secondly, it has liberated several tankers that Iranian oil previously used for storage, assisting Russia in selling oil priced over $60 per barrel. Finally, Iran has shipped a portion of its oil to Venezuela. This supplemented Venezuela's heavy crude, acting as a diluent and enhancing production in the process.

• U.S. supply chain managers are on edge as 22,000 workers at Yellow trucking company plan to strike as soon as next week and 340,000 UPS employees threaten to walkout if a deal isn’t reached this month.

• Strike back on at Canadian ports. The International Longshore and Warehouse Union (ILWU) Canada has rejected a preliminary agreement with the BC Maritime Employers Association (BCMEA) that was announced last week. The union leadership believes the proposed deal does not sufficiently safeguard their members' jobs currently and in the future. The decision was made through a caucus vote by the union leadership that felt the duration of the collective agreement was too protracted given the uncertainty in the global financial markets.

Consequently, the ILWU Canada resumed their strike on the afternoon of July 18. The decision to reject the agreement and continue the strike was criticized by the BCMEA. They argued that the full union membership did not participate in the vote and that this action from the union leadership escalates the harm to Canada's economy, its international reputation, and, most critically, to Canadians' livelihoods that depend on a stable supply chain.

In response to the resumed strike, Labor Minister Seamus O'Regan and Transport Minister Omar Alghabra issued a joint statement (link) expressing the government's intention to consider all available options to address the situation. They emphasized that the scale of disruption witnessed last week cannot be tolerated further and expressed their patience and respect for the collective bargaining process. However, they also asserted their need for the ports to be operational.

The Greater Vancouver Board of Trade issued a statement criticizing the effort, including a running tabulation (link) of the costs they say the work stoppage has caused, putting the impact at over C$10 billion ($7.59 billion).

• Ag trade: Algeria purchased an unspecified amount of corn expected to be sourced from Argentina or Brazil from a tender to buy up to 240,000 MT.

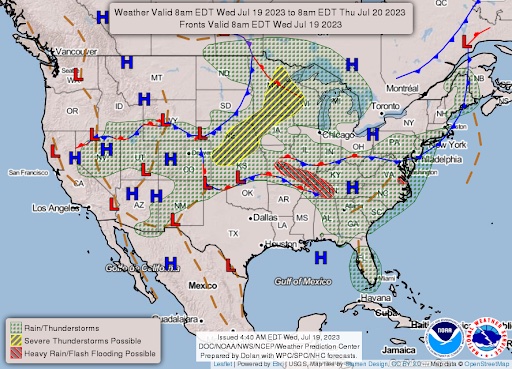

• NWS weather outlook: Lengthy & dangerous heat wave to continue across the Southern Tier this week... ...Flash flooding & severe weather possible from the Nation's Heartland to the Mid-Atlantic through Thursday, headlined by a Moderate Risk in western Kentucky and northwest Tennessee today... ...Tropical Storm Calvin weakening on approach to Hawaii this morning, but heavy rains and tropical storm force wind gusts still expected... ...Canadian wildfires/smoke responsible for Air Quality alerts over parts of the Great Lakes, southern Mid-Atlantic, and Northeast today.

Items in Pro Farmer's First Thing Today include:

• Active followthrough grain buying overnight

• Russia again attacks Odesa

• China to start selling cotton reserves

• Beef margins drop further

• Cash hog index showing no signs of topping

|

RUSSIA/UKRAINE |

— A fire broke out at a military base in Crimea, which Russia annexed in 2014, triggering explosions at a nearby ammunition depot. Russian-installed officials said that about 2,000 residents were being evacuated in response. Ukraine claimed responsibility, saying that its forces had conducted a “successful operation.”

Meanwhile, Russia bombarded Odessa in southern Ukraine for a second night.

— There is a recent escalation of conflict in Ukraine as Russian attacks have severely damaged grain infrastructure at the Chornomorsk port. The attacks resulted in the destruction of 60,000 metric tons of grain which was supposed to be shipped under the Black Sea Grain Initiative. The Russian attack extends to the Odessa port, however reports are varied in terms of the damage inflicted on grain infrastructure there.

Five Central European countries within the EU — Bulgaria, Hungary, Poland, Romania, and Slovakia — will request an extension on the ban of Ukrainian grain imports, according to Hungary’s Agriculture Minister. The ban, which suspends domestic sales of various Ukrainian agricultural commodities like wheat, corn, rapeseed and sunflower seed, but allows their transit, is supposed to end on Sept. 15. The countries are now proposing to extend the ban through Dec. 31.

The collapse of the Black Sea grain deal has raised global concerns of increased Ukrainian agricultural product exports after the ban is lifted. The United Nations is actively looking for ways to facilitate the distribution of Ukrainian and Russian grain and fertilizer to global markets after Russia withdrew from the Black Sea grain deal. Various concepts are being considered, according to U.N. spokesman Stephane Dujarric, as U.N. Secretary-General Antonio Guterres is committed to exploring all possible avenues.

Of note: A Wall Street Journal editorial writes (link): “Putin is capable of anything, but he’d be taking considerable risks if he used military power to enforce a food blockade. The U.S. and the world should let him know that if he does, the result will be a naval escort operation in the Black Sea.

— Russia lays out parameters for restarting Black Sea grain deal. Russia said the United Nations had three months to implement the terms of a memorandum that would facilitate Russian agricultural exports if it wanted Moscow to resume talks about allowing safe Ukrainian grain exports to restart. Russian Foreign Ministry spokeswoman Maria Zakharova said the onus was now on the United Nations. “The Russia/United Nations memorandum itself states, and I'll quote... that the agreement will be in force for three years, and in case one of the parties intends to terminate it (either Russia or the U.N.), it must give three months’ notice. We have given notice,” Zakharova told Radio Sputnik on Wednesday. “Accordingly, the U.N. still has three months to achieve concrete results. Therefore, people should not run to the microphones at the U.N. Secretariat, but use these three months to achieve concrete results. If there are concrete results, we will return to the discussion of this (wider) issue.”

|

POLICY UPDATE |

— House farm bill update. The House Agriculture Committee will soon release a draft bill addressing the structure of the digital asset market, its Chairman, G.T. Thompson (R-Pa.), said during a breakfast session with reporters. Created in collaboration with the House Financial Services Committee, the bill intends to clarify the regulatory landscape following the court ruling in favor of Ripple Labs. Thompson argued the ruling proved current Securities and Exchange Commission authority is inadequate for regulating digital assets, thereby necessitating the legislation. The bill also aims to position the U.S. as a key location for digital asset markets.

This development does not affect the progress of the farm bill, with Thompson planning to carry out parallel work on both projects.

Regarding the farm bill, it is expected to be drafted for a markup in mid-September. It might be considered by the House before some provisions of the current farm law expire on September 30, though demands for floor time are substantial, and the deadline is tight.

The farm bill will unlikely include further work requirements for the Supplemental Nutrition Assistance Program (SNAP) beyond those stated in the recently approved debt ceiling bill. Thompson envisions SNAP as a workforce development program and prefers using incentives to shape participants' shopping habits.

Despite the farm bill's challenges, Thompson aims to achieve as many approving votes as possible from both parties. Furthermore, he's ensuring new representatives are familiar with the bill's complexities before the vote, to avoid misunderstandings and flare-ups on the House floor.

Thompson, along with other members, is also seeking additional funding sources for the bill, but that will likely be the biggest farm bill hurdle that may trip up lawmakers.

Of note: Thompson said he plans a mid-September markup of a draft farm bill once text is ready after August recess. The top four members of the House and Senate Ag committees urged CBO to ramp up staffing to address a backlog of scores for proposed changes to programs the upcoming farm bill, according to a letter (link/pdf). The letter, addressed to the leaders of the congressional Budget committees and CBO director Phillip Swagel, said the Ag committees have “become increasingly concerned at the volume of outstanding requests” for scores related to the farm bill. The lawmakers said they “expect several hundred more preliminary scores will be needed before each chamber, and eventually, the Congress, has a farm bill completed for final scoring.” To address the concerns, the members said CBO and the Budget committees should “use all available resources and authorities to ensure CBO can reorganize staff to prioritize farm bill requests, hire or contract additional staff, or find available qualified professionals who can be assigned on detail.” They added that new hires or detailees should have experience in scoring farm bill-related programs.

Thompson also said that the timeline could be met in getting the bill done by the end of September if the Senate would follow the House schedule. “There would be no need for an extension if the Senate would get their [farm bill version] done in the same timeframe I'm talking about,” he observed.

Bottom line: Thompson acknowledged on Tuesday that Congress would likely need to extend the existing farm bill due to delays caused by unrelated legislation. This marks his first explicit admittance that legislators will miss the imminent deadline, as some of the authorizations from the 2018 Farm Bill are set to expire by the end of September. As his previous comments signaled, his prediction seems to stem from assessing the Senate's progress, being further behind in drafting its version of the farm bill than the House.

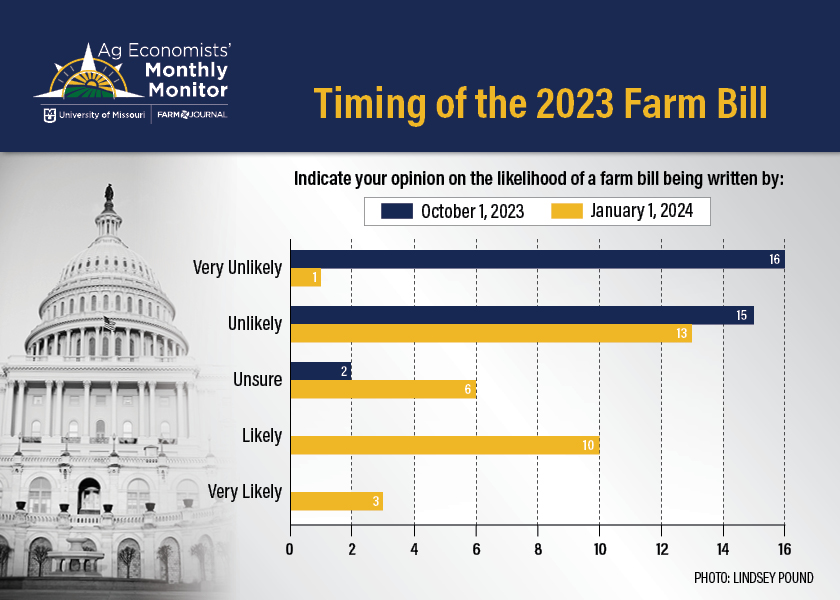

— Most ag economists think it's unlikely the 2023 farm bill will be written in 2023. Some provisions of the current farm bill are set to run out at the end of September, placing policymakers in a race against time to draft a new one. Most agricultural economists predict that a fresh farm bill will not be drawn up before the deadline, as outlined in the latest Ag Economists' Monthly Monitor. A minority of these experts, however, hold out hope that a new bill could be on the table by the end of the year.

Details: The June edition of the Monthly Monitor conducted a survey among ag economists, revealing that the majority labeled the prospect of a new farm bill before Sept. 30, 2023, as "very unlikely" or "unlikely." Despite the pessimism dominating the predictions for a bill by the end of September, there are still some who believe that it could be accomplished by Jan. 1, 2024. (See chart below.)

Background: The Monthly Monitor is a new survey of nearly 50 agricultural economists from across the country. It's the first survey of its kind, collecting insights from economists who represent both the private and public sectors. The economists represent the ag sector across a wide geography and have expertise in grains, livestock and policy. The survey is conducted anonymously to allow the highly respected agricultural economists to speak more openly about their economic and production forecasts because their responses won't be attributed to the university, company or organization they represent. The Ag Economists' Monthly Monitor is a joint effort between the University of Missouri and Farm Journal. The university conducts the survey, collects and crunches the data while Farm Journal distributes the results. The next Monthly Monitor will be released later this week.

|

CHINA UPDATE |

— Chinese President Xi Jinping announced that China will take its own approach to decrease carbon emissions rather than following the strategies of other countries. His remarks were made during a recent national conference on environmental protection and were highlighted by state broadcaster CCTV on Tuesday. The president assured the country's unwavering commitment to its dual-carbon goal: peaking its carbon emissions by 2030 and achieving carbon neutrality by 2060. However, he emphasized that the methodology, pace, and intensity of the efforts towards these goals will be determined independently by China, and they will not be influenced by external parties. This comes in the wake of a meeting between China's Premier Li Qiang and U.S. climate envoy John Kerry, marking the most high-level discussions held during Kerry's visit to Beijing this week.

— More signs of Chinese broadening economic pressure. China’s fiscal revenue growth slowed in June, signaling broadening economic pressures. Last month, fiscal revenue rose 5.6% from a year earlier, slowing sharply from a 32.7% jump in May, according to Reuters calculations based on finance ministry data. Income from land sales, the biggest source of funds that local governments raise directly, shrank 24.26% annually in June, steeper than the 13% drop the previous month. Fiscal revenues grew 13.3% in the first six months of 2023 from a year earlier, slower than a 14.9% rise in the first five months, finance ministry noted.

|

TRADE POLICY |

— The Senate has approved a preliminary trade agreement with Taiwan, clearing its path to President Biden's desk for final approval. This legislation was a result of negotiations between the Biden administration and Taipei.

The bill outlines transparency and cooperation terms for future negotiations and could potentially pave the way for stronger tax ties between the U.S. and the island nation. Though the bill had previously been blocked in the Senate, it managed to secure passage due to its bipartisan support. The bill was initially introduced back in June by Sen. Ron Wyden (D-Ore.), Finance ranking member Mike Crapo (R-Idaho), House Ways and Means Chair Jason Smith (R-Mo.), and ranking member Richard Neal (D-Mass.). These legislators believe that this legislation sends a strong message about the willingness of Congress to enhance its trade relationship with Taiwan, subsequently asserting Congress's constitutional authority over trade agreements.

The leaders also drafted a proposed legislation earlier this month that promises treaty-like benefits for businesses seeking cross-border investment opportunities via the tax code.

Of note: This tax bill will aim to lower withholding taxes on dividends, interest, and royalties associated with cross-border investments, making it accessible for smaller businesses to engage in these types of investments by alleviating related barriers. Thus, encouraging increased economic cooperation and mutual financial benefits between the two nations.

|

ENERGY & CLIMATE CHANGE |

— Gore on climate change. New York Times writer David Gelles writes, “With extreme weather convulsing much of the globe, we decided to check in with Al Gore, who has been warning us about climate change for years now.” In the article (link), Gelles writes: “It’s been 17 years since former Vice President Al Gore raised the alarm about climate change with his documentary, An Inconvenient Truth. Since then, he’s been shouting from the rooftops about the risks of global warming more or less nonstop. But the events of the past few weeks have Gore even more worried than usual.”

Gore, notable for his ongoing activism regarding climate change, has aired his heightened concerns about global warming considering recent extreme weather events. Instances such as abnormal temperatures in the North Atlantic, reduced Antarctic Sea ice, and droughts in South America have him worried, although he acknowledges that it's difficult to definitively attribute each event to climate change.

However, Gore maintains a sense of optimism due to the increasing affordability of clean energy and the rise in electric vehicle sales supported by government subsidies. He believes developed economies can significantly reduce their emissions in the coming decades if current trends continue.

Quoting economist Rudiger Dornbusch, Gore draws attention to the rapid growth in renewable energy despite initial slow adoption. He emphasizes the importance of swift transition to clean energy - reaching a net zero carbon emissions state can help stabilize global temperatures, with notable improvements possible within three years.

Despite this optimism, Gore acknowledges numerous significant hurdles. He criticizes fossil fuel companies, which contribute heavily to global emissions, for their lack of transparency and unwillingness to commit to green initiatives. He also shares his concerns about the undue influence fossil fuel companies have in the United Nations climate change conference, known as COP. He cites the example of the upcoming COP28's president, Sultan al-Jaber, who also heads the UAE's state oil company, suggesting this compromises the process's credibility.

To remedy this, Gore suggests limiting the influence of fossil fuel companies in the COP process, in addition to removing the veto power rich countries have in ceasing fossil fuel usage. He firmly addresses the underlying connection between the climate crisis and reliance on fossil fuels, insisting on their phase-out for a sustainable future.

— The D.C. Circuit Court of Appeals upheld the regulation regarding compliance and reporting deadlines for Renewable Fuel Standard (RFS) on Tuesday. It rejected the plea of two refineries, Wynnewood Refining Company and Coffeyville Resources Refining & Marketing, disputing the validity of the "extension rule" issued in February 2022. According to the contested rule, reporting requirements for RFS years 2020-2022 were supposedly unlawfully condensed. However, the court ruled that the EPA (Environmental Protection Agency) isn't legally bound to grant a minimum of 13 months' compliance lead time nor ensure compliance intervals of at least 12 months when it delays issuing renewable fuel standards, according to the Clean Air Act.

— Lawmakers urge limits on Chinese AVs in U.S. Lawmakers from both parties urged the Biden administration to limit the usage of autonomous vehicles (AVs) produced by Chinese companies within the U.S. In a joint letter, Representatives Debbie Dingell (D-Mich.), Tim Walberg (R-Mich.), Bob Latta (R-Ohio), and Marc Veasey (D-Texas) pleaded with Transportation Secretary Pete Buttigieg and Commerce Secretary Gina Raimondo to restrict Chinese-made AVs. The lawmakers underscored China's existing strict limitations on U.S. AV firms operating on their soil and voiced their anxiety about giving away strategic benefits by not reciprocating these restrictions.

Meanwhile, Vietnamese EV manufacturer VinFast has announced plans to kick-start construction of its factory in North Carolina on July 28, with expectations to take the company public in the U.S. later in the year. The factory is slated to commence production in 2025 with an initial capacity of 150,000 vehicles per annum.

— Markey introduces bill aimed at private jet fuel. Sen. Ed Markey (D-Mass.) today will introduce legislation to tax private jet fuel to fund air monitoring and public transit. “The 1% can’t free ride on our environment and our infrastructure at a discount,” Markey said in a statement. “Billionaires and the ultra-wealthy are getting a bargain, paying less in taxes each year to fly private and contribute more pollution than millions of drivers combined on the roads below.” A release says private jets pollute up to 14 times more than commercial flights and 50 times more than trains.

— The European Union’s plan to put a carbon levy on imported goods from outside the bloc is an attempt to shift the burden for climate action to developing countries and may contravene World Trade Organization rules, South Africa said.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Biden administration launches new competition council; USDA releases plan to partner with states on anticompetitive behavior. The Biden administration has initiated several measures to address competition and anticompetitive practices across various sectors, with particular focus on the agricultural, food, and meat industries.

A key step is the formation of a new Competition Council, led by Hannah Garden-Monheit who has been appointed as the Director of Competition Council Policy at the National Economic Council (NEC). The council will consist of 18 members and aims to build upon efforts the administration has already instigated, such as tackling issues within the meat and ocean shipping industries, and addressing consumer junk fees.

USDA also announced a large-scale collaboration with legal representatives from 31 states along with Washington DC, aiming to reinforce competition and protect consumers in food and agricultural markets. Areas of focus will be grocery, meat and poultry processing, and other related sectors. It also plans to address potential issues involving a lack of choices for both producers and consumers, conflicts of interest, misuse of intellectual property, and other barriers to competition primarily in food and agriculture supply chains.

As part of the initiative, USDA will set up the Agriculture Competition Partnership, a project focused on anticompetitive market structures, price gouging, anti-consumer practices, and other pertinent issues. This partnership will deploy funds to back research and academic work that can be used in future cases, as well as investigations into more complex occurrences of anticompetitive behavior.

USDA's collaboration also features the involvement of the Center for State Enforcement of Antitrust and Consumer Protection Laws and the American Antitrust Institute. Further, USDA plans to continue working on rules under the Packers and Stockyards Act regarding issues in the meat industry.

Of note: Certain House lawmakers are opposing those rules as part of the Agriculture Appropriations measure for fiscal year (FY) 2024, and aim to block USDA from finalizing them.

|

HEALTH UPDATE |

— The Biden administration formally halted the Wuhan Institute of Virology’s access to U.S. funding, citing unanswered safety and security questions for the facility at the center of the Covid lab leak theory.

— Johnson and Johnson sued the Biden administration over the Medicare drug price negotiation program, likening it to "a gun to the head." The company joins Bristol Myers Squibb, Merck, PhRMA and the Chamber of Commerce in challenging the program.

|

CONGRESS |

— Bipartisan bill to revise work visas introduced. A group of House lawmakers, led by Rep. Tony Gonzales (R-Texas), have introduced a draft bill intending to revise seasonal work visa programs to address labor shortages. This is a rare bipartisan attempt in a currently Republican-led chamber.

The proposed legislation seeks to simplify how employers apply and renew H-2A farmworker and H-2B migrant worker visas. It would extend the validity of worker visa documentation up to three years and enable some returning workers to skip in-person interviews. The bill would also permit the Labor Department to promote seasonal jobs as longer-term positions to Americans.

Gonzales stated that the bill targets labor shortages across various industries such as hospitality and construction. He suggested that the bill was designed to reduce unnecessary bureaucracy around visa policies, a lesson learned from the Covid pandemic.

Currently, employers can sponsor migrant workers for seasonal agricultural labor via H-2A visas, or for other temp work (like construction) under H-2B visas. However, these visas don't cover full-year work, and H-2B's annual cap is 66,000, though it has been expanded in recent years due to high demand.

Another bill supporter, Rep. Henry Cuellar (D-Texas) added that easing legal work pathways for economic migrants would allow Border Patrol to concentrate on apprehending those crossing the border with harmful intentions.

Hurdles ahead. Despite the bipartisan support that this draft legislation has managed to gather, the divided Congress poses significant challenges to pass substantial immigration reforms. A previous similar bill that included visa program revisions and provided a path to citizenship for long-term migrant farmworkers, despite bipartisan support, couldn't pass the Senate. Gonzales indicated that achieving significant support for this bill to pass would be "a heavy lift.”

— Senators plan to propose stock-ownership limits on lawmakers and federal officials. Sens. Kirsten Gillibrand (D-N.Y.) and Josh Hawley (R-Mo.) are planning to introduce a bill that would impose restrictions on stock ownership for lawmakers, the President, Vice President, federal officials, and their aides. This legislation would prohibit these officials from owning individual stocks, even if they are held in blind trusts. This proposal was revealed by the Wall Street Journal and appears to be a response to increasing public concerns over possible conflicts of interest, especially regarding policymakers owning shares in companies which fall under their regulatory authority.

|

OTHER ITEMS OF NOTE |

— North Korea recently launched two missiles into waters near its east coast. The move is perceived as an impactful display of discontent, occurring just hours after the U.S. docked a submarine capable of deploying nuclear ballistic missiles in a South Korean port for the first time in nearly forty years. According to South Korea’s Joint Chiefs of Staff, the missiles travelled approximately 340 miles, leading to their classification of the launch as a "grave provocation."

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |