SNAP Payment Error Rates Rise, Getting Attention of Ag Panel Leaders

Jobs report Friday | Canada strike | Tyson Foods to reintroduce certain antibiotics into chicken supply chain

Washington Focus

The House and Senate are still out for their July 4th break. The chambers will periodically meet in pro forma session, guarding again the ability of the White House to potentially put officials in various government posts via a “recess appointment.” No business will be transacted during the week but some staffers are working on lingering budget and other issues, likely including a possible new farm bill.

The combined payment error rate for Supplemental Nutrition Assistance Program (SNAP) payments rose from 7.36% in fiscal year 2019 to 11.54% in fiscal year (FY) 2022 as states provided pandemic-related benefits and coped with staff shortages, USDA’s Food and Nutrition Service (FNS) reported Friday (link). SNAP recipients in FY 2022 were overpaid by 9.84% and underpaid by 1.7% on average. Underpayments and overpayments need to be corrected, with households required to pay back overpayments, even if it were due to the state agency's mistake.

Background. Each year, as required by law, USDA’s Food and Nutrition Service analyzes the final data collected from states and uses the information to determine the payment error rate for states. States which have high payment error rates must work with FNS to reduce the number of cases that have mistakes. Those states experiencing high error rates two years in a row are charged a penalty. The fiscal year 2022 payment error rates are the first to reflect pandemic operations.

Individual state developments varied widely. The highest overpayment rate was recorded in Alaska at 56.69%, followed by Maryland at 32.65%. South Dakota had the lowest error rate at 3.07% for both underpayments and overpayments.

In FY 2019, the average error rates were notably lower — at 6.18% for overpayments and 1.18% for underpayments.

House and Senate Ag panel leaders in a statement labeled these error rates as unacceptable. They urged those in charge to create action plans and collaborate with USDA to address the reasons behind these errors.

USDA responds. Stacy Dean, deputy undersecretary for food, nutrition, and consumer services at USDA, noted that state SNAP workers had to adapt quickly to the surge of needy people during the pandemic, putting a strain on administration of the program. USDA mentioned staff vacancies at state agencies had gone up to 25% during the pandemic, complicating the hiring and training of new case managers.

USDA said that despite overpayments during the pandemic, it doesn't necessarily mean a loss to the government because of the temporary policy circumstances in place at that time.

USDA warned that states risk financial penalties if they do not reduce their error rates in FY 2023. Fines can be imposed on states that consecutively increase error rates for two years.

Comments: There is a side story in how the information was released and it should be instructive for the EPA which should do the same regarding information related to the Renewable Fuel Standard (RFS) because unlike USDA, EPA recently (and in the past) briefed some lawmakers and stakeholders of the market-sensitive biofuel mandates. As for USDA, Tracy Fox, a legislative adviser in USDA’s congressional relations office, notified congressional staffers staff that they wouldn’t receive any briefings on the data that day. “In light of recent reporting and social media, including references to Congressional staff, regarding the release of the SNAP error rates, we will not be sharing any additional error rate information today in order to ensure that States receive the information on rates first,” Fox wrote in an email. “We will communicate these to Hill staff once states have been notified tomorrow.” Bravo for Fox and USDA. EPA should learn something from USDA on how to withhold sensitive information that could possibly allow some to gain an unfair market trading advantage.

House Democrats will hold their first farm bill-focused field roundtable July 7 in Jackson, Mississippi. The task force is headed by Rep. Bennie Thompson (D-Miss.)

President Joe Biden has launched a new effort to provide student loan relief for millions of borrowers. This move comes after his initial plan was struck down Friday by the Supreme Court. Biden's alternate plan is based on the Higher Education Act of 1965, which would enable the Department of Education to compromise, waive, or release loans under certain conditions. However, administration officials noted that developing this plan would take significantly longer than the original one and weren't able to provide specifics on its timeline or eligibility criteria.

Biden's initial plan, which originated from the 2003 HEROES Act, was based around a pandemic-related national emergency, but the Higher Education Act doesn't require such a circumstance. Progressive lawmakers and activists are supportive of this approach, as it would theoretically allow for debt to be waived.

The president placed the blame for the failure of his initial plan on Republican officials, stating that his new strategy is legally sound, but would certainly take longer. He expressed disappointment that 16 million borrowers who had been approved for debt relief won't get it due to interference from Republicans.

As a temporary measure, the Education Department will not be referring borrowers falling behind on loan payments to credit agencies until 12 months after the pandemic-related pause ends.

Biden's initial student loan relief program, which was intended to cancel up to $20,000 in federal student loan debt for borrowers earning up to $125,000 per year, was central to his economic agenda. This was regarded as a significant political issue, with the potential to influence voting demographics and outcomes.

Some analysts say the issue of federal student loan relief will be crucial in shaping the 2024 campaign cycle. Particularly, Democrats could solidify their support among young, Black, Latino, and women voters, who statistically carry more educational debt. However, Biden's economic messaging could be undermined as the loan payments restart, pointing to potential negative political and financial implications. Republicans see this as an opportunity to solidify support among working-class voters without college degrees, even as several of them hold college debt without having received degrees.

On the food policy front, the Wall Street Journal reports (link) that Tyson Foods is set to reintroduce certain antibiotics back into its chicken supply chain, resulting in the removal of the "no antibiotics ever" label from Tyson-branded products. This shift will involve drugs called ionophores, which are not considered crucial for human health and are used to control a poultry disease called coccidiosis. This change will apply to all fresh, frozen, and ready-made products sold under the Tyson brand and will take effect by the end of the year, according to the WSJ.

Background. Several years ago, Tyson became the largest poultry processor to omit the use of all antibiotics in its company-branded products. However, the company has stated that this new decision aligns with its responsible stance and is in the best interest of people and animals. Tyson maintains that its approvals are based on sound science.

The use of antibiotics in the meat industry has been debated, with critics arguing it accelerates the development of antibiotic-resistant bacteria. Some also suggest it makes treatments less effective in combating human illnesses. The Food and Drug Administration supports limited antibiotic use in meat production, with a focus on antibiotics important for human health. They consider antibiotics, such as ionophores, to pose a lower risk of developing drug-resistant bacteria that threaten human health.

In 2017, Tyson pledged to rid its branded products of antibiotics, an initiative backed by the belief consumers would willingly pay a premium in return. Reintroducing certain antibiotics could lead to cost savings for Tyson, especially if consumers are no longer willing to spend more on products raised without antibiotics.

The WSJ article says the change in Tyson's antibiotics policy aligns with its need to manage costs amid falling wholesale chicken prices and the closure of older chicken plants earlier this year. It should be noted that the disease controlled by ionophores, coccidiosis, can be fatal to birds and causes a decrease in poultry production.

Of note: The use of ionophores is allowed in "no antibiotics ever" programs overseas, putting U.S. poultry operations at a potential disadvantage.

On the trade policy front, on Saturday, over 7,000 workers from Canada's busiest ports, Vancouver and Prince Rupert, went on strike, sparking concerns about the potential impact on trade in both the U.S and Canada. These two ports handle approximately $270 billion in trade every year. The workers on strike are mainly responsible for loading and unloading cargo from the vessels.

The issue: This industrial action follows a failure by the International Longshore and Warehouse Union Canada and the BC Maritime Employers Association to negotiate a new contract since talks commenced in March. The union had flagged a potential strike 72 hours prior. Despite continuous negotiations, a resolution has not been reached, however, talks are ongoing.

The union's demands include wage increases to offset inflation, which has cooled to 3.4% as of May, along with limitations on outsourcing and automation. The Maritime Employers Association maintains it has negotiated in good faith and is committed to maintaining competitive and affordable Pacific-Coast ports in Canada.

Recently, around 22,000 dockworkers at U.S. West Coast ports negotiated a new six-year deal with a 32% pay increase effective through 2028. Discussions are now shifting to East Coast and Gulf Coast ports in the U.S., although there are some challenges.

Canadian businesses have issued warnings about the potential impact of this strike on the national and continental economy. There are concerns about fueled inflation, increased costs, and significant harm to the Canadian economy. Amidst these fears, data from Everstream Analytics reveals that weekly cargo arrivals at Vancouver's port have started to decline in anticipation of the strike. There is a possibility of further disruptions and diversions to U.S. ports along the Pacific Coast because of this strike if it continues for a long time.

On the financial front, Wednesday will see FOMC minutes from the Federal Reserve’s June meeting when policy makers decided to keep rates unchanged but signaled the possibility of a quick resumption in rate hikes in the meetings ahead.

Friday brings the important U.S. Jobs/Employment report.

Monday, July 3

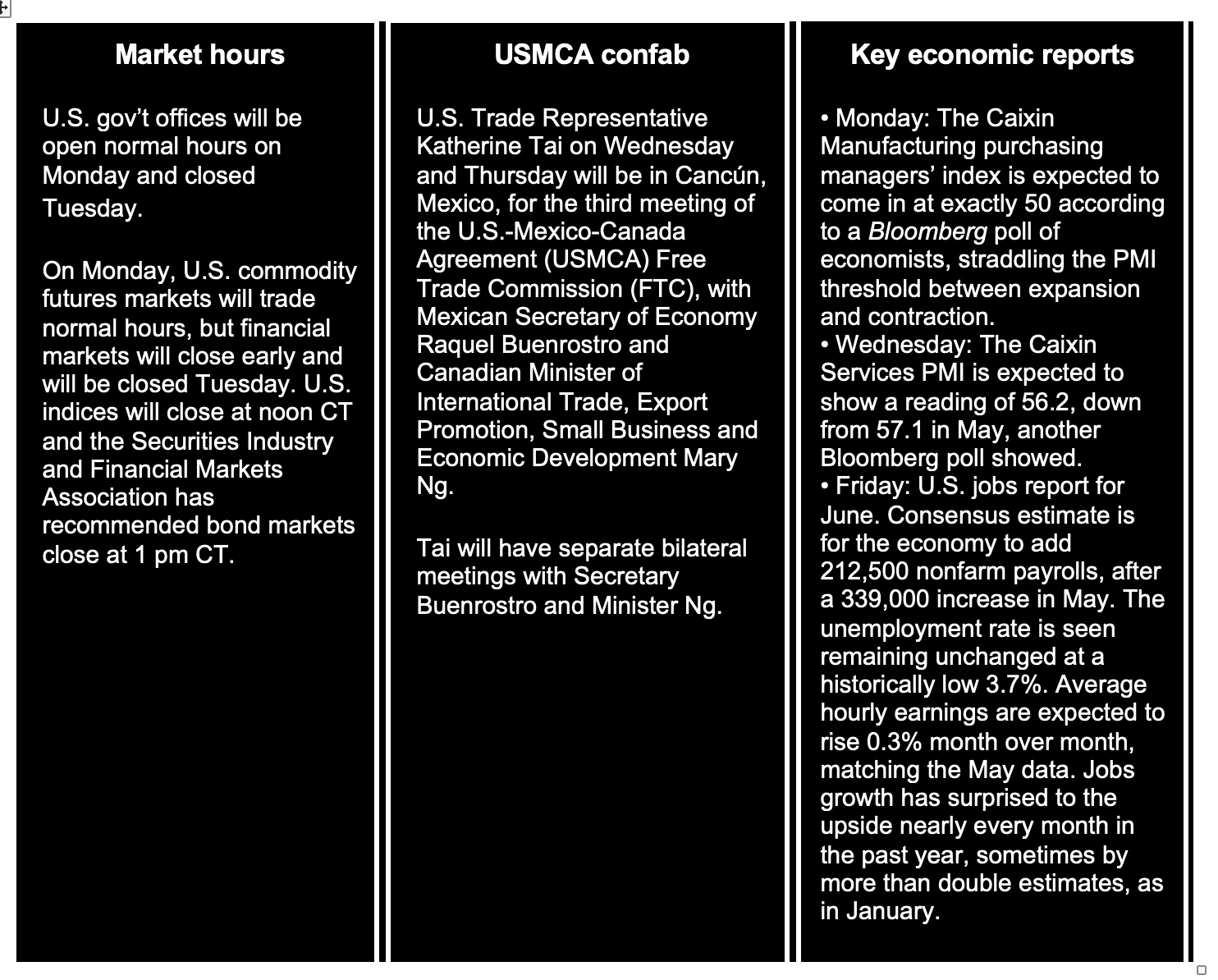

• Market hours. U.S. commodity futures markets will trade normal hours, but financial markets will close early and will be closed Tuesday. U.S. indices will close at noon CT and the Securities Industry and Financial Markets Association has recommended bond markets close at 1 pm CT. U.S. gov’t offices will be open normal hours on Monday and closed Tuesday.

Tuesday, July 4

• U.S. holiday. U.S. markets and gov’t offices are closed in observance of the July 4th holiday.

• Independence Day celebrations. George Washington's Mount Vernon Estate and Gardens holds its annual Independence Day celebration. The National Park Service hosts the National Independence Day Parade, featuring a fife and drum corps, marching bands, floats, military units and giant balloons, and equestrian and drill teams. The National Park Service, the Corporation for Public Broadcasting, the Department of the Army, the Boeing Company, American Airlines and PBS host the Independence Day annual event titled "A Capitol Fourth Concert."

• Adoption of the Declaration of Independence. The National Archives holds a celebration of the 247th anniversary of the adoption of the Declaration of Independence.

Wednesday, July 5

• Federal Reserve. New York Fed President John Williams scheduled to speak.

• China GDP. Center for Strategic and International Studies (CSIS) holds a virtual discussion on "Measurement Problems: China's GDP Growth Data and Potential Proxies."

• Taiwan and China. Washington Post Live virtual discussion on "U.S. Policy Toward Taiwan and China."

• Food and race issues. Washington Post Live virtual discussion on "Bridging Gaps and Fighting Hate Through Food," as part of the Race in America series.

• War in Ukraine. Atlantic Council virtual discussion on "After Prigozhin, What's Next for Belarus?"

Thursday, July 6

• Federal Reserve. Dallas Fed President Lorie Logan is scheduled to speak.

• USMCA meetings. U.S. Trade Representative Katherine Tai in Cancún, Mexico, for the third meeting of the U.S.-Mexico-Canada Agreement (USMCA) Free Trade Commission (FTC), with Mexican Secretary of Economy Raquel Buenrostro and Canadian Minister of International Trade, Export Promotion, Small Business and Economic Development Mary Ng. Tai will have separate bilateral meetings with Secretary Buenrostro and Minister Ng.

• Putin’s future in Russia. Washington Post Live virtual discussion on "Putin's Hold on Power and Russia's Future."

• Ukraine and EU. Center for Strategic and International Studies virtual discussion on "The European Union's Enlargement Conundrum," including the prospect of Ukraine's accession.

• Supply chain issues. CQ Roll Call and FiscalNote's Environmental, Social, and Governance (ESG) Solutions virtual discussion on "Circular Economy Solutions: Transforming Supply Chains for Competitive Advantage."

• Low-carbon hydrogen. Center for Strategic and International Studies virtual discussion on "Low-Carbon Hydrogen: Tax Credits and Emissions Intensity."

• EU elections. FiscalNote virtual discussion on "2024 EU Elections and Beyond: A Discussion on the Future of Europe."

• NATO in Baltic countries. Center for Strategic and International Studies virtual discussion on a new report, "Repel, Don't Expel: Strengthening NATO's Defense and Deterrence in the Baltic States."

• MENA countries outlook. Arab Center virtual discussion on “MENA (Middle East and North Africa) Economies in Crisis: Global Shocks, Structural Challenges, and Prospects for Reform."

• Putin and Prigozhin. Atlantic Council virtual discussion on "Putin's Prigozhin problems: How has power shifted in Russia?"

• India democracy. Center for American Progress virtual discussion on "India's Backsliding Democracy."

Friday, July 7

• USMCA meetings. Final day of the third meeting of the U.S.-Mexico-Canada Agreement (USMCA) Free Trade Commission (FTC) in Cancún, Mexico with U.S. Trade Representative Katherine Tai, Mexican Secretary of Economy Raquel Buenrostro and Canadian Minister of International Trade, Export Promotion, Small Business and Economic Development Mary Ng. Tai will have separate bilateral meetings with Secretary Buenrostro and Minister Ng.

• EU data flows. Atlantic Council virtual discussion on "Beyond adequacy: What is the future for international data flows?" focusing on the European Union.

• Hiroshima summit recap. Center for Strategic and International Studies virtual discussion on "Assessing the Hiroshima Summit."

Economic Reports for the Week

Friday focus on Jobs. Economic releases covering construction spending, factory orders, and initial jobless claims will be sandwiched around the 4th of July holiday before the June jobs report lands on the laps of investors on July 7.

Monday, July 3

- Census Bureau reports construction spending data for May. Consensus estimate is for spending to rise 0.4% month over month to a seasonally adjusted annual rate of $1.92 trillion.

- Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for June. Economists forecast a 47 reading, roughly even with the May data. The index has had seven straight readings below 50, indicating the U.S. is in a manufacturing recession. But continued strength in the services sector has lifted the overall economy up.

Tuesday, July 4

- Holiday in U.S.

- Reserve Bank of Australia announces its monetary-policy decision. Traders are pricing in a 25% chance that the RBA raises its key short-term interest rate by a quarter of a percentage point, to 4.35%. The central bank has raised rates 10 times since April 2022 for a total increase of four percentage points. With regional neighbor New Zealand having entered a recession, Australia’s chances of dodging its second recession since 1991 are 50/50, according to Commonwealth Bank of Australia, the nation’s largest lender.

Wednesday, July 5

- MBA Mortgage Applications

- Federal Open Market Committee releases the minutes of its mid-June monetary-policy meeting.

- Factory orders are expected to rise 0.9% in May versus April's 0.4% gain. Durable goods orders for May, which have already been released and are one of two major components of this report, rose 1.7% on the month.

- Motor vehicle sales: Unit vehicle sales in June are expected to increase to a 15.3 million annualized rate from May's 15.0 million which was lower than expected and down from April's 16.1 million rate.

- Federal Reserve: John Williams speaks.

Thursday, July 6

- Jobless Claims

- ADP releases its National Employment Report for June. Economists see a gain of 250,000 private-sector jobs, following a 278,000 increase in May. The leisure and hospitality sector continues to lead gains while manufacturing and finance shed workers in May.

- Bureau of Labor Statistics (BLS) releases the Job Openings and Labor Turnover Survey (JOLTS). The consensus call is for 9.9 million job openings on the last business day of May, slightly less than in April. Despite falling by nearly two million from the peak of 12 million in March 2022, job openings remain historically elevated. There are currently 1.65 job openings for every unemployed person, and Federal Reserve Chairman Jerome Powell has stressed that he would like to see that ratio approaching 1:1.

- ISM releases its Services PMI for June. Expectations are for a 50.8 reading, a tick higher than the May figure. The index has had only one reading below the expansionary level of 50 in the past three years.

- A deficit of $69.4 billion is expected in May for total goods and services trade which would compare with a $74.6 billion deficit in April. Advance data on the goods side of May's report showed a $6.0 billion narrowing in the deficit.

- Fed Balance Sheet

- Money Supply

- Federal Reserve: Lorie Logan speaks.

Friday, July 7

- BLS releases the jobs report for June. The consensus estimate is for the economy to add 212,500 nonfarm payrolls, after a 339,000 increase in May. The unemployment rate is seen remaining unchanged at a historically low 3.7%. Average hourly earnings are expected to rise 0.3% month over month, matching the May data. Jobs growth has surprised to the upside nearly every month in the past year, sometimes by more than double estimates, as in January.

Key USDA & international Ag & Energy Reports and Events

Focus: Traders will look whether recent rains in the U.S. have stabilized or improved some U.S. crop condition ratings.

Monday, July 3

Ag reports and events:

- Export Inspections

- Crop Progress

- Cotton System Consumption and Stocks

- Fats & Oils: Oilseed Crushings, Production, Consumption and Stocks

- Grain Crushings and Co-Products Production

Energy reports and events:

- Holiday: Egypt, Canada

Tuesday, July 4

Ag reports and events:

- Holiday: U.S.

Wednesday, July 5

Energy reports and events:

- OPEC International Seminar, Vienna; runs through Thursday |

- API weekly U.S. oil inventory report

- Genscape weekly crude inventory report

- Holiday: Venezuela

Thursday, July 6

Ag reports and events:

- Broiler Hatchery

- Dairy Products

Energy reports and events:

- EIA Petroleum Status Report

- Weekly Ethanol Production

- Singapore onshore oil product stockpile weekly data

- Eurogas renewable gas conference; Brussels

- Holiday: Kazakhstan

Friday, July 7

Ag reports and events:

- Weekly Export Sales

- CFTC Commitments of Traders report

- Peanut Prices

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- EIA Natural Gas Report

- ICE weekly Commitments of Traders report for Brent

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |