Waning Days of Year = Congress Finally Getting Things Done

Omnibus spending bill, add-ons, nominations last-minute issues to resolve | WOTUS

Washington Focus

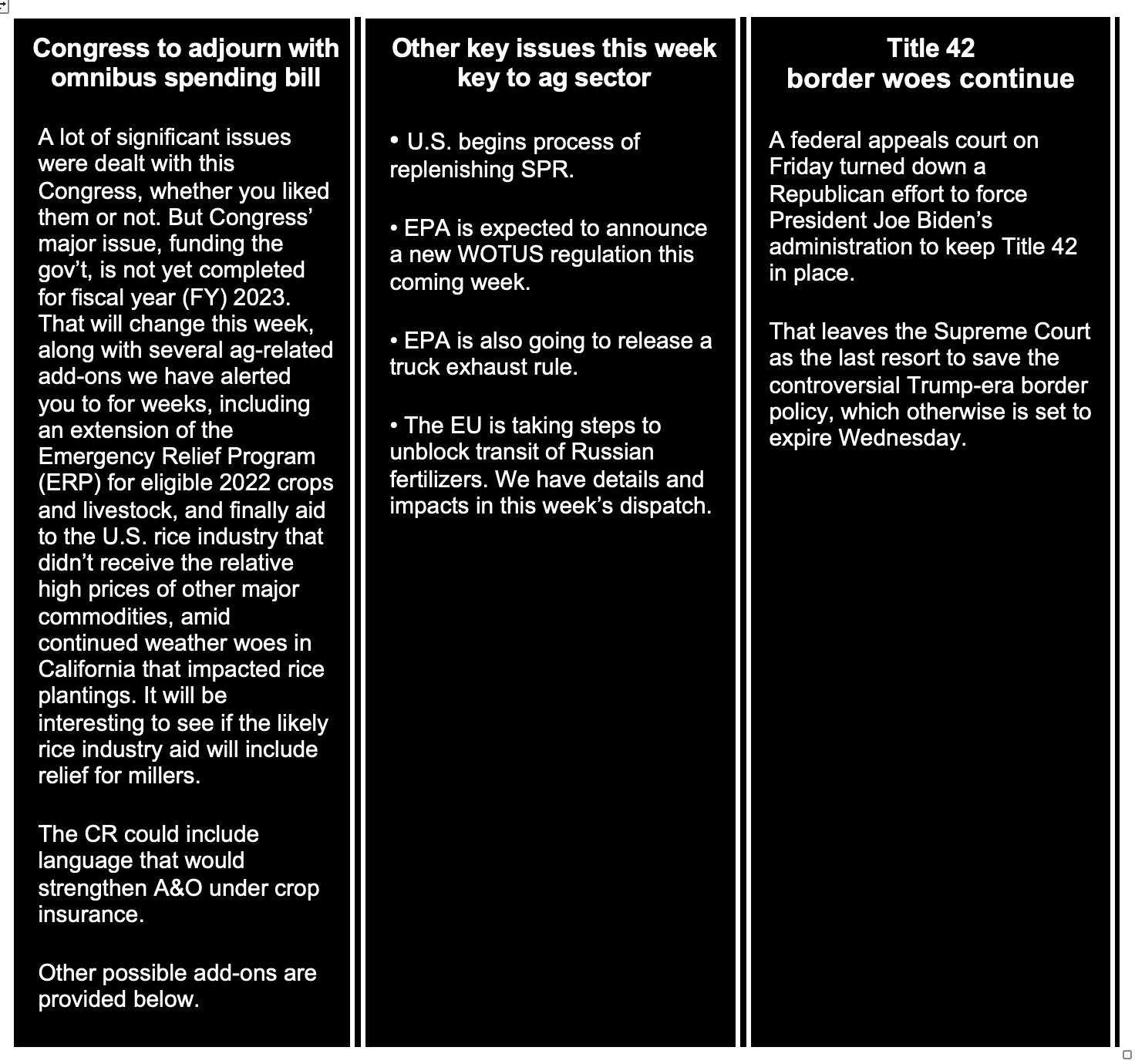

As usual, the Democrats are in alignment on spending issues, but House and Senate Republicans are bickering over strategy and dollar levels in an early signal that Republicans again will have trouble governing the House when they take “control” of the House in January.

Likely timeline for coming omnibus spending package. The monstrous bill is expected to be introduced in the Senate on Monday when cloture would be filed to close the debate on the motion to proceed to the bill. That would ripen by Wednesday and a vote on passage could occur on Thursday. Next step comes Friday with the House taking up and clearing the measure.

Bottom line on omnibus spending measure for fiscal year (FY) 2023:

- The spending measure will clear both chambers by the end of this week.

- Key will be add-ons, which will likely include an extension of the Emergency Relief Program (ERP) for eligible 2022 crops and livestock. And odds favor a rice industry aid package of around $350 million.

- A modified version of the Growing Climate Solutions Act, focused on accelerating ag carbon markets, stands a good chance of being included.

- Possible language that would strengthen A&O under crop insurance.

- There is a push for the SUSTAINS Act that would allow corporations to provide funding for farm bill conservation programs and authorize USDA to match the private contributions.

- Food and child nutrition funding and language typically show up in must-pass end-of-year bills.

Other congressional issues likely this week include:

- Jan. 6 insurrection probe could recommend former President Donald Trump be prosecuted. The Department of Justice, which would handle such a prosecution and is conducting its own probe, is not obliged to follow the suggestion. The former president denies any wrongdoing; a spokesperson called the proceedings “show trials.”

- Environmental Protection Agency to roll out new truck exhaust rule.

- EPA is also expected to announce a new WOTUS regulation this coming week, despite calls from Congress to hold off on announcing any new Waters of the US (WOTUS) U.S. regulation until the Supreme Court ruled on the Sackett v. EPA case in which EPA’s reach under the Clean Water Act is being litigated. Since the release of its proposed rule in December of 2021, EPA has received over 120,000 public comments and conducted 10 regional round tables.

- Nominations, both judicial and hopefully two trade officials (one at USDA, the other at USTR).

U.S. begins process of replenishing SPR. The U.S. EIA reported that 4.7 million barrels of crude oil left the Strategic Petroleum Reserve (SPR) in the week ending Dec. 9, but now the Biden administration has started the process of refilling the nation’s SPR.

Gasoline is now selling across the country at its lowest level since September 2021, the Energy Department said. Average U.S. retail gasoline prices were about $3.24 per gallon last week, according to the EIA, down about a third since hitting a record high in June but still almost 40% higher than when Biden entered office.

The purchase: 3 million barrels of so-called sour oil “produced in the United States by United States producers, with deliveries due in February. Contracts will be awarded to energy companies by Jan. 13. Price to be paid will be determined by offers from vendors. "This approach will lock in a price upfront when companies submit their bids," an official said. The previous SPR withdrawals shrunk levels to just over 380 million barrels, their lowest since 1984, raising concerns about energy security.

While 3 million barrels is a meager amount vs the over barrels released President Biden authorized a 50-million-barrel release from the reserve last year amid a surge in petrol prices and then in March announced an unprecedented 180-million-barrel drawdown following the Kremlin’s full-scale invasion of Ukraine on Feb. 24.

The gesture is seen by some that the White House intends to keep its word to refill when prices fall below $70 per barrel — on a consistent basis. The department's "pilot" solicitation announced on Friday, which provides for the purchase of 3 million barrels, will test a new acquisition program the Biden administration introduced in October when it announced its intention to acquire oil for the reserve when prices on the West Texas Intermediate benchmark were steady in a range of $67-$72 per barrel, a bit below where U.S. benchmark futures were trading on Friday at about $74.

The Energy Department said buying oil back at about current prices is "an opportunity to secure a good deal for American taxpayers by repurchasing oil at a lower price than the $96 per barrel average price it was sold for, as well as to strengthen energy security." By contrast, the SPR oil in need of replacing was drawn down and sold at an average price of $96 per barrel. U.S. oil prices settled at $74.29 a barrel on Friday, well below the average price of $96 the U.S. sold oil from the SPR in recent months, and down from more than $120 in March. Link for release.

The DOE developed the fixed-price contract option with hopes of luring wary producers to increase capital expenditures and raise output. The department's Friday announcement said the strategy would “give producers the assurance to make investments today, knowing that the price they receive when they sell to the SPR will be locked in place.” The U.S. had previously purchased and sold crude for the SPR by opening bids on contracts that would be pegged to a benchmark price.

The administration is separately asking for authority to defer or cancel requirements from the U.S. Congress to sell 147 million barrels of crude from the SPR during fiscal years 2024-27. The administration says it would not make sense to buy and sell crude from the SPR at the same time.

The southern border and Title 42. A federal appeals court on Friday turned down a Republican effort to force President Joe Biden’s administration to keep Title 42 in place. That leaves the Supreme Court as the last resort to save the controversial Trump-era border policy, which otherwise is set to expire Wednesday.

On the international front, EU takes steps to unblock transit of Russian fertilizers. The European Union implemented a new sanctions package on Russia Friday. The sanctions agreement, pushed through by EU leaders when they met for a summit Thursday, came amid intense lobbying by United Nations Secretary-General António Guterres. He called several European leaders to persuade them to ease the transit of Russian fertilizers through EU ports.

Fertilizer update. The EU has consistently noted language in its sanctions legislation stating that food, fertilizers and other key humanitarian goods are exempt from sanctions. But vessels carrying fertilizers have been held up for weeks or denied permission to transit through large European ports, such as Rotterdam in the Netherlands, because of concerns over sanctions. Example: Russia’s elites being sanctioned are current or former owners of some of Russia’s biggest companies producing and distributing fertilizer. Custom officials said that in some member states, vessels carrying fertilizer linked to sanctioned Russian oligarchs couldn’t transit through their ports because the facilities couldn’t accept payments for harbor fees and other costs or permit payments to companies linked to oligarchs whose EU assets had been frozen. Some vessels did transit through but were held up for weeks because of the need to receive clearance from national authorities who themselves were unsure of the sanctions rules, the Wall Street Journal detailed.

Details. National governments can unfreeze the assets if strictly necessary for shipments of fertilizers. Exemptions must be reported to the European Commission, the EU’s executive body, to ensure they are being properly applied. To halt sanctions circumvention, exemptions would only apply to people or entities linked to a significant Russian agri-food business active in the field before being sanctioned. The shipment must also be part of a U.N. program shipment or go to a developing country covered by the U.N.’s food-security priorities.

Impact: The exemption is expected to significantly improve the transit of fertilizers through the bloc, although glitches could linger, such as identifying which countries count as being U.N. priority destinations and ensuring that the final destination is what is claimed.

Economic Reports

This week will be a light one for corporate results and economic data. Monday will see the release of the NAHB Home Builders' Index. Companies reporting results this week include Nike, General Mills and Micron Technology.

Monday, Dec. 19

- National Association of Home Builders releases its Housing Market Index for December. The consensus estimate is for a 33 reading, which would match November’s. The index has declined every month this year and is at its lowest level since the onset of the pandemic. Surging mortgage rates and home-affordability issues have turned home builders quite gloomy on the outlook for the housing market.

Tuesday, Dec. 20

- Census Bureau reports November residential construction data. Economists forecast that private housing starts came in a seasonally adjusted annual rate of 1.41 million last month, slightly lower than in October.

- Bank of Japan announces its monetary-policy decision. The BOJ is widely expected to buck the global trend of central banks tightening and leave its short-term interest rate unchanged at negative 0.1%.

Wednesday, Dec. 21

- MBA Mortgage Applications

- Conference Board releases its Consumer Confidence Index for December. Expectations are for a 99 reading, about one point less than in November. The index has rebounded from its summer lows, but is down sharply over the past year.

- National Association of Realtors (NAR) reports existing-home sales for November. The consensus call is for a seasonally adjusted annual rate of 4.2 million, 230,000 below October’s. The median existing-home sales price increased 6.6% year over year to $379,100 in October according to the NAR.

Thursday, Dec. 22

- Jobless Claims

- Bureau of Economic Analysis (BEA) releases its third and final estimate for third-quarter gross domestic product. The GDP growth rate is expected to remain unchanged from the second estimate — an annualized 2.9%.

- Fed Balance Sheet

- Money Supply

Friday, Dec. 23

- BEA reports on personal income and expenditures for November. Both income and spending are forecast to have risen 0.4%, month over month. This compares with gains of 0.7% and 0.8%, respectively, in October. The Federal Reserve’s preferred inflation gauge, the core personal-consumption expenditures price index, is expected to be up 4.7%, year over year, down from 5% previously.

- Census Bureau releases the durable goods report for November. Economists forecast that new orders for manufactured-durable goods declined 0.7%, month over month, to $275.5 billion.

- Univ. of Michigan Consumer Sentiment

Key USDA & international Ag & Energy Reports and Events

Focus is clearly on South America crop/weather developments and export-related updates regarding Russia/Ukraine (including fertilizer).

Monday, Dec. 19

Ag reports and events:

- Export Inspections

- Cost-of-Production Forecast

- Food Expenditure Series

- Milk Production

- National Hop Report

- MARS monthly report on EU crop conditions

Energy reports and events:

- Petroleum Association of Japan press conference

- EU energy ministers meet in Brussels, resuming talks aimed at agreeing a gas price cap level

- Holiday: Kazakhstan

Tuesday, Dec. 20

Ag reports and events:

- Coffee: World Markets and Trade

- Dairy: World Markets and Trade

- Chickens and Eggs

- China’s third batch of November trade data, including soy, corn and pork imports by country

- EU weekly grain, oilseed import and export data

- Malaysia’s Dec. 1-20 palm oil exports

Energy reports and events:

- API weekly U.S. oil inventory report

- China’s third batch of November trade data, including country breakdowns for energy and commodities

- WTI January futures expire

Wednesday, Dec. 21

Ag reports and events:

- Broiler Hatchery

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

Thursday, Dec. 22

Ag reports and events:

- Weekly Export Sales

- Food Price Outlook

- Cotton Ginnings

- Cold Storage

- Livestock Slaughter

- Poultry Slaughter

- Port of Rouen data on French grain exports

- Sugar, cane and ethanol production data by Brazil’s Conab (tentative)

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Brent February options expire

Friday, Dec. 23

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Cattle on Feed

- Hogs and Pigs

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook |