Vilsack to Testify Several Times Before Congress This Week

Economic focus: Hearings on bank failures, reports on U.S. household spending and home prices, Fed’s preferred inflation gauge

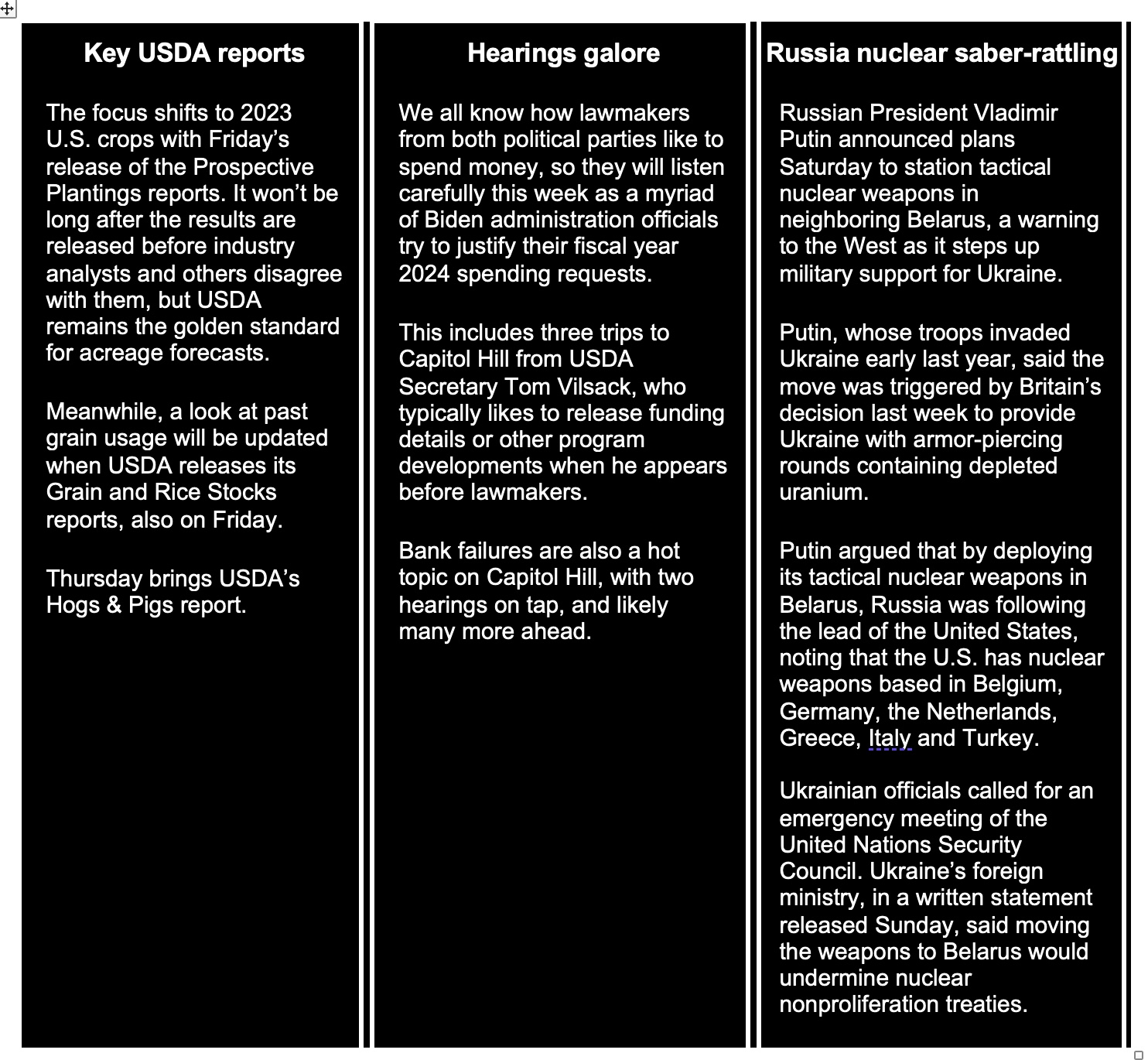

Washington Focus

The House and Senate are in session.

Biden administration officials will continue to present their fiscal year (FY) 2024 spending requests to congressional panels this week, ahead of lawmakers’ two-week Easter recess. This includes USDA Secretary Tom Vilsack, who will make several appearances.

- Vilsack on Tuesday before the House Agriculture panel, Wednesday with Senate Ag Appropriations Subcommittee and Thursday with House Ag Appropriations Subcommittee appropriators.

- Attorney General Merrick Garland on Tuesday with Senate appropriators and Wednesday with House appropriators.

- Defense Secretary Lloyd Austin and Joint Chiefs of Staff Chairman Mark Milley at House Armed Services on Wednesday.

- FDA Commissioner Robert Califf on Wednesday before House Ag Appropriations Subcommittee.

- Health and Human Services Secretary Xavier Becerra on Tuesday with House appropriators and House Ways and Means.

- Homeland Security Secretary Alejandro Mayorkas on Wednesday with both House appropriators and Senate appropriators.

- Interior Secretary Deb Haaland on Tuesday with House appropriators and Wednesday with Senate appropriators.

- Veterans Affairs Secretary Denis McDonough on Wednesday with House appropriators.

Bank failure hearings on tap this week. Federal Deposit Insurance Corp. Chair Martin Gruenberg, Federal Reserve Vice Chairman for Supervision Michael Barr and Treasury Department Undersecretary for Domestic Finance Nellie Liang will testify Tuesday before the Senate Banking Committee on " Recent Bank Failures and the Federal Regulatory Response."

The House Financial Services Committee will hold its banking failure hearing on Wednesday.

The hearings are likely the first of many covering the events that spiraled into a banking crisis that sent customers fleeing from regional banks and sent markets into a frenzy.

The infant formula crisis will be the topic Tuesday when Frank Yiannas, FDA’s former deputy commissioner of food policy and response, is a witness at a House Oversight and Accountability Committee hearing on the 2022 infant formula crisis.

Mergers a focus. The Federal Trade Commission (FTC) and Justice Department's Antitrust Division will co-host a Spring Enforcers Summit on Monday, featuring FTC chair Lina Khan, DOJ assistant attorney general Jonathan Kanter and senior staff from both agencies discussing mergers and conduct enforcement.

Economy conference. Acting Comptroller of the Currency Michael Hsu, Housing and Urban Development Secretary Marcia Fudge and Consumer Financial Protection Bureau Director Rohit Chopra will deliver remarks at the National Community Reinvestment Coalition's Just Economy Conference, which begins Wednesday.

Axios hosts its What's Next Summit on Wednesday, with a focus on artificial intelligence, space travel, the metaverse and the future of work. Guests include NASA administrator Bill Nelson; YouTube Chief Executive Neal Mohan; and Box Inc. co-founder and CEO Aaron Levie.

EV requirements. The Treasury Department will release proposed guidance this week for domestic sourcing requirements for electric vehicles (EVs) to qualify for tax credits provided by the Inflation Reduction Act. The delayed guidance for the $7,500 tax credits was supposed to be released at the end of 2022, but the Treasury temporarily waived the rules and pushed the release date to the end of March.

House Rules Committee will meet Monday to discuss the Lower Energy Costs Act, the energy package introduced by House Republicans earlier this month. The nearly 200-page plan — slammed by Senate Majority Leader Chuck Schumer (D-N.Y.) as a "nonstarter" — contains measures that aim to boost fossil fuel production, speed up approvals of infrastructure projects and repeal major programs in the Inflation Reduction Act. GOP leaders are anticipating passage of Ht in the House before the end of the month by using a limited amendment process.

The package will likely fail in the Senate, but it is seen as a blueprint for the GOP's energy priorities during this congressional session and should they control all chambers of gov’t following 2024 elections.

WOTUS action in Senate. The Senate this week could consider the House-passed resolution that would undo a Biden administration definition of wetlands that allows for regulations on private lands (Waters of the U.S./WOTUS).

Republicans used a procedure allowed under the Congressional Review Act, which permits Congress to reject new executive branch rules. The EPA and the Army Corps of Engineers proposed the new definition in late 2021 and the final rule went into effect on March 20, with court action stopping it in two states, Idaho and Texas.

Perspective: Even if the resolution clears the Senate, by no means a certainty, President Biden has already said he would veto it and Congress very likely does not have the votes to override.

On Wednesday, President Joe Biden co-hosts the second Summit for Democracy — a virtual gathering of world leaders, civil society and private-sector leaders intended to promote democracy in the face of rising autocracies. The first summit, which included representatives from 100 governments around the globe, was held in December 2021.

On the nomination front, President Biden’s Pick to head the FAA withdrew after a Senate panel stalemate. Phil Washington has run Denver International Airport since 2021 and before that had largely surface transportation experience, prompting Republicans to raise concerns about his lack of experience working as a pilot or for an airline. In a Twitter post late Saturday, Transportation Secretary Pete Buttigieg blamed “partisan attacks and procedural obstruction” for Washington’s decision, saying they were “undeserved.” The Commerce, Science and Transportation Committee in the Democratic-led Senate had postponed a scheduled vote on his nomination last week.

On the election front, Rep. Ro Khanna (D-Calif.) on Sunday announced he won’t make a run for Senate next year and instead endorsed Rep. Barbara Lee’s (D-Calif.) campaign to replace retiring Sen. Dianne Feinstein (D-Calif.).

As he gears up for a likely re-election campaign, President Joe Biden kicks off a three-week tour to highlight his signature legislative accomplishments as the impacts of those laws begin to be felt around the country, according to a White House official. The "Invest in America" tour will see Biden, Vice President Kamala Harris, first lady Jill Biden and nearly a dozen Cabinet members hit more than 20 states — including key battleground states like Georgia, Nevada and Pennsylvania.

Thursday is Opening Day for Major League Baseball. The season gets underway at 1:05 p.m. ET when the Braves play the Nationals, and the Giants face the Yankees.

Key Economic Reports & Events for the Week

Key U.S. info comes Friday, including personal income and spending and the Fed's preferred inflation gauge.

Monday, March 27

- Federal Reserve Bank of Dallas releases the Texas Manufacturing Outlook Survey for March. Consensus estimate is for a negative 11 reading, a 2.5-point improvement from February. The index has had 10 consecutive readings of less than zero.

- Fed Governor Philip Jefferson will discuss the "Implementation and Transmission of Monetary Policy" at Washington and Lee University.

- Earnings: BioNTech and Carnival report quarterly results.

Tuesday, March 28

- S&P CoreLogic releases the Case-Shiller National Home Price Index for January. Expectations are for home prices, as measured by the index, to increase 3% year over year, following a 5.8% rise in December. Annualized home-price growth has decelerated every month since peaking last March at a record 20.8%. This past week, the National Association of Realtors reported that the median existing-home sales price was $363,000 in February, a 0.2% decrease from a year earlier. This was the first decline for existing-home prices since 2012.

- FHFA House Price Index: The house price index has flattened out, coming in marginally changed to unchanged the last four reports. January's consensus is a monthly fall of 0.2 percent.

- Conference Board releases its Consumer Confidence Index for March. Economists forecast a 101 reading, roughly two points fewer than in February. The index is off its recent lows from last summer, buoyed by continued strength in the labor market. In February, 52% of consumers responded that jobs were “plentiful,” while only 10.5% said jobs were “hard to get.”

- International Trade in Goods: The U.S. goods deficit (Census basis) is expected to narrow by $1.1 billion to $90.0 billion in February after widening by $1.2 billion in January to $91.1 billion and reflecting in part a second monthly jump in vehicle imports.

- Wholesale Inventories: The second estimate for February wholesale inventories is a draw of 0.2% versus a draw of 0.4% in the first estimate.

- Federal Reserve: Michael Barr, Vice Chair for Supervision of the Board of Governors of the Federal Reserve System, speaks.

- Conference Board releases its Consumer Confidence Index for March. Economists forecast a 101 reading, roughly two points fewer than in February. The index is off its recent lows from last summer, buoyed by continued strength in the labor market. In February, 52% of consumers responded that jobs were "plentiful," while only 10.5% said jobs were "hard to get."

- Earnings: Lululemon Athletica, McCormick, Micron Technology, and Walgreens Boots Alliance announce earnings.

Wednesday, March 29

- MBA Mortgage Applications

- National Association of Realtors releases its Pending Home Sales Index for February. The consensus call is for pending-home sales to decrease 2.3% month over month after a 8.1% jump in January. The January increase was the largest since June of 2020 and followed a rough 2022 for pending-home sales, with declines in the first 11 months of the year.

- Banking regulators appear before the House Financial Services Committee to discuss the collapse of Silicon Valley Bank and Signature Bank. Fed Vice Chair for Supervision Michael Barr and Federal Deposit Insurance Corp. Chairman Martin Gruenberg are scheduled to testify.

- Earnings: Cintas and Paychex hold conference calls to discuss quarterly results. Intel hosts a conference call to discuss the company’s data-center and artificial-intelligence initiatives.

Thursday, March 30

- Jobless Claims: The Labor Department reports the number of worker filings for unemployment benefits in the week ended March 25. Initial jobless claims edged lower the prior week, showing the job market remains strong despite announced layoffs.

- Bureau of Economic Analysis (BEA) reports its third and final estimate of fourth-quarter gross-domestic product growth. GDP is expected to have grown at a seasonally adjusted annual rate of 2.7%, unchanged from the BEA’s second estimate.

- Fed Balance Sheet

- Money Supply

- Richmond Fed President Thomas Barkin will speak at the Virginia Council of CEOs' quarterly meeting.

- Federal Reserve: President and CEO of the Federal Reserve Bank of Boston Susan Collins speaks.

Friday, March 31

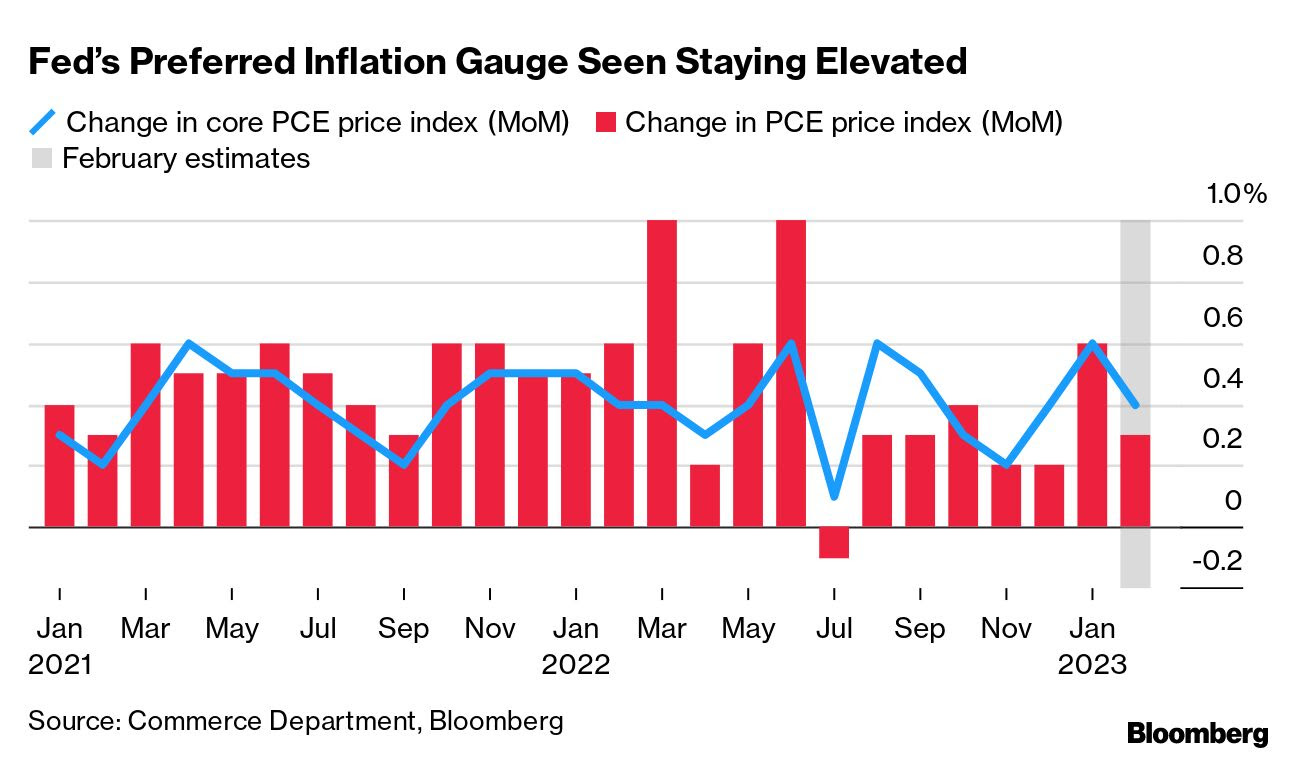

- BEA reports personal income and expenditures for February. Both income and spending are forecast to rise 0.3% month over month. This compares with gains of 0.6% and 1.8%, respectively, in January. The core personal consumption expenditures price index, the Fed’s preferred inflation gauge, is seen increasing 4.7% year over year, which would match the January data. The core PCE is forecast to have risen 0.4% from a month earlier.

- The Chicago PMI is expected to edge higher in March to a still deeply depressed 43.9 versus a lower-than-expected 43.6 in February.

- Consumer sentiment is expected to end March unchanged from the mid-month flash of 63.4.

- Fed Governor Christopher Waller will deliver a speech on "The Unstable Phillips Curve" at the San Francisco Fed's Macroeconomics and Monetary Policy Conference.

- Federal Reserve: John Williams speaks.

- The European Union’s statistics agency releases March inflation figures for the eurozone. The bloc’s consumer prices were 8.5% higher in February from a year earlier, the fourth straight month of easing eurozone inflation.

Key USDA & international Ag & Energy Reports and Events

Friday brings USDA’s Prospective Plantings and Grain Stocks reports and Thursday the latest Hogs & Pigs report.

Monday, March 27

Ag reports and events:

- Export Inspections

- Oil Crops Yearbook

- Peanut Stocks and Processing

Energy reports and events:

Tuesday, March 28

Ag reports and events:

- State Stories

- Livestock and Meat Domestic Data

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- Brent May options expire

- Boao Forum for Asia annual conference in Hainan begins, which includes sessions on the Belt and Road Initiative and global energy markets (runs through Friday). Click here for agenda

- S&P Global’s Singapore Commodity Market Insights Forum Link

- Offshore Energies UK publishes Business Outlook 2023 report on future of North Sea energy supplies, as well as energy security, net zero issues. Link

- EU energy ministers meet in Brussels to hold first policy debate on a planned reform of the electricity market, gas-demand reduction and the rollout of hydrogen and low-carbon gases. Link

- Berlin Energy Transition Dialogue conference (Link, two days). Click here for agenda, here for speakers

- European Gas Conference, Vienna (second day)

Wednesday, March 29

Ag reports and events:

- Broiler Hatchery

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- Berlin Energy Transition Dialogue conference (second day)

- Eurelectric details key findings of study on Europe’s electricity market and net zero. Brussels. Link

- European Hydrogen Conference, Vienna. Link

Thursday, March 30

Ag reports and events:

- Weekly Export Sales

- Fruit and Tree Nuts Outlook

- Rice Yearbook

- Egg Products

- Hogs and Pigs

- Port of Rouen data on French grain exports

- Holiday: India

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

Friday, March 31

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Grain Stocks

- Prospective Plantings

- Rice Stocks

- Agricultural Prices

- FranceAgriMer’s weekly crop condition report

- Malaysia’s March palm oil export data

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- Brent May futures expire

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Russia/Ukraine war timeline | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package | Gov’t payments to farmers by program | Farmer working capital | USDA ag outlook forum |