U.S. Inflation Slips from 40-year Peak but Year-over-Year Remains High at 8.5%

JCT releases analysis of Inflation Reduction Act

|

In Today’s Digital Newspaper |

U.S. inflation ticks down to 8.5%, from 9.1% the previous month, bolstering hopes it might be cresting. Stripping out food and energy prices, the annual rise was 5.9%, the same as June. Both updated figures were lower than market expectations. On a month-to-month basis, prices held steady, compared to the 1.3% increase in June. U.S. equity futures rallied on the news and bond yields fell. “One in a row is not a streak — but it is a start,” Bankrate chief financial analyst Greg McBride wrote in an analyst note. Bottom line: Falling gasoline prices put a dent in the July inflation rate, but other costs such as housing continue to climb, putting a strain on many family budgets.

China consumer prices highest since July 2020. China’s Consumer Price Index (CPI) rose 2.7% from year ago in July, up from 2.5% in June and the fastest rise since July 2020, according to the National Bureau of Statistics (NBS). Food prices rose 6.3% in July.

USDA daily export sale: 196,000 metric tons of soybeans for delivery to China during the 2022-2023 marketing year.

Oil prices soared Tuesday after a dispute over transit fees and sanctions temporarily shut down a Russian crude oil pipeline that runs through Ukraine. The pause renews fears of supply shortages as Europe navigates an energy crisis.

“White papers” from China and Taiwan were released this week and they have different messages. Details in China section.

An analysis of the Inflation Reduction Act by the Congressional Joint Committee on Taxation indicates that corporations will pay roughly $296 billion in additional taxes over the next decade, with about $222.2 billion of that total from the new 15% corporate minimum tax and $73.7 billion from the 1% excise tax on stock repurchases. Households earning less than $100,000 per year will likely see net tax cuts due to the extension of Affordable Care Act premium subsidies, while middle- and low-income households will see no additional change in taxes and households with earnings of more than $500,000 may see taxes increase by 1% due to indirect effects from the new corporate tax measures.

An analysis by Bloomberg of Environmental Protection Agency data indicates that oil and gas companies will have broad leeway to choose how much of their pollution is reported to comply with the methane fee included in the Inflation Reduction Act, which would impose a fee of up to $1,500 a ton on excess emissions and could generate as much as $1.9 billion a year.

Egg prices lead U.S. food inflation surge... Egg prices at grocery stores soared 47% over year-ago in July, according to retail analytics firm Information Resources Inc. Prices have been driven by bird flu outbreaks.

We have an update on Tuesday elections in the Politics & Elections section.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly down overnight. U.S. Dow opened up around 450 points higher and is currently over 500 points higher. Nasdaq opened 300 points higher. In Asia, Japan -0.7%. Hong Kong -2%. China -0.5%. India -0.1%. In Europe, at midday, London +0.1%. Paris flat. Frankfurt +0.2%.

U.S. equities yesterday: The Dow ended down 58.13 points, 0.18%, at 32,774.41. The Nasdaq fell 150.53 points, 1.19%, at 12,493.93. The S&P 500 declined 17.59 points, 0.42%, at 4,127.47.

Bank of America thinks the U.S. yield curve could invert more deeply than at any time since the 1980s because of the Federal Reserve's efforts to cool inflation. The two-year Treasury rate currently exceeds the 10-year by almost 50 basis points. The inversion, around the deepest since 2000, is viewed as a sign of a looming recession.

Agriculture markets yesterday:

- Corn: December corn futures rose 6 3/4 cents to $6.14, the contract’s highest closing price since July 29.

- Soy complex: November soybeans jumped 28 3/4 cents to $14.28 3/4, the contract’s highest closing price since July 29. September soymeal surged $12.70 to $449.10. September soyoil rose 41 points to 65.76 cents per pound.

- Wheat: September SRW wheat rose 1 3/4 cents to $7.81 1/2. September HRW wheat rose 4 cents to $8.51 3/4. September spring wheat climbed 12 cents to $8.92 3/4. Cotton: December cotton surged 348 points to 99.07 cents per pound.

- Cattle: October live cattle fell $1.05 to $143.175. September feeder cattle fell $3.15 to $182.50.

- Hogs: August lean hogs rose 40 cents to $122.20, while October fell 65 cents to $99.65. Firm cash fundamentals supported nearby August futures, which posted the highest settlement for a nearby contract since June 2021. The CME lean hog index fell 17 cents from a 14-month high to $121.92 (as of Aug. 5) but is expected to rise 37 cents today.

Ag markets today: Corn, soybean and wheat futures were boosted by followthrough buying during overnight trade. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents higher, soybeans were fractionally to a penny higher and wheat futures were mostly 7 to 10 cents higher. Front-month crude oil futures were around $1.65 lower and the U.S. dollar index was nearly 400 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S consumer price index for July is expected to increase 0.2% from one month earlier and 8.7% from one year earlier. Excluding food and energy, the CPI is forecast to rise 0.5% and 6.1%. (8:30 a.m. ET) UPDATE: See item below for results.

• U.S. wholesale inventories for June are expected to increase 1.9% from the prior month. (10 a.m. ET)

• Federal Reserve Bank of Chicago President Charles Evans speaks on the economy at 11 a.m. ET

• Bank of England Chief Economist Huw Pill participates in online Q&A at 12 p.m. ET.

• U.S. federal budget deficit is expected to narrow to $175 billion in July from $302 billion one year earlier. (2 p.m. ET)

U.S. consumer prices rose 8.5% in the 12 months ending in July — falling for the first time since April in a potential sign that long-surging inflation may finally be slowing down. Economists were expecting prices to rise 8.7% on an annual basis after they spiked 9.1% in June. On a month-to-month basis, prices held steady, compared to the 1.3% increase in June. U.S. equity futures rallied on the news and bond yields fell.

Gasoline prices fell 7.7% in July, dragging down headline inflation. Other items with falling prices included used cars and trucks (-0.4%) and airfares (down 7.8%). But rents kept rising, a major factor in stubbornly high underlying inflation. Renters faced a 0.7% rise in costs. All told, shelter index rose 5.7% over the last year, accounting for about 40% of the total increase in all items, discounting food and energy.

The food index continued to creep up, rising 1.1% over the month. Bread was up 2.8% over the month, and chicken 1.4%. Canned vegetables were up 1.5%.

Year-over-year price increases for some food products include:

• Eggs, 38%

• Cereal & baking: 15%

• Muffins & rolls: 13.9%

• Meat & fish: 9.3%

• Milk: 15.6%

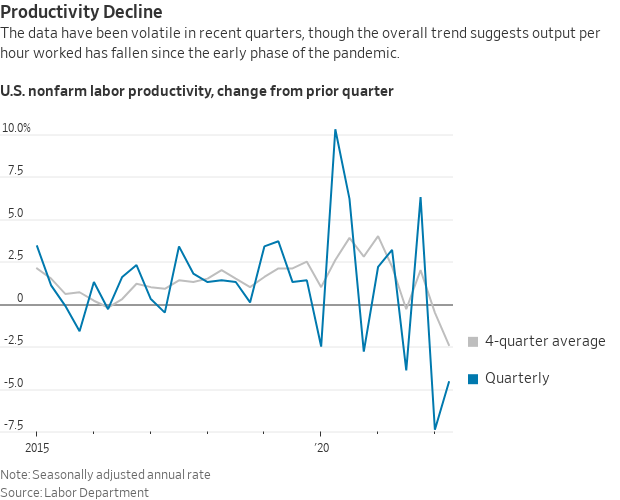

U.S. labor productivity fell for the second straight quarter this spring while labor costs climbed, a bad sign for Federal Reserve officials trying to get inflation back under control. U.S. nonfarm labor productivity — a measure of goods and services produced per hour worked — fell at a seasonally adjusted annual rate of 4.6% in the second quarter from the prior quarter, the Labor Department said Tuesday. Unit labor costs, a measure of worker compensation and productivity, increased at a 10.8% pace in the second quarter from the prior quarter. The quarterly figures are volatile, but the latest numbers follow a 7.4% productivity pullback in the first quarter, the sharpest drop in 74 years. "The Fed simply can't get to 2% inflation with this sort of productivity and wage growth," said Wells Fargo economist Sarah House.

CBO estimates FY 2022 budget deficit at $727 billion. The Congressional Budget Office (CBO) said the U.S. budget deficit so far in fiscal year (FY) 2022 is at $727 billion, $1.8 trillion lower than it was at this point in FY 2021. CBO still expects the deficit will be $1 trillion for FY 2022. Revenues thus far in FY 2022 are $789 billion higher versus this point in FY 2021, with outlays $1 trillion lower. Much of the spending decline is linked to outlays in FY 2021 from Covid aid. The Treasury Department issues their update on the FY 2022 budget deficit this afternoon.

Market perspectives:

• Outside markets: The U.S. dollar index is a bit lower again in early U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 2.793%. Crude is under pressure, with U.S. crude around $89.10 per barrel and Brent around $94.85 per barrel. Gold and silver futures were under pressure, with gold around $1,806 per troy ounce and silver around $20.43 per troy ounce.

• Average price for a gallon of gas is $3.999, GasBuddy reports, a stark 20.5% decline from the June 16’s all-time high of $5.034. Tuesday marked the 55th straight day of declining prices at the pump, according to Patrick De Haan, GasBuddy’s head of petroleum analysis. The nation’s other leading gas price tracker AAA still estimates the average price for a gallon of gas is $4.033, and AAA reports the average price is still over $4 per gallon in 26 states and Washington, D.C., led by California at $5.420 and Hawaii at $5.417.

• The Rhine — a pillar of the German, Dutch and Swiss economies for centuries — is set to become virtually impassable at a key waypoint later this week, stymieing vast flows of diesel and coal, according to Bloomberg News. It’s forecast to drop below a critical depth where it becomes uneconomical to transport commodities and will likely deepen Europe's energy crisis as the region reels from interrupted Russian gas. Link for details.

• Ag trade: Japan purchased 82,955 MT of wheat from its weekly tender, including 25,070 MT U.S. and 57,885 Canadian, and tendered to buy 70,000 MT of feed wheat and 40,000 MT of feed barley. Jordan tendered to buy 120,000 MT of optional origin milling wheat.

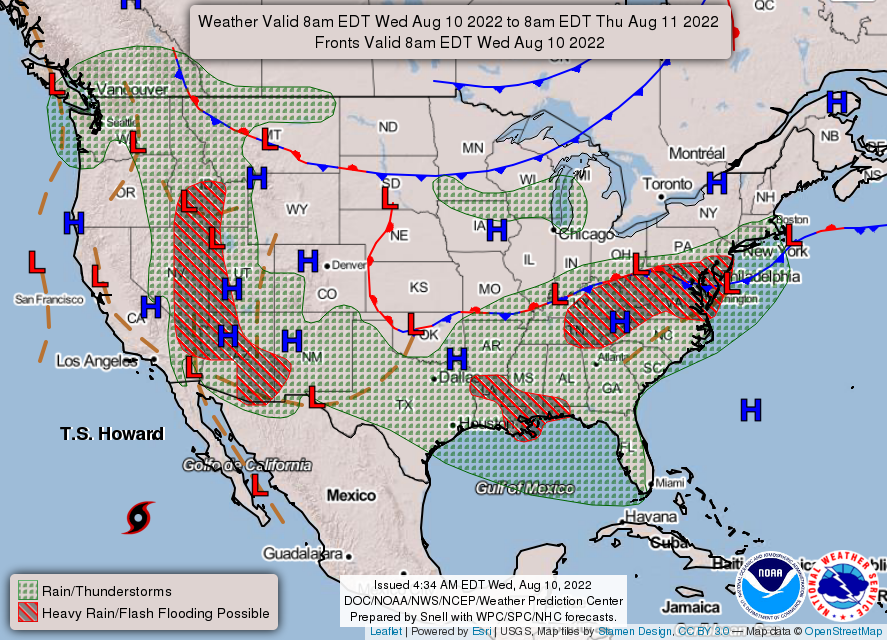

• NWS weather: Hot weather to continue from the Northwest into the Plains, some relief by Wednesday for the Northeast... ...Heavy Rain and Flash Flooding threat from the Ohio Valley into the Central Appalachians and along the Gulf Coast... ...Monsoonal Showers to continue from the Southwest, portions of California, the Great Basin and into the Intermountain West.

Items in Pro Farmer's First Thing Today include:

• Followthrough buying overnight

• Ukrainian grain, oilseed exports surge (details in next section)

• China removes some of Taiwan’s autonomy in document (details in China section)

• Wholesale beef prices continue to chop

• Cash hog fundamentals remain supportive

|

RUSSIA/UKRAINE |

— Summary: On the ground, Russia's heavy rocket fire and artillery attacks hit multiple regions across Ukraine overnight, from Zaporizhzhia in the south to Kharkiv in the north. Ukrainian President Volodymyr Zelenskyy said Ukraine must not be satisfied with a partial victory that would leave Russian troops on Ukrainian soil, citing frozen conflicts in Georgia and, previously, in Donbas, in Ukraine’s east. “Neither smoldering nor frozen conflict should remain after this Russian war against Ukraine,” Zelenskyy said. “This is an important conclusion. Ukraine must [get] everything that Russia temporarily seized, and the aggressor state must be punished for the crime of aggression.”

- Energoatom, a Ukrainian state nuclear-power operator, warned that Russia intends to sever the connection between the Zaporizhzhia nuclear plant and Ukraine’s power grid, and connect it to Russia’s instead. That requires a technically difficult process with potentially disastrous consequences, warned Energoatom’s boss.

- Europe bans Russian coal. The European Union’s ban on imports of Russian coal, agreed in April as part of its fifth package of sanctions, takes effect at midnight on Wednesday. One of the world’s biggest exporters of coal, Russia supplied around 70% of the EU’s imports of thermal coal (used to generate electricity) and 45% of all coal imports last year, according to Bruegel, a think-tank in Brussels. Of the €94.3 billion ($96.5 billion) that the EU spent on Russian fuel last year, just €5.3bn ($5.4 billion) went for coal.

- Russia stops oil flowing through pipeline to Central, Eastern Europe. Russian oil stopped flowing via a pipeline that feeds countries in Central and Eastern Europe. Transneft PJSC, the government-owned oil-pipeline operator, said Tuesday that crude exports through Ukrainian territory had halted on Aug. 4. It blamed payment difficulties caused by Western sanctions on Moscow and said Ukraine’s pipeline operator had declined to carry crude after it didn’t receive funds. The move severs supplies through the southern branch of the Druzhba pipeline that carries oil to Slovakia, Hungary and the Czech Republic.

- Ukraine exports of grains, oilseeds and vegoils reached 2.66 million tonnes in July, up 26% from June. The rise in part was due to wheat and barley exports, the country’s Agriculture Ministry said. The total included 412,000 tonnes of wheat, 183,000 tonnes of barley, 1.1 million tonnes of corn, 362,100 tonnes of sunflowerseed and other commodities. The ministry noted grain exports for 2022-23 were still down nearly 52% at 2.2 million tonnes, including 1.45 million tonnes of corn, 562,000 tonnes of wheat and 192,000 tonnes of barley. The ministry said 2021-22 grain exports (July/June) were 48.5 million tonnes.

“It only takes one missile to fly across the place and hit something, and then it all stops,” says John Rich, chairman of Ukrainian agriculture giant MHP, which has continued operations in the country even while many of its competitors left when war broke out. “There’s light in the tunnel with the ports. But the tunnel could close rapidly. It only takes one act, and that’s gone. It’s a high risk.”

|

POLICY UPDATE |

— U.S. corporations will pay nearly $296 billion more in federal taxes over the next decade, and middle-income households will see some tax cuts under the tax-and-climate bill, according to an analysis released Tuesday by the Congressional Joint Committee on Taxation. About $222.2 billion of the increase on businesses will come from a new corporate minimum tax that requires companies with at least $1 billion in profits to pay a minimum of 15% on the earnings they report to shareholders. An additional $73.7 billion stems from a 1% excise tax on corporations that buy back their own stock, the projections from the nonpartisan scorekeeper showed. Link to JCT analysis.

Households earning less than $100,000 will see net tax cuts through 2025, largely due to an extension of subsidies for Affordable Care Act premiums. After that, taxes for middle- and low-income households are largely unchanged. The Democrats' climate, health care and tax package wouldn't raise taxes on average for households earning less than $200,000, at least for the first three years the bill is in effect.

The data also show that a last-minute addition to the bill, restricting the losses a pass-through business can write off in any given year, will raise $52.8 billion over the decade.

|

CHINA UPDATE |

— China ended military exercises near Taiwan but pledged to continue patrols. The People’s Liberation Army (PLA) “successfully completed all tasks” set out in exercises last week, Eastern Theater Command spokesman Senior Colonel Shi Yi said Wednesday. Still, the PLA planned to “regularly organize patrols in the direction of the Taiwan Strait,” Shi said, adding that such activities would be based on the development of the cross-strait situation. Taiwan accused China of rehearsing possible invasion scenarios.

— The Taiwan Affairs Office of the State Council published a white paper entitled “The Taiwan Question and China’s Reunification in the New Era.” While insisting that eventual reunification is a foregone conclusion, the paper also expressed Beijing’s strong preference for peace.

— China removes some of Taiwan’s autonomy in document. China has withdrawn a promise not to send troops or administrators to Taiwan if it takes control of the island, an official document showed on Wednesday, signaling a decision by President Xi Jinping to grant less autonomy than previously offered. China had said in two previous white papers on Taiwan, in 1993 and 2000, that it “will not send troops or administrative personnel to be based in Taiwan” after achieving what Beijing terms “reunification.” That line, meant to assure Taiwan it would enjoy autonomy after becoming a special administrative region of China, did not appear in the latest white paper. A line in the 2000 white paper that said “anything can be negotiated” as long as Taiwan accepts that there is only one China and does not seek independence, is also missing from the latest white paper. China’s white paper on its position on self-ruled Taiwan follows days of unprecedented Chinese military exercises near the island.

— China’s Consumer Price Index (CPI) rose 2.7% from year ago in July, accelerating from June’s 2.5% gain, and the fastest rise since July 2020, according to the National Bureau of Statistics (NBS). The pace of increase approached the government’s target of around 3%. Food prices rose 6.3% in July, from a 2.9% rise in June on an annualized basis, including a 20.2% surge in pork prices which had declined 6% in June, giving rise to chatter that China may re-enter the U.S. pork market for purchases. But core inflation, which strips out volatile food and energy prices, slowed to 0.8% growth in July, the lowest level in 14 months, due to slack domestic demand. China’s household spending remains one of the weakest links in the overall economy, which has been weighed down by a prolonged property-market slump and frequent Covid flare-ups across the country. Wholesale prices via the Producer Price Index (PPI) increased 4.2%, the National Bureau of Statistics (NBS) reported, down from 5.1% in June and the slowest rise in 17 months. On a monthly basis, PPI fell 1.3% in July from June, the first monthly decline since January.

— China and South Korea discuss chips. On Tuesday, Foreign Minister Wang Yi met with his South Korean counterpart Park Jin in Qingdao, Shandong. Wang laid out his vision for China/South Korea ties. Some 60% of South Korea’s chip exports go to China and Hong Kong. But the U.S. has just asked South Korea to join the Chip 4 “alliance,” which looks to more tightly integrate the chip supply chains of the U.S., Japan, Taiwan, and South Korea, according to the South China Morning Post. But Reuters notes that Park appeared responsive to Wang’s request. “Park…said on Twitter before the talks that he would propose joint action plans to strengthen relations and discuss the issue of stabilizing global supply chains.” China got another win last week when Yoon refused to meet with House Speaker Nancy Pelosi (D-Calif.) when she visited Korea, according to the Financial Times.

|

ENERGY & CLIMATE CHANGE |

— Analysis finds 'loophole' in how U.S. oil and gas companies report methane emissions. An analysis by Bloomberg of Environmental Protection Agency data indicates that oil and gas companies will have broad leeway to choose how much of their pollution is reported to comply with the methane fee included in the Inflation Reduction Act, which would impose a fee of up to $1,500 a ton on excess emissions and could generate as much as $1.9 billion a year. In one instance, shale company Range Resources Corp.'s interpretation of one word in the EPA's regulations allowed it to reduce its reported emissions from energy production by 93% in 2020 compared with the reporting method used by most companies in the oil and gas industry according to the analysis. Link for details.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— IRI: Egg prices in U.S. surge 47% as food inflation soars. Egg prices at grocery stores soaring a whopping 47% in July over last year, according to retail analytics firm Information Resources Inc. Prices have been driven by bird flu outbreaks, killing more than 30 million commercial and wild birds. The crisis hurt egg-laying hens and turkeys the most. Although the outbreak has eased, growers are still repopulating their flocks, which is expected to bring prices down eventually.

Other jumps in prices in the IRI data include:

- Butter up 26% year over year

- Packaged bread up 15%

- Frozen meals up 23%

- Frozen pizza up 18%

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 586,487,784 with 6,423,932 deaths.

- U.S. case count is at 92,343,457 with 1,034,654 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 604,235,972 doses administered, 223,035,566 have been fully vaccinated, or 67.69% of the U.S. population.

|

POLITICS & ELECTIONS |

— Update on Tuesday elections:

- Connecticut: Gov. Ned Lamont and Sen. Richard Blumenthal got their GOP challengers in re-election races they're expected to win in November. Leora Levy, a first-time candidate who was endorsed by former President Donald Trump, won the Republican primary for U.S. Senate . Levy, a member of the Republican National Committee. The state hasn’t sent a Republican to the Senate in more than 30 years. Levy’s victory Tuesday came over the party establishment’s favored candidate, former state House Minority Leader and social moderate Themis Klarides. She also defeated a fellow conservative, immigration attorney Peter Lumaj. Levy is 65 and immigrated to the U.S. from Cuba as a child. She now lives in Greenwich.

- Minnesota: Democratic Rep. Ilhan Omar, a member of the progressive “squad,” narrowly survived a close contest for her Minneapolis-based House seat versus Don Samuels, a former City Council member from Minneapolis. The outcome in the 5th Congressional District was a lot closer than many political observers expected. On Tuesday, the split was 50.3% to 48.2%, with the DFL-endorsed Omar prevailing by about 2,500 votes. Omar is strongly favored to win another term given the DFL's advantage in the Minneapolis-based district. She'll face Republican Cicely Davis in November. Omar’s victory against Samuels makes her the third member of the “squad” to beat back primary challengers. The other two were Representatives Cori Bush of Missouri and Rashida Tlaib of Michigan. Two other members — Representatives Alexandria Ocasio-Cortez of New York and Ayanna Pressley of Massachusetts — did not draw any primary opponents this cycle. A sixth member, Representative Jamaal Bowman of New York, is facing three primary challengers later this month.

Republican Brad Finstad was poised for a 4-point win in the 1st Congressional District special election to succeed late U.S. Rep. Jim Hagedorn. He and Democrat Jeff Ettinger go head-to-head again in November for a full term. Tuesday’s special election in the red-leaning 1st district of Minnesota is one more data point in Democrats’ favor. As Cook Political Report House editor David Wasserman writes, “Democrats’ nominee, retired Hormel Foods CEO Jeff Ettinger, came with four points (47%-51%) of upsetting Republican Brad Finstad, a moderate former state USDA official — despite the 1st CD having voted for Donald Trump by 10 points in 2020 — a result sure to renew questions about whether a “red wave” is receding post-Dobbs.”

Democratic Gov. Tim Walz and Republican challenger Scott Jensen scored easy victories Tuesday in their primaries to set the stage for their fall matchup in Minnesota’s top race this fall.

Business lawyer Jim Schultz won the GOP primary to take on Democratic Attorney General Keith Ellison. Schultz beat Doug Wardlow, who narrowly lost to Ellison in 2018. - Vermont: Progressive Democrat Becca Balint won the Democratic House primary in Vermont, positioning her to become the first woman representing the state in Congress.

- Wisconsin: Former President Donald Trump's chosen candidate Tim Michels, a businessman, won the Republican primary for governor over a rival (former Wisconsin Lt. Gov. Rebecca Kleefisch) backed by former Vice President Mike Pence. He will take on Democratic Gov. Tony Evers. It was President Biden who canceled the contract to build the Keystone XL pipeline, which Michel’s firm was supposed to build. Michels has campaigned on being tough on crime.

Mandela Barnes won the Democratic primary to take on incumbent Republican Ron Johnson for a seat in the Senate. Barnes — a former community organizer from Milwaukee — sets up a race that could help decide control of the Senate. Barnes, Wisconsin’s first Black lieutenant governor, would be its first Black senator if he were to win. He is entering the general election with nearly $1 million cash on hand, according to the latest federal election filings. For Johnson, that number was more than $2 million.

In western Wisconsin, Democratic Rep. Ron Kind’s retirement after 26 years in office opens up a seat in a district that has been trending Republican. There, Republican Derrick Van Orden secured his party's nomination. He'll face Democratic state Sen. Brad Pfaff in November's general election.

— Update on Washington state election. House Republican Jaime Herrera Beutler, who voted to impeach Trump, conceded to Joe Kent in Washington's 3rd District. The six-term incumbent was one of two Republican members of Washington's congressional delegation who voted to impeach former President Donald Trump and drew an intraparty challenger. Trump had endorsed former Green Beret Joe Kent, who was leading Herrera Beutler after several days of vote counts. He will face off against Democrat Marie Gluesenkamp Pérez in November. The district is in southwest Washington, across the border from Portland, Oregon.

— A special election to fill the vacancy left by the death of Rep. Jackie Walorski (R-Ind.) will be held concurrently with the general election on Nov. 8, 2022. Governor Eric J. Holcomb signed an executive order on Tuesday setting the process in motion.

|

OTHER ITEMS OF NOTE |

— Senate Minority Leader Mitch McConnell (R-Ky.) is urging Attorney General Merrick Garland to explain Monday’s search of Mar-a-Lago: “The country deserves a thorough and immediate explanation of what led to the events of Monday. Attorney General Garland and the Department of Justice should already have provided answers to the American people and must do so immediately.”

Meanwhile, former President Donald Trump wrote on social media that he is set to meet with the New York attorney general today. Trump's deposition today by the New York attorney general’s office is part of a civil-fraud investigation. Since 2019, New York Attorney General Letitia James has been investigating whether Trump and his company made false representations to banks, tax authorities and insurers for financial gain, reports Corinne Ramey. Trump and his company have denied wrongdoing.

The FBI seized the cellphone of Rep. Scott Perry (R-Pa.), the House Freedom Caucus said in a statement. An ally of Donald Trump, Perry was a leading voice in the effort to overturn the 2020 election, according to testimony provided to the Jan. 6 committee.

— Monkeypox: The FDA has authorized a change in how the Jynneos monkeypox vaccine is administered, stretching out the supply amid high demand. The monkeypox vaccine can now be given to high-risk adults in a way that will allow health care providers to get five doses out of a standard one-dose vial. The move could increase the number of vaccine doses in the national stockpile from 441,000 to over 2.2 million, officials said Tuesday. As of today, there are more than 9,000 probable or confirmed monkeypox cases nationwide, according to the CDC.

— Elon Musk offloaded $6.9 billion worth of Tesla stock, saying he wanted to avoid a sudden sale in the event he’s forced to go ahead with his deal to acquire Twitter. Tesla's CEO tweeted that he was done selling and would buy shares in the electric-car maker if the Twitter deal doesn’t close.