More Economic Reality? Powell Speaks Wednesday, Employment Report Friday

Congress+Budget=Delays | House elections | Farm income | Antitrust hearing | RFS | Protests in China

Washington Focus

The next time your spouse tells you to do something, ask if it’s on congressional budget time. That’s when lawmakers have at least a year to agree on a budget for the fiscal year (FY). But as usual, we are nearly into December and still no final budget for FY 2023, which began Oct. 1.

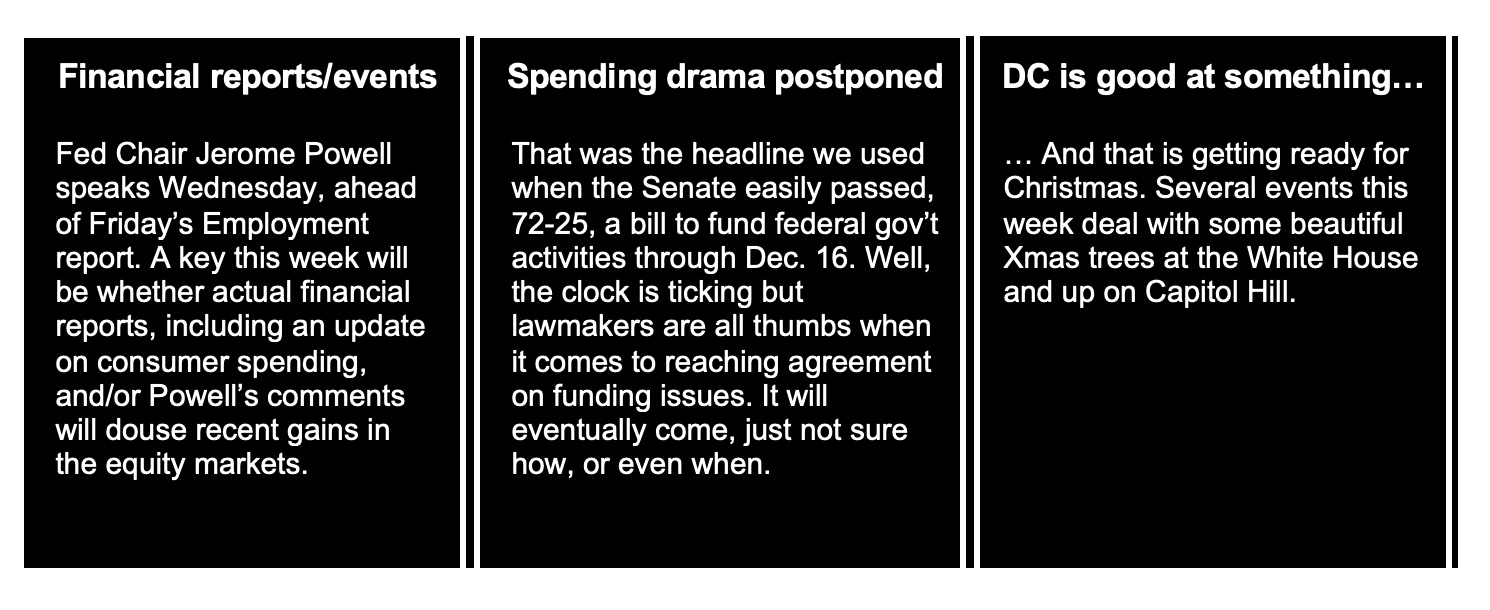

Congress is currently dealing with a continuing resolution (CR) because as usual, lawmakers could not agree on various budget items. The current stopgap spending measure lasts until Dec. 16. Despite all the congressional yak on this topic, no agreement is near, according to reports. If no agreement is reached by the “deadline,” another stopgap spending measure (aka an excuse for more time) will be needed.

Some House Republicans think they have “leverage” because in the new Congress next year, they will “control” the chamber. But like the narrow majority the Democrats have in this Congress, Republicans will have a similar tight margin next year (see related item below). That usually leads to lawmakers from the fringe area of the parties (far right among Republicans, far left for Democrats) to grandstand. And expect that to take place. So much for leverage. The only way for legislation ahead is for practical/centrist/non-activist lawmakers to give and take to get legislation across the finish line.

This week finds some Democrats writing a catch-all omnibus spending measure on their own. Meanwhile, as noted, some Republicans prefer another CR into early 2023 so they can handle the matter when they have “control.” Like the Groundhog Day movie, this show focuses on repetition. But the movie is a lot more fun to watch.

Speaking of someone who was late to reality, Fed Chairman Jerome Powell speaks Wednesday afternoon. Recall when Powell spoke at Jackson Hole and then at his FOMC presser. Result: stock markets tanked. Recall it was Powell and his Fed colleagues who were very late in coming to grips with what they initially termed “transitory” inflation. That in part led them to keep interest rates too low for too long. But since energy and food prices and a host of other price rises were finally evident to them, the Fed has been on a tear to rebuild its tattered reputation.

Despite a plethora of hawkish comments from Fed officials, the stock market has pushed higher since the middle of October. Powell knows the blackout period is quickly approaching for the Dec. 13-14 FOMC meeting. He will speak on Nov. 30 at the Brookings Institution about the labor market and the economic outlook. Some analysts and traders say investors and others completely missed the point of the Fed minutes recently released. They note the Fed minutes emphasized that rates were going higher than previously noted at the September FOMC meeting. Meanwhile, they add, the Fed is willing to risk recession if it means beating inflation. Upshot: Reading the Fed minutes and listening to Fed officials, it seems that Fed Fund rates are destined to exceed 5% by the end of 2023. If so, that translates into 10.5% to 11% farm operating loans. Ugh.

Continuing the theme about being late, this week by court order will have EPA announcing some key information about the Renewable Fuels Standard (RFS) program. Based on history, no one will be happy with the announcements. But at least we will have EPA’s official announcement to comment on, rather than rumors of them. Remember, EPA must make the announcement no later than Nov. 30… this month, this year.

Another contentious congressional topic this week is the proposed merger of supermarket titans Kroger and Albertsons. On Tuesday, a hearing on the proposed merger will be held by the Senate Judiciary Subcommittee on Competition Policy, Antitrust, and Consumer Rights. Subcommittee Chairwoman Amy Klobuchar (D-Minn.) and other Democrats have written the Federal Trade Commission to review the merger, saying it raised “considerable antitrust concerns.” BTW, Klobuchar recently wrote a book on antitrust matters. Link to the panel site.

Courts are already involved. A state court judge in Washington temporarily blocked a $4 billion payout by Albertsons to its shareholders ahead of the merger with Kroger. A second lawsuit challenging the dividend payment was filed in Washington, D.C., by the District of Columbia, California and Illinois. The dividend, the complaint said, “risks seriously hindering Albertsons’ ability to compete with Kroger and other supermarkets in these and other states during the merger review and interfering with the merger review process.”

Crypto focus this week. The Senate Ag Committee will hold a hearing Thursday on the collapse of FTX, the cryptocurrency trading platform founded by San Bankman-Fried, a top contributor to congressional Democrats. FTX filed for bankruptcy in October. The only witness is Commodity Futures Trading Commission Chairman Rostin Behnam. The “hearing” addresses the session’s true intent: “Why Congress Needs to Act: Lessons Learned from the FTX Collapse.” In a long overdue move, Ag Committee Chair Debbie Stabenow (D-Mich.) and ranking Republican John Boozman of Arkansas are sponsoring legislation that would give the CFTC more authority to regulate digital assets.

Congressional members have been warned for months about major negative implications in the freewheeling crypto area. Congress is used to addressing crises after the fact — not before. Also, on Feb. 23, Sen. Elizabeth Warren (D-Mass.) wrote an op-ed in the WSJ titled, “Regulate Crypto or It’ll Take Down the Economy.” Link for details.

The House will vote on a resolution “condemning the use of hunger as a weapon of war and recognizing the effect of conflict on global food security and famine.”

The measure by Rep. Sara Jacobs (D-N.Y.) is largely directed at Russia’s actions in Ukraine. “Putin has repeatedly weaponized food during this war, blockading Odessa and recently striking the port — even after a landmark grain deal was struck just the day before. But we also have to recognize that we can’t only sound the alarm and mobilize aid and attention when and where humanitarian crises affect people who look like us,” Jacobs said during the House Foreign Affairs Committee’s consideration of the resolution. “Around the world, millions are hungry and suffering as a direct result of Putin’s relentless crusade for power.”

Perspective: Putin’s war on Ukraine started Feb. 24. His use of oil and food as weapons of war has been clear for many months. Some say Vladimir Putin is weaponizing winter. On Monday, the Atlantic Council holds a virtual discussion on "How Can Ukraine Defeat Putin's Energy Blitz?"

In a report that gets a lot of coverage but is rarely accurate, USDA on Thursday will release its latest farm income forecast. By the end of the year, you would think economists would be near an accurate assessment.

USDA on Tuesday will release its quarterly update on U.S. agricultural trade.

The House midterm election results are almost complete. Elections were held Nov. 8 and we still do not have final results. Some say this is why many voters have questions regarding why it takes so long for some states to release results, while other states like Florida learned lessons from the past and now is seen as the gold standard for election vote-counting procedures.

In Colorado, GOP Rep. Lauren Boebert was expected to easily defend her seat, but she faced an unexpectedly fierce battle with Democrat opponent Adam Frisch. Boebert leads by just 554 votes, less than 0.5% — but she has already declared victory. If the gap remains below 0.5%, state law does require a recount, but those rarely go the loser’s way.

In the redrawn 13th Congressional District in California, John Duarte, a Republican Party candidate, received 50.2% of the total votes as 99% of the votes have been tabulated. Democrat candidate Adam Gray trailed Duarte by 593 votes, less than 0.5%. There’s no automatic recounting law in California.

Bottom line: If both Boebert and Duarte manage victories, that will give Republicans a 9-seat advantage (but four-vote margin) in the House: 222 – 213. Meanwhile, the Cook Political Report with Amy Walter showed the GOP easily took the overall popular vote, by 3.3 million.

President Biden on Thursday will hold his first state visit at the White House, this one for French President Emmanuel Macron, marking the return of a tradition not seen since before the Covid-19 pandemic. The state visit, which will include a state dinner, “will underscore the deep and enduring relationship between the United States and France – our oldest ally,” White House press secretary Karine Jean-Pierre said when the visit was announced in September.

Biden administration changes ahead? There will likely not be as many personnel changes in the Biden administration now that the Democrats kept a slim majority in the Senate and while losing the House to Republicans next year, the spread was narrower than Republicans and some others predicted.

An area where staff turnover is expected is on Biden’s economic team. Brian Deese, the director of the National Economic Council, will reportedly leave his role in the coming months, and Cecilia Rouse is slated to return to Princeton University in the spring after taking leave to serve as chairwoman of the Council of Economic Advisers. Meanwhile, Treasury Secretary Janet Yellen has repeatedly disputed reports that she would depart her post sometime in 2023.

White House chief of staff Ron Klain will remain in the job for the foreseeable future, reports note. “Ron’s ability to do so many things at the same time is something that I just, you rarely run across this,” Anita Dunn, a senior adviser to the president, said at an Axios event in late October.

On the international front, protests are spreading across China's major cities, reacting against harsh Covid restrictions, including Beijing, with some protesters calling for President Xi Jinping to step down. Protests broke out in Shanghai and other big cities as well as university campuses over the weekend, in a major test for the leadership of strongman Xi and his zero-Covid policy.

Authorities show little sign of relenting on the zero-Covid approach as case numbers and the personal toll mount. The wave of civil disobedience is unprecedented in mainland China since Xi Jinping assumed power a decade ago, Reuters reports (link).

Some Washington-related Christmas events this week:

- Monday: White House hosts a media preview of the 2022 Holidays at the White House.

- Tuesday: Lighting of the Capitol Christmas Tree. The Architect of the Capitol hosts the annual lighting of the U.S. Capitol Christmas Tree.

- Wednesday: National Christmas Tree lighting. National Park Service and the National Park Foundation host a ceremony for the 100th lighting of the National Christmas Tree.

Some other events on tap this week include:

Monday, Nov. 28:

- Feeding the world. Wilson Center's Latin American Program and Argentina Project virtual discussion on "Feeding the World: A Conversation with Latin American Agriculture Ministers."

- Ukraine and Russian energy. Atlantic Council virtual discussion on "How Can Ukraine Defeat Putin's Energy Blitz?"

- EU climate agenda. Washington Post Live virtual discussion with European Commissioner Director General for Energy Ditte Juul Jorgensen on "The EU Climate Agenda and COP27 Climate Talks."

- China trade. The Information Technology and Innovation Foundation (ITIF) holds a discussion on "How Updating a Century-Old Trade Law Could Limit China's Ability to Profit from Unfair Trade Practices."

- Artemis unmanned moon mission. The National Aeronautics and Space Administration (NASA) holds a news conference to discuss "the status of the uncrewed Artemis I flight test as the Orion spacecraft reaches the mid-point of its Moon mission and its farthest distance from Earth at nearly 270,000 miles away."

Tuesday, Nov. 29:

- Kroger-Albertsons merger. Senate Judiciary Competition Policy, Antitrust, and Consumer Rights Subcommittee hearing on "Examining the Competitive Impact of the Proposed Kroger-Albertsons Transaction."

- Urban and indoor agriculture. Natural Resources Conservation Service holds a meeting of the Urban Agriculture and Innovative Production Advisory Committee to discuss interim recommendations for the Secretary of Agriculture on the development of policies and outreach relating to urban, indoor, and other emerging agriculture production practices.

- Vote on energy-related nominees. Senate Environment and Public Works Committee markup to vote on the nominations of Beth Prichard Geer to be a member of the Board of Directors of the Tennessee Valley Authority; Joseph Goffman to be an assistant EPA administrator for the Office of Air and Radiation; and others

- U.S., China and Korea. Wilson Center's Asia Program holds a conference on "Between the Eagle and the Dragon: Challenges and Opportunities for South Korea in the U.S./China Competition."

- Voting rights reform. Punchbowl News holds a virtual discussion with Sen. Roy Blunt (R-Mo.) on the "future of democracy and voting rights reform.

- Korea peninsula. Henry L. Stimson Center virtual discussion on "Tensions on the Korean Peninsula: Is War Possible?"

- U.S. primaries. American Enterprise Institute for Public Policy Research discussion on "What Is the Future for Primaries?"

- Brazil’s new president’s agenda. Atlantic Council virtual discussion on "Mapping President-elect Lula's First 100 Days."

- China preparing for war. Institute of World Politics lecture on "China is Preparing for War, America is Not."

Wednesday, Nov. 30

- Japan security issues. Center for Strategic and International Studies virtual discussion on "The Politics of Policy: Japan's Road Ahead on National Security and Economic Strategy."

- Global issues. Reuters NEXT holds its Leadership Summit with the theme "A New Vision for a Better Tomorrow," with remarks from Canadian Prime Minister Justin Trudeau; Mike Henry, CEO of BHP; Lynn Martin, president of the New York Stock Exchange; Reuters editors participate in a discussion on "Are the United States and China Headed for Conflict?” Runs through Wednesday.

- Private perspectives on infrastructure. Senate Environment and Public Works Committee hearing on "Putting the Bipartisan Infrastructure Law to Work: The Private Sector Perspective."

- Russian ambassador nomination. Senate Foreign Relations Committee hearing on the nomination of Lynne Tracy to be ambassador to the Russian Federation and other diplomatic nominations.

- Trade policy in the digital economy. Senate Finance International Trade, Customs, and Global Competitiveness Subcommittee hearing on "Opportunities and Challenges for Trade Policy in the Digital Economy."

Thursday, Dec. 1

- FTX collapse. Senate Ag Committee hearing on "Why Congress Needs to Act: Lessons Learned from the FTX Collapse." Commodity Futures Trading Commission Chairman Rostin Behnam testifies.

- Screening foreign investment. American Bar Association's Standing Committee on Law and National Security discussion on "CFIUS (Committee on Foreign Investment in the United States) and Investment Screening," focusing on "new enforcement guidelines and President Biden's Executive Order on CFIUS."

- International issues. Final day of the Reuters NEXT Leadership Summit with the theme "A New Vision for a Better Tomorrow," including remarks from International Monetary Fund Managing Director Kristalina Georgieva; U.S. Deputy Treasury Secretary Wally Adeyemo; Albert Bourla, chairman and CEO of Pfizer; and World Bank President David Malpass.

- U.S. and international energy issues. United States Energy Association and the U.S. Agency for International Development host the Business Innovation Partnership Conference.

- Covid and the future of public health. Washington Post Live virtual discussion with former National Institute of Allergy and Infectious Diseases Director Anthony Fauci on "The Coronavirus Pandemic and Future of Public Health."

- GHG reduction. Environmental Protection Agency virtual meeting of the Public Environmental Financial Advisory Board to provide workgroup updates and work products for the Greenhouse Gas Reduction Fund charge.

- Crypto issues. Politico holds its inaugural crypto summit with the theme "Crypto Governance and the Future of Digital Assets: Where is Crypto Headed?"

- Federal Reserve issues. American Enterprise Institute for Public Policy Research discussion on "Assessing the Federal Reserve's Capital Framework."

- Financial stress and economic activity. Johns Hopkins University Paul H. Nitze School of Advanced International Studies virtual discussion on "Financial Stress and Economic Activity: Evidence from a New Worldwide Index."

Friday, Dec. 2:

- COP27. The Environmental and Energy Study Institute virtual discussion on "Climate Summit Recap: Key Outcomes and What Comes Next," as part of the What Congress Needs to Know About COP27 series.

- Foreign aid. Agency For International Development holds a virtual meeting of the Advisory Committee on Voluntary Foreign Aid (ACVFA).

- Energy efficiency. International Energy Agency (IEA) holds an embargoed virtual discussion on a new Energy Efficiency Market Report, focusing on "whether government action in 2022 can be a turning point for energy efficiency."

Economic Reports for the Week

Friday brings another monthly Employment report. The hot U.S. labor market began showing signs of cooling off in October as the pace of hiring slowed and unemployment crept higher. The report may whether the Federal Reserve's series of interest rate hikes meant to lower the temperature of the economy has had any further impact on employers’ desire to hire more workers. Other key reports include updates on consumer confidence on Nov. 29, the second estimate on Q3 GDP on Nov. 30, and a report on construction spending on Dec. 1.

Monday, Nov. 28

- Federal Reserve Bank of Dallas releases the Texas Manufacturing Outlook Survey for November. The consensus estimate is for a negative 12 reading, about seven points better than in October. The index has had negative readings for six consecutive months, suggesting contraction in the region’s manufacturing sector.

- Federal Reserve: New York Fed President John Williams speaks.

- Economic outlook. Organization for Economic Co-Operation and Development (OECD) virtual briefing on "OECD Economic Outlook for 2023-24."

Tuesday, Nov. 29

- S&P CoreLogic releases its Case-Shiller National Home Price Index for September. Economists forecast that home prices increased 10.4%, year over year, following a 13% jump in August. Home price growth has decelerated sharply amid surging mortgage rates and faltering demand. The months of February through May of this year all saw gains of at least 20%.

- Conference Board releases its Consumer Confidence Index for November. Expectations are looking for a 99 reading, 3.5 points fewer than in October.

- FHFA House Price Index: The house price index is expected to fall 1.2% in September after falling 0.7% in August and 0.6% in July. August marked the sharpest fall and first back-to-back fall in 11 years.

Wednesday, Nov. 30

- MBA Mortgage Applications

- Bureau of Labor Statistics (BLS) releases the Job Openings and Labor Turnover Survey. Economists forecast 10.5 million job openings on the last business day of October, about 200,000 fewer than in September. Employers had 10.7 million openings in September, an increase of 437,000 from the prior month, showing that demand for workers remains robust. September openings were well above the 5.8 million unemployed people seeking work that month.

- Institute for Supply Management releases the Chicago Business Barometer for November. The report is expected to show about a two-point gain, to 47.3 from October’s 45.2 reading. The index has had two straight months of readings below 50, indicating a shrinking economy.

- ADP releases its National Employment Report for November. Expectations are that the economy added 180,000 private-sector jobs, after an increase of 239,000 previously.

- GDP: The second estimate of third-quarter GDP, at 2.7% consensus growth, is expected to show little change from 2.6% in the quarter's first estimate. Personal consumption expenditures, at 1.4 % growth in the first estimate, is expected to come in at plus 1.5% in the second estimate.

- Advance International Trade in Goods: The U.S. goods deficit (Census basis) is expected to narrow by $1.3 billion to $90.6 billion in October after narrowing by more than $6 billion in September to $91.9 billion.

- Advance Retail Inventories

- Advance Wholesale Inventories: Wholesale inventories are expected to increase 0.5% in the advance report for October that would follow a 0.6% build in September.

- Beige Book. The Fed releases its periodic compilation of economic anecdotes collected from businesses around the country, known as the Beige Book. The report will include details from businesses on inflation, employment and output growth.

- Federal Reserve: Fed Chairman Jerome Powell to speak on the “Economic Outlook, Inflation and the Labor Market” at the Brookings Institution, Washington, DC; Fed Governor Lisa Cook scheduled to speak on the “Outlook for Monetary Policy and Observations on the Evolving Economy.”

- European Union’s statistics agency releases November inflation figures for the 19-nation eurozone. The bloc’s consumer prices were 10.7% higher in October from the same month a year earlier. That was the fastest pace since records began in 1997.

Thursday, Dec. 1

- Jobless claims for the Nov. 27 week are expected to come in at 235,000 versus 240,000 in the prior week.

- BEA reports personal income and expenditures for October. Income is believed to have risen 0.4%, month over month, while spending is seen up 0.7%. This compares with gains of 0.4% and 0.6%, respectively, in September. The Fed’s favored inflation gauge, the core personal consumption expenditures price index, is forecast to have jumped 5%, year over year, slightly lower than September’s 5.1%.

- Fed Balance Sheet

- Money Supply

- Federal Reserve: Fed Governor Michelle Bowman and Vice Chair for Supervision Michael Barr scheduled to speak; Dallas Fed President Lorie Logan scheduled to speak.

Friday, Dec. 2

- BLS releases the jobs report for November. The consensus estimate is that nonfarm payrolls increased by 220,000, 41,000 fewer than in October. The unemployment rate is seen remaining unchanged at a historically low 3.7%.

- Motor Vehicle Sales: After jumping sharply to a 14.9 million annualized rate in October, unit vehicle sales in November are expected to slow to 14.7 million.

- Federal Reserve: Charles Evans speaks.

Key USDA & international Ag & Energy Reports and Events

Another month, another FAO World Price Index report, on Friday.

Monday, Nov. 28

Ag reports and events:

- Export Inspections

- Crop Progress

- CFTC Commitments of Traders report on positions for various U.S. futures and options. Delayed from Friday due to U.S. holiday.

Tuesday, Nov. 29

Ag reports and events:

- Livestock and Meat Domestic Data

- Outlook for U.S. Agricultural Trade

- EU weekly grain, oilseed import and export data

- Roundtable on Sustainable Palm Oil (RSPO) 2022 conference, Kuala Lumpur, Nov. 29-30

Energy reports and events:

- API weekly U.S. oil inventory report

- Jera CEO media briefing on winter power demand/supply. Tokyo.

- BNEF’s Shanghai Summit (through Nov. 30)

- North Sea loading programs for January expected this week

Wednesday, Nov.30

Ag reports and events:

- Broiler Hatchery

- Agricultural Prices

- Egg Products

- Malaysia’s November palm oil exports

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- Brent January futures expire

Thursday, Dec. 1

Ag reports and events:

- Weekly Export Sales

- Farm Income Forecast

- Cotton System Consumption and Stocks

- Fats & Oils: Oilseed Crushings, Production, Consumption and Stocks

- Grain Crushings and Co-Products Production

- Port of Rouen data on French grain exports

- Australia commodity index

Energy reports and events:

- EIA natural gas storage change

- Insights Global weekly oil product inventories in Europe’s ARA region

- Holidays: Kazakhstan, UAE

Friday, Dec. 2

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Dairy Products

- FAO World Food Price Index

- Stats Canada wheat, canola and barley production data

- FranceAgriMer weekly update on crop conditions

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts

- International Energy Agency publishes Energy Efficiency Market Report

- Holiday: UAE

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook |