China Bristles as U.S, Taiwan Commence Trade Talks

Republicans get nervous about taking over Senate amid indications of very tight contests

|

In Today’s Digital Newspaper |

The U.S. and Taiwan will start formal talks on a trade and economic initiative. The first round of talks is set to take place “early this fall,” the Office of the U.S. Trade Representative said in a statement Wednesday. The U.S. was Taiwan’s third-largest trading partner last year, according to the island’s trade negotiations office. China said Thursday following the announcement that it “firmly opposes” the initiative, with the Ministry of Foreign Affairs warning the U.S. against doing any deal that could imply Taiwanese sovereignty. More in China and Trade Policy sections.

New-crop corn, soybean sales to China in most recent week. USDA weekly Export Sales data showed China as a buyer for U.S. corn, soybeans and upland cotton from the crops to be harvested this year. Activity for 2021-22 for the week ended August 11 to China was reported as net sales of 71,471 tonnes of corn, 51,304 tonnes of sorghum, and 80,836 tonnes of soybeans. For 2022-23, activity included sales of 136,500 tonnes of corn, 779,000 tonnes of soybeans and net sales of 30,016 running bales of upland cotton (2022/23 marketing year began August 1 for cotton). For 2022, exporters reported net sales of 7,356 tonnes of beef and 232 tonnes of pork.

Turkish President Recep Tayyip Erdogan will use his first visit to Ukraine since the war started nearly six months ago to seek ways to expand the export of grain from Europe's breadbasket to the world's needy while U.N. Secretary-General António Guterres will focus on containing the volatile situation at a Russian-occupied nuclear power plant. Erdogan is set to have a one-hour meeting with Zelenskyy in the early afternoon before both are joined by Guterres. More in Russia/Ukraine section.

U.N. expert says there is forced labor in Xinjiang. Special rapporteur claims forced labor could amount to “crimes against humanity.”

The Federal Reserve is prepared to keep hiking rates until inflation comes down in a big way, according to minutes released Wednesday from the central bank’s policy-setting committee last month. The minutes indicated the Fed could ease off rate increases if central bankers see that their tighter policy is successfully fighting the four-decade-high inflation with which consumers are grappling. he market is pricing in a 50 basis point hike at the next meeting but there are still several inflation reports due out before then. More below.

How much could house prices drop? A report from Fitch this week said that the Fed’s interest-rate moves had indeed made housing prices more likely to fall and put the largest plausible drop at 15%.

There are fewer places for U.S. importers to hide from shipping congestion. Backups are growing at gateways from Houston to New York, the writes, as attempts to ship around West Coast bottlenecks swamp landside operations with containers and leave vessels waiting on the water. “It’s a horror show,” says Lori Fellmer, chair of the ocean committee for the National Industrial Transportation League, on spreading U.S. port congestion. Details below.

How hot is it in China? Southern China shipyards declared force majeure on some orders because of the impact of a searing heat wave on production. More in China section.

Want a 24% boost in your salary? Work on a railroad. Details below.

Tax specialists want the Treasury and IRS to issue guidance on the stock buyback tax in the IRA law, seeking clarification on when it applies. See Policy section for details.

The Centers for Disease Control and Prevention admitted after an internal review that it didn’t respond quickly enough to the spread of Covid. So, CDC Director Rochelle Walensky said she would reorganize the agency to address its failures. Walensky admitted the agency made “pretty dramatic, pretty public mistakes” in its Covid-19 response. The overhauls include plans for hiring more staff to respond to public health emergencies; reevaluating how the CDC’s annual $12 billion budget is spent; and ensuring public messaging is easy to understand.

Republicans are getting nervous about taking back the Senate. They won’t like the latest prognostications from the Cook Political Report with Amy Walter. Details in Politics & Elections section.

Election Day 2022 is 82 days away. Election Day 2024 is 810 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight, with Asian indexes mostly down and European indexes mostly up. U.S. Dow opened flat and is now down around 100 points. In Asia, Japan -0.96%. Hong Kong -0.80%. China -0.46%. India -0.03%. In Europe, at midday, London -0.13%. Paris +0.34%. Frankfurt +0.55%.

U.S. equities yesterday: All three major indices were lower most of the session though a lift after release of the FOMC minutes allowed the Dow to briefly poke into positive territory. The Dow ended down 171.69 points, 0.50%, at 33,980.32. The Nasdaq was down 164.43 points, 1.25%, at 12,938.12. The S&P 500 declined 31.16 points, 0.72%, at 4,274.04.

Agriculture markets yesterday:

- Corn: December corn rose 1 3/4 cents to $6.12 1/2, the first gain in three sessions.

- Soy complex: November soybeans gained 9 cents to $13.90. September soymeal rose $4.70 to $440.60. September soyoil fell 43 points to 67.41 cents.

- Wheat: September SRW wheat fell 22 3/4 cents to $7.63 1/4, the contract’s lowest closing price since Feb. 4. September HRW wheat fell 20 3/4 cents to $8.51. Prices closed near their session lows. September spring wheat fell 19 1/4 cents to $8.83 1/2, the lowest close in over a week.

- Cotton: December cotton fell 331 points to 113.54 cents. Cotton fell for the first session in seven on profit-taking and corrective selling follow the past week’s steep rally.

- Cattle: October live cattle gained 17.5 cents to $145.85, the highest close since April 22. September feeders jumped $1.65 to $187.125, the highest close since Feb. 18. Hogs: October lean hogs surged $1.475 to $98.05. Pork cutout values rose $2.38 to $123.53, led by a gain of nearly $19 in bellies. Today’s CME lean hog index is expected to decline another 44 cents to $120.62, the fifth drop in the past six sessions.

Ag markets today: Active followthrough selling weighed on wheat overnight, while corn and soybeans faded amid spillover pressure and favorable weather forecasts. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents lower, soybeans were mostly 8 to 9 cents lower and wheat futures were 13 to 19 cents lower. Front-month crude oil futures were around 90 cents higher and the U.S. dollar index was just above unchanged this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims are expected to fall to 260,000 in the week ended Aug. 13 from 262,000 one week earlier. (8:30 a.m. ET)

• Philadelphia Fed's manufacturing survey is expected to rise to minus 5 in August from minus 12.3 one month earlier. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• U.S. existing-home sales are expected to fall to an annual pace of 4.81 million in July from 5.12 million one month earlier. (10 a.m. ET)

• Conference Board's leading economic index for July is expected to fall 0.5% from the prior month. (10 a.m. ET)

• Federal Reserve speakers: Kansas City's Esther George on the economic outlook at 12 p.m. ET, and Minneapolis's Neel Kashkari in a Q&A at 1:45 p.m. ET.

FOMC minutes: murky but so is the outlook. Some major points of the minutes:

- U.S. economy: "Participants anticipated that U.S. real GDP would expand in the second half of the year, but many expected that growth in economic activity would be at a below-trend pace, as the period ahead would likely see the response of aggregate demand to tighter financial conditions become stronger and more broad based," the minutes read. Translation: Fed officials see U.S. economic growth slowing this year, but not tipping into a recession.

- Officials remained upbeat on the state of the U.S. labor market: "Participants observed that the labor market remained strong, with the unemployment rate very low, job vacancies and quits close to historically high levels, and an elevated rate of nominal wage growth." Some committee members expected the unemployment rate to rise by year end, according to the minutes.

- Inflation: Recent declines in oil and other commodity prices can be largely dismissed, officials discussed, because they could quickly rebound just as easily, while gains in stickier categories like rents are expected to continue. "Participants agreed that there was little evidence to date that inflation pressures were subsiding," the minutes read. "They judged that inflation would respond to monetary policy tightening and the associated moderation in economic activity with a delay and would likely stay uncomfortably high for some time."

- Bottom line: Rates need to continue rising, but the pace will depend on economic fundamentals. The magnitude of rate increases will ease at some point, but rates could stay elevated for some time.

- Next meeting of the Federal Open Market Committee is scheduled for Sept. 20-21. Futures-market pricing suggests roughly two-thirds odds of a 0.5 percentage point increase, and a one-third likelihood of a 0.75 percentage point hike.

Don’t forget: From September, the Fed doubles the pace at which it will shrink the size of its $8.9 trillion balance sheet. As set out in May, it will run down up to $60 billion in Treasuries and $35 billion in mortgage-backed securities a month. Analysts at Bank of America estimate quantitative tightening through 2023 could shave 7% from the value of the S&P 500 from current levels. Others think it could already be priced in.

"Dr. Doom" economist Henry Kaufman said he's still waiting for Jerome Powell to shock the market, and that a dovish move is not what the economy and markets need. "I'm still waiting for him to act boldly," he told the Financial Times (link). The 94-year-old economist — who made a famed 1982 call on interest rates while working at Salomon Brothers — thinks Powell should more closely follow the path forged by former Fed Chair Paul Volcker, who made a series of aggressive rate hikes in his tenure 40 years prior. "If you want to change someone's view...you can't slap them on the hand," Kaufman said. "You have to hit them in the face."

Mortgage applications fell 2.3% to the lowest level since the turn of the century, despite falling mortgage rates. Homes are the least affordable they’ve been in 33 years, according to the Mortgage Bankers Association.

How much could house prices drop? A report from Fitch this week said that the Fed’s interest-rate moves had indeed made housing prices more likely to fall and put the largest plausible drop at 15%. That would be a loss of around $60,000 for the average American homeowner, which is significant, but less than the nearly $120,000 that the average U.S. home gained in value in the past two years.

Eurozone consumer inflation reaches another record. Eurozone inflation rose to a record 8.9% annualized rate in July. Eurostat said that of the total, 4.02 percentage points came from energy and 2.08 percentage points from food, alcohol and tobacco. But even when these most volatile components are excluded, core inflation stood 5.1% above year-ago in July.

Europe’s historic heat wave is pounding its economy. A summer of devastating droughts and extreme temperatures has sparked rare wildfires in Britain and brought ship traffic on parts of the Rhine to a standstill. Declining water levels have also hobbled hydroelectric plants in Norway and nuclear ones in France, during the continent’s worst energy crisis in memory.

Port congestion continues to haunt global trade, spreading fresh fears among exporters and importers over whether massive amounts of cargo will be delivered on time for the busy, year-end shopping season, the Wall Street Journal reports (link). Supply chains never fully recovered from the pandemic shock when goods transported by sea were delayed and shipping prices soared. Now freight rates are falling, but cargo is still delayed at choked European and American ports. In Europe, ports are backed up because dockworkers are on strike or on vacation as ships queue up, and there is an acute shortage of truck drivers. In the U.S., a shortage of rail capacity and warehouse space means boxes remain in ports for too long.

Notable quote: “Ships are still a gamble not worth taking. We are flying in our entire winter collection to make sure it arrives before Christmas.” — Abbie Durkin, owner of Palmer & Purchase, a women’s clothing and accessories boutique with stores in New York.

The FOMC minutes released Wednesday said: “A few participants indicated that some business contacts had assessed that demand and supply were beginning to come into better balance. Even so, contacts in many areas continued to report major supply-chain disruptions and anticipated that these were likely to continue while also indicating that there were signs of improvement in supply conditions in some areas.”

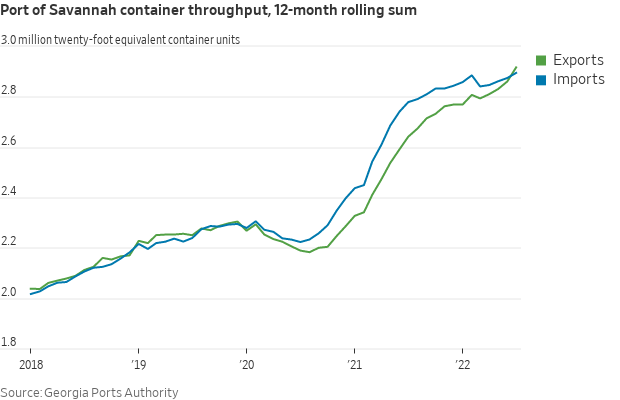

U.S. importers seeking relief from bottlenecks at West Coast gateways are triggering new backups at East Coast and Gulf Coast ports, adding to strains on the country’s troubled supply chains. Backups of dozens of container ships have formed off ports in New York, Houston and Savannah, Ga., authorities said, even as the lineup of vessels waiting to get into the neighboring ports of Los Angeles and Long Beach has dwindled from an armada that once counted more than 100 ships.

Wine, not whine. Treasury Wine Estates, best known for its Penfolds brand, said it expects demand for its premium and luxury products to remain strong even as an economic downturn threatens to exacerbate cost-of-living pressures.

Market perspectives:

• Outside markets: The U.S. dollar index is modestly higher in early U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 2.89%. Crude is moving higher, with U.S. crude around $89.05 per barrel and Brent around $94.95 per barrel. Gold and silver are seeing gains, with gold around $1,784 per troy ounce and silver around $19.83 per troy ounce.

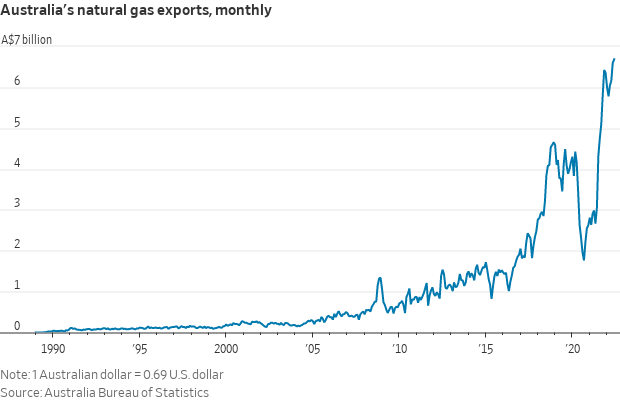

• Australia mulls cutting LNG exports. Australia is shipping so much natural gas overseas that authorities could block some exports to plug shortages at home. Such a move would put global energy supply under further strain as Europe faces the prospect of severe fuel shortages this winter and Asian economies including Japan and China store more gas ahead of seasonal peaks in demand, the Wall Street Journal reports (link). The Ukraine war cut gas supplies at a time when much of Europe experienced a severe heat wave that drove demand higher. Europe’s energy crisis has elevated the importance of stability of energy supply from Australia, which accounted for a fifth of global liquefied-natural-gas exports last year.

• The major freight railroads signaled they’re ready to negotiate a new labor contract based on a presidential report that calls for 24% raises.

• Canadian Pacific gets regulatory OK on KCS deal, secures labor agreement. Canadian Pacific (CP) has received permission from U.S. federal regulators to pursue its acquisition of Kansas City Southern, the railway announced earlier this week. The Committee on Foreign Investment in the United States granted the regulatory clearance. The committee, which is affiliated with the U.S. Department of Treasury, reviews certain transactions involving foreign investment in the U.S. to determine their effect on national security. CP said it expects the acquisition’s review by the Surface Transportation Board to be completed in early 2023.

• Ag trade: Taiwan purchased 34,025 MT of U.S. milling wheat.

• The Rhine has reopened at St. Goar, Germany, for barges, according to the WSA water authority, after a vessel that briefly blocked the waterway was towed away. The river is expected to rise through the weekend.

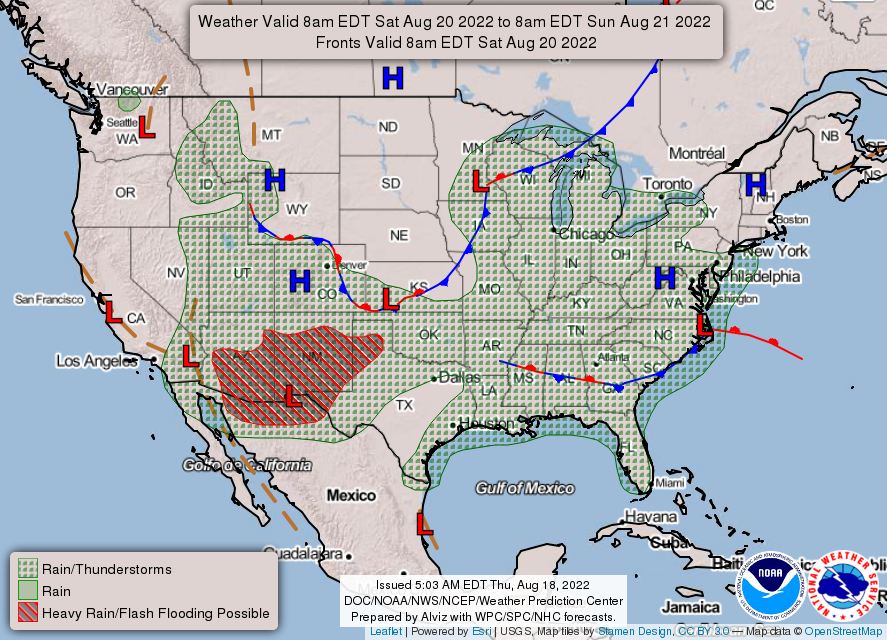

• NWS weather: There is a Moderate Risk of excessive rainfall over parts of the Southwest from Friday into Saturday morning... ...There is a Slight Risk of excessive rainfall over parts of the Southwest/Great Basin, Central Gulf Coast, and the Southeast from Thursday into Friday morning... ...There is an Excessive Heat Watch and Heat Advisory over parts of the West Coast through Friday night.

Items in Pro Farmer's First Thing Today include:

• Wheat pulls corn and beans lower overnight

• Sinograin, COFCO collaborate on China’s state grain reserves (details in China section)

• Cash cattle trade starts at higher prices

• Hog futures bounce back

|

RUSSIA/UKRAINE |

— Summary: Seven people were killed and 20 others wounded in a Russian rocket attack on an apartment building in northeastern Ukraine today, officials in the region said. This comes as Russia is suffering heavy losses among troops in Ukraine, but the true number of casualties has not been disclosed. Russia is also dealing with a population crisis: statistics show the country's population shrank by an average of 86,000 people per month between January and May, a record. In response, Russian President Vladimir Putin this week revived a Soviet-era "Mother Heroine" award for women with more than 10 children. The award is a payment of 1 million rubles ($16,500) for Russian mothers once their 10th child turns 1. Meanwhile, China said it would join military exercises led by Russia. Moscow plans to hold drills in its Far East region near the border with China and North Korea from Aug. 30 to Sept. 5.

- Turkey’s president Recep Tayyip Erdogan visits Ukraine for the first time since Russia’s invasion. In Lviv, he will have his first face-to-face meeting with Volodymyr Zelenskyy, his Ukrainian counterpart. António Guterres, the U.N. secretary-general, will also be there. Turkey has won kudos for brokering, along with the U.N., a deal between Ukraine and Russia to restart grain exports through the Black Sea. Turkish-made Bayraktar drones have also helped the Ukrainian army push back the Russian offensive. But Erdogan is performing a delicate balancing act. On Aug. 5, he met Russian leader Vladimir Putin and signaled that Turkey was open for Russian business.

- The Ukraine grain deal so far. Exports from Ukraine’s Black Sea ports have resumed slowly: just 24 ships carrying food have left those ports since the deal was struck. A five-ship convoy, the largest yet, arrived in Chornomorsk on Wednesday. It’s a sign that Ukraine is edging out of a trial period as it aims for its goal of three million metric tons of exports per month. Overall this month, Ukraine has exported 948,000 metric tons of grain, roughly half as much as it had exported by this time last year.

|

POLICY UPDATE |

— Tax Foundation bottom line on Inflation Reduction Act: “On balance, the long-run impact on inflation is likely close to zero. The law is projected to raise about $324 billion in net revenue from 2022 to 2031, but would do so in an economically inefficient manner, eliminating about 29,000 U.S. jobs and reducing average after-tax incomes for taxpayers across every income group in the long run.”

— Tax specialists want the Treasury and IRS to issue guidance on the stock buyback tax in the IRA law, seeking clarification on when it applies. The package includes an excise tax of 1% of the fair-market value of stocks repurchased by publicly traded domestic firms. The tax doesn’t apply in cases where the total value of a company’s repurchased stock in a year is no more than $1 million.

|

PERSONNEL |

— Ashleigh Wilson is now federal government affairs manager and counsel at Nucor. She most recently was legislative director and counsel to House Majority Whip James Clyburn (D-S.C.).

— Grisella Martinez is now with Vice President Kamala Harris’ office as director of legislative affairs. She was previously chief of staff to Rep. Ruben Gallego (D-Ariz.) and held senior roles for the House Democratic Caucus.

|

CHINA UPDATE |

— Legislators from Japan and Canada are planning to visit Taiwan. Keiji Furuya, head of the Japan-ROC Diet Members' Consultative Council, is expected to meet with Taiwan President Tsai Ing-wen and defense officials of the island, which calls itself the Republic of China, to reaffirm the ties during the three-day visit from next Monday. Meanwhile, a delegation of Canadian lawmakers plans to visit Taiwan in October to seek economic opportunities in the Asia-Pacific region, Liberal Member of Parliament Judy Sgro said on Wednesday.

— U.N. expert says there is forced labor in Xinjiang. The U.N.’s special rapporteur on contemporary forms of slavery said in a new report that there is forced labor in Xinjiang. Foreign Ministry spokesperson Wang Wenbin slammed the report and accused the special rapporteur of “serving certain countries’ political scheme to suppress and contain China by abusing the U.N. platform.” Still ahead is the Xinjiang report from U.N. Human Rights High Commissioner Michelle Bachelet. Says a China-watcher: “The PRC is working very hard to suppress it, which likely means it is damning.”

Special rapporteur claims forced labor could amount to “crimes against humanity.” Link to more via Nikkei Asia.

— China bristles as U.S, Taiwan start trade talks. China’s foreign ministry said Beijing will take resolute measures to defend its territorial integrity and urges the U.S. not to make a wrong judgement regarding Taiwan. The U.S. announced Wednesday that it and Taiwan will start negotiations for a bilateral trade and investment initiative this fall to deepen ties on a range of issues including technology and agriculture. See more in Trade Policy section.

— China lashed out at the recent $52 billion Chips Act to expand American chipmaking, saying the landmark blueprint contains elements that violate fair market principles and targets Beijing’s efforts to build its industries.

Meanwhile, House Speaker Nancy Pelosi (D-Calif.) plans to hold a news conference today at the Exploratorium in San Francisco on the CHIPS bill.

Some upbeat news. Cisco Systems, the biggest maker of machines that run the internet and corporate computer networks, gave a bullish forecast for the quarter as chip supply shortages ease and it’s able to fill more orders.

— Dried-up rivers, scorching heat and power rationing in parts of China are disrupting factories and threatening crop yields, adding to the country’s economic strains and echoing struggles with extreme weather elsewhere around the world. Parts of China are suffering their worst heat wave in six decades, with temperatures as high as 110 degrees Fahrenheit in many parts of the country’s central and southwestern regions. The heat has coincided with a lack of rain, down 40% in July from a year earlier (and the lowest since 1961), and with water levels in the upper stretches of the Yangtze River — a crucial source of hydropower, transport and water for crops — at the lowest level since recordings began. Soaring temperatures have driven up air conditioning demand, overloading the electricity grid. Link to more via the New York Times.

Meanwhile, China is trying to make it rain. China is firing silver iodide rods into clouds in hopes of spurring rainfall after a two-month heatwave pushed the Yangtze River to its lowest-ever levels. The river not only provides drinking water for people and livestock, it’s also a major source of hydropower — and with hydropower reservoirs reduced by as much as half, companies such as Toyota and Apple supplier Foxconn have been forced to suspend operations in southwest China.

China is boosting coal usage as extreme heat triggers power shortages. Southeastern China’s Guangdong province will kick off five coal-fired power projects with construction to start by the end of September and production by the end of 2024, Caixin learned from sources.

— Sinograin, COFCO collaborate on China’s state grain reserves. China’s state stockpiler Sinograin and top state-owned grains trader COFCO have formed a joint venture to operate the country’s grain reserves, state media reported on Thursday. The venture, called the China Enterprise United Grain Reserve Co. Ltd, will be 51% owned and controlled by Sinograin. The move is part of the Beijing’s efforts to reform the grain reserve system and better ensure food security.

— China’s pork imports unchanged in July but well below year-ago. China imported 120,000 MT of pork in July, unchanged from June but down 65.1% from last year. Through the first eight months of this year, China imported 930,000 MT of pork, also down 65.1% from the same period last year.

— China’s biggest builder warns core profit could plunge 70%. China’s largest developer Country Garden Holdings Co. warned that first-half earnings probably tumbled as much as 70% amid an escalating property crisis in the country. Link to more via Bloomberg.

|

TRADE POLICY |

— U.S. and Taiwan said they would begin trade talks, under an initiative established jointly in June. The first round of negotiations will take place in early autumn, said Sarah Bianchi, America’s deputy trade representative. China said it opposes the talks and warned America to “stop making misjudgments.” The announcement comes as tensions between the U.S. and China over the status of the self-governing island — which China regards as a breakaway territory — are at their highest in decades.

The office of the U.S. Trade Representative said the two sides had “reached consensus on the negotiating mandate” and it was expected that the first round of talks would take place early this fall. The negotiating mandate released along with the announcement said the U.S. and Taiwan had set a robust agenda for talks on issues like trade facilitation, good regulatory practices, and removing discriminatory barriers to trade.

Bottom line: Wednesday’s announcement falls short of Taiwan’s hopes for a bilateral free trade deal. Taiwanese officials have said the talks are important to keep trade ties open, and it still hopes it can negotiate such a deal in the future.

|

ENERGY & CLIMATE CHANGE |

— Biden’s oil leasing pause reinstated. President Joe Biden won temporary permission to once again pause energy leasing on federal lands and waters, after a U.S. appeals court found a trial judge’s order against the moratorium too vague to review. The court Wednesday threw out the judge’s nationwide injunction forcing a restart of leasing from the Gulf of Mexico to Alaska and ordered the judge to revisit the issue. In the meantime, Biden’s pause stands.

— Climate liability setback for big oil companies The Third U.S. Circuit Court of Appeals ruled on Wednesday that lawsuits brought by Delaware and Hoboken, N.J., seeking compensation for the impacts of climate change should be decided in state, not federal courts. The decision is the latest procedural victory by state and municipal governments, which have sought to bring climate liability cases against major oil companies under state laws, after earlier efforts under federal laws were unsuccessful. It was the sixth such appeals court ruling this year to keep climate cases by states and cities in state court and represents a growing legal threat to the oil industry.

— Reuters: Oil companies finding end around to Jones Act. U.S. oil companies are sending unfinished gasoline components from the Gulf Coast to Buckeye Partners terminal in the Bahamas where they are blended into gasoline that is then shipped to U.S. East Coast locations, according to Reuters, an action which allows the movement of gasoline to US locations on the East Coast without having to adhere to the Jones Act, which specifies goods can only be moved between U.S. ports via U.S.-built and staffed ships. At least eight vessels have moved gasoline components from the Gulf Coast to the Bahamas and the finished product is then delivered to US East Coast ports.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 593,336,170 with 6,445,639 deaths.

- U.S. case count is at 93,278,100 with 1,039,026 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 606,126,842 doses administered, 223,457,170 have been fully vaccinated, or 67.82% of the U.S. population.

— Head of CDC to shake up agency. Rochelle Walensky, the director of America’s Centers for Disease Control and Prevention, called for a reorganization of the public-health agency on the basis of its clumsy response to the Covid-19 pandemic. An external report found that its messages to the public were often confusing and recommended that lab data and scientific studies be published faster.

|

POLITICS & ELECTIONS |

— Wisconsin Senate race poll. In a new Marquette Law School Poll, 51% of registered Wisconsin voters support Democrat Mandela Barnes, 44% support Republican Ron Johnson in the U.S. Senate race. In June, it was Barnes 46% and Johnson 44%.

— Cook Political Report with Amy Walter: Senate control is a toss up, rating changes in Pennsylvania, Colorado and Utah. The election-watch group writes: “Plagued with weak, divisive candidates in many key races, the palpable trepidation among a dozen GOP insiders we spoke to is that — despite a favorable political climate and history that shows they should be able to net at least one seat to break the 50-50 logjam — their efforts to win back Senate control will fall short even as Republicans easily flip the House. If you had asked us before primaries began in earnest in early May, we put the odds that Republicans would flip the Senate at more than 60 percent, with a gain of as many as four seats possible. Right now, we see the range between Democrats picking up one seat and Republicans gaining three. However, the most probable may be a net change of zero or a GOP pickup of one to two.”

Rating Changes

- Pa. Sen: Toss Up to Lean Democrat in race between Lt. Gov. John Fetterman (D) and Mehmet Oz (R)

- Colo. Sen.: Likely Democrat to Lean Democrat in race between Sen. Michael Bennet (D) and Joe O’Dea (R)

- Utah Sen: Solid Republican to Likely Republican in race between Sen. Mike Lee (R) and Evan McMullin (I)

Politico notes that “Republicans’ hopes of retaking the Senate rest on a slate of Donald Trump's hand-picked nominees. And, across the board, they appear to be struggling.” In Pennsylvania, it says, “a ferocious Democratic campaign to paint Mehmet Oz as an out-of-touch carpetbagger has left him trailing in multiple polls. Herschel Walker may be a Georgia Bulldogs legend, but key voters appear to be doubting him after a series of gaffes and abuse allegations. The backing of Silicon Valley titan Peter Thiel hasn't yet been enough to sell Blake Masters’ sharp-edged conservatism to Arizona voters.” Politico’s bottom line: “Is this year more like 2012, when the party lost at least two winnable seats thanks to extremist candidates Todd Akin and Richard Mourdock, or 2014, when it rode moderate nominees Cory Gardner and Joni Ernst to the majority?”

— Poll shows Biden’s approval rating up 3 points since last week. A Politico-Morning Consult poll of 2,005 registered voters conducted Aug. 12-14 found that “President Biden’s approval rating ticked up 3 percentage points in the past week...as Democrats scored a major legislative win with the passage of their climate, health care and tax reform package” to 42% up from 39% last week. The president’s disapproval declined from 59% to 56%. The results are “likely welcome news for Democrats.”

— Poll shows Democrats leading by four points on generic congressional ballot. A Politico-Morning Consult poll of 2,005 registered voters conducted Aug. 12-14 found that “Democrats are leading Republicans by 4 percentage points on a generic congressional ballot,” with 46% support to 42% for Republicans.

— Sen. Lisa Murkowski is making abortion rights a key element of her re-election race in a year when many other Republicans are avoiding it, after she advanced to the general election Tuesday along with a Trump-backed Republican, Bloomberg notes. Murkowski (R-Alaska) and her allies say they can beat Kelly Tshibaka, the former head of Alaska’s Department of Administration, by painting her as extreme on abortion and other women’s health issues, such as birth control.

— TikTok banned influencers from creating paid political content ahead of the midterm elections as part of its larger strategy to fight misinformation as November approaches. The plan comes as major tech platforms including Facebook and Twitter grapple with stamping out the spread of false information, which they’ve been criticized for amplifying during past elections.

|

OTHER ITEMS OF NOTE |

— EPA begins 60-day comment period on dicamba risk assessment. EPA has published in the Federal Register a notice (link) seeking comments on its revised human health and draft ecological risk assessments for the registration review of dicamba. The comment period runs through Oct. 17. After EPA reviews the comments, they “may issue a revised risk assessment, explain any changes to the draft risk assessment, and respond to comments and may request public input on risk mitigation before completing a proposed registration review decision for dicamba.”

— House Republicans press EPA on atrazine, other farm chemicals. More than 90 House Republicans signed a letter to EPA Administrator Michael Regan expressing concern at the agency’s actions on “revisions to the interim decision for atrazine, a herbicide used to protect corn, sorghum, sugarcane, and a variety of other crops from damaging weeds.” Updated guidance from EPA, the lawmakers stressed, relied on “invalid studies and questionable conclusions” when it issued the guidance to temper atrazine use. They want EPA to reissue the mitigation pick list for atrazine and commit to a former Scientific Advisory Panel under the Federal Insecticide, Fungicide and Rodenticide Act (FIFRA) “to accurately review current sound science regarding the appropriate CE-LOC [concentration equivalent level of concern] for atrazine.”

Why is EPA making crop protection products harder to be approved especially as food security concerns are rising?

Meanwhile, various circuit courts are saying FIFRA does not preempt state laws so this could result in a 50-state patchwork of regulations on pesticides and herbicides. Most say this is unworkable, but President Biden’s solicitor general took this position before the Supreme Court.

— Cuba is seeing its biggest exodus to the U.S. in decades following a series of economic body blows that have worsened shortages and power blackouts.

— Former President Donald Trump is considering releasing surveillance footage of FBI agents searching his Mar-a-Lago residence. Some of Trump's aides and allies have encouraged him to make some of the footage available to the public, believing it could send a jolt of energy through the Republican Party's base, a person close to Trump told CNN. However, others in Trump's orbit have cautioned that releasing the footage could backfire by providing people with a visual understanding of the sheer volume of materials that federal agents seized, including classified materials.

— NASA’s most powerful moon rocket made its public debut, getting pulled from its hangar to a launchpad in preparation for an uncrewed launch on August 29. The Space Launch System rocket’s planned trip to orbit the moon will be the first lunar voyage in the space agency’s costly and long-delayed Artemis program, which aims to get humans back on the moon as a test run for future Mars missions. NASA hopes to land astronauts on the moon in 2025.

— The Japanese government is trying to encourage its young people to drink more alcohol as moves toward a healthier lifestyle have led to a steep decline in the tax take from alcohol sales. Beer consumption has been especially curtailed, with sales down 20% and per capita drinking down almost 10%. The National Tax Agency has launched the “Sake Viva!” campaign to come up with ways to promote alcoholic drink consumption among 20 to 39-year-olds.