Mexico Reaches Accord w/Food Manufacturers to Use Only Non-GMO Corn in Tortilla Production

Impact of Blinken meeting with Xi: Did U.S. make concessions, or will they?

|

In Today’s Digital Newspaper |

Mexico has reached a significant agreement with food manufacturers to use only non-GMO corn in tortilla production throughout the country. Additionally, the government plans to implement new import tariffs on white corn imports. Details in Trade Policy section.

Russia says the Black Sea grain deal cannot be extended, but that it will work with poorer countries to ensure that they won’t run short on food. Thirty-six countries count on Russia and Ukraine for more than half their wheat imports.

Russia's central bank has sounded the alarm on the economy. A weakening ruble and a record labor shortage have added to the country's inflation issues, and policymakers signaled that interest rate hikes could soon be on the way.

Argentina may ditch its peso and adopt the dollar. That's according to the country's presidential frontrunner, Javier Milei, who thinks the move could help ease soaring prices. In May, inflation in Argentina hit 109%.

A promising meeting yesterday between China’s top leader, Xi Jinping, and Secretary of State Antony Blinken in Beijing. But there was no agreement or detail on the most contentious issues: restrictions on Chinese access to advanced technologies; accusations that the U.S. and its allies want to contain Beijing’s ambitions; Taiwan; the war in Ukraine. More in China section.

“For business, the issue is not so much China/U.S. relations per se, but the very worrying state of the Chinese economy at present. Awareness of how challenged that is was probably one of the main issues that created a more communicative China, one that is willing to show just a bit of compromise at the moment,” said Kerry Brown, a professor of Chinese studies at King’s College London and a former British diplomat in Beijing. Yu Jie, a China expert at Chatham House, a British think-tank, added that Xi still hoped “that Western business could be part of his plan to generate much-needed growth and employment.”

Beijing is reportedly planning to build a military training facility in Cuba, according to the Wall Street Journal, sparking alarm in Washington that Chinese troops could be stationed 100 miles off the coast of Florida.

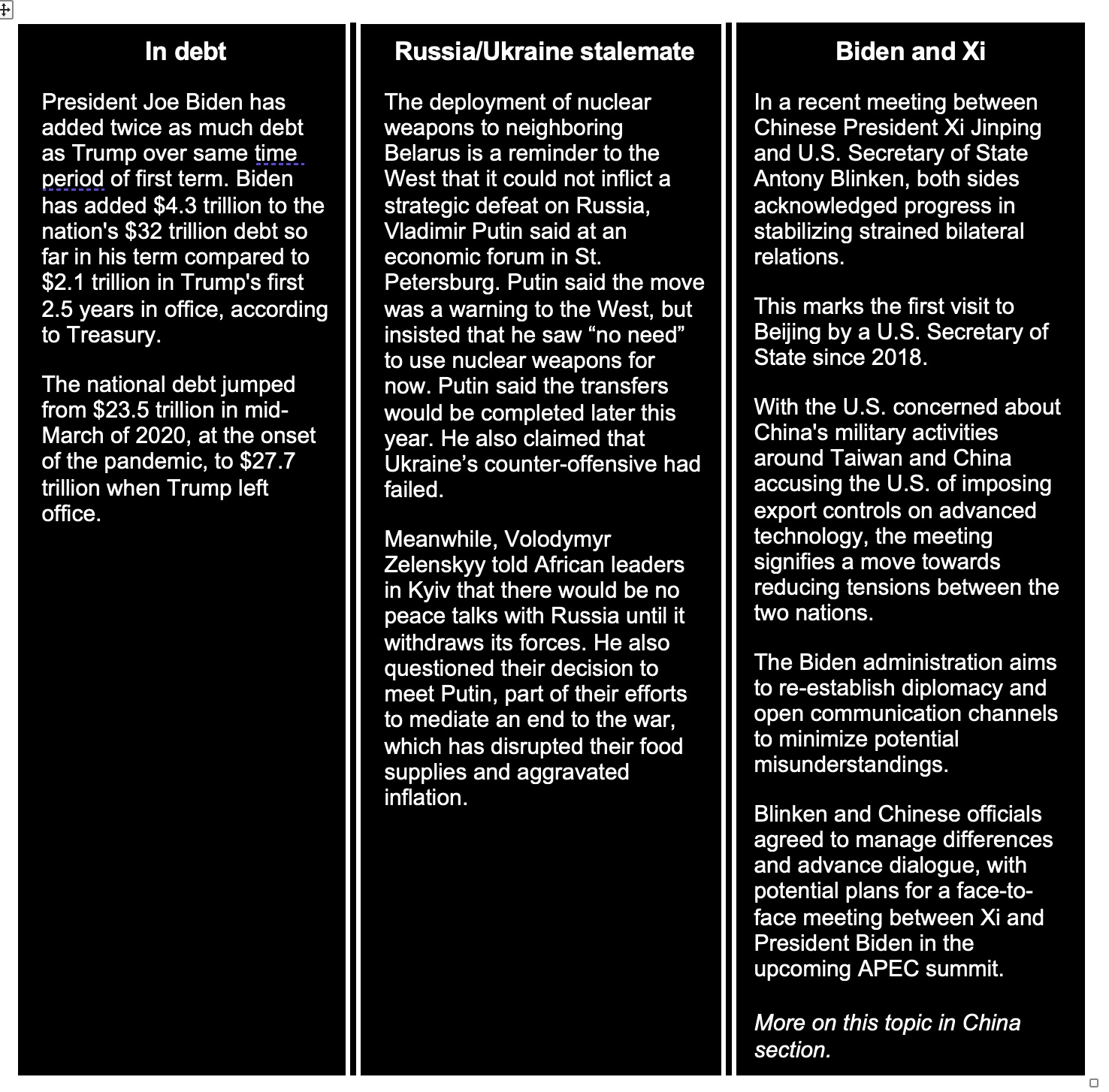

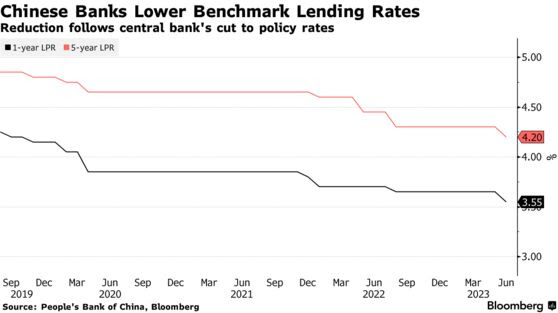

China’s banks disappointed with a modest cut to the five-year lending rate. For the first time in 10 months, the People's Bank of China has reduced its key lending rates by 10 basis points to support economic growth. The 1-year loan prime rate (LPR) was cut to 3.55%, and the 5-year rate was decreased to 4.2%, in line with market expectations. Last week's two easing decisions were followed by this announcement, with further stimulus measures anticipated from Beijing soon. China’s cabinet also pledged to roll out policy measures to bolster the economic recovery after several major banks downgraded their 2023 GDP growth forecasts for China.

The offshore yuan weakened past 7.17, sliding back toward its lowest levels in nearly seven months after China’s central bank cut some of its key lending rates again to counter signs that the post-pandemic recovery is faltering.

Ahead of Wednesday’s Farm Journal update on the farm bill (link), the Policy section includes some farm bill history and key developments.

A proposed megadeal between grain-trading giants Bunge and Glencore-backed Viterra has led to concerns about reduced competition for farmers, higher food prices for consumers, and potential bottlenecks in the agricultural supply chain. More in Markets section.

Kroger CEO Rodney McMullen said the planned $24.6 billion acquisition of Albertsons Cos. is progressing well in both regulatory approval and merger planning aspects. More in Food section.

In Politics & Elections section: Recent Supreme court decision could reshape House battlefield and Virginia today has important primary elections.

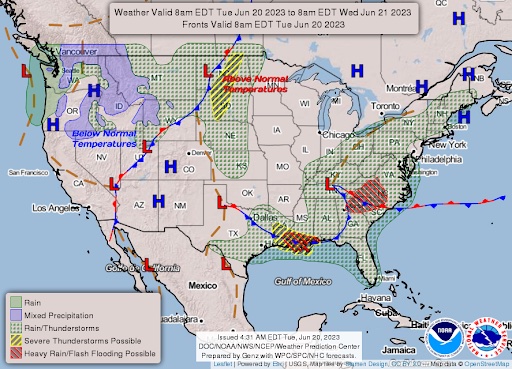

The South has experienced tornadoes daily during the past week, resulting in significant damage, some fatalities, and half a million people without power. SWEPCO's outages account for around 30% of these, and some residents may remain without power for an additional week or more. The heat is adding to the danger, as high humidity creates life-threatening heat indices that could be particularly harmful for those without power.

Meteorologist Michael Berry from the National Weather Service has described the current situation as a "perfect storm." Utility crews from as far away as Michigan and Indiana are working to repair the extensive damage to power lines. More storms are expected over the next few days, though they are predicted to wind down by the end of the week.

“We’re seeing all kinds of record highs across southern Texas,” David Roth, a forecaster with the Weather Prediction Center, said. “Anything above 105 on the heat index is quite dangerous.”

Mississippi and Alabama were placed on flood and tornado watch, following devastating storms in the region last week.

“Strong to severe thunderstorms and excessive rainfall will be common the next few days in the Southeastern quadrant of the U.S.,” the weather service said.

A new tropical depression has also formed in the Atlantic and could turn into a hurricane by midweek. It is too early to tell if it will impact the U.S. mainland.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. stock indexes are pointed toward lower openings. In Asia, Japan +0.1%. Hong Kong -1.5%. China -0.5%. India +0.3%. In Europe, at midday, London flat. Paris -0.2%. Frankfurt -0.5%.

U.S. equities Friday: The Dow was down 108.94 points, 0.32%, at 34,299.94. The Nasdaq lost 93.25 points, 0.68%, at 13,689.57. The S&P 500 eased 16.25 points, 0.37%, at 4,409.59. U.S. stock and bond markets were closed Monday for the Juneteenth holiday.

For the week, all three major indices notched gains of 1.2% for the Dow, 3.2% for the Nasdaq and 2.6% for the S&P 500.

In 2022, the average total contribution rate to 401(k) plans was 11.3% of pay, nearly reaching Vanguard's recommended range of 12%-15%. Despite market turbulence last year, workers maintained their contributions and have benefitted from the stock market's recovery. Retirement plan design, including auto-escalation features that increase contributions annually, has encouraged savings behavior. With the passage of Secure 2.0 law in December, this feature will become mandatory for most new 401(k) plans, further promoting retirement savings.

Agriculture markets Friday:

- Corn: July corn futures finished the day 17 cents higher to $6.40 1/4, marking a 36-cent gain on the week. December futures rallied 23 cents today to $5.97 1/2, closing 67 cents higher on the week and just half a cent lower than this week’s high.

- Soy complex: July soybeans rallied 38 1/4 cents on the day to $14.66 1/2, marking an 80-cent gain on the week. November futures closed 50 cents higher to $13.42 1/4, marking an impressive weekly gain of $1.38 and closed on the week’s high.

- Wheat: December SRW wheat futures rose 29 cents to $7.15 3/4, near the daily high and hit a two-month high. For the week, December SRW gained 57 3/4 cents. December HRW wheat futures closed up 31 cents to $8.37 and nearer the session high. Prices hit a four-week high Friday and for the week rose 44 1/4 cents. December spring wheat futures climbed 22 1/4 cents to $8.60 1/4. July spring wheat futures rose 20 3/4 cents on the session to $8.53 1/2, rising 43 1/4 cents on the week.

- Cotton: December cotton futures rose 50 points to 80.10 cents, near mid-range and for the week down 1.72 cents/pound.

- Cattle: Firming cash market action seemed to boost cattle and feeder futures Friday, with the expiring June live cattle contract rising 77.5 cents to $178.35 at the close. Most-active August rallied 65 cents to $171.725; the settlement price represented a weekly slide of 12.5 cents. August feeder futures settled at $234.925, which marked a daily advance of 80 cents and a weekly drop of $4.075.

- Hogs: The nearby July hog contract ended Friday having risen 92.5 cents to $92.85, while August futures gained 37.5 cents to $90.675. That represented a weekly advance of $6.725.

Ag markets today: Corn, soybean and wheat futures traded higher early in the overnight session but faded and are lower this morning. As of 7:30 a.m. ET, corn futures were trading 1 to 6 cents lower, soybeans were 1 to 11 cents lower and wheat futures were 8 to 10 cents lower. Front-month crude oil futures and the U.S. dollar index were near unchanged.

Market quotes of note:

- U.S. economy: “If the Supreme Court rules against student loan cancellation, it is about a $400 billion tax increase on the affected consumer cohort and could further dampen overall spending. Offsetting this to a degree is that residential construction is stable while factory construction, but not activity, is expanding.” — Dr. Vince Malanga, president of LaSalle Economics.

- The two additional hikes projected by Fed officials for this year are far from certain. The Fed's summary of economic projections "is a communication channel and when the U.S economy weakens in [the 2H] and inflation falls" rate increases will be tougher to deliver, Bannockburn's Marc Chandler says. He sees headline CPI at 3.2%-3.3% before the Fed's July meeting, down from May's 4%. The projected hikes surfaced in the SEP update last Wednesday, but markets so far are pricing only one more rate increase, in July.

- Over the weekend, analysts at Goldman Sachs cut their forecast for China’s full-year economic growth to 5.4% from 6%, citing “persistent growth headwinds and constrained policy responses.” The government’s official growth target is 5%, its lowest in decades, after the economy grew just 3% last year.

- China: “Progress is hard: It takes time. It’s not the product of one visit.” — U.S. Secretary of State Antony Blinken, speaking in Beijing after meeting with Chinese leader Xi Jinping for 35 minutes at China's Great Hall of the People.

- European Central Bank Governing Council member Yannis Stournaras said interest-rate increases may end this year, but warned that they mustn’t cause an economic slump. “It’s important to be careful in our next steps, which should be gradual and measured,” Stournaras told an Economist event Monday in Athens, according to a transcript sent by the Bank of Greece. “We should curb inflation while ensuring financial stability and avoiding driving the economy into a recession.” The ECB raised borrowing costs by another quarter-point last week as it still sees inflation above its 2% goal in 2025.

On tap today:

• U.S. housing starts are expected to fall to an annual rate of 1.39 million in May from 1.4 million one month earlier. (8:30 a.m. ET)

• Federal Reserve speakers: St. Louis's James Bullard on macroeconomic policy at 6:30 a.m. ET, and Vice Chair Michael Barr on bank culture in financial services at 11:45 a.m. ET.

• USDA Weekly Grain Export Inspections, 11 a.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

• WSJ Global Food Forum begins today. Link for details.

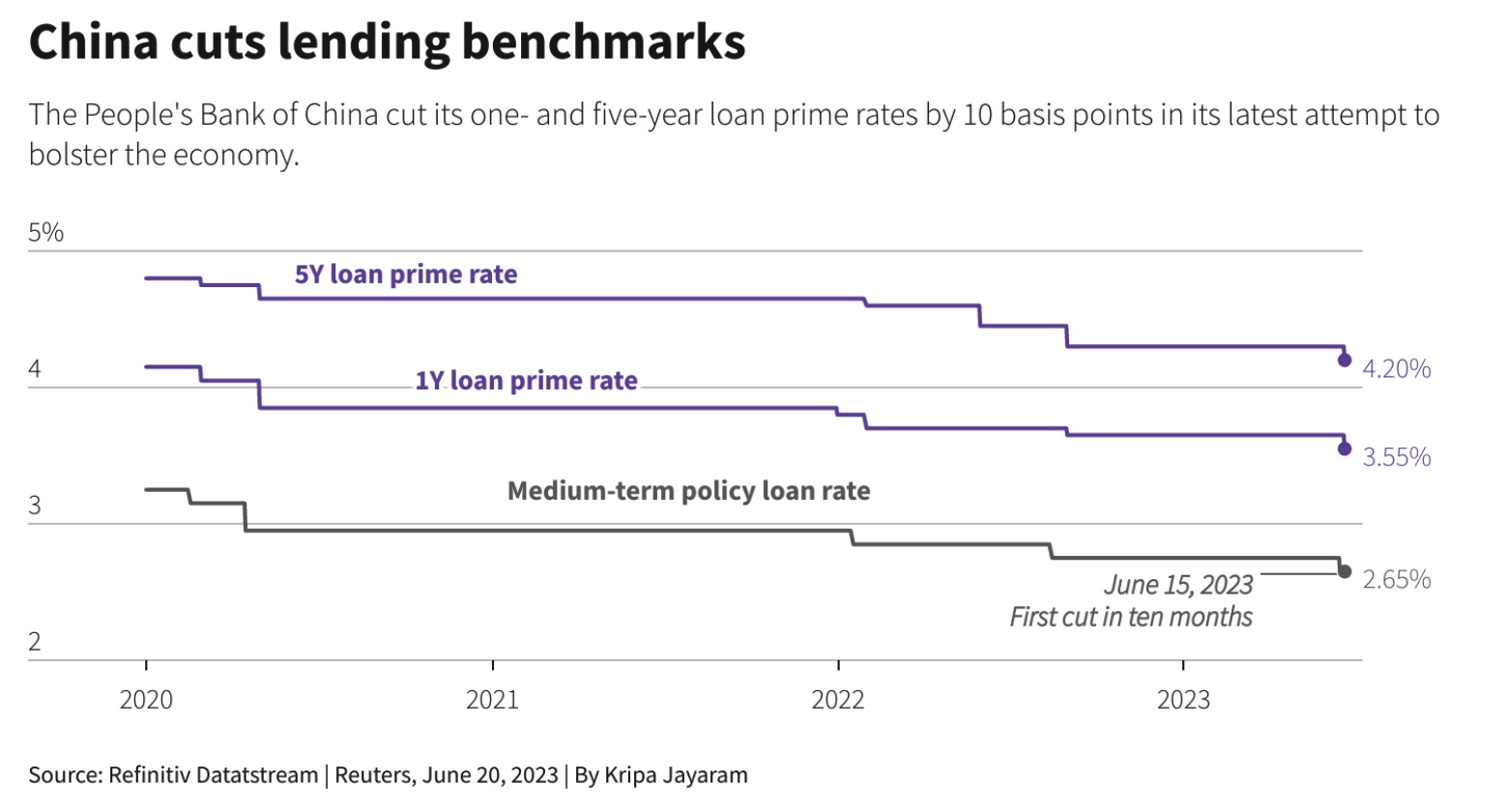

Big recovery in Treasury’s cash balance. A significant increase in bill issuance, along with almost $40 billion from quarterly corporate tax payments, has led to a dramatic recovery in the Treasury's cash balance. This balance reached over $250 billion on June 15th, which is the highest amount in a month. With the recently postponed debt ceiling, the Treasury anticipates its cash pile will exceed $400 billion by the end of June, returning to more normal levels.

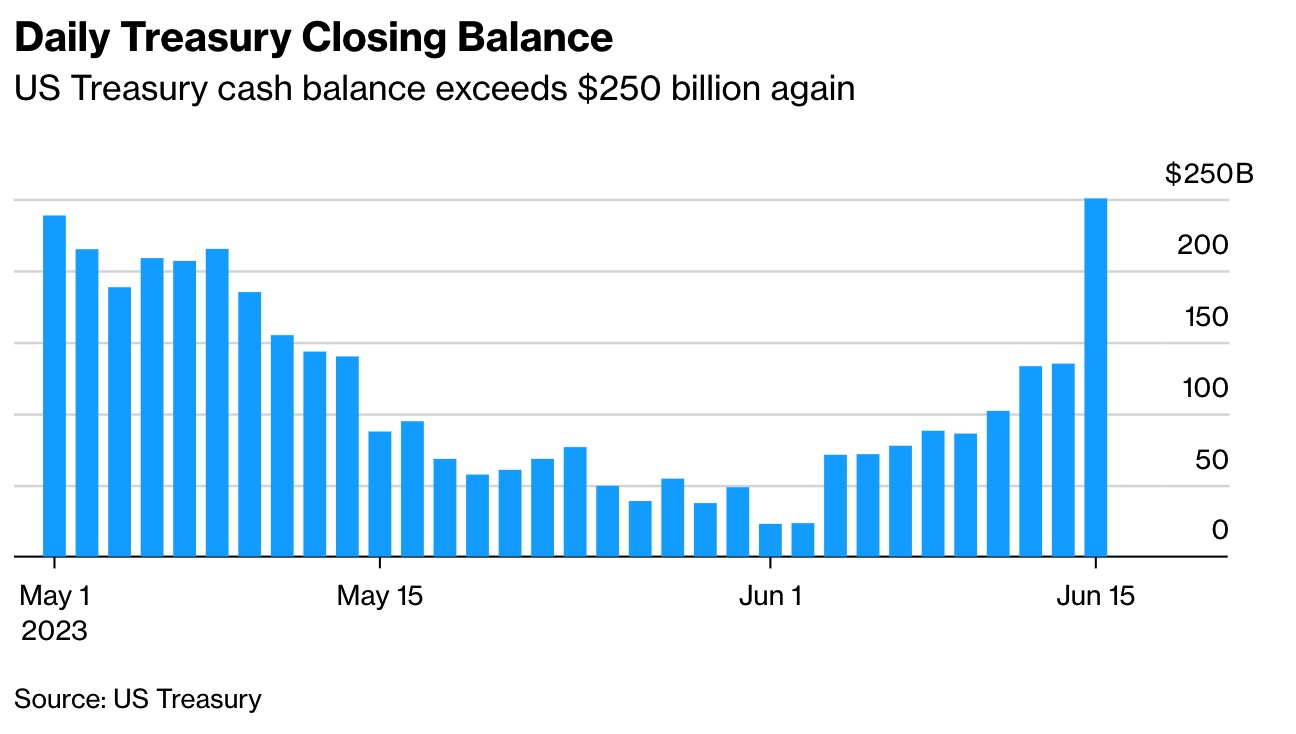

Expectations for inflation in the short term fell to a more than two-year low in early June, helping drive consumer sentiment higher than economists had forecast.

Chinese lenders followed the central bank by lowering their benchmark rates, although a relatively modest reduction to the mortgage reference rate disappointed investors. The PBOC cut the one- and five-year loan prime rates by 10 basis points each.

Market perspectives:

• Outside markets: The U.S. dollar index was, with only the euro showing strength against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.75%, with global government bond yields mostly lower. Crude oil was mixed, with U.S. crude weaker around $71.65 per barrel and Brent higher around $76.55 per barrel. Gold and silver futures were weaker, with gold around $1,962 per troy ounce and silver around $23.89 per troy ounce.

• The London Metal Exchange contributed to last year’s nickel crisis by removing trading curbs just as prices spiked up in a massive short squeeze, according to the two firms suing the LME over its decision to cancel billions of dollars of trades a few hours later. Link to details via Bloomberg.

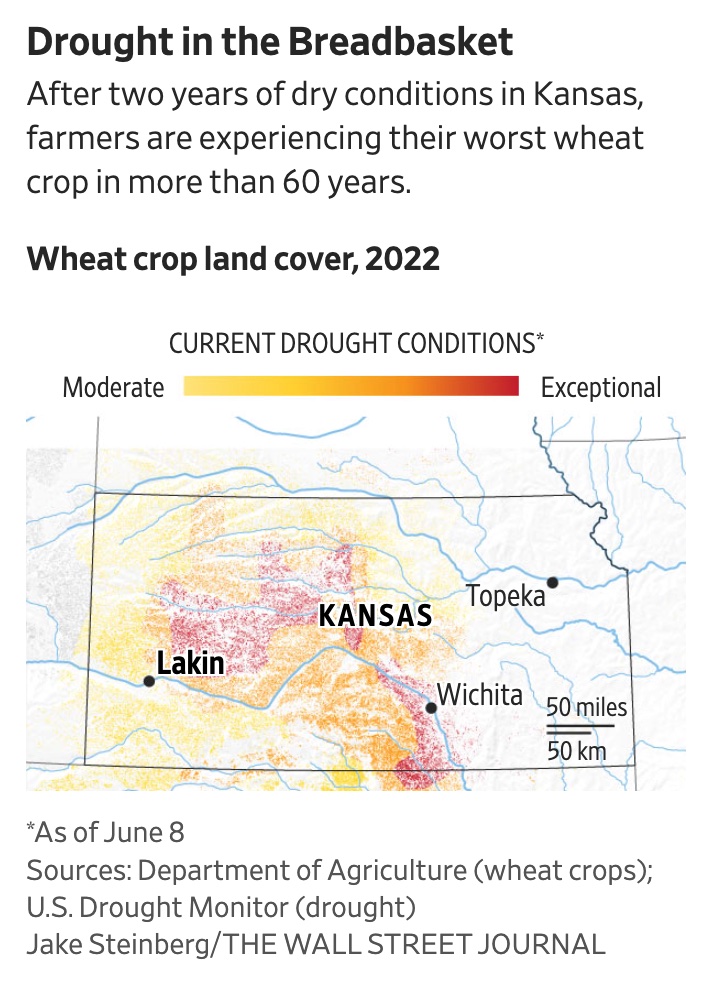

• In the midst of a multiyear drought, U.S. farmers are facing their worst wheat crop in over 60 years, the Wall Street Journal reports (link), forcing many to abandon a significant portion of their fields. The article notes that Gary Millershaski, a farmer from Kansas, is abandoning 90% of his 4,000 acres of wheat; nationwide, a third of the winter wheat is expected to be left unharvested, the highest rate since 1917. The U.S., which is among the top five global exporters of wheat, has enough for domestic consumption, but market volatility has led to increased imports of wheat for flour, heightening the impact on U.S. farmers. As conditions worsen, farmers may rely on crop insurance to recoup some of their costs, but this could lead to debt accumulation. The poor harvest is also affecting dependent businesses and local economies, with a ripple effect on the agricultural sector.

• Sugar prices are high—and El Niño could push them even higher. A Barron’s article (link) says sugar prices are rising, raising concerns for farmers and consumers. Late rainfall last year in India, the world's second-largest sugar exporter, resulted in a limit on sugar exports. This decline in exports, combined with potential El Niño impacts, has pushed prices even higher. A strong El Niño could cause early rains in Brazil, diluting sugar-cane content, and droughts in Thailand, affecting the crops of the world's largest- and third-largest sugar exporters. Other commodities such as cocoa and robusta coffee could also be influenced by El Niño.

The global sugar deficit has led to tight supply, with consumption outpacing production. High sugar prices, while potentially benefitting sugar sellers, also impact consumers struggling with inflation and farmers who have less to sell. The International Sugar Organization states that mills are maximizing sugar production, but the potential of El Niño's repercussions remains a concern. Companies that rely on sugar, such as Tootsie Roll Industries, Hershey, and Coca-Cola, are impacted by rising sugar costs and rely on hedging strategies to mitigate risks.

Higher prices may benefit India's largest sugar manufacturers, Balrampur Chini Mills and Dalmia Bharat Sugar & Industries, but the threat of lower exports from India poses a challenge. Companies like Brazil's Cosan and Luxembourg-based Adecoagro could offset India's loss, although they are not pure sugar-focused businesses.

Sugar exchange-traded funds (ETFs) offer more direct exposure to futures on the commodity. However, sugar futures don’t always track the spot commodity price, and liquidity issues may be a concern for ETFs like Teucrium Sugar and iPath Bloomberg Sugar Subindex Total Return. The outcome largely depends on the extent of El Niño's impact on global sugar production and export dynamics.

• A proposed megadeal between grain-trading giants Bunge and Glencore-backed Viterra has led to concerns about reduced competition for farmers, higher food prices for consumers, and potential bottlenecks in the agricultural supply chain. The $8.2 billion deal would create the world's second-largest agribusiness company, trailing only Cargill. Critics argue that the merger would give Bunge more control over the grain market and food production, limiting competition. While Bunge claims that incorporating Viterra's operations would improve the supply chain for farmers, consumer and advocacy groups plan to ask antitrust authorities to block the deal. The acquisition, slated to close by mid-2024, may face resistance from regulators, especially in Canada and Argentina, where both companies have significant presence. Link for more via the Wall Street Journal.

• Holiday weekend ag demand news: Algeria purchased around 630,000 MT of milling wheat, largely expected to be sourced from Russia. Saudi Arabia purchased 355,000 MT of wheat from unspecified origins. Taiwan tendered to buy up to 65,000 MT of corn from the U.S., Brazil, Argentina or South Africa. Japan is seeking 92,529 MT of milling wheat in its weekly tender. Japan received no offers in its tender to buy 60,000 MT of feed wheat and 20,000 MT of feed barley. Iran passed on tenders to buy 120,000 MT of corn and 120,000 MT of soymeal.

• NWS weather outlook: Excessive Rainfall and Severe Weather likely over parts of the Great Plains, Lower Mississippi Valley, Southeast and Mid-Atlantic... ...Record breaking heat wave persists in Texas.

Items in Pro Farmer's First Thing Today include:

• Grains weaker to open the week

• Some weekend rains but more needed

• Consultant lowers U.S. corn, soybean yields

• Brazil corn crop raised, Argentine soybean crop lowered

• China to auction more state-owned soybean reserves

• Extended cash cattle negotiations likely again this week

• Hog futures supported by firming cash fundamentals

|

RUSSIA/UKRAINE |

— Evidence growing that Russia blew up Kakhovska Dam. A report by the New York Times (link) provides the latest indication Russian forces were behind the dam explosion. Water contamination is becoming an issue. The Kakhovska Dam collapse on June 6 has resulted in 45 deaths so far, with 29 in Russian-occupied territories and 16 in Ukrainian-held regions. In the aftermath of the collapse, southern Ukraine has faced increasing problems related to water contamination, massive flooding, widespread devastation, and ecological catastrophe. This has led to crop damage and the death of millions of fish.

Evidence is mounting that Russia was behind the collapse, with an intentional explosion cited as the cause. The New York Times, quoting engineers, suggested that Russia knew the dam's weak spot in the Soviet-era construction and likely detonated explosives there. The U.S. government agrees with this theory. Similarly, the Associated Press and a group of international legal experts claim that Russia had the means, motive, and opportunity to cause the collapse.

Ukrainian officials have been accusing Russian forces of orchestrating the attack, asserting that it was done to hinder Ukraine's counteroffensive attempts. However, the Kremlin has denied these allegations, claiming that Ukrainian shelling was responsible for the dam's failure.

— The European Union is set to propose a substantial financial aid package worth approximately €50 billion ($54.7 billion) in support of Ukraine. The plan aims to finance Kyiv's ongoing expenses and fund urgent reconstruction priorities. The proposal is expected to be announced today before a donor conference takes place later this week in London.

— Russia conducted an overnight aerial assault on Kyiv and other cities in Ukraine, targeting infrastructure and military installations. Ukraine has claimed to shoot down 32 of the 35 drones launched for the attack. While no casualties were reported, critical infrastructure has been hit in Lviv, a city in western Ukraine. Earlier, Hanna Maliar, Ukraine's deputy defense minister, warned that the biggest counter-offensive from Ukraine is yet to come.

|

POLICY UPDATE |

— Getting ready for Wednesday’s Farm Country Update: 2023 Farm Bill: Influence, Impacts and Odds of Success. Link to sign up for the event.

- CRS Reports:

- 2008 Farm Bill

- 2014 Farm Bill

- 2018 Farm Bill

- This is the legislative history of each bill.

Some farm bill policy changes over the years:

|

|

Name of Farm Bill |

Tools/Programs |

|

2002 |

The Farm Security and Rural Investment Act of 2002 |

· Allows producers choice to update farm program yields (used in CCP calculation only) using 1998-2001 yields. · Add oilseed base acres. Soybeans and minor oilseeds given target price, CCP, and direct payments. · CCPs and fixed payments remain decoupled. · Direct payment limited to $40,000, CCPs limited to $65,000 and LDPs and MLGs limited to $75,000. Three entity rule and generic certificates maintained. Peanuts and wool & mohair given separate payment limit. · County-of-origin labeling for mandatory in two years for meat, fruits, vegetables, fish, and peanuts. For USA product label it must be born, raised, and processed in U.S. · Conservation Security Program to provide incentives to producers for maintaining and enhancing environmental quality. · EQIP funding increased six-fold. |

|

2003

|

Agricultural Assistance Act of 2003 |

|

|

2004

|

Florida Hurricane Agricultural Disaster Assistance Program |

|

|

2004 |

Emergency Programs for Disaster Assistance 2003-2005 |

|

|

2005 |

Energy Policy Act |

|

|

2007 |

Energy Independence and Security Act |

|

|

2008 |

The Food, Conservation, and Energy Act |

|

|

2014 |

Farm bill |

|

|

2018 |

Bipartisan Budget Act |

|

|

2018 |

Farm Bill |

|

|

CHINA UPDATE |

— Chinese President Xi Jinping and U.S. Secretary of State Antony Blinken recently held a long-awaited meeting, signaling progress in stabilizing the strained bilateral relations between the U.S. and China. This meeting in Beijing was the first of its kind since 2018. Xi emphasized the importance of the relationship between the two countries and highlighted some specific points of agreement reached during the two-day visit.

Of note: Blinken’s meeting with Xi on Monday was only announced 45 minutes before it took place.

Xi suggested the two sides “made progress and reached agreement on some specific issues.”

Blinken stressed the U.S. did not want to jeopardize the enormous bilateral trade relationship between the countries. “We don’t want to decouple, we want to de-risk,” he said, gesturing to U.S. export controls on sensitive technologies to China such as advanced semiconductors.

Blinken was unable to get China to agree to reopen military-to-military channels, something U.S. officials have urged in recent months as fears over the possibility of an accidental military encounter and escalation grow.

President Biden praised Blinken's work in China and agreed that both countries have an obligation to manage their relationship responsibly and prevent competition from turning into conflict. The Biden administration is focused on restoring diplomacy and improving channels of communication between the U.S. and China to reduce misunderstandings and miscalculations. “He did a hell of a job,” Biden told reporters on a visit to California. “We’re on the right trail here.” Asked if he felt the U.S. had made progress, Biden responded: “I don’t feel. You know it’s been made… You don’t have to ask that,” he said. “You can ask how much progress was made.”

Both countries are facing challenges at home, with the U.S. concerned about China's increasing military activity near Taiwan and hesitance to condemn Russia, while China is grappling with slowing economic growth and worsening foreign investment sentiment.

The improving dialogue could set the stage for a possible face-to-face meeting between Presidents Xi and Biden at the Asia-Pacific Economic Cooperation forum in November. The next phase of top-level diplomacy between the two countries, perhaps starting in early July, may involve visits by Treasury Secretary Janet Yellen, Commerce Secretary Gina Raimondo and U.S. climate envoy John F. Kerry.

Upshot: The PRC side refused to restart military-military talks, but did agree “to explore setting up a working group or joint effort so that we can shut off the flow of precursor chemicals [for Fentanyl.” China’s top diplomat, Wang Yi, demanded that the U.S. stop playing up the so-called “China threat,” lift illegal unilateral sanctions against China, stop suppressing China’s scientific and technological advances, and not wantonly interfere in China’s internal affairs. Wang specially analyzed the nature of the Taiwan question. Some analysts in Washington believe that dropping some Trump-era tariffs on Chinese goods could serve as a confidence-building measure between the U.S. and China, as these tariffs have harmed American consumers. However, it is uncertain if the White House is willing to face potential backlash from the U.S. right for being perceived as too lenient towards China's Communist regime.

What to watch next? China’s premier, Li Qiang, landed in Germany this week to start a European trip, his first overseas since becoming his country’s second most senior leader earlier this year. China is Germany’s biggest trading partner and, along with France, where Li will travel later this week, a U.S. ally that is trying to find a different path for its relations with Beijing and Washington.

— China and Cuba are in advanced negotiations to establish a joint military training facility on the island, the Wall Street Journal reports (link), raising alarm in Washington about the prospect of Chinese troops being stationed just 100 miles off Florida's coast. The Biden administration has contacted Cuban officials to try and prevent the deal, tapping into potential Cuban concerns about sovereignty. The proposed facility is part of China's "Project 141," an initiative to expand its global military base and logistical support network.

The Wall Street Journal earlier reported that China and Cuba were working on an agreement for a new eavesdropping site. While the White House deemed the reporting inaccurate, it later confirmed that Chinese intelligence facilities have existed in Cuba since at least 2019. This new facility could house Chinese troops permanently and broaden the country's intelligence gathering capabilities, including electronic eavesdropping against the U.S.

Both Chinese and Cuban officials deny knowledge of this deal currently and argue that the U.S. should focus on enhancing mutual trust and regional peace. U.S. officials remain cautious and believe any increase in security coordination between China and Cuba is likely to progress slowly.

— Analysts and investors are rethinking China. Entering 2023, there was an expectation that China's economy would soar, sparked by the end of their zero-Covid policy. However, Wall Street's predictions for China are turning into flops, as China's recovery from Covid has been weak. Industrial production has disappointed; both imports and exports have markedly slowed, there is overwhelming debt in property development, and the private sector, once believed to be the driving force for China's economic bounce back, is faltering.

Meanwhile, the old mechanisms that drove China's economic miracle over the past three decades aren't producing the same results. The bubble in China's property market has popped, which will continue to impact households, banks, and local governments. China's working-age population is getting older, and there are fewer young people to replace them than ever before. Exports remain a key part of the economy, but countries that previously championed free trade have shifted towards protectionism.

China faces major structural issues such as debt, deflation, and slow growth, which will be hard to address under current economic and geopolitical climates. As tensions rise, countries are becoming wary of Chinese investments, resulting in a shifting global landscape. This change might seem slow at first, but could eventually happen all at once, leaving markets and investors grappling with the fallout from the end of China's economic miracle.

— Several U.S. states are accelerating their efforts to prevent China and other "foreign adversaries" from purchasing farmland. Proponents of these measures, mostly Republicans but some Democrats, argue that such legislation is necessary to protect food security, military bases, and other sensitive installations. So far, at least eight states have passed similar laws, and proposals are under consideration in over 24 states.

In 2021, China held less than 1% of the over 40 million acres of agricultural land owned by foreign investors in the U.S. Some states have enacted laws specific to "foreign countries of concern," targeting countries like China, Russia, North Korea, Iran, and Cuba, as well as their governments and operating agencies.

These laws originated partly from concerns about Chinese companies trying to build agricultural sites near military bases in states like North Dakota and Texas. However, some experts worry that these laws could be rooted in racism and xenophobia and urge lawmakers to act on evidence rather than suspicion.

The Chinese Foreign Ministry spokesperson has argued that trade between the two countries is mutually beneficial, and warns that politicizing economic, trade, and investment issues could damage international confidence in the U.S. market environment.

Link to more via CNN.

— Qatar is expected to secure another significant gas supply deal with a Chinese state-controlled company, China National Petroleum Corporation (CNPC), marking China's eagerness to secure long-term agreements with major global exporters of liquefied natural gas (LNG), the Financial Times reports (link). The 27-year agreement will see China purchasing 4 million tonnes of LNG annually from the Gulf state. CNPC will also acquire a 5% stake in one of Qatar's LNG trains as part of the North Field expansion project, the world's largest natural gas reservoir. This comes seven months after China's Sinopec signed a similar 27-year agreement with QatarEnergy, which was then considered the longest gas supply deal in the LNG industry's history.

|

TRADE POLICY |

— Mexico has reached a significant agreement with food manufacturers in an effort to use only non-GMO corn in tortilla production throughout the country. President Andres Manuel Lopez Obrador announced this decision on June 19, emphasizing the importance of preserving the nation's traditional food practices.

Additionally, the government plans to implement new import tariffs on white corn imports.

The decision, however, has raised concerns from the U.S. and Canada. Both countries have asked for consultations regarding Mexico's decree, which aims to ban GMO corn imports for food use by 2024. If these consultations do not yield a resolution, the issue may be advanced to a dispute settlement panel under the U.S.-Mexico-Canada Agreement (USMCA).

Mexico defends its actions, stating that its self-sufficiency in white corn production means that this ban does not qualify as a trade barrier. On the other hand, the U.S. and Canada argue that this policy contradicts Mexico's commitment to make science-based decisions on biotechnology according to the USMCA. As multiple discussions have not yet resolved the issue, it seems probable that the disagreement will be brought to a USMCA panel.

— The EU has outlined its first economic security doctrine, which aims to be more involved in how European companies trade and invest with other countries. The doctrine doesn't specifically mention China, but it is presumed the strategy targets that country, as well as Russia.

The EU is focusing on three sectors to toughen its controls: inbound investment screening, export controls, and outbound investment screening. One of the most significant plans in this doctrine is a new law to prohibit outsourcing of advanced technologies to autocracies to prevent threats to international peace and security.

Remarks in the document indicate that this move would bring an end to unchecked globalization of supply chains. Companies would no longer be able to outsource some advanced technologies, such as quantum computing, artificial intelligence, and advanced semiconductors, to maintain a higher level of security and reduce vulnerability to adversarial nations.

|

ENERGY & CLIMATE CHANGE |

— Four things about traveling 18,000 miles in an EV. Gia Mora and her partner have traveled 18,000 miles on multiple long-distance road trips in their Hyundai Ioniq 5 electric vehicle (EV), and here are the four things that surprised them about these adventures (Source: Insider/Link):

- Plotting out charging is easy thanks to the Electrify America app, which offers directions and compatibility with dashboard navigation. It provides access to a vast network of fast chargers. The network offers 3,500 fast chargers at 800 stations in 47 states.

- EV road trips are faster during summer, as cold weather reduces range and increases charging times. The Ioniq 5 travels about 15% fewer miles on the same charge in the cold as it does in the heat. In moderate temperatures, with the 350-kilowatt Hyper-Fast chargers, the Ioniq 5 can go from 10% to 80% charged in under 20 minutes. But on days when the temperature falls below 20 degrees Fahrenheit, it can take as long as 30 or 35 minutes.

- Mora gained an appreciation for Walmart, as many of their charging stops are in well-lit and well-stocked Walmart and Sam's Club parking lots — 280 Walmart and Sam's Club locations host Electrify America and EVgo stations. Walmart announced plans to quadruple its network of chargers. Since 90% of Americans live within 10 miles of a Walmart, this expanded infrastructure could make road-tripping easier and make EV adoption accessible to more people.

- More remote charging stations can provide unique and enjoyable experiences, like discovering quirky local establishments.

Gia considers road-tripping in the Ioniq 5 along the Electrify America network an enjoyable alternative to flying, as it's cost-effective and environmentally friendly, and is optimistic about the growing charging infrastructure.

Note this: Multiple U.S. owners of Hyundai's popular Ioniq 5 electric SUV have complained of completely or partially losing propulsive power, many after hearing a loud popping noise, the National Highway Traffic Safety Administration (NHTSA) said Saturday. Hyundai said it would offer a software update beginning next month and replace affected components if necessary. The NHTSA said in a notice posted online that it received 30 complaints about the problem in 2022 models, of which it estimated 39,500 were on U.S. highways.

— Ford chairman: U.S. can’t yet compete against China with EVs. In a recent interview with CNN, Ford Motor Co. Executive Chairman Bill Ford Jr. expressed concern over the US's readiness to compete with China in the electric vehicle (EV) market. According to Ford, China has quickly developed and scaled their EV production, which could soon lead to them exporting and entering the U.S. market.

China is on track to become the world's second-largest exporter of passenger vehicles, with shipments of cars produced in the country having tripled since 2020, reaching more than 2.5 million last year. As part of its response, Ford Motor Co. plans to invest $3.5 billion in a Michigan EV battery plant, which has stirred controversy due to its reliance on technology and support from China's Contemporary Amperex Technology Co. Ltd.

U.S. Transportation Secretary Pete Buttigieg has also emphasized the need for the U.S. to develop refining capacity for essential EV battery materials. Bill Ford Jr. believes it is vital for Ford engineers to learn from Chinese technology to build the company's manufacturing capacity and drive costs down for American production.

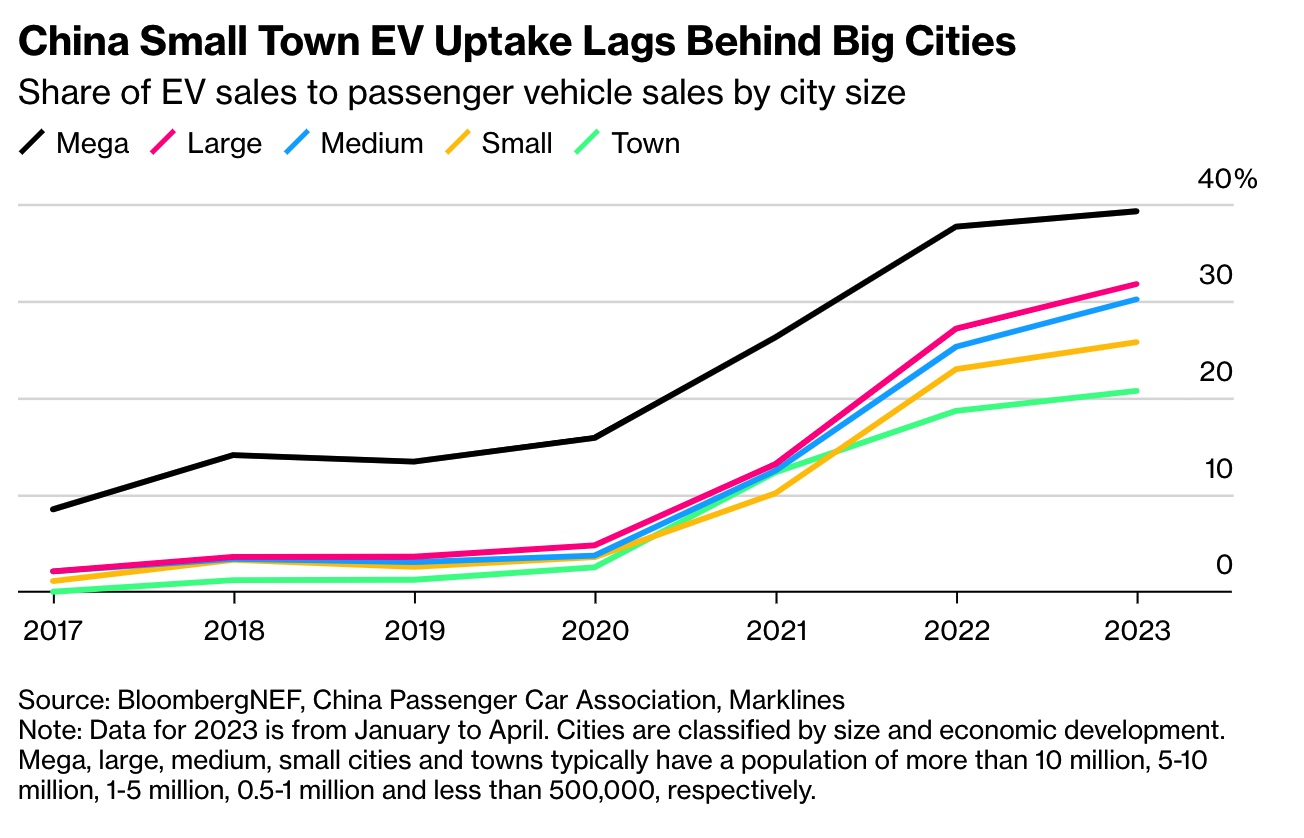

Facts and figures. While China has the world’s largest clean car market, selling 5.67 million such vehicles in 2022, sales have been concentrated in big cities. Overall growth is slowing and the penetration of EVs in less-developed regions is still relatively low — at 21% of new car sales in the first four months of 2023, compared to around 40% in the largest cities, according to BloombergNEF. Closing that gap is key toward China’s goal of reaching net zero emissions by 2060 and supporting the nation’s auto industry.

— The Department of Energy (DOE) announced a $77 million investment to help modernize the electric grids of seven states, three tribal nations, and Washington, DC. This funding, sourced from the Bipartisan Infrastructure Law, will be allocated through the Grid Resilience State and Tribal Formula Grants. The aim is to support grid updates which will reduce the impacts of extreme weather and natural disasters, while ensuring power sector reliability. Over the next five years, the DOE plans to distribute a total of $2.3 billion to states, territories, and tribal nations through this program. The initiative is being overseen by the DOE's Grid Deployment Office.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Kroger CEO Rodney McMullen said the planned $24.6 billion acquisition of Albertsons Cos. is progressing well in both regulatory approval and merger planning aspects. The merging companies had estimated a need to divest between 100 and 375 stores to clear antitrust review, with a ceiling of 650 store divestitures if necessary. Combined, Kroger and Albertsons operate 4,996 stores, 66 distribution centers, 52 manufacturing plants, 3,972 pharmacies and 2,015 fuel centers. The companies employ 710,000 workers. McMullen stated they are cooperating with regulators and working on identifying potential buyers for the stores expected to be divested, while striving to maintain competitiveness. He expressed satisfaction with the level of interest from potential buyers so far.

— Meat recall. Over 42,000 pounds of Johnsonville sausages have been recalled due to possible contamination with thin black plastic strands. The affected product is the brand's "Beddar With Cheddar" pork links. The USDA cautions that consumers might still have the recalled items in their refrigerators or freezers and advises against consumption. Instead, the product should be thrown away or returned to the place of purchase. The 14-oz. packages have a "best by" date of July 11, 2023, and were shipped to retailers in Colorado, Iowa, Kansas, Missouri, Nebraska, North Dakota, Oklahoma, and Texas.

|

POLITICS & ELECTIONS |

— Recent Supreme court decision could reshape House battlefield. The U.S. Supreme Court recently made a pivotal decision by ruling that Alabama's congressional map violates the Voting Rights Act, saying that it dilutes the political power of Black voters. The court ordered the state to redraw its map, which had only one majority-Black district. Erin Covey and Jacob Rubashkin, writing for Inside Elections with Nathan L. Gonzales, says the decision has vital implications for the fight for control of the U.S. House in 2024 and affects maps in Louisiana and Georgia, where similar cases have been pursued. They conclude Democrats could potentially gain three seats across these states depending on the pace of legal processes. Voting is highly polarized, especially in the South, so creating more majority-Black districts is likely to result in more Democratic-won seats, they conclude.

The ruling also adds another layer to the redistricting landscape heading into the 2024 election cycle. In states like North Carolina and Ohio, Republican-controlled legislatures are attempting to redraw the maps to their advantage, while Democrats hope for favorable maps in Wisconsin and New York. South Carolina's map faces a legal challenge due to alleged racial gerrymandering violating the 14th Amendment.

Reaction: Democratic Congressional Campaign Committee Chair Rep. Suzan DelBene called the Supreme Court's Alabama ruling "a victory for democracy," while the National Republican Congressional Committee's spokesperson accused Democrats of trying "to rig the game."

— Virginia is holding crucial primary elections today, which will shape each party's approach to key issues like abortion rights and gun violence as they vie for control of the General Assembly. Polling will determine candidates for every seat in the state legislature this fall, with redrawn political maps ensuring a high level of turnover. Around 50% of the 140 General Assembly lawmakers have been placed in new districts, resulting in multiple retirements and several candidates running for the Senate to avoid challenging their colleagues. The competition between Republicans and Democrats for control in both chambers has been characterized by plenty of funding, as well as support from Republican Gov. Glenn Youngkin in pushing for a conservative legislative agenda if Republicans secure majorities.

|

CONGRESS |

— Senate panel to consider failed bank pay clawback bill. The Senate Banking Committee will convene on Wednesday to discuss a bill that grants federal regulators the power to take back compensation from top executives of failed banks. Authored by Chair Sherrod Brown (D-Ohio) and Sen. Tim Scott (R-S.C.), the bipartisan legislation addresses executive responsibility following the Silicon Valley Bank and Signature Bank collapses. The proposed law enables the FDIC and bank boards to confiscate executive pay from the 24 months preceding a bank's failure. Brown asserts that it is time for bank CEOs to face consequences for their decisions, while Scott acknowledges the bill's positive direction, but highlights that regulatory supervision deficiencies and the Biden administration's fiscal policies were also factors in the bank crises.

Additionally, the committee will review a bill aimed at tackling the fentanyl crisis, which imposes sanctions on the drug trade and money laundering activities, originally supported by Sen. Tim Scott. The meeting will be followed by a hearing for the nominations of Philip Jefferson as vice chair of the Federal Reserve and Lisa DeNeil Cook and Adriana Debora Kugler as members of the Fed's Board of Governors.

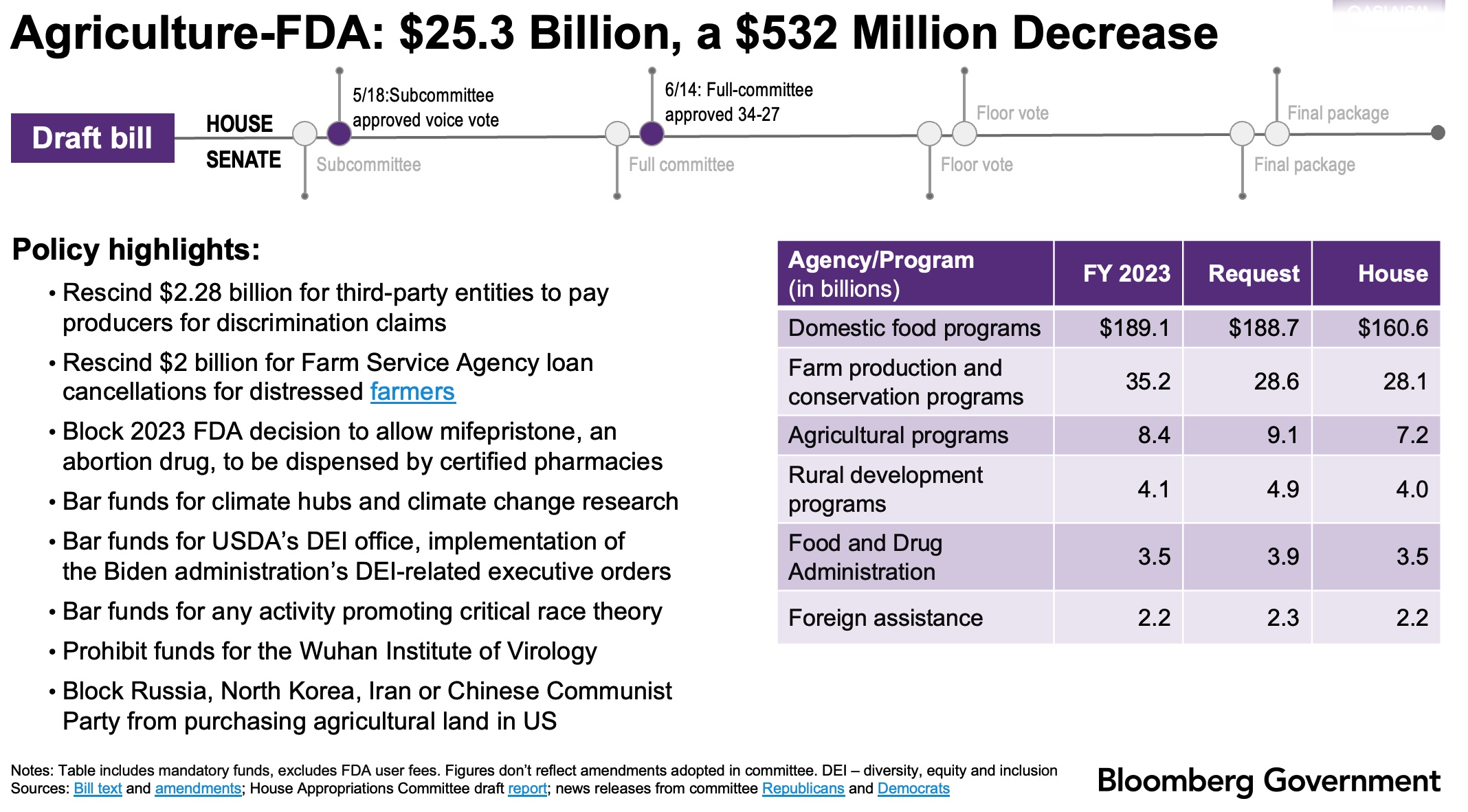

— The Senate Appropriations Committee will meet Thursday to debate its version of the fiscal year (FY) 2024 Agriculture bill as well as the Military Construction-Veterans Affairs measure. The committee will meet to officially set the toplines for each of the 12 appropriations bills.

|

OTHER ITEMS OF NOTE |

— South Korea recovers large North Korean rocket fragment from ocean floor. South Korea has successfully retrieved a massive 14.5-meter segment of a North Korean rocket that failed during flight on May 31. The fragment, which was found on the sea floor, is expected to offer valuable insights into the secretive nation's rocket technology. Photos of the recovered section were shared by Seoul, revealing details about North Korea's engine design capabilities. The find could also potentially expose illegal components that have been supplied to Kim Jong Un's regime in violation of international sanctions.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |