March Inflation Report Less Than Expected, But Core Prices Stay Elevated

EPA’s Vehicle Emissions Standards Proposal Aims to Spur EV Sales

|

In Today’s Digital Newspaper |

A key inflation reading showed that consumer prices rose less than expected in March. The March consumer price index showed a rise of 0.1% in March. Economists polled by Dow Jones were expecting CPI to rise by 0.2% month over month. The report could impact the Federal Reserve’s rate decision come May 2-3. However, core prices stayed elevated. Details in Market section.

Ahead of the CPI report, markets were pricing in about 74% odds of a quarter-point Fed rate hike on May 3, dropping to 67% after the data. Just a week ago, those odds were only 43%. Upshot: Inflation slows but stays high enough for the Fed to hike again.

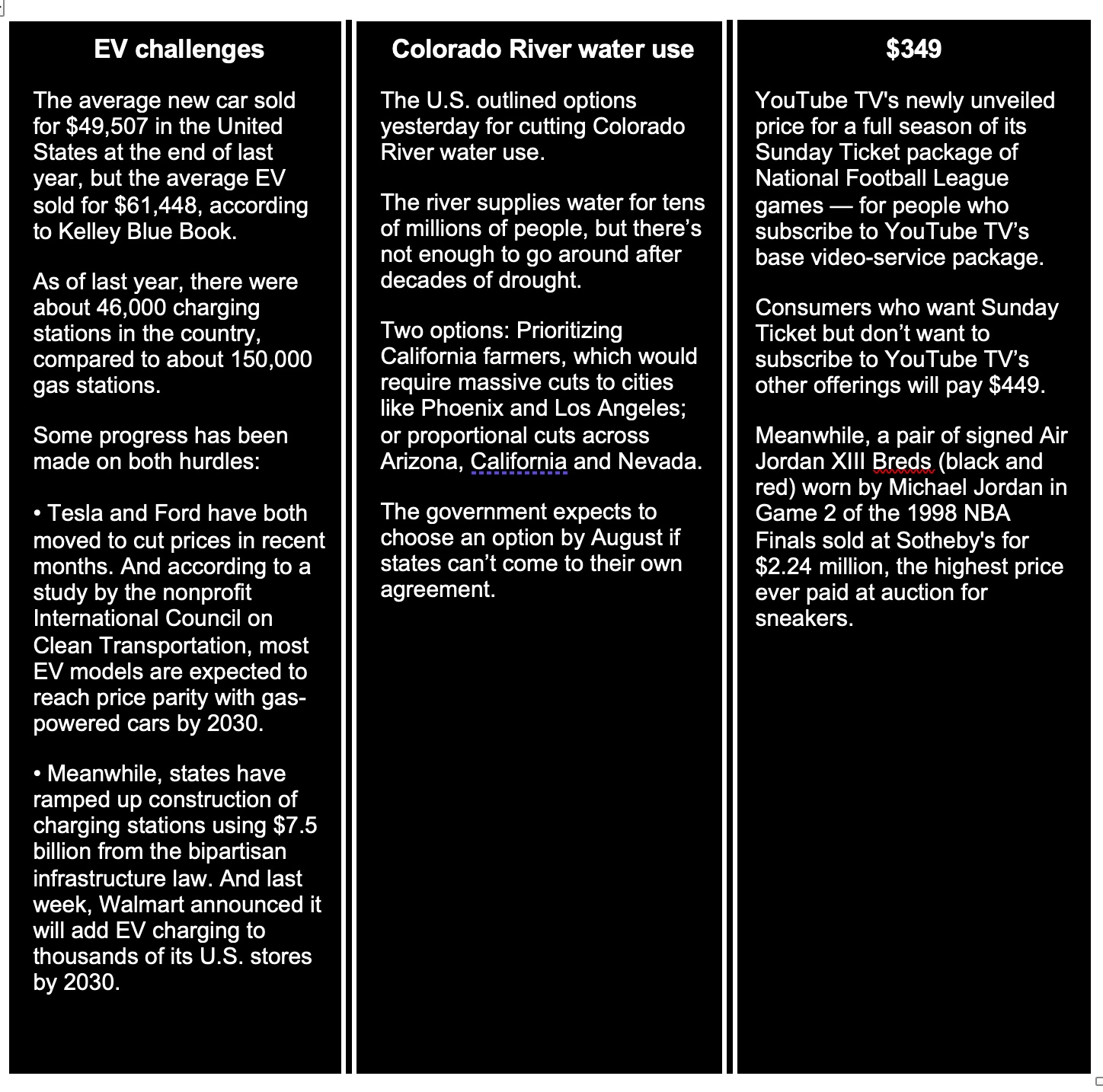

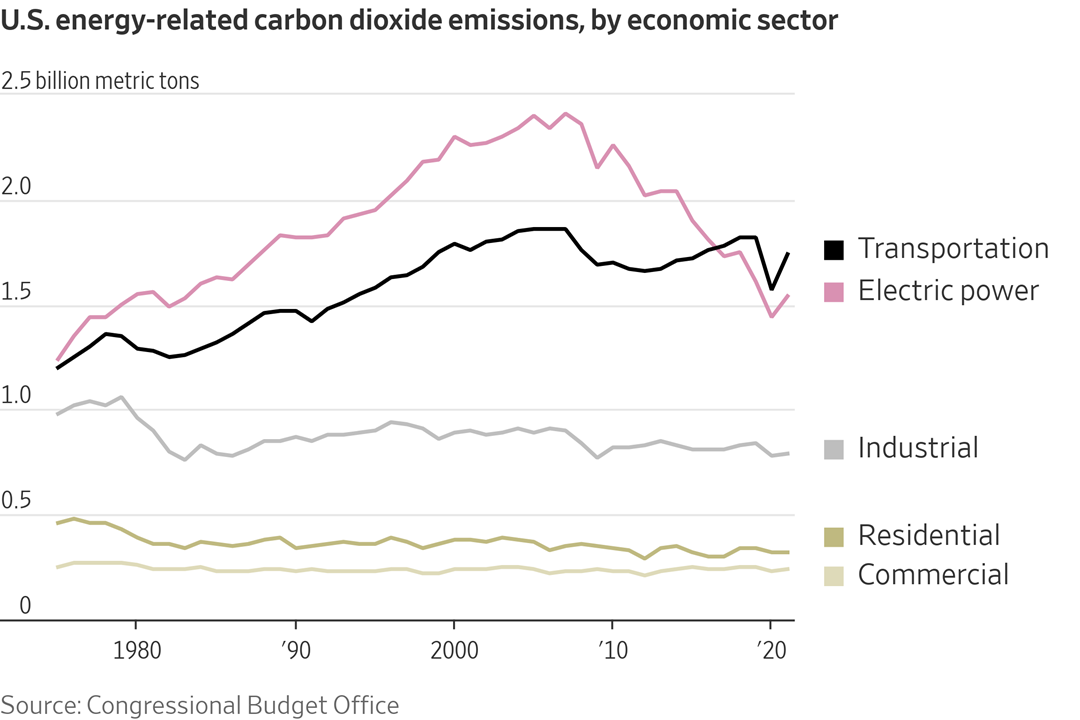

The EPA draft rule on tailpipe emissions (see Energy section for details) is aimed at accelerating growth of electric vehicles to fight climate change. The rules set CO2 limits for cars, SUVs and pickups for model years 2027-2032, and heavy-duty vehicles for the same period. They don't mandate specific tech, but instead set declining limits on fleet-wide grams of CO2 per mile. But they are strict enough to effectively require far more EVs, and better efficiency of gas-powered models. EPA estimates its main proposal would mean EVs rising to 60% of light-duty sales — sedans, SUVs, pickups and vans — by 2030, and 67% in 2032. That's up from roughly 10% today. Electric models would be 50% of sales of new vocational vehicles (such as buses and garbage trucks) in 2032.

The World Health Organization said a woman in China had become the first person to die from the H3N8 subtype of bird flu. The strain, which cannot spread from person to person, infected two people in the southern province of Guangdong last year, and one last month. The WHO said the risk of the virus spreading among humans nationally or internationally was low.

The confusing Ukraine grain export pact got more so after the Kremlin issued some comments. See Russia/Ukraine section.

Ukraine says Russia has pilfered lumber in its invasion of Ukraine, adding timber to the list that already includes grain and land.

Treasury Secretary Janet Yellen is sparring with the IMF and some trade policy analysts. See Markets section.

Raw sugar futures extended their rally to over $24.5 per pound in April, the highest since March 2012.

Dreyfus announces plan to more than double canola crush plant.

In politics, former President Donald Trump gave an interview Tuesday evening on Tucker Carlson’s show and it was Trump 101 in his wide-ranging remarks. Meanwhile, the Democrats picked Chicago to host their next convention and Sen. Tim Scott (R-S.C.) is launching a presidential exploratory committee today. More in Politics & Elections section.

|

MARKET FOCUS |

Equities today: In Asia, Japan +0.6%. Hong Kong -0.9%. China +0.4%. India +0.4%. In Europe, at midday, London +0.6%. Paris +0.5%. Frankfurt +0.3%. U.S. stock futures tracking the broader market rallied 1% on Wednesday, putting Wall Street on track to open higher after U.S. inflation slowed more than expected in March, raising hopes that the Federal Reserve monetary tightening is nearing an end. A Bureau of Labor Statistics report showed that the annual inflation rate rose 5% last month, below economists' forecasts of 5.2%, prompting bets that policymakers will deliver one more interest rate hike in May before a pause and pivot to a dovish policy in the year's second half.

Regarding the coming CPI report, the Sevens Report said before the CPI report was issued: “The “good scenario” is a headline below 5.2% with Core below 5.5%, the “bad scenario” is a headline between 5.2% and 6.0% with Core at 5.6%, and the “ugly scenario” is a headline above 6.0% with Core above 5.6%.

U.S. equities yesterday: The Dow ended up 98.27 points, 0.29%, at 33,684.70, despite a late fall that took it well off its session highs. The Nasdaq fell 52.48 points, 0.43%, at 12,031.88. The S&P 500 eased 0.17 point, 0.00%, at 4,108.94.

Agriculture markets yesterday:

- Corn: May corn futures fell 3 cents at $6.51 and the nearer the session low.

- Soy complex: May soybeans rose 10 cents to $14.97 1/4, ending the session above the 10- and 100-day moving averages, while May soymeal rose $7.10 to $457.80. May soyoil ended 41 points higher at 54.89 cents.

- Wheat: May SRW wheat fell 4 1/2 cents at $6.74, nearer the session low and hit a two-week low. May HRW wheat dropped 7 3/4 cents at $8.68 1/4 and nearer the session low. Spring wheat futures fell 12 3/4 cents to $8.62 1/4.

- Cotton: May cotton rose 30 points to 82.75 cents, near the session high.

- Cattle: Expiring April live cattle futures climbed another 92.5 cents to $172.30 Tuesday, while most-active June futures gained 25 cents to $163.95. May feeder futures jumped $2.20 to $207.825.

- Hogs: June lean hogs closed $1.30 lower at $87.85, near the lower end of today’s trading range.

Ag markets today: Corn and wheat futures rebounded from Tuesday’s losses overnight, while soybeans pulled back from yesterday’s gains. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were 2 to 3 cents lower and wheat futures were mostly 3 to 6 cents higher. Front-month crude oil futures were trading near unchanged, while the U.S. dollar index is more than 100 points lower.

Market quotes of note:

- Fed and data. Chicago Fed’s Austan Goolsbee, who votes on monetary policy decisions this year, called for “prudence and patience” in assessing the economic impact of tighter credit conditions. “We should gather further data and be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation,” Goolsbee said in prepared remarks at an event hosted by the Economic Club of Chicago.

- Treasury Secretary Janet Yellen pushes back on trade policy issue. “The argument that friendshoring is going to cause huge fragmentation and loss of the benefits of trade is really not valid,” she said. The approach still maintains “tremendous scope for global trade to continue. We’re mainly concerned about over-dependence on China.”

- Yellen more upbeat than IMF. U.S. Treasury Secretary Janet Yellen downplayed the greater risks associated with recent banking stresses that the International Monetary Fund (IMF) raised as a serious concern — Global economic growth is cooling while facing risks from the volatile banking sector, high inflation and climbing interest rates, the IMF said Tuesday. When asked about the IMF trimming its 2023 global growth forecast, Yellen said, "I wouldn't overdo the negativism about the global economy. The U.S. banking system remains sound," she said. She noted that the global financial system remains resilient due to significant reforms implemented after the financial crisis. Yellen remains vigilant to the downside risks surrounding the world economy in the wake of the Ukraine war and banking pressures. "I'm not anticipating a downturn in the economy, although that remains a risk," she said.

- Wells Fargo issued a near-term bearish call on the U.S. stock market, arguing that Wall Street should anticipate a market correction over the next 3-6 months. The firm said the S&P 500 could fall as far as 10% during that period, which would send the index to a level near 3,700 points. "We are maintaining our 2023 SPX price target of 4,200, but believe the risk/reward over the next six months is skewed to the downside," Wells Fargo said. "Over the next 3-6 months, we expect to see a 10% correction, with the SPX trading down to 3,700." The rationale behind the call includes: the Federal Reserve's aggressive tightening, potential liquidity problems brought on by the bank crisis, and concerns over consumers being increasingly more dependent on credit to sustain spending.

- Grain trader and analyst Richard Crow: “The ending stocks for U.S. grain and soybeans are tight. In the future, meal demand still has to be adjusted. The California carbon could tighten soy oil. A variable that needs to be watched for soybeans is the export sales of beans. With Brazil’s bean trading as cheap as they are, U.S. exports could be replaced, even adjusting for moisture issues. Some 40 to 70 million bushels of exports would not be a surprise. The Thursday export sales report will be the summary of what is happening.”

On tap today:

• U.S. consumer price index for March is expected to increase 0.2% from one month earlier and 5.1% from one year earlier. Excluding food and energy, the CPI is forecast to rise 0.4% and 5.6%. (8:30 a.m. ET) See item below for an update on the report.

• Bank of Canada releases its interest-rate decision at 10 a.m. ET. The central bank is expected to keep short-term interest rates unchanged at 4.5%. The BOC has raised rates by 4.25 percentage points since last March.

• Federal Reserve releases minutes from its March 21-22 meeting at 2 p.m. ET, which will be closely watched for clues on how policymakers assessed the rate path in the wake of the banking crisis.

• U.S. federal budget deficit is expected to widen to $312.5 billion in March from $193 billion one year earlier. (2 p.m. ET)

• Federal Reserve speakers: Richmond's Thomas Barkin on investing in rural America at 9 a.m. ET, and San Francisco's Mary Daly on the economic outlook at 12 p.m. ET.

U.S. inflation rate falls more than expected; core rate rises. The annual inflation rate in the U.S. eased for a ninth consecutive period to 5% in March, the lowest since May 2021 and compared to market expectations of 5.2%, as the cost of food grew at a slower pace and the energy index declined. Link to report.

Still, the core inflation inched higher for the first time in six months to 5.6% from 5.5% boosted by higher shelter costs. It was the first acceleration since September, matching market estimates. On a monthly basis, core consumer prices rose by 0.4% from a month earlier in March of 2023, in line with market expectations, and slowing slightly from the 0.5% increase in the previous month.

Details: Food prices grew at a slower rate (8.5% vs 9.5% in February) and energy cost fell (-6.4% vs +5.2%), namely gasoline (-17.4%) and fuel oil (-14.2%). At the same time, prices for used cars and trucks declined once again (-11.6% vs -13.6%). On the other hand, inflation for shelter which accounts for over 30% of the total CPI basket, continued to march higher (8.2% vs 8.1%). Compared to the previous month, the CPI edged 0.1% higher, also below expectations of 0.2%, with higher shelter prices (0.6%) offsetting a 3.5% fall in energy cost. Food prices were unchanged.

Inflation has been moderating after peaking at about 9% last summer, but the process has been gradual. It remains a long way back to the 2% inflation that was normal before the onset of the pandemic in 2020. Fed officials target 2% inflation, which they define using a different index: the Personal Consumption Expenditures measure, which uses some data from the consumer price measure but is calculated differently and released a few weeks later. That measure has also been sharply elevated.

Bottom line: Veteran analysts say the report does not change the dynamics for the Fed. Inflation is still too high and they think the Fed will boost rates another 25bp during the May 2-3 FOMC.

Graphic source: New York Times

Used car prices are set to rise again — and some models are already selling for more than new ones. So while the typical used vehicle costs an average of $3,700 less than a factory-fresh equivalent, one-year-old Ford Maverick compact pickup trucks, for example, are going for an average 12.3% more, a $4,000 difference.

Mortgage applications in the U.S. rose 5.3% in the week ended April 7, 2023, rebounding from a 4.1% drop in the previous week, data from the Mortgage Bankers Association showed. Applications to purchase a home jumped 7.8% and those to refinance a home loan edged 0.1% higher.

Meanwhile, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) fell by 10bps to 6.3%, declining for a fifth consecutive week to the lowest level since early February.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker, with the euro and yen both firmer against the greenback. The yield on the 10-year U.S. Treasury note moved up to trade around 3.44%, with a mixed tone in global government bond yields. Crude oil was slightly weaker ahead of US government inventory data and the CPI report, with U.S. crude around $81.45 per barrel and Brent around $85.55 per barrel. Gold and silver futures were firmer ahead of the inflation figures, with gold around $2,023 per troy ounce and silver around $25.26 per troy ounce.

• Energy produced from renewable sources and nuclear power is “set to dominate the growth of the world’s electricity supply” over the next three years, according to a new report by the International Energy Agency (link). It adds that the energy crisis is not over for many of the world’s biggest economies.

• Dreyfus announces plan to more than double canola crush plant. The Louis Dreyfus Corporation said it would more than double its canola crushing plant in Yorkton, Saskatchewan, where construction will start this year, taking the capacity at the plant to more than 2 million tonnes by the end of 2025. The push toward renewable diesel using canola as a feedstock has spurred expansion of canola crush capacity as firms rush to capture a portion of the growing market.

• Drought, biodiesel impacting soyoil prices, exports. As a result of tighter global exportable supplies and higher industrial consumption, soybean oil as a percentage of global vegetable oil consumption is forecast to fall below 30% in 2022-23 for the first time in nearly a decade,” said the monthly USDA Oilseeds: World Markets and Trade circular (link). Palm, rape and sunflower oil will fill the gap in vegetable oil supplies. Some 44% of U.S. soybean oil will go to biofuels during the current marketing year, said the monthly WASDE report. Two years ago, the biofuel share of soyoil consumption was 37%.

USDA comments: “For soybean oil, imports are forecast to be the lowest in five years driven by lower Argentina exportable supplies and strong U.S. renewable diesel production, which has rendered U.S. soybean oil export prices uncompetitive on the global market,” said the USDA circular. “Soybean oil trade is further dampened by the announcement that the Brazil biodiesel blend mandate has been raised to 12%, putting further pressure on exportable supplies.”

• Raw sugar futures extended their rally to over $24.5 per pound in April, the highest since March 2012, amid rising concerns over global supplies. Sugar output in India, the second largest producer, is estimated to fall to 33.5 million tonnes in the 2022-23 crop year from 34.5 million tonnes, according to All India Sugar Trade Association. As a result, the country may not approve additional sugar exports in the year ending September, India's food secretary recently said. Also, production is expected to decrease in Thailand and China, as the latter cut its forecast to less than 9 million tons from 9.5 million tons. On the other hand, Brazil, the leading producer, is expected to produce 40.3 million tonnes of sugar in the season that just started, the second-highest amount on record. Still, elevated ethanol prices due to OPEC's surprise oil output cut encourage sugarcane producers to allocate crops to more profitable biofuel blending instead of sugar crushing.

• Ag trade: Taiwan purchased 65,000 MT of Argentine corn. South Korea purchased 45,000 MT of U.S. milling wheat and 60,000 MT of optional origin feed wheat. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

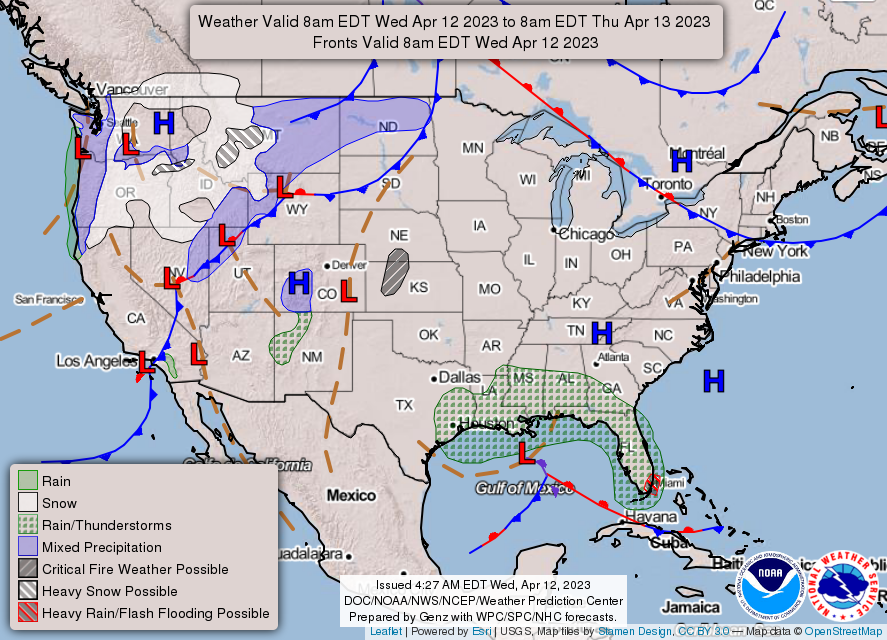

• NWS weather outlook: Widespread showers and storms with locally heavy rainfall to expand across the Southeast... ...Unsettled weather shifts into the northern tier of the Intermountain West, with locally heavy snow for the Northern Rockies... ...Well above average, early summer-like temperatures continue to expand across the Plains, Midwest, and Northeast.

Items in Pro Farmer's First Thing Today include:

• Corrective grain trade overnight

• Kremlin: Outlook for Black Sea grain deal ‘not so great’ (see Russia/Ukraine section)

• Traders remain conservative with cattle futures

• Wholesale pork should find support from beef

|

RUSSIA/UKRAINE |

— Ukraine says Russia has pilfered lumber in its invasion of Ukraine, adding timber to the list that already includes grain and land. The Ukrainian Defense Ministry released a letter from the head of Russia’s defense ministry from March 2022 which sought permission from Russian President Vladimir Putin to harvest timber during the military operation, with wood not used for defense purposes to be sold to finance the military operation, according to the Wall Street Journal. The item noted that a review of surveillance photos indicated that the logging appeared to focus areas of possibly higher-value timber species within managed forests, including oak and pine, rather than simply stripping the entire area of its wood.

— Ukraine’s army said it repelled attacks by Russian forces in the east of the country as officials in Kyiv sought to play down purported U.S. intelligence leaks that could compromise a planned offensive. The leaked classified Pentagon documents posted to social media suggest the U.S. is pessimistic that Ukraine can quickly end the war against Russia. The documents highlight specific weaknesses in both Ukraine's weaponry and Russia's military offensive, predicting a stalemate for months to come.

— Kremlin: Outlook for Black Sea grain deal ‘not so great’. The Kremlin said not all of the United Nations’ efforts to remedy the Black Sea grain deal are working. As a result, the outlook for the deal is “not so great” as promises to remove obstacles to Russia’s grain and fertilizer exports were not being fulfilled.

Meanwhile, inspections resumed on Wednesday aboard ships operating under the Ukraine Black Sea grain deal after a one-day halt. On Tuesday, the U.N. said inspections temporarily stopped as parties needed more time to agree operational priorities.

— Russia and Ukraine tightened their conscription rules ahead of an expected Ukrainian counteroffensive. Russia’s parliament passed legislation allowing call-up papers to be served online. The Kremlin insisted the changes “have nothing to do with mobilization”. In Ukraine, the government approved rules allowing recruitment centers to send summonses anywhere in the country. Previously they could be sent only to registered addresses.

|

POLICY UPDATE |

— Planned Colorado River water cuts to preserve dams. The Bureau of Reclamation issued its draft environmental review of possible ways the agency will go about cutting Colorado River water use to protect the Hoover and Glen Canyon dams from low reservoir levels. The draft review, which will soon be made available for public comment, is expected to be finalized later this summer. The bureau said it will use the final review to inform decisions it plans to make in August about how it will operate the dams in 2024. Still, the agency is hoping states will come to an agreement for water cuts so the Interior Department won’t have to act, Deputy Interior Secretary Tommy Beaudreau said Tuesday.

— Slight changes in USDA aid payments. USDA info indicates little change in totals that have been paid out to farmers via the Emergency Relief Program (ERP) and the Coronavirus Food Assistance Program (CFAP) efforts.

Under ERP, total payments as of April 10 remained at $7.42 billion which includes $6.29 billion for non-specialty crops and $1.13 billion for specialty crops. The ERP Phase 2 payments increased to $112,236 to 60 recipients after being at $47,302 the prior week.

CFAP 2 payments held at $19.44 billion for total payments, $14.53 billion in original payments and $4.91 billion in top-up payments. For CFAP 1, total payments are at $11.83 billion, including $10.64 billion in original payments ($10.63 billion prior) and top-up payments of $1.13 billion.

|

CHINA UPDATE |

— Mainland China to probe Taiwan’s ‘trade barriers’ affecting 2,455 products. China’s Ministry of Commerce said on Wednesday it had launched an investigation into Taiwan’s restrictive trade measures against 2,455 mainland products amid growing cross-strait tensions. The ministry said in a statement that it would review complaints by three mainland trade groups spanning agriculture, textiles and mineral-metal chemicals. “The Taiwan region is working on and implementing measures to ban imports of the mainland products. It involves 2,455 products when applicants made the request, mainly including agriculture, minerals and chemicals, and textiles,” the statement said.

The probe, which started on Wednesday, will take six to nine months, according to the statement. “The probe should be concluded by October 12, 2023. Under special circumstances, it can be extended to January 12, 2024,” the ministry said.

Taiwan will hold its next presidential election on January 13 next year, the Central Election Commission confirmed last month.

— Chinese woman dies of H3N8, marking first known human fatality from bird flu strain. The World Health Organization confirmed the death of 56-year-old patient in southern China and stressed the likelihood of human-to-human spread remains low. “The available epidemiological and virological information suggests that avian influenza A (H3N8) viruses do not have the capacity for sustained transmission among humans,” it said.

The woman, a resident of the city of Zhongshan, fell ill on February 22 and was hospitalized for severe pneumonia on March 3, according to a statement from WHO. It added that the patient had multiple underlying conditions and a history of exposure to live poultry before the onset of the disease.

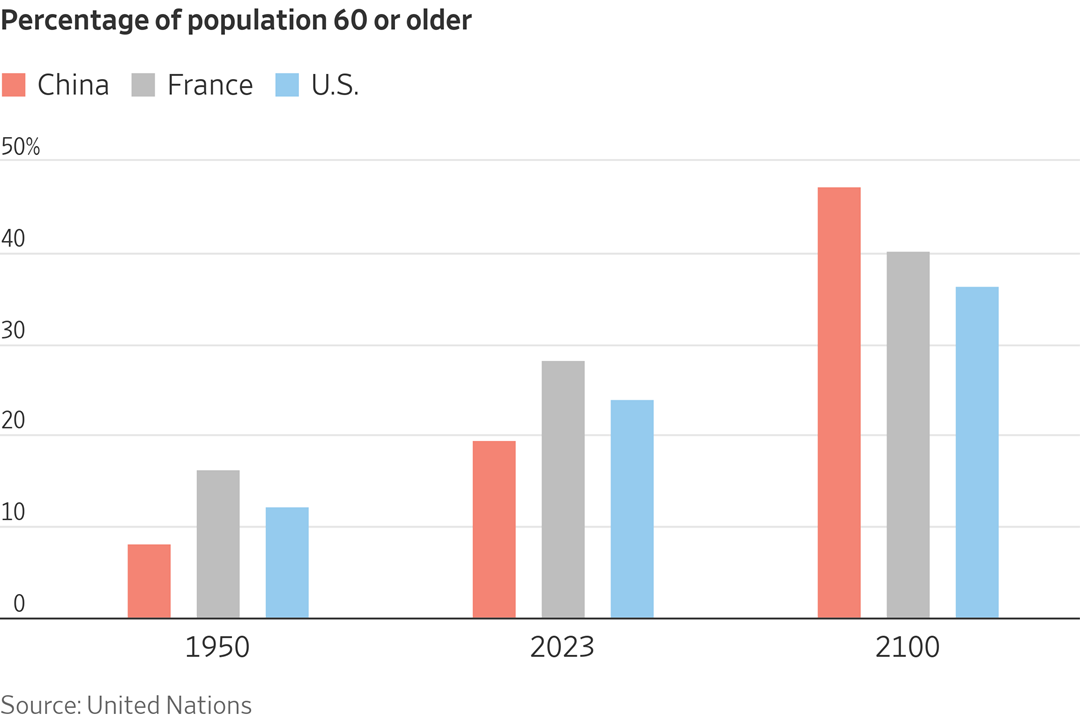

— China has one of the lowest retirement ages among major economies, allowing women to retire as early as at age 50 and men at 60. Now, local governments are running out of money just as a wave of retirees — China’s version of “baby boomers” — hits. That is leaving Beijing with little choice but to ask people to work longer, a move economists say is long overdue but one still likely to meet with resistance, the Wall Street Journal reports (link).

|

ENERGY & CLIMATE CHANGE |

— EPA is set to announce its crack down on vehicle pollution this morning with tailpipe emission limits so tough they will compel automakers to ensure two out of every three cars and light trucks sold in 2032 are electric models. Ali Zaidi, Biden’s national climate advisor, said as much as $1.6 trillion in savings could be generated by the tailpipe emissions standard and electric vehicle push through 2055. Link to EPA summary.

EPA says the new emissions targets for light-, medium- and heavy-duty vehicles beginning with the 2027 model year would avoid nearly 10 billion tons of carbon-dioxide through 2055. Under the proposed standards, sales of electric vehicles could climb to 67% of light-duty and 46% of medium-duty vehicle sales by model year 2032, leading to a projected 56% fleet-average emissions reduction.

“This is a very ambitious proposal, but it's also a proposal, and it's designed to solicit a number of questions.,” said EPA Administrator Michael Regan commenting on the agency’s new proposed standards for vehicle emissions.

Regan will unveil two separate rules during a ceremony at EPA headquarters. The first will require automakers to slash greenhouse gas emissions from passenger cars and light-duty trucks, while the second will mandate emissions reductions from heavy-duty vehicles such as delivery trucks and school buses.

|

POLITICS & ELECTIONS |

— Sen. Tim Scott (R-S.C.) is launching a presidential exploratory committee today, another step toward an official White House run. Link for details via The Post and Courier who broke the news on Tuesday night.

— Trump says he'll run even if convicted. Fox News' Tucker Carlson, during an interview (link) at Mar-a-Lago that aired last night, asked former President Donald Trump: "Is there anything they could throw at you legally that would convince you to drop out of the race — if you get convicted in this case in New York?" Trump replied: "No, I'd never drop out — it's not my thing. I wouldn't do it."

On Biden, 80, running in '24: "I don't see how it's possible… And it's not an age thing," said Trump, 76. "I have friends that are 88, 89, 92. ... But there's something wrong. ... I don't think he can."

Trump described China leader Xi Jinping as a “brilliant man” and “top of the line” smart.

Trump commented on who blew up the Nord Stream pipeline and said our biggest problem is “nuclear warming.”

— Chicago selected to host 2024 Democratic Convention. President Biden and the Democratic Party selected Chicago to host the 2024 Democratic National Convention, tapping a large liberal city in the heart of the Midwest to hold its nominating party, the Democratic National Committee announced on Tuesday. Chicago beat out New York, another progressive city, as well as Atlanta, a city in the presidential battleground state of Georgia that helped Biden win the White House and gain control of the Senate.

|

CONGRESS |

— House Manhattan District Attorney Alvin Bragg on Tuesday filed a lawsuit against the U.S. House Judiciary Committee and its GOP chairman, Rep. Jim Jordan, alleging Republican lawmakers were illegitimately interfering with his prosecution of former President Donald Trump.

|

OTHER ITEMS OF NOTE |

— Elon Musk described owning Twitter as “quite painful” but said he believes the social-media platform is “headed to a good place.” Speaking to the BBC in a surprise interview, Musk said the company would begin to make money in “a matter of months.” He estimated that Twitter now has around 1,500 employees, down from 8,000 when he bought the firm last year.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |