Former Prime Minister Shinzo Abe Killed at Campaign Event for LDP

Payrolls increased 372,000 in June, more than expected | Biden to head China tariff meeting

|

In Today’s Digital Newspaper |

Former Japanese Prime Minister Shinzo Abe has died after being shot during a campaign speech Friday in western Japan for the ruling Liberal Democratic Party for a national election on Sunday. Abe, 67, was shot from behind minutes after he started his speech in Nara. He was airlifted to a hospital for emergency treatment but was not breathing and his heart had stopped. He was pronounced dead later at the hospital, NHK said (link). Police arrested the suspected gunman at the scene of an attack that shocked many in Japan, which is one of the world's safest nations and has some of the strictest gun control laws anywhere. A detained suspect was identified by local media as a 41-year-old man who was a veteran of the Japan Maritime Self-Defense Force. Police said the weapon used appeared to be an improvised gun. After the shooting, current Prime Minister Kishida called the incident a despicable, barbarous act.” A nationalist, Abe thought Japan shouldn’t keep apologizing for its past colonization of other Asian countries. He emphasized close ties to the U.S. While Japan’s its longest serving leader, Abe’s policies divided the public. His critics said his economic policies of monetary easing, fiscal stimulus and structural reform, known as “Abenomics” amplified inequality.

Prime Minister Fumio Kishida canceled his own campaign events and returned to Tokyo for emergency meetings.

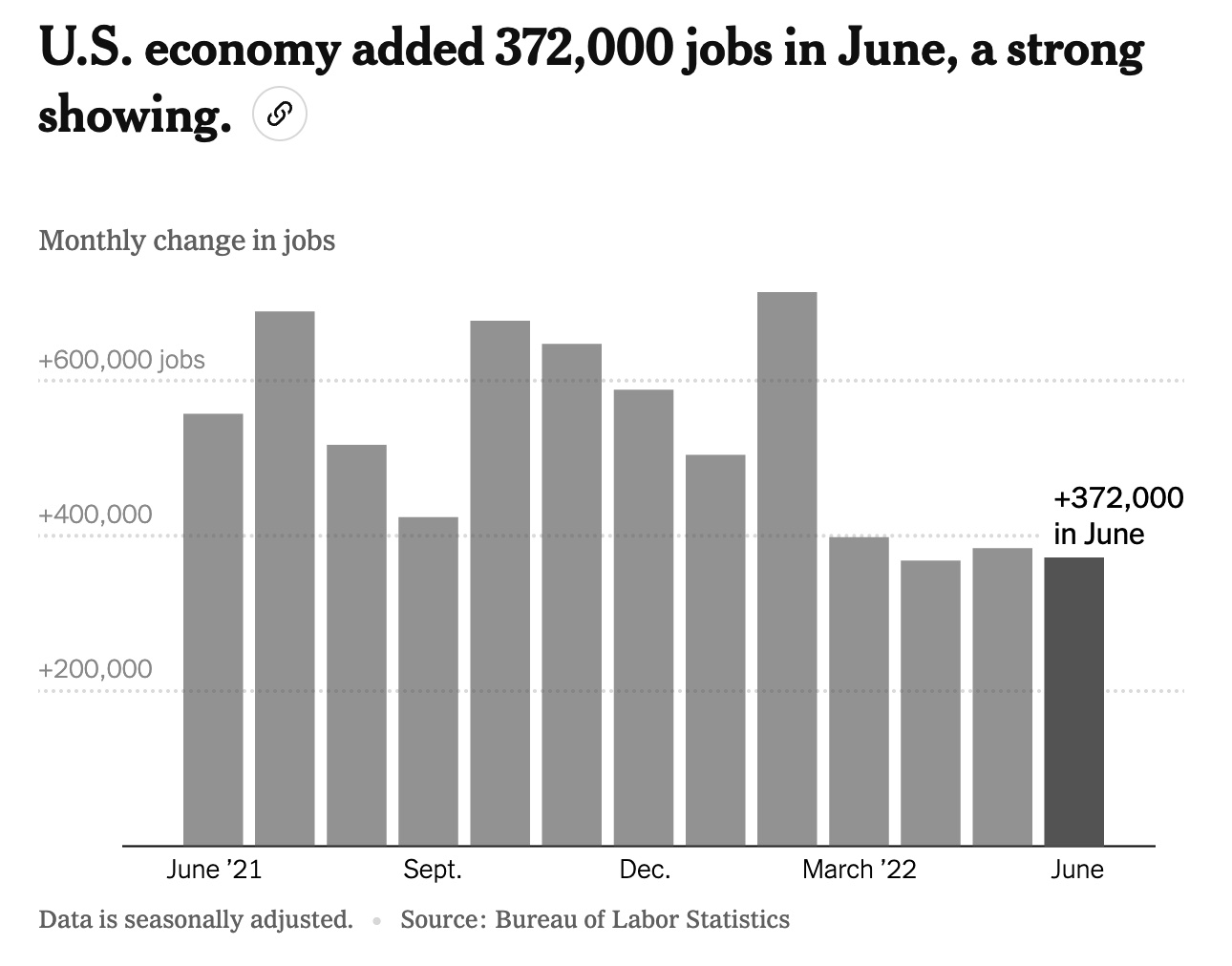

The U.S. economy added 372,000 jobs in June, extending a streak of strong gains despite signs of slowing economic growth and a surprisingly strong gain that will likely spur the Federal Reserve to keep sharply raising interest rates to cool the economy and slow price increases. The jobless rate remained at 3.6%. More below.

Sales of U.S. corn, cancellations of soybean sales to China. USDA data for the week ending June 30 showed cancellations of U.S. soybean and beef sales to China but net sales of both old- and new-crop corn. Activity for 2021-22 included 59,200 tonnes of soybeans, and net sales of 63,400 tonnes or corn, 6,900 tonnes of wheat, 2,600 tonnes of sorghum and 10,000 running bales of upland cotton were reported. For 2022-23, sales of 84,000 tonnes of corn and 22,000 running bales of upland cotton were reported. For 2022, net reductions of 1,600 tonnes of beef and net sales of 11,400 tonnes of pork were reported.

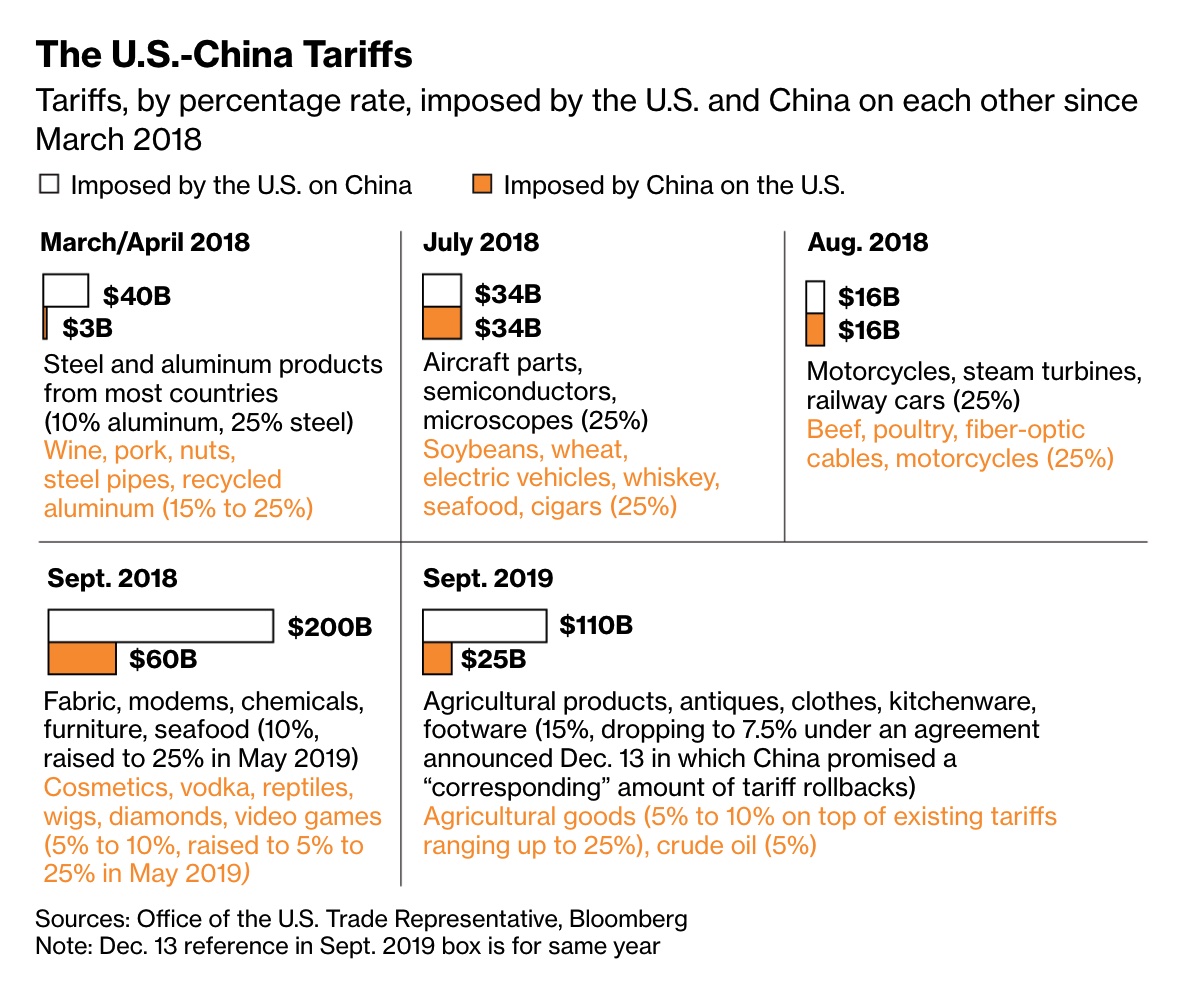

Tariff talk. President Joe Biden will discuss potential reductions in U.S. tariffs on Chinese goods in a meeting today with advisers, Bloomberg reports. He's been weighing whether to remove some of the duties imposed by Donald Trump on more than $300 billion in Chinese imports. More in Trade Policy section.

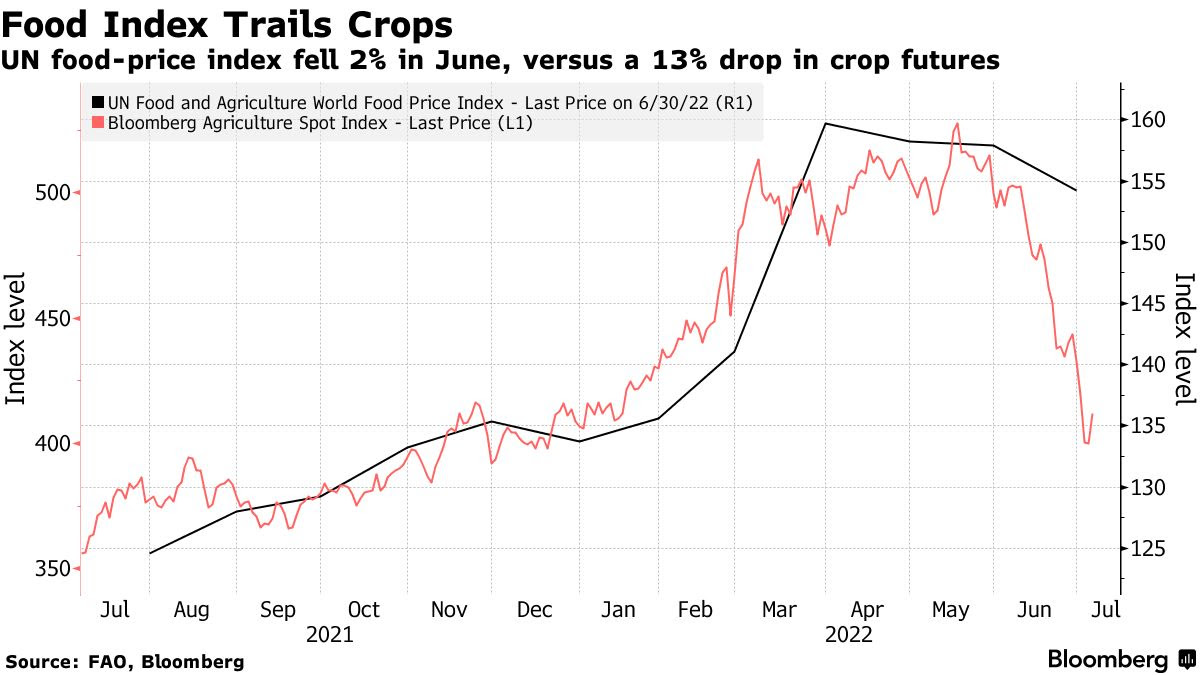

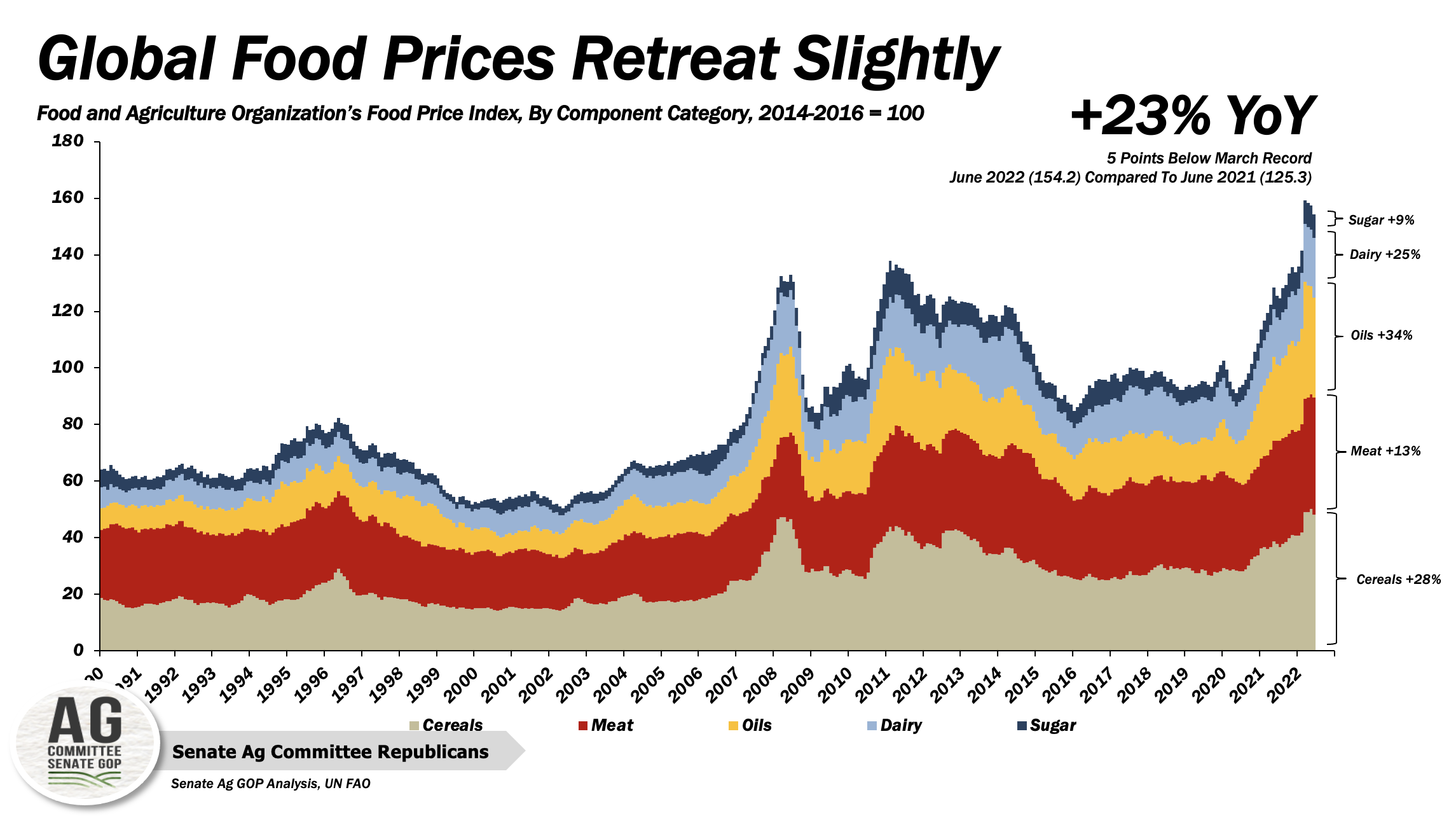

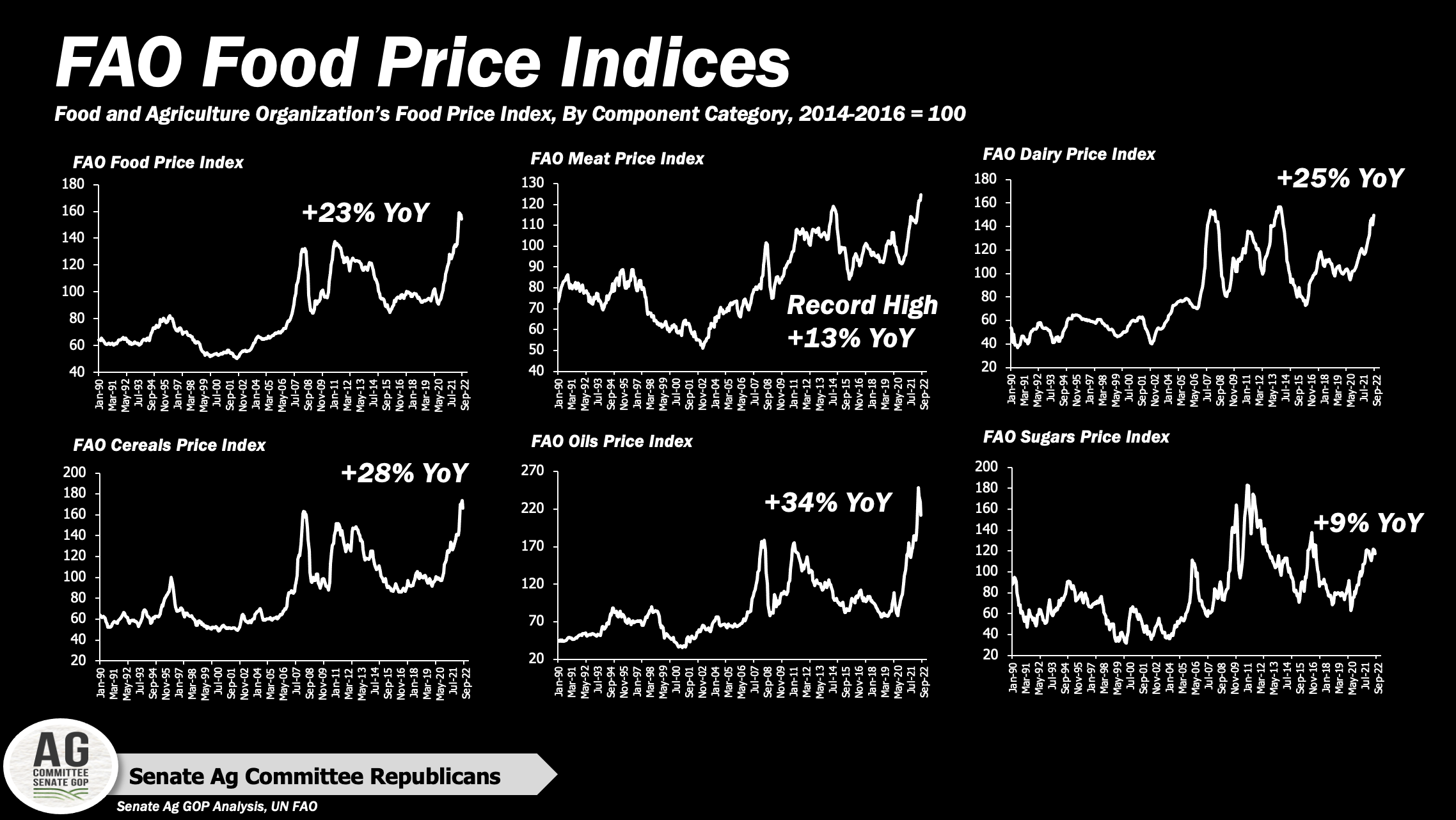

Global food prices ease for third consecutive month but still elevated. The U.N. Food and Agriculture Organization (FAO) global food price index dropped 2.3% in June – the third straight monthly decline after hitting a record high in March but was still 23.1% above year-ago. Declines in the price of cereal grains, vegoils and sugar more than offset increases in meat and dairy.

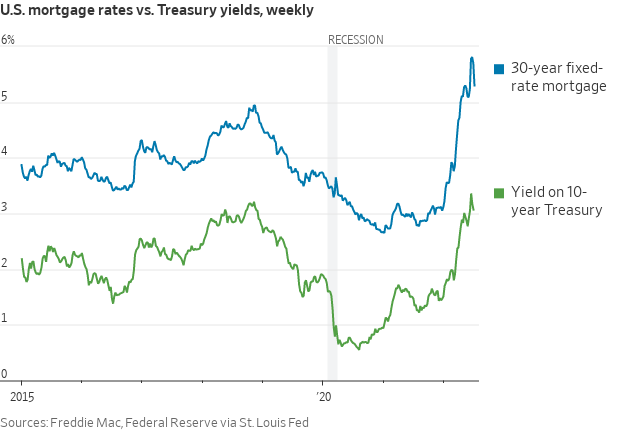

Mortgage rates record their largest decline since 2008. The falling rates, which were down for a second-straight week, added to fears of a recession. According to data from Freddie Mac released yesterday, the 30-year fixed rate fell to 5.30%, from 5.70% last week.

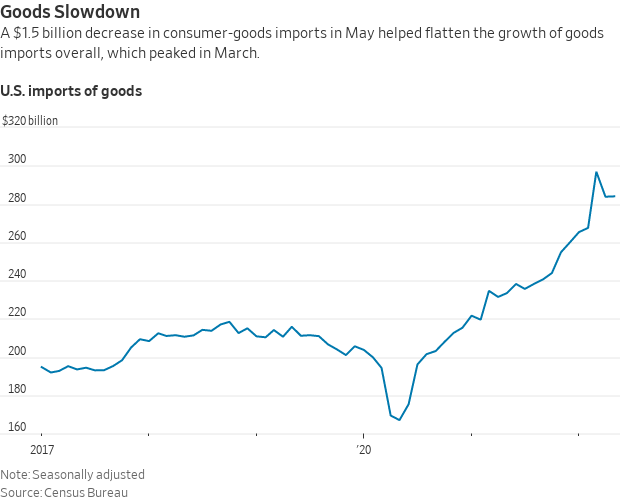

U.S. consumer goods imports fell by some $1.5 billion by value in May, helping narrow the trade gap for the second month in a row. Meanwhile, U.S. agricultural exports and imports in May both topped $17 billion for the third straight month. U.S. agricultural exports eased 3.5% in May to $17.09 billion while imports rose 0.3% to $17.75 billion, for a deficit of $656 million.

Sens. Schumer and Manchin have made progress on a reconciliation bill that would provide approximately $300 billion in energy and climate spending, raise corporate taxes and allow Medicare to negotiate the price of prescription drugs directly with the pharmaceutical industry.

Democrats may move to have House approve Senate-passed USICA measure. The United States Innovation and Competition Act (USICA) is the industrial policy legislation that would provide the semiconductor industry with $52 billion of incentives to ramp up chip-making in America. More in Policy section.

The Biden administration released a draft rule that would require states and cities to measure their transportation-related emissions and develop their own reduction targets. State transportation departments and metropolitan planning organizations with National Highway System mileage within their boundaries would be tasked with reporting their progress on their emissions targets twice a year.

Biden to sign executive order to try to protect abortion access. The order expected to try to mitigate some potential penalties that women seeking abortion may face and to push back on efforts to limit their ability to travel across state lines to access services. It will also try to protect the privacy of those seeking information about reproductive care online.

Looking at House midterm elections, Cook Political Report House editor David Wasserman is looking for GOP gains in the 20-35 seat range. Some other forecasters see higher gains.

Texas Governor Greg Abbott authorized National Guard troops and state police to apprehend migrants who illegally cross from Mexico and return them to the border.

The Treasury Department’s inspector general will investigate why two former top FBI officials who ran afoul of Donald Trump were subjected to rare tax audits.

Elon Musk's deal to buy Twitter in 'peril'. Advisors to the Tesla CEO have concluded that Twitter's figures on spam accounts are unverifiable, the Washington Post reported. Meanwhile, the billionaire has stopped engaging in certain discussions around funding for the $44 billion deal, including with a likely backer, WaPo said, citing anonymous sources. The NYT said it could not confirm the information.

Election Day 2022 is 123 days away. Election Day 2024 is 851 days away.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened around 25 points lower. Nasdaq opened around 1% lower. In Asia, Japan +0.1%. Hong Kong +0.4%. China -0.3%. India +0.6%. In Europe, at midday, London -0.2%. Paris -0.2%. Frankfurt +0.3%.

U.S. equities yesterday: The Dow gained 346.87 points, 1.12%, 31,384.55. The Nasdaq was up 259.49 points, 2.28%, at 11,621.35. The S&P 500 rose 57.54 points, 1.50%, at 3,902.62.

Shares for Deere closed 5.1% higher at $303.97 on Thursday. Deere hit a 52-week closing low of $289.14 on Wednesday. The stock has fallen 12% in 2022. D.A. Davidson Analyst Michael Shlisky reiterated his Buy rating for Deere maintaining his target of $445 for the price, citing improved expectations for earnings from corn and soybeans. “Bottom line, for both crops, our proprietary crop model points to record cash receipts and profits both this year and next, suggesting a strong heavy-tractor outlook through at least 2024,” he wrote in a research note. Link for more via Barron’s.

Agriculture markets yesterday:

- Corn: December corn futures rose 11 1/4 cents to $5.96 1/4, after earlier rising as high as $6.08 3/4.

- Soy complex: November soybeans rallied 42 3/4 cents to $13.65 1/2. August soyoil soared 306 points to 61.62 cents per pound. August soymeal surged $7.90 to $423.50 per ton.

- Wheat: September SRW wheat rose 32 cents to $8.36 1/2. September HRW wheat rose 37 3/4 cents to $8.89 1/4. September spring wheat rose 48 1/4 cents to $9.34 1/2.

- Cotton: December cotton rose 327 points to 91.88 cents per pound.

- Cattle: August live cattle rose 5 cents to $134.55. August feeder cattle fell $1.025 to $176.05.

- Hogs: August lean hogs rose 30 cents at $109.50, the highest close since June 21.

Ag markets today: Corn and wheat futures built on Thursday’s strong corrective gains during overnight trade. Soybeans traded higher initially but failed to sustain the firmer tone. As of 7:30 a.m. ET, corn futures were trading 5 to 7 cents higher, soybeans were fractionally to 6 cents lower, winter wheat futures were 12 to 20 cents higher and spring wheat was 23 to 27 cents higher. Front-month U.S. crude oil futures were near unchanged and the U.S. dollar index was around 130 points higher this morning after earlier marking a fresh 20-year high.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. nonfarm payrolls for June are expected to rise 250,000 from the prior month and the unemployment rate is forecast to hold steady at 3.6%. (8:30 a.m. ET) UPDATE BELOW.

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• New York Fed President John Williams speaks at separate events in Puerto Rico at 8:30 a.m. ET and 11 a.m. ET.

• U.S. wholesale inventories for May are expected to rise 2% from the prior month. (10 a.m. ET)

• Federal Reserve reports May consumer credit at 3 p.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

• China's producer- and consumer-price indexes for June are out at 9:30 p.m. ET.

Job growth accelerated at a much faster pace than expected in June. Nonfarm payrolls increased 372,000 in the month, better than the 250,000 forecast and continuing what has been a strong year for job growth, according to data Friday from the Bureau of Labor Statistics. The unemployment rate was 3.6%, unchanged from May and in line with estimates, but falling short of the prepandemic rate of 3.5% in February 2020, when unemployment was hovering at its lowest level since 1969. The Federal Reserve expects the jobless rate to rise gradually to 4.1% by 2024. Source of chart: New York Times.

Growth was most pronounced in the professional and business services, leisure and hospitality, and health care industries, the government said.

Wages climbed 5.1%, a still-rapid pace as the Fed awaits a slowdown. moderating slightly from 5.3% in the year through May. Economists in a Bloomberg survey had expected a slightly bigger cool-down, to 5%. “Wages are not principally responsible for the inflation that we’re seeing, but going forward, they would be very important, particularly in the service sector,” Jerome Powell, the Fed chair, said at his news conference in June. He has repeatedly made the case that slowing the job market is necessary to put it on a more sustainable longer-run path.

Labor force participation remained nearly the same as the month before, at 62.2%.

Mortgage rates see largest decline since 2008. The average rate on a 30-year fixed-rate mortgage fell to 5.30%, down from 5.70% last week, mortgage-finance giant Freddie Mac said. Growing fears of a recession in the U.S. stand to further push down mortgage rates as investors pile into U.S. Treasurys, widely seen as safe investments during times of economic uncertainty. Mortgage rates are closely tied to yields on the benchmark 10-year U.S. Treasury, which fell to their lowest level in more than a month this week.

U.S. trade deficit narrowed for the second consecutive month in May as imports were held down by lower goods spending by American households and exports jumped on energy shipments. The trade gap in goods and services shrank 1.3% in May from the previous month to $85.5 billion, the Commerce Department said Thursday. Exports were up 1.2% to $255.9 billion on higher crude-oil and natural-gas exports. Energy commodity prices rose sharply in the spring because of market disruptions caused by Russia’s invasion of Ukraine, which has driven up the value of both imports and exports of energy products. Countries in Europe have also sought to shift energy purchases away from Russia.

U.S. ag trade deficit builds in May. U.S. agricultural exports and imports in May both topped $17 billion for the third straight month. U.S. agricultural exports eased 3.5% in May to $17.09 billion while imports rose 0.3% to $17.75 billion, for a deficit of $656 million. It was the third consecutive monthly deficit for the sector. USDA forecasts U.S. ag exports at $191 billion in fiscal year (FY) 2022 with imports of $180.5 billion for a trade surplus of $10.5 billion. Through May, the trade balance is at $8.3 billion. To meet USDA’s forecast, exports need to reach $13.63 billion over the next four months and imports of $13.08 billion. In the final four months of FY 2021, U.S. ag exports were under $13 billion each month, while imports topped $14 billion in all but September when they were $13.97 billion.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly up early today. The yield on the 10-year U.S. Treasury note is fetching 2.978%. U.S. crude was weaker at $102.65 per barrel and Brent crude firmer around $104.75 per barrel. Gold was firmer at around $1,740 per troy ounce and silver weaker around $19.09 per troy ounce.

• The euro is moving toward parity with the U.S. dollar for the first time since its early years of existence. Investors are betting it could get a lot worse for the common currency, the WSJ reports (link). The descent adds to the eurozone’s inflation woes and complicates the European Central Bank’s plans for unwinding its pandemic stimulus.

• Regulating cryptocurrencies. The U.S. Treasury Dept. delivered a “framework” to President Joe Biden which outlined the need for shared global standards to better regulate cryptocurrencies. Treasury said that “uneven regulation, supervision and compliance across jurisdictions” risks hurting businesses, consumers, investors and markets. The framework also says that America should lead global discussions on central bank’s issuing digital currencies.

• Price of liquefied natural gas has rocketed 1900% from the bottom hit two years ago amid suppressed demand during the Covid-19 pandemic. Current prices are the equivalent of buying oil at $230 a barrel, more than double the current price of oil. LNG normally trades at a discount to oil.

• GasBuddy reports that 2,535 stations across the country had prices of $3.99 a gallon or less on Thursday, citing analyst Patrick De Haan. As of Thursday, AAA estimates that the national average price for a gallon of gas is $4.752 — down from a record $5.02 set last month — with more relief expected in the pipeline.

• Renewable diesel advantage means it will supplant biodiesel in the near term, said an investment bank, and the scramble for feedstocks will be mediated by limits on government incentives for the biofuel. Link for details.

• Old River Lock closure delayed until Aug. 30. On Aug. 30, the U.S. Army Corps of Engineers (USACE) will close the Old River Lock, Lettsworth, La., on the Mississippi River. Originally scheduled for Aug. 15, the closure for necessary repairs will last an estimated 75 days (until Nov. 12), down from the original 90 days. The agricultural industry had raised concerns that the timing of the closure, coinciding with harvest season, would negatively impact grain exports. Because trucking and other alternative logistics exceed the costs of river transportation, closing the lock for the entire harvest season would have been costly to farmers. The lock closure will directly impact two grain elevators, preventing them from shipping grain down the Mississippi River for the duration of the closure. To sync with the closure of the Old River Lock, USACE will also shift until Aug. 30 its planned closure of the Lindy C. Boggs Lock, on the Red River, Marksville, La. The Lindy C. Boggs Lock will close for a month, reopen for 2 weeks to clear the traffic backlog, and then close again for another month. Source: USDA Grain Transportation Report.

• U.S. soybean acres. Scott Gerlt, American Soybean Assn. Chief Economist, writes: “As markets unwrapped their June 30th Acreage Report gift, they were met with a surprise. Found inside the packaging was a larger reduction in soybean acres than had been anticipated. The trade estimates averaged 90.4 million acres, whereas only 88.3 million soybean acres were in the report. The markets then responded with a surprise gift of their own, an over $1.50 drop in the soybean futures harvest price since the release of the report last week. Rain through critical growing regions and overall economic concerns have fueled the decline. This column (link) looks to better understand USDA’s planting numbers.”

• Ag trade: South Korea purchased 65,000 MT of corn expected to be sourced from South America.

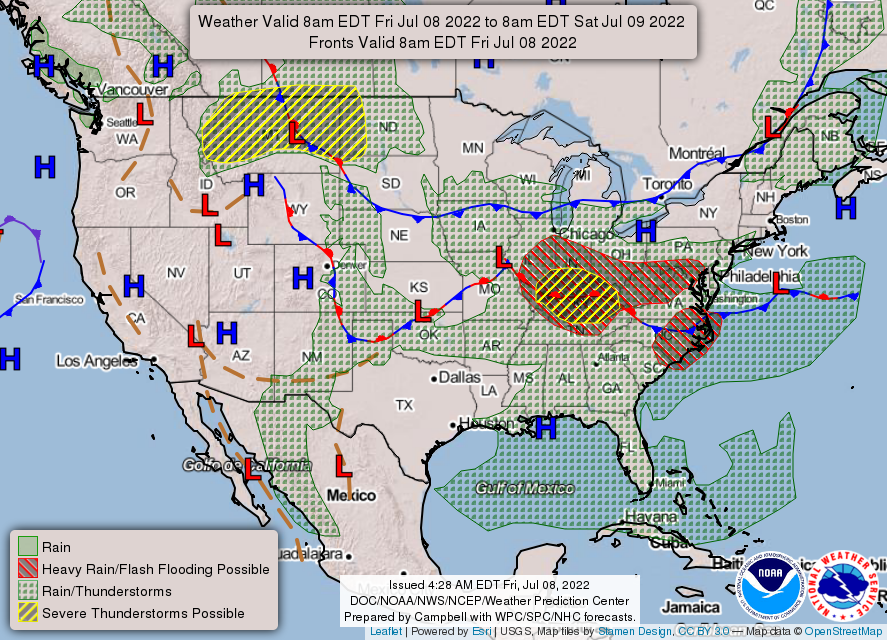

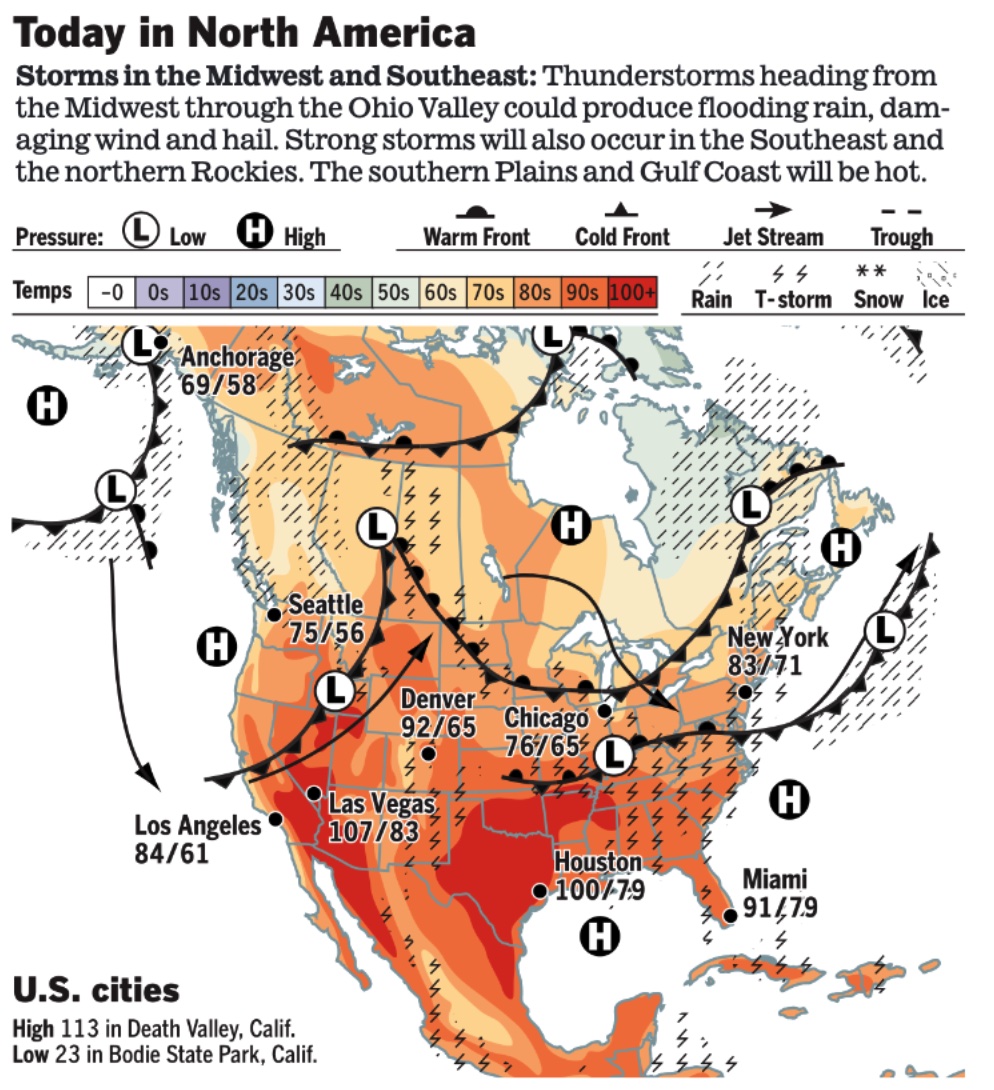

• NWS weather: Dangerous heat and humidity across parts of the South Plains to the Lower Mississippi and Tennessee Valleys through Sunday... ...There is a Slight Risk of severe thunderstorms over parts of the Northern Rockies to Northern Plains on Friday into Sunday morning and the Ohio Valley on Friday... ...There is a Slight Risk of excessive rainfall over parts of the Ohio Valley to the Mid-Atlantic/Southeast on Friday into Sunday morning.

Items in Pro Farmer's First Thing Today include:

• Followthrough buying in corn and wheat, soybeans mixed

• Global food prices ease for third consecutive month but still elevated

• Ukraine grain export saga update (details in Russia/Ukraine section)

• Russian wheat export tax rises

• French wheat crop continues to deteriorate

• Indonesia to raise palm oil blend in biodiesel

• China to sell more soybean reserves

• Light cash cattle activity

• Bellies lead pork cutout rebound

|

RUSSIA/UKRAINE |

— Summary: Vladimir Putin, Russia’s president, claimed that his country was only getting started in its invasion of Ukraine but suggested that he was still open to peace talks. Putin also warned the West that the war is heading towards a “tragedy for the Ukrainian people.” Meanwhile Ukraine raised its flag on Snake Island, a strategically important landmass in the Black Sea, one week after Russia’s withdrawal.

— Market impacts:

- Russia is using a secret network to steal Ukraine’s grain, a Wall Street Journal investigation found. Moscow has quietly institutionalized the theft of hundreds of thousands of metric tons of the crop from newly occupied areas of Ukraine, shipping it to allies in the Middle East, the investigation found. Russian officials denied the accusations. Link for details.

- Ukraine grain export saga update. Russia is ready to negotiate with Ukraine and Turkey about grain exports, but it is unclear when such talks might take place, Foreign Minister Sergei Lavrov said on Friday. U.S. Secretary of State Antony Blinken addressed Russia directly at a G20 foreign ministers meeting in Bali, Indonesia, on Friday and called on Moscow to let Ukrainian grain be exported. A Western official said Blinken’s message directly to Russia was, “Ukraine is not your country. Its grain is not your grain. Why are you blocking the ports? You should let the grain out.” However, Russian President Vladimir Putin continued to blame the West for the situation, warning that Russia’s military operations in Ukraine had barely started and prospects for negotiation would grow dimmer the longer the conflict dragged on.

- Romania reopened a Soviet-era rail link connecting its Danube River port of Galati to Ukraine a month earlier than expected to help boost vital grain exports from its neighbor.

- Turkey released a Russian-flagged vessel suspected of carrying looted Ukrainian grain.

|

POLICY UPDATE |

— Democrats may move to have House approve Senate-passed USICA measure. The United States Innovation and Competition Act (USICA) is the industrial policy legislation that would provide the semiconductor industry with $52 billion of incentives to ramp up chip-making in America. Supporters like the bill because it makes the U.S. less reliant on Chinese imports. The Biden administration hails it as a policy that will strengthen the supply chain, boost domestic manufacturing, and “help us outcompete China.”

Background. Senate Minority Leader Mitch McConnell (R-Ky.) recently tweeted, “There will be no bipartisan USICA as long as Democrats are pursuing a partisan reconciliation bill.” But Democratic leaders may have the House approve the USICA bill already approved in the Senate, However, there may not be 218 votes in the House for such a move because it would not include several key provisions House Democrats want in the measure.

Senate Majority Leader Chuck Schumer (D-N.Y.) requested an all-Senators classified briefing from the administration on the global innovation and technology race and USICA. The briefing is scheduled for next Wednesday.

— Sens. Schumer and Manchin have made progress on a reconciliation bill that would provide approximately $300 billion in energy and climate spending, raise corporate taxes and allow Medicare to negotiate the price of prescription drugs directly with the pharmaceutical industry. Updates:

- Some form of a methane fee is still in play.

- Talks are down to a few items.

- Several renewable energy tax credits could be included.

- Package of climate-focused and clean energy spending could total around $300 billion, below the $555 billion measure the House passed last year.

|

PERSONNEL |

— Patrick Stauffer, the White House’s director of finance, is headed to the Democratic National Committee to become its new chief financial officer, Politico reports. Stauffer was the deputy chief finance officer for Biden during the general election and worked for Buttigieg during the 2020 primary.

— Kapnick named chief scientist at NOAA. The Biden administration Thursday announced Sarah Kapnick will serve as chief scientist to the National Oceanic and Atmospheric Administration (NOAA).

|

CHINA UPDATE |

— China data show economy shrinking in challenge to Xi’s target. The consensus forecast from economists in a Bloomberg survey is that the government will next week report gross domestic product grew about 1.5% in the second quarter from a year earlier. Yet high-frequency data for June and losses in the previous two months suggest the economy contracted over that period due to the lingering effects of lockdowns in dozens of cities. Link for details.

— A U.S. Air Force officer has issued a stark warning about China’s rapid gains in defense acquisition, with the result that its military is now getting its hands on new equipment “five to six times” faster than the United States. This is the latest sobering evidence from a U.S. defense official suggesting that the Pentagon needs to urgently overhaul the way it goes about fielding new weapons, while China increasingly appears to be jockeying for the lead in the development of all kinds of high-end military technologies as part of its broader drive to become a preeminent strategic power. Link for details.

— China to buy cotton for state reserves. The China National Cotton Reserve Corporation (NCRC) said its purchases of cotton for state reserves will start July 13, targeting purchases of 300,000 tonnes to 500,000 tonnes of cotton from the 2021-22 Xinjiang cotton crop. This will help Chinese textile firms meet restrictions from the U.S. and others against any supplies sourced from Xinjiang over allegations of forced labor.

— Local authorities in Beijing dropped plans to require proof of vaccination for entering public venues, following a backlash online. The city’s vaccine mandate would have been the first of its kind in China. Instead, Beijing residents will have to show proof of a negative Covid-19 test obtained within 72 hours to enter public venues.

|

TRADE POLICY |

— Biden to meet with advisers to discuss cutting China tariffs. President Joe Biden will discuss possible reductions in U.S. tariffs on Chinese goods in a meeting with his advisers set for today, Bloomberg reports, citing people familiar with the matter, as his administration nears a closely watched decision on trade with China. Not attending the meeting: Treasury Sec. Janet Yellen, Commerce Secretary Gina Raimondo and U.S. Trade Representative Katherine Tai. The White House has also been weighing a new investigation into Chinese subsidies and their damage to the American economy as a way to pressure Beijing on trade.

Perspective: The extended indecision on tariffs on China “underscores that President Biden essentially has no trade policy while the rest of the world moves ahead with new trade deals,” the Wall Street Journal said in an editorial. “While Mr. Biden dithers, Pacific nations continue to strengthen trade with each other,” it adds.

|

ENERGY & CLIMATE CHANGE |

— Energy export ban requests continue. Some environmental groups are clinging to the fall in prices since the explosion at Freeport LNG’s Gulf Coast terminal to promote an export ban. “Stopping exports through that one facility actually had a dramatic impact on lowering natural gas prices around the country,” Jim Walsh, policy director for Food & Water Watch, said recently. He said the administration should take action to reduce and eliminate all fossil fuel exports. There’s already some appetite among Democrats in Congress for an export ban for both petroleum and gas exports, although an LNG export ban would compete directly with the administration’s initiative to get Europe more shipments.

Market action: Next-month natural gas futures have fallen more than 40% since their most recent peak to close Wednesday at $5.51 per MMBtu, territory that’s much more familiar to traders and consumers than the $9.32 level where NYMEX futures closed on June 6.

— GOP blasts new highway emissions rule. The Biden administration is moving ahead on plans for states to track and reduce their greenhouse gas emissions on highways, but Republicans are pushing back. The Federal Highway Administration Thursday announced a new proposed rule that would require states and metropolitan regions to set their own emissions targets and report on progress — a move that the administration says can be funded through a $27 billion pool of money in the bipartisan infrastructure law. The effort is part of the administration’s climate goals, as the transportation sector generates the largest share of the nation’s greenhouse gas emissions, the EPA has said.

Republican lawmakers say Congress never gave the U.S. Dept. of Transportation the authority to impose those performance measures on states. “Unfortunately, this action follows a common theme by both DOT and the administration, which is implementing partisan policy priorities they wish had been included,” Shelley Moore Capito (R-W.Va.), ranking member of the Senate Environment and Public Works Committee, said.

Responding, Committee Chairman Tom Carper (D-Del.) defended the proposed rule, saying the department has the authority to act under goals set a decade ago by Congress to make roads and highways more sustainable and create a state-based system to measure efforts.

— U.S. exports record volumes of crude oil from the SPR. Europe is set to receive the lion’s share of record-setting exports from the U.S. Strategic Petroleum Reserve (SPR) shipped out last month in a bid to plug supply gaps left behind by Russia’s invasion of Ukraine. Of the 5.35 million barrels of oil from the strategic reserve exported in June, nearly two thirds will be landing in Europe, according to Matt Smith, an oil analyst at commodity data firm Kpler.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Global food prices dropped from a near record amid prospects for fresh supplies and fears about a recession, potentially offering some respite to strained households. A UN index of world food costs slipped 2.3% last month, the third decline in a row, but the index is still up 15% this year.

— Five chicken industry executives were found not guilty of conspiring to fix prices from 2012 to 2019, a defeat for prosecutors that came after two mistrials and a major setback for the Biden administration’s attempts to police rising meat costs.

— Virtually all HPAI restrictions removed from U.S. commercial poultry operations. Only three of the 186 commercial poultry complexes depopulated for highly pathogenic avian influenza (HPAI) have yet to be released from quarantine, according to Animal and Plant Health Inspection Service (APHIS) data. All three are egg laying operations representing about 2.3 million head — less than 1% of the U.S. commercial egg layer flock.

— Krispy Kreme offers free doughnuts for year for selected customers. Krispy Kreme is giving away free doughnuts for a year to 8,500 lucky fans to celebrate the franchise's 85th anniversary. From July 11 to 14, participating Krispy Kreme shops in the U.S. will randomly select a series of customers to receive a free dozen Original Glazed doughnuts for a full year. In all, Krispy Kreme will be giving away 8,500 years of free doughnuts, or a total of 1.2 million.

— Food insecurity is hitting rich countries as inflation makes basics unaffordable for many. Some 44% of adults polled by the U.K. recently said they were buying less food, as the pain from higher prices spreads beyond less-developed nations.

— Sysco alleges conspiracy. In an antitrust lawsuit filed in federal court in Houston, food service company Sysco alleged that meatpackers Cargill, JBS, Tyson Foods, and National Beef had “exploited their market power ... by conspiring to limit the supply and fix” wholesale beef prices since at least 2015. Link for details.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 553,528,977 with 6,347,666 deaths.

- U.S. case count is at 88,381,768 with 1,020,261 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 592,269,252 doses administered, 221,924,152 have been fully vaccinated, or 67.35% of the U.S. population.

— About 300,000 children under the age of five in the U.S. have received at least one shot of the Covid-19 vaccine since it was recommended by the CDC last month, a senior White House official told CNN on Thursday. This makes up about 2% of that age group — a number the official says aligns with the Biden administration's expectations, though the number is lower than other age groups.

|

POLITICS & ELECTIONS |

— Biden to sign executive order on abortion, outline new steps aimed at protecting access. The Washington Post reports (link) that President Biden is planning to outline several steps aimed at bolstering abortion rights Friday morning, a move that comes two weeks after the Supreme Court overturned Roe v. Wade and after many Democrats called on Biden to respond with bolder and more urgent action.

— Midterm House election math. Amy Walter of the Cook Political Report writes: “Just about every election analyst and handicapper agrees that the House is all-but-certain to flip. The only disagreement these days is how many seats Republicans will gain. On paper, the grim political environment suggests the kind of wave election that rivals the wipeouts of 1994 and 2010, when the party in power lost more than 50 seats. However, our current forecast, as analyzed by House editor David Wasserman, is for GOP gains in the 20-35 seat range.”

|

CONGRESS |

— Lawmakers support improved WRDA cost-share formula. In a July 7 letter (link) to leaders of the Senate Committee on Environment and Public Works and the House Committee on Transportation and Infrastructure, 75 House lawmakers requested that waterways legislation being negotiated in a conference include an updated funding cost-share. “Historically, Congress and the nation have consistently recognized the vital contribution that waterborne transportation makes to overall economic prosperity,” lawmakers noted. “As a result, public expenditures to maintain navigation channels and build related infrastructure were among the nation’s earliest investments. However, our constituents have a growing concern over our aging inland waterways infrastructure as they become more vital to our economy with agriculture exports increasing each year.” More than 80% of the locks and dams on the inland waterways system are past their design life of 50 years, they noted.

|

OTHER ITEMS OF NOTE |

— Auditing tax audits. The IRS said its commissioner asked the Treasury Department’s inspector general for tax administration to investigate audits of James Comey and Andrew McCabe. Both had high profile fights with former President Trump, and the rare audits were conducted on Trump’s watch under the Trump-appointed IRS commissioner Charles Rettig. Lawmakers on Thursday were calling for a full investigation into whether the high-profile Trump adversaries had been illegally targeted, and if so, how.

— Greg Abbott directs Texas police and military to return illegal immigrants to border. The Republican governor of Texas directed state military and police forces to arrest and transport back to the southern border any person suspected of illegally entering the United States from Mexico. Abbott said he chose to act suddenly after 5,000 noncitizens were apprehended illegally crossing into Texas from Mexico over the holiday weekend. "While President Biden refuses to do his job and enforce the immigration laws enacted by Congress, the State of Texas is once again stepping up and taking unprecedented action to protect Americans and secure our southern border," Abbott said in a statement.

— Elon Musk’s proposed acquisition of Twitter may fall apart over his doubts that the company is accurately reporting the number of spam bots on the service, the Washington Post reported (link). Musk’s team has concluded that Twitter can’t verify its figures on the spam accounts and has “stopped engaging” in discussions around funding the deal, according to the report. Twitter has repeatedly said that spam bots represent less than 5% of its total user base. Musk, meanwhile, has complained that the number is much higher.

— New dicamba trial. A U.S. appeals court in St. Louis ordered a new trial to determine punitive damages that Bayer and BASF must pay for harm caused by the weedkiller dicamba at a Missouri peach orchard. Link for details.

— Cotton AWP eases again. The Adjusted World Price (AWP) for cotton fell to 113.37 cents per pound, effective today (July 8), down from 116.83 cents per pound the prior week. The fall in the AWP reflects the plunge in U.S. and global cotton prices. Meanwhile, USDA said that Special Import Quota #12 will be established July 14 for 55,798 bales of upland cotton, applying to supplies purchased no later than Oct. 11 and imported into the U.S. no later than Jan. 9, 2023.