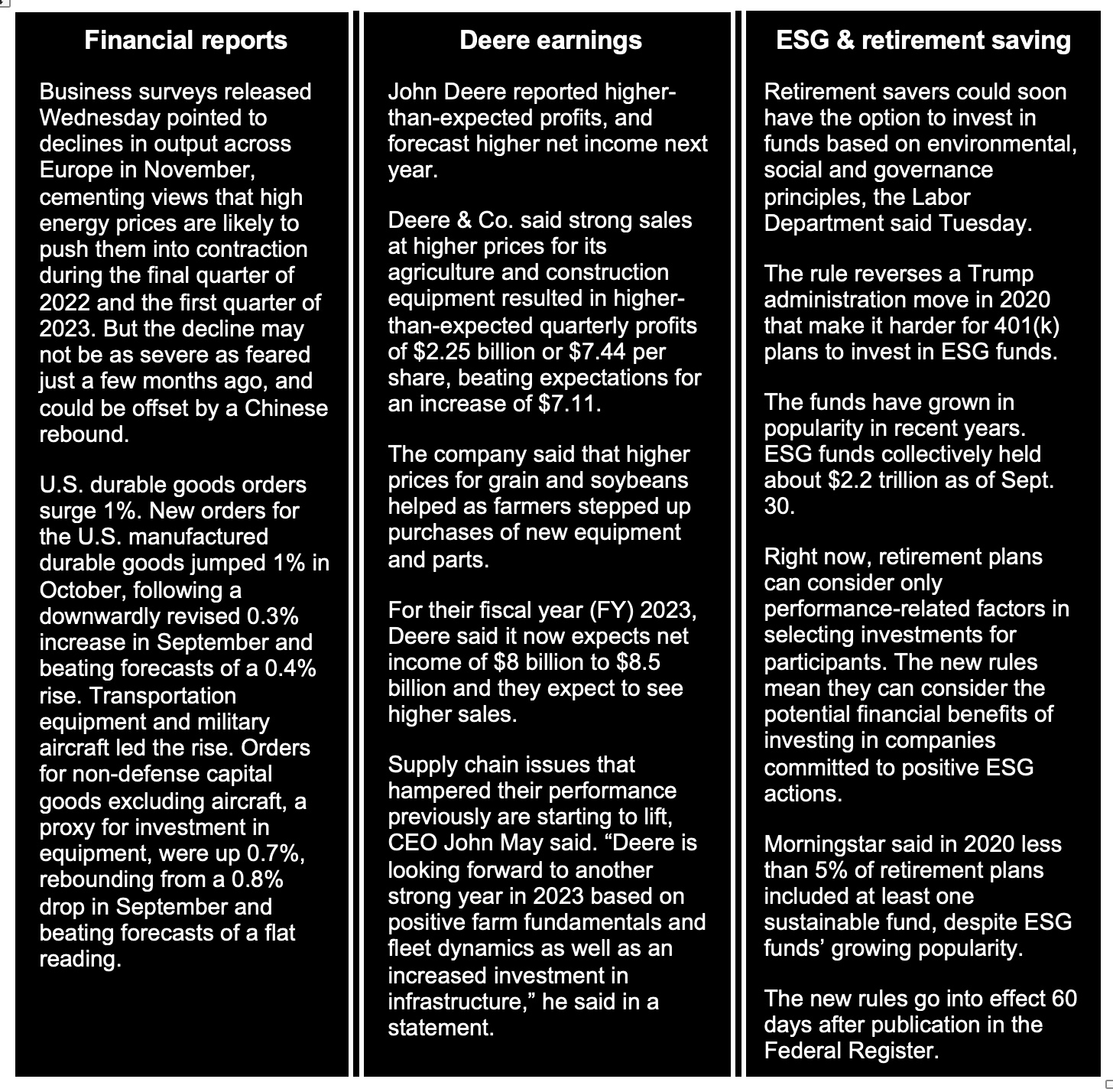

U.S. Durable Goods Orders Surge 1%; U.S. Initial Jobless Claims at 3-Month High

Deere reports higher-than-expected profits, forecasts higher net income next year

|

In Today’s Digital Newspaper |

USDA daily export sale: 110,000 metric tons of soybeans for delivery to China during the 2022-2023 marketing year.

U.S. markets will trade normal hours today, but trading volume is expected to be light as many traders have opted to take an extended holiday and some facilities are closed. U.S. markets and gov’t offices will be closed in observance of the Thanksgiving holiday Thursday (Nov. 24). On Friday (Nov. 25), U.S. gov’t offices are open, but U.S. equity markets will close early at 1 p.m. ET while the bond market will close at 2 pm ET. U.S. commodity markets will also observe an abbreviated trading session with agricultural commodity trade halting at 1:05 pm ET. The CFTC Commitments of Traders report will not be released until Monday, Nov. 28. USDA’s Weekly Export Sales report will be released Friday.

Russian oil price cap. The U.S. and its Western allies aim to reach an agreement today on a price cap on Russian oil — central to efforts to sanction Russia for its invasion of Ukraine — after months of discussion. The policy aims to limit Russian energy revenue without causing a major spike in oil prices. Ambassadors from European Union member states will meet first to nail down a price with unanimous agreement. The G7 countries and Australia plan to enforce the price cap beginning Dec. 5. More info in Russia/Ukraine section.

Brent crude futures dropped over 3% to below $86 per barrel as investors weighed persistent demand concerns against tight global supplies. A deteriorating outlook for global demand has been keeping markets on edge, with advanced economies, mainly the U.S. and Europe, seeing a drop in economic activity due to tightening financial conditions and top crude importer China's facing the possibility of tighter coronavirus-induced restrictions amid rising infections. On the supply side, prospects that OPEC could further intervene in markets to shore up prices in case of a recession-driven demand downturn have been offering support. As previously noted, an EU ban on Russian crude imports from December 5 and an imminent G7 price cap on Putin's oil exacerbated concerns about tighter supplies.

The Eurozone Composite PMI Flash came in at 47.8 vs. (E) 47.0 helping European shares rise modestly.

The Labor Department cleared a path for 401(k) plans to offer ESG funds. Few retirement plans currently give the option to make investments based on environmental, social and governance principles. See black box above for details.

The Federal Reserve is set to release at 2 p.m. ET minutes from its November meeting, in which officials agreed to raise interest rates by 0.75 percentage point and signaled plans to keep increasing rates.

Russia-Ukraine war: Russian missiles struck a hospital and other civilian infrastructure in Ukraine’s east and south, killing at least three people including an infant, Ukrainian authorities said. Meanwhile, Russia’s munitions shortages raise questions over how long it can continue its Ukraine war.

USDA holds food price inflation forecasts for 2022, 2023 steady, leaving their November forecasts for 2022 increases in all food prices at 9.5% to 10.5%, food at home (grocery) prices at 11% to 12%, and food away from home (restaurant) prices at 7% to 8%. Those are the same levels they forecast in October. USDA also kept their forecasts for 2023 unchanged from October at 3% to 4% for all food, 2.5% to 3.5% for grocery prices, and 4% to 5% for restaurant prices. More details in Food industry section.

Biden again extends student loan pause. President Joe Biden’s administration Tuesday said it extended a pause on federal student loan payments through June, or before then if courts allow Biden’s student loan forgiveness program to go into effect. A federal appeals court last week halted the plan, which offers up to $20,000 in loan forgiveness, with a nationwide injunction. “We’re extending the payment pause because it would be deeply unfair to ask borrowers to pay a debt that they wouldn’t have to pay, were it not for the baseless lawsuits brought by Republican officials and special interests,” Education Secretary Miguel Cardona said Tuesday.

The Biden administration has launched a six-week push aimed at stepping up Americans’ Covid-19 booster vaccinations heading into the holiday season. Biden’s chief medical adviser, Dr. Anthony Fauci, kicked off the campaign on Tuesday during his final White House press briefing before he retires in December.

A Senate antitrust panel plans to schedule hearings on the lack of competition in the ticketing industry following the chaos that erupted over Taylor Swift concert tickets.

|

MARKET FOCUS |

Equities today: Most global stock markets were slightly up overnight. U.S. Dow opened slightly lower and then moved slightly higher. In Asia, Japan closed. Hong Kong +0.57%. China -0.27%. India +0.15%. In Europe, at midday, London +0.57%. Paris +0.01%. Frankfurt +0.11%.

U.S. equities yesterday: All three major indices registered gains Tuesday, with the Dow finishing up 397.82 points, 1.18%, at 34,098.10. The Nasdaq rose 149.90 points, 1.36%, at 11,174.41. The S&P 500 was up 53.64 points, 1.36%, at 4,003.58.

Computer company HP Inc. said Tuesday that it would lay off between 4,000 and 6,000 employees over the next three years as demand for personal computers weakens. The announcement came as HP released quarterly results that included a 13% year-over-year decline in revenue for its business segment that includes PCs. Chief Executive Enrique Lores admitted that after a difficult fiscal fourth quarter, and not-so-great outlook, cutting potentially more than 10% of HP's workforce was necessary. Lores said the job cuts are part of a strategy to create a "Future Ready" HP.

Agriculture markets yesterday:

- Corn: December corn fell 2 3/4 cents to $6.56 3/4, while March corn fell 4 1/4 to $6.59 1/4, the contract’s lowest close since Nov. 15.

- Soy complex: January soybeans fell 7 cents to $14.29 3/4. January soymeal fell $3 to $405.00. January soyoil fell 71 points to 71.44 cents.

- Wheat: March SRW wheat fell 7 3/4 cents to $8.10 1/2, the contract’s lowest close since Aug. 25. March HRW wheat fell 10 3/4 cents to $9.12. March spring wheat fell 3 1/2 cents to $9.50 1/4.

- Cotton: March cotton futures rose 264 points to 82.42 cents after hitting a three-week low earlier.

- Cattle: February live cattle fell 30 cents to $156.425. January feeder cattle dropped 95 cents to $181.675.

- Hogs: February lean hogs fell 7.5 cents to $90.075.

Ag markets today: Corn and soybean futures favored the upside in overnight trade while wheat futures traded mostly lower. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were steady to a penny higher, winter wheat futures were 2 to 4 cents lower and spring wheat was 3 cents lower to 2 cents higher. Front-month crude oil futures were around $1.75 lower and the U.S. dollar index was nearly 200 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. durable goods orders are expected to rise 0.5% in October following a 0.4% rise in September. (8:30 a.m. ET) UPDATE: See black box above for results.

• Jobless claims are expected to rise slightly to 225,000 in the week ended Nov. 19. (8:30 a.m. ET) UPDATE: The number of American filing new claims for unemployment benefits rose by 17,000 to 240,000 on the week ending Nov. 19, the most since August and well above expectations of 225,000. The sharp increase pointed to a looser labor market as the Federal Reserve raised its target funds rate by 375 bps since March. On a seasonally unadjusted basis, initial claims soared by 47,909 to 248,185, with significant increases in Illinois (+7,306), California (+5,024), and Georgia (+3,434). The four-week moving average, which removes week-to-week volatility, rose by 5,500 to 226,750.

• Initial purchasing managers index for manufacturing is expected to rise to 50 while the index for services is seen rising to 48. (9:45 a.m. ET)

• U.S. consumer sentiment is expected to fall 54.9 in November's final reading from 59.9. (10 a.m. ET)

• U.S. new home sales are forecast to fall to 570,000 in October from 603,000 the previous month. (10 a.m. ET)

• Federal Reserve will release minutes from its November meeting. (2 p.m. ET). Investors will be watching for any sign of a split between governors on when the central bank should adopt a more gradual approach to rate rises.

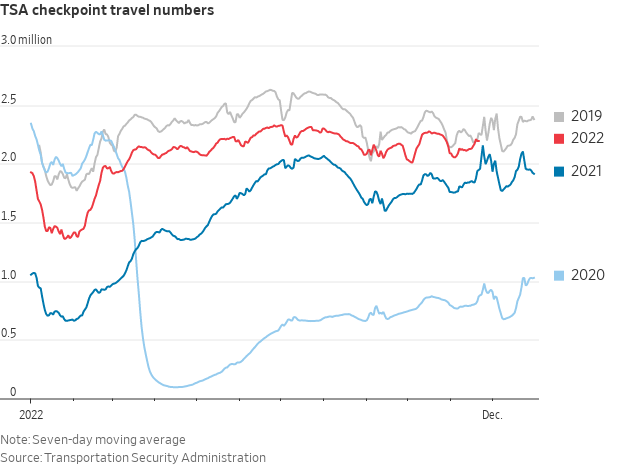

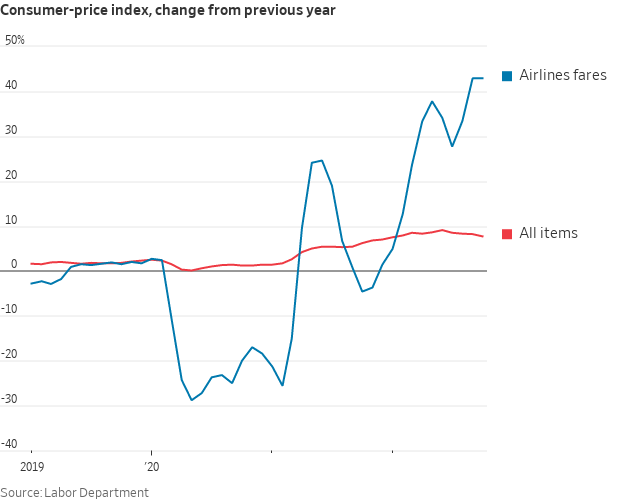

Thanksgiving travel is back to normal, with packed flights and expensive tickets. More than 2 million people a day now routinely pass through U.S. airports, according to the Transportation Security Administration, similar levels to 2019, before the Covid-19 pandemic shut down air travel. Since the start of October, U.S. carriers have canceled about 1% of flights, only slightly more than in the same period in 2019. AAA predicts that nearly 55 million people in the U.S. will be traveling this Thanksgiving holiday weekend.

U.S. mortgage rates fall again. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) in the U.S. fell by 23bps to 6.67% in the week ended Nov. 18, following a 24bps drop in the previous week which was the biggest decline since the last week of July, data from the Mortgage Bankers Association (MBA) showed. It is the first time in four months that borrowing costs fell for two consecutive weeks and now stand at their lowest level in eight weeks, tracking a retreat in bond yields. Still, mortgage rates remain close to levels not seen since 2001, and more than double the 3% reported a year earlier.

Eurozone reported its November manufacturing purchasing managers index (PMI) at 47.3, slightly above market expectations and compares to the October reading of 46.4. Still, a reading below 50.0 suggests contraction in the sector. It was the fifth month in a row of manufacturing sector contraction for the Eurozone. The better than feared headline is helping European shares edge higher today.

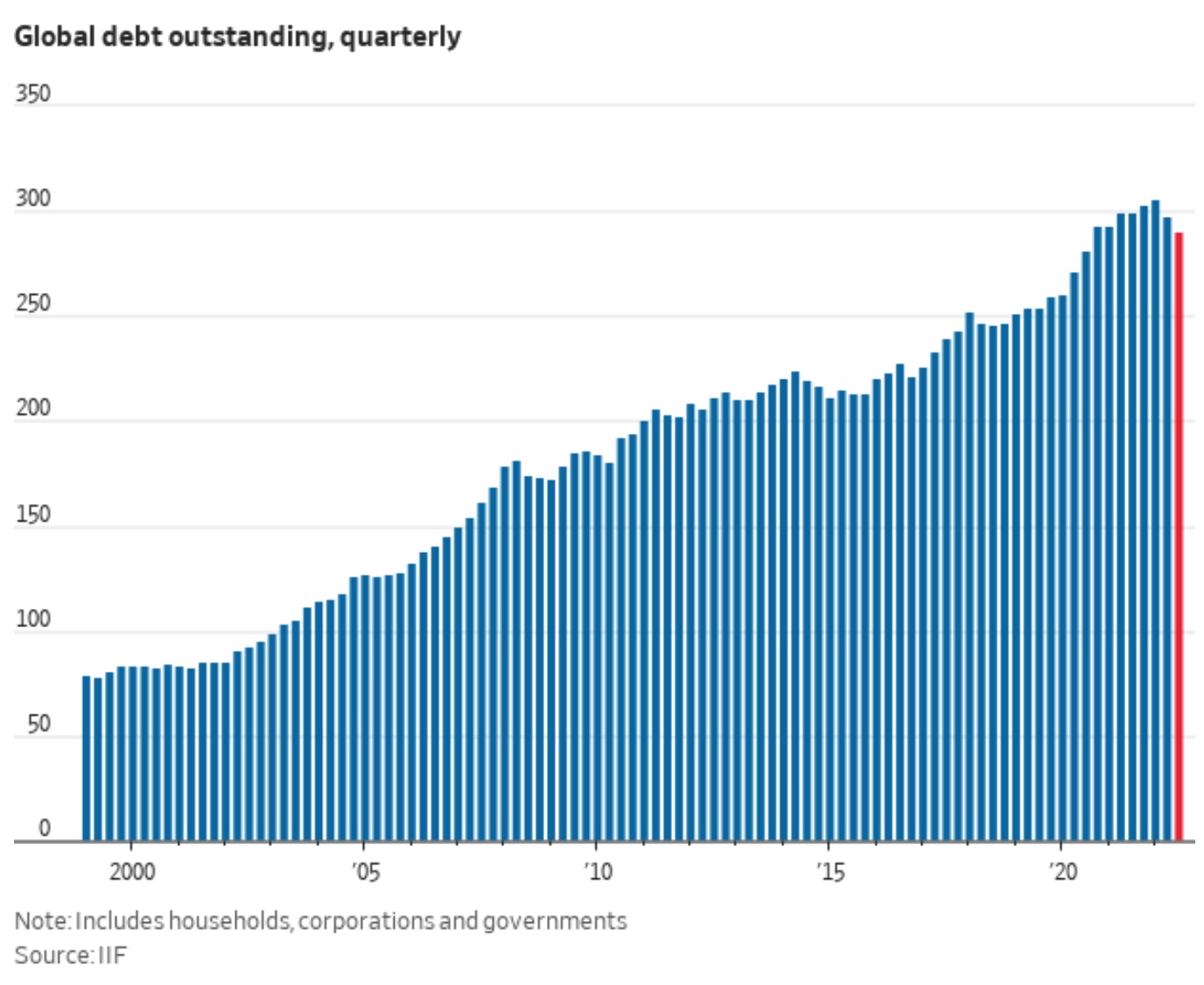

The global debt stockpile shrank by $6.4 trillion in the third quarter, according to a new report from the Institute of International Finance. Debt levels have been on the decline all year as soaring interest rates make it more difficult to borrow.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker. The yield on the 10-year U.S. Treasury note was firmer, trading around 3.78%. Crude has been under pressure, with U.S. crude around $78.80 per barrel and Brent crude around $85.50 per barrel. Gold and silver futures were narrowly mixed, with gold around $1,735 per troy ounce and silver around $21.16 per troy ounce.

• The risk of a rail strike in early December is growing after some unions voted down the deal that the White House brokered in September. But based on the performance of stocks tied closest to rail transport, investors expect the issue to be resolved without a strike. December 9 is now the first possible rail strike as the Brotherhood of Railroad Signalmen (BRS) union said it will set the end of its cooling off period relative to negotiations with railroads at Dec. 8, now setting it in sync with two other unions that are still negotiating with railroads after rejecting the initial labor agreement.

BRS President Michael Baldwin said there has been no progress “whatsoever” in negotiations with the railroads since the union rejected the tentative labor agreement October 26. Craig Ferguson, president of the SMART-Transportation Division union, indicated he was downbeat at the prospect of reaching a deal before the end of the cooling off period. “I’m hopeful, but I doubt it’s really in the cards,” he said. “I’ve got a lot of issues outstanding… that are reasons our guys voted it down.”

Sen. Chuck Grassley (R-Iowa) Tuesday told reporters that if a rail strike takes place, Congress should do “exactly the same thing we did 30 years ago,” referring to April 1991 when lawmakers quickly approved legislation to end a rail strike less than 24 hours after it began.

• Backup of ships at Southern California's ports has ended, more than two years after vessels began long queues that became one of the most visible signs of the U.S. supply chain turmoil. The backup that at one point in January climbed as high as 109 vessels has fallen to zero, according to the Marine Exchange of Southern California.

• Ag trade: Turkey tendered to buy 455,000 MT of milling wheat from unspecified origins, including supplies already stored in domestic warehouses.

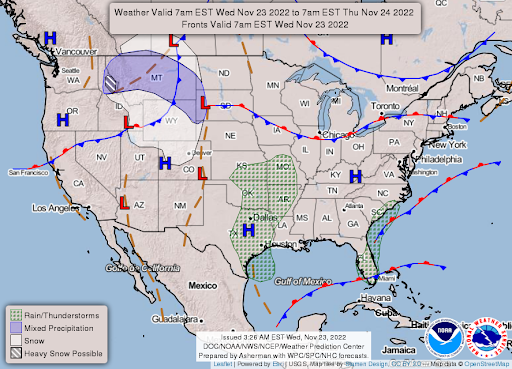

• NWS weather: Rain and mountain snow possible across the Northern/Central Rockies and Northern Plains today... ...Heavy rainfall to spread across parts of the Southern Plains and Lower Mississippi Valley on Thanksgiving Day... ...Potentially impactful snow could begin as early as Thursday night for parts of the Southern Plains.

Items in Pro Farmer's First Thing Today include:

• Quiet overnight session

• IMF urges China to boost Covid vaccinations, support property sector

• U.S. aims to sanction Brazilian deforesters

• Brazil corn exports could make big jump in 2023

• Ukraine grain crop expected to fall to 51 MMT (details in next section)

• China will auction more wheat next week

• Cash cattle activity expected today

• More seasonal pressure on cash hogs, pork cutout

|

RUSSIA/UKRAINE |

— Summary: The World Health Organization warned that Ukraine faces a “devastating energy crisis” this winter. Some 10 million people, a quarter of the population, do not have access to power as Russian strikes have halved the country’s generating capacity. Separately, Russian officials in Crimea said they had repelled two Ukrainian drone attacks near Sevastopol, home to Russia’s Black Sea naval fleet. Meanwhile, Russia’s munitions shortages raise questions over how long it can continue its Ukraine war.

- The U.S. and its allies are looking to agree on a price cap for Russian oil as early as today, according to the Wall Street Journal. Officials are talking about setting it at $60 a barrel as the group rushes to put the plan into place before Dec. 5. But others note a limit as high as $70 a barrel is being discussed. The plan is designed to crimp Russia’s energy export revenue while avoiding a surge in oil prices. Under the proposed price cap, the U.S., the European Union and Australia would ban maritime services for vessels that are shipping Russian crude unless it’s sold below the cap. It leverages the fact that the West controls most of the world’s insurance and financing for shipping. Bottom line: A price cap would further isolate Russia, which has managed to continue to export oil into Asia even after Western nations vowed to wean themselves off it.

Bottom line, according to the Sevens Report: “The threat of Russia retaliating to such political actions with a steep production cut offset worries about Covid restrictions in China. The oil market is still rangebound between $78 and $93 (on a closing basis) with Russia’s response to the EU and G7 policies a bullish wildcard to watch in early December.” - Ukraine grain crop expected to fall to 51 MMT. Ukraine has harvested 39 MMT of grain from this year’s crops to date, according to the country’s ag ministry. It forecasts production will fall to 51 MMT from a record 86 MMT in 2021. Planting plans for corn next year partly will depend on the condition of the winter wheat crop when it breaks dormancy next spring, but the ag ministry says area planted to corn could decline.

- Drones for Ukraine. A bipartisan group of senators is urging the Biden administration to provide Ukraine with armed drones. In a Nov. 22 letter to Defense Secretary Lloyd Austin, 16 senators said that the technology could help Kyiv to hold its territory and gain battlefield momentum. The Pentagon declined Ukraine’s request for the drones this month. U.S. officials, at times, have worried that the technology aboard the drone could be stolen on the battlefield.

|

CHINA UPDATE |

— China tightens Covid rules. Not long after making some changes to its strict zero-Covid policy, some Chinese cities have doubled down again as cases rise. Health authorities reported the first official deaths from Covid-19 since May this week, along with recording 28,000 new cases on Monday — nearing a record set in April. In response to outbreaks, Beijing has closed parks in museums and Shanghai announced new rules for recent arrivals to the city. It has also spooked investors, who have hoped for easing of the policy as Beijing’s economy suffers. On Tuesday, large protests erupted at a FoxConn factory that produces Apple iPhones in Zhengzhou.

More than 95% of iPhones are produced in China, and Apple has warned of delays in deliveries of its latest high-end devices just ahead of the crucial holiday shopping season. Some workers have fled the facility, forcing Chinese authorities to recruit villagers and bus them in to work on the assembly lines.

Lockdowns could extend to even bigger manufacturing centers. A big worry is that the southern manufacturing hub of Guangzhou, the epicenter of the latest surge of cases, could be next, the Financial Times reports (link). Everything from electronics and cars to telecom equipment and steel is produced in Guangzhou, so a lockdown there could have severe consequences for global supply chains and hit the share prices of companies with a heavy presence in China. Tesla’s stock, for example, is down more than 11% over the past five days.

— IMF urges China to boost Covid vaccinations, support property sector. The International Monetary Fund (IMF) urged China on Wednesday to boost Covid-19 vaccination rates and give more robust support to its troubled property sector to restore confidence and reduce risks from a global economic slowdown and high energy prices. IMF maintained its economic growth forecasts for China at 3.2% this year and 4.4% in 2023, assuming a gradual lifting of China's strict zero-Covid strategy in the second half of next year. IMF said economic risks for China were tilted to the downside, due to headwinds from a global slowdown, higher energy prices and tighter global financial conditions. IMF recommended China’s fiscal policy should be neutral in 2023 after strong support this year but should protect the recovery and facilitate rebalancing toward more domestic consumption. It said China’s monetary policy should remain accommodative and rely on interest-rate based measures.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA extends comment period for 45 days on livestock, poultry proposed rule on competition under the Packers and Stockyards Act (P&SA). The comment period ends on Jan. 17, 2023. Several groups and lawmakers have been urging USDA to extend the comment period as the original 60-day-comment-period close of Dec. 2 approached. The National Cattlemen’s Beef Association (NCBA) welcomed the USDA decision, but urged the agency to “tap the brakes” on its entire rulemaking process under the P&SA given that this rule, a prior one filed on the poultry tournament system and a yet-to-be released rule are linked and need to be considered together.

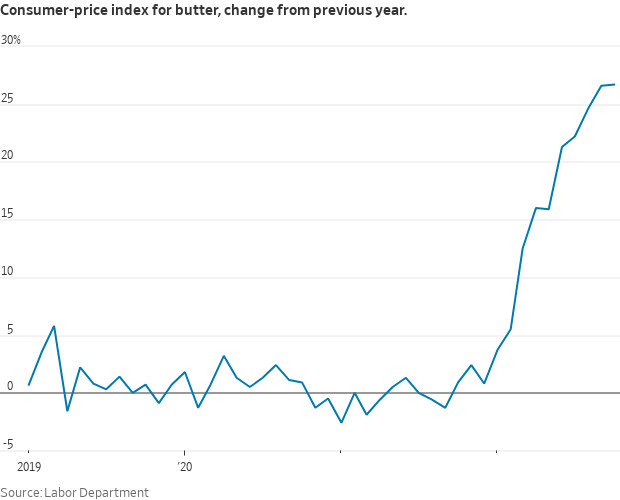

— People who like to bake are scouting cheap butter and posting about it on social media. They post pictures of store shelves showing prices. Butter prices reached record highs in September but are expected to come down by the end of the year. That’s because we’ve been eating more butter — consumption rose to 6.5 ponds per person in 2021 from 5.6 pounds in 2015 — and lower supply, according to the Wall Street Journal (link).

— USDA holds food price inflation outlook at lofty levels. The Consumer Price Index (CPI) for all food in 2022 is forecast to rise by 9.5% to 10.5% while food at home (grocery) prices are forecast up 11% to 12% with an increase for food away from home (restaurant) prices of 7% to 8%. Those figures would be the highest for all food since they were up 11% in 1979, for grocery store prices the biggest rise since 1974 when they moved up 12.7%, and the biggest rise in restaurant prices since they increased 9% in 1981.

The CPI for all food increased 0.7% from September 2022 to October 2022, and food prices were 10.9% higher than in October 2021. Grocery store prices were up 0.5% in October compared with September and up 12.4% from year-ago, while restaurant prices were 0.9% higher in October and 8.6% higher than year-ago marks.

Adjustments this month were in several food categories — ranges for seven food categories and one aggregate category were revised upward, while three food price categories were revised downward.

USDA analysis: USDA said the “continuing increases in the Federal funds (interest) rate by the Federal Reserve place downward pressure on prices, and prices for unprocessed agricultural commodities have decreased each month since peaking in May 2022.”

The impact of bird flu cases is being felt relative to egg prices and USDA said the situation needs to be monitored closely with over 50 million birds in 267 flocks in 46 states affected. “Retail egg prices increased 10.1% in October 2022 and reached 43.0% above October 2021 prices,” USDA said. “The ongoing outbreak of highly pathogenic avian influenza (HPAI) reduced the US egg-layer flock, as well as the poultry flock to a lesser extent. This decrease in the poultry flock and spike in HPAI prevalence are expected to increase wholesale and retail egg prices for the coming months.”

USDA also adjusted upward its forecasts for forecast ranges for fats and oils, sugar and sweets, and nonalcoholic beverages. “Economy-wide factors, including ongoing supply-chain issues and energy, transportation, and labor costs, have contributed to increases in prices across food categories,” USDA noted. “However, recent declines in agricultural commodity and energy prices are expected to ease price increases across these categories through the remainder of 2022.” Compared with 2021, USDA sees 2022 prices for fats and oils rising by 18.5% to 19.5%, sugar and sweets are predicted to increase between 10% and 11%, while nonalcoholic beverages prices are predicted to increase between 10.5% and 11.5%.

Areas were USDA trimmed forecasts: Beef and veal prices are now seen rising 5% to 6% versus their October outlook for increases of 5.5% to 6.5%, while dairy product prices are now seen up 11.5% to 12.5% compared with 12% to 13% in their October forecasts. “Beef and veal prices declined by 0.8% in October 2022 and were 3.6% lower than October 2021,” USDA said, noting they were the “only food category to experience a decline year over year.” But that is coming off of large increases in 2020 and 2021.

USDA held with its forecasts for all food prices to rise 3% to 4% in 2023, with increases for grocery store prices of 2.5% to 3.5% and restaurant prices of 4% to 5%. Despite being down sharply from their forecasts for 2022, the levels remain well above the 20-year average for all food prices to rise 2.4%, grocery prices to be up 2% and restaurant prices to increase 2.9%. No food categories are expected to see double-digit-percentage increases in 2023, with flat prices for fresh fruits and vegetables; no food categories are currently forecast to decline from 2022 levels.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 639,182,117 with 6,623,966 deaths.

- U.S. case count is at 98,386,527 with 1,077,800 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 650,810,290 doses administered, 267,476,279 have received at least one vaccine, or 81.18% of the U.S. population.

— Another vaccine push as Fauci set to leave government. The Biden administration announced a six-week campaign to urge more people to get updated Covid-19 vaccines, especially seniors, high-risk and other vulnerable individuals, making the shots available through tens of thousands of mobile, drive-up and pop-up clinics through the end of 2022. A report Tuesday by the Centers for Disease Control and Prevention found that the updated Covid-19 boosters from Moderna and Pfizer — BioNTech were 43% effective at preventing mild illness in people under 50 compared with not getting vaccinated, 28% more effective in people ages 50 to 64, and 22% effective in people 65 and older. Some experts say it’s still unclear if updated shots are better than earlier versions at preventing hospitalization and severe illness.

White House chief medical advisor Dr. Anthony Fauci, at his last press briefing before retiring from his government job in December, urged people to get their vaccines or boosters. Public health officials are concerned about a new wave of cases this winter, along with flu and respiratory syncytial virus.

|

POLITICS & ELECTIONS |

— Valadao wins in race for Congress. California dairy farmer David Valadao, one of 10 House Republicans who voted to impeach President Trump, defeated Democratic state legislator Rudy Salas for a fifth term in the House representing the agriculture-rich Central Valley, according to unofficial results. The victory expanded the GOP majority in the upcoming session to 219 seats — a one-vote cushion — with four races yet to be decided.

— Jair Bolsonaro, still Brazil’s sitting president, formally challenged the result of the election that he lost to Luiz Inácio Lula da Silva on October 30. During his campaign Bolsonaro signaled that he would refuse to acknowledge the legitimacy of his own possible defeat. But Brazil’s courts, as well as political leaders at home and abroad, have already accepted it. Even if Bolsonaro’s claim that older voting machines were untrustworthy is rejected, it might rouse his diehard supporters; it also precipitated a sharp drop in the real against the dollar.

|

CONGRESS |

— A Senate committee will hold an antitrust hearing on Ticketmaster and the lack of competition in ticketing markets after the entertainment company canceled the general sale of Taylor Swift tour tickets last week amid “historically unprecedented” demand for them. The bungled sale upset politicians and fans alike; the platform was set up for 1.5 million selected fans during pre-sale but 14 million tried for tickets.

— Meatpackers would be required to prepare disaster plans and contribute to a fund to assist producers culling livestock during catastrophes, such as the Covid-19 pandemic, under a bill unveiled by New Jersey Dem Sen. Cory Booker. Outlook: It will go nowhere in a GOP-controlled House, and will likely face hurdles in the Senate.

|

OTHER ITEMS OF NOTE |

— Biden administration is again extending a pause on federal student loan payments following the legal challenges that have halted President Biden’s plan to forgive up to $20,000 in student debt. Payments were set to resume Jan. 1 but the Department of Education said the extension will be in effect until 60 days after the Biden administration is allowed to implement the plan, or if it cannot proceed and legal challenges are still taking place by June 30, 2023, repayments would start 60 days after that. President Joe Biden said the plan was “legal” and that “Republican special interests and elected officials sued to deny this relief even for their own constituents.” He said it was not fair to ask those eligible for the debt forgiveness to resume paying their student loan debt “while the courts consider the lawsuit.” The delay in repayments will allow the “Supreme Court time to hear the case in its current term.” More than 26 million have applied for the aid and 16 million have been approved under the plan to cancel up to $20,000 in student loan debt.

— Supreme Court on Tuesday cleared the way for the IRS to release former President Donald Trump’s tax returns to a Democratic-led House committee. Trump has sought to shield the release of his tax returns for years and is currently under multiple investigations.

— Ag Census. USDA mailed letters to farmers and ranchers throughout the nation with codes allowing them to respond online to the Census of Agriculture, conducted every five years, with responses due by Feb 6. Printed questionnaires will be mailed in December.

— A gunman opened fire in a Walmart store in Chesapeake, Va., killing six people, police said, the state’s second mass shooting in less than two weeks. The shooter also died.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook |