Congress Adjourns; New Congress Begins Jan. 3 with GOP House Speaker Contest

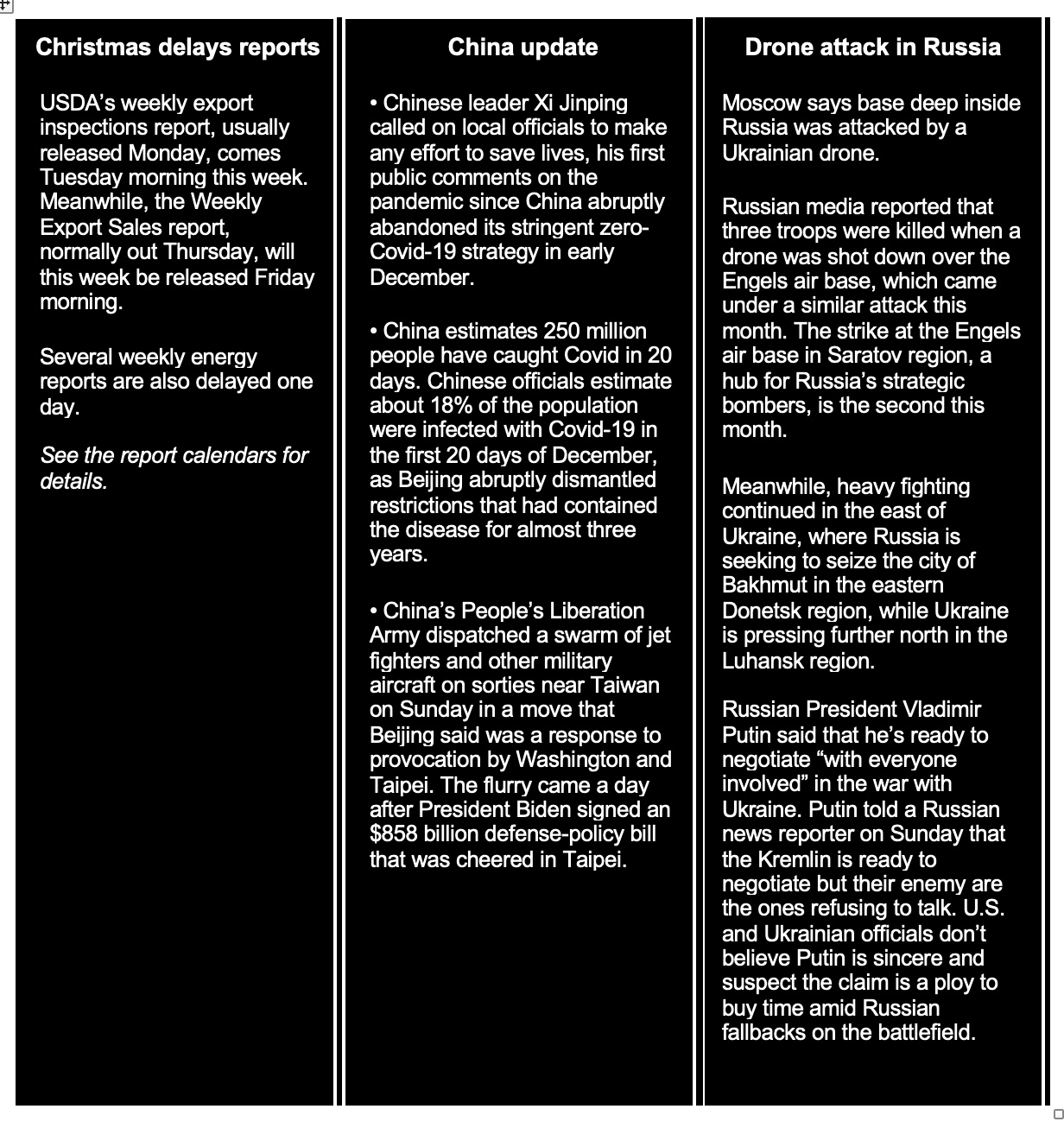

China Covid-19 update | Chinese army swarms near Taiwan | Drone attack in Russia

Washington Focus

Congress is adjourned. The first session of the new Congress begins Jan. 3. Key issue is a vote on the Speaker of the House and whether current GOP House leader Kevin McCarthy (R-Calif.) can find the needed 218 votes as some maverick far-right Republicans are leveraging the matter for all they can get.

The recent omnibus budget package for fiscal year (FY) 2023, which began Oct. 1, attracted nine Republican votes in the House:

- Liz Cheney (Wyo.)

- Rodney Davis (Ill.)

- Brian Fitzpatrick (Pa.)

- Jaime Herrera Beutler (Wash.)

- Chris Jacobs (N.Y.)

- John Katko (N.Y.)

- Adam Kinzinger (Ill.)

- Fred Upton (Mich.)

- Steve Womack (Ark.)

Seven of them left Congress. Only Fitzpatrick and Womack are sticking around.

Rep. Alexandria Ocasio-Cortez (D-N.Y.) voted against the bill and Rep. Rashida Tlaib (D-Mich.) voted “present” — by proxy.

Here is a recap of the key ag sector features of the omnibus package:

- $3.7 bil. in farm disaster aid, to cover eligible 2022 crop and livestock losses, with $494.5 mil. used for livestock losses due to drought or wildfires, as part of overall $40.6 bil. for disasters.

- Requires USDA to make a one-time payment to each rice producer on a U.S. farm in the 2022 crop year. The measure would rescind $250 mil. from the fiscal 2021 omnibus and reappropriate it for the payments. USDA would determine payment rates based on yield history and acreage. Rice farmers are experiencing amongst the highest increases in production costs but are not sharing in the rise in commodity prices.

- Authorizes $100 mil. for USDA to make pandemic aid payments to cotton merchandisers purchasing cotton from a U.S. producer from March 1, 2020, through the measure’s enactment date.

- $1.92 bil. for farm programs, including $61 mil. to resolve ownership and succession of farmland issues. This funding will continue support for various farm, conservation, and emergency loan programs.

- Includes the Growing Climate Solutions Act, which authorizes USDA to oversee the registration of farm technical advisers and carbon-credit verification services.

- Includes the SUSTAINS Act, which allows corporations and other private entities to contribute funding for conservation projects and authorizes USDA to match the donations.

- Reauthorizes the Pesticide Registration Improvement Act, which imposes fees for maintenance and registration of active ingredients. It boosts registration and maintenance fees 30% and allows EPA to raise fees by 5% in 2024 and 2026.

- Makes permanent a summer EBT (food stamp) program to provide up to $40 a month per child. It allows grab-and-go or home delivery of meals to kids in rural areas as an alternative to meals in group settings. Any summer meals benefits issued to a household in the summer of 2023 couldn’t exceed $120 per child. USDA would be required to establish a program beginning in the summer of 2024 and annually thereafter to issue EBT benefits to eligible households to ensure continued access to food when school isn’t in session in the summer.

- $25 mil. for specialty crop equitable relief.

- A&O instructions. A provision recognizes the legal authority of USDA to index all administrative and operating (A&O/crop insurance) for inflation going forward in a manner consistent with the indexing for inflation during the 2011-2015 period and calls on USDA to take this action, including a provision for future equitable relief for specialty crops, without a renegotiation of the Standard Reinsurance Agreement... SRA.

- Food aid: Aid for Food for Peace... $1.8 bil... and McGovern-Dole International Food for Education... $248 mil... programs.

- Army Corps Emergency Funding: $1.48 bil. is included besides annual appropriations funding for the Army Corps of Engineers to make emergency repairs and navigation improvements needed after extreme weather events, including ongoing low water on the Mississippi River.

- Agricultural research: Ag research funding would increase by $175 mil., to $3.45 bil. in 2023, including monies for the Agricultural Research Service, National Institute of Food and Agriculture, Agriculture and Food Research Initiative, and Sustainable Agriculture Research and Education program.

- Rural Development: USDA’s ReConnect loan and grant program for rural broadband would get $348 mil. for fiscal 2023.

Economic Reports for the Week

Economic indicators are coming this week that will help gauge the health and trajectory of housing amid higher rates.

Tuesday, Dec. 27

- Federal Housing Finance Agency releases its House Price Index for October. Consensus estimate is for 0.7% a month-over-month decline, following a 0.1% gain in September.

- S&P CoreLogic releases its Case-Shiller National Home Price Index for October. Consensus estimate is for a 8.2% year-over-year increase, following a 10.6% gain in September.

- Federal Reserve Bank of Dallas releases its Texas Manufacturing Outlook Survey for December. Economists forecast a negative 10.5 reading, about four points better than in November. The index has had seven consecutive monthly readings of less than zero, indicating a slumping manufacturing sector in the region.

- International Trade. The U.S. goods deficit (Census basis) is expected to narrow to $97.0 billion in November after deepening by more than $6 billion in October to $98.8 billion.

- Wholesale inventories, where builds have been slowing, are expected to rise 0.4% in the advance report for November.

Wednesday, Dec. 28

- MBA Mortgage Applications

- National Association of Realtors reports pending home sales for November. Expectations are for sales to decline 3.8% month over month, after falling 4.6% in October.

- Federal Reserve Bank of Richmond releases its Fifth District Survey of Manufacturing Activity for December. The consensus call is for a negative 8.5 reading, roughly even with the previous month’s data.

Thursday, Dec. 29

- Department of Labor reports initial jobless claims for the week ending Dec. 24. Claims have averaged 220,000 in December, about the same level as the two previous months. While that’s more than the half-century lows reached in March, it’s still less than historical averages. This suggests that the labor market is still tight and Federal Reserve’s interest-rate hikes haven’t yet dented employment and wage growth as much as the FOMC would like.

- Fed Balance Sheet

- Money Supply

Friday, Dec. 30

- The Institute for Supply Management releases its Chicago Business Barometer for December. Economists forecast a 43 reading, about six points better than the prior month. Excluding the 2020 pandemic shock, November’s 37.2 reading was the lowest reading since the 2008-09 financial crisis.

Key USDA & international Ag & Energy Reports and Events

USDA Export Inspections and the Weekly Export Sales report are both delayed a day from their usual Monday/Thursday release dates due to the Christmas holiday.

Tuesday, Dec. 27

Ag reports and events:

- Export Inspections

- Malaysia Dec. 1-25 palm oil exports

- Holiday: U.K., Australia, Hong Kong

Wednesday, Dec. 28

Ag reports and events:

- Broiler Hatchery

- Livestock and Meat Domestic Data

- Egg Products

- Peanut Stocks and Processing

Energy reports and events:

- Genscape weekly crude inventory report for Europe’s ARA region

- API weekly report on US oil inventories (delayed one day by US holiday)

Thursday, Dec. 29

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Brent February futures expire

Friday, Dec. 30

Ag reports and events:

- CFTC Commitments of Traders report

- Weekly Export Sales

- Agricultural Prices

- Peanut Prices

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook | Omnibus spending package |