Fed May Boost Rates by 75 Basis Points at Wednesday’s FOMC; PPI at 10.8% in May

House clears bill to overhaul ocean shipping laws, sending it to Biden’s desk

|

In Today’s Digital Newspaper |

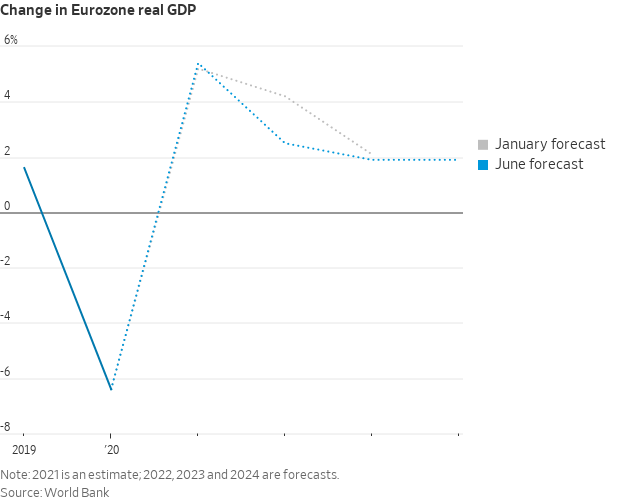

The Federal Reserve begins its two-day policy meeting today, and a 0.75-percentage-point increase could be in the cards when it makes its decision Wednesday. If so, it would be the biggest single hike since 1994. Fed Chair Jerome Powell had previously suggested a 75-basis-point rise was not even on the table, but that assumed economic conditions continued to evolve as policymakers expected. They have not. Last week, the World Bank issued a dire warning that global growth may be choked, especially as the war in Ukraine drags on.

Wholesale prices rose 10.8% in May, near a record annual pace. The Producer Price Index, a measure of the prices paid to producers of goods and services, rose 0.8% for the month and 10.8% over the past year. The monthly rise was in line with estimates and a doubling of the 0.4% pace in April. Excluding food, energy and trade, so-called core PPI rose 0.5% on the month, slightly below the 0.6% estimate but an increase from the 0.4% in the previous month. On a year-over-year basis, the core measure was up 6.8%, matching April’s gain. The two PPI measures remained near their historic highs — 11.5% for headline, and 7.1% for core, both hit in March.

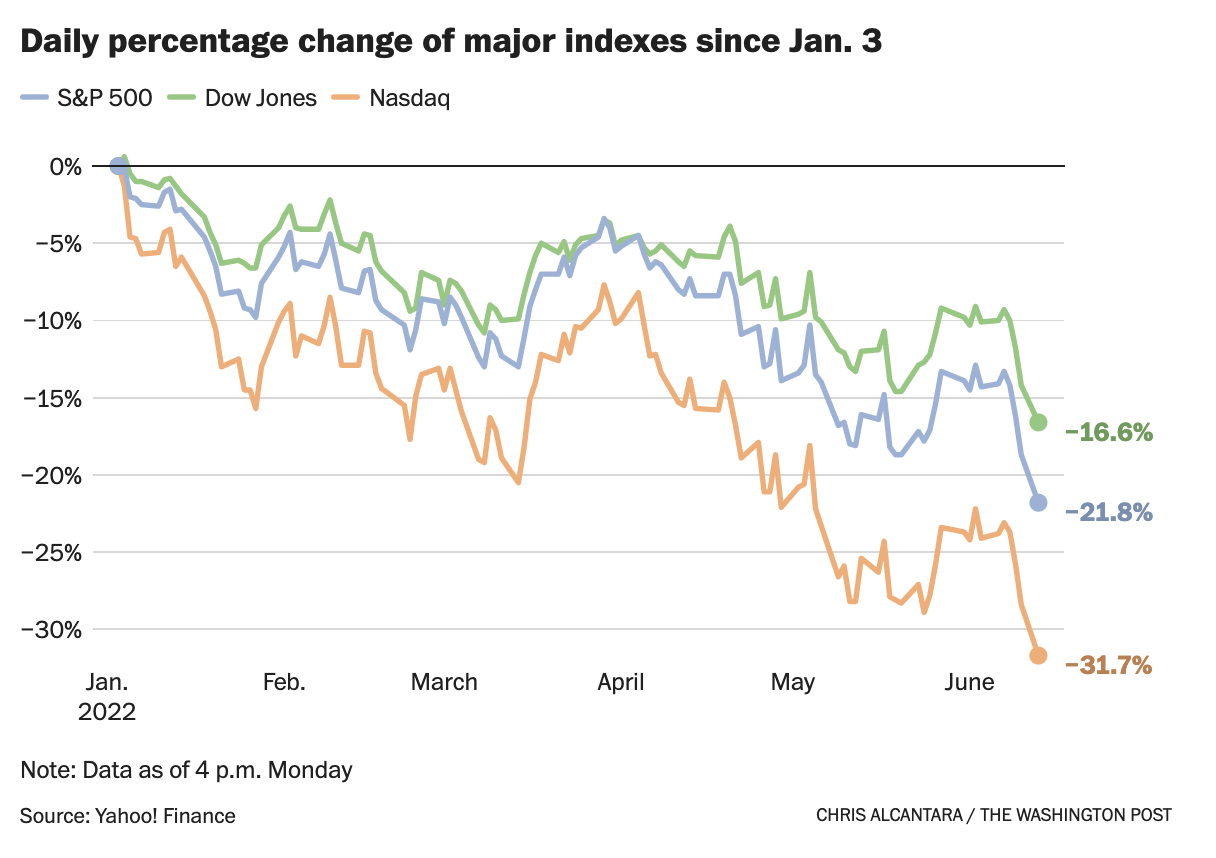

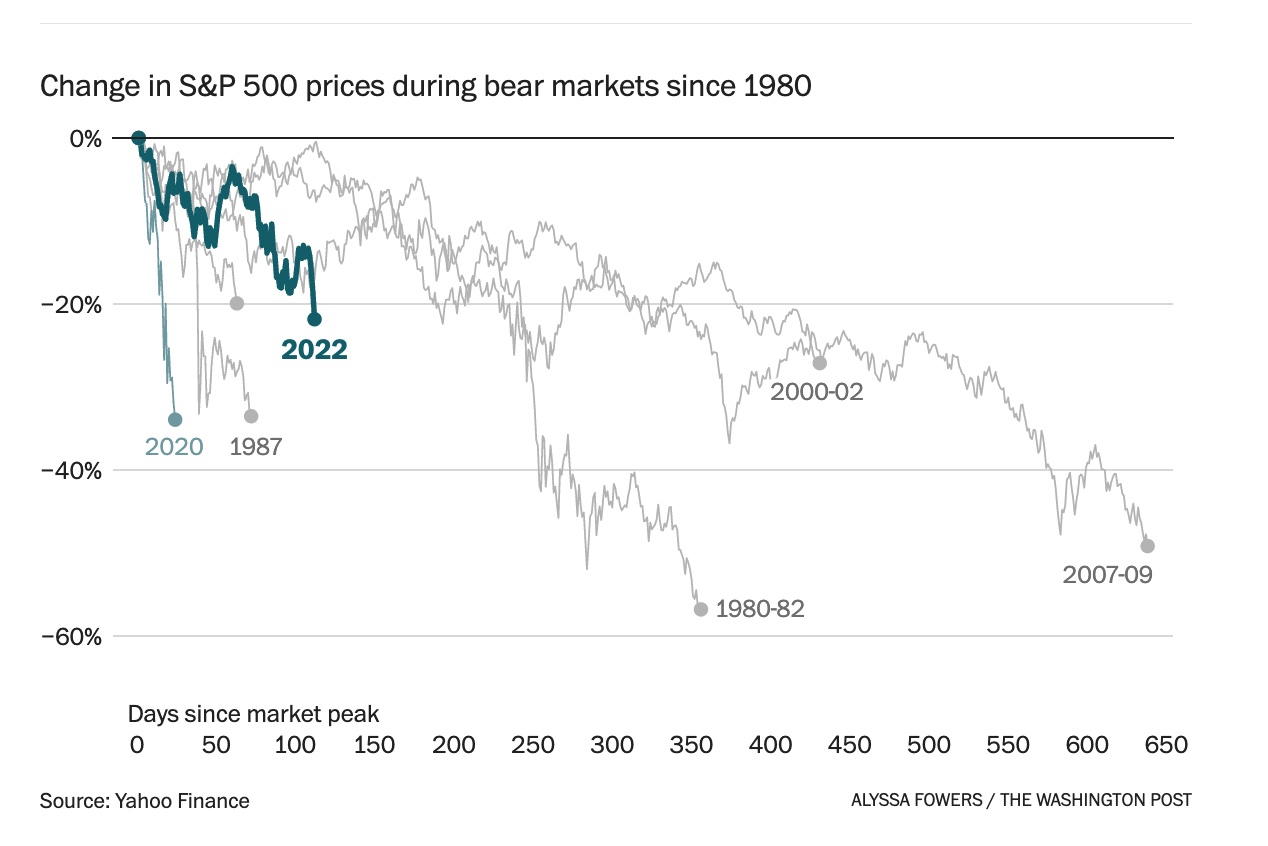

The S&P 500 is in a bear market, after closing on Monday with a greater than 20% decline from its recent peak. Since 1929, the S&P has experienced more than two dozen bear markets. This time, it has been a quicker-than-average descent into bear territory, at 111 trading days since the index’s Jan. 3 record high, according to Dow Jones Market Data.

Only the 1987, 2009, and 2020 bear markets took fewer trading days to achieve a 20% drop among the past 10 bear markets. The average bear market peak-to-trough decline for the S&P has been almost 36%, and the index has taken a median of 52 trading days to bottom out. That would mean another 10 weeks or so of continued declines, putting the bottom at roughly late August. The 2020 bear market was a peak-to-trough drawdown of 34% but lasted only 33 days, where the 1962 bear market resulted in a 22% drawdown but lasted 240 days.

USDA daily export sale: Private exporters reported sales of 148,000 metric tons of corn for delivery to Mexico. Of the total, 103,000 metric tons is for delivery during the 2021-2022 marketing year and 45,000 metric tons is for delivery during the 2022-2023 marketing year.

White House announced President Biden will visit Saudi Arabia, expects to meet crown prince. The agenda for Biden's mid-July Middle East trip is set, and it includes a visit to Saudi Arabia during which he expects to meet Crown Prince Mohammed bin Salman, a senior administration official told reporters. Biden's visit to the Middle East will take place from July 13-16 and include stops in Israel, the occupied West Bank and Saudi Arabia. Israeli officials say he's expected to land in Israel in the evening local time of July 13. White House press secretary Karine Jean-Pierre stressed on Monday that there are several regional security issues Biden is seeking to discuss with the Saudi leaders, whom the president has criticized for the kingdom’s poor human rights record. “To look at this trip as it being only about oil, it would be simply wrong to do that,” Jean-Pierre said Monday.

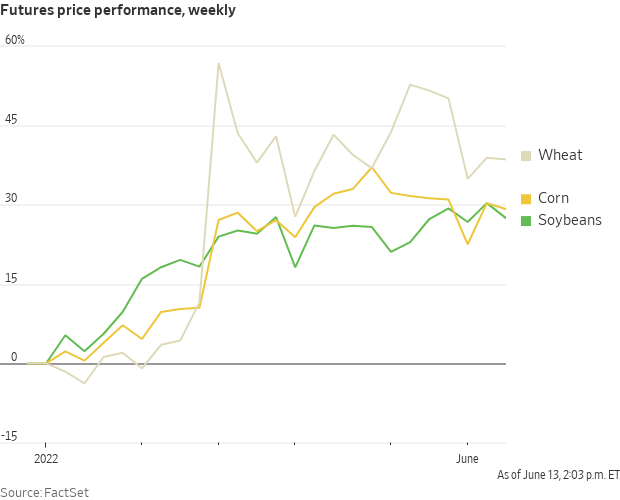

Soybean prices have soared some 30% this year, a surge that promises further pain for consumers facing the most severe bout of food inflation in a decade.

Richard Crow, commodity trader and analyst notes: “While energy prices are high, world freight values broke yesterday. A break in freight could signal the demand for bulk-carrier vessels has slowed. Freight rates were off 3 to 5 dollars a ton for longer voyages.”

Morgan Stanley’s James Gorman is “pretty relaxed” about the recession threat. The bank’s CEO reiterated at an investor conference that he expects any U.S. downturn to be mild and short-lived. Others are not so confident, with some no one saw the 2008-09 financial crisis getting as bad as it did, either. At the time, analysts recall, the Fed threw out a couple of gentle rate increases to take the froth out of the housing market, but then it collapsed. The Fed repeatedly said that subprime problems were contained —until they weren’t.

The House easily cleared a bill (369 to 42) to overhaul ocean shipping laws, sending it to President Joe Biden’s desk. The legislation could outlaw ocean carriers leaving U.S. ports with empty containers — a pandemic-era development that has hurt U.S. agricultural exporters, with ag export shipments considerably being delayed.

The U.S. Department of Defense (DoD) has signed a $120 million deal with Australia's Lynas to build the first "heavy" rare earths separation facility in Texas. The contract, which will be entirely bankrolled by the Pentagon.

Authorities in Beijing attempt to contain a Covid-19 outbreak of 228 cases tied to a 24-hour bar, which had reopened last week after the Chinese capital relaxed restrictions. Meanwhile, Canadian Prime Minister Justin Trudeau tests positive for Covid-19 for the second time.

South Carolina, Nevada, and Maine hold statewide primary races today… details in Politics. A special election in Texas could also signal whether Hispanic voters continue to move toward Republicans.

Elon Musk is expected to participate in an all-hands meeting with Twitter employees Thursday in what would mark the first time the billionaire has visited the company's workforce amid a bid to buy the social media platform.

Amazon plans to launch its first commercial drone delivery program later this year in the town of Lockeford, California, the company announced. The plan must receive final approval from federal regulators, though Amazon has already been granted approval from the Federal Aviation Administration to carry out drone operations. The e-commerce giant accounted for more than 43% of U.S. e-commerce last year, delivering roughly $380 billion in goods. The company says thousands of products will be available via drones — though reports suggest the proprietary drone's maximum current payload is 5 pounds.

Election Day 2022 is 147 days away. Election Day 2024 is 875 days away.

|

MARKET FOCUS |

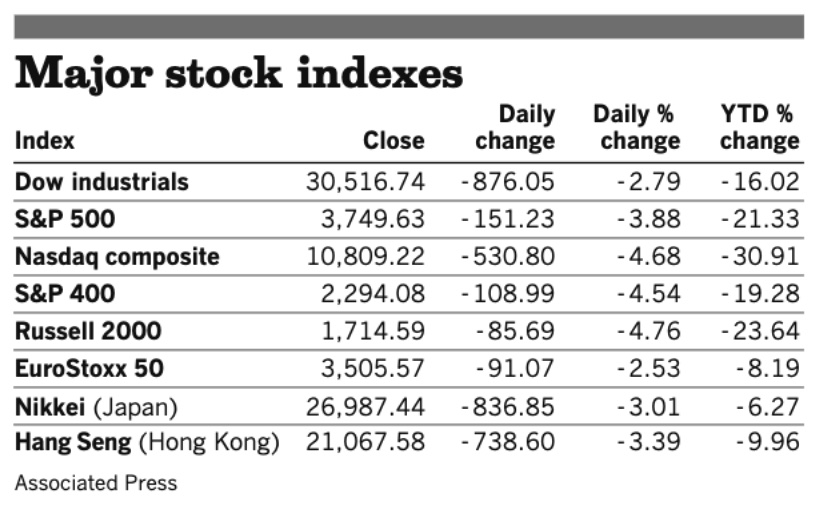

Equities today: U.S. Dow opened 100 points higher (but quickly tempered the gains), a day after a rout pushed the S&P 500 into bear market territory amid fears that the Federal Reserve will announce a sharper interest rate hike on Wednesday. In Asia, the Nikkei declined 357.58 points, 1.32%, at 26,629.86. The Hang Seng Index edged up 0.41 point, 0.00%, at 21,067.99.

U.S. equities yesterday: U.S. stocks suffered a second straight session of losses, with the S&P 500 finishing in bear market territory. The Dow lost 876.05 points, 2.79%, at 30,516.74. The Nasdaq dropped 530.80 points, 4.68%, at 10,809.23. The S&P 500 declined 151.23 points, 3.88%, at 3,749.63. Each of the indexes is down sharply in 2022, and there is no clear indication of when the markets could stabilize.

Bear market. Monday’s decline puts the S&P 500 back in bear market territory, defined as a 20% fall from the most recent high, after it briefly touched the benchmark in intraday trading last month. The Nasdaq, meanwhile, is down more than 30 % so far this year.

Recession fears are spooking investors. But even after Monday's deep losses, BlackRock analysts broke down three reasons why it isn't time to buy the dip just yet:

- Margin pressures are a risk to earnings, so stocks may slide further.

- The Fed will hike rates too high.

- Valuations aren't much cheaper given rising interest rates.

Agriculture markets yesterday:

- Corn: July corn futures fell 4 cents to $7.69 1/4 and December corn fell 1 cent to $7.21 1/2.

- Soy complex: July soybeans fell 38 cents to $17.07 1/2, while November futures tumbled 34 1/2 cents $15.33 3/4. July soymeal fell $14 to $415.10 per ton and July soyoil fell 130 points to 79.51 cents per pound, near a two-week low.

- Wheat: July SRW wheat rose 1/4 cent to $10.71. July HRW wheat fell 3/4 cent to $11.61 3/4. July spring wheat rose 1/4 cent to $12.21 3/4.

- Cotton: July cotton rose 60 points to 145.66 cents per pound, while December futures rose 45 points to 122.81 cents.

- Cattle: August live cattle fell $2.325 to $133.875. August feeders dropped $3.15 to $171.325

- Hogs: July lean hogs rose $1.20 to $106.675. Today’s CME lean hog index fell 12 cents to $107.19 but is projected to rise 21 cents Tuesday to $107.40 (as of June 10).

Ag markets today: Soybeans rebounded some from Monday’s sharp losses, while corn and wheat traded lower overnight but held above yesterday’s lows. As of 7:30 a.m. eT, corn futures were trading 3 to 5 cents lower, soybeans were 5 to 9 cents higher and wheat futures were 6 to 11 cents lower. Front-month U.S. crude oil futures were around 75 cents higher and the U.S. dollar index was holding near unchanged this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Producer Price Index is expected to rise 0.8% in May from the previous month, up from 0.5% in April. (8:30 a.m. ET) UPDATE: The PPI rose a seasonally adjusted 0.8% in May from the prior month, up from a 0.4% monthly gain in April, the Labor Department said Tuesday. That means inflation has not abated. Producer prices had moderated somewhat in April, after the March gain had been the highest since records began in 2010, pushed up by surging energy prices after Russia invaded Ukraine. The so-called core price index — which excludes the often-volatile categories of food, energy and supplier margins — rose 0.5% after a 0.4% gain the prior month. On an annualized basis, the PPI rose 10.8% in May from a year ago, down slightly from a revised 10.9% in April. May marked the sixth consecutive month of double-digit annual gains for producer prices.

• Federal Reserve begins its two-day policy meeting in Washington, DC.

• Gary Gensler, chair of the U.S. Securities and Exchange Commission (SEC), will provide an overview of the agency's agenda, which includes a record number of proposed rules yet to be adopted. He will address two industry audiences: one of institutional and retail investors at the RFK Compass Summer Investors Conference and another at the Wall Street Journal CFO Network Summit.

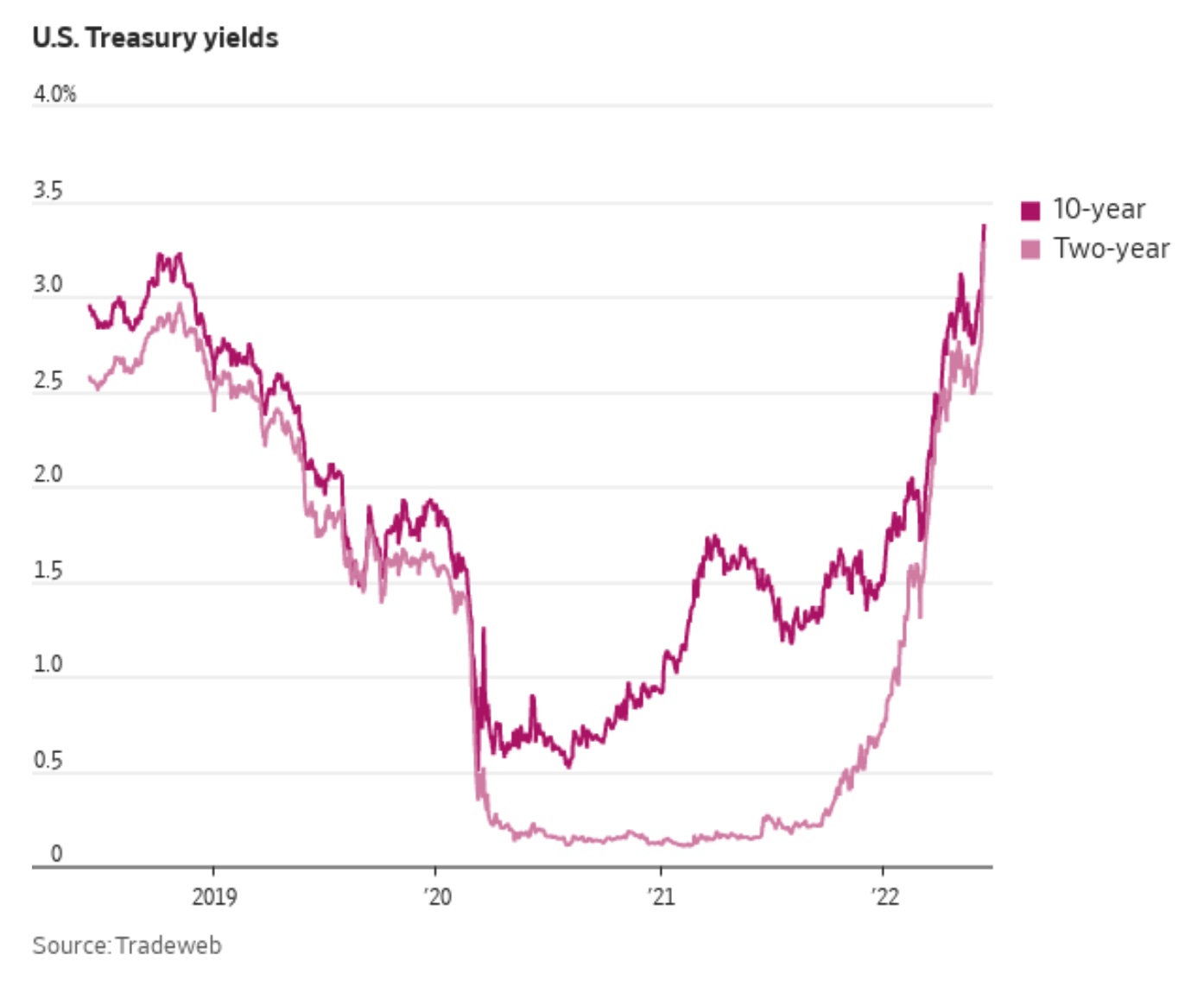

Fed’s math: How many hikes, how deep? The Fed is on track to raise interest rates seven times this year, with the third rate hike expected Wednesday at the conclusion of the central bank’s meeting. It is expected to raise rates by half a percentage point, as it did in May, but the stubborn pace of inflation has some economists saying the fed will have to act even more aggressively.

But an even higher rate boost is possible. The Wall Street Journal reports (link) Federal Reserve officials are starting to think about raising rates by three quarters of a percentage point. That would be an abrupt shift from the Fed’s carefully orchestrated message that it planned to move in half-percentage points both at this meeting and at next month’s. Friday’s ugly inflation news could have scrambled those plans and officials are also worried about recent surveys showing that households’ expectations of future inflation have increased. Fed officials worry those expectations could be self-fulfilling. Some forecasters, such as investment banks Barclays and Jefferies, had said Friday that they believed the inflation data would prompt a 0.75-percentage-point rate rise. Other firms, such as JPMorgan Chase & Co. and Goldman Sachs Group Inc., joined in the same call on Monday afternoon.

The Federal Reserve in prior statements have given themselves a way out if a higher-than-expected rate is announced on Wednesday. "What we need to see is clear and convincing evidence that inflation pressures are abating, and inflation is coming down. And if we don't see that, then we'll have to consider moving more aggressively," Fed Chair Jerome Powell said at a recent Wall Street Journal conference. Still, one month ago, Powell said that the central bank was not "actively considering" raising interest rates by three-quarters of a percentage point to fight inflation.

Meanwhile, the average rate for a 30-year fixed mortgage reached 5.09%, according to Freddie Mac. A year ago, it hovered near 3%. before the Fed’s rate hikes a $400,000 mortgage would typically carry a monthly payment of about $1,686, not including taxes and insurance, according to an analysis by Farr, Miller and Washington. With today’s interest rates, it costs $2,398 ― a 30% increase.

The value of all cryptocurrencies fell below $1 trillion, according to coinmarketcap.com, down from a November peak of almost $3 trillion.

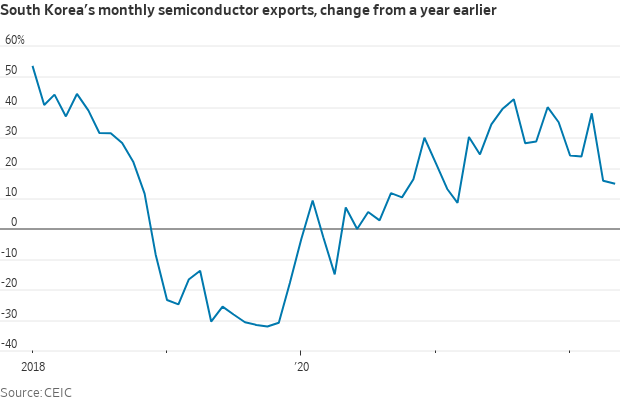

Worries about S. Korean economy grow amid truckers' strike. South Korea’s prime minister warned Tuesday that the disruption of cargo transport could cause “irrecoverable” damages on the country’s economy, as a nationwide truckers' strike entered its eighth day. About 6,840 truckers were rallying Monday at 14 sites across South Korea. The trucker strike has shut steel plants, disrupted car production and delayed shipments of raw materials needed for semiconductors. In the past week, the cost of those disruptions has amounted to $1.2 billion, South Korean officials say. Truckers are striking over pay and high diesel costs.

Rare earths. The U.S. Department of Defense (DoD) has signed a $120 million deal with Australia's Lynas to build the first "heavy" rare earths separation facility in Texas. The contract, which will be entirely bankrolled by the Pentagon, builds on a similar award granted to MP Materials in February for a heavy facility in Mountain Pass, California. Last year, the DoD awarded the two companies contracts to construct "light" rare earths facilities as Washington looks to counter China's dominance of critical mineral supply chains. Rare earths refers to a group of 17 elements that are used in everything from high-tech consumer electronics to military equipment. Despite the name, there are deposits of them all over the world (some of them are even hundreds or thousands of more times abundant than gold), but the elements are still called "rare" as it is unusual to find them in pure form or in concentrated quantities. As a result, they are difficult to mine and refine profitably, and in the past, there have been strict U.S. environmental regulations related to extracting and processing (toxic wastewater and radioactive residues).

The U.S. is highly dependent on rare earths for its military capabilities like lasers and guidance systems (a Congressional Research Service report in 2020 even found that each F-35 required 920 pounds of the materials). Chinese dominance of the market has meanwhile allowed the country to control prices, leading to additional barriers to entry and putting pressure on upcoming challengers. In fact, Beijing's "Made in China 2025" strategy aims to create a vertically integrated supply chain that dominates mining, magnets and high-tech manufacturing that could also impact everything from defense components to electric vehicles.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly weaker with the euro and yen edging slightly higher. The yield on the 10-year U.S. Treasury note has eased to trade around 3.34% with most global government bond yields higher.

• U.S. Treasury yields have surged to new multiyear highs, reflecting uncertainty over how high the Fed will have to raise interest rates to tame inflation.

• Bitcoin’s recent selloff has now become the fourth deepest in the cryptocurrency’s 13-year history. It traded at about $22,725 on Tuesday, losing another 2.3%. It is down 67% from its most recent record high.

• Crude oil futures: U.S. crude was around $121.60 per barrel and Brent around $123.20 per barrel.

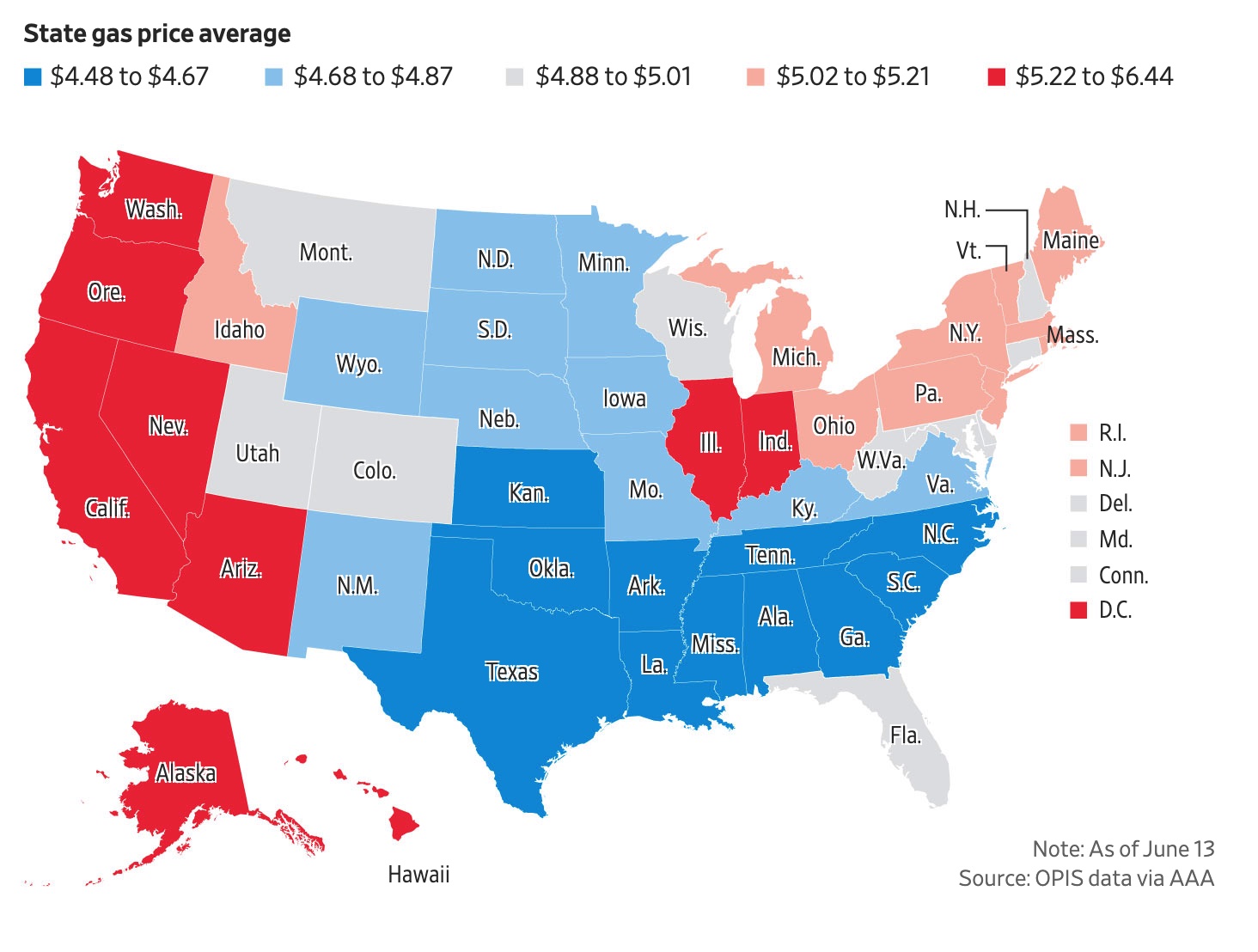

• The states with the most and least expensive gas. Gas taxes, fuel infrastructure availability, and cost of labor and real estate all determine gas prices across states.

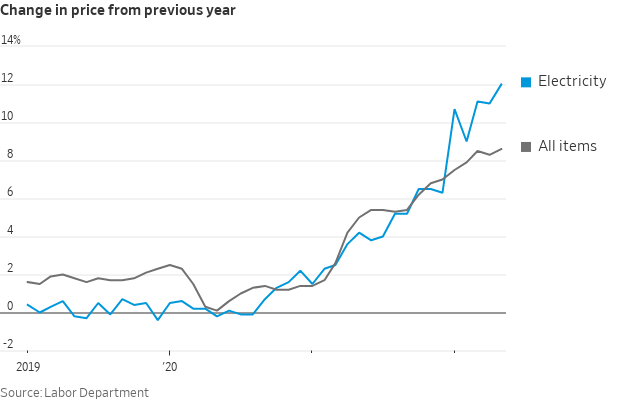

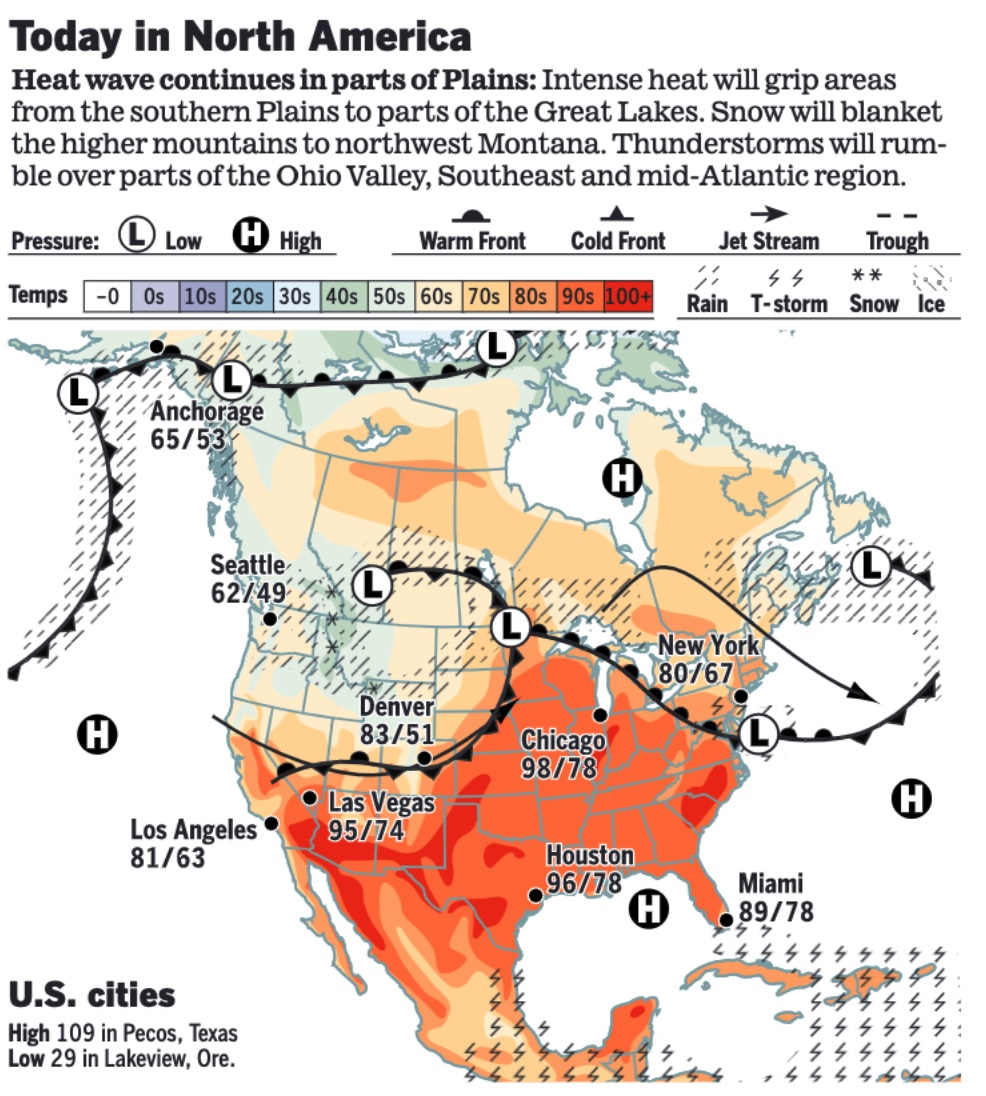

• Electricity prices are up 12% on the year, according to the latest inflation figures, and are likely to continue rising. That will push up the power bill for the average American household by $90 to $540 between June and August, according to the National Energy Assistance Directors Association. In the hotter parts of the country, air conditioning accounts for as much as 27% of summer electric bills.

• Soybean prices have risen 30% this year to a new record, promising further pain for consumers already struggling with high food prices. The possibility of weather disruptions in the U.S. Corn Belt could push prices higher still, writes the WSJ (link). Soybeans are usually used to feed chicken, pigs and cows as well as crushed to make cooking oils or biofuels.

• Ag trade: Japan is seeking 186,441 MT of milling wheat in its weekly tender. Bangladesh tendered to buy 50,000 MT of optional origin milling wheat.

• Yellowstone National Park has temporarily closed all entrances to the park through at least Wednesday due to "unprecedented" amounts of rainfall and flooding.

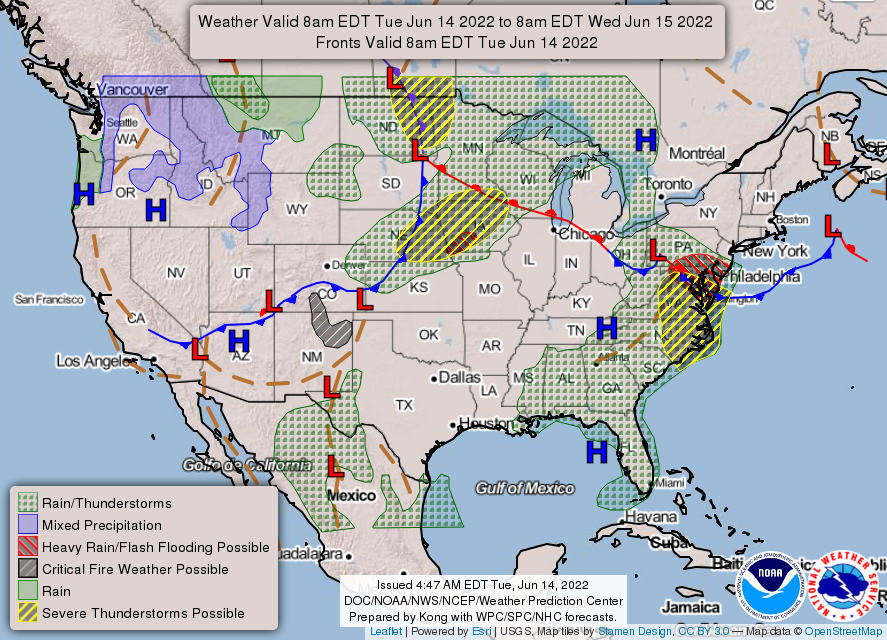

• NWS weather: Dangerous, record-setting heat to continue from the Upper Midwest to the Southeast through midweek.... ...Severe thunderstorms likely across portions of the Upper Midwest on Wednesday... ...Elevated to critical fire weather conditions expected across portions of the Southwest to the central and southern High Plains on Tuesday.

Items in Pro Farmer's First Thing Today include:

• Corn and wheat weaker, soybeans firmer overnight

• Ukraine asks Europe for temporary grain storage (details below)

• Corn CCI rating slips, soybeans start above average

• Consultant raises South American crop estimates

• Indonesia details palm oil export taxes

• Weak start for wholesale beef trade

• Cash hog index ends mini slump

|

RUSSIA/UKRAINE |

— Summary: The embattled Ukrainian city of Severodonetsk is nearly completely controlled by Russian forces, according to Ukrainian military officials. The third of three main bridges to the city was deemed impassable on Monday, making evacuations extremely difficult. Russian forces destroyed the last remaining bridge to Severodonetsk, cutting Ukrainian supply lines and moving to consolidate control over the strategic city in Ukraine’s east. President Volodymyr Zelenskyy says the fight in Donbas region will go down in history as one of the most brutal battles in Europe.

- Warning: With the U.S. sending roughly $130 million a day in military aid to Ukraine plus economic and other assistance, current and former U.S. officials warn that more must be done to ensure arms and money aren’t diverted, stolen or misused. $54 billion is the rough total that Congress has appropriated for Ukraine since January, dwarfing annual U.S. aid to any other country

- There's no playbook and little agreement about how the U.S. would respond if Russia used nuclear weapons in the Ukraine war, a half dozen current and former government officials briefed on the issue and several outside experts say. Link for details.

— Market impacts:

- Some European factories run out of gas. Europe’s energy costs are soaring in the wake of Russia’s war on Ukraine, forcing some energy-dependent manufacturers to shut down. As of last year, Russia supplied about 40% of the European Union’s natural gas. Now Europe is preparing to ration gas if Russia shuts off supplies to the region. High energy costs are forecast to drag down Europe’s economy this year. Economists expect the German economy to shrink in the second quarter due to energy costs.

- Ukraine asks Europe for temporary grain storage. Bloomberg reports Ukraine asked European partners for temporary grain storage to help with its upcoming harvest. Ukraine’s Deputy Agriculture Minister Markian Dmytrasevych said Russian attacks and occupation in southern and eastern areas of the country reduced grain storage capacity by 15 MMT.

|

POLICY UPDATE |

— House clears ocean shipping reform package which now goes to President Biden. The House Monday easily cleared the Ocean Shipping Reform Act. The Federal Maritime Commission (FMC) will draw up new rules covering the U.S. shipping industry. The version that cleared the House 369-42 now heads to President Joe Biden as it was passed earlier by the Senate via unanimous consent. The Senate measure is not as stringent as the previous bill passed by the House. The bill:

- Revises requirements governing ocean shipping to promote the growth and development of U.S. exports. For example, the bill prohibits common ocean carriers, marine terminal operators, or ocean transportation intermediaries from refusing cargo space when available or resorting to other unfair methods.

- Requires the FMC to (1) investigate complaints about detention and demurrage charges (i.e., late fees) charged by common ocean carriers, (2) determine whether those charges are reasonable, and (3) order refunds for unreasonable charges. It also prohibits common ocean carriers, marine terminal operators, or ocean transportation intermediaries from unreasonably refusing cargo space when available or resorting to other unfair or unjustly discriminatory methods.

— Republicans push a different approach on energy and ag policies. Rep. G.T. Thompson (Pa.), the top Republican on the House Ag Committee, and a group of Republicans are pressing the president to reverse some of his energy and agriculture policies. Thompson and the lawmakers dispute President Biden’s explanation that Russia’s war in Ukraine is to blame for rising food prices, which were elevated even before the war. The GOP lawmakers argue that the president “has neglected to take serious action to increase American production.” They also urge the administration to help lower the high cost of food production by rolling back environmental regulations and proposed rules around pesticides and waterways. Link to letter.

The letter to President Biden outlines administrative actions which would immediately provide real, near-term solutions to address the ongoing crises facing American producers, including:

- Addressing farm input costs

- Halting changes to "Waters of the United States" (WOTUS)

- Ensuring the Environmental Protection Agency (EPA) refocuses on sound science

- Ending onerous climate rules

|

PERSONNEL |

— New U.N. human rights chief. The position of U.N. High Commissioner for Human Rights will soon be open after its current occupant, Michelle Bachelet, said on Monday that she would not seek a second term in a surprise announcement. Her decision comes shortly after her visit to China, which was criticized for glossing over alleged abuses of Uyghurs in Xinjiang.

— New member of House Ag panel. House Speaker Nancy Pelosi announced Rep. Sharice Davids (D-Kan.) will be the newest member of the House Ag Committee.

|

CHINA UPDATE |

— Residents will need to show proof of a negative Covid-19 test to enter bars, pubs or clubs starting on Thursday, Hong Kong’s health minister has announced, as clusters linked to the city’s nightlife district continue to worsen. Secretary for Food and Health Sophia Chan Siu-chee on Tuesday also said authorities were concerned patrons and operators of nightspots had not complied with anti-epidemic rules, citing the identification of several outbreaks connected to such premises. China is the last country in the world that is trying to eliminate Covid, but the spread of the highly contagious Omicron variant is challenging its strategy of mass lockdowns and quarantines. The country already uses apps to surveil its citizens and track infections, and it imposes stringent lockdowns and centralized quarantines for confirmed cases and close contacts.

— China’s zero-Covid approach has fed public anger in some places. Last night, frustrated residents in Shanghai’s northeastern district of Yangpu banged on pots and shouted “End the lockdown!” after their compound was locked down over the weekend, said Jaap Grolleman, a Dutch teacher who lives in the neighborhood. “People are worried about taking the subway or going to the shopping mall,” said Grolleman.

— U.S. Congress is pressing ahead with legislation that could rewrite the rules for American companies investing abroad, proposing the screening of investments in countries like China seen as adversaries to protect U.S. technologies and rebuild critical supply chains, the WSJ reports (link). The broader legislative package has been stuck in debate for months over its scope, though House Majority Leader Steny Hoyer (D-Md.) has said that he wants a vote before the July 4 recess.

|

TRADE POLICY |

— The World Trade Organization is struggling for relevance, reports the WSJ (link). Trade ministers are set to meet this week in Geneva for the first time since 2017 and must grapple with several problems, including how to respond to food shortages amid rising commodity prices, the continuing pandemic shock and other long-running issues such as the depletion of global fishing stocks. Meanwhile, major economies such as the U.S. and the European Union are moving away from globalization and focusing more on domestic production and trade with like-minded nations.

|

ENERGY & CLIMATE CHANGE |

— U.S. automaker CEOs, Toyota urge Congress to lift EV tax credit cap. General Motors, Ford, Chrysler-parent Stellantis and Toyota urged Congress to lift a cap on the $7,500 electric vehicle tax credit, citing higher costs to produce zero-emission vehicles, according to a letter seen by Reuters.

— USDA again extends deadline on comments regarding fertilizer competition issues. USDA’s Agricultural Market Service (AMS) said in a notice (link) published in today’s Federal Register that it is again extending the comment period for public input on “competition-related challenges in the U.S. fertilizer market and other obstacles to producers accessing affordable, responsibly manufactured fertilizer.” Comments are due July 15. AMS has already received more than 1,000 comments.

— President Biden wasn’t sold on his administration’s summer-time ethanol waivers to bring down gasoline prices, expressing doubt that it would have a major impact, the Washington Post reports (link). Key quote: “Biden had worried even before the announcement that it exaggerated ethanol’s ability to cut gas prices and could harm his climate goals… But Agriculture Secretary Tom Vilsack and other officials urged Biden to go, arguing that it would at least help the Midwest — and the White House, after all, was desperate for ways to lower gas prices.”

— House Dems use agriculture bills for food and fuel messages. House Democrats are touting legislation that would create a special investigator for agricultural competition and permanently allow year-round sales of E15 fuel as inflation-fighting tools in a package to be considered on the floor later this week, according to House Majority Leader Steny Hoyer (D-Md.). “The House will consider the Lower Food and Fuel Costs Act from the Committee on Agriculture and the Committee on Energy and Commerce to address food prices and help bring down the cost of fertilizer for farmers while providing more affordable options at the gas pump for Americans,” Hoyer said during a floor colloquy.

- The package (HR 7606) incorporates seven bills that advance Democratic messages that a few companies' domination of the meat and poultry processing has contributed to higher food prices and that lawmakers’ are tackling pocketbook issues, such as gasoline prices of around $5 a gallon.

- The bill would establish an Office of the Special Investigator for Competition Matters at USDA, giving it subpoena powers and the ability to file civil lawsuits or take administrative actions over violations by meatpacking companies and live poultry dealers under the Packers and Stockyards Act of 1921. The legislation doesn't authorize funding, but the Congressional Budget Office estimates an office of 10 attorneys and staff would cost a total of $9 million over fiscal years 2022 to 2027. House Agriculture ranking member Glenn “GT” Thompson (R-Pa.) called the bill’s language flawed and said it would add regulatory compliance costs that would raise grocery expenses for consumers. Thompson said the special investigator was part of “President Biden’s dishonest blame game” of holding large corporations to blame for inflation. Foes say the special investigator’s office, reporting to the Agriculture secretary, would be a politicized office that duplicated the work of USDA’s Packers and Stockyards Administration and the Justice Department.

- The measure would use loans, loan guarantees and grants to help communities and individuals expand networks of local and regional processors and increase job opportunities. It would authorize $100 million for each fiscal year from 2023 to 2025. The bill also would authorize $20 million per fiscal year for fiscal 2023 through 2025 for grants.

- The bill would authorize $200 million for fiscal 2022 and 2023 funding for competitive USDA grants to fuel retailers and distributors to offset costs of installing blender pumps that can dispense fuel mixtures with more than 10% ethanol or 20% biodiesel. The goal is to increase the availability of such fuels and support increased biofuel production and use.

- The bill would make permanent the waiver the Biden administration announced in April to allow summer sales of a gasoline blend of 15% ethanol and 85% gasoline. The administration said the decision was among steps it was taking to try to reduce pump prices since ethanol costs less than gasoline. The measure would amend the law to allow ethanol blends of more than 10% to qualify for sales between June 1 and Sept. 15. A federal court had ruled that the Trump administration didn't have the authority under the law to allow such sales.

- The package includes language that would increase cost-sharing payments and federal payments through existing USDA conservation programs to encourage farmers and ranchers to buy precision agriculture equipment, systems and technology. The Environmental Quality Incentives and the Conservation Stewardship programs would make higher payments to producers to help meet the expense of precision technology and higher payments to producers who use precision agriculture practices. Loan guarantees through the Conservation Loan and Business and Industry programs would be available for private lenders to encourage them to finance farmers and ranchers' precision agriculture purchases.

- Language would direct USDA to establish the Agricultural and Food System Supply Chain Resilience and Crisis Response Task Force within 60 days of enactment. The Agriculture secretary would name the task force leader, who would be a special adviser to the department. The special adviser would have 270 days after the bill is enacted to report on the food and agricultural system. The task force would sunset by Sept. 30, 2023.

- The measure would authorize $500 million to be used in fiscal years 2022 and 2023 for additional payments to participants in the Environmental Quality Incentives Program who are using conservation practices to limit fertilizer and other nutrient runoff. The payments would be in addition to any cost-sharing funds a farmer or rancher already receives through the program. However, a participant couldn't receive total payments that exceed the cost for managing nutrient runoff.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Colorado infections push HPAI losses above 40 million birds. More than 40 million birds in domestic flocks, mostly chickens and turkeys, have died in the worst outbreak of bird flu since the 2014-15 epidemic, according to USDA data released Monday (link). The outbreaks have killed 6% of the egg-laying hens in the country.

|

CORONAVIRUS UPDATE |

— Summary:

- Global cases at 535,872,229 with 6,310,613 deaths.

- U.S. case count is at 85,632,808 with 1,011,543 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 591,103,144 doses administered, 221,727,733 have been fully vaccinated, or 67.29% of the U.S. population.

— Sanofi and GlaxoSmithKline say their next-generation Covid-19 booster shot provoked a “strong immune response” against Omicron and other variants — promising news as more companies vie to enter the maturing coronavirus vaccine market.

— FDA advisers will vote today on whether to recommend Moderna’s Covid-19 vaccine for children ages 6 through 17. The advisory committee’s vote will factor into the FDA’s final decision on whether to clear the vaccine for use in children 6 years and older, an authorization that would open the use of Moderna’s vaccine to children for the first time in the U.S. The same advisory panel will meet Wednesday to consider whether Moderna’s vaccine should be used in younger children, ages 6 months through 5 years old. At the same time, the panel will consider whether to expand use of the Pfizer-BioNTech vaccine to children ages 6 months through 4 years old.

|

POLITICS & ELECTIONS |

— Four states — Maine, Nevada, North Dakota, and South Carolina — are holding primary elections today. In Nevada, eight candidates are running in the state’s Republican U.S. Senate primary, including retired Army captain Sam Brown and former state Attorney General Adam Laxalt, who was endorsed by former President Donald Trump (R) and maintains a solid lead in public polls.” Incumbent U.S. Sen. Catherine Cortez Masto (D), first elected in 2016, faces three primary challengers. In South Carolina, in the 7th District, Rep. Tom Rice (R) faces six challengers including state Rep. Russell Fry (R). Rice is one of 10 Republicans in the U.S. House who voted to impeach Trump in 2021. Trump has endorsed Fry.

— Israel’s government. Israeli Prime Minister Naftali Bennett’s governing coalition is now two seats short of a parliamentary majority after Yamina party member Nir Orbach left the bloc over what he called “extremist, anti-Zionist elements,” holding the group of lawmakers “hostage.” Bennett said his government may collapse within “a week or two,” if defecting members did not return.

|

CONGRESS |

— Monday’s Jan. 6 Capitol riot hearing detailed a litany of aides whose advice President Trump ignored — and one whose advice he fatefully heeded. Lawmakers presented evidence of how Trump ignored officials’ insistence that his election claims were false, how his campaign and family cashed in on spreading that misinformation, and how he instead followed the Election Night guidance of an apparently drunk Rudy Giuliani.

|

OTHER ITEMS OF NOTE |

— Elon Musk to speak with Twitter staff on Thursday. Elon Musk will be meeting Twitter employees in an all-hands meeting on Thursday, the first time he will do so since agreeing to buy the social-media company for $44 billion in April. Twitter CEO Parag Agrawal announced the meeting in an email to staffers. Musk last week filed a 13D stating that he could walk away from the agreement to buy Twitter because of its spam-bot problem. A report from the Washington Post said Twitter would comply with a demand from Musk for internal numbers so he can analyze the prevalence of bot accounts. Twitter said it has shared — and will continue to share — information with Musk to close the deal. Twitter said it intends to enforce the merger agreement.

— No action on glyphosate case. The Supreme Court is nearing the end of its term but has yet to decide whether to hear Bayer's appeal of a $25 million award to a California man who said Roundup weedkiller was the cause of his cancer. Link for details.

— Delivery drones ready for takeoff. It has been nine years in the making, but Amazon just announced it will begin Prime Air drone deliveries later this year as it attempts to get the long-delayed project off the ground. The service will initially be available in Lockeford, California - which is about 40 miles south of Sacramento - and will use feedback from the service to improve its operations. To fly delivery drones in the U.S., companies have to be approved by the FAA, and the retail behemoth is one of only three firms that has received Part 135 certification.

— North America's 50 best bars. I doubt your favorite pub is on it, but here is a link to see what some likely elitists think are the best.