House Ag Chair G.T. Thompson Talks Farm Bill Matters

FOMC decision day: Skip now and boost ahead?

|

In Today’s Digital Newspaper |

We held this dispatch to give you highlights (Policy section) of our interview this morning with House Ag Chair G.T. Thompson.

U.S. Secretary of State Antony Blinken spoke to China’s foreign minister, Qin Gang, ahead of an expected visit to Beijing. Qin urged America to “stop interfering” in China’s affairs, while Blinken advocated for communication “to avoid miscalculation and conflict”. Blinken’s planned visit to China in February was postponed after a suspected Chinese spy balloon was shot down over American territory. More in China section.

Russian missiles killed six people in Odessa, a city in southern Ukraine, and Donetsk, an eastern region, according to local officials. The strikes came as Vladimir Putin, Russia’s president, claimed without evidence that Ukraine had suffered “catastrophic losses” in its counter-offensive. Putin also ruled out the need for any further mobilization in Russia.

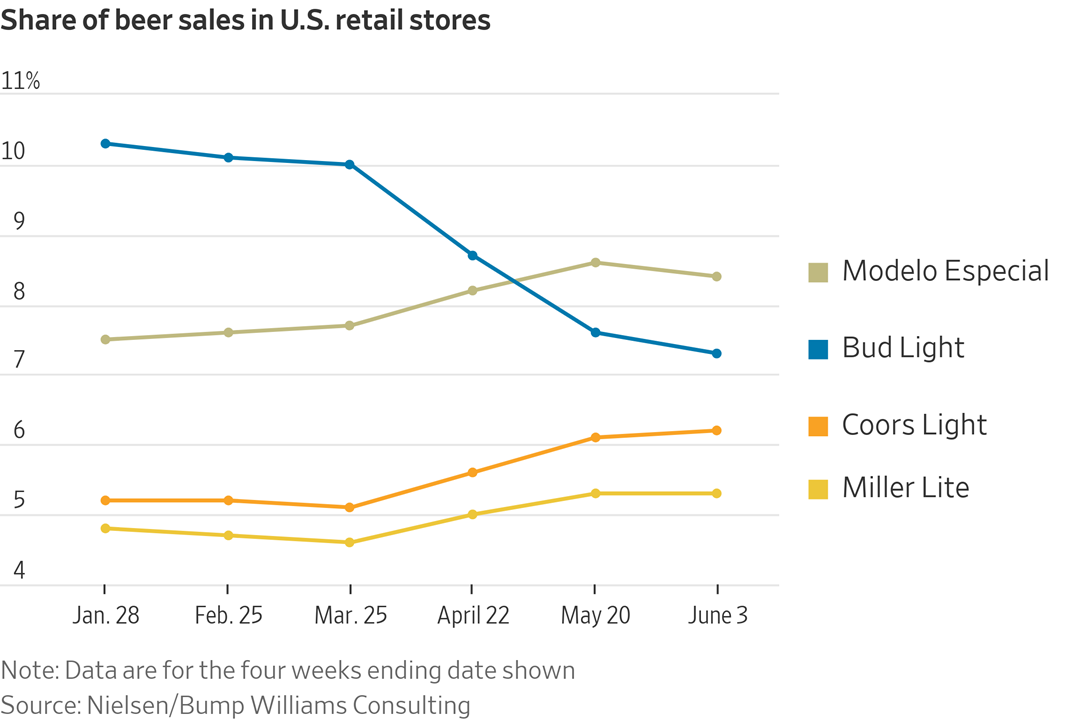

Anheuser-Busch InBev's Bud Light has lost its crown as the top selling beer in the U.S. to Constellation Brands' Modelo Especial. Modelo took the lead with 8.4% of U.S. retail-store beer sales in the four weeks ended June 3, compared with 7.3% for Bud Light, according to an analysis of Nielsen data by consulting firm Bump Williams.

U.S. Treasury Secretary Janet Yellen stated that the dollar's share of global reserves will likely decline slowly, but it will not be replaced entirely as there are no viable alternatives.

IEA: Oil demand to peak this decade as EVs boom.

West Coast ports have received some breathing room in their ongoing labor negotiations as the dockworkers' union and port employers agreed to a grace period this week.

Jared Bernstein, a top economic adviser to President Biden, was narrowly confirmed by the Senate Tuesday night to serve as chairman of the White House's Council of Economic Advisers (CEA).

International investors' negative sentiment towards Chinese IPOs has led American investment banks to abandon potential listings.

New Midwest battles brew over CO2 pipelines, with environmental and property rights concerns.

EPA has until the end of June 21 to finalize RFS quotas under an agreement reached with ethanol advocacy group Growth Energy and filed with a Washington, DC-based U.S. District Court. But what few are reporting: This may not mean EPA will announce the mandates on June 21. More in Energy section.

EPA has not yet set a timeline for finalizing its January 2021 Notice of Proposed Rulemaking (NPRM) regarding E15 fuel labeling and underground storage tank (UST) compatibility.

The Inflation Reduction Act's clean-energy tax credits ended up costing significantly more than initially projected. Details in Energy & Climate Change section.

The Biden administration's spring regulatory agenda outlines the potential timeline for several livestock-related actions. Details in Livestock section.

|

MARKET FOCUS |

Equities today: Global stock markets. In Asia, Japan +1.5%. Hong Kong -0.6%. China -0.1%. India +0.1%. In Europe, at midday, London +0.5%. Paris +0.9%. Frankfurt +0.6%. The U.S. Dow is currently down around 150 points.

U.S. equities yesterday: All three major indices scored gains as a US inflation report had market participants all but assured the Fed will keep rates steady when its two-day meeting concludes this afternoon. The Dow ended up 145.79 points, 0.43%, at 34,212.12. The Nasdaq gained 111.40 points, 0.83%, at 13,573.32. The S&P 500 rose 30.08 points, 0.69%, at 4,369.01.

A federal judge in California has temporarily blocked Microsoft's $69 billion acquisition of Activision Blizzard due to a restraining order while the FTC challenges the deal. This ruling keeps the companies apart for five days following a decision on a more permanent pause. This comes after Microsoft faced opposition from U.K. competition regulators, a decision they are currently appealing.

Bud Light loses title as top-selling U.S. beer. Modelo Especial overtook Bud Light as the top-selling U.S. beer in May, punctuating a monthslong boycott of Bud Light that has reshuffled the beer industry. Bud Light’s sales have tanked since April, when transgender influencer Dylan Mulvaney posted an image on Instagram of a personalized Bud Light can that the brand had sent her as a gift. Link for more via the WSJ.

Nvidia, a chipmaker, ended trading on Tuesday with a valuation over $1 trillion, becoming the seventh American company to do so. Shares in the firm have risen 181% this year, driven by booming demand for its semiconductors, which power generative artificial-intelligence systems. Nividia’s stock closed at $410.22, having risen 3.9% over the day. Its market capitalization stood at around $1.01 trillion.

Agriculture markets yesterday:

- Corn: July corn futures fell 4 3/4 cents to $6.12 1/2 and was the only contract in the complex to close lower on the day as December futures rallied 2 cents to $5.51 1/4.

- Soy complex: July soybeans rose 26 1/2 cents to $13.99 1/4, finishing the session above the 40-day moving average for the first time in nearly two months and marking the highest close since May 15.

- Wheat: July SRW futures rallied 2 1/2 cents to $6.36 1/4, the highest close in five weeks. July HRW futures fell 4 3/4 cents to $7.91 3/4 after being up as much as 10 cents, while July spring wheat fell 4 1/2 cents to $8.09 3/4.

- Cotton: July cotton fell 77 points to 82.72 cents, ending the session below the 100- and 40-day moving averages.

- Cattle: Cattle futures bounced from early losses today and closed near the daily highs. The expiring June contract settled at $179.425, up 35 cents, while most-active August rose 72.5 cents to $173.925. August feeder futures rallied $1.40 to $240.45.

- Hogs: Hog futures were mixed Tuesday, with nearby contracts weak and the deferred rising. The expiring June contract slipped 5 cents to $87.125, while August edged up 5 cents to $87.425.

Ag markets today: Corn and soybeans pulled back from their recent gains during overnight trade. Wheat was led lower by HRW contracts amid increased harvest activity. As of 7:30 a.m. ET, corn futures were trading 4 to 6 cents lower, soybeans were 3 to 4 cents lower and wheat futures were 4 to 10 cents lower. Front-month crude oil futures were around 90 cents higher, and the U.S. dollar index was about 200 points lower this morning.

Market quotes of note:

- Sevens Report on what’s expected from FOMC: “No rate hike. The 2023 dots show one additional rate hike at 5.375%. Likely Market Reaction: A mild rally, depending on how hawkish Powell is at the press conference. Market momentum is higher, and if the Fed meets expectations and pauses and signals the possibility of one more rate hike in 2023, it’ll enable momentum to stay higher. We’d expect the growth on trade to continue as this would bolster the Immaculate Disinflation possibility… Bond yields should be mostly little changed on this outcome as it’s already priced in, while the dollar could see a mild bounce and commodities a mild decline, but that’d mostly be driven by the undoing of yesterday’s rally. Bottom line, this outcome is largely expected and reflected in current levels across most assets.”

- China: “You will go where opportunity comes your way.” — Saudi Energy Minister Prince Abdulaziz bin Salman, on the kingdom’s growing trade ties with China.

On tap today:

• U.S. producer price index for May is expected to fall 0.1% from the prior month. (8:30 a.m. ET)

• Federal Reserve releases a policy statement and economic projections at 2 p.m. ET, and Chair Jerome Powell holds a press conference at 2:30 p.m. ET.

• China retail sales, industrial output and investment data for May are due out at 10 p.m. ET.

Most expect the FOMC to “skip” regarding interest rates when it releases its decision at 2 p.m. ET. The Federal Reserve is set to release its dot plot, which gives insight into officials' expectations of future interest rates. Investors remain uncertain about potential outcomes in July. Current predictions for July show a 63% chance for a 25-basis-point increase and a 34% chance rates will hold, as per CME Group's FedWatch tool. Uncertainty around interest rates could potentially increase market volatility, although the VIX remains low and the S&P 500 is at a 14-month high. Market conditions are currently driven by an abundance of cash, leading to investments in riskier assets, but concerns over a liquidity crunch loom. Markets are usually calm before the Fed's announcements, but U.S. producer price inflation data, to be released at 8:30 a.m. ET, may induce some movement. Despite uncertainty around interest rates, U.S. Treasury yields increased on Tuesday after inflation data, with the 10-year yield reversing 4 basis points this morning.

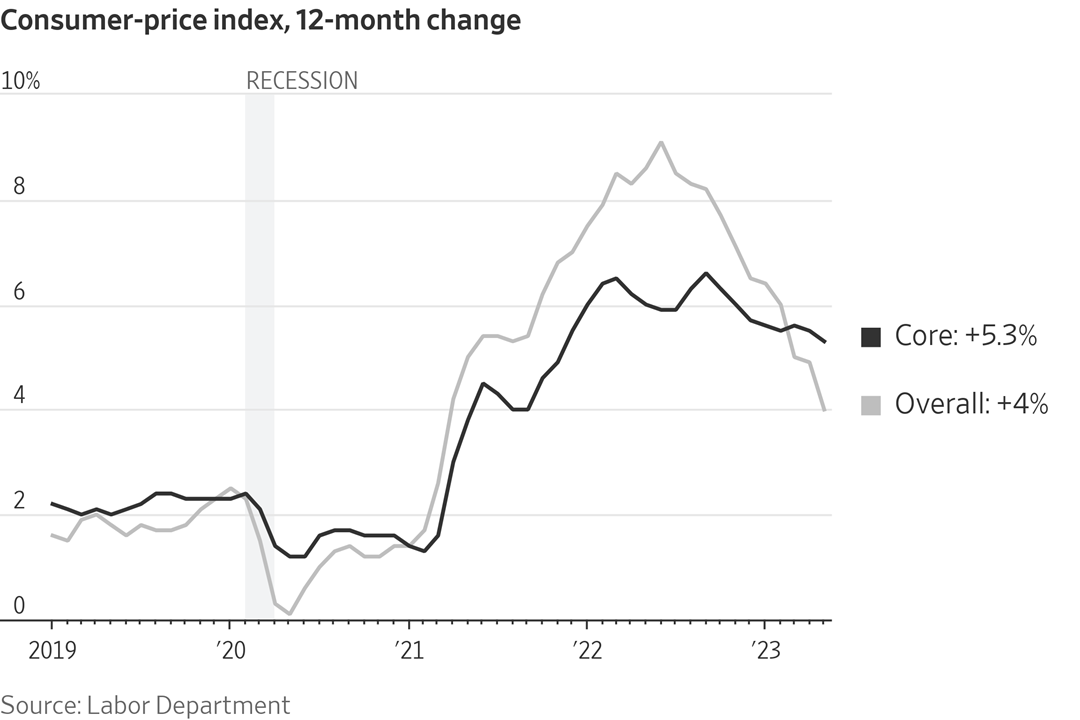

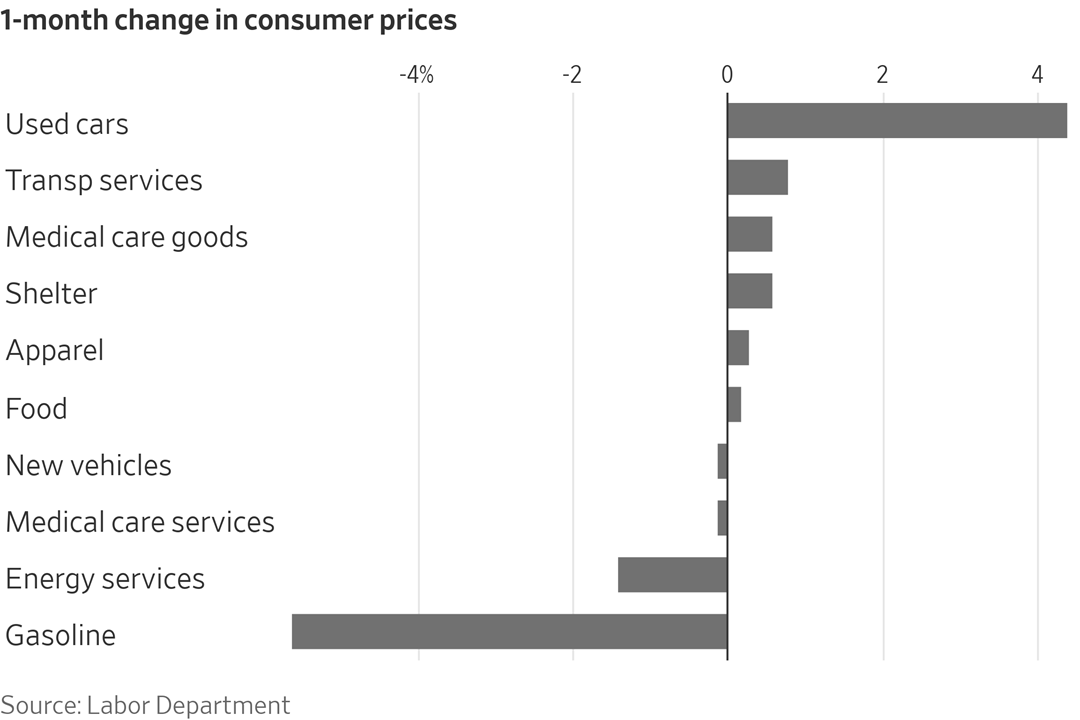

Overall consumer prices increased a seasonally adjusted 0.1% in May from the prior month, down from April’s 0.4%. Core consumer prices rose 0.4% in May from the prior month, the same pace as in April and March, suggesting underlying price pressures remain firm.

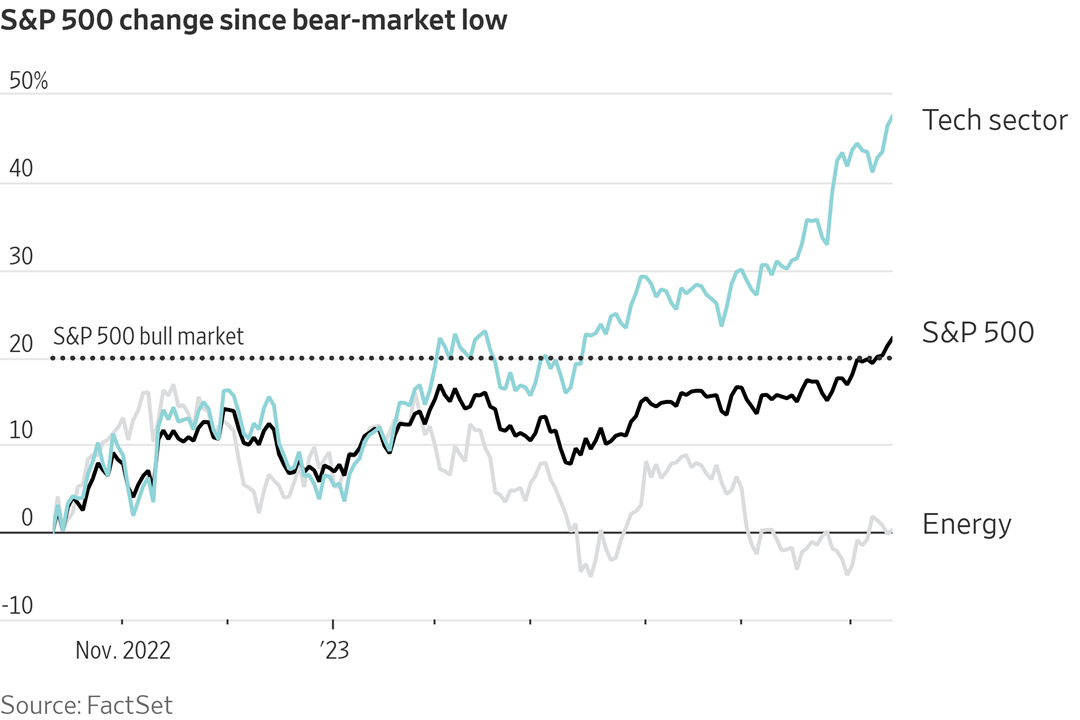

Stock market to Fed: You haven’t done enough. Federal Reserve officials plan to take a break from raising interest rates Wednesday because they think monetary policy is already plenty tight. To which the markets say: no, it ain’t. The Fed’s mission has been to get interest rates high enough to slash inflation from its current 4%-5% range to 2%, even if that means pushing the economy into recession and unemployment higher. If the Fed had succeeded, you probably wouldn’t be seeing these things: stocks entering a new bull market, a rebounding housing market or long-term Treasury yields well below the inflation rate. In other words, the premise behind the Fed’s pause is suspect, the Wall Street Journal’s Greg Ip writes (link).

U.S. Treasury Secretary Janet Yellen stated that the dollar's share of global reserves will likely decline slowly, but it will not be replaced entirely as there are no viable alternatives. Speaking at a House Financial Services Committee meeting, Yellen acknowledged that U.S. sanctions have led some countries to consider other currencies, yet the dollar remains dominant due to factors like deep liquid open financial markets, strong rule of law, and an absence of capital controls.

Yellen maintained that even traditional allies, like France using non-dollar transactions, have not found meaningful workarounds for using the dollar as a reserve currency. She also noted that the gradual increase in the share of other assets in countries' reserve holdings is a natural progression in a growing global economy.

The dollar's reserve status has been eroding over the past two decades, with a steep decline in 2022, but it remains strong in international trade. Some central banks are looking to gold as an alternative way to reduce their reliance on dollar reserves. However, Yellen cautioned that U.S. lawmakers are not helping the dollar's standing when they prolonged the debt ceiling crisis, which undermines global faith in America's ability to meet its debt obligations and weakens the greenback's reputation.

Britain’s economy returned to growth in April as GDP increased by 0.2% compared with the previous month. The expansion, which partially reversed a 0.3% contraction in March, was driven by the services sector. The positive GDP figures, coupled with strong labor-market data released on Tuesday, increase the chances that the central bank will raise interest rates again next week.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker ahead of wholesale inflation data, with the euro and British pound both slightly higher against the greenback. The yield on the 10-year US Treasury note was weaker ahead of the U.S. Fed meeting conclusion, trading around 3.81%, while there was a mixed tone in global government bond yields. Crude oil was firmer ahead of U.S. gov’t inventory data due later this morning, with U.S. crude around $69.80 per barrel and Brent around $74.80 per barrel. Gold and silver futures were, with gold around $1,960 per troy ounce and silver around $23.93 per troy ounce.

• Saudi Aramco allocates full volumes despite cut. According to media reports, Saudi Arabia’s national oil company has assured its Asian term buyers that they would get full crude volumes they had asked for in July, despite committing to a 1 million b/d production cut.

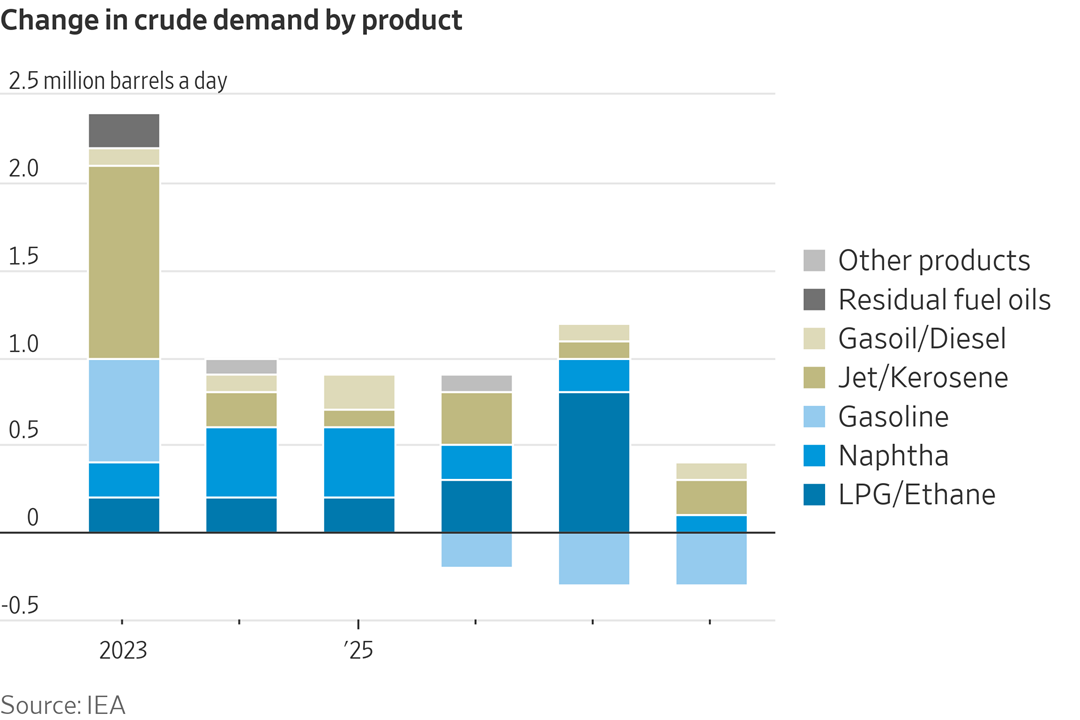

• IEA: Oil demand to peak this decade as EVs boom. Rising demand for crude oil is set to slow to a trickle within five years and peak before the end of the decade, as electric-vehicle uptake surges and developed nations rapidly transition to cleaner sources of energy, according to a prominent energy forecaster. But the International Energy Agency (IEA), a group funded by some of the world’s largest oil consumers, said the oil-market outlook appears sharply different in the near term as Asian economies ramp up demand, and OPEC and its allies constrain output.

• The West Coast ports have received some breathing room in their ongoing labor negotiations as the dockworkers' union and port employers agreed to a grace period this week. This comes after Labor Secretary-designate Julie Su meditated between both parties in attempts to ease tensions and resolve job actions that have affected cargo handling. While the situation remains urgent due to fears of a broader slowdown, the major issue still dividing the two sides is wages, which has proven to be a significant obstacle in the talks.

• Ag trade: Taiwan purchased 56,000 MT of U.S. milling wheat.

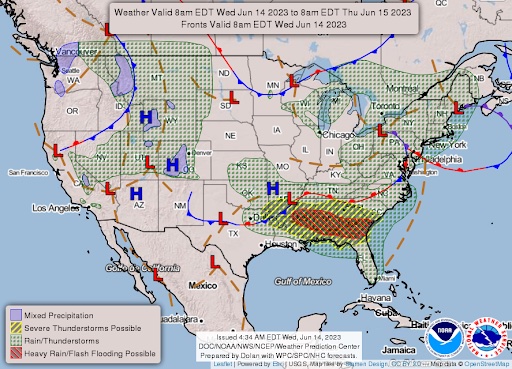

• NWS weather outlook: Significant severe thunderstorms and heavy rain are possible across parts of the Lower Mississippi Valley and Southeast today... ...Unsettled and cool weather forecast across the Northeast, Great Basin, and Rockies through the end of the week... ...Record-breaking and oppressive heat anticipated to expand throughout much of Texas.

Items in Pro Farmer's First Thing Today include:

• Grains face pressure overnight

• Argentina competition bureau to review Bunge/Viterra merger

• France cuts wheat export forecast

• Choice beef continues to climb

• Pork prices strengthen and movement improves

|

RUSSIA/UKRAINE |

— Russian President Vladimir Putin admitted at a meeting of pro-war bloggers that his armed forces are facing shortages of essential military equipment, which has impeded their progress in the war in Ukraine. Shortages include precision-guided munitions, communications equipment, aircraft, and drones, among other things. Moscow is striving to increase weapons production to close this gap, even claiming a nearly threefold overall increase and a tenfold increase for highly in-demand equipment.

Lack of precision-guided munitions has hindered Russia's invasion strategy, forcing their military to rely on less accurate weapons like poorly navigated drones and naval missiles targeting residential buildings. A study by the Center for Strategic and International Studies revealed that Western sanctions have blocked Russia from obtaining necessary components to build advanced weaponry, causing a decline in their military equipment quality. In contrast, Ukraine's arsenal has improved because of Western aid, including the recent acquisitions of British Challenger 2 and German Leopard 2 tanks.

— The U.S. previously warned Ukraine in June not to attack the Nord Stream pipelines, which transport Russian natural gas to Europe. This followed a tip from the Dutch military intelligence service concerning a Ukrainian plot to target the pipelines. CIA officials took the warning seriously, but questioned whether Kyiv had the capacity to carry out such an underwater attack. Despite this, the pipelines were struck on Sept. 26. Ukraine has denied any involvement in the incident.

— The Biden administration unveiled a $325 million military assistance package for Ukraine, which includes Bradley fighting vehicles, Stryker armored personnel carriers, Javelin anti-armor systems, artillery rounds, TOW missiles, munitions for surface-to-air missile systems, and communications equipment. These supplies will support Ukraine's efforts in their ongoing counteroffensive to remove Russian forces from the invaded territory. This is the 40th time the administration has used its Presidential Drawdown Authority to provide such aid.

— Ukraine’s grain exports slightly behind year-ago. To date, Ukraine exported 47.1 MMT of grain in the 2022-23 marketing year, 700,000 MT behind last year’s pace for mid-June. That total included 27.9 MMT of corn, 16.2 MMT of wheat and 2.7 MMT of barley.

|

POLICY UPDATE |

— Highlights of AgriTalk/Pro Farmer/Signal to Noise interview with House Ag Chair G.T. Thompson (R-Pa.) (slightly edited for clarity).

Question: Do the current issues between House Speaker Kevin McCarthy and the far-right House GOP members mean no additional funding for a new farm bill?

Thompson: “No. Absolutely not. There's no real bearing or implications that I see with a small group of folks who have really tried to hold the House hostage here. You know, Speaker McCarthy has been a great ally. To me, a great ally in the farm bill process so far. I mean, he understands the seriousness of it, the logistics to make it happen, what's needed. One important point is: We’ve never had Republican leadership rowing in the same direction when it comes to a farm bill as it now is with Speaker McCarthy, Scalise, Stefanik and Whip Emmer. They are all great champions and proponents for the farm bill. We're working together on everything from member education, to quite frankly, future whip operations. As our Budget Views and Estimates letter said, there really is no better return on investment when it comes to federal funding. The agriculture industry provides 46 million jobs, $2.6 trillion in wages, over $947 billion in tax revenue, and $202 billion in exports, and $8.6 trillion in economic output. That is why agriculture is this nation's number-one industry.”

Question: You listed those figures and they're good ones for the ag sector. Does that mean you've convinced House Speaker McCarthy for additional funding beyond the baseline because some mainstream farm groups say they'd rather have an extension than a baseline farm bill?

Thompson: “An extension is short sighted, and it really falls short of us making the refinements needed. I use a baseball analogy when it comes to the farm bill: We're rounding first base, and that means we're really doing a great job and probably beginning to wrap up the fact-finding, the audit phase. And we're going to be, I think, on course to do this by what I've always committed to completing a farm bill on time. We've made the case again that a successful farm bill enhances our farm safety net for our producers and a baseline funded bill does not mean that we can't make program improvements. But whether the bill passes this year or after an extension, but I'm not rooting for the extension. We must invest in the safety net for our farmers and ranchers. I think the Speaker heard that loud and clear from those in attendance in Tulare, California, when we were at the world agriculture exposition. Many of those were his own constituents, by the way, in the central valley. We need to find new dollars. And I think one of the allies that we haven't had is quite frankly Budget Chairman Jody Arrington (R-Texas). He's a great aggie himself. I think there are efficiencies that can bring us some new dollars, just as we look at incorporating some of the disaster relief that we normally spend in an emotional way. Anytime you do that you don't do it efficiently. The Senate usually puts in some additional legislation on must-pass pieces of legislation. It would spend a lot of money and not all that very smartly. By incorporating some of that disaster relief into crop insurance, we will enhance crop insurance, make it more attractive for more subscriptions. At the same time. I think we can do that by spending less money, so we'll bring new dollars in and that's just one of a number of ideas we have when there's a recognition that in certain areas, certain titles of the farm bill, we need to find some new dollars.”

Follow up question: You can move around dollars even though Senate Ag Chair Debbie Stabenow (D-Mich.) has said don't go into one area to get more funding elsewhere?

Thompson: “The House will chair the farm bill this time around. But I think there's dollars to be had and common sense tells us especially when we've been going through such an emotional time of spending, look at the trillions of dollars just in the past two and a half years. We're talking trillions of dollars. You can't tell me some of that was not spent emotionally and was appropriated. The funding is sitting out there in different corners of the federal government. And I'm talking things specific to agriculture.”

Question: Will some of those refinements include a voluntary update of base acres chairman, because soybean and other grower groups want that, while others don't. But getting base acre data is like looking into a black hole trying to get accurate data. We understand your committee staff is working with USDA to get some information. Is that correct?

Thompson: “We definitely are working on a deep dive on all the information we need, and base acres is one of those areas. This is something you need to have good data to be able to do. Having base acres is like winning the lottery. What about those new young and beginning farmers that do not have base acres, but we're relying on them to feed us well into the future for decades? So their base acres is something that has come up a lot in our listening sessions across the country and it's certainly something we're looking at right now. We really don't have any conclusions at this point.”

Question: On food stamps, we know you've been wanting to expand language beyond what the debt limit package included… you want to expand career and technical education to those excluded from the work requirements for food stamps. Is that correct?

Thompson: “There's a lot that we need to look at. I was pleased that the Speaker came to me and asked me what we should put forward in the debt ceiling. He wanted something that was going to perhaps save some money and at the same time, not blow up the farm bill process. And we were able to accomplish that. Just the fact that we reduced the percentage of waivers that states can use. We zeroed out as of the first of the year… hundreds of thousands of waivers states stockpiled basically exempting anyone from having access to the SNAP employment and career and technical education benefits. I was very disappointed of what the president and his people put into the debt ceiling package related to this. They basically excluded folks who are homeless, people who are veterans and young adults 18 year old… foster youth who all of a sudden overnight become adults and therefore some of them leave their foster homes with all their life belongings in a garbage bag. This is a pretty sad situation. They essentially put language into the debt ceiling measure that prevented anyone within those three groups of having access to the SNAP employment, career and technical education benefits that we provide by waiving that opportunity for them. That's something we need to look at.”

Question: Will you seek to get language in the farm bill to curtail USDA’s ability to tap the Commodity Credit Corporation Charter Act for funding. House Republicans in the FY 2024 appropriations bill includes this language. Will that also be a topic in the farm bill debate?

Thompson: “It's certainly going to be a topic. As you noted, the current proposed bill from the Ag Appropriations Subcommittee reinstated some guardrails that would limit the Secretary's discretionary authority to use the CCC and then, quite frankly, that's where it belongs. That could be very, very helpful if it survives the appropriation process. You know, a recent GAO report reinforced the fact that the climate smart commodity pilot program should have gone through a rulemaking process. And Secretary Vilsack circumvented Congress and while I like working with the secretary… I think we have a good relationship… I was not happy with what happened there. You know, from the Ag committee's perspective, I'm concerned that using the farm bill to legislate sideboards around USDA interpretations of the CCC authority would impede the ability of a future Ag Secretary so we should exercise our oversight authority, and we are definitely doing that at this point.”

|

PERSONNEL |

— Senate confirms new CEA chair. Jared Bernstein, a top economic adviser to President Biden, was narrowly confirmed by the Senate Tuesday night to serve as chairman of the White House's Council of Economic Advisers (CEA). Bernstein, who has served as a CEA member during the Biden administration and previously worked as then-Vice President Biden’s chief economist, won Senate confirmation in a 50-49 vote. Sen. Joe Manchin of West Virginia, a Democrat, opposed the nomination.

|

CHINA UPDATE |

— Chinese Foreign Minister Qin Gang urged the U.S. to respect China's sovereignty, security, and development interests and to stop undercutting them. In a phone call with U.S. Secretary of State Antony Blinken, Qin emphasized the need for both nations to act on the consensus reached during a meeting between Chinese leader Xi Jinping and President Joe Biden in Bali. This includes effectively managing differences, promoting exchanges, and enhancing cooperation.

The communication comes after a series of high-level exchanges between Beijing and Washington amidst strained ties, which worsened after an alleged Chinese spy balloon was shot down in U.S. airspace earlier this year.

During their call, Qin reiterated Beijing's strong stance on core concerns like Taiwan, emphasizing the importance of respect and non-interference. Despite tensions, there have been signs of improved relations in recent months, as highlighted by several high-level engagements.

— International investors' negative sentiment towards Chinese IPOs has led American investment banks to abandon potential listings. The challenging market circumstances for Chinese companies aiming to go public on international stock exchanges arise from factors like falling stock prices, increased political tensions between the U.S. and China, and a slow economic recovery in China. Even smaller deals are now hard to close due to these unfavorable conditions.

|

TRADE POLICY |

— The European Union Wednesday charged Google with violating the bloc’s antitrust laws by favoring its own online advertising technology to the “detriment of competing providers,” marking the latest regulatory blow to the American tech giant. The European Commission — the EU’s executive arm — said its investigation found Google is throttling competition by leveraging its position as the region's most dominant provider of ad-buying tools for advertisers and ad-serving tools for publishers. The commission’s preliminary findings suggest any behavioral remedy would be ineffective and that “mandatory divestment” — i.e. selling a part of its business — may be the only way to resolve the competition issues.

|

ENERGY & CLIMATE CHANGE |

— New Midwest battles brew over CO2 pipelines, with environmental and property rights concerns. Stateline reports (link) that in the quiet prairie town of Granite Falls, Minnesota, a small hydroelectric plant provides power, but the real energy powerhouse is the Granite Falls Energy plant producing 63 million gallons of ethanol annually. Ethanol production is a significant part of the state's economy, with 45% of U.S. corn production destined for ethanol plants. However, the industry is in a crossroads as proposed pipelines to move carbon dioxide, a byproduct of ethanol production, face controversy.

Proponents believe that carbon dioxide storage can open new ethanol markets, secure federal tax credits, and prevent emissions. However, opponents argue that pipelines threaten property rights, land productivity, values, ancestral grounds, and the environment. They contend that ethanol use delays the shift to carbon-free energy, and even climate change deniers oppose the pipelines.

Currently, the proposed pipeline network is at a much larger scale than existing pipelines that carry carbon dioxide from ethanol. Three carbon pipeline companies anticipate construction to begin in 2024. State officials across the Midwest grapple with whether and how to approve the pipeline projects, leading to legislative battles over property rights and eminent domain.

Pipeline opponents are fighting for stronger eminent domain requirements to protect landowners' rights. While some pipeline proponents emphasize that eminent domain will be used as a last resort, opponents remain skeptical. Landowners are also concerned about the safety of the high-pressure pipelines and the potential challenges they pose for local first responders.

— EPA has until the end of June 21 to finalize RFS quotas under an agreement reached with ethanol advocacy group Growth Energy and filed with a Washington, DC-based U.S. District Court. The delay could allow EPA to incorporate more data on biofuel production into the final rule.

Growth Energy expects “a robust final rule that strengthens the RFS and enhances the biofuels industry’s ability to decarbonize the transportation sector,” the group’s CEO, Emily Skor, said in an emailed statement.

EPA previously had agreed to finalize mandates for 2023, 2024 and 2025 by June 14 under a settlement agreement with the group.

Note: The filing stated June 21 is “EPA’s deadline to sign a final rule. Based on the parties’ discussions and mutual understandings, the parties so stipulate with the understanding that EPA will not seek a further extension of any deadline established by the decree.” That does not necessarily mean EPA will announce it by that timeline.

— E15 and underground storage tank compatibility. EPA has not yet set a timeline for finalizing its January 2021 Notice of Proposed Rulemaking (NPRM) regarding E15 fuel labeling and underground storage tank (UST) compatibility. In the NPRM, the EPA suggested two possible changes to E15 labels: altering the text and color or removing the label requirement altogether. Moreover, the proposal highlighted the need for future UST equipment to be compatible with higher ethanol blends while also addressing ways to demonstrate the compatibility of existing UST systems.

In the spring regulatory agenda, the EPA again classified this plan as a long-term action, indicating that a regulatory decision will not likely occur within 12 months of the agenda's publication. Many experts believe that E15 sales will face constraints from both seasonal sale restrictions and limited availability to consumers without the addition of supporting infrastructure.

— The Securities and Exchange Commission (SEC) plans to release their final rule on the controversial climate reporting rule in October, according to the Biden administration's spring regulatory agenda. The original target for finalizing the rule was 2022, but the comment period was extended until November 2022. The rule will primarily focus on reporting requirements for Scope 1 (direct greenhouse gas emissions), Scope 2 (indirect emissions from energy sources), and Scope 3 (certain types of GHG emissions from upstream and downstream supply chain activities). Agriculture interests, including the American Farm Bureau Federation, have expressed concerns about the possibility of farmers being required to report their GHG emissions under Scope 3. They have urged the SEC to explicitly exempt farmers from reporting under that portion of the rule.

— The Inflation Reduction Act's clean-energy tax credits ended up costing significantly more than initially projected. Originally estimated at $270 billion for the next decade, the nonpartisan Joint Committee on Taxation now projects the cost at $663 billion, while other experts predict it could reach up to $1.2 trillion in 10 years.

This disparity has fueled a debate between Republicans and Democrats. Republicans argue that Democrats vastly underestimated the cost of the subsidies and their impact on the economy, while Democrats contend that the increased uptake of these tax credits is good for the environment.

In response to the growing cost, House Republicans are attempting to repeal some of the tax credits to offset the expense of a tax-cut package. In contrast, Democrats say that the increased popularity of clean-energy credits will help the country reduce emissions and limit the damage caused by climate change.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— The Biden administration's spring regulatory agenda outlines the potential timeline for several livestock-related actions. Among these is a Notice of Proposed Rulemaking (NPRM) for cell-based meat labeling, expected by the end of the year. There are also plans under the Packers and Stockyards Act: a) an NPRM for poultry grower payment systems and capital improvement systems in July, b) a final rule for transparency in poultry grower contracting and tournaments, expected this month (June) but not sent to the Office of Management and Budget for review yet, c) an NPRM on revised regulations concerning conduct that could violate the Act in November, and d) a final rule on inclusive competition and market integrity targeted for September. Additionally, USDA plans to release a final rule in August outlining organic livestock and poultry standards.

— The Biden administration's spring regulatory agenda proposes two key actions for the meat industry. The first revolves around allowing beef imports from Paraguay by the Animal and Plant Health Inspection Service (APHIS), with a final decision targeted for March 2024. However, the actual date is still subject to change based on APHIS evaluation of public comments. The second action pertains to "Product of USA" labeling, where the Food Safety and Inspection Service (FSIS) plans to release a final decision in May 2024. FSIS proposed that the "Product of USA" and "Made in USA" labels to be used for meat products from animals that were born, raised, slaughtered, and processed in the U.S. In the meantime, FSIS is reviewing comments on the proposed rule. Additionally, APHIS is expected to release a final rule on cattle ID tags requiring both visual and electronic readability by February 2024. The Product of USA labeling effort is being monitored by Canada and Mexico to assess potential impacts on them.

|

CONGRESS |

— Yesterday, the House passed the Gas Stove Protection and Freedom Act with a 248-180 vote. The legislation, introduced by Rep. Kelly Armstrong (R-N.D.), had been postponed for nearly a week due to negotiations between Speaker Kevin McCarthy (R-Calif.) and the ultraconservative House Freedom Caucus. The bill aims to prevent the Consumer Product Safety Commission from banning gas stoves or imposing regulations that would significantly increase their cost. The decision comes after a commission member claimed not to have ruled out a ban, although the Biden administration later clarified that a ban was not being considered.

Additionally, the House approved an amendment by Rep. Lauren Boebert (R-Colo.), one of 11 members of the hard-right Freedom Caucus who delayed the bill's consideration. The amendment extends the bill's restrictions to any type of appliance based on its fuel source. The delay came out of frustration over McCarthy's handling of debt ceiling negotiations.

Today, the House is expected to consider another bill to prevent the Energy Department from establishing proposed efficiency standards for gas and electric stoves. However, both bills targeting gas stove regulations are likely to fail in the Democratic-controlled Senate. The White House has stated that President Biden opposes these measures, but it has not issued a veto threat.

— House appropriators today are reviewing the Agriculture spending bill in full committee. The bill drafted by the subcommittee proposes $25.3 billion in discretionary spending for USDA, Food and Drug Administration, Commodity Futures Trading Commission (CFTC), and related agencies. Subcommittee Chairman Andy Harris (R-Md.) described the bill as an attempt to maintain a balance between needs and spending. However, Democrats argued that the inclusion of funds for the CFTC, which was previously in the Financial Services bill in fiscal 2023, masks reductions in the Agriculture spending bill.

The markup follows GOP leaders ceding to pressure from ultra-far-right lawmakers to tighten spending. Appropriations Chairwoman Kay Granger (R-Texas) stated that overall appropriators would match funding levels for fiscal 2022 based on caps agreed upon in the debt ceiling law signed earlier this month.

However, the Senate maintains a different perspective. Senate Appropriations Chair Patty Murray (D-Wash.) has stated that the Senate plans to adhere to the agreed-upon caps in the new law.

Of note: The bill would be funded in part by restricting USDA Secretary Tom Vilsack’s use of the Commodity Credit Corporation Charter Act. The provision would reinstate a restriction Republicans lifted so that then-President Donald Trump could issue payments to farmers for his trade war with China.

Bottom line: The Senate will have a far different approach to FY 2024 spending matters and thus this House bill is simply a message bill by ultra-far-right Republicans.

— Coalition opposes Packers and Stockyards rider. A coalition has requested that the House Appropriations Committee remove a policy rider from the fiscal year (FY) 2024 Agriculture Appropriations bill during Wednesday's markup. The organizations argue that the rider would prevent USDA from properly preparing and implementing rules to strengthen the Packers and Stockyards Act — a law designed to protect farmers and ranchers from abusive and anti-competitive behavior. Link to letter.

Billy Hackett of the National Sustainable Agriculture Coalition (NSAC) argued that using an appropriations bill to block improvements to the Packers and Stockyards Act was improper. He emphasized the importance of promoting transparency and competition in the market through the ongoing public process to modernize the Act.

National Farmers Union President, Rob Larew, also expressed concerns that the funding bill would limit USDA's ability to update and enforce the law effectively. The signers of the letter include the NSAC, National Farmers Union, and the Farm Action Fund.

— House hearing could be springboard for border impeachment. A House Homeland Security hearing today could potentially lead to an investigation and subsequent impeachment of Homeland Security Secretary Alejandro Mayorkas. Chad Wolf, who acted as the secretary under former President Donald Trump, as well as former Border Patrol and Citizenship and Immigration Services heads, are scheduled to testify.

Background. House Speaker Kevin McCarthy (R-Calif.) and members of his caucus have accused Mayorkas of mismanaging operations at the U.S. southern border and have called for his resignation. They have also promised to investigate him before initiating a possible impeachment inquiry. Four Republicans, including Georgia Rep. Marjorie Taylor Greene, have filed impeachment resolutions against Mayorkas, but these haven't gained momentum.

Mayorkas has attributed the current situation to Congress not providing sufficient resources for border policy enforcement.

Meanwhile, the Senate Homeland Security panel is voting on Wednesday on legislation (S 1444) to increase pay for border agents, and (S 1253) to authorize additional funding for Customs and Border Protection to hire more officers and support staff.

|

OTHER ITEMS OF NOTE |

— Child labor in agriculture. A new initiative, aimed at the cocoa, coffee and cotton sectors, seeks to reduce child labor in agriculture, which accounts for 70 percent of child labor worldwide. Link for details.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum | Debt-limit/budget package |