Lawmakers Return for Three Weeks Until August Recess

WASDE | Trump blasts Biden, DeSantis on farm, energy policies | Biden to Europe

Washington Focus

Lawmakers are back, but they will have only three weeks until the August recess.

Congress is preparing to process the National Defense Authorization Act, which has passed annually for over 60 years. They'll need to manage more than 1,400 amendments, approve the bill (HR 2670), and reconcile it with the Senate's version.

Some hardline House Republicans are balking at voting for the measure if it contains continued funding for Ukraine’s battle against Russian aggression, spending that Senate Minority Leader Mitch McConnell (R-Ky.) sees as an imperative. Senators from both parties have expressed support for a supplemental stipend to bolster the Ukrainian counteroffensive. The U.S. has provided Ukraine with more than $75 billion in assistance since Russia invaded its neighbor Feb. 24, 2022, including $30 billion in military aid, $24 billion in economic aid and $11 billion for humanitarian purposes. More than 4 in 10 (44%) Republicans now say the U.S. is giving too much aid to Ukraine, up from 40% in January, according to a Pew Research Center poll released in June.

This month, other government spending bills may also proceed, but it is unlikely all will pass by the Sept. 30 deadline. If negotiations fail, a stopgap spending measure may be implemented to prevent a government shutdown.

The House Appropriations Committee has so far progressed six of its 12 bills. Senate appropriators have considered two spending bills with plans to evaluate three more covering Commerce-Justice-Science, Financial Services and General Government, and Legislative Branch funding.

Of note: A provision in the debt-ceiling agreement would impose cuts on military and other spending if lawmakers fail to enact spending bills by Jan. 1. However, lawmakers could push past the Jan. 1 deadline, since the automatic cuts don’t take effect until April.

Several policy authorizations, including the Federal Aviation Administration's, and some farm bill programs, are due to expire at the end of September.

Behind-the-scenes work continues on getting a draft completed for a new farm bill, with a timeline of late August or September. The goal is to get a new farm bill completed by the end of the calendar year. One of the primary points of contention usually boils down to the food-stamp program. As part of a previous debt limit increase compromise, lawmakers consented to enhanced work requirements for food aid recipients. However, some Republicans may push for additional modifications in the farm bill. Meanwhile, complications may arise due to budget constraints, leading to debates about which, if any, farm safety-net programs should receive added funding. Hardline conservative Republicans frequently express resistance to some aspects of government support encompassed in the farm bill. This poses a challenge for House Speaker Kevin McCarthy (R-Calif.) who, as the bill’s sponsor, will likely need bipartisan approval for it to advance in the House. If so, that could place him in opposition with conservatives from the House Freedom Caucus.

The House is eyeing a vote on a five-year FAA bill (HR 3935) the week of July 17, with a deadline for amendment submissions set for the subsequent week. Both the House and Senate have introduced bipartisan reauthorization bills, but conflict could still surface as the measures move to the floor.

The Senate will vote on several nominations this week, including Xochitl Torres Small as deputy USDA Secretary, Rosemarie Hidalgo as director of the Justice Department’s Violence Against Women Office, and two judge candidates for the Washington state federal district court.

FBI Director Chris Wray is scheduled to testify before the House Judiciary Committee on matters relating to former President Trump and Hunter Biden investigations.

On Tuesday, the Senate’s Permanent Subcommittee on Investigations will review the merger of the PGA Tour and Saudi-backed LIV. Officials from golf's PGA Tour will appear on Tuesday before a Senate subcommittee investigating its proposed partnership with LIV Golf, which is backed by the Saudi Public Investment Fund. Last month, two Democratic lawmakers sent a letter to the Treasury Department requesting that the Committee on Foreign Investment in the United States examine the national security risks of the proposed golf tour tie-up.

An ongoing issue is the proposed legislation by Sen. Bernie Sanders (I-Vt.) to raise the federal minimum wage to $17 per hour, which is facing both internal and external obstacles. This difficulty is illustrative of the struggle Congress has faced for over a decade in raising the federal minimum wage above $7.25.

Looking ahead, Senate Majority Leader Chuck Schumer (D., N.Y.) has said he wants to take up a freight-rail safety bill introduced by Ohio Sens. Sherrod Brown, a Democrat, and J.D. Vance, a Republican.

The White House plans to host farm and ranch groups July 12 for a roundtable listening session on competition issues. Unlike a White House roundtable last year, President Joe Biden is not expected to attend. "Promoting competition, including in agricultural markets, is a core pillar of Bidenomics," said a White House spokesperson in a statement. "The White House and Department of Agriculture are meeting on Thursday with a range of stakeholders to hear their priorities in this space."

USDA is also holding a webinar July 11 on a recently released report (link) on competition in agricultural markets.

President Biden is heading to Europe for a five-day visit to three countries, aiming to strengthen NATO's unity amid fractures in the alliance due to the ongoing war in Ukraine. Notably on the agenda is NATO's recent addition of Finland, and debates over accepting Ukraine and Sweden into the alliance, overshadowed by disagreements between members.

During his trip, Biden will meet British Prime Minister Rishi Sunak and King Charles III in London, before heading to Lithuania for the NATO summit. Here, he is expected to make a substantial speech about his global vision. He will also visit Helsinki to mark Finland's joining of NATO and to meet with Nordic leaders.

U.S. Treasury Secretary Janet Yellen reported signs of progress in stabilizing the strained relationship between the U.S. and China following her latest diplomatic visit. During Yellen's time in Beijing, the talks touched on several contentious issues, revealing a willingness from both sides to negotiate and improve ties. Yellen characterized the U.S. restrictions on business with China as narrow and aimed to reassure Beijing they are not intended to significantly impact the Chinese economy.

Yellen's visit has changed this tone, as she was received without preconditions or demands for changes. This could be partly due to Yellen's perceived less hawkish stance towards China, and her focus on economic and financial matters that are less sensitive than issues such as human rights and Taiwan.

Yellen addressed Chinese economic leaders during a meeting held at the Diaoyutai State Guest House in Beijing, stating that a significant portion of both economies could work together without any controversies.

While noting recent tensions, she said bilateral trade in 2022 hit a record high, suggesting great potential for future trade and investment interaction between the two nations. Yellen emphasized the necessity for improved communication between Beijing and Washington, focusing on macroeconomic and financial stability, in the complicated global economic scenario.

She also met with Chinese climate finance experts, encouraging joint responsibilities for tackling climate change, given the position of both nations as the largest global greenhouse gas emitters and renewable energy investors.

Her meeting with He Lifeng, Chinese economic tsar, is considered the most significant part of her four-day visit. He, a protégé of President Xi Jinping, is largely unknown outside China, but is recognized for advocating increased foreign investment openness, even though some fear his loyalty to Xi might lead him to support increased control by state-owned corporations. Yellen's visit follows Secretary of State Antony Blinken, and precedes John Kerry, President Biden's special envoy for climate change, indicating a trend of high-level diplomatic visits aimed at stabilizing U.S./China relations.

Of note: At Sunday’s news conference, Yellen said the U.S. would listen to China’s objections to American regulations. She also hinted at possible flexibility by saying in some cases the U.S. might be willing to “respond to unintended consequences of our actions if they’re not carefully targeted.” Yellen didn’t detail what a mechanism for talking with China about these issues might look like, and U.S. officials have said figuring this out was one reason for the trip. Yellen said she expects lower-level officials to continue working on this after she returns to the U.S.

Top trade officials from the U.S., Mexico and Canada met late last week in Cancún Mexico. Despite initial reports saying that contentious issues like Mexico’s GM corn policy and U.S. problems with Canada dairy programs would not be discussed, those issues were, indeed, part of the meetings.

The biotechnology issue refers to Mexico’s plan to ban imports of GM corn for human consumption by 2024, as well as GM corn used as animal feed at an unspecified later date. The United States, a large exporter of yellow corn to Mexico, requested dispute settlement consultations on that issue early last month, and Canada subsequently said it would participate in the talks as a third party. President López Obrador is steadfastly committed to Mexico’s plan to ban GM corn and acknowledged last month that the U.S. “might take us to a panel.” The president, who alleges that GM corn is harmful to human health and poses a threat to native Mexican corn, said earlier this year that “no agreement in the world allows goods that are harmful to health to be bought or sold.” The USMCA has “clauses that protect consumers, just as the environment and workers are protected,” he added.

The U.S. can request the establishment of a panel if a resolution isn’t reached 75 days after the commencement of the consultations.

U.S. Trade Representative Katherine Tai reiterated the U.S. position on the GM corn issue before Thursday’s meeting with Mexico’s Economy Minister Raquel Buenrostro. “We stand behind the safety of our agricultural products that have been enjoying a very robust trade between our three countries for several decades now and will continue to pursue our rights and interests,” she said.

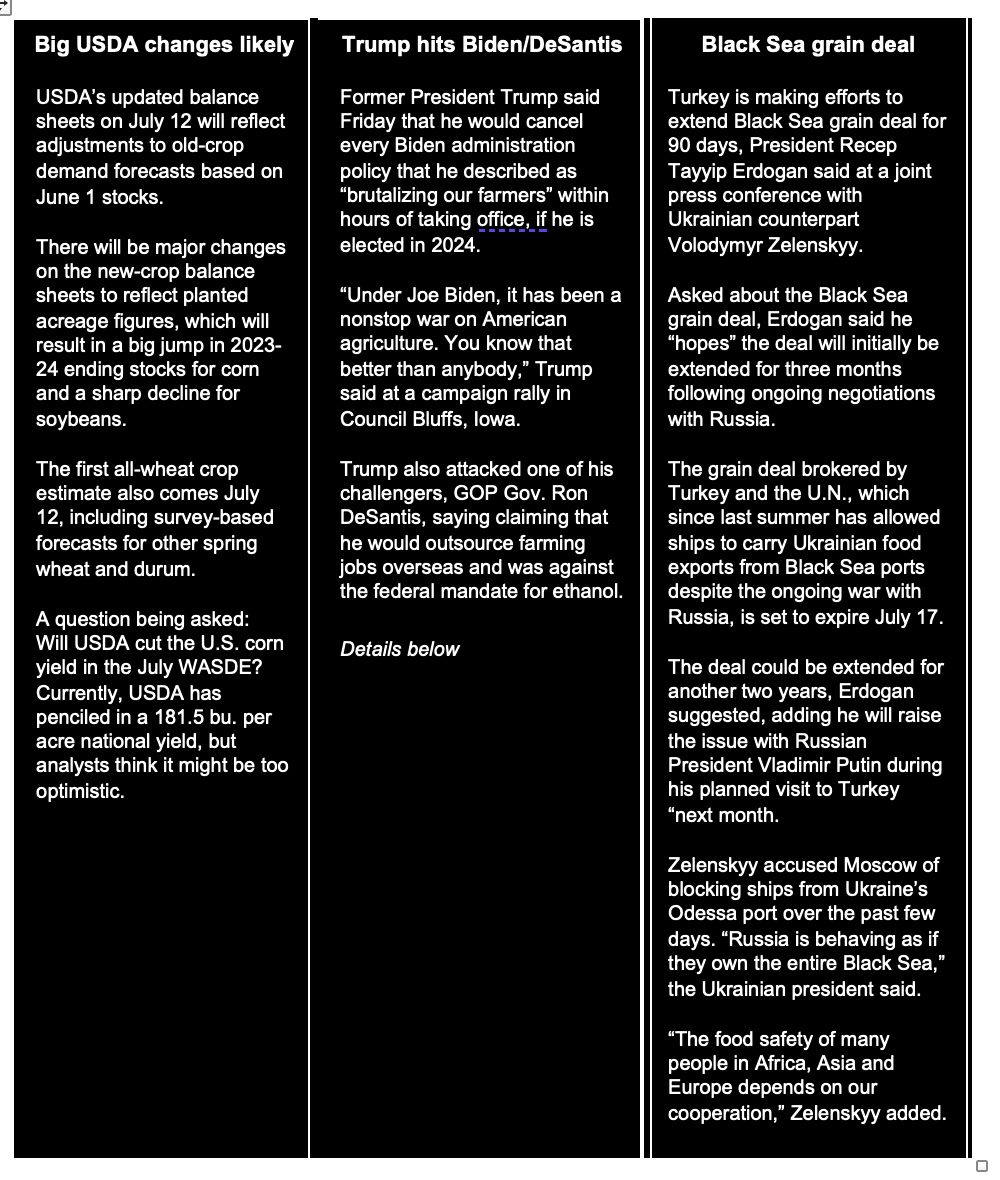

Trump attacks DeSantis’ ag sector views. At a recent rally held in Council Bluffs, Iowa, former President Donald Trump opposed his chief Republican presidential rival, Governor Ron DeSantis of Florida, especially highlighting his views on the ag sector. Trump criticized DeSantis' stance towards farmers, claiming that he would outsource farming jobs overseas and was against the federal mandate for ethanol. Council Bluffs, at Iowa’s far western edge and across the Missouri River from Omaha, Nebraska, is in the more agricultural region of the state.

Trump vowed to increase ethanol exports, slash regulations on farming and fund farm subsidies through increased tariffs.

Trump told supporters that DeSantis “totally despises Iowa ethanol… He has been fighting for years to kill every single job supported by this very important industry,” Trump said. “If he had his way, the entire economy of Iowa would absolutely collapse.” As a congressman in 2017, DeSantis co-sponsored the Renewable Fuel Standard Elimination Act, which would have done away with the Clean Air Act provisions requiring the use of ethanol in gasoline for cars and trucks.

Comparatively, Trump noted his record in terms of policies favorable to farmers, such as increasing the exemption limit on the estate tax and replacing the North American Free Trade Agreement.

Responding to these allegations, Bryan Griffin, a spokesperson for the DeSantis campaign, dismissed Trump's comments as false representation and evidence of his waning influence in Iowa. He assured that DeSantis, if elected president, would earnestly champion farmers' interests and work to expand new markets.

Interestingly, the event, located near the Nebraska border, saw robust participation from non-early voting Nebraska voters who were present in significant numbers. “I hope Nebraska is represented here,” Trump said as the crowd exploded in cheers. “That’s a big contingent.”

Trump’s Council Bluffs rally led with a 20-minute direct appeal to farmers before launching into his trademark freewheeling stump speech. He rolled out a “Farmers for Trump” coalition that included Iowa House Agriculture Committee Chairman Mike Sexton.

Trump also targeted the Biden administration's ethanol blending levels, accusing it of trying to replace Iowa's ethanol industry with costly electric cars. Trump assured that, if elected in 2024, he would nullify any Biden policies harming farmers in the first few hours of his term. The subject of Trump's critique was a recent adjustment by the Environmental Protection Agency (EPA) to biofuel blending standards. In 2019, under Trump's administration, there had been an effort to lift restrictions on the summertime sale of gasoline blended with 15% ethanol, which was later voided by a federal appeals court in 2021.

EATS Act introduced in House. Reps. Ashley Hinson (R-Iowa) and Zach Nunn (R-Iowa) introduced a legislative proposal titled "Exposing Agricultural Trade Suppression (EATS) Act," aiming to prevent local and state governments from imposing laws and regulations that directly affect agricultural practices beyond their borders.

Similar measure in Senate. The "Ending Agriculture Trade Suppression (EATS) Act," is being introduced in the Senate by Sen. Roger Marshall (R-Kan.) and is supported by several other Senators, like Joni Ernst (R-Iowa) and Chuck Grassley (R-Iowa).

The EATS Act is seen as a counter to measures such as California’s Proposition 12 and Massachusetts’ Question 3, which bar the sale of pork from pigs whose mothers were raised in housing that does not meet specific standards. Rep. Hinson has criticized Proposition 12 as it significantly increases the production costs for farmers and escalates food prices during a time of already substantial inflation.

The EATS Act invokes the U.S. Constitution's Commerce Clause, specifying Congress's exclusive role in regulating interstate trade and prohibiting states from regulating commerce beyond their borders. The EATS Act is expected to counterbalance any extraterritorial regulations that influence the agricultural practices of other states, thereby upholding the traditional relationship between the states and the federal government.

These external regulations pose an economic burden on farmers who wish to adhere to new standards. For instance, the National Pork Producers Council (NPPC) supports the EATS Act as a solution to Proposition 12 because complying with these new laws would cost pork producers wishing to sell to California's consumers anywhere between $1.9 billion and $3.2 billion. This estimate is based on a University of Minnesota study which investigated the costs associated with converting existing sow pens to those compliant with Proposition 12.

Regarding Massachusetts’ Question 3 (Q3), NPPC and various New England-based state restaurant associations, alongside the state of Massachusetts, have petitioned the U.S. District Court for Massachusetts to delay the implementation of Q3 until Aug. 23, 2023. This comes as the anticipated start date of Q3 on July 13 approaches, with crucial aspects of the implementation remaining uncertain. The request for extension is currently with a judge pending approval.

This delay is significant, NPPC says, because Massachusetts has been slow to make necessary preparations for implementing Q3. Following the U.S. Supreme Court's May 11 decision on California Prop 12, Massachusetts gained the ability to enforce production standards on pork sold within its market. However, other issues raised by the NPPC against Q3 last summer, such as restrictions on the transshipment of pork products through Massachusetts to other New England states and export regulations, are yet to be resolved.

Postponing Q3's implementation until Aug. 23 would grant the Massachusetts administration, NPPC, and its coalition partners additional time to address these issues, in particular, the problem regarding transshipment. NPPC says it allows for a smoother, more organized transition for the industry and supply chain as Q3 comes into effect.

If granted by the judge, this delay would safeguard the ability of pork producers to sustain pork sales throughout New England. NPPC concludes that while it won't postpone the need for producers to make amendments on their farms, it does provide a buffer period to sort out and rectify significant issues tied to Q3, thereby preventing the exclusion of potential markets for producers.

Outlook: There appears to be growing support to include proposed legislation as part of any new farm bill, but the timeline on that measure continues murky. Link to a Southern Ag Today article on, “How will Proposition 12 Ruling Impact the Farm Bill?”

Economic Reports for the Week

Fed speakers are rampant this week. Key economic report comes Wednesday via the Consumer Price Index. Economists forecast headline inflation to fall to 3.0% from 4.0% in May and core inflation to be reported at 5.0% from 5.3% in May. A CPI surprise could reset expectations on the direction of the Federal Reserve. Traders are pricing in around a 90% probability that the Federal Reserve will raise rates by 25 basis points at the meeting FOMC meeting July 25-26.

Monday, July 10

- Federal Reserve reports consumer credit data for May. Total consumer credit rose at a seasonally adjusted annual rate of 5.7% in April to a record $4.86 trillion. Revolving credit, chiefly credit-card debt, jumped 13.1%, while nonrevolving credit, such as home mortgages and auto loans, increased 3.2%.

- U.S. Commerce Department releases wholesale sales data for May. The second estimate for May wholesale inventories is a 0.1% draw, unchanged from the first estimate.

- Federal Reserve Vice Chair for Supervision Michael Barr to speak on "Bank Capital" before the Bipartisan Policy Center in Washington. San Francisco Fed President Mary Daly to participate in a fireside chat hosted by the Brookings Institution Hutchins Center on Fiscal and Monetary Policy in Washington. Cleveland Fed President Loretta Mester to speak virtually on the economic and policy outlook before the University of California, San Diego 2023 Economics Roundtable Lecture Series: "An Update from the Federal Reserve with Loretta Mester,” in Cleveland, Ohio. Federal Reserve Bank of Atlanta's President Raphael Bostic to participate in "National and Metro Atlanta Economies" armchair conversation before the Cobb Chamber of Commerce Marquee Monday event in Atlanta, Georgia.

Tuesday, July 11

- National Federation of Independent Business releases its Small Business Optimism Index for June. Consensus estimate is for a 89.9 reading, slightly higher than the May figure. The index remains anchored near a decade low, as supply-chain disruptions and labor shortages — even as they have eased some in the past year — continue to hurt small businesses.

Wednesday, July 12

- MBA Mortgage Applications

- Bureau of Labor Statistics (BLS) releases the Consumer Price Index for June. Economists forecast that the CPI will increase 3.1% year over year, nearly a full percentage point less than in May. The core CPI, which excludes volatile food and energy prices, is seen rising 5%, three-tenths of a percentage point less than previously. The CPI is at its lowest level since March 2021, and the core CPI since November 2021.

- Federal Reserve publishes Beige Book

- Richmond Fed President Thomas Barkin to speak on inflation before the Anne Arundel County Chamber of Commerce in Arnold, Maryland. Minneapolis Fed President Neel Kashkari to participate in "Banking Solvency and Monetary Policy" panel before the National Bureau of Economic Research Summer Institute: Macro, Money and Financial Frictions," at Cambridge, Massachusetts. Raphael Bostic to speak on "Financial and Payments Inclusion" before the Federal Reserve Bank of Atlanta 2023 Payments Inclusion Forum: "Breaking Barriers," in Atlanta, Georgia. Loretta Mester to speak on "FedNow" before a session on Instant Payment Systems before the National Bureau of Economic Research Summer Institute: Macro, Money and Financial Frictions," at Cambridge, Massachusetts.

- Bank of Canada (BOC) announces its monetary-policy decision. Traders are pricing in a two-in-three chance that the central bank will raise its key short-term interest rate by a quarter of a percentage point, to 5%. The BOC began this hiking cycle the same month as the Federal Open Market Committee, March 2022, and raised interest rates nine times, bringing them from 0.25% to 4.75%.

Thursday, July 13

- BLS releases the Producer Price Index for June. The PPI is expected to rise a scant 0.4% year over year, while the core PPI is seen increasing 2.5%. This compares with gains of 1.1% and 2.8%, respectively, in May. The PPI is at its lowest level since late 2020, and the core PPI since early 2021.

- Department of Labor reports initial jobless claims for the week ending July 8. Claims averaged 255,000 in June, the most since late 2021, a sign that the hot labor market might be cooling.

- Fed Balance Sheet

- Money Supply

- Treasury Budget

- Federal Reserve Board Governor Christopher Waller to speak on the economic outlook before the Money Marketeers of New York University, in New York.

- Cintas, Conagra Brands, Delta Air Lines, Fastenal, and PepsiCo release quarterly results.

Friday, July 14

- University of Michigan releases its Consumer Sentiment index for July. The consensus call is for a 65.8 reading, slightly higher than June’s. Consumers’ expectations of inflation for the year ahead was 3.3% in June, the lowest in more than two years.

- Import & Export Prices. Import prices fell 0.6% in May with June's expectations at a 0.2% fall. Export prices, which fell a very steep 1.9% in May, are expected to fall 0.4%. This report has been pointing consistently to cooling if not chilling in cross-border price pressures.

- Second-quarter earnings season kicks off with three of the largest banks — Citigroup, JPMorgan Chase, and Wells Fargo — reporting. S&P 500 earnings are expected to decline 6.8% year over year. That would mark the largest drop since second-quarter 2020's 31.6% plummet.

- BlackRock, State Street, and UnitedHealth Group announce earnings.

Key USDA & international Ag & Energy Reports and Events

Ag focus comes Wednesday via USDA’s World Agricultural Supply & Demand Estimates (WASDE). France agriculture ministry’s release on field crops comes Tuesday, and the FAO’s State of Food Security and Nutrition in the World report will be out Wednesday.

Energy focus: OPEC and the International Energy Agency will issue their monthly oil market reports Thursday. The U.S. Energy Information Administration will release its monthly Short-Term Energy Outlook, or STEO, on Tuesday.

Monday, July 10

Ag reports and events:

- Export Inspections

- Crop Progress

- U.S. Agricultural Trade Data Update

- Malaysian Palm Oil Board’s monthly data for output, exports and stockpiles

- Cane crush and sugar production report by Brazil’s Unica (tentative)

Energy reports and events:

- EU environment ministers meet informally in Valladolid, Spain (through July 11)

Tuesday, July 11

Ag reports and events:

- France agriculture ministry report on field crops

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- EU environment ministers meet informally in Valladolid (second day)

- EU energy ministers meet informally in Valladolid (through July 12)

- EIA releases its monthly Short-Term Energy Outlook, or STEO

Wednesday, July 12

Ag reports and events:

- Broiler Hatchery

- Meat Price Spreads

- Crop Production

- WASDE

- Cotton: World Markets and Trade

- Grains: World Markets and Trade

- Oilseeds: World Markets and Trade

- World Agricultural Production

- Livestock and Poultry: World Markets and Trade

- China’s agriculture ministry (CASDE) releases monthly supply and demand report

- FAO’s annual State of Food Security and Nutrition in the World report

- Far East Grain Forum 2023 in Vladivostok, Russia, day 1

- FranceAgriMer’s monthly grains balance sheet

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- EU energy ministers meet informally in Valladolid (second day)

- EU’s second joint gas-purchasing tender results

- ICE gasoil July futures expire

Thursday, July 13

Ag reports and events:

- Weekly Export Sales

- Feed Grains Database

- Dairy Monthly Tables

- Season Average Price Forecasts

- Wheat Data

- China’s 1st batch of June trade data, including soybean, edible oil, rubber and meat & offal imports

- Far East Grain Forum 2023 in Vladivostok, Russia, day 2

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Port of Rouen data on French grain exports

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- China trade balance; nation also releases first batch of June trade data, including oil, gas and coal imports; oil products imports and exports

- IEA publishes monthly Oil Market Report

- OPEC publishes its monthly Oil Market Report

- International ministerial meeting on climate action in Brussels (through July 14)

- Aker BP results; Wood Group results

Friday, July 14

Ag reports and events:

- CFTC Commitments of Traders report

- Cotton and Wool Outlook

- Oil Crops Outlook

- Feed Outlook

- Rice Outlook

- Wheat Outlook

- Mink

- Peanut Prices

- Turkey Hatchery

- FranceAgriMer’s weekly crop condition report

- Holiday: New Zealand

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- International ministerial meeting on climate action in Brussels (second day)

- ICE Futures Europe weekly commitment of traders report

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |