Fed’s Powell Will Not Yield in Battle to Defeat Inflation | U.S. Dollar Surges

Mexico’s president shakes up his trade team as USTR Tai holds virtual meeting

|

In Today’s Digital Newspaper |

Sales of U.S. soybeans to China continue with additional cotton business reported. Sales of U.S. soybeans to China continued in the week ended Oct. 27, with USDA Export Sales figures showing net sales of 744,983 tonnes of soybeans and 121,972 running bales of upland cotton, but net reductions of 65,865 tonnes of corn. No activity for 2023-/24 was reported. For 2022, USDA said there were net reductions of 851 tonnes of beef and net sales of 11,219 tonnes of pork.

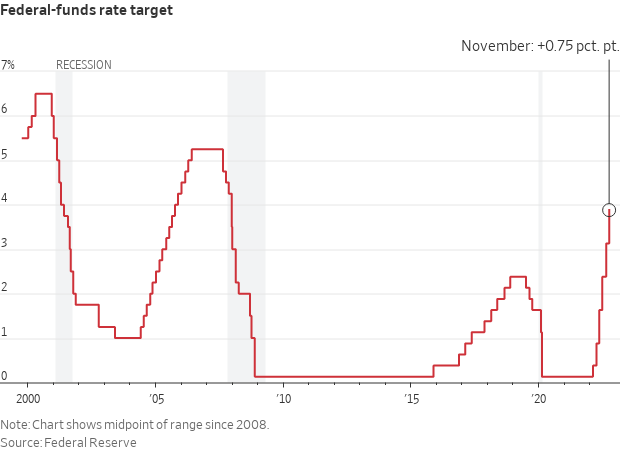

Economic tightening efforts by the Federal Reserve are starting to dampen wage growth in select sectors. The Federal Reserve on Wednesday raised interest rates by another 75 basis points, further pushing borrowing costs to the highest level since the Great Recession in efforts to stamp out stubbornly high inflation. This is the sixth rate increase of 2022, and it sent stocks plummeting. For the second straight meeting, Fed Chair Jerome Powell dashed hopes of any near-term Fed pivot during his press conference and reversed a post-FOMC statement rally, as stocks dropped sharply and ended near the lows of the day. Result: Some expect the S&P 500 to give back much of the past two week’s rally.

Some economists think the Fed is now pushing the U.S. — and world — into a deeper than needed recession, risking millions of jobs and market stability. The worry, according to Forbes (link): “Could Fed Chair Jerome Powell, haunted by the ghost of Paul Volcker, end up tanking the economy? During Volcker's own reign, unemployment stayed above 10% for nine straight months and the mortgage rate hit nearly 17%.” Powell had a snarky answer to the question when asked about it during his Wednesday presser. See below for his response.

The Bank of England voted by a majority of 7-2 to raise interest rates by 75 bps to 3% during its November meeting, the largest rate hike since 1989, increasing the cost of borrowing to the highest level since late-2008. The British pound sunk 2% against the dollar after the Bank of England’s recession warning.

The U.S. dollar soared this morning. See more under Markets section.

The Bank of England raised the prime lending rate by 0.75 percentage points, the biggest rise since 1989, in an effort to tamp down inflation.

Ukraine said its Zaporizhzhia nuclear power plant has been disconnected from the power grid after Russian shelling damaged transmission lines and left the facility reliant on diesel generators.

Russian president Vladimir Putin said in a phone conversation with Turkish President Recep Tayyip Erdogan that Russia has no plans to use nuclear weapons in its efforts in Ukraine, according to Ibrahim Kalin, an adviser to Erdogan.

Russia's repeated attacks on critical infrastructure in Ukraine prompted emergency power outages and restrictions today, according to national energy company Ukrenergo. This week alone, attacks in several regions of Ukraine have left millions without electricity and water intermittently.

There's been some debate over how much leverage Russia's Vladimir Putin really holds over the Ukraine grain pact deal, with the grain shipments continuing. Some say that the parties involved could push ahead despite Moscow's objections, though others feel that it would be hard to ink shipping and insurance contracts to underwrite the voyages. Others say Putin will likely try to gain additional leverage ahead of the deal's original expiration date of Nov. 19, and before the upcoming G20 Summit in Bali. Over the past two months, more than 400 ships departing Ukraine exported 9.9 million metric tons of corn, wheat, sunflower products, barley, rapeseed and soy under the Black Sea Grain Initiative.

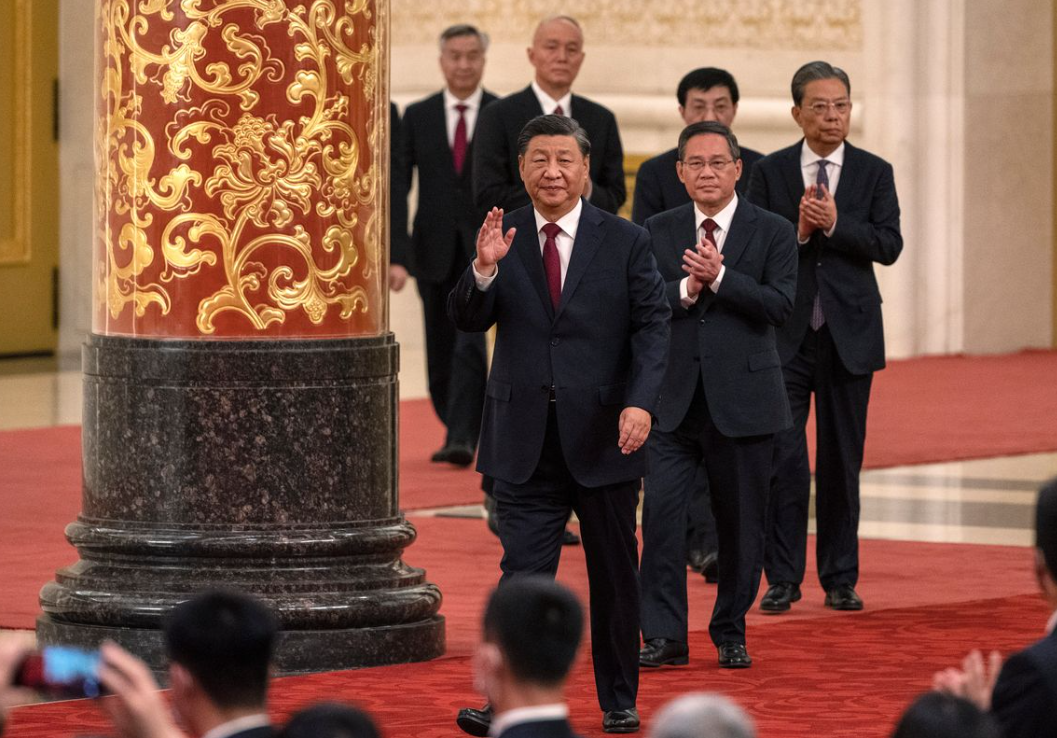

Will China’s new No. 2 be more pragmatist or loyalist? That’s what a Wall Street Journal article (see China section) is asking. Li Qiang is known inside the country as a pro-business pragmatist. Some Chinese entrepreneurs, investors and scholars say his record suggests he could be a moderating influence on Xi Jinping. But Li has fallen in line with Xi when it mattered. As Shanghai’s top leader he experimented with a looser approach to Covid but then imposed one of China’s harshest lockdowns. Many investors and analysts worry that Xi’s new team, stacked with loyalists, will debate policy less, raising the risk of major missteps.

Natural gas consumption in China could see a 1% decline this year, according to a researcher with Chinese oil giant CNOOC. The reduction, driven by an economic slowdown due to the country’s Covid policy, would be the first drop in China’s oil demand for 20 years. China is expected to cede its title as the world’s largest LNG importer to Japan this year, although it is planning to increase pipeline imports. More in China section.

Benjamin Netanyahu moved closer to regaining power in Israel. With over 93% of votes counted, his Likud party maintained its lead with 32 seats and his right-wing religious and nationalist bloc was on course to win 65 seats in the 120-seat Knesset.

Alaska, New Hampshire, Georgia, and Oregon are among the handful of states where third-party candidates could get enough votes to derail plans by either Democrats or Republicans.

Election Day 2022 is 5 days away. 30,555,755 early votes cast as of 11:51 p.m. Wednesday, per the United States Elections Project. Election Day 2024 is 733 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. Dow opened down around 240 points. In Asia, Japan closed. Hong Kong -3.1%. China -0.2%. India -0.1%. In Europe, at midday, London -0.4%. Paris -0.7%. Frankfurt -0.9%.

U.S. equities yesterday: The Fed meeting conclusion on Wednesday went from a positive initial response to sharp losses by the closing bell for all three major indices. The Dow fell 505.44 points, 1.55%, at 32,147.76. The Nasdaq dropped 366.05 points, 3.36%, at 10,524.80. The S&P 500 was down 96.41 points, 2.50%, at 3,759.69.

Agriculture markets yesterday:

- Corn: December corn fell 10 1/4 cents to $6.87 1/2.

- Soy complex: January soybeans rose 6 1/4 cents to $14.54, the contract’s highest close since Sept. 22. December soyoil rallied 224 points to 75.61 cents, the contract's highest close since June 10. December soymeal fell 30 cents to $424.50.

- Wheat: December SRW wheat fell 56 1/2 cents to $8.46. December HRW wheat dropped 49 3/4 cents to $9.40 1/4. December spring wheat fell 40 1/2 cents to $9.49 1/4.

- Cotton: December cotton rose the expanded 400-point limit to 79.00 cents, the contract’s highest close since Oct. 21.

- Cattle: December live cattle fell 55 cents to $151.40, the contract’s lowest close since Oct. 19. January feeder cattle gained $1.80 to $180.00.

- Hogs: December lean hog futures fell $1.90 to $83.30, the contract’s lowest settlement since Oct. 14.

Ag markets today: Corn and wheat futures faced followthrough selling overnight, while soybeans gave back more than they gained on Wednesday. As of 7:30 a.m. ET, corn futures were trading 3 to 5 cents lower, soybeans were 12 to 15 cents lower and wheat futures were mostly 8 to 15 cents lower. Front-month crude oil futures were around $1.50 lower and the U.S. dollar index was more than 1,600 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Bank of England is expected to raise its benchmark interest rate to 3% from 2.25%. (8 a.m. ET) UPDATE: As expected, the raised interest rates by 0.75 percentage points. More below.

• U.S. jobless claims are expected to rise to 220,000 in the week ended Oct. 29 from 217,000 one week earlier. (8:30 a.m. ET) UPDATE: The number of Americans filing new claims for unemployment benefits fell by 1,000 to 217,000 on the week ending Oct. 29, below market forecasts of 220,000. The result pointed that labor market conditions remain tight, backing the hawkish policy signaled by the Federal Reserve at its November meeting. On a seasonally unadjusted basis, initial claims rose by 1,174 to 185,594, with a notable increase in California (+2,535) and a sharp decline in Florida (-1,832). The four-week moving average, which removes week-to-week volatility, fell by 500 individuals to 218,750. Meanwhile, continuing claims rose to 1.49 million in the week ending Oct. 22, the highest since March.

• U.S. trade deficit is expected to widen to $72.3 billion in September from $67.4 billion one month earlier. (8:30 a.m. ET) UPDATE: The U.S. trade gap widened to a three-month high of $73.3 billion in September of 2022 from a downwardly revised $65.7 billion deficit in August and above market forecasts of $72.2 billion. It reflects an increase in the goods deficit of $6.6 billion to $92.7 billion and a decrease in the services surplus of $1.0 billion to $19.5 billion. Total imports went up 1.5% to $331.3 billion, prompted by purchases of semiconductors, civilian aircraft, telecommunications equipment, cell phones, pharmaceutical preparations, travel and transport services. Meanwhile, imports fell for fuel, crude and other petroleum products. Meanwhile, exports went down 1.1% to $258 billion, led by lower sales of crude oil, nonmonetary gold, and soybeans while shipments went up for telecommunications equipment, semiconductors and services, including travel and financial. The deficit increased with the EU and Mexico but narrowed with China.

• U.S. labor productivity for the third quarter is expected to advance at a 0.4% annualized pace from the second quarter. (8:30 a.m. ET) UPDATE: Non-farm labor productivity in the U.S. increased an annualized 0.3% in the third quarter of 2022, below market expectations, preliminary estimates showed. Output advanced 2.8%, recovering from a 1.2% fall in Q2 and hours worked rose 2.4%, easing from a 2.9%. Year-on-year, non-farm business sector labor productivity fell by 1.4%, following a 2.1% drop in Q2.

• USDA Weekly Export Sales report, 8:30 a.m. ET

• S&P Global's U.S. services index for October is expected to hold at 46.6, unchanged from a preliminary reading. (9:45 a.m. ET)

• Institute for Supply Management's services index is expected to fall to 55.5 in October from 56.7 one month earlier. (10 a.m. ET)

• U.S. factory orders for September are expected to climb 0.3% from the prior month. (10 a.m. ET)

• President Biden is scheduled to depart the White House at 10:30 a.m. ET en route to Albuquerque, N.M., where he is set to deliver remarks on student debt forgiveness at 3:45 p.m. ET.

Fed Chair Powell makes clear he/Fed will focus on inflation until it consistently declines. Traders saw two different Feds on Wednesday. A somewhat dovish Fed statement and then a very hawkish Fed Chair Jerome Powell during his presser. The Federal Open Market Committee (FOMC) increased its target range for the fed funds rate by 0.75 percentage points, to 3.75%-4%, as the Fed primed markets to expect. While allowing that the pace of rate increases might slow, he quickly added data suggest the top rate the FOMC needs to reach may be higher than the Fed has previously predicted in September. He also dismissed Wall Street’s fretting about “overtightening” by saying he believes the greater risk would be not to tighten enough.

Bottom line: Higher rates for a longer timeframe than many expected. Rates rising above the inflation rate is the historical norm. “We think we have a ways to go,” to cool inflation, Powell suggested.

Powell in the press conference highlighted an important distinction between the pace of rate hikes and what will be the ultimate, or terminal, rate level. He said the Fed doesn't want to fail to tighten enough and loosen too soon.

The Fed wants to see some evidence that price pressures are starting to moderate. The core (ex food and energy) CPI and core PCE deflator continue to show prices rising 0.5% or 0.6% month-on-month, whereas we need to see numbers closer to 0.1%/0.2% to get annual inflation down to 2% over time.

Markets read the press conference hawkishly, especially comments from Powell that he expected the Fed terminal rate to be higher than the Fed expected back in September. Those September Dot Plots saw the policy rate ending 2023 in the 4.50-4.75% area. Some private analysts now signal a policy rate of 5% to 6%.

Powell rebuked critics abroad who fret that the Fed will plunge the global economy into recession. The U.N. Conference on Trade and Development and the International Monetary Fund, among others, warned last month that rising interest rates and a strong dollar endanger the world economy, especially developing economies. Powell’s retort: “The world’s not going to be better off if we fail [to get inflation under control]. Price stability in the United States is a good thing for the global economy over a long period of time.”

Higher inflation, rising rates hit family budgets. Families across the country are facing higher costs and fewer options for school meals as districts contend with rising food and labor prices and the loss of universal free pandemic meals. Many districts across the country have raised prices for school food by as much as 50 cents a meal this year as they face ingredient prices that have risen by 50% or more, the Wall Street Journal reports (link).

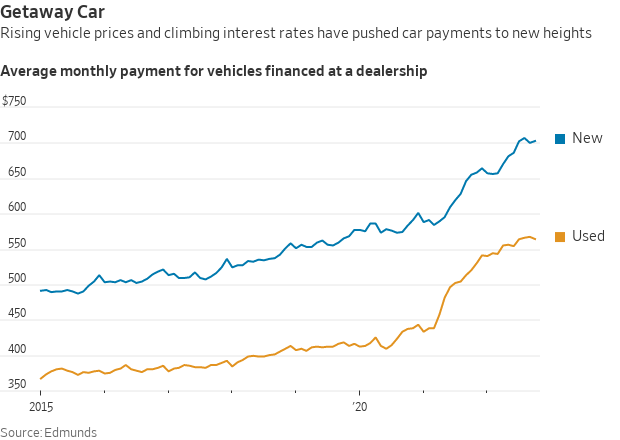

The Federal Reserve's interest-rate increases are forcing people to reorder their financial priorities. Mortgage rates have doubled this year. Carrying a credit-card balance or borrowing money for a car are significantly more expensive. Returns on saving accounts, on the other hand, are slowly improving. A Wall Street Journal article (link) looks at what the Fed's rate increases mean for your debts, savings and financial plans.

Bank of England raised interest rates by 75 bps to 3% during its November 2022 meeting, its largest rate hike since 1989, pushing borrowing costs to the highest since late-2008. It also marked the eighth consecutive interest rate rise, as the central bank tries to push inflation down which holds at 40-year highs, while a recession is under way. The central bank also said further increases in rates may be to tame inflation.

The SEC’s enforcement penalties hit a record $6.4 billion during Gary Gensler’s first fiscal year as chairman. The total beat the previous record, set in fiscal year 2020, by nearly 40%, as Gensler focuses the agency’s enforcement strategy on high-profile cases and steep penalties for misconduct. The commissioners on Wednesday advanced two more regulatory initiatives as part of Gensler's overhaul campaign.

Market perspectives:

• Outside markets: The U.S. dollar index was sharply higher, up by around 1.4%. The yield on the 10-year U.S. Treasury note was trading above 4.18%. Crude is under pressure on concerns over economic prospects, with U.S. crude around $89 per barrel and Brent around $95.30 per barrel. Gold and silver were under significant pressure, with gold under $1,625 per troy ounce and silver under $19 per troy ounce.

• The dollar index extended gains to approach 113 on Thursday and is on track to move back to 20-year highs after the Fed said interest rates will be higher than previously expected and that it is very premature to talk about pausing the rate-hike cycle. Markets got surprised by such a hawkish message and some were expecting the Fed to eventually signal a pivot. Traders now turn their attention to the nonfarm payrolls report due Friday.

• Spot silver fell to below $19 per ounce, the lowest in two weeks after Fed Chair Powell kept hammering a hawkish message on rates increasing, hurting demand for non-interest-baring bullion investments. The cost of silver is more than 25% below its March peak when Russia’s invasion of Ukraine spurred a rally in precious metals.

• Indonesia mulls boosting fuel bio-content following oil price rise. Higher oil prices are leading Indonesia to perhaps increase the bio-content in fuel more feasible, Coordinating Minister for Economic Affairs Airlangga Hartarto said during the Indonesia Palm Oil Conference in Bali. The government is considering raising its mandatory 30% content of palm oil in biodiesel, with Hartarto saying the government is testing B40 which would boost the palm oil content in biodiesel to 40%. "The effort to substitute fossil fuel with biodiesel, and green fuel and petrochemical with palm-based oleochemical is a strategy that will make it more feasible for the palm oil industry to maintain prices," he said. Another official this week indicated the trials were in their final stages and could be completed in about two weeks. Under B30, some 11.15 million kiloliters of palm oil are used in biodiesel, with the palm oil fund indicating a B40 mixture could boost usage to 15 million kiloliters.

• StoneX raises corn estimate, lowers soybean peg. StoneX raised its U.S. corn crop estimate to 14.109 billion bu. on a yield of 174.5 bu. per acre, up from its October forecasts of 14.056 billion bu. and 173.9 bu. per acre. The commodity brokerage firm lowered its soybean crop estimate to 4.413 billion bu. on a yield of 50.9 bu. per acre, down from 4.442 billion bu. and 51.3 bu. per acre last month.

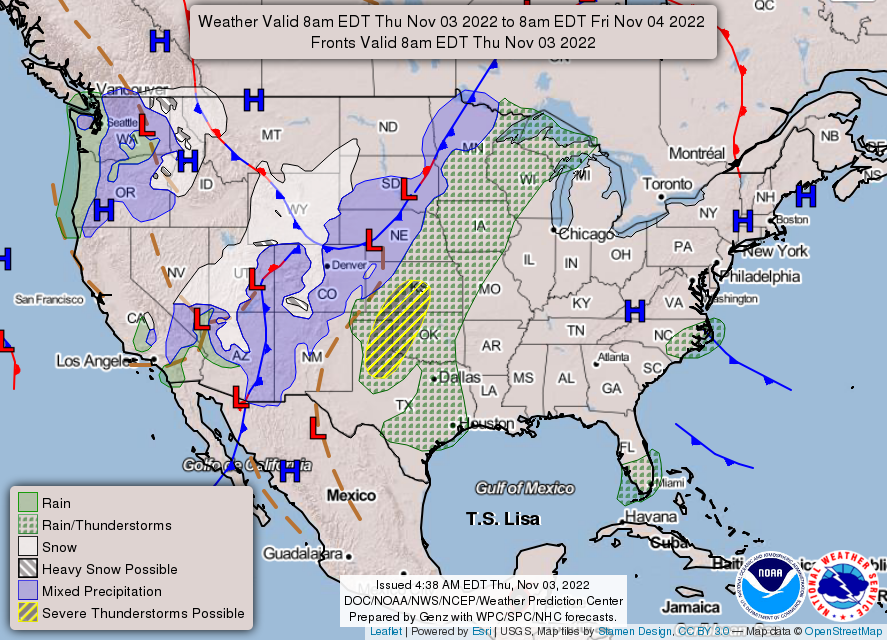

• NWS weather: Moderate to heavy mountain snow moving across the central Rockies today into early Friday... ...Severe thunderstorms likely across the southern Plains on Friday ahead of and along a potent cold front... ...Atmospheric River will bring widespread rain and high-elevation snow across the Pacific Northwest.

Items in Pro Farmer's First Thing Today include:

• Corn and wheat extend losses, soybeans retreat

• Aussie wheat crop hurt by excessive rains

• Russia raises wheat export tax.

• China approves Brazilian firms for soymeal exports, too.

• China’s natty gas consumption may drop for first time in 20 years (details, China section)

• Packers slow playing cash negotiations

• Cash hog index slips again

|

RUSSIA/UKRAINE |

— Summary: Russia is paying an economic price for its Feb. 24 invasion of Ukraine. The country’s gross domestic product fell 5% in September, according to the Russian Ministry of Economic Development. Inflation remains high in Russia, with inflation growing at a double-digit pace. (See details below.) Ukraine, meanwhile, is contending with damage to its infrastructure due to Russian missile strikes while discovering evidence of atrocities in areas that had been occupied by the Kremlin’s forces.

- Russian equities fall by over 1.5%. The ruble-based MOEX Russia index fell more than 1.5% on Thursday, led by losses of over 2% in both financials and metals & mining. Oil and gas stocks were also down more than 1.5% tracking losses in Brent. Meanwhile, the economy ministry estimated that the GDP contracted by 4.4% year-on-year in Q3 2022. In September, the economy shrank by 5% and considering the first nine months of the year, GDP decreased by 2%. October PMI data showed a strong decline in private sector output in October driven by the service sector, as manufacturers registered a further rise in production.

- Russia hasn’t decided whether to extend grain export deal beyond Nov. 19 deadline. The Kremlin said it needs to assess whether the deal was working before deciding whether to extend its participation. Russian Foreign Minister Sergei Lavrov urged the United Nations to step up its efforts to ensure Western countries ease restrictions Moscow says hinder its agricultural and fertilizer exports, which also formed part of the deal. “We still do not see any results regarding a second aspect: the removal of obstacles to the export of Russian fertilizers and grain,” Lavrov said.

Meanwhile, Russian inspectors resumed work at the Joint Coordination Centre in Istanbul.

- Ukraine offers no new concessions in grain deal. Ukraine said on Thursday it had made no commitments to Russia that go beyond the terms of the Black Sea grain deal to persuade Moscow to resume its participation. Ukrainian Foreign Ministry spokesman Oleg Nikolenko said, “Our state has not undertaken any new commitments that go beyond those already existing in the grain agreement. Recall that within this agreement (in July), the parties committed to guarantee a safe and reliable functioning environment for the grain corridor. Ukraine has never put a grain route in danger. Ukraine did not use and did not plan to use the grain corridor for military purposes.”

- North Korea is covertly supplying Russia with artillery shells for its war on Ukraine, the White House said. The Biden administration said a significant number of shells are moving through indirect routes, but they aren’t expected to change the course of Ukraine’s effort to defend its territory. Ukrainian forces have made advances in the eastern part of the country and are pushing to take Kherson in the south, where a major battle looms. Russian officials in Kherson said that up to 70,000 people would be transferred to southern parts of the region and Russia.

- The International Energy Agency (IEA) said that Europe needs to act now to avert natural gas shortages in 2023 given the loss of Russian supplies. While Europe has filled natural gas storage to around 95% ahead of winter, IEA said 2023 holds a potential major challenge. “We are ringing the alarm bells for the European government and the European Commission for next year,” IEA chief Fatih Birol said in releasing their European supply/demand balances for 2023-24. There could be a gap of up to 30 billion cubic meters of gas in the summer period of low demand, the IEA said, which could translate into stage only getting to 65% ahead of next winter.

|

CHINA UPDATE |

— China’s new No. 2. Li Qiang is known inside China as a pro-business pragmatist unafraid to push the boundaries of Communist Party rule. Party insiders say he’s also a loyalist who will implement Beijing’s policies effectively and aggressively when needed. Li previously served as a close aide to leader Xi Jinping, who begins his third term as party chief after a push to suppress any potential opposition and consolidate his power. The Wall Street Journal profiles (link) President Xi Jinping’s new right-hand man.

— China’s natty gas consumption may drop for first time in 20 years. China’s 2022 natural gas consumption may post the first decline in two decades amid a struggling economy, with demand this winter set to rise more modestly than in previous years, state energy officials said. Total natural gas demand is likely to fall 1% this year to 363.6 billion cubic meters, said Li Jianping, a researcher with China National Offshore Oil Company, which would mark the first annual decline since at least 2002. Covid restrictions and high import costs have reduced China’s demand.

— “China remains an important business and trading partner for Germany and Europe — we don’t want to decouple from it,” Olaf Scholz, Germany’s chancellor, writes in an opinion article (link) ahead of a contentious trip to Beijing this week (link), the first by a leader of a Group of 7 nation since the coronavirus pandemic’s start.

— Canada ordered Chinese companies to divest from lithium mines, saying their stakes pose a national security risk. Link to more via the Financial Times.

|

ENERGY & CLIMATE CHANGE |

— Small refineries pay more for U.S. RFS mandates: Report. Small oil refineries pay more than larger competitors to fulfill U.S. mandates to blend biofuels into gasoline and diesel, congressional investigators have found, a conclusion that could intensify calls to ease the requirements in the name of lowering fuel prices. The findings are contained in a draft of a report from the Government Accountability Office (GAO) which is due to be published today. “We found that smaller buyers pay more, and smaller sellers receive less, when buying or selling RINs compared to larger buyers and sellers,” according to the draft report. Link to report.

The GAO said that its analysis alone doesn’t show that there is “disproportionate economic hardship for small refineries.” The group’s recommendations include calling on the Environmental Protection Agency to identify and communicate what information refineries need to submit to show they shoulder an excessive burden.

EPA comments. In an Oct. 13 letter to the GAO included in the report, the EPA said several of the investigation’s initial conclusions were “erroneous and/or unsupported… GAO’s analysis of renewable identification number trades suffers from several fundamental flaws,” the EPA said. “Each of these flaws calls into question the relevance of GAO’s analysis.”

— U.S., Europe create task force on U.S. EV credits in IRA legislation. The European Union (EU) and U.S. have formed a task force focused on the clean energy credits for electric vehicles (EVs) in the Inflation Reduction Act (IRA). Their first in a series of weekly meetings will be held Friday. The U.S. National Security Council and the cabinet of European Commission President Ursula von der Leyen are leading the effort.

European officials want an exemption from the rules, especially those given to EVs assembled in North America and provisions that will increase the level of critical minerals used in EV batteries from 40% in 2023 that would have to be sourced from the U.S. or countries the U.S. has a free trade agreement with.

A spokesman for the Office of the U.S. Trade Representative (USTR) told the Wall Street Journal that talks with the EU have been positive and the task force should “help deepen the bilateral understanding of this legislation. South Korea and Japan have been complained about the U.S. law.”

— OECD: Countries using carbon pricing more for reducing greenhouse gas emissions. The introduction and expansion of carbon pricing efforts covered 40% of greenhouse gas (GHG) emissions in 71 countries responsible for 80% of GHG emissions in 2021, up from 32% in 2018, according to a report from the Organization for Economic Cooperation and Development (OECD).

Countries could raise about 2.2% of GDP if they set carbon prices at 120 euros ($118) per tonne of carbon dioxide by then end of the decade, but the OECD said that would need to linked with other policies to “overcome barriers to the transition to net-zero.”

“Progressively increasing carbon prices while phasing out fossil fuel subsidies can help countries to implement more ambitious, effective and efficient climate policy,” according to the report. But it also warned that subsidies to help consumers with rising energy costs such as those linked to the Russian war on Ukraine could actually reduce the carbon price and boost GHG emissions.

There is no federal carbon pricing system in place in the U.S. even though there are some private-sector efforts. The OECD said that 10% of the U.S. electricity sector was covered by carbon pricing in 2021, up from 7% in 2018. Efforts to implement a government-run nationwide carbon pricing scheme have not gained traction to date.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— More attorneys general move to block a big planned dividend at Albertsons. The District of Columbia, California and Illinois sued to block the grocery chain from issuing a $4 billion special payout to shareholders before antitrust regulators review its proposed sale to Kroger. It’s the latest pushback against a merger that critics say could lead to higher prices. Link for details via the New York Times.

|

HEALTH UPDATE |

— Summary:

- Global Covid-19 cases at 631,399,938 with 6,594,950 deaths.

- U.S. case count is at 97,611,400 with 1,071,578 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 636,871,557 doses administered, 266,031,472 have received at least one vaccine, or 80.74% of the US population.

|

POLITICS & ELECTIONS |

— Republican Senate candidate victim of attempted assault before debate. Don Bolduc, 60, a retired Army brigadier general, was apparently unharmed, and the individual who attempted to assault the Senate candidate was arrested, according to his campaign. Republican New Hampshire Senate candidate Don Bolduc dodged a punch from a would-be assailant before stepping onstage to debate Sen. Maggie Hassan (D-N.H.) on Wednesday, according to reports.

— Some updated poll results:

- Wisconsin: Republican Sen. Ron Johnson is leading Democrat Mandela Barnes 50% to 48% in the final Marquette Law School Poll ahead of Election Day. (Johnson led 52% to 46% in the previous poll.) Meanwhile, Democratic Gov. Tony Evers and Republican Tim Michels are locked up at 48% in the gubernatorial race.

- Pennsylvania: Democrat John Fetterman Republican Mehmet Oz 48% to 44%, per a new Monmouth University poll.

- Colorado: Democratic Sen. Michael Bennet holds a slim lead over Republican Joe O’Dea 47.6% to 46.1%, per a Trafalgar Group poll.

— In the latest Gallup poll, just 17% of Americans say they were satisfied with the direction the country was going. That’s the worst in any midterm since at least 1982, when Gallup first measured satisfaction in a midterm. Biden’s approval in Gallup’s poll stood at 40%, which is the second worst for an incumbent president in a midterm since 1974. It is the worst for a first term incumbent.

— Democratic enthusiasm about voting is significantly lower than it was in 2018, according to a new CNN poll. Four years ago, 44% of Democratic registered voters said they were extremely enthusiastic about voting; now, just 24% say the same.

|

CONGRESS |

— Capitol Police announces probe into Pelosi attack as House Administration Committee Chairwoman Zoe Lofgren (D-Calif.) sent a letter to U.S. Capitol Police (USCP) Chief Tom Manger, demanding to know why USCP “did not do more to prevent” David DePape’s entry into House Speaker Pelosi’s San Francisco residence where he attacked the Speaker’s husband, Paul Pelosi, with a hammer. She also asked whether Capitol Police have taken action on her panel’s requested plans to create field offices in San Francisco and Tampa, Fla. to deal with increased threats. Lofgren raised further concerns about the Capitol Police’s ability to coordinate, referencing an offer from the FBI to have Capitol Police officers who were detailed in San Francisco and Tampa assigned as task force officers to the FBI’s Joint Terrorism Task Forces, which investigate threats to lawmakers. CNN reported the lack of security at Pelosi’s home has raised significant questions about the lack of security at her San Francisco home and the law enforcement response after Paul Pelosi “managed to call 911.

The USCP announced it will “conduct an internal review” into the attack at the Pelosi residence. USCP said in a statement, “The Department has begun an internal security review and will be gathering input and questions from our Congressional stakeholders.” The announcement follows Manger’s call for more funding to protect lawmakers and is working on a formal request.

|

OTHER ITEMS OF NOTE |

— Former Pakistani PM wounded as would-be assassin shoots at convoy. Former Pakistan Prime Minister Imran Khan was wounded in the shin on Thursday when his convoy was shot at in the country's east on Thursday, an aide said.

— World Series produces a no hitter, but with multiple pitchers. For just the second time in World Series history, a no-hitter was thrown as the Houston Astros defeated the Philadelphia Phillies in Game 4. The best-of-seven series is now tied at 2-2. In Game 4, pitcher Cristian Javier started for the Astros, tossing six innings of no-hit ball, striking out nine and walking two. He threw 97 pitches before being relieved. Bryan Abreu and Rafael Montero each pitched a perfect inning before Ryan Pressly closed out the Phillies in the ninth at Citizens Bank Park in Philadelphia. The only previous no-hitter in 118 years of World Series history occurred in 1956 (actually a perfect game by Don Larsen).

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | Student loan forgiveness | Russia/Ukraine war, lessons learned | Election predictions: Split-ticket | Congress to-do list | SCOTUS on WOTUS | SCOTUS on Prop 12 | New farm bill primer | China outlook |