Listen Carefully to House Ag Chair Thompson Re: Funding Levels for Key Farm Bill Topics

WSJ: West Coast dockworkers won 32% pay increase through 2028; to get one-time ‘hero bonus’

|

In Today’s Digital Newspaper |

Americans celebrate Juneteenth on June 19. The three-year-old federal holiday marks the day in 1865 when black slaves in Texas learned of freedom — two years after emancipation.

Juneteenth holiday schedule: Grain and livestock markets will trade normal hours today. Markets and government offices are closed Monday, June 19, for the federal Juneteenth holiday. As a result, there will be no Updates on Monday unless there are major developments. Grain markets will reopen with the overnight session at 7:00 p.m. CT on Monday. Livestock markets will resume trade at 8:30 a.m. CT on Tuesday, June 20.

West Coast dockworkers won a 32% pay increase through 2028 and will get a one-time “hero bonus” for working through the pandemic under a tentative contract agreement reached with port employers, the Wall Street Journal reports, citing people familiar with negotiations. The agreement announced late Wednesday, which must be ratified by employers and dockworkers, includes improvements in benefits and other provisions reached.

Lawrence Summers sees “disturbing” signs internal politics are driving the Fed. “I found the Fed’s action a little bit confusing,” the former Treasury Secretary said, as a pause is inconsistent with adding two further hikes to the outlook for this year and with raising the growth forecast. More in Markets section.

Central banks of the world's three largest economic blocs had sharply contrasting approaches this past week, leading to increased confusion about the global economy. More in Markets section.

Xi Jinping said China is willing to work with the world on technology innovation and global challenges including pandemic prevention during a meeting with American billionaire Bill Gates. More in China section.

China plans stimulus to revive its flagging economy. Infrastructure spending and rule changes encouraging property investors to buy more homes are on the table, people familiar with the discussions say, as fresh data shows the economic recovery flickering out. China’s central bank already cut interest rates this week. But stimulus might not help, some economists warn, because businesses and consumers are wary of debt.

Former U.S. Secretary of State Henry Kissinger said he believes military conflict between China and Taiwan is likely if tensions continue on their current course, though he still holds out for dialogue that will lead to de-escalation — as he’s been urging. More in China section.

Gasoline prices ease for the summer driving season. After widespread pain at the pump last year, prices this year have been pushed down by recession fears, China’s stalling economy and an uninterrupted flow of Russian crude into markets. A gallon of regular gasoline averaged about $3.59 on Thursday, according to AAA, down from a record high of $5 a year ago, when the war in Ukraine was upending energy markets.

Recent decline in oil prices have had a knock-on effect on the stocks of onshore drilling companies.

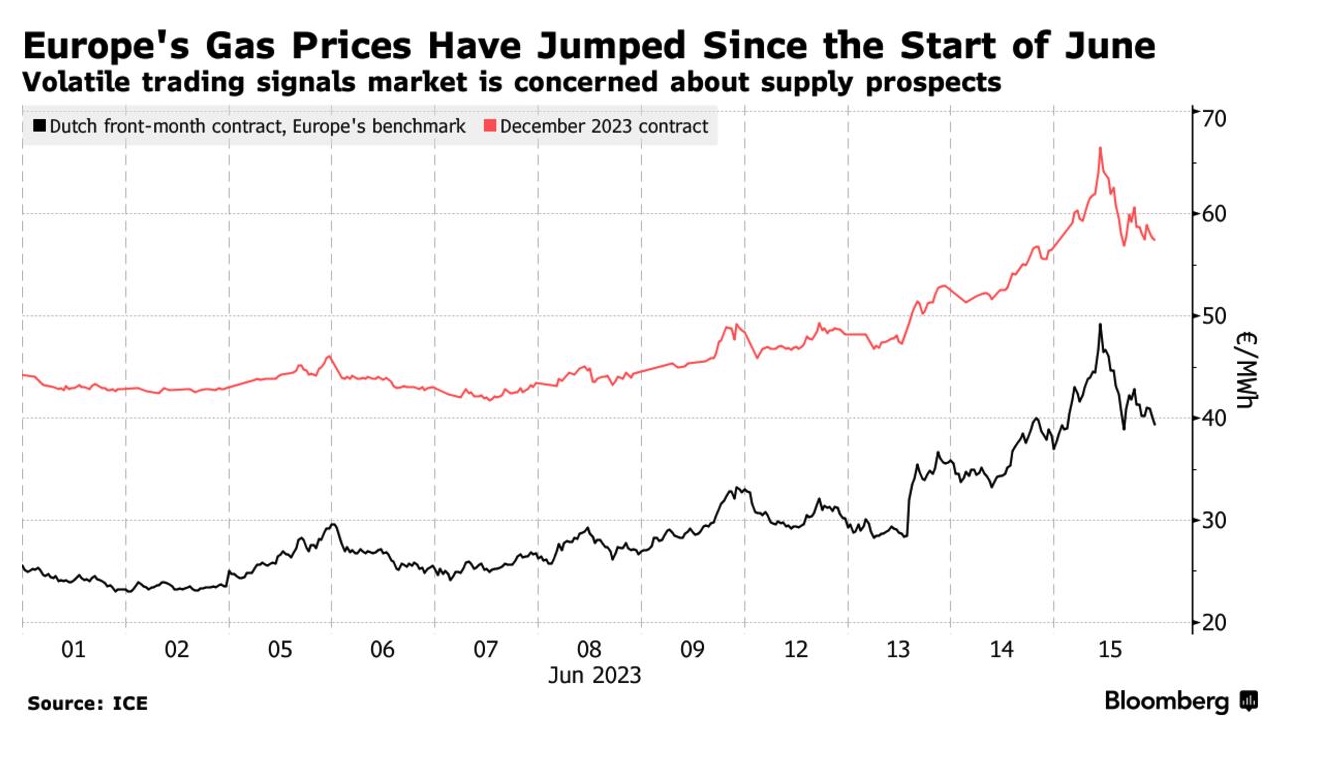

The gas market is flashing warning signs that Europe could easily plunge back into crisis.

Goldman Sachs is reportedly under investigation by the Federal Reserve and the SEC concerning its involvement in Silicon Valley Bank's final days.

House Ag leaders and staff are mining all sorts of areas in coming up with ways to find new funding and/or shifts in funding to prioritize farm bill spending needs. See Policy section.

Economist: Lula’s ambitious plans to save the Amazon clash with reality.

U.S. has seen consistent growth in agricultural exports to Mexico under NAFTA and USMCA, according to Southern Ag Today. See Trade Policy section.

Developers of the Mountain Valley Pipeline are seeking a three-year extension to finish construction and begin operation. See Energy section.

Sonora, the second-largest pork producing state in Mexico with 308,499 MT in 2022, has concerns over California Proposition 12's impact on its pork exports to the U.S. Meanwhile, there has been support from state governors on legislation to override Prop 12. See Livestock section.

FDA advisors have recommended that upcoming Covid-19 booster vaccines for this fall should target a new strain of the Omicron variant and exclude components targeting the original virus strain.

Senate panel advances bill for new feed additive category.

Ultra-right House Republicans are demanding spending cuts far deeper than those agreed to by President Biden and Speaker Kevin McCarthy (R-Calif).

In Politics & Elections section:

- Report: Latino voters who sat out midterms provide opportunity for GOP in 2024.

- Will Trump's indictment hurt his nomination path? Charlie Cook says, ‘Don’t count on it.”

U.S. agencies breached in cyberattack by Russian ransomware group. The top U.S. cybersecurity agency said it did not have evidence that the group was acting in coordination with the Russian government.

A panel of 21 advisers to the FDA unanimously voted Thursday that Covid-19 vaccines should be updated for the fall. More in Health section.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. stock Dow opened up around 100 points but has since shaved some of the upside. In Asia, Japan +0.7%. Hong Kong +1.1%. China +0.6%. India +0.7%. In Europe, at midday, London +0.4%. Paris +1%. Frankfurt +0.4%.

U.S. equities yesterday: All three major indices scored gains of more than 1% on Thursday, with the Dow up 428.73 points, 1.26%, at 34,408.06. The Nasdaq gained 156.34 points, 1.15%, at 13,782.82. The S&P 500 rose 53.25 points, 1.22%, at 4,425.84.

Agriculture markets yesterday:

- Corn: July corn futures rallied 15 1/2 cents on the session to $6.23 1/4, though gains were led by the December contract closing 25 1/4 cents higher at $5.74 1/2.

- Soy complex: July soybeans rose 40 cents to $14.28 1/4, marking the largest daily gain since September 2022, while November soybeans rose 52 1/4 cents to $12.92 1/4, near the session high and the 100-day moving average of $12.95 1/4. July meal rose $4.50 to $394.20, while July soyoil rose 247 points to 58.43 cents, the highest close since March 8.

- Wheat: July SRW wheat gained 31 1/4 cents to $6.62 1/2, the highest close since April 21, while December SRW wheat gained 29 3/4 cents to $6.86 3/4. Prices closed near the session high. July HRW wheat rose 27 cents to $8.12 3/4 and December HRW wheat gained 26 3/4 cents at $8.06, both ending near the session high. July spring wheat futures rose 23 1/2 cents to $8.32 3/4.

- Cotton: July cotton fell 115 points to 80.64 cents, the lowest close since May 25.

- Cattle: August live cattle rose 10 cents to $171.075 and nearer the session high. August feeder cattle fell $1.775 to $234.125. Feeder prices gapped lower on the daily bar chart and hit a three-week low but closed nearer the session high.

- Hogs: Hog futures set back from early highs, with nearby July falling 85 cents to $91.925 and August sustaining a 62.5-cent rise to $90.30.

Ag markets today: Corn, soybean and wheat futures built on Thursday’s strong gains during overnight trade amid heightened crop concerns. As of 7:30 a.m. ET, corn futures were trading 9 to 12 cents higher, soybeans were 19 to 23 cents higher and wheat futures were mostly 5 to 8 cents higher. Front-month crude oil futures and the U.S. dollar index were both near unchanged.

Goldman Sachs is reportedly under investigation by the Federal Reserve and the SEC concerning its involvement in Silicon Valley Bank's final days. Authorities are specifically examining Goldman's activities in purchasing the tech lender's securities book, while also advising on its unsuccessful capital raising efforts. This marks another instance where Goldman Sachs faces scrutiny for its dual roles in the collapse of Silicon Valley Bank.

Market quotes of note:

- Economists at Bank of America this week scrapped their prediction for a U.S. downturn this year. But they also warned, in a research note, that further Fed hikes could renew banking sector stress and spark a credit crunch, particularly harming the small businesses that contribute about 50% of U.S. employment.

- Why didn’t Fed hike rates? “The risk going forward is that they’re simply not raising rates enough compared to the stickiness in inflation that they’re worried about,” Apollo chief economist Torsten Slok said on Bloomberg Television after Wednesday’s presser. “If you’re worried about inflation today, you should be hiking rates today. It does seem slightly odd that they took a pause or a skip or whatever they did today.”

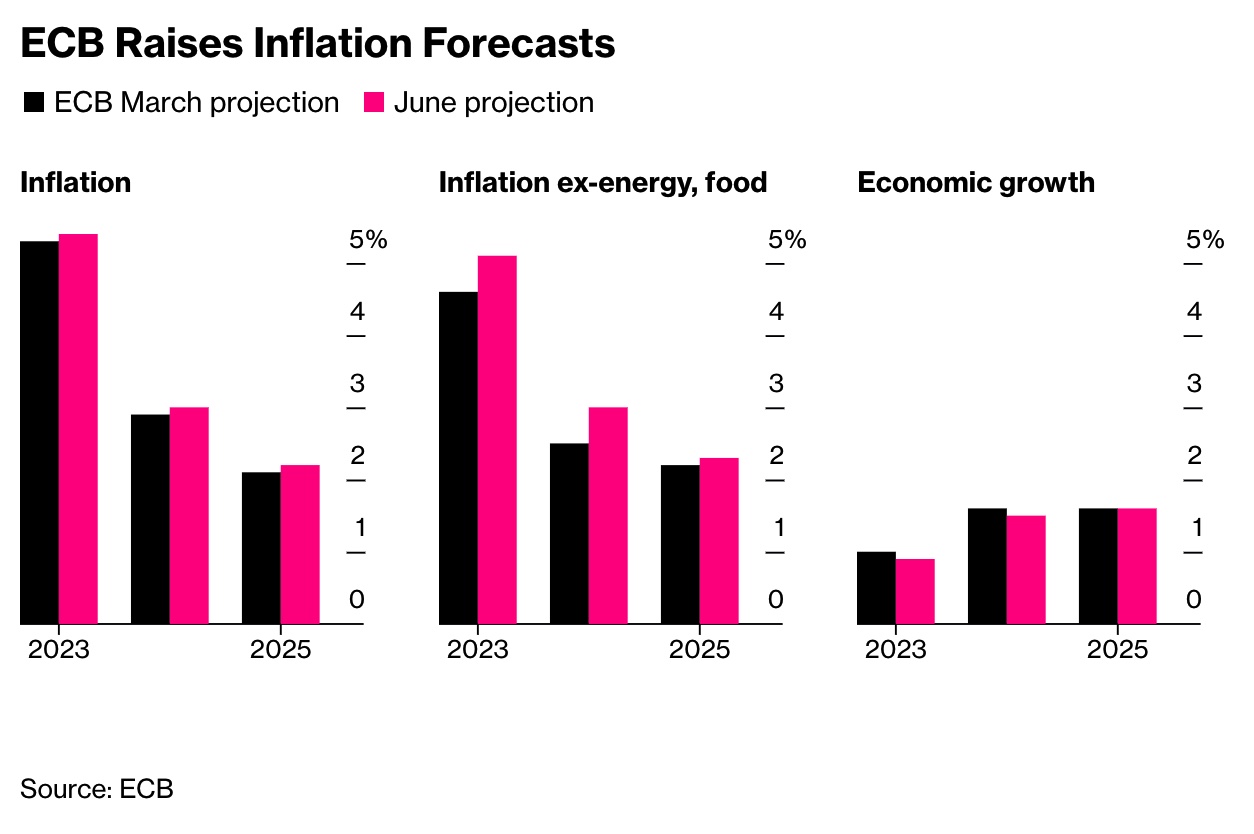

- The surprise at the European Central Bank's meeting, much like the Fed's view on Wednesday, was that inflation forecasts have been increased through to 2025, Charles Hepworth, investment director at GAM Investments, says. "Central banks collectively now seem to think that higher rates are still warranted even if their economies are softening or are already in recession," he says, adding that policy mistakes could well be the unintended results. Hepworth says markets are pricing in a terminal rate — where the ECB pauses — of 4% now.

- Sevens Report: “The fed funds rate is currently 5.125%, which is close to in line with the latest headline Core CPI reading in the U.S. of 5.3%. But in Europe the benchmark policy rate is at 4% which is nearly 3% below the latest Eurozone Core CPI print of 6.85%. That suggests the ECB will be raising rates for some time to come while the Fed could technically already be done with its hiking cycle which is bullish for the euro and bearish for the dollar.”

On tap today:

• Federal Reserve governor Christopher Waller speaks on financial stability and macroeconomic policy at 7:45 a.m. ET.

• University of Michigan's preliminary consumer sentiment index for June is expected to rise to 60.1 from a final reading of 59.2 in May. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Japan holds rates as expected. The Bank of Japan kept its key short-term interest rate unchanged at -0.1% and that of 10-year bond yields at around 0% in its June meeting by a unanimous vote. Policymakers said they will patiently continue with monetary easing and reiterated inflation will slow over the coming months. Governor Kazuo Ueda later said any major change in the bank’s inflation outlook may lead to a policy change.

Summers sees ‘disturbing’ signs Fed Driven by internal politics. In an interview with Bloomberg Television, former U.S. Treasury Secretary Lawrence Summers expressed confusion over the Federal Reserve's actions during their meeting this week. While the Fed decided not to raise interest rates on Wednesday, it added two rate hikes to its outlook for the rest of the year and boosted its growth forecast, which Summer finds inconsistent.

The Fed Chair, Jerome Powell, stated that the central bank would benefit from more data before making any changes. The policy decision was unanimous, although some panel members were open to discussing a rate increase in June. Summers suggested that the meeting was influenced more by internal political dynamics than an accurate assessment of the economy.

While Summers believes that the Fed needs to maintain a posture of "moving towards restraint," he doesn't think the precise timing is critical. He commended the strong U.S. economic indicators, such as the robust consumer sector, strong employment data, and mixed but generally strong wage indicators. However, he also noted that clear evidence of an inflation slowdown has not yet emerged.

Regarding the European Central Bank, which raised its key interest rate by 0.25 percentage points, Summers said it likely needs to continue acting, as the inflation issue in Europe is more severe than in the U.S.

As for China, Summers reiterated the difficult challenges the country faces, such as a shrinking population and capital flight pressures, which may be impacting global commodity prices.

The central banks of the world's three largest economic blocs had sharply contrasting approaches this past week, leading to increased confusion about the global economy and potentially making it harder for the Federal Reserve to control inflation. The eurozone raised rates, the U.S. held them steady, and China cut rates. WSJ's James Mackintosh suggests (link) that the conflicting moves are due to economies increasingly operating under local rhythms, which affects currency values and weakens the U.S. dollar, further challenging the Federal Reserve's efforts.

The International Monetary Fund urged the European Central Bank to further restrict monetary policy, a day after the ECB raised interest rates by a quarter of a percentage point to 3.5%, their highest level in 22 years. The IMF said a “sustained period” of tightened policy would be needed to ward off “persistently high” inflation.

Eurozone inflation slows to 6.1% rise, in line with preliminary data. Eurostat confirmed its earlier estimates that consumer in the Eurozone was 6.1% higher than year-ago in May, down from a 7.0% jump the previous month. The main contributor to consumer inflation was the cost of food, alcohol and tobacco, which added 2.54 points to the final figure. The second biggest contributor was the rising prices of services, adding 2.15 points, with industrial goods adding another 1.51 points.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the euro, yen and British pound all firmer against the greenback. The yield on the 10-year U.S. Treasury note was slightly higher, around 3.74%, while there was a narrowly mixed tone in global government bond yields. Crude oil is pivoting around unchanged, with U.S. crude around $70.60 per barrel and Brent around $75.70 per barrel. Gold and silver futures were higher, with gold around $1,978 per troy ounce and silver around $24.21 per troy ounce.

• BlackRock sought approval from America’s securities watchdog to offer a bitcoin exchange-traded fund on the Nasdaq stock market. The launch of the first-of-its-kind ETF by the world’s largest asset manager would be welcome news for the cryptocurrency industry, which has been squeezed by regulators in recent months. The Securities and Exchange Commission, however, has previously rejected similar applications.

• Gas prices are predicted to be lower this summer driving season compared to last year, primarily due to recession concerns, a slowing economic recovery in China, and a continuous flow of Russian crude oil into markets. Presently, the average price for a gallon of regular gasoline is around $3.59, a notable decrease from last year's record-high of $5. Global oil prices have also experienced a drop, currently at approximately $75 a barrel, down from over $120 last summer.

• The recent decline in oil prices have had a knock-on effect on the stocks of onshore drilling companies. Investors are concerned that these falling prices and rig idlings could indicate a coming drop in oil demand due to a slowing economy. Shares of the four largest onshore drilling companies have plummeted by an average of 32% this year, while the S&P 500 energy index has declined by 8.2% and the broader S&P 500 index has risen by 15%. This steep drop in drilling stocks comes as the number of active rigs for crude oil and natural gas in the U.S. has decreased by 11% to 695, according to Baker Hughes. Rigs are typically considered as bellwethers for the industry, as they are deployed and idled during the early stages of booms and busts. The recent decline in the number of active rigs has investors increasingly worried about the future of oil prices and wondering whether they have yet to hit bottom. Link to more via the Wall Street Journal.

• The gas market is flashing warning signs that Europe could easily plunge back into crisis, according to a Bloomberg report (link). The fragility has been laid bare in recent days by huge price swings caused by a series of outages in Norway and the planned shutdown of a key production site in the Netherlands.

• IEA sees India Becoming the key oil demand driver. According to the International Energy Agency (IEA), India will overtake China by 2027 as the largest source of global crude demand growth, with 75% of future global growth in 2023-2028 generally coming from Asian nations.

• China adds impetus to oil buying with new quota. Giving a new boost to private refineries’ buying in China, authorities in Beijing have issued the third batch of 2023 crude oil import quotas for a total volume of 62.28 million tonnes, taking this year’s total to 194.1 million tonnes, up 20% year-on-year.

• U.S. sets 12-million-barrel SPR replenishment goal. As the U.S. Strategic Petroleum Reserve remains at the lowest level since 1983, the White House is reportedly hoping to buy back at least 12 million barrels this year, implying there will be another 6 million barrels bought in October-December 2023. Link to more via Reuters.

• First Quantum Minerals Ltd. rebuffed an informal takeover approach from Barrick Gold Corp., the world’s second-largest producer of the precious metal, as miners scour the globe for deals, according to Bloomberg, citing people with knowledge of the matter.

• WSJ report outlines components of West Coast port deal. A Wall Street Journal report (link) on the tentative agreement between the Pacific Maritime Association (PMA) and the International Longshore and Warehouse Union (ILWU) outlines a pay increase of 32% for port dockworkers by 2028. The agreement includes a "hero bonus" due to workers' efforts during the pandemic. Wages will increase by $4.62 per hour in the first contract year and $2 per hour in subsequent years, with the pay rise to be retroactive from July 1. The WSJ report states that the “hero bonus” will consist of a one-time payment of $70 million. Union President Willie Adams anticipates the ratification process, which involves a contract caucus from 29 local West Coast unions, may take a few months to complete.

The agreement is the latest labor deal bringing significant pay increases to transport workers, including a recent tentative pact between FedEx and its unionized pilots. The ports pact also comes as United Parcel Service is negotiating with the Teamsters.

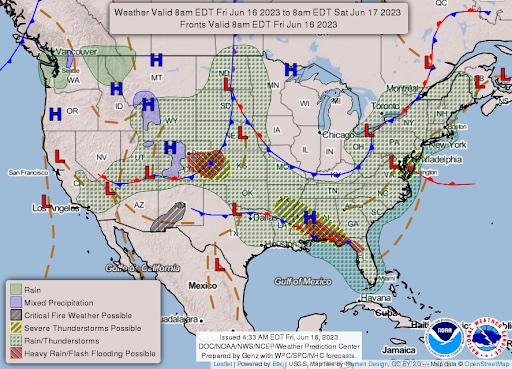

• NWS weather outlook: Heavy Rain, Flash Flooding and Severe Thunderstorms possible across portions of the Central Plains, Gulf/East Coast... ...Record high temperatures possible across portions of central to southern Texas and across portions of eastern Louisiana; Critical Fire Weather likely over portions of the Southern Plains and Southwest... ...Smoke from Canadian wildfires to continue impacting the Upper Mississippi Valley, Great Lakes, Midwest and interior Northeast.

Items in Pro Farmer's First Thing Today include:

• Followthrough buying in grains overnight

• French wheat crop ratings decline again

• Still waiting on active cash cattle trade

• Pork cutout tops $90

|

RUSSIA/UKRAINE |

— Russia launched 12 missiles and two drones at Kyiv as African leaders arrived in the Ukrainian capital to broker peace talks. They were shot down by the city’s air defenses, according to the Ukrainian air force. The African delegation, which includes the presidents of South Africa and Zambia, will meet with Volodymyr Zelenskyy, Ukraine’s president, before travelling to St. Petersburg on Saturday to meet Vladimir Putin, Russia’s president. Ukraine’s foreign minister said the attack was evidence that “Russia wants more war, not peace.”

|

POLICY UPDATE |

— Listen closely to House Ag Chair for possible ways for more farm bill funding for some areas. House Ag Chair G.T. Thompson (R-Pa.), in our interview with him this week, said: “There are efficiencies that can bring us some new dollars, just as we look at incorporating some of the disaster relief that we normally spend in an emotional way. By incorporating some of that disaster relief into crop insurance, we will enhance crop insurance, make it more attractive for more subscriptions. At the same time. I think we can do that by spending less money, so we’ll bring new dollars in and that’s just one of a number of ideas we have when there’s a recognition that in certain areas, certain titles of the farm bill, we need to find some new dollars.”

Upshot: Modifying the ag disaster funding approach, thereby actually saving dollars, and “a number of ideas” elsewhere could bring in a lot more farm bill funding than most think, based on our contacts. Any spending holes that develop from such maneuvers could be dealt with via annual appropriations measures.

— Economist: Lula’s ambitious plans to save the Amazon clash with reality. Brazilian President Luiz Inácio Lula da Silva faces challenges in fulfilling his commitment to stop illegal deforestation in the Amazon by the end of the decade, the Economist reports (link). Although his green agenda has strong support from international climate activists, numerous obstacles are hindering its progress.

Firstly, Lula is less popular in Congress than during his earlier terms and leads a coalition that frequently fails to vote in unison, making it more difficult for him to drive environmental initiatives forward. The agricultural sector has also grown in importance and holds considerable influence in Congress, making efforts to reduce deforestation and preserve indigenous lands more challenging.

Additionally, the state oil firm, Petrobras, remains a powerful entity in Brazil and has ambitious plans to expand oil production in the coming years, including drilling for oil near the Amazon basin, potentially conflicting with Lula's environmental goals. Petrobras's focus on oil nationalism also undermines the push for renewable energy investment.

Lastly, there is a desire to develop the Amazon and surrounding regions to alleviate poverty and stimulate economic growth, with proposals for highways and railways that could further threaten the rainforest.

Bottom line: The article says to successfully realize his green vision, Lula needs to navigate these obstacles while finding ways to align the goals of Brazil's economic growth, agribusiness, and environmental protection.

|

CHINA UPDATE |

— U.S. Secretary of State Antony Blinken will visit China this weekend to try to repair deteriorating ties between Washington and Beijing and maintain open lines of communication. The visit, the first by a senior U.S. official since President Biden took office, follows lower-level engagements and ongoing hostilities. While there, Blinken will discuss the importance of responsibly managing the U.S./China relationship, address bilateral issues of concern, and explore potential cooperation on global challenges.

Senior U.S. officials do not expect significant breakthroughs, but aim to restore a sense of calm and normalcy to high-level contacts. The trip takes place amid escalating concerns about trade, industrial espionage, human rights, and more.

Following his meetings in Beijing, Blinken will travel to London for a Ukraine reconstruction conference.

— Microsoft co-founder Bill Gates recently met with Chinese President Xi Jinping in Beijing, shortly after a visit to the city by Tesla CEO Elon Musk. During their meeting, Xi expressed his delight in seeing Gates, referring to him as an "old friend" and acknowledging their hiatus caused by the pandemic. Xi emphasized that the foundation of Sino-U.S. relations lies in the people and, given the current global climate, proposed engaging in various activities to benefit both countries and humanity. Gates replied by stating he was "very honored" to have the opportunity to meet with Xi.

— China’s weaker-than-expected data for May spurred economists at several banks to lower their growth forecasts for the year. JPMorgan, UBS and StanChart all trimmed their GDP growth forecasts to 5.5% or lower. Expectations are growing that China will boost spending, especially on infrastructure, as part of a broader stimulus push.

Stubborn property sector woes and lagging exports are jeopardizing the country’s post-Covid rebound, the Financial Times reports (link).

— To strengthen its economy, China is planning major spending initiatives that may involve investing billions of dollars in infrastructure and relaxing regulations for property investors, the Wall Street Journal reports (link). These measures are in addition to the People's Bank of China's interest rate cuts and signify growing concerns over the economy's future after the excitement of relaxed Covid-19 restrictions has faded. The steps could involve issuing approximately 1 trillion yuan ($140 billion) in special treasury bonds to assist local governments and boost business confidence. These bonds would be utilized in infrastructure projects and other activities aimed at fostering economic growth, while also helping local governments repay their debts. Additionally, officials are considering lifting purchase restrictions on second homes in smaller cities to support the property market. However, there is skepticism over whether the efforts will result in the desired economic boost, given recent indicators that the economy is struggling.

— To support rural areas of China, the People's Bank of China has announced around 30 measures aimed at aiding the agricultural sector. Some of these measures include financing for major grain producers to expand capacity and upgrade equipment and technology. The central bank's plan requests financial institutions to issue medium- and long-term loans, which will be used for upgrading agricultural facilities and supporting the seed industry. Furthermore, the plan highlights the importance of ensuring grain production and supply. The statement reveals that re-lending and rediscount facilities will also be utilized to help financial institutions in this endeavor.

— Kissinger sees war over Taiwan likely unless US, China back down. Henry Kissinger, former U.S. Secretary of State, has expressed that a military conflict between China and Taiwan is probable if current tensions continue. During an interview with Bloomberg News Editor-in-Chief John Micklethwait, he urged for dialogue to deescalate the situation, warning that both Washington and Beijing should step back from their standoff. Kissinger's comments have significance due to his role in normalizing U.S./China relations in the past. U.S. Secretary of State Antony Blinken is set to visit Beijing this weekend, but no major breakthroughs are expected. China has long aimed to regain control of Taiwan and has warned the U.S. against arms sales or political engagement with the island. Kissinger believes that wars between superpowers are un-winnable, with the biggest threats being the perception of each country towards the other.

Meanwhile, U.S. strategists hope that Russia’s failures and the strong response from the West will give Beijing second thoughts about attacking Taiwan. But Xi Jinping could be drawing different lessons, the Wall Street Journal reports (link).

Conflict could break out in the Taiwan Strait "much sooner" than 2027, and recent American efforts to restore bilateral ties with China could backfire, a U.S. congressman told Nikkei this week (link). Known for his hawkish stance on Beijing, Rep. Mike Gallagher (R-Wis.) chairs the House Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party, launched in January. The situation surrounding Taiwan has entered the "window of maximum danger," he warned. "I think 2027 might be the end of the window, not the beginning of it," Gallagher also said.

— Syngenta gets the nod to launch $9.1 billion Shanghai IPO, anchoring the world’s biggest stock sale this year in China’s commercial hub. The Shanghai Stock Exchange has approved the $9.1 billion IPO of Syngenta Group, taking the Swiss agricultural giant a step closer to completing what could possibly be the world’s largest offering this year. Link to more via the South China Morning Post.

— What does China want from Latin America and the Caribbean? An Economist article (link) says along with trading with the region, it is increasingly important in geopolitical terms.

|

TRADE POLICY |

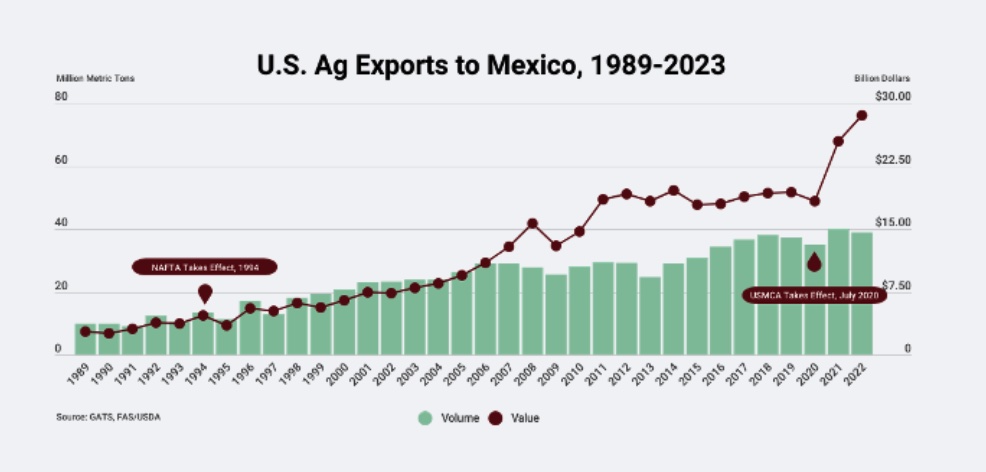

— U.S. has seen consistent growth in agricultural exports to Mexico under NAFTA and USMCA, according to Southern Ag Today (link). In 2022, the U.S. exported 38.9 MMT of agricultural products to Mexico with a value of $28.5 billion, showing significant growth since NAFTA started in 1994 with exports of 13.4 MMT and $4.67 billion. Over the 29 years of free trade, U.S. ag exports to Mexico increased both in terms of volume and value, although there were some years where growth was not positive.

Trade value growth stagnated during the mid and late 2010s, despite volume growth. This is thought to be due to the decreased per unit export value of several major commodities. Nevertheless, value grew significantly over time, as shown in Chart 1: U.S. Ag Exports to Mexico, 1989-2023. While the USMCA coincided with a sudden rise in value in 2020, the pandemic and high inflation were likely factors in this growth.

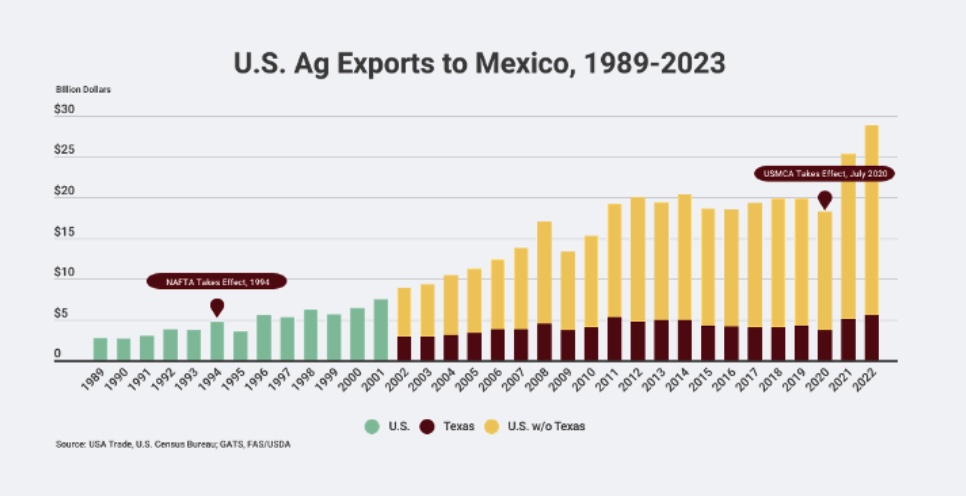

Texas has contributed to the overall growth of U.S. ag exports to Mexico, accounting for 19% ($5.55 billion) of total U.S. ag exports in 2022. Chart 2: U.S. Ag Exports to Mexico, 1989-2023 demonstrates how Texas' export values have increased in 13 of the past 20 years, while the U.S. as a whole increased in 15 of the past 20 years.

|

ENERGY & CLIMATE CHANGE |

— Developers of the Mountain Valley Pipeline are seeking a three-year extension to finish construction and begin operation. They have submitted a request to the Federal Energy Regulatory Commission (FERC), asking for a new deadline of June 18, 2026. The original permit for the pipeline's Southgate Project was set to expire on June 18. The company has experienced numerous delays in the project due to ongoing litigation.

— RFS update. EPA's proposal for volume requirements under the Renewable Fuel Standard (RFS) for 2023-2025 remains under review at the Office of Management and Budget (OMB) as of June 16. The EPA faces a deadline of June 21 to finalize the levels, following a one-week extension from the original court date. There have been 35 meetings at the OMB regarding the plan, with a focus on establishing Renewable Identification Numbers for electricity (eRINs), although reports suggest that this provision may have been removed from the final rule. Although the EPA is required to sign the final rule by June 21, they are not obligated to announce it by that date.

— The Department of Energy (DOE) has announced its plan to invest $135 million in 40 industrial decarbonization projects, as part of the Technologies for Industrial Emissions Reduction Development Program (TIEReD). Managed by the Industrial Efficiency and Decarbonization Office, this effort aims to curb carbon pollution and contribute to a sustainable future. A wide range of universities, National Laboratories, and companies will lead these projects across 21 states. The initiative focuses on various industrial subsectors, including chemicals, iron and steel, food and beverage products, cement and concrete, paper and forest products, and others. The projects will involve research, development, and pilot-scale demonstrations aimed at reducing energy usage and emissions.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Sonora, the second-largest pork producing state in Mexico with 308,499 MT in 2022, has concerns over California Proposition 12's impact on its pork exports to the U.S. This is because their swine production system doesn't align with the guidelines of the new regulation. As an exporting state to Japan and the U.S., Sonora would be negatively affected economically because it provides approximately 10,000 tons of pork annually to the U.S. This equates to over $43 million in income and could be at risk due to Prop 12.

— Support from state governors on legislation to override Prop 12. Republican governors from 11 states representing 54% of US pork production have shown support for the Exposing Agricultural Trade Suppression (EATS) Act, legislation that seeks to override California's Proposition 12. They claim that Prop 12 imposes expensive and unscientific requirements on pork producers, potentially leading to billions of dollars in additional expense. It remains unclear whether the EATS Act will garner enough support to become law, but finding a "must-pass" legislative vehicle could be key.

Meanwhile, Kitty Block, president and CEO of the Humane Society of the United States, said: “The EATS Act presents a shocking threat to animals, consumers, workers, the environment and states’ rights.”

Sara Amundson, president of Humane Society Legislative Fund said, “It’s not California that’s trying to foist its standards on the rest of the country. It’s the pork industry’s trade association that’s trying to force every state to accept the terms of any other state that chooses not to ensure humane treatment, food safety, environmental rules, child labor protection or other standards.

Says one observer: “If they can’t see the irony in these statements, there’s not much hope of a conversation with these people.:

|

HEALTH UPDATE |

— FDA advisors have recommended that upcoming Covid-19 booster vaccines for this fall should target a new strain of the Omicron variant and exclude components targeting the original virus strain. Despite a decline in cases and deaths, Pfizer and Moderna plan to manufacture and sell tens of millions of vaccine doses, estimating significant revenue from Covid-19 vaccines. Protection against hospitalization from last year's boosters decreased, but it didn't overwhelm hospitals due to existing immunity. The FDA recently authorized a second booster focused on both the variant and original strains for adults over 65. Unless a new strain emerges that evades current protection, this new booster will be the only one offered this year. However, analysts predict a drop in Covid-19 vaccine sales, as only 17% of Americans received the updated booster last year.

|

POLITICS & ELECTIONS |

— Report: Latino voters who sat out midterms provide opportunity for GOP in 2024. Amy Walter of the Cook Political Report with Amy Walter says a new report seeks to answer the question of whether Republican gains with Latino voters in 2020 was the start of a trend, or more of a fluke. She writes: “Latinos who voted only in 2020 but not 2018 or 2022 midterms, are more open to voting for Republicans in 2024. Among these voters, Republicans are seen as stronger on issues like inflation, but they also think the GOP ‘prioritizes the rich over working people.’”

— Will Trump's indictment hurt his nomination path? Charlie Cook says, ‘Don’t count on it.” The veteran election watcher writes: “Just because an event is big news does not mean that it will have a big impact. Former President Trump’s 49-page, 37-count indictment is obviously big news, but will it significantly change the contest for the GOP presidential nomination and affect the outcome at the Republican National Convention in Milwaukee exactly 400 days from today? I think not.”

|

CONGRESS |

— Senate panel advances bill for new feed additive category. The Senate Committee on Health, Education, Labor and Pensions this week advanced a bill that would establish a new pathway at the U.S. Food and Drug Administration (FDA) for novel feed additives to increase livestock efficiency and production. The Innovative Feed Enhancement and Economic Development (FEED) Act of 2023 (S1842) by the Senate Committee on Health, Education, Labor and Pensions aims to establish a new pathway at the U.S. Food and Drug Administration (FDA) for novel feed additives that increase livestock efficiency and production.

The FEED Act sets out to modernize the Federal Food, Drug, and Cosmetic Act, paving the way for innovative products to reach the market and advance improvements in food safety. The National Grain and Feed Association (NGFA) has expressed strong support for this bill, highlighting its potential to promote products with novel benefits, such as environmental improvements and reduced human foodborne illness.

The lawmakers who introduced the bill cite examples from Europe, Asia, and South America where feed products have demonstrated increased efficiency in meat production, as well as byproduct and waste reduction. The FDA has also acknowledged that some animal food products do not fit clearly within its existing categories and could use updated regulations.

The Innovative FEED Act would allow products with substantiated claims to be approved as feed additives, offering a more efficient and predictable process compared to the current system that classifies them as animal drugs. To ensure that this new pathway is safe and effective, the bill also establishes guardrails for product eligibility.

— Ultra-right House Republicans are demanding spending cuts far deeper than those agreed to by President Biden and Speaker Kevin McCarthy (R-Calif). This is leading major media to report that the odds are rising for a government shutdown. But these are the same publications/reporters who focused their coverage of the debt-limit package by talking primarily to the naysayers.

|

OTHER ITEMS OF NOTE |

— U.S. federal agencies were targeted on June 15 in a global hacking campaign that exploited a vulnerability in the commonly used file transfer software MOVEit by Progress Software Corp. The cybersecurity watchdog CISA did not identify the affected agencies or provide further details. Stock prices for Progress Software dropped by 4%. The online extortion group Cl0p, which has claimed responsibility for the MOVEit breach, mentioned that they had deleted any data stolen and would not use it against the government agencies involved.

— The U.S. has resumed indirect talks with Iran to restrict Iran's nuclear program. These talks started again late last year after a failed attempt to revive the Iran nuclear deal, which the Trump administration left in 2018. Since then, Iran's nuclear program has grown. Renewed talks face considerable pressure with the approach of the 2024 U.S. presidential election, potential objections from Congress, and concerns from key ally Israel. Additionally, the U.S. is working to secure the release of several detained Americans in Iran, an action the Biden administration considers a high priority.

— The U.S. Supreme Court has just two weeks left to release rulings on 20 remaining cases from October to April. On Thursday, the highest-profile decision was in Haaland v Brackeen, where justices voted 7-2 to uphold the Indian Child Welfare Act. This law from 1978 is aimed at preventing Native American children from being separated from their families and tribes. Justices Alito and Thomas dissented, arguing the law was an example of congressional overreach.

Key decisions anticipated cover topics such as the First Amendment rights of a Christian web designer, President Biden's student debt relief plan, employers' accommodations of religious beliefs, and the constitutionality of race-based affirmative action in university admissions.

— Cotton AWP eases; Special Import Quota announced. The Adjusted World Price (AWP) for cotton declined to 67 cents per pound, effective today (June 16), down from 69.38 cents per pound the prior week.

USDA also announced Special Import Quota #9, the first such quota announcement since November 2022. The quota will be established June 22, allowing the import of 37,110 bales of upland cotton and will apply to supplies purchased not later than September 19 and imported into the U.S. not later than Dec. 18. The quota is equivalent to one week’s consumption of cotton by domestic mills. An import quota is required to be determined and announced if the U.S. Far East price exceeds the prevailing world market price for any consecutive four-week period. That condition was met June 15. While USDA has announced the import quotas, they have been rarely used.

— Bayer settles Roundup suit. As part of a settlement of a lawsuit filed by New York Attorney General Letitia James, Bayer will pay $6.9 million and stop advertising Roundup, an herbicide that contains glyphosate, as safe and nontoxic. Link to more via Reuters.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |